Global Point Of Care Poc Clinical Chemistry And Immunodiagnostic Market

Market Size in USD Billion

CAGR :

%

USD

11.88 Billion

USD

16.47 Billion

2024

2032

USD

11.88 Billion

USD

16.47 Billion

2024

2032

| 2025 –2032 | |

| USD 11.88 Billion | |

| USD 16.47 Billion | |

|

|

|

|

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Analysis

The Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market is experiencing significant growth due to the increasing demand for rapid and efficient diagnostic solutions across various healthcare settings. This market encompasses diagnostic tests conducted near the patient, offering real-time results, which is crucial for timely decision-making and treatment. Advancements in technology, such as the development of portable and user-friendly devices, have made POC testing more accessible and efficient, particularly in remote and underserved areas. In addition, the growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and infectious diseases is driving the need for frequent monitoring and early diagnosis. Key advancements in the field include the introduction of molecular diagnostics and immunoassays that allow for faster and more accurate detection of diseases. The rise of telemedicine and home-based care, accelerated by the COVID-19 pandemic, has further fueled the demand for POC testing devices. Companies such as Abbott, Thermo Fisher Scientific, and Bio-Rad Laboratories are leading the development of innovative diagnostic platforms, expanding the market's scope. As healthcare systems move toward personalized and decentralized care, the POC clinical chemistry and immunodiagnostic market is poised for continued growth, providing more efficient and timely healthcare solutions.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Size

The global point of care (POC) clinical chemistry and immunodiagnostic market size was valued at USD 11.88 billion in 2024 and is projected to reach USD 16.47 billion by 2032, with a CAGR of 4.16% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Trends

“Growing Adoption of Molecular Diagnostics and Immunoassays for Quicker Disease Detection”

The point of care (POC) clinical chemistry and immunodiagnostic market is rapidly expanding, driven by technological advancements in diagnostic tools and the increasing demand for real-time, on-site testing. One prominent trend in this market is the growing adoption of molecular diagnostics and immunoassays for quicker disease detection. These tests are revolutionizing the healthcare landscape, providing fast, accurate results for conditions such as infectious diseases, diabetes, and cardiovascular issues. For instance, Abbott’s ID NOW platform, which provides rapid molecular testing for COVID-19, has gained significant traction due to its efficiency in delivering results in under 15 minutes. The convenience of these compact, portable devices has made them indispensable in hospitals, clinics, and even home care settings. In addition, the rise of telehealth and remote patient monitoring is accelerating the demand for POC testing, as it enables healthcare providers to make timely decisions without requiring patients to visit healthcare facilities. This trend is expected to drive continued growth in the POC clinical chemistry and immunodiagnostic market.

Report Scope and Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Segmentation

|

Attributes |

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott (U.S.), QIAGEN (Germany), Danaher (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Beckman Coulter, Inc. (U.S.), Horiba, Ltd. (Japan), QuidelOrtho Corporation (U.S.), DiaSorin S.p.A. (Italy), Accurex (India), ELITechGroup - A Bruker company (France), Alfa Wassermann, Inc. (U.S.), BIOMÉRIEUX (France), Bio-Rad Laboratories, Inc. (U.S.), Cardinal Health (U.S.), Siemens Healthineers AG (Germany), Mindray Medical India Pvt. Ltd. (India), Omega Diagnostics Ltd (U.K.), Hologic, Inc. (U.S.), Quest Diagnostics Incorporated (U.S.), and Agilent Technologies, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Definition

Point of Care (POC) Clinical Chemistry and Immunodiagnostics refers to diagnostic testing conducted at or near the site of patient care, allowing for immediate results without the need to send samples to a centralized laboratory. This category includes tests that analyze blood, urine, or other biological samples to detect a wide range of conditions such as infections, metabolic disorders, and cardiovascular diseases. Clinical chemistry tests typically measure specific chemical components, such as glucose or electrolytes, while immunodiagnostic tests detect antibodies, antigens, or other biomarkers related to immune responses.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Dynamics

Drivers

- Increase in the Incidence and Prevalence of Infectious Diseases

The increase in the incidence and prevalence of infectious diseases is significantly driving the Point of Care (POC) clinical chemistry and immunodiagnostic market. According to the World Health Organization (WHO), infectious diseases remain a major global health concern, with emerging diseases such as COVID-19, influenza, and tuberculosis continuing to spread, especially in developing regions. For instance, the COVID-19 pandemic highlighted the critical need for rapid testing, leading to a surge in demand for POC diagnostic solutions that can quickly detect viral infections. In addition, the rise of antibiotic-resistant bacteria has increased the importance of fast and accurate diagnostic testing to guide appropriate treatment. As a result, POC testing devices that provide immediate results are essential for timely diagnosis and treatment, particularly in high-risk areas. This growing burden of infectious diseases, coupled with the need for quick, on-site diagnostics, is fueling the expansion of the POC clinical chemistry and immunodiagnostic market.

- Rising Preference for Automated Clinical Chemistry Solutions

The rise in the preference for automated clinical chemistry solutions among medical professionals is a key driver of the Point of Care (POC) clinical chemistry and immunodiagnostic market. Automation in clinical diagnostics offers significant benefits, including faster test results, reduced human error, and increased efficiency in healthcare settings. A study published in the Journal of Clinical Chemistry found that automation in clinical chemistry labs led to faster processing times and improved diagnostic accuracy, which is crucial for delivering timely patient care. Furthermore, with the increasing demand for high-throughput testing and the growing pressure on healthcare systems to improve patient outcomes while reducing costs, automated POC systems are gaining traction. For instance, Roche's Cobas Liat PCR System allows healthcare providers to perform molecular diagnostics on-site with minimal human intervention, improving both speed and accuracy. The automation trend is particularly beneficial in emergency departments, outpatient clinics, and remote settings, where quick and reliable test results are critical. This shift towards automated systems is propelling the growth of the POC clinical chemistry and immunodiagnostic market.

Opportunities

- Rising Healthcare Initiatives from Governments

The rise in healthcare initiatives from governments around the world presents a significant opportunity for the Point of Care (POC) clinical chemistry and immunodiagnostic market. Governments are increasingly prioritizing healthcare accessibility, affordability, and quality, which has led to a surge in investments and policy support for diagnostic innovations. For instance, the U.S. government’s initiative to promote the use of point-of-care testing in remote and underserved areas has been bolstered by programs such as the FDA’s COVID-19 diagnostic test authorization, which helped fast-track the availability of POC diagnostic devices. Similarly, the European Union's commitment to improving healthcare infrastructure includes funding for the development and implementation of advanced diagnostic solutions. These governmental efforts are driving demand for affordable, rapid, and accurate diagnostic tools that can be used at the point of care. Such initiatives stimulate the adoption of POC technologies and encourage innovation and expansion in the clinical chemistry and immunodiagnostic sectors, creating a favorable environment for market growth.

- Rising Need for Advanced Technologies in Diagnostic Tests

The rising need for advanced technologies in diagnostic tests presents a significant market opportunity for the Point of Care (POC) clinical chemistry and immunodiagnostic market. As healthcare demands evolve, particularly in the wake of global health crises such as the COVID-19 pandemic, there is a growing focus on quick, accurate, and accessible diagnostic solutions. For instance, during the pandemic, the need for rapid testing solutions led to the accelerated adoption of POC devices, such as portable PCR machines and rapid antigen tests, which allowed for faster patient diagnosis and reduced strain on healthcare facilities. This shift towards advanced technologies is driven by the need for efficiency and by the increasing prevalence of chronic diseases, infectious conditions, and the growing emphasis on personalized medicine. Governments and healthcare providers are now prioritizing the integration of innovative diagnostic tools in hospitals, clinics, and even at-home settings, thus boosting the demand for sophisticated POC systems that can provide real-time results. These advancements offer a considerable opportunity for market players to introduce cutting-edge solutions, fueling market growth.

Restraints/Challenges

- High Cost of Point of Care (POC) Devices and their Associated Reagents

The high cost of Point of Care (POC) devices and their associated reagents presents a major barrier to their widespread adoption, particularly in low- and middle-income countries (LMICs). POC devices, such as those used for clinical chemistry and immunodiagnostics, often require specialized equipment and consumables that are expensive to produce and maintain. For instance, a portable glucose monitoring device or a rapid diagnostic test for infectious diseases can cost several hundred to thousands of dollars upfront, with ongoing costs for reagents and calibration. In LMICs, where healthcare budgets are limited, these expenses can be prohibitive, restricting access to timely diagnosis and treatment. Hospitals and healthcare facilities in underfunded regions may be unable to afford or justify the investment in such technologies, leading to reliance on traditional, slower diagnostic methods or inadequate healthcare services. This cost barrier limits the market potential for POC devices in these regions and impedes the growth of the global POC clinical chemistry and immunodiagnostic market. Reducing the cost of devices and reagents is essential to make these technologies more accessible and effective in improving global healthcare outcomes.

- Training and skill Requirements

Training and skill requirements present a significant challenge in the Point of Care (POC) diagnostics market. Effective use of POC devices, including those for clinical chemistry and immunodiagnostics, requires healthcare providers to be well-trained in operating the devices and in interpreting the results accurately and understanding their limitations. For instance, a clinician using a portable cardiac biomarker test must be familiar with factors such as sample handling, device calibration, and the context in which results are valid. Without proper training, there is a risk of errors in testing, misinterpretation of results, or inconsistent use of devices, which can lead to incorrect diagnoses or delayed treatments. In rural or resource-limited settings, where staff turnover is high and ongoing education may be lacking, the effectiveness of POC diagnostics can be compromised. This training gap limits the reliability and efficiency of POC devices, hindering their adoption and reducing their impact in improving patient outcomes. To overcome this challenge, manufacturers must invest in comprehensive training programs and user-friendly interfaces to ensure that healthcare professionals are equipped with the knowledge and skills needed to use these devices effectively.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Scope

The market is segmented on the basis of test type, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- Clinical Chemistry

- Immunodiagnostics

Application

- Infectious Diseases

- Oncology

- Endocrinology

- Autoimmune Disorders

- Basic Metabolite Panel

- Liver Function Test

- Electrolyte Panel

- Kidney Function Test

- Lipid Profile

- Specialty Chemical Test

- Thyroid Profile

- Others

End User

- Hospitals

- Clinical Laboratories

- Diagnostic Centers

- Academic and Research Institutes

- Others

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, test type, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

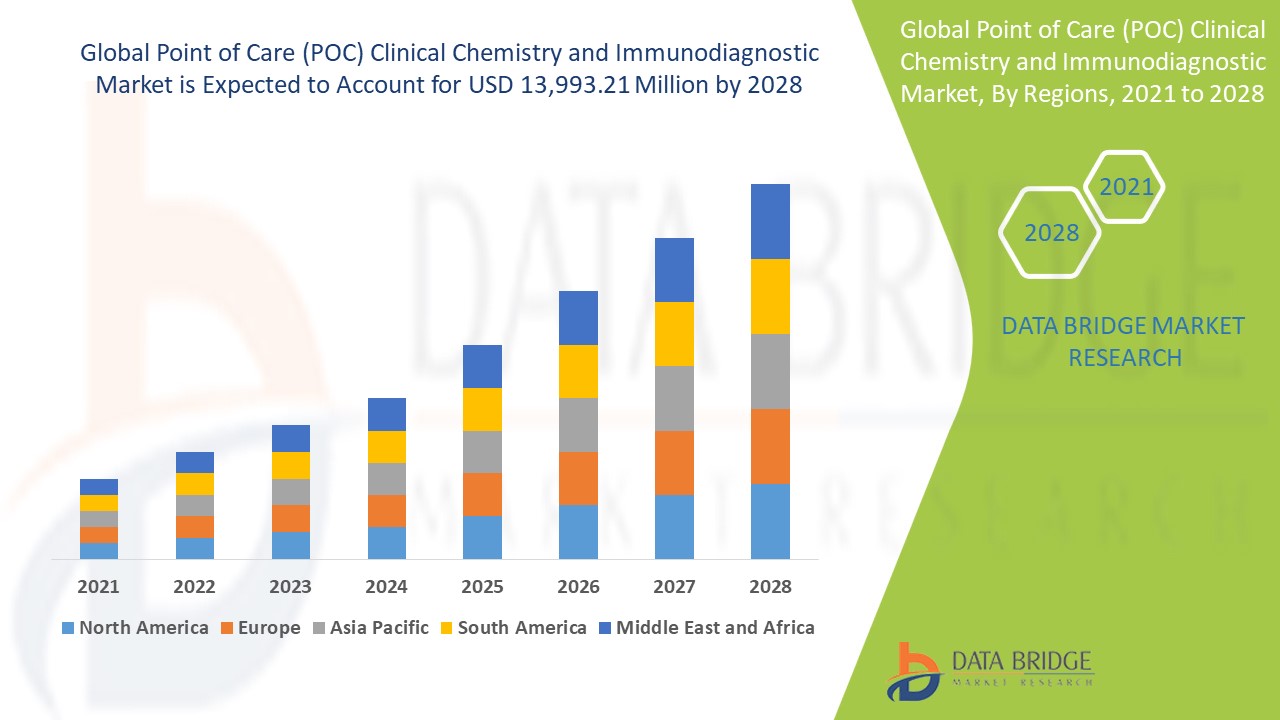

North America holds a dominant position in the point-of-care (POC) clinical chemistry and immunodiagnostic market due to the increasing demand for advanced diagnostic technologies. The region's well-established healthcare infrastructure and high adoption rate of innovative medical devices are driving market growth. In addition, the rising prevalence of chronic diseases and infections within the population further fuels the need for rapid and accurate diagnostic solutions. These factors, combined with a supportive regulatory environment, contribute to North America's leading role in this market.

Asia-Pacific is anticipated to experience substantial growth in the point-of-care (POC) clinical chemistry and immunodiagnostic market during the forecast period of 2025 to 2032. The increasing demand for cost-effective immunoassay methods and advanced diagnostic platforms in the region is a key driver of this growth. With rising healthcare awareness and improved access to medical technologies, there is a growing adoption of rapid diagnostic tools. In addition, the expansion of healthcare infrastructure and government initiatives to improve healthcare accessibility further support the market's growth in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- QIAGEN (Germany)

- Danaher (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Horiba, Ltd. (Japan)

- QuidelOrtho Corporation (U.S.)

- DiaSorin S.p.A. (Italy)

- Accurex (India)

- ELITechGroup - A Bruker company (France)

- Alfa Wassermann, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cardinal Health (U.S.)

- Siemens Healthineers AG (Germany)

- Mindray Medical India Pvt. Ltd. (India)

- Omega Diagnostics Ltd (U.K.)

- Hologic, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Agilent Technologies, Inc. (U.S.)

Latest Developments in Point of Care (POC) Clinical Chemistry and Immunodiagnostic Market

- In June 2024, BIOMÉRIEUX received FDA approval for its BIOFIRE SPOTFIRE Respiratory/Sore Throat, a point-of-care (POC) platform

- In May 2024, Cipla entered into an agreement to invest in Achira Labs Private Limited, a company responsible for the commercialization of point-of-care test kits in India

- In May 2023, bioMérieux obtained the US FDA CLIA-waiver for the BIOFIRE SPOTFIRE Respiratory (R) Panel Mini, a multiplex PCR-based test approved for use on the BIOFIRE SPOTFIRE System

- In August 2023, BD received US FDA approval for its BD Respiratory Viral Panel (RVP) for the BD MAX System, a molecular diagnostic test that identifies and distinguishes SARS-CoV-2, influenza A, influenza B, and Respiratory Syncytial Virus (RSV) in approximately 2 hours

- In March 2023, bioLytical Laboratories Inc. received Health Canada approval for its INSTI Multiplex HIV-1/2 Syphilis Antibody Test

- In December 2023, Thermo Fisher Scientific Inc. partnered with Project HOPE, a leading global health organization, to expand the accessibility of HIV diagnostic services for HIV-positive youth in Sub-Saharan Africa

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.