Global Pretreatment Coatings Market

Market Size in USD Billion

CAGR :

%

USD

14.13 Billion

USD

20.45 Billion

2024

2032

USD

14.13 Billion

USD

20.45 Billion

2024

2032

| 2025 –2032 | |

| USD 14.13 Billion | |

| USD 20.45 Billion | |

|

|

|

|

Pre-treatment Coatings Market Analysis

The pre-treatment coatings market is witnessing significant growth driven by advancements in coating technologies and the increasing need for sustainable and durable coatings across industries. Pre-treatment coatings are essential for preparing substrates, such as metals and alloys, ensuring proper adhesion, corrosion resistance, and long-term protection of the surface. Recent innovations in the market include eco-friendly formulations that reduce harmful emissions and the use of chromium-free solutions, aligning with stricter environmental regulations. Companies are also integrating nanotechnology into coatings to enhance their properties, offering better durability and protection with thinner layers. The growth in sectors such as automotive, aerospace, construction, and general industry continues to drive demand for advanced pre-treatment coatings that improve the lifespan and performance of coated materials. The Asia-Pacific region leads the market due to the easy availability of raw materials, rapid industrialization, and expanding construction and automotive industries. Increased emphasis on sustainable and energy-efficient coatings has further boosted research and development efforts. These advancements position the pre-treatment coatings market to capitalize on opportunities for innovation and expanded application across various industries.

Pre-treatment Coatings Market Size

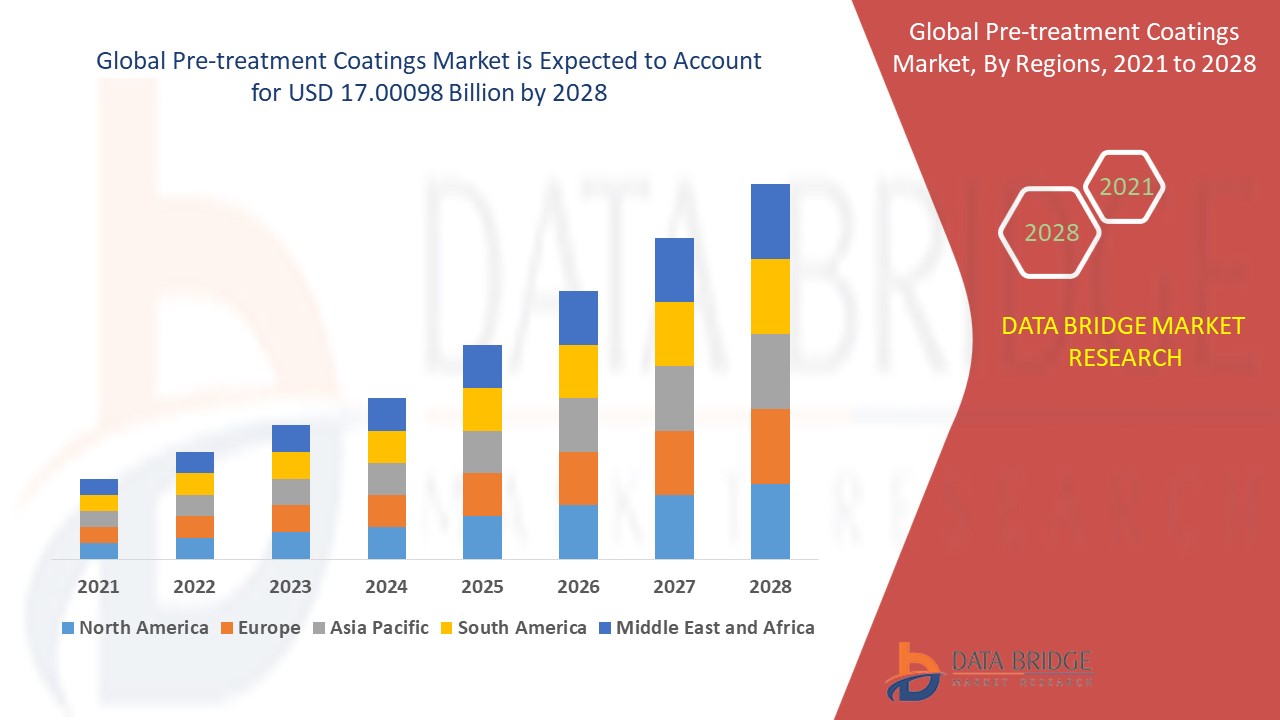

The global pre-treatment coatings market size was valued at USD 14.13 billion in 2024 and is projected to reach USD 20.45 billion by 2032, with a CAGR of 4.73% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Pre-treatment Coatings Market Trends

“Increasing Shift towards Eco-Friendly and Sustainable Formulations”

One significant trend in the pre-treatment coatings market is the shift towards eco-friendly and sustainable formulations. As industries face increased regulatory pressure to reduce environmental impact, manufacturers are investing in chromium-free and water-based pre-treatment solutions that offer robust corrosion protection without harmful emissions. For instance, Henkel’s Bonderite M-NT 41044 technology, introduced in 2024, has streamlined processing steps and minimized water and energy usage while ensuring strong corrosion resistance and paint adhesion. This trend is especially prominent in the automotive and construction industries, where environmental standards are becoming more stringent and the demand for green technologies is rising. Nanotechnology is also being integrated into pre-treatment coatings to enhance adhesion, durability, and protection with thinner coatings, further promoting sustainability. These advancements align with global efforts toward reducing the carbon footprint, positioning eco-friendly pre-treatment coatings as a major driver of market growth and innovation.

Report Scope and Pre-treatment Coatings Market Segmentation

|

Attributes |

Pre-treatment Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

3M (U.S.), Akzo Nobel N.V. (Netherlands), Axalta Coating Systems (U.S.), The Sherwin-Williams Company (U.S.), Nippon Paint (India) Private Limited (India), RPM International Inc. (U.S.), PPG Industries, Inc. (U.S.), Henkel AG & Co. KGaA (Germany), BASF (Germany), NIHON PARKERIZING INDIA PVT. LTD. (India), NEI Corporation (U.S.), Crystal Mark, Inc. (U.S.), Vanchem Performance Chemicals (U.S.), Kansai Paint Co., Ltd. (Japan), Plastic Coatings Limited (U.K.), DUBOIS CHEMICALS (U.S.), and A.D. INTERNATIONAL INDIA (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pre-treatment Coatings Market Definition

Pre-treatment coatings are specialized coatings applied to substrates, typically metals, to prepare their surfaces for subsequent layers such as paint or other protective finishes. These coatings enhance the adhesion of the top coat, provide corrosion resistance, and improve the overall durability of the material. The pre-treatment process often involves cleaning, phosphating, or applying conversion coatings that create a suitable surface for optimal bonding and long-term protection.

Pre-treatment Coatings Market Dynamics

Drivers

- Growing Demand for Corrosion Protection

The growing demand for corrosion protection is a significant market driver for the pre-treatment coatings market, as industries such as automotive, aerospace, and construction require reliable solutions to safeguard their products from corrosion and degradation. Effective pre-treatment coatings help extend the lifespan of materials and ensure consistent performance, which is critical for safety and cost-effectiveness. For instance, in the automotive industry, manufacturers apply pre-treatment coatings to metal components to protect them from moisture, salt, and other environmental elements that could lead to rust and damage. This practice is vital for maintaining vehicle safety and aesthetics over time. Similarly, in the aerospace sector, pre-treatment coatings are used on aircraft parts to withstand harsh weather conditions and reduce the risk of structural failure. The need for durable and long-lasting pre-treatment coatings that enhance corrosion resistance continues to fuel the growth of the market, as industries strive for higher performance, reduced maintenance costs, and improved sustainability.

- Increasing Industrialization and Urbanization

Increasing industrialization and urbanization is a major market driver for the pre-treatment coatings market, particularly in regions such as Asia-Pacific, where rapid economic growth is leading to significant infrastructure and construction projects. This surge in urban development necessitates the use of pre-treatment coatings to prepare and protect metal surfaces from corrosion, wear, and other environmental stressors. For instance, in Asia-Pacific, countries such as China and India are investing heavily in modernizing their infrastructure, including bridges, high-rise buildings, and transportation systems, which requires high-quality pre-treatment coatings to ensure durability and longevity. In addition, the expansion of manufacturing facilities and industrial plants in this region has increased the demand for robust and reliable pre-treatment solutions that can handle harsh working environments and extend the lifespan of machinery and structural components. This trend is driving the market as industries seek cost-effective, long-lasting protection solutions to support their growing infrastructure needs.

Opportunities

- Increasing Regulatory Pressures for Eco-Friendly Solutions

Regulatory pressures for eco-friendly solutions present a significant market opportunity for the pre-treatment coatings market, as stricter environmental standards push industries to adopt sustainable practices. Governments and regulatory bodies worldwide are emphasizing the reduction of harmful chemicals and emissions in manufacturing processes, driving the development of eco-friendly pre-treatment coatings. This has led to innovations such as chromium-free and water-based formulations that minimize environmental impact without compromising on performance. For instance, in the automotive industry, companies are increasingly adopting water-based pre-treatment coatings to reduce VOC (volatile organic compound) emissions, aligning with global efforts to improve air quality and adhere to environmental standards. These eco-friendly solutions help companies meet regulatory requirements and appeal to consumers who prioritize sustainability. As a result, the demand for green and environmentally safe pre-treatment coatings is rising, creating opportunities for manufacturers to invest in research and development to meet the evolving needs of the market.

- Increasing Advancements in Coating Technologies

Advancements in coating technologies represent a significant market opportunity for the pre-treatment coatings market, as innovations such as nanotechnology and smart coatings offer enhanced properties that cater to the growing demand for more efficient and durable solutions. These advancements improve the adhesion, corrosion resistance, and overall performance of coatings, making them suitable for a variety of demanding applications. For instance, nanotechnology allows for the development of ultra-thin coatings that provide superior protection without adding bulk, which is particularly valuable in sectors such as aerospace and automotive, where weight reduction and enhanced durability are critical. Similarly, smart coatings equipped with self-healing properties can automatically repair minor damage, ensuring long-term protection and reducing maintenance costs. This trend is driving market growth as industries seek to leverage these technologies for better performance, reduced downtime, and increased operational efficiency. As a result, manufacturers investing in cutting-edge coating technologies are well-positioned to meet the evolving needs of the market and gain a competitive edge.

Restraints/Challenges

- Rising Environmental Concerns over Metal Finishing and Toxic Effects

Rising environmental concerns over metal finishing and toxic effects pose a significant market challenge for the pre-treatment coatings market, as industries face increasing pressure to adopt safer and more sustainable practices. Traditional metal finishing processes often involve hazardous chemicals, such as chromium and zinc, which pose risks to both human health and the environment through emissions and waste products. For instance, the use of hexavalent chromium in pre-treatment coatings has been linked to serious health issues and is subject to stringent regulatory restrictions. This has led to higher compliance costs and a need for industries to shift towards eco-friendly alternatives that minimize toxicity and environmental impact. The transition to safer, non-toxic formulations such as chromium-free and water-based coatings requires significant investment in research and development, posing a challenge for companies to balance performance, cost, and environmental responsibility. As environmental regulations become stricter, manufacturers must innovate to meet these standards while maintaining product effectiveness.

- Stringent Regulations Imposed by Governments

Stringent regulations imposed by governments present a significant market challenge for the pre-treatment coatings market, as industries must navigate complex compliance requirements to remain operational. Governments worldwide are enforcing stricter environmental standards to reduce pollution and protect public health, which directly impacts the production and use of certain pre-treatment coatings. For instance, regulations on volatile organic compounds (VOCs) limit the emissions from coatings, pushing manufacturers to develop more eco-friendly products that meet these criteria. The European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation and the U.S. EPA (Environmental Protection Agency) standards are among the stringent policies that require industries to phase out hazardous substances such as lead and hexavalent chromium, leading to increased research, development, and compliance costs. This shift can be financially burdensome for manufacturers, especially smaller companies, and may hinder innovation or increase the price of pre-treatment coatings, presenting challenges in maintaining market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Pre-treatment Coatings Market Scope

The market is segmented on the basis of product, end user, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Pre-Paint Conversion Coatings

- Anti-Corrosive Coatings

- Metalworking Fluids Coatings

- Cleaners Coatings

- Final Seals Coatings

End User

- Aerospace

- Automotive

- General Industry

- Coil Industry

- Cold Forming Industry

- Others

Application

- Metal

- Aluminum

- Zn-Al Alloys and Die Casting

- Others

Pre-treatment Coatings Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, end user, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the pre-treatment coatings market. This can be attributed to the abundant availability of resources, including raw materials. In addition, the region is expected to register the highest compound annual growth rate (CAGR) during the forecast period due to the increasing adoption of pre-treatment coatings across various end-user sectors. Factors such as rapid urbanization and the expansion of construction activities are also key drivers of market growth. Moreover, the rising emphasis on environmentally friendly coating materials is set to create attractive opportunities for further market development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Pre-treatment Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Pre-treatment Coatings Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Axalta Coating Systems (U.S.)

- The Sherwin-Williams Company (U.S.)

- Nippon Paint (India) Private Limited (India)

- RPM International Inc. (U.S.)

- PPG Industries, Inc. (U.S.)

- Henkel AG & Co. KGaA (Germany)

- BASF (Germany)

- NIHON PARKERIZING INDIA PVT. LTD. (India)

- NEI Corporation (U.S.)

- Crystal Mark, Inc. (U.S.)

- Vanchem Performance Chemicals (U.S.)

- Kansai Paint Co., Ltd. (Japan)

- Plastic Coatings Limited (U.K.)

- DUBOIS CHEMICALS (U.S.)

- A.D. INTERNATIONAL INDIA (India)

Latest Developments in Pre-treatment Coatings Market

- In June 2024, Henkel, a leader in coating pretreatment solutions, launched its new cleaner and coater technology, Bonderite M-NT 41044, designed to enhance efficiency and sustainability in metal pretreatment. In addition, this advanced solution streamlines processing steps from ten to four, significantly saving water and energy while ensuring strong corrosion protection and paint adhesion

- In November 2023, Henkel expanded its manufacturing capacity in Spain by introducing solvent- and chromium-free metal pretreatment technologies, boosting its range of coating solutions available to European facilities

- In December 2022, AkzoNobel acquired the liquid wheel coatings division of Lankwitzer Lackfabrik GmbH, enhancing its performance coatings portfolio. In addition, this acquisition complements AkzoNobel’s existing powder coatings range and broadens the scope of innovative products offered by the company

- In February 2022, PPG announced its acquisition of Arsonsisi’s powder coatings business, an industrial coatings firm based in Milan, Italy. In addition, Arsonsisi is known for its specialty powder coatings catering to the industrial and architectural sectors. In addition, the deal included Arsonsisi’s highly automated powder manufacturing plant in Verbania, capable of producing both small and large batches

- In February 2021, Henkel Adhesive Technologies partnered with ChemPoint, a subsidiary of Univar Solutions Inc., to establish a distribution agreement for the sale, marketing, and distribution of Henkel’s BONDERITE products in the U.S. and Canada

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pretreatment Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pretreatment Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pretreatment Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.