Global Polyglycolic Acid In Oil And Gas Industry

Market Size in USD Million

CAGR :

%

USD

89.27 Million

USD

127.93 Million

2024

2032

USD

89.27 Million

USD

127.93 Million

2024

2032

| 2025 –2032 | |

| USD 89.27 Million | |

| USD 127.93 Million | |

|

|

|

|

Polyglycolic Acid Market in Oil and Gas industry Size

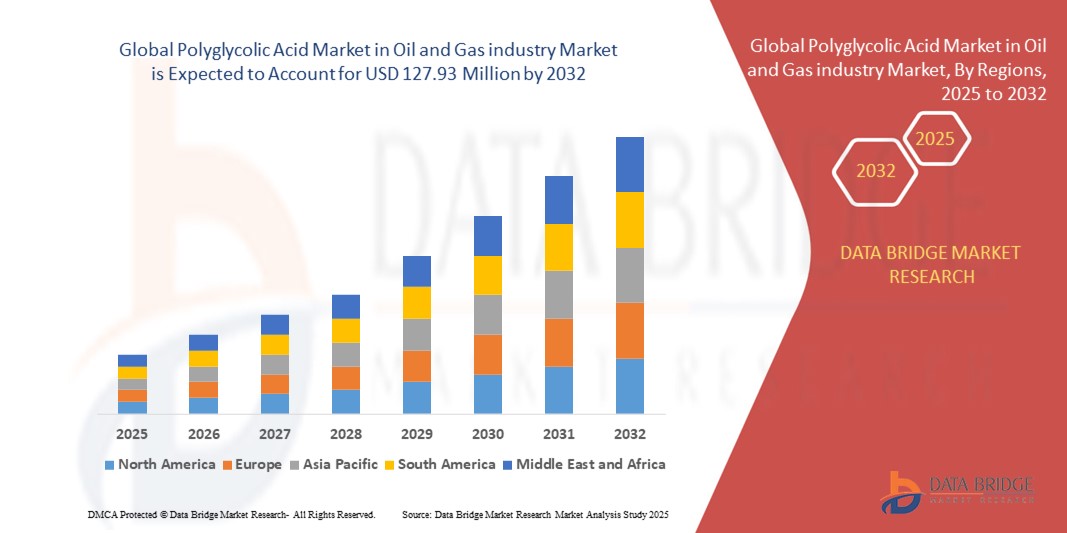

- The global polyglycolic acid market in oil and gas industry size was valued at USD 89.27 million in 2024 and is expected to reach USD 127.93 million by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is primarily driven by the increasing deployment of PGA-based materials in hydraulic fracturing and wellbore cleanup operations due to their high mechanical strength and excellent biodegradability under downhole conditions

- In addition, the rising demand for cost-effective, high-performance degradable materials that enhance drilling efficiency and reduce post-operation cleanup is establishing PGA as a preferred choice. These dynamics are fueling the adoption of polyglycolic acid solutions, substantially propelling market expansion within the oil and gas sector

Polyglycolic Acid Market in Oil and Gas industry Analysis

- Polyglycolic acid (PGA), a high-performance biodegradable polymer, is becoming a crucial material in oil and gas operations, particularly for downhole tools and hydraulic fracturing, due to its strength, controlled degradation, and environmental compatibility in challenging wellbore conditions

- The rising demand for sustainable and cost-effective solutions that eliminate the need for mechanical retrieval is accelerating the adoption of PGA-based tools in drilling and stimulation processes across both conventional and unconventional fields

- North America dominated the polyglycolic acid market in the oil and gas sector with the largest revenue share of 39.2% in 2024, driven by widespread shale gas exploration, technological innovation in degradable tool design, and growing focus on reducing post-frac cleanup times

- Asia-Pacific is expected to be the fastest growing region in the polyglycolic acid market during the forecast period, supported by increasing drilling activities in China and India, rising energy demands, and growing awareness of biodegradable materials in well intervention practices

- Hydraulic fracturing segment dominated the polyglycolic acid market with a 41.8% share in 2024, driven by the growing use of degradable frac plugs and diverters that simplify operations and reduce costs in multi-stage fracturing environments

Report Scope and Polyglycolic Acid Market in Oil and Gas industry Segmentation

|

Attributes |

Polyglycolic Acid Market in Oil and Gas Industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyglycolic Acid Market in Oil and Gas Industry Trends

Increased Use of Biodegradable Tools for Operational Efficiency and Environmental Compliance

- A significant and accelerating trend in the global polyglycolic acid (PGA) market within the oil and gas industry is the increasing adoption of biodegradable downhole tools that offer both operational efficiency and compliance with environmental regulations

- For instance, leading service providers such as Halliburton and Baker Hughes are deploying PGA-based frac plugs and diverters that naturally degrade in the wellbore, eliminating the need for mechanical retrieval and reducing overall well completion time

- PGA’s controlled degradability under specific temperature and pressure conditions makes it ideal for temporary zonal isolation and other stimulation applications. As the industry prioritizes time savings and reduced post-frac intervention, these degradable tools are gaining rapid traction

- Moreover, the use of environmentally friendly materials is becoming more critical in meeting regulatory standards, especially in regions with strict environmental guidelines. This shift is encouraging oilfield operators to incorporate sustainable practices using degradable polymers such as PGA

- The integration of PGA into standard well construction and completion workflows is fundamentally changing operational approaches. Manufacturers such as Kureha Corporation and Evonik are scaling up R&D to enhance the thermal resistance and mechanical strength of PGA for broader well compatibility

- This ongoing trend toward operational simplicity, cost savings, and regulatory alignment is reshaping the PGA landscape, making it a key material in the future of sustainable oilfield development

Polyglycolic Acid Market in Oil and Gas Industry Dynamics

Driver

Operational Time and Cost Savings with Degradable Downhole Tools

- The growing demand for reducing rig time, post-frac interventions, and overall operational costs is a primary driver fueling the adoption of polyglycolic acid in oil and gas operations

- For instance, PGA-based frac plugs degrade after use, removing the need for milling, which typically involves coiled tubing and additional labor. This results in significant cost savings and faster well completion timelines

- PGA’s combination of high mechanical strength and predictable degradation provides operators with a reliable and efficient solution for temporary downhole applications such as flow diversion and plug-and-perf operations

- As operators seek to increase output while reducing capital expenditures, particularly in high-activity regions such as North America’s Permian Basin, PGA-based tools are becoming a preferred alternative to conventional metallic or composite tools

- The scalability and ease of integration into current drilling and completion systems further strengthen PGA’s role as a driver of modern oilfield efficiency, positioning it as a high-value solution for operators

Restraint/Challenge

High Material Cost and Limited Compatibility in Harsh Downhole Environments

- One of the primary challenges facing the widespread adoption of polyglycolic acid is its relatively high production cost compared to traditional downhole tool materials, limiting its appeal in cost-sensitive markets

- In addition, PGA may not perform optimally in certain harsh downhole conditions, such as ultra-high temperatures or highly corrosive environments, where premature degradation could compromise tool integrity and operational outcomes

- For instance, operators working in deepwater or high-temperature wells may be reluctant to adopt PGA tools without proven long-term data, citing risks associated with material performance variability

- The need for specialized handling and storage conditions, as well as the limited availability of PGA-compatible tools across some global regions, further constrains its market reach

- Addressing these limitations through continued R&D, development of thermally and chemically resistant PGA variants, and achieving economies of scale in production will be critical to overcoming these challenges and expanding PGA's presence in the oil and gas sector

Polyglycolic Acid Market in Oil and Gas Industry Scope

The market is segmented on the basis of form and application.

- By Form

On the basis of form, the polyglycolic acid (PGA) market in the oil and gas industry is segmented into powder/granular, fibrous materials, films, and others. The fibrous materials segment dominated the market with the largest revenue share of 39.6% in 2024, owing to its widespread use in manufacturing degradable downhole tools such as frac plugs, diverters, and ball sealers. Fibrous PGA offers high mechanical strength, controlled degradation rates, and compatibility with standard wellbore conditions, making it ideal for demanding oilfield applications. The ability of fibrous forms to be customized for specific pressure and temperature profiles also contributes to their dominance in the market.

The powder/granular segment is anticipated to witness the fastest growth rate of 20.4% from 2025 to 2032, driven by its increasing adoption in scale control and remediation applications. Powdered PGA enables efficient dispersion and targeted performance in fluid systems, making it suitable for temporary blockage, removal of water-soluble organics, and other fluid-based well treatments. Its ease of injection and dissolution in complex well conditions supports its growing demand in secondary and tertiary recovery operations.

- By Application

On the basis of application, the PGA market is segmented into scale control and remediation, horizontal well stimulation, gypsum removal, metal naphthenate dissolution, removal of water-soluble organics, hydraulic fracturing, downhole tools, pressure management, well control, oil extraction, and others. The hydraulic fracturing segment dominated the market with the largest market revenue share of 41.8% in 2024, driven by the rising deployment of degradable frac plugs and diverters that dissolve post-operation, eliminating the need for mechanical retrieval. PGA’s reliable degradation under specific downhole conditions significantly reduces operational time and cost, making it highly preferred for plug-and-perf fracturing methods in shale gas and tight oil formations.

The downhole tools segment is projected to witness the fastest CAGR of 19.6% from 2025 to 2032, fueled by expanding unconventional drilling operations and a growing preference for environmentally friendly materials. Degradable PGA-based components in tools such as ball sealers, bridge plugs, and packers are gaining popularity for their ability to simplify operations and comply with environmental standards. Their ability to maintain high structural integrity while ensuring complete disintegration post-use is critical in modern oilfield completion strategies.

Polyglycolic Acid Market in Oil and Gas Industry Regional Analysis

- North America dominated the polyglycolic acid market in the oil and gas sector with the largest revenue share of 39.2% in 2024, driven by widespread shale gas exploration, technological innovation in degradable tool design, and growing focus on reducing post-frac cleanup times

- Operators in the region prioritize materials such as PGA that can enhance well productivity while minimizing post-operation intervention. The use of degradable frac plugs and diverters is becoming standard practice in major plays such as the Permian Basin and Eagle Ford

- This regional dominance is further supported by advanced drilling infrastructure, the presence of key oilfield service providers, and growing demand for sustainable materials that reduce environmental impact and simplify well operations, positioning PGA as a preferred solution in North American unconventional resource development

U.S. Polyglycolic Acid Market in Oil and Gas Industry Insight

The U.S. polyglycolic acid market captured the largest revenue share of 81.2% in 2024 within North America, driven by high shale gas production and widespread adoption of degradable tools in hydraulic fracturing operations. Operators are increasingly integrating PGA-based frac plugs and diverters to reduce well completion time and eliminate post-frac retrieval operations. The strong presence of oilfield service providers and an emphasis on cost-efficiency and environmental sustainability continue to reinforce the use of PGA in unconventional drilling across major basins such as the Permian and Bakken.

Europe Polyglycolic Acid Market Insight in Oil & Gas Industry

The Europe PGA market in oil and gas is projected to expand at a substantial CAGR throughout the forecast period, propelled by tightening environmental regulations and increasing demand for degradable materials in well stimulation processes. Countries in the region are investing in eco-conscious drilling technologies, and PGA is gaining attention for its ability to reduce operational waste. In addition, the push toward greener energy solutions in mature oilfields, especially in the North Sea, is fostering the gradual replacement of metallic downhole tools with biodegradable alternatives such as PGA.

U.K. Polyglycolic Acid Market Insight in Oil & Gas Industry

The U.K. PGA market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s stringent offshore drilling standards and growing focus on sustainable oilfield operations. With increased activity in offshore zones and aging wells, operators are turning to PGA-based solutions for their ability to simplify plug removal and reduce intervention time. Government-backed initiatives promoting environmental safety and efficient resource utilization further support the adoption of PGA in U.K. oilfield applications.

Germany Polyglycolic Acid Market Insight in Oil & Gas Industry

The Germany PGA market is expected to expand at a considerable CAGR during the forecast period, fueled by technological innovation and a strong emphasis on environmentally sustainable practices in industrial operations. The country’s well-established chemical manufacturing base is contributing to domestic PGA production, while oilfield service providers are increasingly exploring degradable tool options for onshore exploration and maintenance activities. Germany's focus on clean technology aligns with the use of PGA in low-impact drilling processes.

Asia-Pacific Polyglycolic Acid Market Insight in Oil & Gas Industry

The Asia-Pacific PGA market is poised to grow at the fastest CAGR of 24.1% during 2025 to 2032, driven by expanding drilling activities, especially in China and India, and government-led energy infrastructure development. The shift towards sustainable exploration techniques and increasing awareness of biodegradable materials in oilfield applications are propelling market growth. In addition, the emergence of regional manufacturing hubs is improving PGA affordability and availability across the region, supporting adoption in both national and private sector energy projects.

Japan Polyglycolic Acid Market Insight in Oil & Gas Industry

The Japan PGA market is gaining momentum owing to the country’s focus on energy efficiency, advanced material science capabilities, and environmentally responsible oilfield practices. Japan’s emphasis on minimizing the ecological footprint of its offshore and maintenance operations is encouraging the use of PGA-based degradable tools. Furthermore, collaborations between Japanese chemical manufacturers and global oilfield service companies are fostering innovation in high-performance PGA formulations tailored for local conditions.

India Polyglycolic Acid Market Insight in Oil & Gas Industry

The India PGA market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the nation’s growing energy demand, rapid oilfield development, and policy emphasis on domestic production efficiency. PGA tools are gaining popularity in India’s high-activity drilling zones due to their ability to streamline completion processes and reduce intervention costs. Local manufacturing support, government-backed smart exploration initiatives, and increased awareness of degradable technologies are collectively advancing PGA adoption in the Indian oil and gas industry.

Polyglycolic Acid Market in Oil and Gas Industry Share

The polyglycolic acid market in oil and gas industry industry is primarily led by well-established companies, including:

- Kureha Corporation (Japan)

- Evonik Industries AG (Germany)

- Corbion N.V. (Netherlands)

- DuPont de Nemours, Inc. (U.S.)

- BMG Incorporated (Japan)

- Shenzhen Polymtek Biomaterial Co., Ltd. (China)

- Samyang Holdings Corporation (South Korea)

- Huizhou Foryou Medical Devices Co., Ltd. (China)

- Teleflex Incorporated (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Toray Industries, Inc. (Japan)

- Ashland Inc. (U.S.)

- BASF SE (Germany)

- EMS-Grivory (Switzerland)

- SABIC (Saudi Arabia)

- Jiangsu Junhua High Performance Specialty Engineering Plastics Co., Ltd. (China)

- NatureWorks LLC (U.S.)

- Perstorp Holding AB (Sweden)

- DSM Engineering Materials (Netherlands)

- Arkema S.A. (France)

What are the Recent Developments in Global Polyglycolic Acid Market in Oil and Gas Industry?

- In April 2023, Evonik Industries AG, a leading specialty chemicals company, announced the expansion of its PGA production capabilities to meet the rising global demand from the oil and gas sector. The company introduced a new high-performance PGA grade designed specifically for harsh downhole environments, supporting hydraulic fracturing and wellbore isolation applications. This development reinforces Evonik’s strategy to provide innovative, sustainable materials tailored for demanding oilfield operations while enabling operators to reduce their environmental footprint

- In March 2023, Kureha Corporation, a key producer of polyglycolic acid, revealed its strategic partnership with a major oilfield service provider to co-develop degradable downhole tools using advanced PGA formulations. The collaboration focuses on creating frac plugs and ball sealers that offer controlled degradation in various temperature and pressure conditions, aligning with the industry's increasing shift toward cost-effective and environmentally friendly completion technologies

- In February 2023, Saudi Aramco conducted field trials of PGA-based degradable diverter systems in several unconventional gas wells as part of its commitment to sustainable energy development. The trials demonstrated significant time and cost savings by eliminating post-frac milling operations. The success of these trials is expected to drive further integration of PGA solutions in Middle Eastern operations, contributing to Aramco’s long-term goals of reducing operational complexity and environmental impact

- In January 2023, Baker Hughes, a global energy technology company, launched a new line of degradable downhole tools incorporating polyglycolic acid, aimed at optimizing zonal isolation in multi-stage hydraulic fracturing. The tools are engineered for efficient degradation after use, enhancing operational efficiency and eliminating the need for mechanical removal. This product launch highlights Baker Hughes’ continued investment in advanced materials that support sustainable oilfield operations and operational simplification

- In January 2023, Schlumberger partnered with a composite materials manufacturer to develop next-generation PGA blends with enhanced thermal resistance for use in high-pressure, high-temperature (HPHT) well environments. The initiative aims to expand the applicability of PGA in more extreme conditions, addressing a key challenge in broader adoption. This collaboration demonstrates SLB’s focus on innovative material engineering to meet the evolving technical demands of the global energy sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyglycolic Acid In Oil And Gas Industry, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyglycolic Acid In Oil And Gas Industry research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyglycolic Acid In Oil And Gas Industry consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.