Global Private 5g Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

57.24 Billion

2024

2032

USD

2.97 Billion

USD

57.24 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 57.24 Billion | |

|

|

|

|

Private 5G Market Size

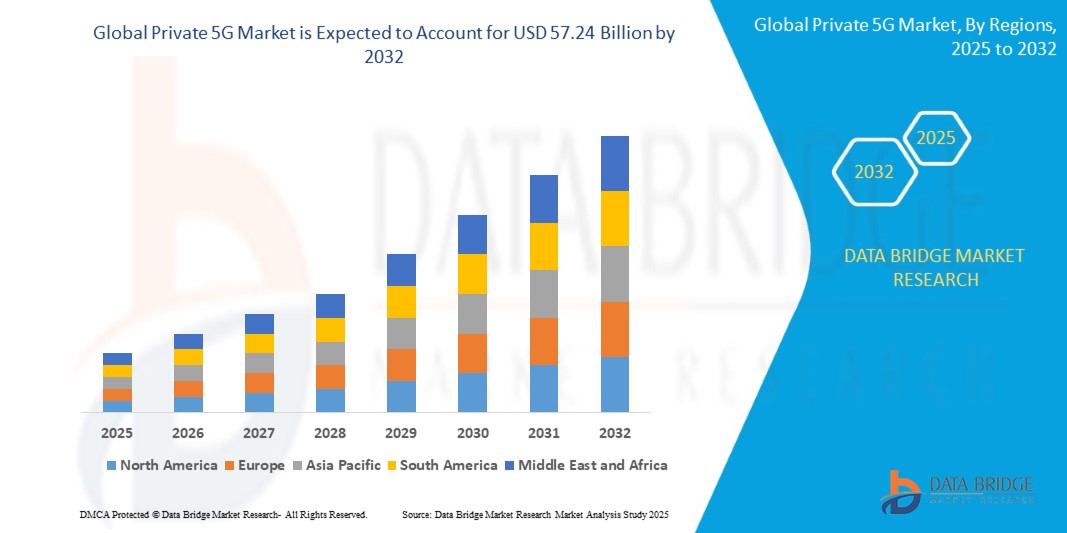

- The global private 5G market size was valued at USD 2.97 billion in 2024 and is expected to reach USD 57.24 billion by 2032, at a CAGR of 44.7% during the forecast period

- The market growth is largely fuelled by the increasing adoption of private networks across industries for enhanced connectivity, security, and control

- Rising demand for low-latency and reliable networks to support automation, IoT, and Industry 4.0 applications

Private 5G Market Analysis

- The private 5G market is witnessing rapid expansion due to enterprises seeking customized and secure network solutions that support digital transformation initiatives.

- Industries such as manufacturing, healthcare, logistics, and energy are increasingly deploying private 5G networks to improve operational efficiency, enable real-time monitoring, and enhance data privacy

- North America dominated the global private 5G market with the largest revenue share of 32.5% in 2024, driven by the increasing deployment of private networks across manufacturing, healthcare, and enterprise campuses. The region’s early adoption of 5G technology, robust industrial infrastructure, and strong government support for spectrum allocation are major contributors

- Asia-Pacific region is expected to witness the highest growth rate in the global private 5G market, driven by rapid urbanization, expanding manufacturing and logistics sectors, and rising investments in smart factories and IoT-enabled enterprise solutions

- The hardware segment held the largest revenue share in 2024, driven by the high demand for network infrastructure including base stations, routers, and antennas. Hardware investment is critical for ensuring reliable coverage, low latency, and high bandwidth, particularly in industrial and enterprise environment

Report Scope and Private 5G Market Segmentation

|

Attributes |

Private 5G Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Private 5G Market Trends

Adoption of Private 5G Networks Across Industries

- The increasing deployment of private 5G networks is reshaping enterprise connectivity by providing high-speed, low-latency, and secure communication tailored to organizational needs. Companies are leveraging these networks for real-time data transfer, automation, and IoT integration, enhancing operational efficiency and reducing dependency on public networks

- The demand for reliable and dedicated network infrastructure is rising in sectors such as manufacturing, logistics, energy, and healthcare, where downtime and delays can be costly. Enterprises are investing in private 5G to enable seamless operations, support industrial automation, and facilitate smart factory initiatives

- Advances in network slicing, edge computing, and AI-driven management tools are driving adoption, allowing companies to customize network performance for specific applications. The scalability and flexibility of private 5G solutions make them suitable for large campuses, multi-site operations, and mission-critical environments

- For instance, in 2023, several automotive manufacturers in Germany implemented private 5G networks across production plants to support real-time robotics control and predictive maintenance, significantly reducing operational interruptions and improving throughput

- While private 5G networks are enabling digital transformation and operational efficiency, their success depends on deployment expertise, interoperability, and regulatory compliance. Providers must focus on industry-specific solutions and localized support to fully capitalize on this market trend

Private 5G Market Dynamics

Driver

Growing Demand for Low-Latency and Reliable Connectivity in Enterprises

- Enterprises are increasingly prioritizing private 5G networks to support real-time applications, mission-critical operations, and IoT-driven automation. Low latency and high reliability enable better control over industrial processes, logistics tracking, and remote monitoring. This allows enterprises to implement advanced technologies such as robotics, AR/VR, and predictive maintenance with minimal downtime

- Companies are recognizing the business value of secure, private networks in minimizing downtime, protecting sensitive data, and improving productivity. The shift is further reinforced by digital transformation initiatives and the need to support remote operations. Enterprises are also able to maintain end-to-end network visibility and enhance cybersecurity, which is critical in regulated industries

- Government initiatives and industry standards promoting 5G adoption provide a favorable environment for private networks. Policies encouraging spectrum allocation and public-private partnerships are helping enterprises deploy private 5G solutions effectively. In addition, funding programs and pilot projects are enabling early adoption across industrial hubs

- For example, in 2022, a leading port authority in Singapore deployed a private 5G network to optimize logistics operations and enable autonomous vehicle management, boosting efficiency and safety. The deployment also improved predictive monitoring of cargo movements and reduced operational bottlenecks, serving as a model for other port authorities globally

- While demand is driving adoption, successful deployment requires skilled personnel, integration with legacy systems, and ongoing network management to ensure consistent performance. Companies must also invest in training programs, monitoring tools, and maintenance frameworks to fully realize the benefits of private 5G networks

Restraint/Challenge

High Deployment Costs and Regulatory Complexities

- The significant investment required for private 5G network deployment, including spectrum licensing, infrastructure, and maintenance, limits adoption among small and medium-sized enterprises. Initial capital expenditure remains a critical barrier, often delaying or preventing implementation. Organizations must carefully evaluate ROI and consider phased or shared deployment models to manage costs effectively

- Regulatory hurdles, including spectrum allocation, local compliance, and interoperability standards, pose challenges for companies seeking to implement private 5G networks across multiple regions. Navigating differing regulatory frameworks increases deployment timelines and requires close coordination with authorities, which can hinder expansion plans for multinational operations

- Integration with existing IT infrastructure and legacy systems can be complex, requiring technical expertise and long-term planning. Without proper integration, enterprises risk network inefficiencies and security vulnerabilities. Aligning 5G deployment with existing ERP, cloud, and edge computing systems is critical to ensure seamless operations

- For instance, in 2023, several mid-sized manufacturers in India delayed private 5G adoption due to high infrastructure costs and uncertainty around regulatory approvals. These delays also affected their ability to deploy automation and smart factory solutions, impacting operational efficiency and competitiveness in regional markets

- While technology and adoption continue to evolve, addressing cost and regulatory challenges is essential. Market stakeholders must focus on scalable deployment models, partnerships, and industry-specific solutions to maximize long-term growth potential. Investments in flexible infrastructure, vendor collaboration, and public-private initiatives can help overcome these barriers and accelerate adoption

Private 5G Market Scope

The market is segmented on the basis of component, frequency, spectrum, enterprise size, and vertical.

• By Component

On the basis of component, the market is categorized into hardware, software, and services. The hardware segment held the largest revenue share in 2024, driven by the high demand for network infrastructure including base stations, routers, and antennas. Hardware investment is critical for ensuring reliable coverage, low latency, and high bandwidth, particularly in industrial and enterprise environments.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing adoption of network management platforms, analytics tools, and security solutions. Software-enabled private 5G networks allow enterprises to optimize performance, manage traffic, and enforce security policies efficiently across multiple sites.

• By Frequency

On the basis of frequency, the market is segmented into Sub-6 GHz and mmWave. The Sub-6 GHz segment dominated in 2024 due to its broader coverage, better penetration, and suitability for industrial campuses and enterprise buildings. Sub-6 GHz frequencies provide a reliable balance between range and speed, supporting IoT devices, automation, and real-time monitoring.

The mmWave segment is expected to witness the fastest growth rate from 2025 to 2032, driven by ultra-high-speed connectivity and low-latency requirements for applications such as autonomous robots, AR/VR-enabled training, and real-time AI analytics. mmWave networks are particularly deployed in dense enterprise environments requiring high throughput.

• By Spectrum

Based on spectrum, the market is divided into licensed and unlicensed/shared. The licensed spectrum segment accounted for the largest revenue share in 2024, as enterprises prefer dedicated spectrum for secure, reliable, and interference-free communication. Licensed spectrum enables predictable network performance and compliance with regulatory standards.

The unlicensed/shared spectrum segment is expected to witness the fastest growth rate from 2025 to 2032 due to cost advantages and flexible deployment options. Shared spectrum allows enterprises to implement private 5G without the high costs of acquiring licensed bands, making it attractive for SMEs and pilot deployments.

• By Enterprise Size

On the basis of enterprise size, the market is categorized into small & medium enterprises (SMEs) and large enterprises. Large enterprises accounted for the majority of revenue in 2024, driven by their capability to invest in infrastructure-heavy private 5G deployments across multiple locations. These networks enable automation, remote monitoring, and high-security communication for critical operations.

SMEs is expected to witness the fastest growth rate from 2025 to 2032, due to the availability of scalable, cloud-managed solutions and flexible deployment models. SMEs are increasingly adopting private 5G to enhance operational efficiency, reduce network dependency, and support digital transformation initiatives.

• By Vertical

On the basis of vertical, the market is segmented into manufacturing/factories, energy & utilities, transportation & logistics, defense, enterprises & campus, mining, healthcare/hospitals, oil & gas, retail, agriculture, smart cities, and others. The manufacturing and factory vertical led the market in 2024 due to the high adoption of industrial automation, robotics, and IoT-enabled production systems. Private 5G networks in manufacturing improve operational efficiency, predictive maintenance, and real-time monitoring.

The healthcare/hospitals and smart cities verticals is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for connected devices, remote monitoring, and critical communication infrastructure. These verticals benefit from low-latency, high-reliability networks for patient care, surveillance, and smart city applications.

Private 5G Market Regional Analysis

- North America dominated the global private 5G market with the largest revenue share of 32.5% in 2024, driven by the increasing deployment of private networks across manufacturing, healthcare, and enterprise campuses. The region’s early adoption of 5G technology, robust industrial infrastructure, and strong government support for spectrum allocation are major contributors

- Enterprises in North America highly value low-latency, high-security, and reliable connectivity for real-time operations, industrial automation, and IoT applications. The ability to deploy customized networks enables organizations to enhance operational efficiency and maintain competitive advantage

- This widespread adoption is further supported by high technological awareness, substantial R&D investment, and collaborations between telecom providers and enterprise customers, establishing private 5G networks as a key enabler of digital transformation in the region

U.S. Private 5G Market Insight

The U.S. private 5G market captured the largest revenue share in North America in 2024, driven by extensive adoption in large-scale industrial facilities, logistics hubs, and smart campuses. Enterprises are increasingly investing in private 5G to support mission-critical applications, industrial IoT, and automation initiatives. The growing integration of edge computing, AI-driven network management, and cloud-based solutions is further boosting market growth. Moreover, U.S. government initiatives promoting 5G adoption and spectrum allocation are significantly contributing to the expansion of private networks.

Europe Private 5G Market Insight

The Europe private 5G market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by industrial digitalization, automation initiatives, and regulatory support for spectrum licensing. Countries such as Germany, France, and the U.K. are witnessing increased deployment of private 5G in manufacturing, logistics, and healthcare sectors. European enterprises are adopting private networks for enhanced cybersecurity, real-time monitoring, and operational efficiency, while smart campus and industrial use cases are fueling demand.

U.K. Private 5G Market Insight

The U.K. private 5G market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising enterprise investments in Industry 4.0 solutions and smart infrastructure. Key industries, including manufacturing and transportation, are deploying private 5G to optimize automation, reduce downtime, and improve operational safety. The U.K.’s strong telecommunications ecosystem and digital initiatives are further driving adoption across commercial and enterprise campuses.

Germany Private 5G Market Insight

The Germany private 5G market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s advanced manufacturing sector, Industry 4.0 initiatives, and strong industrial automation ecosystem. Enterprises are increasingly deploying private 5G networks to support connected factories, robotics, and real-time analytics. Germany’s emphasis on innovation, cybersecurity, and efficient production practices is encouraging large-scale adoption of private 5G solutions.

Asia-Pacific Private 5G Market Insight

The Asia-Pacific private 5G market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid urbanization, industrial modernization, and growing investments in smart manufacturing and logistics. Countries such as China, Japan, South Korea, and India are at the forefront of deploying private networks to enable low-latency, high-speed communication for enterprises. Government initiatives supporting 5G infrastructure, coupled with the region’s strong manufacturing base, are further driving adoption.

Japan Private 5G Market Insight

The Japan private 5G market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s technologically advanced industries, high smartphone penetration, and growing demand for smart factories and IoT-enabled operations. Enterprises are deploying private 5G to support automation, predictive maintenance, and real-time monitoring across commercial and industrial sectors. Integration with AI, edge computing, and industrial IoT platforms is fueling growth in the Japanese market.

China Private 5G Market Insight

The China private 5G market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to extensive adoption across manufacturing, logistics, and healthcare sectors. The country’s rapid industrialization, smart city initiatives, and government support for 5G deployment are key growth drivers. Affordable private 5G solutions and a robust domestic telecom ecosystem are further facilitating widespread enterprise adoption.

Private 5G Market Share

The Private 5G industry is primarily led by well-established companies, including:

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia Corporation (Finland)

- Samsung Electronics Co., Ltd. (South Korea)

- ZTE Corporation (China)

- Deutsche Telekom Group (Germany)

- AT&T Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Verizon Communications (U.S.)

- Altiostar (U.S.)

- HUAWEI TECHNOLOGIES CO., LTD. (China)

- Mavenir (U.S.)

- T-Systems International GmbH (Germany)

- Cisco Systems, Inc. (U.S.)

- Vodafone Group Plc (U.K.)

- BT Group (U.K.)

Latest Developments in Global Private 5G Market

- In March 2024, SoftBank Corp. launched its dedicated Private 5G service, enabling local governments, organizations, and enterprises to deploy customized 5G networks with dedicated base stations on their premises. The service is designed to provide low-latency, high-performance connectivity, making it ideal for smart factory applications and advanced industrial operations, thereby enhancing productivity and driving adoption of private 5G in enterprise sectors

- In December 2023, Telefonaktiebolaget LM Ericsson partnered with Orange to offer B2B customers the ability to implement their own private 5G networks. This collaboration aims to provide scalable, secure, and enterprise-focused connectivity solutions, supporting digital transformation and accelerating private 5G deployment across industries

- In September 2023, Deutsche Telekom launched its ‘Campus Network Smart’ private 5G solution in partnership with Microsoft Corporation. The cloud-based, scalable solution uses a pay-as-you-grow model, allowing enterprises to efficiently deploy and expand private 5G networks, enhancing operational flexibility and strengthening the company’s presence in the growing private 5G market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Private 5g Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Private 5g Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Private 5g Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.