Global Plastic Tumblers Market

Market Size in USD Billion

CAGR :

%

USD

3.71 Billion

USD

4.71 Billion

2024

2032

USD

3.71 Billion

USD

4.71 Billion

2024

2032

| 2025 –2032 | |

| USD 3.71 Billion | |

| USD 4.71 Billion | |

|

|

|

|

What is the Global Plastic Tumblers Market Size and Growth Rate?

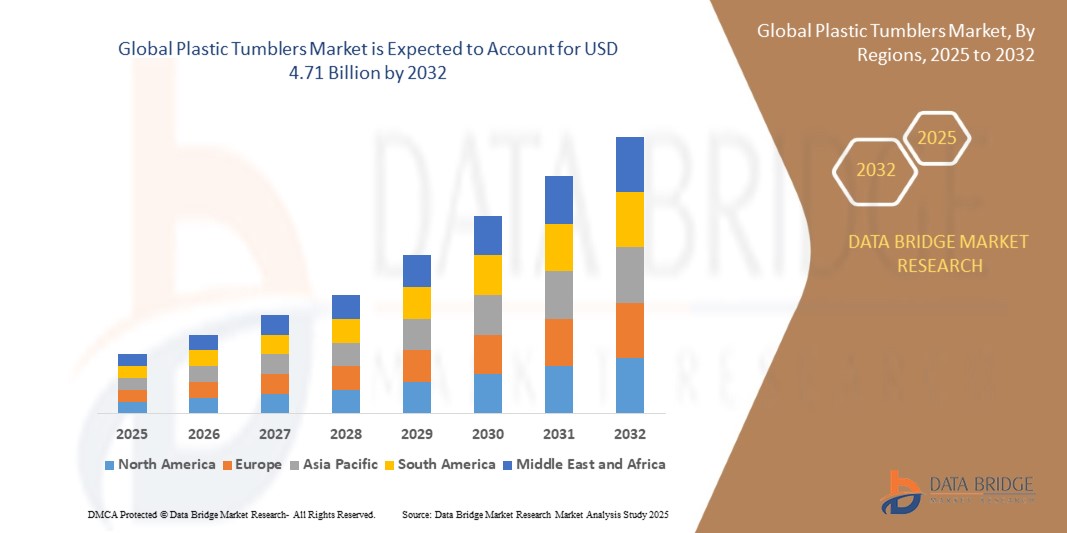

- The global plastic tumblers market size was valued at USD 3.71billion in 2024 and is expected to reach USD 4.71 billion by 2032, at a CAGR of 3.02% during the forecast period

- The plastic tumblers market is experiencing significant growth driven by the increasing demand for versatile and durable drinkware solutions across various sectors. As consumer preferences shift towards affordable and lightweight alternatives to glass and ceramic, plastic tumblers are becoming a popular choice in both residential and commercial setting

- The convenience of plastic tumblers, including their resistance to breakage and ease of cleaning, appeals to a wide range of consumers, from households to hospitality businesses. Additionally, the growing trend towards outdoor activities and picnics has further bolstered the demand for these practical drinkware options. The market is also witnessing innovation in design and functionality, with advancements in plastic materials enhancing the aesthetic appeal and performance of tumblers

What are the Major Takeaways of Plastic Tumblers Market?

- The growing preference for cost-effective and durable drinkware solutions is a significant driver of the plastic tumblers market. Consumers increasingly seek budget-friendly alternatives to traditional glass and ceramic tumblers, which can be more expensive and prone to breakage

- Plastic tumblers offer a practical solution with their lower cost, durability, and convenience, making them an attractive option for both households and businesses. This demand is further fueled by the need for drinkware that can withstand frequent use and handling without compromising on quality

- North America dominated the plastic tumblers market with the largest revenue share of 38.5% in 2024, driven by high consumption of reusable beverage containers and growing environmental awareness across the U.S. and Canada

- Asia-Pacific plastic tumblers market is set to grow at the fastest CAGR of 13.1% from 2025 to 2032, supported by rising health awareness, urban lifestyles, and increasing demand for affordable, reusable drinkware

- The Polypropylene (PP) segment dominated the plastic tumblers market with the largest market revenue share of 34.6% in 2024, attributed to its excellent durability, flexibility, and resistance to heat and chemical corrosion

Report Scope and Plastic Tumblers Market Segmentation

|

Attributes |

Plastic Tumblers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plastic Tumblers Market?

“Sustainability and Smart Design in Everyday Drinkware”

- A major trend reshaping the global plastic tumblers market is the rising consumer preference for eco-friendly materials and multifunctional design. As sustainability becomes a core value among modern consumers, manufacturers are shifting from traditional plastics toward recyclable, BPA-free, and plant-based polymers, while also enhancing usability features like insulation and smart lids

- For example, Tupperware introduced Eco+ tumblers made from sustainable, recycled materials, and Hydro Flask expanded its tumbler line with stainless steel interiors and sweat-proof exteriors, aiming at reducing single-use cup consumption

- Smart design trends include double-wall insulation, spill-resistant lids, stackable shapes, and ergonomic grips to enhance portability and convenience, especially for on-the-go consumers. Some brands are even exploring temperature-sensing lids and embedded NFC tags for branding or traceability

- With consumers increasingly conscious of health and environmental impact, tumblers made from non-toxic, microwave-safe, and dishwasher-friendly materials are gaining traction. Customization through vibrant colors, prints, and logo-friendly surfaces has also boosted their appeal in both personal and promotional product segments

- Key brands like Yeti, CamelBak, and Cool Gear are investing in design patents, brand collaborations, and retail visibility to meet the growing demand for versatile, sustainable tumblers in both home and commercial use

- This convergence of eco-conscious design and functional innovation is setting new expectations for daily-use drinkware, making sustainability a permanent cornerstone of consumer decision-making in the tumbler category

What are the Key Drivers of Plastic Tumblers Market?

- The growing demand for reusable, eco-friendly drinkware amid rising environmental awareness is a primary growth driver. Consumers are moving away from single-use cups and opting for plastic tumblers that offer durability, portability, and reduced environmental impact

- For example, in February 2024, CamelBak launched a new line of BPA-free plastic tumblers with recycled content and modular lids, targeting both outdoor and office-going users. This aligns with wider global movements toward sustainable lifestyle products

- The rise of health and fitness culture is also boosting demand, with consumers using plastic tumblers to track hydration, carry smoothies, or support active routines. Their lightweight, shatter-resistant build makes them ideal for travel, school, and gym use

- Furthermore, branding opportunities have made plastic tumblers popular as promotional products for corporates, events, and hospitality businesses. Custom printing and mass production capabilities help brands like Pelican and Bubba tap into the marketing value of reusable tumblers

- Growth in online retail platforms, especially during seasonal campaigns and flash sales, has expanded consumer access and accelerated product discovery, offering value-added bundles, multipacks, and limited-edition designs. This has further supported volume sales and category awareness

Which Factor is challenging the Growth of the Plastic Tumblers Market?

- A major challenge in the plastic tumblers market is the environmental concern over conventional plastics, particularly in regions with stringent recycling policies or growing anti-plastic sentiment. Consumers often conflate all plastic products as harmful, even when some tumblers use safe, recyclable materials

- High-profile advocacy against plastic pollution has led some retailers to limit or scrutinize plastic-based drinkware, impacting shelf space and public perception. Additionally, competition from stainless steel, glass, and silicone-based alternatives—which are seen as more premium or eco-responsible poses a substitution threat

- For example, Klean Kanteen and Hydro Flask have gained market share with their steel tumblers, often marketed as sustainable and stylish alternatives. This has pressured plastic tumbler manufacturers to clearly differentiate through innovation and certified eco-labeling

- Another challenge is price sensitivity in developing regions, where premium plastic tumblers are often seen as non-essential. As a result, local manufacturers with low-cost alternatives may dominate, limiting the entry of global eco-brands

- Lastly, product quality concerns, such as leaching from low-grade plastics or lids losing seal integrity, can undermine consumer trust and lead to negative word-of-mouth or reviews. Addressing this requires consistent quality control, material transparency, and education on safe use and care

- To overcome these challenges, companies must focus on green certification, consumer awareness campaigns, and hybrid product development to retain relevance and unlock growth in an increasingly eco-conscious drinkware market

How is the Plastic Tumblers Market Segmented?

The market is segmented on the basis of material type, capacity, and sales channel.

• By Material Type

On the basis of material type, the plastic tumblers market is segmented into Polypropylene (PP), Polyethylene (PE), Low Density Polyethylene (LDPE), High Density Polyethylene (HDPE), Polystyrene (PS), Polyethylene Terephthalate (PET), Polylactic Acid (PLA), Biodegradable Plastic, and Others. The Polypropylene (PP) segment dominated the plastic tumblers market with the largest market revenue share of 34.6% in 2024, attributed to its excellent durability, flexibility, and resistance to heat and chemical corrosion. Widely used in reusable tumblers, PP is lightweight and cost-effective, making it a preferred choice among manufacturers and consumers alike.

Meanwhile, the Polylactic Acid (PLA) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for sustainable and biodegradable alternatives. PLA-based tumblers are gaining traction amid global sustainability trends, particularly in regions with strict regulations on single-use plastics.

• By Capacity

On the basis of capacity, the plastic tumblers market is segmented into Less than 10oz, 10oz to 20oz, 20oz to 35oz, and 35oz and Above. The 10oz to 20oz segment held the largest market revenue share of 41.9% in 2024, owing to its suitability for both home and on-the-go use, striking a balance between portability and sufficient volume. These tumblers are widely used across office settings, gyms, and household applications, contributing to strong and consistent demand.

The 20oz to 35oz segment is projected to witness the highest growth rate during the forecast period, propelled by rising health awareness and increasing fluid consumption trends. This category is particularly popular among fitness enthusiasts and consumers seeking larger hydration solutions throughout the day.

• By Sales Channel

On the basis of sales channel, the plastic tumblers market is segmented into Convenience Store, Hypermarket, Supermarket, and E-commerce. The Supermarket segment led the market in 2024 with the highest revenue share of 38.2%, supported by the availability of a wide variety of brands, discounts, and consumer trust in physical inspection before purchase. Consumers often prefer supermarkets for everyday household goods, including plastic tumblers, due to the in-store product comparison and instant gratification.

However, the E-commerce segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rise in online shopping habits, home delivery convenience, and the availability of a broader range of designs and personalization options. Influencer marketing and seasonal promotions further accelerate sales through digital channels.

Which Region Holds the Largest Share of the Plastic Tumblers Market?

- North America dominated the plastic tumblers market with the largest revenue share of 38.5% in 2024, driven by high consumption of reusable beverage containers and growing environmental awareness across the U.S. and Canada

- The region benefits from strong consumer preferences for sustainable, BPA-free, and stylish plastic drinkware used in households, fitness centers, outdoor activities, and restaurants

- Growing health consciousness and the move away from single-use plastics further accelerate the adoption of plastic tumblers, especially those made from eco-friendly materials like Tritan and PLA

U.S. Plastic Tumblers Market Insight

The U.S. plastic tumblers market captured a dominant share within North America in 2024, supported by increasing consumer demand for portable and durable drinkware. The popularity of personalized tumblers, especially in offices, schools, and fitness facilities, has led to a surge in demand. In addition, e-commerce platforms and brand collaborations with influencers have propelled sales. The U.S. market also shows a strong inclination toward double-walled, insulated tumblers suitable for both hot and cold beverages.

Europe Plastic Tumblers Market Insight

The Europe plastic tumblers market is expected to register a robust CAGR over the forecast period, driven by growing sustainability regulations and consumer interest in eco-friendly alternatives to disposable cups. The shift toward reusables in cafes and public spaces is bolstered by regulatory bans on single-use plastics. Design innovation and demand for recyclable and biodegradable materials like PLA and PET are pushing manufacturers toward green solutions across major countries, including Germany, France, and the U.K.

U.K. Plastic Tumblers Market Insight

The U.K. plastic tumblers market is projected to grow steadily, backed by rising adoption of portable, aesthetic drinkware among students, professionals, and fitness enthusiasts. Trends in health, hydration, and sustainable living—along with a booming café culture—are fostering growth. The popularity of customized tumblers and promotional merchandise is also contributing to increasing demand in retail and corporate gifting sectors.

Germany Plastic Tumblers Market Insight

Germany’s plastic tumblers market is expanding due to the country's strong recycling culture and innovation-driven consumer base. Manufacturers are focusing on BPA-free, dishwasher-safe, and ergonomically designed tumblers that cater to diverse user preferences. Government initiatives promoting reusable packaging across sectors and increasing use of tumblers in schools and public venues support sustained market growth in Germany.

Which Region is the Fastest Growing Region in the Plastic Tumblers Market?

Asia-Pacific plastic tumblers market is set to grow at the fastest CAGR of 13.1% from 2025 to 2032, supported by rising health awareness, urban lifestyles, and increasing demand for affordable, reusable drinkware. Markets in China, India, and Southeast Asia are rapidly shifting toward plastic tumblers for both personal and institutional use, thanks to their cost-efficiency, lightweight design, and availability through both modern retail and online platforms.

Japan Plastic Tumblers Market Insight

Japan’s market is driven by minimalist designs, product compactness, and the high importance of cleanliness and reusability. Japanese consumers prefer tumblers with leak-proof, heat-resistant features for use at work, school, and travel. The cultural emphasis on environmental consciousness and urban convenience positions Japan as a promising market for innovation in plastic tumbler design and material technology.

China Plastic Tumblers Market Insight

China held the largest revenue share in Asia-Pacific in 2024, owing to its large population base, growing middle class, and rapid urbanization. With the surge of online retail platforms, stylish and functional tumblers are increasingly popular among millennials and Gen Z. Government policies advocating green consumption, along with domestic manufacturing dominance, make China a central hub in the global Plastic Tumblers supply chain.

Which are the Top Companies in Plastic Tumblers Market?

The plastic tumblers industry is primarily led by well-established companies, including:

- Tupperware Brands Corporation (U.S.)

- Pelican Products, Inc. (U.S.)

- CamelBak Products, LLC (U.S.)

- Hydro Flask (U.S.)

- Yeti Coolers, LLC (U.S.)

- Cool Gear International, LLC (U.S.)

- Klean Kanteen, Inc. (U.S.)

- O2COOL, LLC (U.S.)

- Bubba Brands, Inc. (U.S.)

What are the Recent Developments in Global Plastic Tumblers Market?

- In April 2025, Hydro Flask Philippines collaborated with the Philippine Football Federation to unveil a limited edition bottle celebrating the achievements of the women’s national football team, reinforcing the brand’s presence in community and sports engagement

- In September 2024, CamelBak, in collaboration with Revelyst and 5 Horizons Group, launched “CamelBak Pro,” a specialized line of hydration products engineered for job site workers, underscoring the brand’s commitment to performance and worker safety

- In March 2024, CamelBak expanded its cycling product lineup by introducing the Podium Steel and Podium Titanium bottles, both featuring vacuum insulation for superior temperature retention, enhancing its appeal among professional and recreational cyclists

- In February 2024, Faerch Group rolled out its new line of recyclable beverage tumblers designed for on-the-go usage, made with a minimum of 30% post-consumer recycled materials, demonstrating its commitment to sustainable packaging through fully recyclable, food-safe solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Tumblers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Tumblers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Tumblers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.