Global Prescription Digital Therapeutics Dtx Market

Market Size in USD Billion

CAGR :

%

USD

5.64 Billion

USD

24.86 Billion

2024

2032

USD

5.64 Billion

USD

24.86 Billion

2024

2032

| 2025 –2032 | |

| USD 5.64 Billion | |

| USD 24.86 Billion | |

|

|

|

|

Prescription Digital Therapeutics (PDTx) Market Size

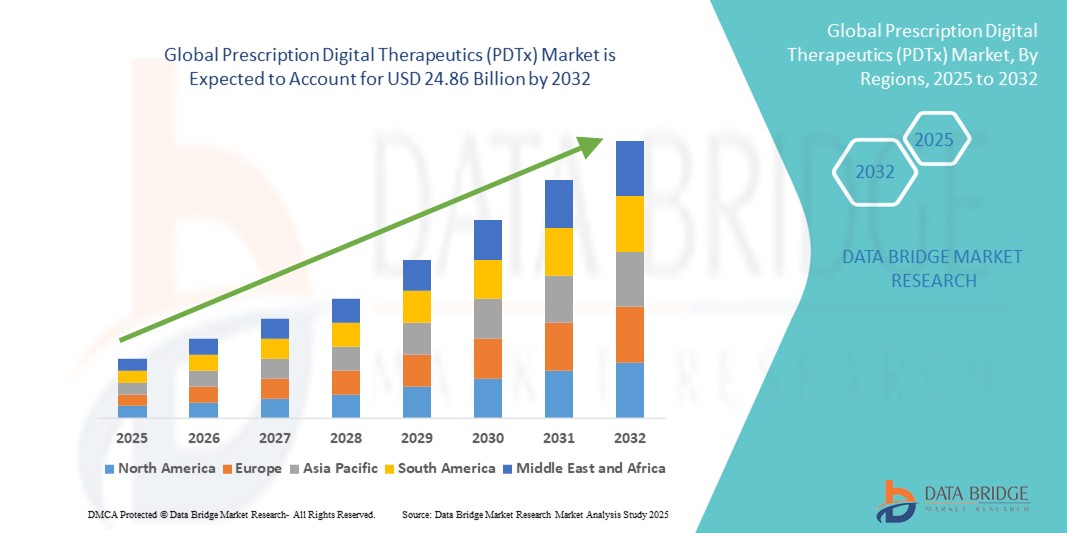

- The global prescription digital therapeutics (PDTx) market size was valued at USD 5.64 billion in 2024 and is expected to reach USD 24.86 billion by 2032, at a CAGR of 20.35% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases, mental health disorders, and the need for scalable, evidence-based digital treatments that go beyond traditional care models

- In addition, growing regulatory support, rising adoption of digital health tools by healthcare providers, and patient preference for non-invasive, accessible therapies are positioning PDTx as a transformative component of personalized healthcare. These trends are propelling significant momentum in the PDTx industry, fostering widespread clinical integration and market expansion

Prescription Digital Therapeutics (PDTx) Market Analysis

- Prescription digital therapeutics (PDTx), which deliver clinically validated software-based interventions for treating a variety of medical conditions, are becoming increasingly integral to modern healthcare due to their ability to provide scalable, personalized, and non-invasive therapies through digital platforms

- The growing adoption of PDTx is driven by the rising prevalence of chronic and mental health conditions, increasing demand for remote healthcare solutions, and favorable regulatory support for digital therapeutics integration into traditional care models

- North America dominated the prescription digital therapeutics (PDTx) market with the largest revenue share of 47.2% in 2024, supported by a well-established digital infrastructure, regulatory approvals by agencies such as the FDA, and significant investments by both pharma and tech giants, with the U.S. leading in commercial adoption and clinical deployment of PDTx solutions

- Asia-Pacific is projected to be the fastest growing region in the prescription digital therapeutics (PDTx) market during the forecast period due to rising digital literacy, increased smartphone usage, and expanding telehealth initiatives across countries such as India, China, and Japan

- Software for Mental Health segment dominated the prescription digital therapeutics (PDTx) market with a market share of 42% in 2024, fueled by the escalating burden of anxiety, depression, and stress-related disorders, and the proven clinical efficacy of PDTx interventions in delivering cognitive behavioral therapy digitally

Report Scope and Prescription Digital Therapeutics (PDTx) Market Segmentation

|

Attributes |

Prescription Digital Therapeutics (PDTx) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Prescription Digital Therapeutics (PDTx) Market Trends

Expansion of AI-Driven Personalization and Integration with Remote Care Platforms

- A defining trend in the global PDTx market is the growing incorporation of artificial intelligence (AI) and machine learning algorithms to personalize therapeutic interventions and enhance treatment efficacy. These advanced capabilities enable PDTx solutions to dynamically adapt to user behavior, health data, and real-time progress, creating a more individualized and effective therapy experience

- For instance, Pear Therapeutics' reSET-O uses adaptive algorithms to support patients with opioid use disorder, adjusting treatment pathways based on real-time engagement. Similarly, apps such as Big Health’s Sleepio utilize AI to tailor cognitive behavioral therapy for insomnia, learning from user inputs and patterns

- Integration with telehealth platforms and electronic health records (EHRs) is also accelerating, enabling seamless data sharing between patients and providers. This allows clinicians to monitor progress, intervene when necessary, and make data-driven decisions about treatment modifications

- The convergence of PDTx with broader digital health ecosystems—such as wearable health trackers and remote monitoring tools supports more holistic, continuous care outside of traditional clinical settings. This interconnected approach is reshaping chronic disease management by providing timely, real-world insights

- Companies such as Akili Interactive and Click Therapeutics are leveraging AI for real-time feedback, engagement tracking, and outcome prediction, setting a new standard for personalized, technology-enabled therapeutic care

- As demand for cost-effective, scalable, and accessible treatment continues to grow, AI-enhanced PDTx solutions are poised to become a foundational component of the future digital health landscape

Prescription Digital Therapeutics (PDTx) Market Dynamics

Driver

Rising Demand for Scalable Mental Health and Chronic Disease Solutions

- The global increase in chronic conditions and mental health disorders, alongside limitations in traditional healthcare infrastructure, is fueling demand for scalable, non-invasive therapeutic solutions such as PDTx

- For instance, in March 2024, the FDA approved Otsuka and Click Therapeutics’ reSET-A, a PDTx solution targeting major depressive disorder (MDD), reinforcing the clinical credibility and therapeutic value of these software-based interventions

- PDTx platforms offer several advantages, including real-time monitoring, standardized interventions, and the ability to reach patients in underserved or remote areas. These features make PDTx an attractive option for healthcare providers and patients asuch as

- In addition, the growing emphasis on value-based care and preventive treatment is pushing health systems and insurers to embrace PDTx as cost-effective alternatives or complements to medication and therapy

- The convenience of smartphone-based delivery, 24/7 accessibility, and progress tracking features enhance patient engagement and adherence critical factors in achieving better outcomes in mental health, diabetes, and substance use treatment

Restraint/Challenge

Regulatory, Reimbursement, and Awareness Gaps

- Despite the promise of PDTx, several barriers continue to slow widespread adoption. These include fragmented regulatory pathways, varying regional definitions of PDTx, and a lack of standardized reimbursement models from payers

- For instance, while the FDA has approved multiple PDTx products under the Software as a Medical Device (SaMD) framework, many regions lack equivalent approval processes, creating inconsistency and market entry challenges for developers

- In addition, limited awareness and understanding of PDTx among both healthcare providers and patients hampers prescribing and usage rates. Unsuch as traditional medications, PDTx often require training and technical familiarity, which can deter adoption

- Companies must also navigate concerns about data privacy, security, and the ethical use of patient-generated health data, especially in markets with strict regulations such as GDPR in Europe

- To overcome these hurdles, stakeholders must work collaboratively to establish clear regulatory guidelines, expand coverage and reimbursement, and implement robust education initiatives that emphasize the safety, efficacy, and value of PDTx in modern care models

Prescription Digital Therapeutics (PDTx) Market Scope

The market is segmented on the basis of mechanism, category, treatment, software, services, app accessibility, app type, application, and patients.

- By Mechanism

On the basis of mechanism, the prescription digital therapeutics (PDTx) market is segmented into input mechanisms and output mechanisms. The input mechanisms segment held the larger market revenue share in 2024, driven by its foundational role in capturing patient-generated health data through mobile devices, sensors, and questionnaires. These inputs are essential for enabling real-time monitoring, dynamic therapy adjustments, and personalized care pathways. The growth of wearable technologies and smartphone adoption further strengthens the dominance of input mechanisms in the PDTx ecosystem.

The output mechanisms segment is expected to witness steady growth during the forecast period, as software platforms increasingly incorporate interactive content, behavioral nudges, and adaptive feedback to drive patient engagement and therapy adherence. These outputs are crucial for delivering therapeutic benefits in mental health, chronic conditions, and cognitive disorders.

- By Category

On the basis of category, the prescription digital therapeutics (PDTx) market is segmented into medication augmentation and medication replacement. The medication augmentation segment dominated the market in 2024, with the largest revenue share, due to its ability to enhance treatment outcomes when used alongside pharmacological interventions. PDTx solutions in this category are increasingly prescribed by clinicians to support behavioral therapies, monitor medication adherence, and deliver education modules, particularly in mental health and substance use disorder treatment.

The medication replacement segment is anticipated to grow at a notable rate, driven by the regulatory approval of standalone PDTx therapies that serve as digital-first treatments, especially in mild to moderate conditions such as insomnia and anxiety. These platforms appeal to users seeking non-pharmacological, low-risk interventions with clinically validated results.

- By Treatment

On the basis of treatment, the prescription digital therapeutics (PDTx) market is segmented into outpatient treatment and monotherapy. The outpatient treatment segment held the majority market share in 2024, supported by its widespread use in chronic care management and behavioral health programs. PDTx platforms enable remote delivery of therapy, eliminating the need for frequent clinic visits and enhancing accessibility for patients across diverse geographies.

The monotherapy segment is gaining traction during forecast period, particularly in conditions such as ADHD, where digital therapeutics are FDA-approved to deliver primary treatment without adjunct medications. Growing clinical evidence and patient preference for non-drug interventions are expected to drive this segment forward.

- By Software

On the basis of software, the prescription digital therapeutics (PDTx) market is segmented by software into software for mental health, software for opioid use disorder, software for diabetes, software for respiratory conditions, and others. The mental health software segment dominated the market in 2024 with the largest revenue share of 42%, fueled by increasing prevalence of depression, anxiety, and stress-related disorders. Clinically validated solutions delivering cognitive behavioral therapy (CBT) digitally are widely adopted by both patients and healthcare providers.

The software for diabetes segment is projected to grow rapidly during forecast period, supported by rising global diabetes incidence and the proven efficacy of PDTx in lifestyle management, blood glucose monitoring, and behavioral coaching.

- By Services

On the basis of services, the prescription digital therapeutics (PDTx) market is divided into behavioral microservices and medical microservices. The behavioral microservices segment held the dominant share in 2024, driven by strong uptake of digital CBT, motivational interviewing tools, and adherence-focused behavioral interventions.

Medical microservices are expected to witness increased adoption during the forecast period, as PDTx expands into conditions such as cardiovascular and metabolic disorders, requiring clinical-grade data capture and integration with electronic health records.

- By App Accessibility

On the basis of app accessibility, the prescription digital therapeutics (PDTx) market is segmented into Android, iOS, and Windows. The Android segment held the largest market share in 2024, driven by the platform’s global smartphone dominance and ease of access in emerging markets. PDTx developers often prioritize Android for initial rollouts due to its broader user base and compatibility with budget devices.

The iOS segment is expected to witness fastest growth during forecast period, as it commands strong presence in high-income regions and is preferred for premium PDTx offerings, especially in North America and Western Europe.

- By App Type

On the basis of app type, the prescription digital therapeutics (PDTx) market is segmented into native apps and web apps based on app type. Native apps dominated the PDTx market in 2024 due to their superior performance, offline access, and advanced features such as push notifications, biometric security, and real-time data syncing. These characteristics make native apps ideal for delivering personalized and interactive therapeutic content.

Web apps, is expected to witness fastest growth during forecast period, as it offer cross-platform accessibility and faster updates, and as developers seek scalable, browser-based solutions for broader reach.

- By Application

On the basis of application segment, the prescription digital therapeutics (PDTx) market is segmented into substance use disorder (SUD), opioid use disorder (OUD), attention deficit/hyperactivity disorder (ADHD), Alzheimer’s disease, major depressive disorder (MDD), insomnia, epilepsy, movement disorder, multiple sclerosis, migraine, autism spectrum disorder, oncology, inflammation, respiratory, cardiovascular, pain management, metabolic conditions, and others. The major depressive disorder (MDD) segment held the largest market share in 2024, driven by increasing mental health awareness and the availability of FDA-approved PDTx solutions such as reSET-A and Sleepio.

The Attention Deficit/Hyperactivity Disorder (ADHD) segment is experiencing rapid growth during forecast period, with digital therapeutics such as EndeavorRx and Somryst gaining recognition for their clinical efficacy and patient-centered design.

- By Patients

On the basis of patient group, the prescription digital therapeutics (PDTx) market is segmented into children and adults. The adult segment dominated the market in 2024 due to the high prevalence of chronic and behavioral health conditions among the adult population. Adults are also more such asly to own smartphones and engage with mobile health solutions, supporting higher adoption rates for PDTx.

The children segment is projected to expand during forecast period, with the growing use of PDTx for pediatric conditions such as ADHD and autism, supported by increasing regulatory approvals and parental demand for safe, digital-first interventions.

Prescription Digital Therapeutics (PDTx) Market Regional Analysis

- North America dominated the prescription digital therapeutics (PDTx) market with the largest revenue share of 47.2% in 2024, supported by a well-established digital infrastructure, regulatory approvals by agencies such as the FDA, and significant investments by both pharma and tech giants, with the U.S. leading in commercial adoption and clinical deployment of PDTx solutions

- The region's strong digital infrastructure, increasing acceptance of app-based therapy, and rising partnerships between tech firms and healthcare providers fuel widespread implementation of PDTx solutions

- In addition, the presence of leading PDTx developers, coupled with FDA approvals and reimbursement support, positions North America as a mature and innovation-driven market, especially for indications such as MDD, ADHD, and substance use disorders

U.S. Prescription Digital Therapeutics (PDTx) Market Insight

The U.S. prescription digital therapeutics (PDTx) market accounted for the largest revenue share of 82.6% in North America in 2024, driven by high digital literacy, early regulatory approvals by the FDA, and increasing payer reimbursement for PDTx solutions. The strong presence of key players, including Pear Therapeutics and Akili Interactive, and the focus on conditions such as depression, ADHD, and substance use disorders, are driving adoption. Integration with electronic health records (EHRs) and growing clinical validation of app-based interventions continue to support market expansion across outpatient settings.

Europe Prescription Digital Therapeutics (PDTx) Market Insight

The Europe prescription digital therapeutics (PDTx) market is projected to grow at a significant CAGR throughout the forecast period, spurred by rising healthcare digitization initiatives and supportive regulatory frameworks such as the EU Medical Device Regulation (MDR). Increasing awareness among healthcare providers and patients about non-invasive, software-based treatments is promoting widespread adoption. Chronic disease burden, along with favorable health insurance policies and investments in digital health infrastructure, is boosting the use of PDTx for mental health and metabolic conditions across both public and private health systems.

U.K. Prescription Digital Therapeutics (PDTx) Market Insight

The U.K. prescription digital therapeutics (PDTx) market is expected to witness robust growth during the forecast period, supported by the National Health Service’s (NHS) digital-first strategy and growing mental health challenges post-COVID. The country's progressive stance on digital health and increased investments in digital therapeutics platforms are accelerating adoption. The focus on reducing treatment gaps in behavioral health and chronic disease management positions the U.K. as a critical market in Europe for validated PDTx interventions.

Germany Prescription Digital Therapeutics (PDTx) Market Insight

The Germany prescription digital therapeutics (PDTx) market is poised for substantial growth, driven by the pioneering DiGA Fast Track framework, which allows digital health apps to be prescribed and reimbursed. With a strong emphasis on regulatory compliance and evidence-based efficacy, Germany has created a favorable environment for PDTx adoption. The rising incidence of lifestyle-related disorders and mental health conditions, alongside increasing patient engagement in self-care, is reinforcing the demand for prescription-based therapeutic software in both inpatient and outpatient care.

Asia-Pacific Prescription Digital Therapeutics (PDTx) Market Insight

The Asia-Pacific prescription digital therapeutics (PDTx) market is forecasted to grow at the fastest CAGR of 25.7% from 2025 to 2032, fueled by digital health transformation efforts in emerging economies. Rapid urbanization, expanding internet penetration, and increasing investments in healthcare IT infrastructure are driving the market. Government-backed digital health policies in countries such as India, China, and Japan, coupled with a rising need for scalable mental health and chronic disease solutions, are enhancing the adoption of PDTx across hospitals and clinics.

Japan Prescription Digital Therapeutics (PDTx) Market Insight

The Japan prescription digital therapeutics (PDTx) market is gaining traction due to its aging population, rising chronic disease burden, and government efforts to digitize healthcare under the “Society 5.0” vision. High smartphone penetration, patient openness to digital tools, and insurance initiatives supporting digital health solutions make Japan a fertile ground for PDTx deployment. Mental health and cognitive decline in the elderly are key therapeutic areas being addressed through software-based interventions integrated with clinical workflows.

India Prescription Digital Therapeutics (PDTx) Market Insight

The India prescription digital therapeutics (PDTx) market captured the largest revenue share in the Asia-Pacific PDTx market in 2024, driven by its fast-growing digital health ecosystem, increased smartphone adoption, and government-backed programs such as Ayushman Bharat Digital Mission. The rising prevalence of diabetes, hypertension, and depression is prompting demand for accessible, low-cost therapeutic solutions. The country's large patient pool, digital-savvy youth population, and a growing base of health-tech startups are positioning India as a vital market for scalable PDTx solutions.

Prescription Digital Therapeutics (PDTx) Market Share

The prescription digital therapeutics (PDTx) industry is primarily led by well-established companies, including:

- ResMed (U.S.)

- SAMSUNGHEALTHCARE (South Korea)

- Biofourmis (US)

- Novartis AG (Switzerland)

- Medtronic (Ireland)

- Pear Therapeutics, Inc. (U.S.)

- Voluntis (France)

- Omada Health, Inc. (U.S.)

- GAIA AG (Germany)

- Welldoc’s Bluestar (U.S.)

- Solera Network (U.S.)

- Akili Interactive Labs, Inc. (U.S.)

- Better Therapeutics, LLC (U.S.)

- BigHealth (U.S.)

- Biofourmis (U.S.)

- Click Therapeutics, Inc. (U.S.)

- Happify, Inc. (U.S.)

- Limbix Health, Inc. (U.S.)

- Naturalcycles Nordic AB (Sweden)

- NuvoAir AB (Sweden)

- Sensyne Health plc. (U.K.)

- Xealth (U.S.)

What are the Recent Developments in Global Prescription Digital Therapeutics (PDTx) Market?

- In May 2025, U.S. lawmakers reintroduced the Access to Prescription Digital Therapeutics Act, seeking to establish Medicare and Medicaid reimbursement pathways for FDA-authorized PDTx. The bill represents a pivotal step toward formal payer recognition of digital therapeutics as legitimate, reimbursable treatments and is expected to enhance adoption, affordability, and provider engagement across the U.S. healthcare system

- In May 2025, the Centers for Medicare & Medicaid Services (CMS), together with the Office of the National Coordinator for Health Information Technology (ONC), issued a Request for Information (RFI) titled “Health Technology Ecosystem.” The aim is to gather public input on the digital health landscape for Medicare beneficiaries, focusing on data interoperability and broader health technology infrastructure

- In April 2025, Click Therapeutics secured FDA marketing authorization for CT‑132, the first prescription digital therapeutic approved for the preventive treatment of episodic migraine in adults under the De Novo classification. This groundbreaking approval underscores the expanding clinical relevance of PDTx solutions beyond behavioral and mental health, highlighting regulatory confidence in digital platforms as viable and effective treatment modalities. The development marks a major milestone in the evolution of digital health and positions Click Therapeutics as a leading innovator in neurology-focused PDTx

- In March 2025, Dassault Systèmes expanded its strategic alliance with Click Therapeutics by investing directly in the company to support advanced digital therapeutics development. This move aims to connect clinical research and digital patient engagement via Dassault’s Medidata platform, thereby strengthening the pipeline of software-driven treatments from clinical trials to market delivery. This partnership reflects a broader trend of traditional life sciences firms integrating AI and software to redefine therapeutic value across the continuum of care

- In June 2024, Akili Interactive received FDA clearance for EndeavorOTC, the first over-the-counter digital therapeutic for adult ADHD, allowing broader public access without a physician's prescription. Previously available as a pediatric prescription therapy, this version represents a major leap in democratizing digital care access and making neurocognitive therapy more scalable. The milestone sets a precedent for future non-prescription PDTx solutions to enter consumer markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (PDTX) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE PRESCRIPTION DIGITAL THERAPEUTICS (PDTX) SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (PDTX) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (PDTX) MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY MECHANISM

16.1 OVERVIEW

16.2 INPUT MECHANISMS

16.2.1 BY TYPE

16.2.1.1. SCREEN

16.2.1.2. ACCELEROMETER

16.2.1.3. MICROPHONE

16.2.2 BY APPLICATION

16.2.2.1. PATIENT DATA COLLECTION

16.2.2.1.1. MOOD

16.2.2.1.2. COGNITION

16.2.2.1.3. MEMORY

16.2.2.1.4. FAMILIAL RECOGNITION

16.2.2.1.5. CONCENTRATION

16.2.2.1.6. OTHERS

16.2.2.2. DEXTERITY OR STEADINESS MEASUREMENT

16.2.2.2.1. STRETCHING

16.2.2.2.2. RANGE OF MOTION TESTS

16.2.2.2.3. OTHERS

16.2.2.3. AUDIO ANALYSIS

16.2.2.3.1. VOICE QUALITY

16.2.2.3.2. SHAKINESS

16.2.2.3.3. OTHERS

16.3 OUTPUT MECHANISMS

16.3.1 BY TYPE

16.3.1.1. SCREEN

16.3.1.2. CHAT

16.3.1.3. NOTIFICATION

16.3.2 BY APPLICATION

16.3.2.1. CONTENT DELIVERY

16.3.2.1.1. BLOGS

16.3.2.1.2. TIPS

16.3.2.1.3. FAQS

16.3.2.1.4. VIDEOS

16.3.2.1.5. OTHERS

16.3.2.2. PATIENT COMMUNICATION

16.3.2.2.1. PROFESSIONAL COACHING

16.3.2.2.2. PEER-TO-PEER SUPPORT

16.3.2.2.3. OTHERS

16.3.2.3. ADHERENCE PROMPTS

16.3.2.3.1. INACTIVITY

16.3.2.3.2. SLEEP

16.3.2.3.3. DIET

16.3.2.3.4. OTHERS

17 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY TREATMENT

17.1 OVERVIEW

17.2 BY USAGE

17.2.1 MEDICATION AUGMENTATION

17.2.2 MEDICATION REPLACEMENT

17.3 BY TYPE

17.3.1 OUTPATIENT TREATMENT

17.3.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

17.3.1.2. FLUENCY TRANING

17.3.1.3. CONTIGENCY MANAGEMENT

17.3.1.4. CRAVING AND TRIGGER ASSESSMENT

17.3.1.5. TRANSMUCOSAL BUPRENORPHINE

17.3.1.6. OTHERS

17.3.2 MONOTHERAPY

17.3.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

17.3.2.2. COGNITIVE RESTRUCTURING

17.3.2.3. OTHERS

17.3.3 OTHERS

18 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY SOFTWARE

18.1 OVERVIEW

18.2 SOFTWARE FOR RESPIATIORY CONDITIONS

18.3 SOFTWARE FOR MENTAL HEALTH

18.4 SOFTWARE FOR OPIOID USE DISORDER

18.5 SOFTWARE FOR DIABETES

18.6 OTHERS

19 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY SERVICES

19.1 OVERVIEW

19.2 BEHAVIORAL MICROSERVICES

19.2.1 PHYSICAL ACITIVITY

19.2.2 RELAXATION TECHNIQUE

19.2.3 DIET OPTIMIZATION

19.2.4 CONTROLLED BREATHING

19.2.5 TELEMEDICINE

19.2.6 MINDFULNESS TRAINING

19.2.7 OTHERS

19.3 MEDICAL MICROSERVICES

19.3.1 MEDICATION MANAGAMENT SYSTEM

19.3.2 FAGERSTROM TEST

19.3.3 PATIENT HEALTH QUESTIONNAIRE

19.3.4 FINANCIAL SAVING ENGINE

19.3.5 HEALTH RECOVERED ENGINE

19.3.6 MORISKY MEDICATION ADHERENCE SCALE

19.3.7 OTHERS

20 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY APP ACCESSIBILITY

20.1 OVERVIEW

20.2 ANDROID

20.2.1 SMARTPHONE

20.2.2 TABLET

20.3 IOS

20.3.1 SMARTPHONE

20.3.2 TABLET

20.4 WINDOWS

20.4.1 SMARTPHONE

20.4.2 TABLET

21 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY APP TYPE

21.1 OVERVIEW

21.2 NATIVE APPS

21.3 WEB APPS

21.4 HYBRID APPS

22 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY APPLICATION

22.1 OVERVIEW

22.2 SUBSTANCE USE DISORDER (SUD)

22.2.1 BY USAGE

22.2.1.1. MEDICATION AUGMENTATION

22.2.1.2. MEDICATION REPLACEMENT

22.2.2 BY TYPE

22.2.2.1. OUTPATIENT TREATMENT

22.2.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.2.2.1.2. FLUENCY TRANING

22.2.2.1.3. CONTIGENCY MANAGEMENT

22.2.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.2.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.2.2.1.6. OTHERS

22.2.2.2. MONOTHERAPY

22.2.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.2.2.2.2. COGNITIVE RESTRUCTURING

22.2.2.2.3. OTHERS

22.2.2.3. OTHERS

22.3 OPIOID USE DISORDER (OUD)

22.3.1 BY USAGE

22.3.1.1. MEDICATION AUGMENTATION

22.3.1.2. MEDICATION REPLACEMENT

22.3.2 BY TYPE

22.3.2.1. OUTPATIENT TREATMENT

22.3.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.3.2.1.2. FLUENCY TRANING

22.3.2.1.3. CONTIGENCY MANAGEMENT

22.3.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.3.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.3.2.1.6. OTHERS

22.3.2.2. MONOTHERAPY

22.3.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.3.2.2.2. COGNITIVE RESTRUCTURING

22.3.2.2.3. OTHERS

22.3.2.3. OTHERS

22.4 ATTENTION DEFICIT/HYPERACTIVITY DISORDER (ADHD)

22.4.1 BY USAGE

22.4.1.1. MEDICATION AUGMENTATION

22.4.1.2. MEDICATION REPLACEMENT

22.4.2 BY TYPE

22.4.2.1. OUTPATIENT TREATMENT

22.4.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.4.2.1.2. FLUENCY TRANING

22.4.2.1.3. CONTIGENCY MANAGEMENT

22.4.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.4.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.4.2.1.6. OTHERS

22.4.2.2. MONOTHERAPY

22.4.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.4.2.2.2. COGNITIVE RESTRUCTURING

22.4.2.2.3. OTHERS

22.5 OTHERSALZHEIMER’S DISEASE

22.5.1 BY USAGE

22.5.1.1. MEDICATION AUGMENTATION

22.5.1.2. MEDICATION REPLACEMENT

22.5.2 BY TYPE

22.5.2.1. OUTPATIENT TREATMENT

22.5.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.5.2.1.2. FLUENCY TRANING

22.5.2.1.3. CONTIGENCY MANAGEMENT

22.5.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.5.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.5.2.1.6. OTHERS

22.5.2.2. MONOTHERAPY

22.5.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.5.2.2.2. COGNITIVE RESTRUCTURING

22.5.2.2.3. OTHERS

22.5.2.3. OTHERS

22.6 MAJOR DEPRESSIVE DISORDER (MDD)

22.6.1 BY USAGE

22.6.1.1. MEDICATION AUGMENTATION

22.6.1.2. MEDICATION REPLACEMENT

22.6.2 BY TYPE

22.6.2.1. OUTPATIENT TREATMENT

22.6.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.6.2.1.2. FLUENCY TRANING

22.6.2.1.3. CONTIGENCY MANAGEMENT

22.6.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.6.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.6.2.1.6. OTHERS

22.6.2.2. MONOTHERAPY

22.6.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.6.2.2.2. COGNITIVE RESTRUCTURING

22.6.2.2.3. OTHERS

22.6.2.3. OTHERS

22.7 INSOMNIA

22.7.1 BY USAGE

22.7.1.1. MEDICATION AUGMENTATION

22.7.1.2. MEDICATION REPLACEMENT

22.7.2 BY TYPE

22.7.2.1. OUTPATIENT TREATMENT

22.7.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.7.2.1.2. FLUENCY TRANING

22.7.2.1.3. CONTIGENCY MANAGEMENT

22.7.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.7.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.7.2.1.6. OTHERS

22.7.2.2. MONOTHERAPY

22.7.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.7.2.2.2. COGNITIVE RESTRUCTURING

22.7.2.2.3. OTHERS

22.7.2.3. OTHERS

22.8 COGNITION

22.8.1 BY USAGE

22.8.1.1. MEDICATION AUGMENTATION

22.8.1.2. MEDICATION REPLACEMENT

22.8.2 BY TYPE

22.8.2.1. OUTPATIENT TREATMENT

22.8.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.8.2.1.2. FLUENCY TRANING

22.8.2.1.3. CONTIGENCY MANAGEMENT

22.8.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.8.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.8.2.1.6. OTHERS

22.8.2.2. MONOTHERAPY

22.8.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.8.2.2.2. COGNITIVE RESTRUCTURING

22.8.2.2.3. OTHERS

22.8.2.3. OTHERS

22.9 EPILEPSY

22.9.1 BY USAGE

22.9.1.1. MEDICATION AUGMENTATION

22.9.1.2. MEDICATION REPLACEMENT

22.9.2 BY TYPE

22.9.2.1. OUTPATIENT TREATMENT

22.9.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.9.2.1.2. FLUENCY TRANING

22.9.2.1.3. CONTIGENCY MANAGEMENT

22.9.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.9.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.9.2.1.6. OTHERS

22.9.2.2. MONOTHERAPY

22.9.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.9.2.2.2. COGNITIVE RESTRUCTURING

22.9.2.2.3. OTHERS

22.9.2.3. OTHERS

22.1 MOVEMENT DISORDER

22.10.1 BY USAGE

22.10.1.1. MEDICATION AUGMENTATION

22.10.1.2. MEDICATION REPLACEMENT

22.10.2 BY TYPE

22.10.2.1. OUTPATIENT TREATMENT

22.10.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.10.2.1.2. FLUENCY TRANING

22.10.2.1.3. CONTIGENCY MANAGEMENT

22.10.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.10.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.10.2.1.6. OTHERS

22.10.2.2. MONOTHERAPY

22.10.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.10.2.2.2. COGNITIVE RESTRUCTURING

22.10.2.2.3. OTHERS

22.10.2.3. OTHERS

22.11 MULTIPLE SCLEROSIS

22.11.1 BY USAGE

22.11.1.1. MEDICATION AUGMENTATION

22.11.1.2. MEDICATION REPLACEMENT

22.11.2 BY TYPE

22.11.2.1. OUTPATIENT TREATMENT

22.11.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.11.2.1.2. FLUENCY TRANING

22.11.2.1.3. CONTIGENCY MANAGEMENT

22.11.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.11.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.11.2.1.6. OTHERS

22.11.2.2. MONOTHERAPY

22.11.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.11.2.2.2. COGNITIVE RESTRUCTURING

22.11.2.2.3. OTHERS

22.11.2.3. OTHERS

22.12 MIGRAINE

22.12.1 BY USAGE

22.12.1.1. MEDICATION AUGMENTATION

22.12.1.2. MEDICATION REPLACEMENT

22.12.2 BY TYPE

22.12.2.1. OUTPATIENT TREATMENT

22.12.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.12.2.1.2. FLUENCY TRANING

22.12.2.1.3. CONTIGENCY MANAGEMENT

22.12.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.12.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.12.2.1.6. OTHERS

22.12.2.2. MONOTHERAPY

22.12.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.12.2.2.2. COGNITIVE RESTRUCTURING

22.12.2.2.3. OTHERS

22.12.2.3. OTHERS

22.13 AUSTISM SPECTRUM DISORDER

22.13.1 BY USAGE

22.13.1.1. MEDICATION AUGMENTATION

22.13.1.2. MEDICATION REPLACEMENT

22.13.2 BY TYPE

22.13.2.1. OUTPATIENT TREATMENT

22.13.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.13.2.1.2. FLUENCY TRANING

22.13.2.1.3. CONTIGENCY MANAGEMENT

22.13.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.13.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.13.2.1.6. OTHERS

22.13.2.2. MONOTHERAPY

22.13.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.13.2.2.2. COGNITIVE RESTRUCTURING

22.13.2.2.3. OTHERS

22.13.2.3. OTHERS

22.14 ONCLOGY

22.14.1 BY USAGE

22.14.1.1. MEDICATION AUGMENTATION

22.14.1.2. MEDICATION REPLACEMENT

22.14.2 BY TYPE

22.14.2.1. OUTPATIENT TREATMENT

22.14.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.14.2.1.2. FLUENCY TRANING

22.14.2.1.3. CONTIGENCY MANAGEMENT

22.14.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.14.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.14.2.1.6. OTHERS

22.14.2.2. MONOTHERAPY

22.14.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.14.2.2.2. COGNITIVE RESTRUCTURING

22.14.2.2.3. OTHERS

22.14.2.3. OTHERS

22.15 INFLAMMATION

22.15.1 BY USAGE

22.15.1.1. MEDICATION AUGMENTATION

22.15.1.2. MEDICATION REPLACEMENT

22.15.2 BY TYPE

22.15.2.1. OUTPATIENT TREATMENT

22.15.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.15.2.1.2. FLUENCY TRANING

22.15.2.1.3. CONTIGENCY MANAGEMENT

22.15.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.15.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.15.2.1.6. OTHERS

22.15.2.2. MONOTHERAPY

22.15.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.15.2.2.2. COGNITIVE RESTRUCTURING

22.15.2.2.3. OTHERS

22.15.2.3. OTHERS

22.16 RESPIRATORY

22.16.1 BY USAGE

22.16.1.1. MEDICATION AUGMENTATION

22.16.1.2. MEDICATION REPLACEMENT

22.16.2 BY TYPE

22.16.2.1. OUTPATIENT TREATMENT

22.16.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.16.2.1.2. FLUENCY TRANING

22.16.2.1.3. CONTIGENCY MANAGEMENT

22.16.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.16.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.16.2.1.6. OTHERS

22.16.2.2. MONOTHERAPY

22.16.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.16.2.2.2. COGNITIVE RESTRUCTURING

22.16.2.2.3. OTHERS

22.16.2.3. OTHERS

22.17 CARDIOVASACULAR

22.17.1 BY USAGE

22.17.1.1. MEDICATION AUGMENTATION

22.17.1.2. MEDICATION REPLACEMENT

22.17.2 BY TYPE

22.17.2.1. OUTPATIENT TREATMENT

22.17.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.17.2.1.2. FLUENCY TRANING

22.17.2.1.3. CONTIGENCY MANAGEMENT

22.17.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.17.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.17.2.1.6. OTHERS

22.17.2.2. MONOTHERAPY

22.17.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.17.2.2.2. COGNITIVE RESTRUCTURING

22.17.2.2.3. OTHERS

22.17.2.3. OTHERS

22.18 PAIN MANAGEMENT

22.18.1 BY USAGE

22.18.1.1. MEDICATION AUGMENTATION

22.18.1.2. MEDICATION REPLACEMENT

22.18.2 BY TYPE

22.18.2.1. OUTPATIENT TREATMENT

22.18.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.18.2.1.2. FLUENCY TRANING

22.18.2.1.3. CONTIGENCY MANAGEMENT

22.18.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.18.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.18.2.1.6. OTHERS

22.18.2.2. MONOTHERAPY

22.18.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.18.2.2.2. COGNITIVE RESTRUCTURING

22.18.2.2.3. OTHERS

22.18.2.3. OTHERS

22.19 METABOLIC CONDITIONS

22.19.1 BY USAGE

22.19.1.1. MEDICATION AUGMENTATION

22.19.1.2. MEDICATION REPLACEMENT

22.19.2 BY TYPE

22.19.2.1. OUTPATIENT TREATMENT

22.19.2.1.1. COGNITIVE BEHAVIORAL THERAPY (CBT)

22.19.2.1.2. FLUENCY TRANING

22.19.2.1.3. CONTIGENCY MANAGEMENT

22.19.2.1.4. CRAVING AND TRIGGER ASSESSMENT

22.19.2.1.5. TRANSMUCOSAL BUPRENORPHINE

22.19.2.1.6. OTHERS

22.19.2.2. MONOTHERAPY

22.19.2.2.1. INSOMNIA-SPECIFIC COGNITIVE BEHAVIORAL THERAPY (CBTI)

22.19.2.2.2. COGNITIVE RESTRUCTURING

22.19.2.2.3. OTHERS

22.19.2.3. OTHERS

22.2 OTHERS

23 GLOBAL PRESCRIPTION DIGITAL THERAPEUTICS (DTX) MARKET, BY PATIENTS

23.1 OVERVIEW

23.2 CHILDREN

23.3 ADULTS

24 GLOBAL CELL ANALYSIS MARKET, BY GEOGRAPHY

GLOBAL CELL ANALYSIS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1 NORTH AMERICA

24.1.1 U.S.

24.1.2 CANADA

24.1.3 MEXICO

24.2 EUROPE

24.2.1 GERMANY

24.2.2 FRANCE

24.2.3 U.K.

24.2.4 ITALY

24.2.5 SPAIN

24.2.6 RUSSIA

24.2.7 TURKEY

24.2.8 BELGIUM

24.2.9 NETHERLANDS

24.2.10 SWITZERLAND

24.2.11 REST OF EUROPE

24.3 ASIA-PACIFIC

24.3.1 JAPAN

24.3.2 CHINA

24.3.3 SOUTH KOREA

24.3.4 INDIA

24.3.5 AUSTRALIA

24.3.6 SINGAPORE

24.3.7 THAILAND

24.3.8 MALAYSIA

24.3.9 INDONESIA

24.3.10 PHILIPPINES

24.3.11 REST OF ASIA-PACIFIC

24.4 SOUTH AMERICA

24.4.1 BRAZIL

24.4.2 ARGENTINA

24.4.3 PERU

24.4.4 CHILE

24.4.5 COLOMBIA

24.4.6 VENEZUELA

24.4.7 REST OF SOUTH AMERICA

24.5 MIDDLE EAST AND AFRICA

24.5.1 SOUTH AFRICA

24.5.2 SAUDI ARABIA

24.5.3 UAE

24.5.4 EGYPT

24.5.5 ISRAEL

24.5.6 REST OF MIDDLE EAST AND AFRICA

24.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL CELL ANALYSIS MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL CELL ANALYSIS MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL CELL ANALYSIS MARKET, COMPANY PROFILE

27.1 PEAR THERAPEUTICS, INC.

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPEMENTS

27.2 AKILI INTERACTIVE LABS, INC.

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPEMENTS

27.3 CLICK THERAPEUTICS, INC.

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPEMENTS

27.4 BETTER THERAPEUTICS, LLC

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPEMENTS

27.5 XEALTH

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPEMENTS

27.6 KAIA HEALTH

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPEMENTS

27.7 OMADA HEALTH, INC.

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPEMENTS

27.8 WELLDOC

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPEMENTS

27.9 VOLUNTIS

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPEMENTS

27.1 SOLERA NETWORK

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPEMENTS

27.11 2MORROW INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPEMENTS

27.12 GAIA

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPEMENTS

27.13 RESMED

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPEMENTS

27.14 DTHERA SCIENCES

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPEMENTS

27.15 SAMSUNG

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPEMENTS

27.16 BIGHEALTH

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPEMENTS

27.17 PROPELLER HEALTH

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPEMENTS

27.18 F. HOFFMANN-LA ROCHE LTD

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPEMENTS

27.19 LIMBIX HEALTH, INC

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPEMENTS

27.2 NUVOAIR AB

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPEMENTS

27.21 ALTRAN

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPEMENTS

27.22 SENSYNE HEALTH PLC

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPEMENTS

27.23 BIOFOURMIS

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPEMENTS

27.24 SMARTPATIENT GMBH

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPEMENTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.