Global Pocket Sized Ecg Devices Market

Market Size in USD Million

CAGR :

%

USD

693.00 Million

USD

2,018.54 Million

2024

2032

USD

693.00 Million

USD

2,018.54 Million

2024

2032

| 2025 –2032 | |

| USD 693.00 Million | |

| USD 2,018.54 Million | |

|

|

|

|

Pocket-Sized ECG Devices Market Size

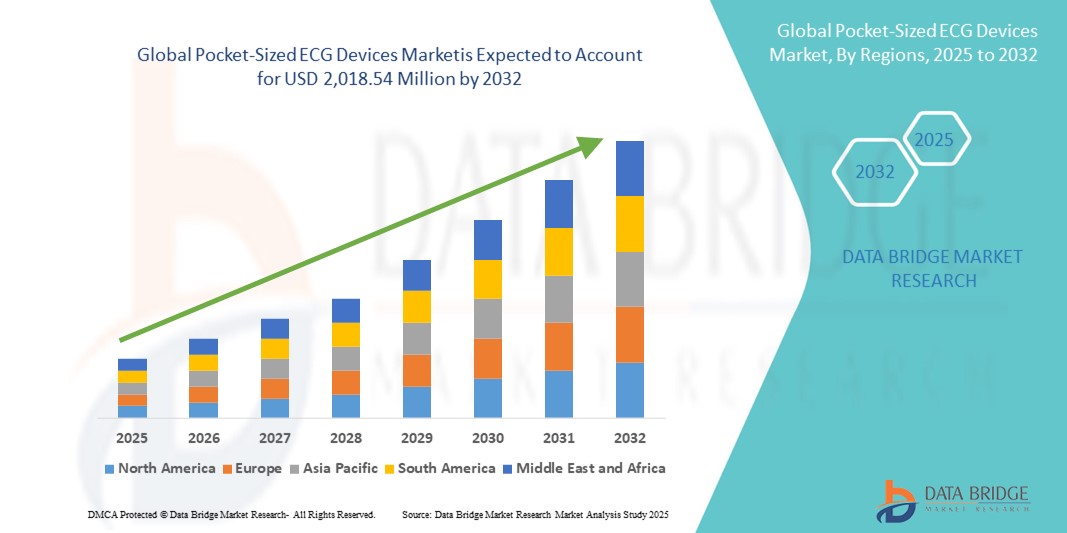

- The global pocket-sized ECG devices market size was valued at USD 693.0 million in 2024 and is expected to reach USD 2,018.54 million by 2032, at a CAGR of 14.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising awareness of heart health, and the demand for continuous cardiac monitoring. Advances in miniaturization, wireless connectivity, and wearable technology have enabled the development of portable, user-friendly, and accurate ECG devices suitable for home and point-of-care use

- Furthermore, the growing need for remote patient monitoring, early detection of arrhythmias, and real-time data transmission to healthcare providers is driving the adoption of Pocket-Sized ECG Devices. These factors are accelerating the uptake of compact, portable cardiac monitoring solutions, thereby significantly boosting the overall growth of the Pocket-Sized ECG Devices market

Pocket-Sized ECG Devices Market Analysis

- Pocket-Sized ECG Devices, offering portable and compact cardiac monitoring solutions, are increasingly vital for early detection of heart conditions, continuous patient monitoring, and remote healthcare applications in both clinical and homecare settings due to their convenience, real-time data capabilities, and ease of use

- The escalating demand for Pocket-Sized ECG Devices is primarily fueled by the rising prevalence of cardiovascular diseases, increasing awareness of heart health, and the need for accurate, real-time monitoring outside traditional hospital settings

- North America dominated the pocket-sized ECG devices market with the largest revenue share of 38.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of digital health solutions, and strong presence of key market players. The U.S. witnessed substantial growth in the adoption of pocket-sized ECG solutions, particularly in outpatient care, home monitoring, and wearable integration, driven by innovations from established medical device companies and startups focusing on AI-enabled analysis and cloud connectivity

- Asia-Pacific is expected to be the fastest-growing region in the pocket-sized ECG devices market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing awareness of cardiovascular health in countries such as China, India, and Japan

- The Smartphone-Integrated segment dominated the pocket-sized ECG devices market with a revenue share of 45% in 2024, owing to the widespread use of mobile applications, the convenience of instant data access, and the ability to share results directly with healthcare professionals

Report Scope and Pocket-Sized ECG Devices Market Segmentation

|

Attributes |

Pocket-Sized ECG Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pocket-Sized ECG Devices Market Trends

Enhanced Convenience Through Digital Health Features

- A significant and accelerating trend in the global Pocket-Sized ECG Devices market is the integration of advanced digital health features, including real-time data analytics, cloud-based reporting, and smartphone connectivity. These innovations are significantly enhancing user convenience and enabling continuous cardiac monitoring both at home and in clinical settings

- For instance, devices like KardiaMobile 6L and Omron HeartGuide allow users to record ECG readings and instantly share results with healthcare providers via mobile applications, supporting timely medical intervention and personalized health management

- Integration with mobile applications enables features such as automated trend tracking, medication reminders, and alert notifications for irregular heart rhythms. For example, KardiaMobile can detect atrial fibrillation and bradycardia and notify users or physicians of abnormal readings for prompt attention

- The seamless connection of Pocket-Sized ECG Devices with smartphones, tablets, and cloud platforms facilitates centralized management of heart health data, allowing patients and clinicians to access, review, and analyze historical ECG trends from a single interface

- This trend toward more connected, user-friendly, and insightful cardiac monitoring solutions is reshaping patient expectations for heart health management. Consequently, companies such as AliveCor and Omron are developing next-generation pocket-sized ECG devices with features like multi-lead recordings, remote physician access, and customizable reporting dashboards

- The demand for portable ECG devices with advanced digital health capabilities is growing rapidly across both clinical and homecare settings, as consumers and healthcare providers increasingly prioritize convenience, early detection, and continuous cardiac monitoring

Pocket-Sized ECG Devices Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Health Awareness and Remote Monitoring

- The increasing prevalence of cardiovascular diseases and the growing emphasis on preventive healthcare are significant drivers for the heightened demand for Pocket-Sized ECG Devices. Patients and healthcare providers are increasingly seeking convenient, portable solutions for continuous heart monitoring

- For instance, in April 2024, AliveCor launched the KardiaMobile 6L ECG device with enhanced multi-lead recording and real-time cloud integration, enabling seamless remote monitoring by clinicians. Such product innovations by key companies are expected to drive the Pocket-Sized ECG Devices market growth during the forecast period

- As consumers become more aware of the risks associated with irregular heart rhythms, atrial fibrillation, and other cardiac conditions, Pocket-Sized ECG Devices offer advanced features such as instant ECG recording, trend analysis, and activity logs, providing a compelling alternative to conventional clinic-based monitoring

- Furthermore, the rising adoption of telemedicine and mobile health applications is making Pocket-Sized ECG Devices integral to remote patient management, allowing seamless integration with smartphones and cloud platforms for centralized cardiac data monitoring

- The convenience of portable, user-friendly devices, coupled with the ability to share readings instantly with healthcare providers, are key factors propelling the adoption of Pocket-Sized ECG Devices in both homecare and clinical settings. The trend toward preventive care and the increasing availability of affordable, easy-to-use devices further contribute to market growth

Restraint/Challenge

Concerns Regarding Accuracy, Device Costs, and Data Privacy

- Concerns surrounding the accuracy of portable ECG readings, device reliability, and patient data privacy pose challenges to broader market adoption. Pocket-Sized ECG Devices rely on digital connectivity and cloud-based storage, which may raise apprehensions regarding data security and clinical reliability

- For instance, occasional discrepancies between portable ECG readings and traditional 12-lead ECG results have made some clinicians cautious in fully relying on these devices for diagnosis

- Addressing these challenges through rigorous clinical validation, secure cloud-based encryption, regular software updates, and adherence to medical device regulations is crucial for building consumer and provider trust. Additionally, the relatively high initial cost of advanced Pocket-Sized ECG Devices compared to conventional monitoring solutions can limit adoption among price-sensitive consumers and healthcare facilities in developing regions

- While prices are gradually decreasing, premium features such as multi-lead recording, cloud connectivity, and AI-assisted trend analysis often come with higher costs, which may hinder widespread adoption

- Overcoming these challenges through enhanced device accuracy, patient education, regulatory compliance, and the development of more affordable Pocket-Sized ECG Devices will be vital for sustained market growth and improved cardiovascular health outcomes

Pocket-Sized ECG Devices Market Scope

The market is segmented on the basis of type, communication protocol, measurement mechanism, and application.

- By Type

On the basis of type, the Pocket-Sized ECG Devices market is segmented into single-lead, three-lead, six-lead, twelve-lead, and others. The single-lead segment dominated the largest market revenue share of 38% in 2024, attributed to its affordability, portability, and suitability for basic heart monitoring in homecare and outpatient settings. Single-lead devices are widely adopted due to their ease of use and minimal setup requirements, particularly among patients managing chronic cardiac conditions.

The Twelve-Lead segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, driven by its advanced diagnostic capabilities, increasing adoption in clinical environments, and rising demand for remote cardiac monitoring in hospitals and specialty clinics. Twelve-lead devices provide comprehensive cardiac insights comparable to traditional clinical ECG machines, boosting their appeal in professional settings.

- By Communication Protocol

On the basis of communication protocol, the market is segmented into Bluetooth, Wi-Fi, USB, NFC, and Others. The Bluetooth segment held the largest revenue share of 41% in 2024, due to its seamless smartphone connectivity, low power consumption, and ease of integration with mobile health applications. Bluetooth-enabled devices are particularly favored for personal health monitoring, allowing real-time data transmission to healthcare providers.

The Wi-Fi segment is expected to witness the fastest CAGR of 20.5% during 2025–2032, supported by growing telemedicine adoption, cloud-based patient monitoring systems, and the increasing need for continuous remote cardiac monitoring. Wi-Fi-enabled devices facilitate larger data transfers and support integration with hospital information systems, enhancing patient management.

- By Measurement Mechanism

On the basis of measurement mechanism, the market is segmented into Manual Recording, Automatic Recording, and Smartphone-Integrated ECG Monitoring. The Smartphone-Integrated segment accounted for the largest revenue share of 45% in 2024, owing to the widespread use of mobile applications, the convenience of instant data access, and the ability to share results directly with healthcare professionals.

The Automatic Recording segment is projected to witness the fastest CAGR of 21% from 2025 to 2032, driven by the increasing preference for continuous, hands-free monitoring in clinical, homecare, and emergency response settings. Automatic devices reduce user error and enable proactive management of cardiac conditions, boosting adoption.

- By Application

On the basis of application, the market is segmented into Clinical, Homecare, Sports and Fitness, Emergency Response, and Others. The Homecare segment dominated the largest revenue share of 42% in 2024, fueled by the growing awareness of preventive cardiac care, rising prevalence of cardiovascular diseases, and the convenience of self-monitoring at home.

The Emergency Response segment is anticipated to witness the fastest CAGR of 23% during 2025–2032, driven by the need for rapid cardiac diagnostics in ambulances, emergency departments, and disaster response scenarios. The increasing integration of portable ECG devices into telehealth and emergency medical services further accelerates growth in this segment.

Pocket-Sized ECG Devices Market Regional Analysis

- North America led the pocket-sized ECG devices market in 2024, accounting for the largest revenue share of 38.5%. This dominance is primarily driven by the region’s high prevalence of cardiovascular diseases, increasing focus on early diagnosis, and a growing trend toward home-based and remote health monitoring solutions

- The market growth is further supported by widespread access to advanced healthcare infrastructure, substantial disposable incomes among consumers, a strong network of hospitals and clinics, and the presence of key regional and global device manufacturers

- All of which contribute to accelerated adoption and innovation in portable ECG technology

U.S. Pocket-Sized ECG Devices Market Insight

The U.S. pocket-sized ECG devices market captured the largest revenue share of 65% in 2024 within North America, fueled by the increasing demand for portable, user-friendly, and clinically accurate ECG monitoring devices. Growing awareness among patients and healthcare providers regarding early detection and continuous cardiac monitoring is propelling market growth. Additionally, innovations in device miniaturization, wireless connectivity, and smartphone integration are further expanding adoption across hospitals, homecare, and fitness applications.

Europe Pocket-Sized ECG Devices Market Insight

The Europe pocket-sized ECG devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of cardiovascular diseases, technological advancements in diagnostic tools, and government initiatives supporting digital health adoption. Countries in the region are witnessing increased deployment of portable ECG devices in clinics, emergency response units, and homecare settings, boosting market penetration.

U.K. Pocket-Sized ECG Devices Market Insight

The U.K. pocket-sized ECG devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of cardiovascular health, the adoption of remote patient monitoring, and a robust healthcare infrastructure. Rising investment in digital health technologies and telemedicine platforms is expected to support further market growth across both clinical and homecare applications.

Germany Pocket-Sized ECG Devices Market Insight

The Germany pocket-sized ECG devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong focus on preventive healthcare, advanced medical technology adoption, and a high standard of care in cardiac diagnostics. Integration of portable ECG devices in hospitals, specialty clinics, and home monitoring programs is promoting broader utilization of these devices.

Asia-Pacific Pocket-Sized ECG Devices Market Insight

The Asia-Pacific pocket-sized ECG devices market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by increasing cardiovascular disease prevalence, rising disposable incomes, and growing adoption of mobile health technologies in countries such as China, Japan, and India. Expansion of healthcare infrastructure, government initiatives promoting digital health, and affordability of pocket-sized ECG devices are expected to increase adoption across clinical, homecare, and fitness applications.

Japan Pocket-Sized ECG Devices Market Insight

The Japan pocket-sized ECG devices market is experiencing notable growth, driven by rising health awareness, rapid urbanization, and increasing demand for portable, user-friendly diagnostic tools. The country’s aging population, combined with a strong focus on preventive healthcare and home-based monitoring, is expected to significantly boost the adoption of compact ECG devices. Hospitals, clinics, and homecare providers are increasingly incorporating these solutions to enable timely cardiac monitoring, improve patient outcomes, and reduce the burden on healthcare facilities, thereby supporting sustained market expansion

China Pocket-Sized ECG Devices Market Insight

The China pocket-sized ECG devices market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by the country’s expanding middle class, rapid urbanization, and increasing adoption of digital health technologies. Rising prevalence of cardiovascular diseases, combined with government initiatives promoting healthcare digitization, is fueling the deployment of portable ECG devices in hospitals, homecare, and emergency response settings.

Pocket-Sized ECG Devices Market Share

The Pocket-Sized ECG Devices industry is primarily led by well-established companies, including:

- iRhythm Technologies (U.S.)

- AliveCor (U.S.)

- Medtronic (Ireland)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- BioTelemetry (U.S.)

- Omron Healthcare (Japan)

- CONTEC Medical Systems (China)

- CardioComm Solutions (Canada)

- Biosense Webster (U.S.)

Latest Developments in Global Pocket-Sized ECG Devices Market

- In February 2022, U.S.-based medical and AI firm AliveCor Inc. unveiled the KardiaMobile Card, the world's first credit-card-sized personal ECG device. This device offers medical-grade, single-lead ECG readings in 30 seconds and integrates with mobile phones via Bluetooth. It is capable of detecting six common arrhythmias and provides features like monthly cardiac health summaries and automatic ECG reporting

- In June 2023, AliveCor's KardiaMobile 6L became the first personal ECG device recommended for use in psychiatric services in England and Wales. This recommendation underscores the device's utility in monitoring cardiac health in diverse healthcare settings

- In June 2024, AliveCor received FDA clearance for its pocket-sized Kardia 12L device and its AI-powered KAI 12L algorithm. This device, which offers 12-lead ECG capabilities, was also assigned Category III Current Procedural Terminology (CPT) codes, effective January 1, 2025

- In November 2023, AliveCor's AI-backed ECG offerings were featured in a new film series on innovative technologies presented by the Consumer Technology Association, highlighting the integration of AI in personal ECG devices

- In June 2025, Australian company Lubdub Technologies announced the development of three portable diagnostic tools: a wearable ECG patch, a saliva biosensor measuring five key cardiac biomarkers, and a wearable ultrasound device for real-time heart imaging. These tools aim to provide advanced cardiac care at home, especially benefiting underserved remote communities. The project received a USD 100,000 Catalyst Partnership Grant from the Heart Foundation

- In March 2025, Royal Philips launched the Philips ECG AI Marketplace, a platform providing cardiac care teams with access to a broad portfolio of AI tools to enhance early cardiac diagnosis. Anumana's FDA-cleared ECG-AI LEF algorithm was the first offering on this platform, analyzing standard 12-lead resting ECGs to identify reduced ejection fraction, an early indicator of heart failure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.