Global Point Of Care Ultrasound Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.26 Billion

2025

2033

USD

2.88 Billion

USD

4.26 Billion

2025

2033

| 2026 –2033 | |

| USD 2.88 Billion | |

| USD 4.26 Billion | |

|

|

|

|

Point-of-Care Ultrasound Market Size

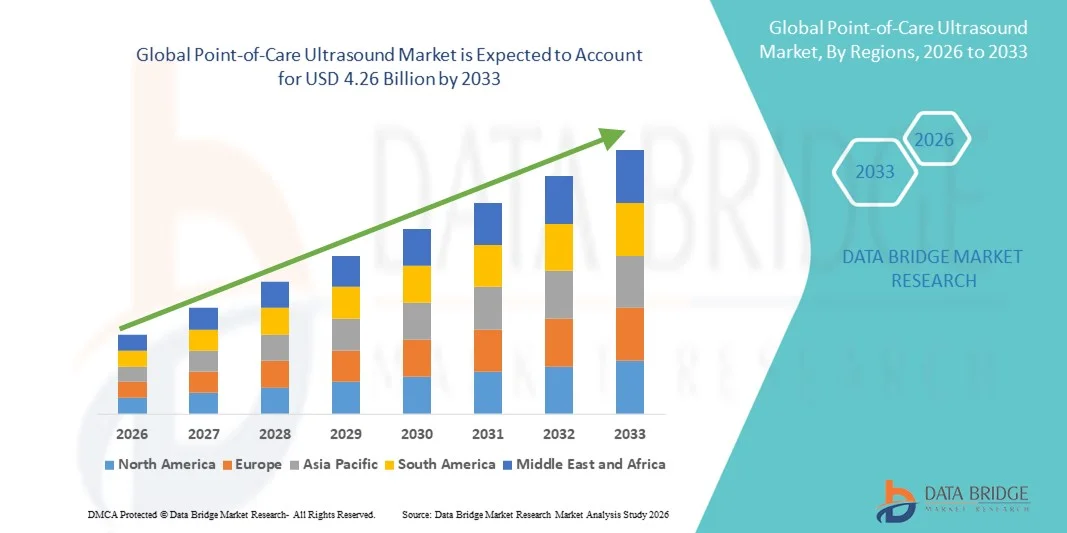

- The global point-of-care ultrasound market size was valued at USD 2.88 billion in 2025 and is expected to reach USD 4.26 billion by 2033, at a CAGR of 5.03% during the forecast period

- The market growth is primarily driven by the increasing demand for portable, real-time imaging solutions in emergency care, critical care, and bedside diagnostics, along with technological advancements in compact and handheld ultrasound devices

- In addition, the rising prevalence of chronic diseases, growing adoption of ultrasound by non-radiologist clinicians, and the need for rapid, cost-effective diagnostic tools in both developed and emerging economies are propelling the adoption of POCUS systems, thereby significantly accelerating the market expansion

Point-of-Care Ultrasound Market Analysis

- Point-of-care ultrasound systems, offering portable, real-time imaging at the bedside, are increasingly essential tools in emergency care, critical care, and outpatient diagnostics due to their ability to provide rapid, non-invasive, and accurate clinical assessments

- The rising adoption of point-of-care ultrasound is primarily driven by the growing need for early and accurate diagnosis, increasing prevalence of chronic and acute diseases, and the expansion of ultrasound use by non-radiologist clinicians in both hospital and outpatient settings.

- North America dominated the point-of-care ultrasound market with the largest revenue share of 38.7% in 2025, supported by high healthcare spending, early adoption of innovative medical technologies, and strong presence of leading ultrasound device manufacturers, with the U.S. witnessing significant deployment in emergency rooms, intensive care units, and primary care centers

- Asia-Pacific is expected to be the fastest-growing region in the point-of-care ultrasound market during the forecast period, owing to rising healthcare infrastructure investments, expanding awareness of ultrasound applications, and increasing demand for portable diagnostic solutions in rural and urban areas

- Handheld devices segment dominated the point-of-care ultrasound market with a market share of 46.5% in 2025, driven by their ease of use, affordability, and ability to deliver immediate imaging at the patient’s point of care

Report Scope and Point-of-Care Ultrasound Market Segmentation

|

Attributes |

Point-of-Care Ultrasound Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Point-of-Care Ultrasound Market Trends

Advancement Through AI and Cloud-Enabled Imaging

- A significant and accelerating trend in the global point-of-care ultrasound market is the integration of artificial intelligence (AI) and cloud-enabled imaging platforms, enabling faster and more accurate diagnostics at the bedside

- For instance, Butterfly iQ+ leverages AI-powered imaging to assist clinicians in identifying anatomical structures and improving diagnostic accuracy in real time, while also offering cloud-based data sharing for telemedicine applications

- AI integration allows features such as automated image interpretation, anomaly detection, and workflow optimization, reducing clinician dependency on extensive ultrasound training and enabling broader adoption across specialties

- The trend toward portable, wireless, and handheld POCUS devices is gaining momentum, offering flexibility in bedside imaging, ambulance care, and remote healthcare settings

- Enhanced image resolution and multi-modal imaging capabilities in new POCUS devices are improving diagnostic confidence across multiple clinical applications, including cardiac, lung, and abdominal assessments

- This trend toward smarter, connected, and more accessible imaging devices is reshaping expectations for bedside diagnostics, prompting companies such as Philips and GE Healthcare to develop AI-enhanced POCUS systems with cloud connectivity and automated measurement features

- The demand for point-of-care ultrasound devices with AI and cloud-enabled functionalities is growing rapidly in both hospital and outpatient settings, as clinicians increasingly prioritize efficiency, diagnostic accuracy, and seamless integration into healthcare workflows

Point-of-Care Ultrasound Market Dynamics

Driver

Rising Need for Rapid, Accurate Bedside Diagnostics

- The increasing prevalence of chronic and acute diseases, coupled with the need for immediate clinical decision-making, is a significant driver for the heightened adoption of point-of-care ultrasound

- For instance, in March 2025, GE Healthcare announced the expansion of its Vscan Air POCUS system, emphasizing rapid bedside diagnostics for emergency and critical care units

- Point-of-care ultrasound enables early diagnosis, procedural guidance, and continuous patient monitoring, reducing dependency on centralized imaging departments and improving clinical outcomes

- Furthermore, growing adoption by non-radiologist clinicians and integration with electronic medical records are making POCUS an essential tool in emergency rooms, ICU settings, and outpatient clinics

- The portability, real-time imaging, and immediate availability of results are key factors driving adoption across hospitals, clinics, and rural healthcare centers, complementing other point-of-care diagnostic technologies

- Increasing investments in healthcare infrastructure and telemedicine programs in emerging markets are expanding access to POCUS devices, creating new growth avenues

- Collaborations between POCUS manufacturers and academic institutions for clinician training and research are boosting adoption and fostering innovation in device applications

Restraint/Challenge

Training Requirements and Cost Constraints

- The limited ultrasound expertise among some healthcare professionals poses a challenge for the widespread adoption of point-of-care ultrasound, necessitating structured training programs and credentialing

- For instance, reports highlighting misinterpretation of ultrasound images by undertrained clinicians have prompted hospitals to implement certification requirements before independent POCUS use

- High initial acquisition costs for advanced handheld or AI-enabled POCUS devices can restrict access for small clinics and resource-limited hospitals, particularly in emerging markets

- Although costs are gradually decreasing, additional expenses for training, maintenance, and software updates can hinder adoption in budget-constrained healthcare setups

- Integration with hospital IT systems and ensuring cybersecurity of cloud-connected devices remain operational challenges that may slow adoption

- Limited reimbursement policies for point-of-care ultrasound procedures in some regions can impact hospital investment decisions and clinician uptake

- Overcoming these challenges through clinician education, simplified AI-assisted imaging, and the development of cost-effective POCUS solutions will be crucial for sustained market growth globally

Point-of-Care Ultrasound Market Scope

The market is segmented on the basis of type, portability, application, and end-use.

- By Type

On the basis of type, the point-of-care ultrasound market is segmented into diagnostic devices and therapeutic devices. The diagnostic devices segment dominated the market with the largest market revenue share of 62.4% in 2025, driven by their widespread use in rapid bedside imaging across emergency care, critical care, and outpatient diagnostics. Diagnostic POCUS devices are prioritized by hospitals and clinics for their ability to provide real-time imaging, assist in early disease detection, and guide minimally invasive procedures. The segment benefits from continuous technological advancements such as AI-assisted imaging, high-resolution probes, and cloud connectivity, which improve diagnostic accuracy and workflow efficiency. Moreover, the growing adoption of POCUS by non-radiologist clinicians across multiple specialties is further strengthening the demand for diagnostic devices.

The therapeutic devices segment is anticipated to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by the rising use of ultrasound for focused therapy applications such as lithotripsy, physiotherapy, and targeted drug delivery. Therapeutic POCUS devices are increasingly being integrated with portable and handheld models, enabling clinicians to administer therapy at the bedside or in outpatient settings. In addition, ongoing R&D efforts in enhancing device precision and patient safety are driving adoption in specialized hospitals and surgical centers. The convergence of diagnostic and therapeutic functionalities in newer devices is also contributing to this rapid growth.

- By Portability

On the basis of portability, the point-of-care ultrasound market is segmented into trolley-based devices and handheld devices. The handheld devices segment dominated the market with a market share of 46.5% in 2025, driven by the growing demand for portable, lightweight, and bedside imaging solutions in emergency rooms, ICUs, outpatient clinics, and remote healthcare settings. Handheld POCUS devices provide immediate imaging, ease of transport, and smartphone or tablet integration, enabling clinicians to make rapid diagnostic decisions without reliance on centralized imaging departments. The segment benefits from increasing adoption of AI-assisted imaging, cloud connectivity, and telemedicine applications, which enhance accuracy, workflow efficiency, and patient care. The affordability, convenience, and versatility of handheld devices make them particularly popular in both developed and emerging markets.

The trolley-based devices segment is expected to witness the fastest CAGR of 27.5% from 2026 to 2033, fueled by their high-performance imaging capabilities, larger displays, and multi-probe options suitable for hospitals, surgical centers, and high-volume clinical environments. Trolley-based POCUS systems support advanced imaging modes, integration with hospital IT systems, and repeated use across multiple departments, making them ideal for intensive care units, emergency departments, and specialized clinical applications. Continuous technological innovations and increasing demand for hybrid diagnostic-therapeutic functionalities are further contributing to the rapid growth of this segment.

- By Application

On the basis of application, the point-of-care ultrasound market is segmented into emergency medicine, cardiology, obstetrics & gynecology, urology, vascular surgery, and musculoskeletal. The emergency medicine segment dominated the market with a revenue share of 41.3% in 2025, driven by the critical need for fast bedside diagnosis in trauma cases, cardiac events, and acute abdominal conditions. Emergency care POCUS devices enable rapid decision-making, reduce patient transfer time to radiology departments, and improve outcomes through real-time imaging. The segment benefits from hospitals increasingly equipping ERs and ICUs with AI-enabled ultrasound systems to streamline patient care and support non-radiologist clinicians in high-pressure environments.

The cardiology segment is expected to witness the fastest growth rate of 22.8% from 2026 to 2033, due to increasing cardiovascular disease prevalence and the rising adoption of handheld and portable devices for echocardiography at the point of care. Cardiology-focused POCUS devices provide rapid evaluation of heart function, volume status, and structural abnormalities, particularly in outpatient clinics, emergency settings, and telemedicine initiatives. Technological advancements such as automated ejection fraction calculations, Doppler imaging, and cloud-based data sharing are further driving segment growth.

- By End-Use

On the basis of end-use, the point-of-care ultrasound market is segmented into hospitals, clinics, maternity centers, and ambulatory surgical centers. The hospitals segment dominated the market with the largest revenue share of 58.9% in 2025, supported by high patient throughput, the need for emergency diagnostics, and the availability of advanced imaging infrastructure. Hospitals leverage POCUS systems for critical care, surgical guidance, and routine bedside diagnostics across multiple departments. Adoption is further enhanced by collaborations with device manufacturers for training programs, integration with hospital IT systems, and investment in AI-powered devices to improve workflow efficiency.

The clinics segment is anticipated to witness the fastest CAGR of 24.3% from 2026 to 2033, driven by growing demand for affordable, portable, and easy-to-use POCUS devices in outpatient care, primary health centers, and rural facilities. Clinics increasingly adopt handheld and AI-assisted ultrasound systems to enhance diagnostic capabilities, reduce patient referral time, and improve service accessibility. Government initiatives promoting preventive healthcare, rising telemedicine adoption, and growing awareness of point-of-care imaging benefits further contribute to rapid growth in this segment.

Point-of-Care Ultrasound Market Regional Analysis

- North America dominated the point-of-care ultrasound market with the largest revenue share of 38.7% in 2025, supported by high healthcare spending, early adoption of innovative medical technologies, and strong presence of leading ultrasound device manufacturers

- Healthcare providers in the region prioritize POCUS devices for their portability, real-time imaging capabilities, and integration with electronic medical records, enabling faster clinical decision-making in hospitals, emergency rooms, and outpatient clinics

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced medical workforce, and increasing awareness among clinicians of the benefits of AI-assisted and handheld ultrasound devices, establishing POCUS as a preferred diagnostic solution across multiple specialties in North America

U.S. Point-of-Care Ultrasound Market Insight

The e U.S. point-of-care ultrasound market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid adoption of handheld and AI-assisted devices in hospitals, emergency rooms, and outpatient clinics. Clinicians are increasingly prioritizing bedside diagnostics for faster decision-making, procedural guidance, and improved patient outcomes. The growing integration of POCUS with electronic medical records and telemedicine platforms further supports market expansion. In addition, continuous technological advancements, such as cloud-enabled imaging and AI-based automated measurements, are enhancing diagnostic accuracy and workflow efficiency, driving adoption across multiple clinical specialties.

Europe Point-of-Care Ultrasound Market Insight

The Europe point-of-care ultrasound market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising awareness of rapid bedside diagnostics and the increasing demand for early disease detection in hospitals and clinics. The region’s well-developed healthcare infrastructure, coupled with government initiatives to improve emergency and primary care services, fosters the adoption of POCUS devices. European healthcare providers value the integration of portable, AI-assisted ultrasound systems for efficient patient management. The market is witnessing growth across emergency care, cardiology, obstetrics & gynecology, and outpatient diagnostics applications.

U.K. Point-of-Care Ultrasound Market Insight

The U.K. point-of-care ultrasound market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising adoption of portable imaging systems in emergency rooms, ICUs, and clinics. In addition, the focus on improving diagnostic speed and accuracy in both hospitals and outpatient care is encouraging clinicians to adopt POCUS devices. The U.K.’s well-established healthcare ecosystem, coupled with telemedicine expansion and increasing clinician awareness of AI-assisted ultrasound benefits, is expected to further stimulate market growth.

Germany Point-of-Care Ultrasound Market Insight

The Germany point-of-care ultrasound market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of real-time bedside diagnostics and the demand for technologically advanced imaging systems in hospitals and specialty clinics. Germany’s robust healthcare infrastructure, emphasis on precision medicine, and high adoption of AI-based medical technologies promote the uptake of POCUS devices. Integration with hospital IT systems and emphasis on accurate, non-invasive diagnostics are strengthening the market, particularly in cardiology, emergency care, and critical care applications.

Asia-Pacific Point-of-Care Ultrasound Market Insight

The Asia-Pacific point-of-care ultrasound market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising healthcare expenditure, and growing demand for portable diagnostic solutions in countries such as China, Japan, and India. Increasing awareness of POCUS applications in emergency care, primary health centers, and telemedicine programs is boosting adoption. Technological advancements, affordability of handheld ultrasound devices, and government initiatives to enhance rural healthcare infrastructure are expanding market access across the region.

Japan Point-of-Care Ultrasound Market Insight

The Japan point-of-care ultrasound market is gaining momentum due to the country’s technologically advanced healthcare ecosystem and high adoption of portable imaging solutions. Hospitals and outpatient clinics increasingly rely on handheld POCUS devices for rapid diagnostics, particularly in cardiology, emergency medicine, and critical care. The integration of AI-assisted imaging and cloud-based platforms enhances workflow efficiency and improves diagnostic accuracy. Moreover, Japan’s aging population is likely to drive demand for quick, accessible, and non-invasive diagnostic tools across both residential and hospital care settings.

India Point-of-Care Ultrasound Market Insight

The India point-of-care ultrasound market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing healthcare infrastructure, expanding middle class, and increasing adoption of portable and handheld diagnostic devices. Hospitals, clinics, and outpatient centers are adopting POCUS solutions to improve rapid bedside diagnostics and reduce patient referral times. The push toward digital healthcare, telemedicine expansion, and availability of cost-effective handheld devices are key factors propelling market growth. Domestic manufacturers and collaborations for clinician training are further supporting the market’s rapid development in India.

Point-of-Care Ultrasound Market Share

The Point-of-Care Ultrasound industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Butterfly Network, Inc (U.S.)

- FUJIFILM Sonosite, Inc (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Mindray Bio Medical Electronics Co., Ltd (China)

- Samsung Medison Co., Ltd (South Korea)

- Hitachi, Ltd (Japan)

- Esaote SpA (Italy)

- Hologic, Inc (U.S.)

- Analogic Corporation (U.S.)

- Clarius Mobile Health (Canada)

- BK Medical (Denmark)

- SonoScape (Shenzhen) Medical Corp. (China)

- Terason (U.S.)

- ZONARE Medical Systems (U.S.)

- Samsung Electronics Co., Ltd (South Korea)

- Mindray DS USA, Inc (U.S.)

- Fujifilm VisualSonics (Canada)

What are the Recent Developments in Global Point-of-Care Ultrasound Market?

- In July 2025, Fujifilm Sonosite unveiled the UHF46‑20 Transducer, the first 46 MHz ultra‑high frequency transducer for point‑of‑care ultrasound. When paired with the Sonosite LX system, this transducer enables exceptionally high‑resolution imaging of superficial structures improving visualization of small nerves and vessels and broadening diagnostic precision for applications such as NICU or rheumatology

- In June 2025, Royal Philips announced the global launch of its Flash Ultrasound System 5100 POC, a next‑generation portable point‑of‑care ultrasound designed for anesthesia, critical care, emergency medicine, and musculoskeletal imaging. The system combines high image clarity, smart automation, and intuitive controls to support rapid bedside decision‑making and real‑time exams without waiting for formal orders, advancing POCUS usability across clinical settings

- In August 2024, AISAP announced that its CARDIO AI‑powered point‑of‑care ultrasound diagnostic assessment software received 510(k) clearance from the U.S. Food and Drug Administration (FDA), marking a major milestone as one of the first AI‑driven POCUS diagnostic software platforms cleared for comprehensive cardiac assessment directly at the bedside

- In March 2024, FUJIFILM Sonosite launched Sonosite Voice Assist, a first‑of‑its‑kind voice command feature for POCUS systems (Sonosite PX and Sonosite LX). This hands‑free control feature streamlines workflows and enhances procedural efficiency by enabling clinicians to operate the ultrasound system via voice commands particularly useful in sterile or busy clinical environments

- In March 2021, GE HealthCare expanded its point‑of‑care ultrasound portfolio with the Venue Fit system, a compact and efficient addition to the Venue family. Designed with a small footprint, touchscreen interface, and intuitive scanning tools, Venue Fit supports rapid and confident bedside imaging in tight clinical environments, reinforcing the trend toward portable and adaptable POCUS solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.