Global Pms And Menstrual Health Supplements Market

Market Size in USD Billion

CAGR :

%

USD

1.34 Billion

USD

2.11 Billion

2024

2032

USD

1.34 Billion

USD

2.11 Billion

2024

2032

| 2025 –2032 | |

| USD 1.34 Billion | |

| USD 2.11 Billion | |

|

|

|

|

PMS and Menstrual Health Supplements Market Size

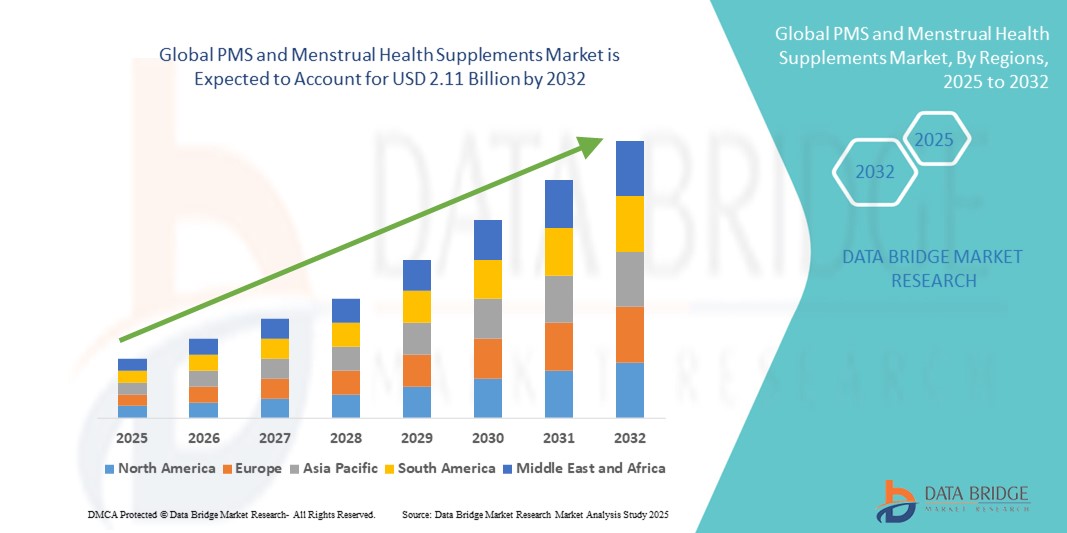

- The global PMS and menstrual health supplements market size was valued at USD 1.34 billion in 2024 and is expected to reach USD 2.11 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by increasing awareness of women's health, greater openness in addressing menstrual wellness, and the rising prevalence of PMS-related symptoms, leading to a surge in demand for natural and functional supplements

- In addition, shifting consumer preferences towards plant-based, hormone-free, and clean-label products is further fueling innovation and product development. These evolving trends are positioning PMS and menstrual health supplements as essential wellness solutions, significantly accelerating the market’s expansion

PMS and Menstrual Health Supplements Market Analysis

- PMS and menstrual health supplements, designed to alleviate symptoms such as mood swings, cramps, bloating, and fatigue, are becoming vital components of women’s wellness routines due to growing health consciousness and rising awareness around hormonal health and menstrual hygiene

- The increasing demand for these supplements is largely driven by lifestyle changes, higher stress levels, and a growing preference for natural and non-pharmaceutical remedies to manage menstrual discomfort

- North America dominated the PMS and menstrual health supplements market with the largest revenue share of 39.2% in 2024, supported by high consumer awareness, easy access to wellness products, and a strong presence of nutraceutical and women’s health brands actively promoting evidence-based formulations

- Asia-Pacific is projected to be the fastest growing region in the PMS and menstrual health supplements market during the forecast period due to improving female health education, increasing acceptance of menstrual care products, and expanding e-commerce channels

- The Vitamins & Minerals segment dominated the PMS and menstrual health supplements market with a share of 46.1% in 2024, favored for their multi-symptom relief, wide availability, and inclusion in daily health regimens

Report Scope and PMS and Menstrual Health Supplements Market Segmentation

|

Attributes |

PMS and Menstrual Health Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PMS and Menstrual Health Supplements Market Trends

Shift Toward Natural, Hormone-Free, and Functional Formulations

- A significant and growing trend in the global PMS and menstrual health supplements market is the increasing consumer preference for natural, hormone-free, and evidence-based formulations aimed at managing menstrual symptoms such as cramps, bloating, fatigue, and mood swings without synthetic medications

- For instance, popular brands such as FLO by O Positiv and HUM Nutrition offer supplements based on ingredients such as chasteberry, magnesium, and vitamin B6—clinically studied for their effectiveness in alleviating PMS symptoms. Similarly, Rae Wellness and De Lune emphasize botanical and adaptogenic formulations such as ashwagandha and turmeric, appealing to consumers seeking holistic and plant-based solutions

- This trend is driven by rising awareness of long-term hormonal balance, fertility wellness, and a desire for side-effect-free alternatives to conventional medications. Many products now combine vitamins, minerals, and herbal extracts to support both physical and emotional well-being during the menstrual cycle

- Moreover, there is increasing alignment of menstrual health supplements with broader wellness routines, including daily multivitamin regimens and gut-brain-skin axis support, allowing women to personalize their approach to symptom relief

- Companies are also innovating through convenient delivery formats such as gummies, drink powders, and vegan capsules, and incorporating eco-conscious packaging to appeal to younger, sustainability-minded consumers

- This evolution of menstrual health products into lifestyle-oriented wellness solutions is reshaping consumer expectations and encouraging regular supplementation, contributing to the market's upward momentum

PMS and Menstrual Health Supplements Market Dynamics

Driver

Increased Awareness of Menstrual Health and Demand for Non-Pharmaceutical Symptom Management

- The rising global awareness surrounding women’s reproductive health, along with increasing de-stigmatization of menstruation, is a key driver of market growth. Public health campaigns, social media advocacy, and wellness influencers are empowering consumers to seek targeted solutions for managing PMS symptoms

- For instance, the availability of science-backed, over-the-counter supplements designed to support hormone balance, reduce menstrual discomfort, and promote mood stability has significantly increased, making PMS care more accessible to a broader population

- Moreover, the preference for preventive, daily-use wellness supplements over pharmaceutical interventions has led to high product uptake, especially among Gen Z and millennial women

- The growing number of working women, increasing stress levels, and changing dietary habits have also contributed to greater hormonal imbalances, further driving demand for products that address cyclical discomfort holistically and conveniently

- E-commerce platforms, DTC (direct-to-consumer) models, and personalized subscription-based services have made these products more discoverable and affordable, enabling easier access and brand loyalty

Restraint/Challenge

Lack of Standardization and Limited Clinical Validation

- Despite rising popularity, the PMS and menstrual health supplements market faces challenges related to inconsistent product quality, limited clinical evidence for certain ingredients, and a lack of global regulatory standardization

- For instance, many herbal and botanical ingredients are marketed with anecdotal benefits but lack rigorous clinical validation or FDA approval, which can create skepticism among healthcare professionals and consumers

- Variability in ingredient sourcing, formulation transparency, and dosage guidelines across brands can impact efficacy and consumer trust. Inconsistent labeling or overpromising marketing claims may further hinder the credibility of the market

- In addition, regulatory frameworks for supplements differ significantly across regions, with some markets requiring more stringent quality control and safety evaluations than others, leading to challenges for global expansion

- Addressing these issues through improved research and development, third-party certifications, and consumer education will be critical to ensuring long-term trust, compliance, and sustainable market growth

PMS and Menstrual Health Supplements Market Scope

The market is segmented on the basis of product type, formulation, target audience, price range, and distribution channel.

- By Product Type

On the basis of product type, the PMS and menstrual health supplements market is segmented into vitamins & minerals, herbal extracts, and others. The vitamins & minerals segment dominated the market with the largest revenue share of 46.1% in 2024, driven by their clinically supported role in managing PMS symptoms such as mood swings, fatigue, and bloating. Supplements containing vitamin B6, magnesium, calcium, and vitamin D have shown efficacy in alleviating hormonal imbalances and menstrual discomfort. This product type benefits from high consumer trust, wide availability, and easy incorporation into daily wellness routines.

The herbal extracts segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer preference for natural and hormone-free alternatives. Ingredients such as chasteberry, ashwagandha, dong quai, and evening primrose oil are gaining popularity for their traditional use and perceived effectiveness. The clean-label trend and rising demand for plant-based remedies are expected to drive growth in this segment.

- By Formulation

On the basis of formulation, the PMS and menstrual health supplements market is segmented into capsules/tablets, powders, liquids, and others. The capsules/tablets segment held the largest market share in 2024, favored for their standardized dosing, ease of consumption, and widespread use in both retail and online channels. These formats remain a top choice among working women and health-conscious consumers due to their portability and shelf stability.

The powders segment is expected to witness notable growth during the forecast period, particularly among younger consumers seeking personalized wellness solutions. Powders allow for flexible dosing, faster absorption, and easy mixing with drinks or smoothies, aligning with evolving health routines and lifestyle choices.

- By Target Audience

On the basis of target audience, the PMS and menstrual health supplements market is segmented into women, teens, and menopausal women. The women segment dominated the market in 2024, accounting for the highest revenue share due to the high prevalence of PMS symptoms among women aged 20–40. This demographic actively seeks nutritional support to manage monthly cycles and improve overall hormonal health, making them the largest consumer base for menstrual supplements.

The teens segment is projected to grow at the fastest rate during the forecast period, driven by early intervention trends, increasing menstrual education, and the availability of age-appropriate, gentle supplements tailored for adolescent hormonal fluctuations.

- By Price Range

On the basis of price range, the PMS and menstrual health supplements market is segmented into mass market and premium. The mass market segment held the largest market revenue share in 2024, driven by affordability and wide distribution through supermarkets, pharmacies, and e-commerce. These products cater to price-sensitive consumers and offer basic yet effective formulations for common PMS symptoms.

The premium segment is expected to experience strong growth during the forecast period, supported by rising demand for high-quality, organic, vegan, and clinically formulated supplements. This segment often includes branded offerings with advanced ingredient combinations, attractive packaging, and targeted health benefits, appealing to health-conscious millennials and urban consumers.

- By Distribution Channel

On the basis of distribution channel, the PMS and menstrual health supplements market is segmented into online pharmacies, retail pharmacies, drug stores & specialty stores, and others. The online pharmacies segment dominated the market in 2024, reflecting the surge in e-commerce adoption and consumer preference for discreet, convenient access to health and wellness products. Subscription-based models, digital wellness platforms, and influencer marketing further support growth in this segment.

The drug stores & specialty stores segment is projected to expand significantly during the forecast period, driven by in-store consultations, growing shelf space for women’s health products, and brand visibility in physical retail environments. Specialty retailers focusing on organic and natural wellness are also contributing to category expansion.

PMS and Menstrual Health Supplements Market Regional Analysis

- North America dominated the PMS and menstrual health supplements market with the largest revenue share of 39.2% in 2024, supported by high consumer awareness, easy access to wellness products, and a strong presence of nutraceutical and women’s health brands actively promoting evidence-based formulations

- Consumers in the region place high value on natural, science-backed, and hormone-free supplements, often integrating them into broader wellness routines that prioritize preventative care and personalized health

- This strong market presence is further supported by a well-developed e-commerce infrastructure, rising acceptance of menstrual health conversations, and robust product offerings from both established nutraceutical brands and emerging direct-to-consumer companies, positioning the region as a leader in both innovation and adoption

U.S. PMS and Menstrual Health Supplements Market Insight

The U.S. PMS and menstrual health supplements market captured the largest revenue share of 79% in 2024 within North America, fueled by growing consumer awareness around hormonal balance and the widespread availability of wellness-focused products. The market benefits from a proactive health culture, strong presence of leading supplement brands, and high engagement in digital health platforms. The trend of personalization and clean-label formulations, combined with increased retail visibility and influencer marketing, continues to drive category growth across both mass and premium segments.

Europe PMS and Menstrual Health Supplements Market Insight

The Europe PMS and menstrual health supplements market is projected to expand at a steady CAGR throughout the forecast period, supported by increasing health consciousness, government-led menstrual health initiatives, and the demand for plant-based, hormone-free products. Rising consumer interest in preventative care and the growing female workforce are accelerating supplement adoption. The region is also seeing expanded product offerings through pharmacies and online wellness retailers, particularly across countries emphasizing gender-specific health solutions and sustainability.

U.K. PMS and Menstrual Health Supplements Market Insight

The U.K. PMS and menstrual health supplements market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a progressive approach toward women’s health and rising consumer focus on managing PMS naturally. Clean-label, vegan, and organic supplements are gaining traction, especially among millennials and Gen Z. With strong e-commerce infrastructure and expanding visibility of wellness brands in high street retail, the U.K. is becoming a key market for innovative menstrual health products targeting symptom relief and emotional balance.

Germany PMS and Menstrual Health Supplements Market Insight

The Germany PMS and menstrual health supplements market is expected to expand at a considerable CAGR during the forecast period, supported by a strong preference for clinically validated, natural health solutions. Consumers are increasingly turning to herbal formulations and micronutrient blends for PMS relief, with pharmacies and health stores offering a wide range of regulated supplements. The country’s focus on sustainable health practices and scientific research contributes to the growth of high-quality, certified PMS supplements in both urban and rural settings.

Asia-Pacific PMS and Menstrual Health Supplements Market Insight

The Asia-Pacific PMS and menstrual health supplements market is poised to grow at the fastest CAGR of 23.4% during the forecast period of 2025 to 2032, driven by increasing menstrual health education, shifting societal attitudes, and expanding middle-class populations in countries such as India, China, and Japan. The region’s improving access to healthcare, rising female workforce, and growing online wellness communities are contributing to rising demand. Local brands and multinational players are launching affordable, culturally tailored products to tap into this rapidly evolving market.

Japan PMS and Menstrual Health Supplements Market Insight

The Japan PMS and menstrual health supplements market is gaining traction due to the country’s strong focus on functional foods, personalized health, and preventive care. Japanese consumers value clinically supported, minimalistic formulations and are increasingly incorporating menstrual health supplements into their daily wellness routines. With an aging female population and high awareness of hormone-related issues, Japan is witnessing growth in demand for gentle, non-invasive solutions backed by scientific credibility and traditional herbal knowledge.

India PMS and Menstrual Health Supplements Market Insight

The India PMS and menstrual health supplements market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a young, urban population and increasing menstrual health awareness. The growing middle class, wider social acceptance of women’s wellness products, and rapid digital adoption are encouraging the use of supplements among teens and working women. Government health campaigns, along with the emergence of local D2C brands and Ayurveda-based offerings, are further fueling market momentum across urban and semi-urban regions.

PMS and Menstrual Health Supplements Market Share

The PMS and menstrual health supplements industry is primarily led by well-established companies, including:

- HUM Nutrition Inc. (U.S.)

- O Positiv Inc. (U.S.)

- De Lune Inc. (U.S.)

- Rae Wellness, Inc. (U.S.)

- Pink Stork, LLC (U.S.)

- FoodState Inc (U.S.)

- Holland & Barrett Retail Limited (U.K.)

- Himalaya Wellness Company (India)

- Swisse Wellness Pty Ltd (Australia)

- The Honest Company, Inc. (U.S.)

- Nature’s Way Products, LLC (U.S.)

- NutraBlast (NB Solutions) (U.S.)

- Now Foods (U.S.)

- Garden of Life LLC (U.S.)

- OLLY Public Benefit Corporation (U.S.)

- Vitabiotics Ltd. (U.K.)

- Goli Nutrition Inc. (U.S.)

- Eu Natural Inc. (U.S.)

- Nature’s Bounty (U.S.)

- Havasu Nutrition Inc. (U.S.)

What are the Recent Developments in Global PMS and Menstrual Health Supplements Market?

- In May 2023, HUM Nutrition, a leading U.S.-based women’s wellness brand, launched Moody Bird+, an upgraded version of its popular PMS supplement featuring clinically studied doses of chasteberry and saffron. The new formulation aims to offer enhanced emotional and physical symptom relief, targeting mood swings, irritability, and cramps. This launch reinforces HUM’s commitment to evidence-backed, hormone-free products tailored to modern menstrual health needs

- In April 2023, O Positiv, the maker of the popular FLO Gummies, expanded its PMS product line with FLO-Biotic, a supplement formulated with probiotics to support gut and hormonal health. This development reflects the brand’s strategy to offer multifunctional solutions that address the root causes of PMS symptoms, such as inflammation and hormonal imbalance, while tapping into the growing interest in the gut-hormone connection

- In March 2023, De Lune Health, a wellness brand known for its herbal PMS supplements, announced a retail expansion into major pharmacy chains across the U.S., including CVS and Target. This move significantly boosts consumer access to its flagship products, such as Steady Mood and Cramps Relief, highlighting the increasing mainstream acceptance and demand for clean-label menstrual health supplements

- In February 2023, Holland & Barrett, a major European wellness retailer, partnered with several emerging menstrual health brands to introduce a curated selection of PMS supplements in its U.K. and EU stores. This initiative promotes the visibility of innovative herbal and micronutrient-based formulations, aligning with the retailer’s focus on women’s health and wellness

- In January 2023, Swisse Wellness, a global supplement brand headquartered in Australia, launched a region-specific PMS relief supplement in Southeast Asia, formulated with dong quai, magnesium, and vitamin B6. The product is tailored to meet local health preferences and dietary habits, marking the brand’s effort to localize menstrual health solutions in fast-growing APAC markets and expand its women’s health portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.