Global Preventive Health Screening Services Market

Market Size in USD Billion

CAGR :

%

USD

5.15 Billion

USD

26.74 Billion

2024

2032

USD

5.15 Billion

USD

26.74 Billion

2024

2032

| 2025 –2032 | |

| USD 5.15 Billion | |

| USD 26.74 Billion | |

|

|

|

|

Preventive Health Screening Services Market Size

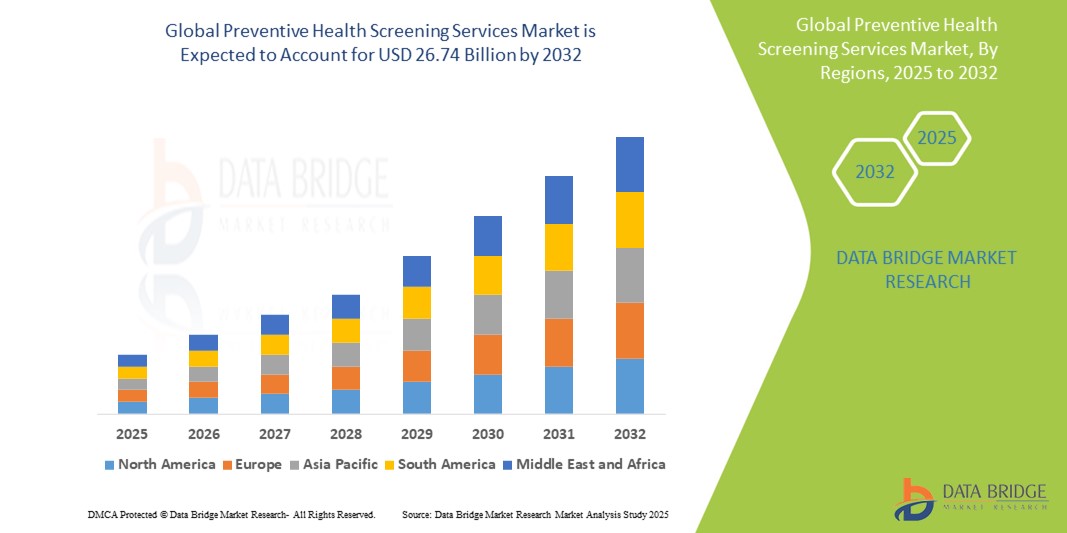

- The global preventive health screening services market size was valued at USD 5.15 billion in 2024 and is expected to reach USD 26.74 billion by 2032, at a CAGR of 22.90% during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, increasing health awareness, and a growing emphasis on early disease detection and preventive healthcare

Preventive Health Screening Services Market Analysis

- Preventive health screening services are essential tools used to detect diseases at an early stage, enabling timely intervention and improved health outcomes. These services include screenings for cardiovascular diseases, cancers, diabetes, and other chronic conditions

- The market demand is driven by rising awareness of preventive healthcare, increasing incidence of lifestyle-related diseases, and growing investments in health infrastructure

- North America is expected to dominate the preventive health screening services market with a market share of 39.2%, due to well-established healthcare infrastructure, widespread adoption of preventive care practices, and supportive government initiatives

- Asia Pacific is expected to be the fastest growing region in the preventive health screening services market with a market share of 28.4%, during the forecast period due to rising healthcare awareness, expanding medical infrastructure, and government-led health screening campaigns

- Telemedicine segment is expected to dominate the market with a market share of 33.1% due to its ability to provide convenient, remote access to healthcare, especially in underserved and rural areas. It enables real-time consultations, continuous health monitoring, and early detection of chronic conditions without the need for physical visits

Report Scope and Preventive Health Screening Services Market Segmentation

|

Attributes |

Preventive Health Screening Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Preventive Health Screening Services Market Trends

“Integration of AI and Digital Health Technologies in Preventive Screenings”

- One prominent trend in the preventive health screening services market is the growing adoption of artificial intelligence (AI) and digital health tools to enhance the accuracy, accessibility, and efficiency of screening services

- These technologies enable early and more precise detection of diseases by analyzing large datasets, identifying risk factors, and offering personalized health recommendations

- For instance, AI-powered diagnostic platforms and wearable devices are being used for continuous health monitoring and early identification of anomalies, significantly aiding in the screening of conditions such as cardiovascular diseases and diabetes

- This trend is reshaping the preventive care landscape by enabling proactive health management, expanding access to screenings in remote areas, and driving demand for smart, technology-enabled preventive solutions

Preventive Health Screening Services Market Dynamics

Driver

“Rising Burden of Chronic Diseases and Need for Early Detection”

- The increasing global burden of chronic diseases such as cardiovascular disorders, cancer, diabetes, and respiratory illnesses is a major driver for the preventive health screening services market

- Early detection through regular screenings is essential in reducing disease progression, lowering treatment costs, and improving long-term health outcomes, prompting higher uptake of preventive services

- With aging populations and lifestyle changes contributing to the rise in chronic conditions, governments and healthcare providers are placing a stronger emphasis on preventive care strategies

For instance,

- According to the World Health Organization (WHO), noncommunicable diseases account for over 70% of all global deaths, with many of these conditions being preventable or manageable through early detection and lifestyle interventions

- As a result of the growing prevalence of chronic diseases, there is a heightened demand for accessible and effective preventive screening services across healthcare systems worldwide

Opportunity

“Leveraging AI and Digital Platforms to Expand Screening Access and Precision”

- The integration of artificial intelligence (AI) and digital platforms presents a significant opportunity to enhance the reach, efficiency, and accuracy of preventive health screening services

- AI tools can analyze health data to identify at-risk individuals, personalize screening schedules, and detect early signs of diseases with greater precision, even in asymptomatic populations

- Digital health platforms, including mobile health apps and telemedicine services, can facilitate remote screenings, improve patient engagement, and expand access in underserved and rural regions

For instance,

- In February 2024, according to a report by the Lancet Digital Health, AI-based models have demonstrated high accuracy in screening for conditions such as breast cancer and cardiovascular risk factors using imaging and patient data. These tools are not only enhancing diagnostic accuracy but are also streamlining workflows and reducing clinician workload

- The widespread adoption of AI and digital technologies in preventive health screening can lead to early diagnosis, improved health outcomes, and reduced healthcare costs by enabling proactive, data-driven care delivery

Restraint/Challenge

“High Costs and Limited Reimbursement for Preventive Screening”

- The high cost of certain preventive screening services and the lack of comprehensive reimbursement policies in several countries pose significant barriers to widespread adoption

- While early detection can reduce long-term treatment expenses, the upfront costs of advanced screening technologies or regular health check-ups may be unaffordable for individuals in low- and middle-income regions

- Inadequate insurance coverage for preventive services can discourage individuals from undergoing timely screenings, especially in markets where out-of-pocket expenses remain high

For instance,

- According to a report published by the OECD in September 2023, despite the recognized benefits of preventive care, limited public funding and coverage gaps in insurance plans result in underutilization of screening services, particularly among low-income and underserved populations

- Consequently, the lack of affordable and accessible screening options can lead to missed opportunities for early diagnosis, perpetuating health disparities and constraining market growth globally

Preventive Health Screening Services Market Scope

The market is segmented on the basis of service type, technology type, and end user

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Technology Type |

|

|

By End User |

|

In 2025, the telemedicine is projected to dominate the market with a largest share in technology type segment

The telemedicine segment is expected to dominate the preventive health screening services market with the largest share of 33.1% in 2025 due to its ability to provide convenient, remote access to healthcare, especially in underserved and rural areas. It enables real-time consultations, continuous health monitoring, and early detection of chronic conditions without the need for physical visits. In addition, telemedicine reduces healthcare costs and enhances patient engagement, making preventive screenings more accessible and efficient

The diagnostic services is expected to account for the largest share during the forecast period in service type market

In 2025, the diagnostic services segment is expected to dominate the market with the largest market share of 32.8% due to its critical role in early disease detection and health risk assessment. The growing prevalence of chronic diseases and increasing awareness of routine health check-ups are driving demand for accurate and timely diagnostics. Advancements in diagnostic technologies and greater availability of laboratory services further support this segment's growth

Preventive Health Screening Services Market Regional Analysis

“North America Holds the Largest Share in the Preventive Health Screening Services Market”

- North America dominates the preventive health screening services market with a market share of estimated 39.2%, driven, by well-established healthcare infrastructure, widespread adoption of preventive care practices, and supportive government initiatives

- U.S. holds a market share of 60.5%, due to high healthcare spending, advanced diagnostic technologies, and strong emphasis on early disease detection

- Robust insurance coverage for preventive screenings under programs such as Medicare and the Affordable Care Act further promotes accessibility and utilization of these services

- In addition, the increasing public awareness, growing chronic disease burden, and integration of digital health solutions continue to support market growth across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Preventive Health Screening Services Market”

- Asia-Pacific is expected to witness the highest growth rate in the Preventive Health Screening Services market with a market share of 28.4%, driven by rising healthcare awareness, expanding medical infrastructure, and government-led health screening campaigns

- Countries such as China, India, and South Korea are emerging as significant contributors due to growing aging populations and increased prevalence of lifestyle-related diseases such as diabetes and cardiovascular disorders

- Japan remains a key market, benefiting from early adoption of AI and digital health solutions to enhance the efficiency and precision of preventive screenings

- India is projected to register the highest CAGR in the region, supported by government initiatives such as Ayushman Bharat, increasing urbanization, and improved access to primary and preventive healthcare services

Preventive Health Screening Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Labcorp (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- BD (U.S.)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Medtronic (Ireland)

- Henry Schein, Inc. (U.S.)

- Canon Medical Systems Corporation (Japan)

- Hologic, Inc. (U.S.)

- Cerner Corporation (U.S.)

- Mayo Clinic (U.S.)

- Bupa (U.K.)

- HealthScreen UK (U.K.)

- Preventive Medicine Institute (U.S.)

- ZorgSaam (Netherlands)

- Sutter Health (U.S.)

Latest Developments in Global Preventive Health Screening Services Market

- In May 2025, The U.S. Food and Drug Administration approved Teal Health's at-home cervical cancer screening device, the Teal Wand. This innovative tool allows women to self-collect samples for HPV testing, offering a more comfortable alternative to traditional Pap smears. Clinical trials demonstrated that the test produced accurate results on the first try in 98% of cases, with 94% of users preferring it over in-office screenings. The device is set to launch in California in June 2025, with plans for nationwide availability later in the year

- In May 2025, The Tamil Nadu government initiated a door-to-door cancer screening campaign in Coimbatore city. The program involves health volunteers conducting screenings for oral, breast, and cervical cancers, aiming to screen approximately 13.7 lakh people for oral cancer and six lakh women for breast and cervical cancers. Advanced diagnostic procedures are conducted at specialized medical facilities, with confirmed cases referred to Coimbatore Medical College and Hospital

- In March 2025, The public health department in Trichy launched a comprehensive cancer screening program targeting individuals aged 18 and above. The initiative focuses on detecting oral, breast, and cervical cancers across 87 primary health centers and 167 urban health and wellness centers. The program aims to screen around 22.2 lakh individuals for oral cancer and 7.7 lakh women for breast and cervical cancers

- In February 2025, Kerala's Health Minister announced that special cancer screenings will be conducted twice a week at family health centers as part of the 'Aarogyam Anandam - Akattam Arbudam' campaign. Since its inception on World Cancer Day, over 1.55 million people have been screened, with 242 cancer cases detected, mostly in early stages. The initiative includes screenings for various cancers, such as breast, cervical, oral, lung, rectal, prostate, and liver cancers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.