Global Polyester Staple Fiber Market

Market Size in USD Billion

CAGR :

%

USD

33.93 Billion

USD

46.80 Billion

2024

2032

USD

33.93 Billion

USD

46.80 Billion

2024

2032

| 2025 –2032 | |

| USD 33.93 Billion | |

| USD 46.80 Billion | |

|

|

|

|

What is the Global Polyester Staple Fiber Market Size and Growth Rate?

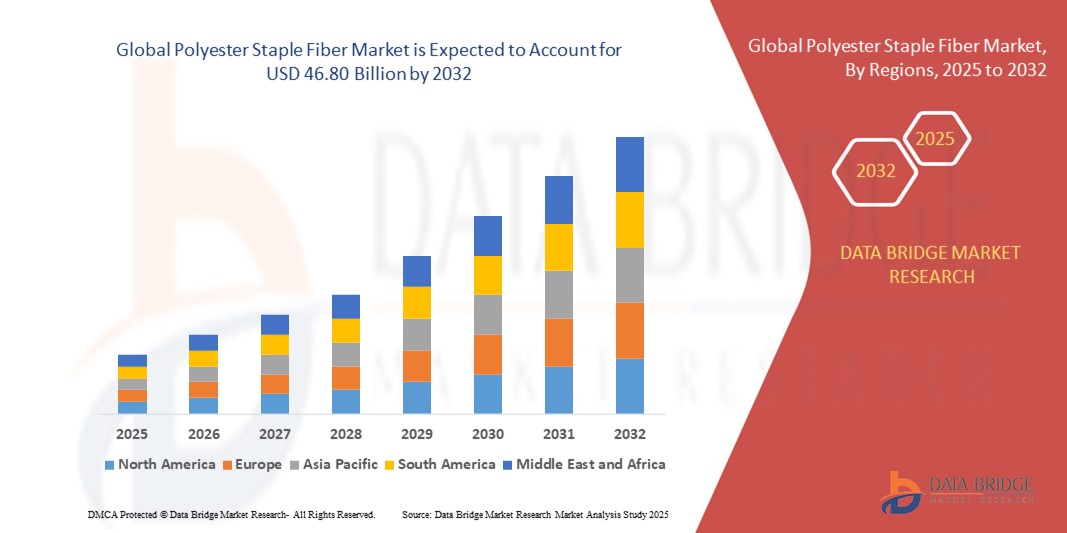

- The global polyester staple fiber market size was valued at USD 33.93 billion in 2024 and is expected to reach USD 46.80 billion by 2032, at a CAGR of 4.10% during the forecast period

- The polyester staple Fiber market is driven by the healthy growth of the textile and apparel industry universal, powered by cumulative demand for multipurpose, durable, and cost-effective Fiber s. As the global population expands and consumer spending on clothing rises, polyester staple fibers are expected to experience heightened demand

- In addition, the market faces stiff competition from natural Fibers, including cotton and wool, which are perceived as more sustainable alternatives, posing a challenge to polyester staple Fiber growth. However, the market is propelled by the expanding applications of polyester staple fibers in nonwoven fabrics, catering to diverse sectors such as healthcare, construction, and automotive. Despite this, opportunities arise from an increasing focus on sustainability and recycling, where manufacturers can capitalize on the rising demand for eco-friendly fibers and products alongside emerging markets and industrial applications that drive further expansion

What are the Major Takeaways of Polyester Staple Fiber Market?

- The global textile and vestment industry's solid enlargement is the principal driver of the polyester staple Fiber market. Because of their cost-effectiveness, durability, and compliance, polyester staple Fibers are widely utilised in the industrial of textiles, clothes, and fabrics. It is anticipated that demand for polyester staple Fibers would expand in tandem with the world's population growth and rising consumer expenditure on apparel. Polyester staple Fibers are in high demand in the textile and clothing industries due to the rapid fashion trend and the use of polyester as a sustainable substitute for natural Fibers

- Asia Pacific dominated the polyester staple fiber market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, increasing industrialization, and the growing demand for textiles, home furnishings, and automotive fabrics

- Middle East & Africa (MEA) region is expected to grow at the fastest CAGR of 13.32% during the forecast period of 2025 to 2032, driven by increasing textile manufacturing investments, rising demand for home furnishings, and growing industrial applications

- The PSF segment dominated the market with a revenue share of 62.5% in 2024, driven by its versatility, cost-effectiveness, and widespread use in textiles, home furnishings, and industrial applications

Report Scope and Polyester Staple Fiber Market Segmentation

|

Attributes |

Polyester Staple Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyester Staple Fiber Market?

Shift Towards Sustainable and High-Performance Fibers

- A major trend in the global polyester staple fiber market is the increasing focus on sustainable and recycled polyester fibers, driven by environmental concerns, regulations, and growing demand from eco-conscious consumers. This shift is reshaping production practices and product offerings

- For instance, companies such as Indorama Ventures and Reliance Industries are investing heavily in recycled PET-based PSF, offering fibers that maintain performance while reducing environmental impact. These sustainable fibers are gaining traction across textiles, automotive, and home furnishings

- Technological advancements in high-tenacity and specialty PSF, such as flame-retardant, moisture-wicking, and anti-microbial fibers, are providing new opportunities for premium applications in sportswear, medical textiles, and industrial fabrics

- The integration of PSF into blended fabrics and technical textiles is enabling manufacturers to enhance durability, comfort, and functionality, driving adoption in fashion, upholstery, and technical sectors

- This trend is accelerating the market shift towards high-performance, environmentally responsible fibers, compelling PSF producers to innovate and meet evolving consumer and industrial demands

- Demand for advanced, sustainable, and functional PSF is rising rapidly, particularly in Asia-Pacific and Europe, where textile manufacturing is heavily concentrated

What are the Key Drivers of Polyester Staple Fiber Market?

- Increasing consumer demand for durable, versatile, and affordable fabrics is a primary driver of PSF growth. Polyester’s inherent strength, wrinkle resistance, and cost-effectiveness make it a preferred choice across textiles, apparel, and industrial applications

- For instance, in 2024, Indorama Ventures expanded its production capacity for recycled PSF, targeting eco-conscious apparel manufacturers. Such initiatives are expected to propel the market during the forecast period

- Rising industrial applications, including automotive interiors, non-woven fabrics, and home textiles, are boosting PSF consumption due to its lightweight, thermal, and mechanical performance

- The adoption of recycled and specialty fibers in fashion, sportswear, and medical textiles is contributing to market expansion, driven by the global push for sustainability and high-performance materials

- Enhanced manufacturing capabilities, including textile blending and fiber finishing technologies, are enabling PSF to meet the specific performance requirements of modern applications, fueling adoption across multiple sectors

Which Factor is Challenging the Growth of the Polyester Staple Fiber Market?

- Growing environmental concerns over non-biodegradable synthetic fibers pose a challenge for PSF adoption, as manufacturers face pressure to reduce waste and improve recyclability

- For instance, certain regions have introduced regulations limiting the use of virgin polyester, prompting a shift towards recycled alternatives and adding compliance costs for manufacturers

- The volatility of raw material prices, particularly PTA and MEG, can impact production costs and profitability for PSF producers. Companies must balance cost management with sustainability initiatives

- Competition from natural fibers such as cotton, hemp, and bamboo, which are perceived as eco-friendly, continues to challenge PSF in specific markets such as premium apparel and home textiles

- Overcoming these challenges through recycling technologies, sustainable production practices, and consumer awareness campaigns is vital to sustaining long-term growth in the polyester staple fiber market

How is the Polyester Staple Fiber Market Segmented?

The market is segmented on the basis of product type, material, form, and application.

- By Type

On the basis of type, the polyester staple fiber market is segmented into Polyester Filament Yarn (PFY) and Polyester Staple Fiber (PSF). The PSF segment dominated the market with a revenue share of 62.5% in 2024, driven by its versatility, cost-effectiveness, and widespread use in textiles, home furnishings, and industrial applications. PSF is highly preferred in apparel, nonwoven fabrics, and automotive textiles due to its softness, resilience, and ease of blending with other fibers.

The PFY segment is expected to witness the fastest CAGR of 8.3% from 2025 to 2032, fueled by increasing demand in high-strength fabrics, technical textiles, and premium apparel segments where durability and tensile strength are critical. Technological advancements in spinning and drawing processes are further boosting PFY adoption, particularly in industrial and technical textile applications.

- By Material

On the basis of material, the polyester staple fiber market is segmented into Polyethylene terephthalate (PET) Polyester and PCDT Polyester. The PET Polyester segment held the largest market share of 75% in 2024, driven by its low cost, thermal stability, and extensive industrial and consumer applications. PET PSF is widely utilized in textiles, nonwovens, and home furnishings due to its excellent mechanical and chemical properties.

The PCDT Polyester segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, propelled by the growing demand for high-performance fibers in automotive, filtration, and specialty textile applications. Its superior thermal resistance, flame retardancy, and durability make it suitable for technical and industrial uses where conventional PET may not suffice.

- By Form

On the basis of form, the polyester staple fiber market is segmented into solid and hollow fibers. The solid fiber segment dominated the market with a revenue share of 68% in 2024, primarily due to its wide application across apparel, bedding, and industrial textiles. Solid PSF offers consistent strength, durability, and easy blending capabilities, making it a preferred choice for mass-market textile production.

The hollow fiber segment is projected to witness the fastest CAGR of 8.7% from 2025 to 2032, driven by its superior insulation, lightweight characteristics, and increasing use in technical applications such as thermal wear, upholstery, and filtration media. Hollow fibers’ ability to trap air and provide thermal comfort is boosting their demand in both consumer and industrial sectors.

- By Application

On the basis of application, the polyester staple fiber market is segmented into automotive, home furnishing, textile, filtration, construction, and others. The textile segment dominated the market with a revenue share of 55% in 2024, fueled by the large-scale adoption of PSF in apparel, nonwoven fabrics, and blended textiles. The demand for functional textiles, sustainable fabrics, and easy-care materials is further supporting PSF adoption.

The automotive segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032, driven by the increasing use of PSF in automotive interiors, seat fabrics, and insulation materials. Growing automotive production, lightweighting initiatives, and the shift toward recyclable materials are fueling the use of polyester fibers in this sector.

Which Region Holds the Largest Share of the Polyester Staple Fiber Market?

- Asia Pacific dominated the polyester staple fiber market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, increasing industrialization, and the growing demand for textiles, home furnishings, and automotive fabrics

- Consumers and manufacturers in the region highly value the versatility, cost-effectiveness, and performance of polyester staple fibers, making PSF a preferred choice for various applications including apparel, nonwovens, and industrial fabrics

- The widespread adoption is further supported by a robust manufacturing base, competitive production costs, and government initiatives promoting textile exports, establishing Asia Pacific as the global leader in polyester staple fiber consumption and production

China Polyester Staple Fiber Market Insight

The China polyester staple fiber market captured the largest revenue share of 35% in 2024 within Asia Pacific, fueled by the country’s expanding textile industry, growing middle-class population, and high rates of technological adoption. Increasing investments in smart manufacturing and sustainable fiber production are further enhancing PSF production capabilities and market penetration across both domestic and international markets.

Japan Polyester Staple Fiber Market Insight

The Japan polyester staple fiber market is witnessing steady growth due to high demand for functional textiles, advanced industrial fabrics, and sustainable fibers. Japan’s emphasis on high-quality textiles and technical fabrics, coupled with growing adoption in automotive and filtration sectors, is driving PSF consumption. The integration of innovative textile manufacturing techniques is also supporting market expansion.

Which Region is the Fastest Growing Region in the Polyester Staple Fiber Market?

Middle East & Africa (MEA) region is expected to grow at the fastest CAGR of 13.32% during the forecast period of 2025 to 2032, driven by increasing textile manufacturing investments, rising demand for home furnishings, and growing industrial applications. Countries such as Saudi Arabia, UAE, and South Africa are expanding textile and industrial fiber production, creating higher accessibility of PSF products in the region. The adoption of Polyester Staple Fibers is further fueled by government incentives, infrastructure development, and a focus on local production to meet regional textile and industrial needs.

Saudi Arabia Polyester Staple Fiber Market Insight

The Saudi Arabia polyester staple fiber market is expanding at a notable CAGR, driven by rising textile and home furnishing industries, growing industrial applications, and increasing local fiber production. Investments in modern spinning and nonwoven facilities are supporting higher adoption of PSF across both domestic and export-oriented markets.

UAE Polyester Staple Fiber Market Insight

The UAE polyester staple fiber market is anticipated to grow at a rapid pace, fueled by government initiatives promoting industrialization, growing demand for home textiles and construction fabrics, and investments in regional logistics and trade hubs. The adoption of PSF in industrial, filtration, and commercial textile applications is also increasing.

Which are the Top Companies in Polyester Staple Fiber Market?

The polyester staple fiber industry is primarily led by well-established companies, including:

- Georg Fischer AG (Switzerland)

- Fusion Group Limited (U.K.)

- Plasson Ltd. (Israel)

- Radius Systems Ltd. (U.K.)

- Ritmo S.p.A. (Italy)

- Agru Kunststofftechnik GmbH (Austria)

- PLASSON USA (U.S.)

- GPS PE Pipe Systems (U.K.)

- Friatec AG - Division Rheinhuette Pumpen (Germany)

- McElroy Manufacturing, Inc. (U.S.)

- Astore Keymak (South Africa)

- Georg Fischer Piping Systems Ltd. (Switzerland)

- Tessenderlo Group NV (Belgium)

- Rehau AG + Co (Germany)

- Advanced Piping Systems (Australia)

What are the Recent Developments in Global Polyester Staple Fiber Market?

- In May 2025, Indorama Ventures Public Company Limited, a global leader in sustainable chemicals, expanded its dejaTM fiber and filament yarn portfolio to strengthen sustainability. The portfolio now includes PET filament and fiber, which are extensively used in polyester staple fiber production, supporting circularity and reducing greenhouse gas emissions. This initiative reinforces Indorama’s position as a pioneer in sustainable fiber solutions

- In January 2025, Ambercycle, Inc. partnered with Hang Zhou Benma Chemfibre and Spinning Co., Ltd. to scale cycora staple fiber production by merging their expertise in technology scale-up. The collaboration seeks to address textile waste challenges, reduce reliance on virgin resources, and integrate circular materials into the Chinese textile value chain. This partnership marks a vital step toward building a sustainable fiber ecosystem

- In August 2024, UNIFI, a well-known innovator in synthetic and recycled yarn, introduced REPREVE, a comprehensive portfolio of performance polyester. The portfolio features black and white staple fiber and black filament yarn with inherent tracer technology to ensure authenticity and sustainability. This launch enhances UNIFI’s commitment to traceable and eco-friendly fiber production

- In April 2024, Toray Group collaborated with Hyundai Motor Group to advance mobility through material innovation. The partnership focuses on developing and applying sustainable, innovative materials within Hyundai’s vehicle lineup to support next-generation mobility. This collaboration highlights the growing convergence of automotive and sustainable material industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyester Staple Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyester Staple Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyester Staple Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.