Global Polyurethane Processing Machine Market

Market Size in USD Billion

CAGR :

%

USD

4.26 Billion

USD

5.88 Billion

2024

2032

USD

4.26 Billion

USD

5.88 Billion

2024

2032

| 2025 –2032 | |

| USD 4.26 Billion | |

| USD 5.88 Billion | |

|

|

|

|

What is the Global Polyurethane Processing Machine Market Size and Growth Rate?

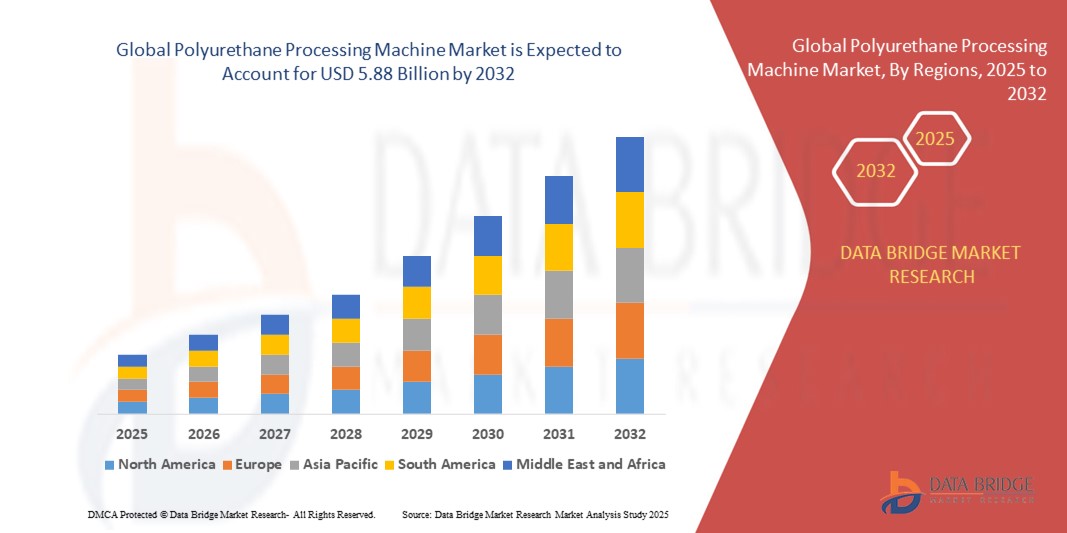

- The global polyurethane processing machine market size was valued at USD 4.26 billion in 2024 and is expected to reach USD 5.88 billion by 2032, at a CAGR of 4.10% during the forecast period

- The global polyurethane processing machine market experiences steady growth driven by demand from the automotive, construction, and furniture industries. The automotive sector's preference for lightweight vehicles and efficient insulation materials, coupled with construction industry expansion in emerging economies, boosts demand

- In addition, the furniture industry's adoption of polyurethane foam contributes to market growth. Technological advancements such as automation enhance production efficiency, attracting investments and creating opportunities for the market to grow

What are the Major Takeaways of Polyurethane Processing Machine Market?

- The booming construction industry, particularly in emerging economies, is a key driver for the polyurethane processing machine market. Polyurethane foam is widely used in construction for insulation, sealing, and structural applications, driving the demand for processing machines to manufacture foam products

- As infrastructure development projects continue to escalate globally, there is a corresponding increase in the adoption of polyurethane processing machines to meet the construction sector's needs

- Asia-Pacific dominated the polyurethane processing machine market with the largest revenue share of 41.5% in 2024, driven by the region’s strong manufacturing base, rapid industrialization, and rising demand for polyurethane applications across construction, automotive, and consumer goods sectors

- Europe polyurethane processing machine market is projected to grow at the fastest CAGR of 21.9% from 2025 to 2032, fueled by stringent energy efficiency regulations, sustainability goals, and rising demand for eco-friendly materials

- The Dosing Systems segment dominated the market in 2024 with the largest revenue share, driven by their critical role in ensuring accurate chemical ratios and minimizing raw material wastage

Report Scope and Polyurethane Processing Machine Market Segmentation

|

Attributes |

Polyurethane Processing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyurethane Processing Machine Market?

Automation and Digitalization for Precision Processing

- A major and accelerating trend in the global polyurethane processing machine market is the integration of automation, robotics, and digital control technologies to enhance production efficiency, precision, and consistency in foam processing

- For instance, modern dosing and mixing machines are increasingly equipped with IoT-enabled sensors and PLC systems, allowing real-time monitoring of flow rates, temperature, and mixing ratios to reduce material waste and improve quality

- The adoption of digital twin technology in polyurethane processing enables manufacturers to simulate machine performance, predict maintenance needs, and optimize throughput before actual production. KraussMaffei and Hennecke GmbH are investing heavily in such innovations

- Furthermore, manufacturers are embedding AI-driven process optimization tools into polyurethane machines, enabling adaptive control of parameters such as injection pressure and curing time to maximize productivity

- The trend towards smart factories and Industry 4.0 has made automated polyurethane processing solutions an essential part of furniture, automotive, and insulation material production lines

- This increasing focus on automation and digitalization is reshaping the industry, pushing companies to invest in next-gen machines that deliver higher output, lower scrap rates, and improved energy efficiency

What are the Key Drivers of Polyurethane Processing Machine Market?

- Growing demand from automotive, furniture, and construction industries for polyurethane-based foams, coatings, adhesives, and sealants is fueling market growth. These industries require high-precision processing machines to ensure product durability and performance

- For instance, in March 2024, Linde plc announced advancements in its gas-based solutions for polyurethane foam manufacturing, highlighting the increasing importance of efficient processing technologies to meet rising demand in insulation and lightweight automotive parts

- The rising need for energy-efficient insulation materials in buildings and appliances is driving demand for advanced high-pressure polyurethane machines that can produce rigid foams with superior thermal performance

- The trend toward lightweight vehicles and improved fuel efficiency is boosting polyurethane applications in seating, interior panels, and lightweight composites, directly increasing machine utilization

- In addition, the shift toward sustainable production has prompted companies to develop machines compatible with bio-based polyols and low-emission formulations, driving replacement demand for older systems

- Collectively, these factors are positioning polyurethane processing machines as a core enabler of innovation across multiple downstream industries

Which Factor is Challenging the Growth of the Polyurethane Processing Machine Market?

- A major challenge for the market is the high capital investment and maintenance cost associated with advanced polyurethane processing machines, which can be a significant barrier for small and medium-sized enterprises (SMEs)

- For instance, many SMEs in Asia-Pacific hesitate to upgrade to fully automated or digitalized processing systems due to budget constraints, even though these solutions enhance efficiency

- Another pressing issue is the volatility in raw material prices, particularly polyols and isocyanates, which directly impacts machine utilization rates and investment decisions by manufacturers

- Furthermore, the complexity of machine operation and maintenance requires skilled operators, and the shortage of trained technicians in emerging economies is a hurdle for wider adoption

- While leading companies such as Hennecke GmbH and Graco Inc. are offering training programs and remote support systems, adoption still lags in developing regions

- Unless addressed through cost-effective solutions, financing models, and operator training initiatives, these challenges could slow down the widespread deployment of advanced polyurethane processing machines

How is the Polyurethane Processing Machine Market Segmented?

The market is segmented on the basis of type, product, and end use.

- By Type

On the basis of type, the polyurethane processing machine market is segmented into Dosing Systems, Mixing Head, Metering Equipment, Foaming Equipment, and Others. The Dosing Systems segment dominated the market in 2024 with the largest revenue share of 54.87%, driven by their critical role in ensuring accurate chemical ratios and minimizing raw material wastage. Industries such as construction and automotive increasingly prefer advanced dosing units integrated with sensors and automation to achieve higher consistency and productivity.

The Mixing Head segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to rising demand for precision mixing in the production of flexible foams, coatings, and adhesives. Their design innovations, including self-cleaning mechanisms and high-speed operation, make them essential for manufacturers aiming to enhance efficiency and reduce downtime.

- By Product

On the basis of product, the market is segmented into High Pressure and Low Pressure machines. The High Pressure segment held the largest market share in 2024, primarily due to its widespread use in applications requiring high-speed production and superior mixing quality, such as automotive seating and rigid insulation foams. These machines are favored for delivering reduced cycle times and improved output.

The Low Pressure segment is expected to record the fastest CAGR between 2025 and 2032, driven by its suitability for smaller-scale production and applications requiring greater flexibility, such as prototyping, medical products, and specialty consumer goods. Their relatively lower investment cost and ease of operation make them particularly attractive for SMEs and niche manufacturers.

- By End Use

On the basis of end use, the polyurethane processing machine market is segmented into Construction, Automotive, Medical, Consumer Products, and Others. The Construction segment accounted for the largest market revenue share in 2024, supported by rising demand for energy-efficient insulation foams, sealants, and adhesives. Growing emphasis on green buildings and stricter energy regulations are further propelling machine adoption in this sector.

The Automotive segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing use of polyurethane in lightweight components, seating systems, and interior parts. The industry’s push toward fuel efficiency and electric vehicle development is accelerating demand for precision processing machines.

Which Region Holds the Largest Share of the Polyurethane Processing Machine Market?

- Asia-Pacific dominated the polyurethane processing machine market with the largest revenue share of 41.5% in 2024, driven by the region’s strong manufacturing base, rapid industrialization, and rising demand for polyurethane applications across construction, automotive, and consumer goods sectors

- The widespread use of polyurethane foams for insulation, seating, and packaging, coupled with government initiatives supporting infrastructure development, is accelerating the adoption of advanced polyurethane processing technologies

- In addition, the availability of cost-effective labor, local machinery manufacturers, and favorable policies promoting industrial automation further strengthen Asia-Pacific’s leadership position in the global market

China Polyurethane Processing Machine Market Insight

China polyurethane processing machine market captured the largest revenue share of 64% in Asia-Pacific in 2024, fueled by the country’s dominance in construction, automotive production, and electronics manufacturing. The push toward smart cities, demand for lightweight materials, and large-scale insulation projects are boosting polyurethane processing capacity. Strong domestic machinery suppliers and a robust export base also contribute to China’s leading position in the region.

Japan Polyurethane Processing Machine Market Insight

Japan market is witnessing steady growth, driven by its advanced manufacturing sector, high standards for product quality, and continuous innovation. The adoption of polyurethane processing machines is particularly strong in automotive seating, medical devices, and consumer electronics. Japan’s focus on precision engineering and sustainability is encouraging demand for high-pressure and digitally controlled polyurethane machinery.

India Polyurethane Processing Machine Market Insight

India market is anticipated to grow at a robust CAGR during the forecast period, supported by rapid urbanization, housing development projects, and the expansion of its automotive sector. Increasing investments in industrial manufacturing and the government’s “Make in India” initiative are fueling demand for polyurethane foams in construction, mattresses, and transportation, thereby driving machine adoption.

Which Region is the Fastest Growing in the Polyurethane Processing Machine Market?

Europe polyurethane processing machine market is projected to grow at the fastest CAGR of 21.9% from 2025 to 2032, fueled by stringent energy efficiency regulations, sustainability goals, and rising demand for eco-friendly materials. The region’s focus on green buildings, recycling, and low-emission production is encouraging companies to adopt advanced polyurethane processing machines compatible with bio-based polyols and alternative blowing agents.

Germany Polyurethane Processing Machine Market Insight

Germany market is expected to hold the largest share within Europe in 2024, driven by its strong automotive industry, focus on lightweight materials, and advanced infrastructure. Manufacturers are increasingly investing in high-pressure machines and automation solutions to enhance productivity while complying with stringent EU sustainability standards.

U.K. Polyurethane Processing Machine Market Insight

U.K. market is anticipated to expand at a healthy CAGR, supported by growth in the housing and construction industries, as well as demand for insulation foams to meet energy-saving requirements. Rising emphasis on modern infrastructure projects and adoption of eco-conscious solutions are key drivers in the country.

France Polyurethane Processing Machine Market Insight

France market is projected to grow steadily during the forecast period, owing to its focus on residential and commercial retrofitting projects. Government incentives for sustainable building materials and energy-efficient construction are expected to boost demand for polyurethane foams and, consequently, processing machinery.

Which are the Top Companies in Polyurethane Processing Machine Market?

The polyurethane processing machine industry is primarily led by well-established companies, including:

- Linde plc (Ireland)

- Frimo Group GmbH (Germany)

- Rim Polymer Industries Pte. Ltd. (Singapore)

- LEWA GmbH (Germany)

- Haitian Group (China)

- KraussMaffei Group (Germany)

- Hennecke GmbH (Germany)

- Wittmann Group (Austria)

- Engel Austria GmbH (Austria)

- Graco Inc. (U.S.)

What are the Recent Developments in Global Polyurethane Processing Machine Market?

- In April 2022, Mitsubishi Chemical partnered with Origin Materials to jointly develop carbon-negative products for tire manufacturing, a step aimed at driving sustainable innovation in the automotive industry. This collaboration is expected to accelerate the adoption of eco-friendly materials in tire production

- In January 2022, Eastman Chemical announced an investment of USD 1 billion to establish the world’s largest molecular plastics recycling facility in France, with the goal of advancing circular economy solutions. This initiative is set to significantly enhance global recycling capabilities and reduce plastic waste

- In February 2020, Hennecke GmbH and Frimo Group revealed a strategic partnership in the field of polyurethane and other reactive plastic applications, designed to deliver added value for automotive industry customers. This alliance is anticipated to strengthen both companies’ presence in the polyurethane processing market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyurethane Processing Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyurethane Processing Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyurethane Processing Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.