Global Plant Based Yogurt Market

Market Size in USD Million

CAGR :

%

USD

3,117.40 Million

USD

13,857.63 Million

2021

2029

USD

3,117.40 Million

USD

13,857.63 Million

2021

2029

| 2022 –2029 | |

| USD 3,117.40 Million | |

| USD 13,857.63 Million | |

|

|

|

|

Market Analysis and Size

The primary factor driving the market in the medium term is increased consumer preference for non-dairy, low-calorie, high-protein, and healthier desserts. Furthermore, the growing popularity of low-fat plant-based yogurt and the introduction of healthy product variants in various flavours are likely to provide consumers looking for a healthy alternative to desserts with ample options. Furthermore, busy lifestyles and health and wellness concerns drive consumers to choose convenient plant-based yogurt as meal replacements.

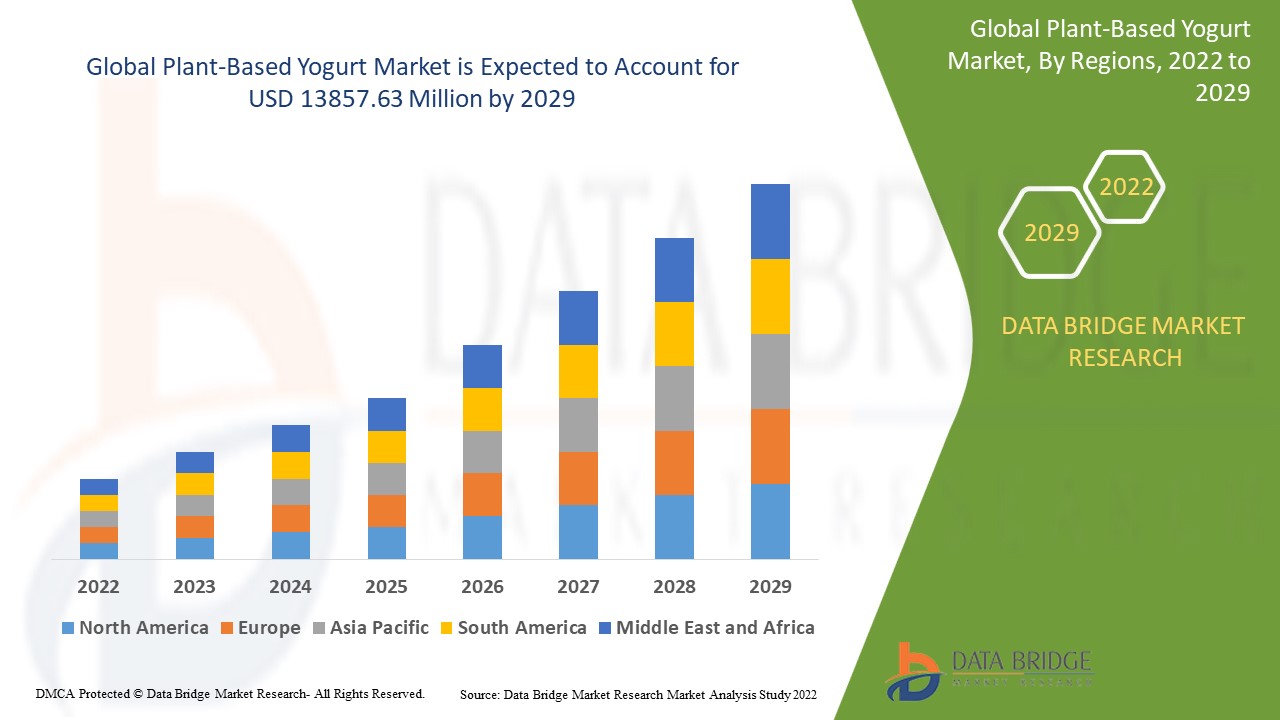

Data Bridge Market Research analyses that the plant-based yogurt market was valued at USD 3117.4 million in 2021 and is expected to reach the value of USD 13857.63 million by 2029, at a CAGR of 20.50% during the forecast period of 2022 to 2029.

Market Definition

Plant-based yogurt is a creamy, healthy, non-dairy vegan food product that helps the vegan population meet their nutritional needs. It is made with plant-based ingredients such as almonds, soy, coconuts, flax, hemp, oats, peas, and cashews. It contains a high concentration of vitamins, minerals, amino acids, and essential fats, which helps to reduce inflammation and boost metabolism.

Report scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Nature (Conventional, Organic), Product Type (Cereal Type, Oat, Legume, Nut, Seed, Pseudo Cereal), Flavour (Regular, Vanilla, Strawberry, Blueberry, Cherry, Peach, Raspberry, Coconut, Coffee, Others), Price Range (Economic, Mid-Range, Premium), Sales Channel (Food Service, Retail, Modern Trade, Convenience Stores, Specialty Stores, Discounters, Independent Small Groceries, E-commerce, Others), Application (Household, HoReCa) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Chr. Hansen Holding A/S (Denmark), Yakult Honsha Co., Ltd (Japan), Nestlé (Switzerland), DuPont (US), MORINAGA & CO., LTD (Japan), BioGaia AB (Sweden), Protexin (UK), Daflorn Probiotics UK (UK), DANONE (France), Yakult U.S.A. Inc. (US), Deerland Enzymes, Inc. (US), UAS Laboratories (US), Goerlich Pharma GmbH (Germany), SANZYME BIOLOGICS PVT. LTD. (India), DSM (Netherlands), NutraScience Labs (US),Kerry Group plc (Ireland), Lallemand Inc. (Canada), Lonza (Switzerland), Winclove Probiotics (Netherlands), Probi (Sweden) |

|

Opportunities |

|

Plant-Based Yogurt Market Dynamics

Drivers

- Rising popularity of low-fat desserts

The rising popularity of low-fat, low-sugar desserts will propel the plant-based yogurt market. Furthermore, children's rising demand for refreshing ice cream alternatives and rising consumer health awareness are macroeconomic factors that positively impact the global plant-based yogurt market.

- Rising disposable income and rising urbanisation

Another important factor is the growing demand for healthy dessert alternatives, and Plant-Based yogurts meet both of these needs, which will accelerate the plant-based yogurt market's growth rate. The rise in disposable income and increasing urbanisation will boost the Plant-Based yogurt market's growth rate

Opportunity

Increasing plant-based yogurt sales, primarily through online platforms, as online retailers offer a wide variety of plant-based yogurt, will accelerate the plant-based yogurt market's growth rate.

Restraints

However, rising concerns about the high sugar and fat content of the product will slow the market's growth rate. Furthermore, the negative impact of COVID-19 on production and supply chain will impede the overall growth of the plant-based yogurt market. Moreover, the availability of substitutes and the entry of new companies will pose additional challenges to the plant-based yogurt market throughout the forecast period.

This plant-based yogurt market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Plant-Based yogurt market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Plant-Based Yogurt Market

Plant-based yogurt sales initially fell due to COVID-19 restrictions on brick-and-mortar stores. However, major players are attempting to solidify their market position by focusing on e-commerce and online marketing in order to reach consumers across geographical boundaries. Furthermore, the pandemic prompted consumers to seek out immunity-boosting products as well as other fortified products that provide health benefits, resulting in major players improving the composition of their yogurt products by incorporating organic ingredients, making them cholesterol-free, and launching vegan variants with no added preservatives or additives.

Recent Development

- In 2021, Yasso introduced a new line of Greek yogurt bites called "Yasso Poppables" in coffee, sea salt caramel, vanilla bean, and mint flavours. These Plant-Based Greek yogurt bites are dipped in dark chocolate and topped with quinoa crunch. These poppables are now available in participating retail locations, including supermarkets.

- Yogurtland will roll out its first oat milk-based vegan Plant-Based yogurt flavour, "Plant-Based Cinnamon Oatmeal Cookie," across participating locations in 2021. This addition came just in time following the launch of its Plant-Based Salted Chocolate Soufflé flavoured Plant-Based yogurt in January 2020, followed by the relaunch of its coconut milk-based flavour due to consumer demand.

Global Plant-Based Yogurt Market Scope

The plant-based yogurt market is segmented on the basis of nature, product type, flavour, price range, sales channel and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Conventional

- Organics

Product type

- Cereal Type

- Oat

- Legume

- Nut

- Seed

- Pseudo Cereal

Flavour

- Regular

- Vanilla

- Strawberry

- Blueberry

- Cherry

- Peach

- Raspberry

- Coconut

- Coffee

- Others

Product Type

- Economic

- Mid-Range

- Premium

Distribution channel

- Food Service

- Retail

- Modern Trade

- Convenience Stores

- Specialty Stores

- Discounters

- Independent Small Groceries

- E-commerce

- Others

Application

- Household

- HoReCa

Plant-Based Yogurt Market Regional Analysis/Insights

The plant-based yogurt market is analysed and market size insights and trends are provided by country, nature, product type, flavour, price range, sales channel and application as referenced above.

The countries covered in the Plant-based yogurt market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the plant-based yogurt market and will continue to do so during the forecast period due to consumer preferences in this region shifting from dairy-based plant-based yogurt to non-dairy-based plant-based yogurt products. Furthermore, product development, a high disposable income level, and various plant-based yogurt flavours will accelerate the market's growth rate in this region. Due to rising consumer demand for plant-based yogurt and rising incidences of digestive disorders such as lactose intolerance in this region, Asia-Pacific is expected to grow at a significant rate during the forecast period of 2022-2029.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Plant-Based Yogurt Market Share Analysis

The plant-based yogurt market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to plant-based yogurt market.

Some of the major players operating in the plant-based yogurt market are:

- Chr. Hansen Holding A/S (Denmark)

- Yakult Honsha Co., Ltd (Japan)

- Nestlé (Switzerland)

- DuPont (US)

- MORINAGA & CO., LTD (Japan)

- BioGaia AB (Sweden)

- Protexin (UK)

- Daflorn Probiotics UK (UK)

- DANONE (France)

- Yakult U.S.A. Inc. (US)

- Deerland Enzymes, Inc. (US)

- UAS Laboratories (US)

- Goerlich Pharma GmbH (Germany)

- SANZYME BIOLOGICS PVT. LTD. (India)

- DSM (Netherlands)

- NutraScience Labs (US)

- Kerry Group plc (Ireland)

- Lallemand Inc. (Canada)

- Lonza (Switzerland)

- Winclove Probiotics (Netherlands)

- Probi (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PLANT-BASED YOGURT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PLANT-BASED YOGURT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PLANT-BASED YOGURT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TELEVISION ADVERTISEMENT

5.4.4.2. ONLINE ADVERTISEMENT

5.4.4.3. IN-STORE ADVERTISEMENT

5.4.4.4. OUTDOOR ADVERTISEMENT

5.5 PRIVATE LABEL VS BRAND ANALYSIS

5.6 PROMOTIONAL ACTIVITIES

5.7 NEW PRODUCT LAUNCH STRATEGY

5.7.1 NUMBER OF NEW PRODUCT LAUNCH

5.7.1.1. LINE EXTENSTION

5.7.1.2. NEW PACKAGING

5.7.1.3. RE-LAUNCHED

5.7.1.4. NEW FORMULATION

5.7.2 DIFFERNTIAL PRODUCT OFFERING

5.7.3 MEETING CONSUMER REQUIREMENT

5.7.4 PACKAGE DESIGNING

5.7.5 PRICING ANALYSIS

5.7.6 PRODUCT POSITIONING

5.8 CONSUMER LEVEL TRENDS

5.9 MEETING CONSUMER REQUIREMENT

5.1 BRAND COMAPARATIVE ANALYSIS

5.11 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF YOGURTS

6 REGULATIONS, CERTIFICATION AND LABELLING CLAIMS

7 GLOBAL PLANT-BASED YOGURT MARKET, BY TYPE

7.1 OVERVIEW

7.2 REGULAR YOGURT

7.2.1 REGULAR YOGURT, BY PRODUCT TYPE

7.2.1.1. DRINKABLE YOGURT

7.2.1.2. SPOONABLE YOGURT

7.2.1.3. FROZEN YOGURT

7.2.1.4. OTHERS

7.2.2 REGULAR YOGURT, BY ORGANIC CATEGORY

7.2.2.1. CONEVETIONAL

7.2.2.2. ORGANIC

7.2.3 REGULAR YOGURT, BY SOURCE

7.2.3.1. ALMOND

7.2.3.2. OAT

7.2.3.3. CASHEW

7.2.3.4. SOY

7.2.3.5. COCONUT

7.2.3.6. SEAME

7.2.3.7. OTHERS

7.3 CONCENTRATED YOGURT

7.3.1 CONCENTRATED YOGURT, BY PRODUCT TYPE

7.3.1.1. DRINKABLE YOGURT

7.3.1.2. SPOONABLE YOGURT

7.3.1.3. FROZEN YOGURT

7.3.1.4. OTHERS

7.3.2 CONCENTRATED YOGURT, BY ORGANIC CATEGORY

7.3.2.1. CONEVETIONAL

7.3.2.2. ORGANIC

7.3.3 CONCENTRATED YOGURT, BY SOURCE

7.3.3.1. ALMOND

7.3.3.2. OAT

7.3.3.3. CASHEW

7.3.3.4. SOY

7.3.3.5. COCONUT

7.3.3.6. SEAME

7.3.3.7. OTHERS

7.4 PROBIOTIC YOGURT

7.4.1 PROBIOTIC YOGURT, BY PRODUCT TYPE

7.4.1.1. DRINKABLE YOGURT

7.4.1.2. SPOONABLE YOGURT

7.4.1.3. FROZEN YOGURT

7.4.1.4. OTHERS

7.4.2 PROBIOTIC YOGURT, BY ORGANIC CATEGORY

7.4.2.1. CONEVETIONAL

7.4.2.2. ORGANIC

7.4.3 PROBIOTIC YOGURT, BY SOURCE

7.4.3.1. ALMOND

7.4.3.2. OAT

7.4.3.3. CASHEW

7.4.3.4. SOY

7.4.3.5. COCONUT

7.4.3.6. SEAME

7.4.3.7. OTHERS

7.5 SET YOGURT

7.5.1 SET YOGURT, BY PRODUCT TYPE

7.5.1.1. DRINKABLE YOGURT

7.5.1.2. SPOONABLE YOGURT

7.5.1.3. FROZEN YOGURT

7.5.1.4. OTHERS

7.5.2 SET YOGURT, BY ORGANIC CATEGORY

7.5.2.1. CONEVETIONAL

7.5.2.2. ORGANIC

7.5.3 SET YOGURT, BY SOURCE

7.5.3.1. ALMOND

7.5.3.2. OAT

7.5.3.3. CASHEW

7.5.3.4. SOY

7.5.3.5. COCONUT

7.5.3.6. SEAME

7.5.3.7. OTHERS

7.6 BIO LIVE YOGURT

7.6.1 BIO LIVE YOGURT, BY PRODUCT TYPE

7.6.1.1. DRINKABLE YOGURT

7.6.1.2. SPOONABLE YOGURT

7.6.1.3. FROZEN YOGURT

7.6.1.4. OTHERS

7.6.2 BIO LIVE YOGURT, BY ORGANIC CATEGORY

7.6.2.1. CONEVETIONAL

7.6.2.2. ORGANIC

7.6.3 BIO LIVE YOGURT, BY SOURCE

7.6.3.1. ALMOND

7.6.3.2. OAT

7.6.3.3. CASHEW

7.6.3.4. SOY

7.6.3.5. COCONUT

7.6.3.6. SEAME

7.6.3.7. OTHERS

7.7 STIRRED YOGURT

7.7.1 STIRRED YOGURT, BY PRODUCT TYPE

7.7.1.1. DRINKABLE YOGURT

7.7.1.2. SPOONABLE YOGURT

7.7.1.3. FROZEN YOGURT

7.7.1.4. OTHERS

7.7.2 STIRRED YOGURT, BY ORGANIC CATEGORY

7.7.2.1. CONEVETIONAL

7.7.2.2. ORGANIC

7.7.3 STIRRED YOGURT, BY SOURCE

7.7.3.1. ALMOND

7.7.3.2. OAT

7.7.3.3. CASHEW

7.7.3.4. SOY

7.7.3.5. COCONUT

7.7.3.6. SEAME

7.7.3.7. OTHERS

7.8 OTHERS

8 GLOBAL PLANT-BASED YOGURT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DRINKABLE YOGURT

8.3 SPOONABLE YOGURT

8.4 FROZEN YOGURT

8.5 OTHERS

9 GLOBAL PLANT-BASED YOGURT MARKET, BY SOURCE

9.1 OVERVIEW

9.2 ALMOND

9.3 OAT

9.4 CASHEW

9.5 SOY

9.6 COCONUT

9.7 SEAME

9.8 OTHERS

10 GLOBAL PLANT-BASED YOGURT MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 FULL FAT

10.3 LOW FAT

10.4 FAT FREE

11 GLOBAL PLANT-BASED YOGURT MARKET, BY FLAVOR

11.1 OVERVIEW

11.2 PLAIN

11.3 FLAVORED

11.3.1 CARAMEL

11.3.2 BUTTERSCOTCH

11.3.3 PEPPERMINT

11.3.4 VANILLA

11.3.5 MOCHA

11.3.6 STRAWBERRY

11.3.7 BLUBERRY

11.3.8 BLACKBERRY

11.3.9 BANANA

11.3.10 CHERRY

11.3.11 NUTS

11.3.12 CHOCOLATES

11.3.13 PEACH

11.3.14 AMARETTO

11.3.15 POMOGRANETT

11.3.16 PUMPKIN

11.3.17 COTTON CANDY

11.3.18 ORCHARD CHERRY

11.3.19 COCONUT

11.3.20 HONEY

11.3.21 NUTS

11.3.22 OTHERS

12 GLOBAL PLANT-BASED YOGURT MARKET, BY FORMULATION

12.1 OVERVIEW

12.2 SWEETENED

12.3 UNSWEETENED

13 GLOBAL PLANT-BASED YOGURT MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 PLAIN

13.3 WITH INCLUSIONS & TOPPINGS

13.3.1 SPRINKLES

13.3.2 CHOCOLATES

13.3.2.1. CHUNKS

13.3.2.2. FLAKES

13.3.2.3. SYRUP

13.3.2.4. OTHERS

13.3.3 NONPAREILS

13.3.4 CONFETTI

13.3.5 BAKED PIECES

13.3.6 PEARLS

13.3.7 DRAGEES

13.3.8 PECAN PRALINES

13.3.9 CARAMEL CRUNCHIES

13.3.10 NUTS

13.3.10.1. ALMONDS

13.3.10.2. CASHEWS

13.3.10.3. PISTACHIO

13.3.10.4. HAZELNUTS

13.3.10.5. RAISINS

13.3.10.6. MADAMIA NUTS

13.3.10.7. CHESTNUTS

13.3.10.8. OTHERS

14 GLOBAL PLANT-BASED YOGURT MARKET, BY FORTIFICATION

14.1 OVERVIEW

14.2 REGULAR

14.3 FORTIFIED

15 GLOBAL PLANT-BASED YOGURT MARKET, BY ORGANIC CATEGORY

15.1 OVERVIEW

15.2 CONVENTIONAL

15.3 ORGANIC

16 GLOBAL PLANT-BASED YOGURT MARKET, BY BRAND

16.1 OVERVIEW

16.2 BRANDED

16.3 PRIVATE LABEL

17 GLOBAL PLANT-BASED YOGURT MARKET, BY PACKAGING

17.1 OVERVIEW

17.2 BAG-IN-BOX

17.3 POUCHES

17.4 JARS

17.4.1 GLASS

17.4.2 PLASTIC

17.5 CUPS

17.6 BOTTLES

17.6.1 GLASS

17.6.2 PLASTIC

17.7 TETRA PACKS

17.8 OTHERS

18 GLOBAL PLANT-BASED YOGURT MARKET, BY PACKAGING SIZE

18.1 OVERVIEW

18.2 LESS THAN 100 GRAMS

18.3 100-200 GRAMS

18.4 201-300 GRAMS

18.5 MORE THAN 300 GRAMS

19 GLOBAL PLANT-BASED YOGURT MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 STORE-BASED RETAILING

19.2.1 CONVENIENCE STORES

19.2.2 YOGURT SHOPS/PARLORS

19.2.3 SUPERMARKETS/HYPERMARKETS

19.2.4 SPECIALTY STORES

19.2.5 GROCERY STORES

19.2.6 WHOLESALERS

19.2.7 OTHERS

19.3 NON-STORE RETAILING

19.3.1 VENDING MACHINE

19.3.2 ONLINE RETAILERS

20 GLOBAL PLANT-BASED YOGURT MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 GLOBAL PLANT-BASED YOGURT MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

21.1 NORTH AMERICA

21.1.1 U.S.

21.1.2 CANADA

21.1.3 MEXICO

21.2 EUROPE

21.2.1 GERMANY

21.2.2 U.K.

21.2.3 ITALY

21.2.4 FRANCE

21.2.5 SPAIN

21.2.6 SWITZERLAND

21.2.7 NETHERLANDS

21.2.8 BELGIUM

21.2.9 RUSSIA

21.2.10 TURKEY

21.2.11 REST OF EUROPE

21.3 ASIA-PACIFIC

21.3.1 JAPAN

21.3.2 CHINA

21.3.3 SOUTH KOREA

21.3.4 INDIA

21.3.5 AUSTRALIA

21.3.6 SINGAPORE

21.3.7 THAILAND

21.3.8 INDONESIA

21.3.9 MALAYSIA

21.3.10 PHILIPPINES

21.3.11 REST OF ASIA-PACIFIC

21.4 SOUTH AMERICA

21.4.1 BRAZIL

21.4.2 ARGENTINA

21.4.3 REST OF SOUTH AMERICA

21.5 MIDDLE EAST AND AFRICA

21.5.1 SOUTH AFRICA

21.5.2 UAE

21.5.3 SAUDI ARABIA

21.5.4 KUWAIT

21.5.5 REST OF MIDDLE EAST AND AFRICA

22 GLOBAL PLANT-BASED YOGURT MARKET, SWOT & DBMR ANALYSIS

23 GLOBAL PLANT-BASED YOGURT MARKET, COMPANY PROFILE

23.1 OATLY

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHICAL PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

24 CHOBANI

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHICAL PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 DANONE

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHICAL PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 NESTLE

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHICAL PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 ARLA FOODS

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHICAL PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 NANCY'S

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHICAL PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 YOPLAIT

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHICAL PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 STONYFIELD FARM

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHICAL PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 SO DELICIOUS DAIRY FREE

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHICAL PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 LACTALIS AMERICAN GROUP

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHICAL PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 CALIFIA FARMS

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHICAL PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 ORAGER PROJECT

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHICAL PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 GOOD PLANTS

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHICAL PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 GOOD KARMA

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHICAL PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 KITE HILL

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHICAL PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 LAVVA

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHICAL PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 NANCY’S

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHICAL PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 SILK

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHICAL PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 SO DELICIOUS

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHICAL PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 COYO PTY LTD.

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHICAL PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Global Plant Based Yogurt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Based Yogurt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Based Yogurt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.