Global Real Time Health Monitoring Via Iot Market

Market Size in USD Billion

CAGR :

%

USD

4.41 Billion

USD

12.32 Billion

2024

2032

USD

4.41 Billion

USD

12.32 Billion

2024

2032

| 2025 –2032 | |

| USD 4.41 Billion | |

| USD 12.32 Billion | |

|

|

|

|

Real-Time Health Monitoring via IoT Market Size

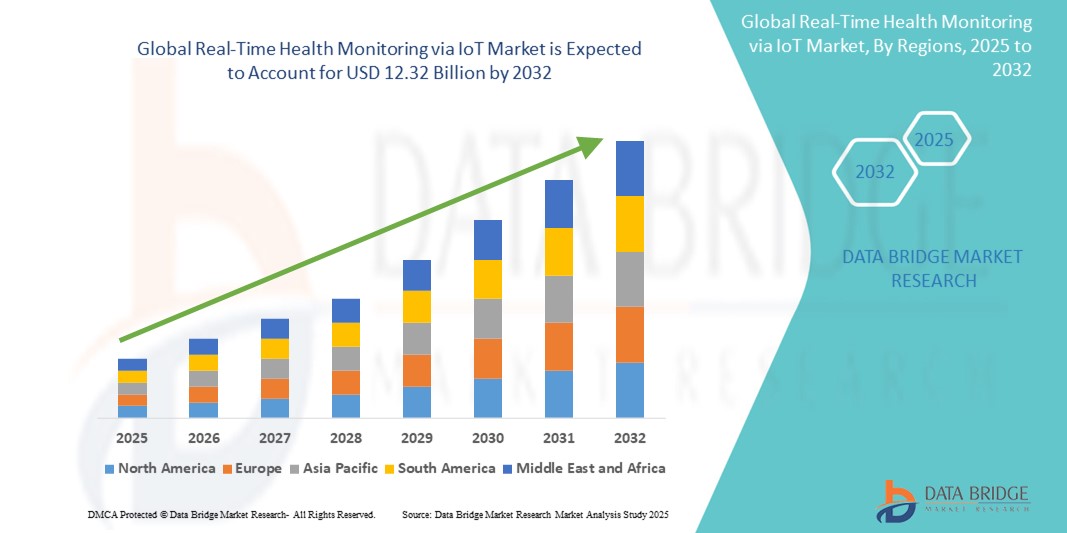

- The global real-time health monitoring via IoT market size was valued at USD 4.41 billion in 2024 and is expected to reach USD 12.32 billion by 2032, at a CAGR of 13.70% during the forecast period

- The market growth is largely fueled by the rising integration of IoT-enabled devices in healthcare, enabling continuous and remote monitoring of patient vitals, thereby transforming traditional care models

- Furthermore, increasing demand for proactive and preventive healthcare, coupled with technological advancements in wearable and implantable medical devices, is establishing real-time health monitoring as a cornerstone of modern digital health. These converging factors are accelerating the adoption of IoT-based monitoring solutions, thereby significantly boosting the industry’s growth

Real-Time Health Monitoring via IoT Market Analysis

- Real-time health monitoring via IoT is reshaping healthcare delivery by integrating medical devices, systems, and software with advanced connectivity to enable continuous, remote, and data-driven patient monitoring across clinical and non-clinical settings

- The accelerating market demand is fueled by increasing deployment of remote patient monitoring solutions, expansion of digital health infrastructure, and a growing focus on improving clinical workflow efficiency through connected systems

- North America dominated the real-time health monitoring via IoT market with the largest revenue share of 39.1% in 2024, supported by wide adoption of Bluetooth and Wi-Fi–enabled devices, strong healthcare IT infrastructure, and active government initiatives promoting telehealth and patient monitoring in hospitals and home care

- Asia-Pacific is expected to be the fastest growing region during the forecast period, driven by expanding telemedicine networks, increasing investment in cellular and LPWAN-based medical IoT infrastructure, and growing uptake of wearable devices for at-home care

- The medical devices segment dominated the market with a 47.2% share in 2024, driven by widespread use of wearable and implantable technologies for real-time tracking of health metrics

Report Scope and Real-Time Health Monitoring via IoT Market Segmentation

|

Attributes |

Real-Time Health Monitoring via IoT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Real-Time Health Monitoring via IoT Market Trends

“AI-Powered Predictive Monitoring and Digital Health Integration”

- A significant and accelerating trend in the global real-time health monitoring via IoT market is the growing integration of artificial intelligence (AI) with connected medical devices and digital health platforms. This convergence is enabling predictive analytics, real-time alerts, and personalized insights, significantly enhancing patient care and decision-making for healthcare providers

- For instance, the BioIntelliSense BioSticker and Apple Watch utilize AI to monitor vital signs such as heart rate, temperature, and respiratory rate, enabling early detection of anomalies. Similarly, AI-based platforms integrated with wearables can forecast potential health risks, helping in preventive care planning

- AI integration in real-time health monitoring enables features such as automated anomaly detection, adaptive alert thresholds, and health trend forecasting. For instance, connected ECG monitors powered by AI can identify arrhythmias with higher precision, while predictive models in glucose monitoring systems can suggest adjustments before abnormal spikes occur. Furthermore, AI-powered alerts improve clinical response times by notifying providers only when critical deviations are detected, reducing alarm fatigue

- The seamless integration of IoT-enabled monitoring systems with electronic health records (EHRs), telehealth platforms, and digital therapeutics facilitates centralized access to longitudinal patient data. Through unified interfaces, clinicians can make informed decisions, track disease progression, and personalize treatment strategies

- This trend towards intelligent, automated, and integrated health monitoring systems is fundamentally reshaping expectations in both clinical and consumer healthcare settings. Consequently, companies such as Philips and Medtronic are expanding their AI-enabled IoT solutions with enhanced interoperability, predictive modeling, and real-time diagnostics

- The demand for real-time monitoring systems that incorporate AI and offer seamless integration with digital health ecosystems is rapidly increasing across hospitals, home care settings, and research institutions, as healthcare providers aim to improve outcomes and optimize resource utilization

Real-Time Health Monitoring via IoT Market Dynamics

Driver

“Rising Demand for Preventive Healthcare and Chronic Disease Management”

- The increasing prevalence of chronic diseases, aging populations, and rising healthcare costs are driving the demand for real-time health monitoring via IoT, particularly in preventive care and long-term disease management settings

- For instance, remote monitoring devices for hypertension, diabetes, and heart disease are being deployed to support continuous care, with companies such as Dexcom and Abbott expanding real-time glucose monitoring options. Such developments are expected to propel market growth over the forecast period

- As healthcare systems focus on reducing hospital readmissions and promoting at-home patient care, IoT-based monitoring devices offer critical features such as continuous vital sign tracking, patient engagement, and real-time alerts. These systems improve treatment adherence, reduce emergency visits, and support personalized care interventions

- Furthermore, policy support and reimbursement frameworks in regions such as North America and Europe are encouraging the adoption of remote health monitoring, integrating it as a core component of modern value-based healthcare models

- The convenience of continuous monitoring, improved patient autonomy, and real-time data access for providers are key factors driving the uptake of IoT health monitoring technologies in hospitals, clinics, and home care environments. The trend towards connected, proactive healthcare solutions continues to shape industry growth

Restraint/Challenge

“Data Security Risks and Interoperability Limitations”

- Concerns over data privacy, cybersecurity vulnerabilities, and lack of interoperability present significant barriers to the widespread adoption of real-time health monitoring via IoT technologies

- For instance, health data transmitted from wearable or implantable devices may be exposed to hacking, unauthorized access, or breaches if not adequately secured. High-profile incidents involving compromised healthcare data have increased consumer hesitancy in embracing connected monitoring solutions

- Addressing these concerns through end-to-end encryption, secure data storage, robust authentication, and compliance with global regulations such as HIPAA and GDPR is essential for building user trust. Companies such as GE HealthCare and Siemens Healthineers emphasize their security architecture and regular firmware updates to mitigate risks

- In addition, the lack of standardized communication protocols across devices and platforms limits seamless data sharing and integration with clinical systems. This challenge is especially critical in multi-vendor healthcare environments and resource-limited settings

- While technological advancements are making IoT monitoring solutions more accessible, the high initial cost of AI-enhanced systems and ongoing maintenance requirements can deter adoption, particularly among smaller healthcare providers and developing markets. Overcoming these challenges through scalable design, enhanced data security, and greater system interoperability will be crucial for sustaining long-term market growth

Real-Time Health Monitoring via IoT Market Scope

The market is segmented on the basis of component, connectivity technology, application, and end user.

- By Component

On the basis of component, the real-time health monitoring via IoT market is segmented into medical devices, systems & software, and services. The medical devices segment dominated the market with the largest revenue share of 47.2% in 2024, driven by the widespread use of wearable and implantable devices that enable continuous monitoring of patient vitals such as heart rate, glucose levels, and oxygen saturation. Increasing consumer demand for health tracking tools and growing clinical deployment of real-time monitoring hardware in hospitals and home care settings are fueling this segment’s dominance.

The systems & software segment is anticipated to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by increasing demand for integrated platforms that support data analytics, interoperability, and remote diagnostics. These platforms are critical in aggregating, analyzing, and presenting patient data in actionable formats, enabling physicians and healthcare institutions to make real-time decisions and enhance operational efficiency.

- By Connectivity Technology

On the basis of connectivity technology, the real-time health monitoring via IoT market is segmented into Bluetooth, Wi-Fi, Cellular, LPWAN, ZigBee, RFID/NFC, and Others. The Bluetooth segment held the largest market revenue share in 2024, driven by its low energy consumption and wide adoption in wearable health monitoring devices such as fitness bands and smartwatches. Bluetooth’s ability to support direct communication with smartphones and tablets without requiring additional infrastructure has made it the preferred choice for both consumer and clinical-grade devices.

The LPWAN segment is expected to witness the fastest CAGR from 2025 to 2032, due to its long-range, low-power characteristics that enable effective deployment in remote patient monitoring and rural health settings. Technologies such as NB-IoT and LoRaWAN are increasingly being adopted in applications that require low data transmission rates and long battery life, especially in large-scale healthcare networks and remote diagnostics.

- By Application

On the basis of application, the real-time health monitoring via IoT market is segmented into remote patient monitoring, clinical workflow management, medication management, connected imaging, telemedicine, inpatient monitoring, and others. The remote patient monitoring segment accounted for the largest market share in 2024, attributed to the rising burden of chronic diseases and the demand for continuous patient oversight outside traditional care settings. Remote monitoring solutions are increasingly used for managing hypertension, diabetes, and cardiac conditions, with devices transmitting real-time data to physicians for early intervention.

The telemedicine segment is projected to grow at the fastest rate during the forecast period, fueled by the global expansion of virtual care platforms and policy support for remote consultations. Integration of real-time monitoring devices into telehealth solutions enables virtual diagnosis and follow-up care, improving access to medical services, particularly in underserved regions.

- By End User

On the basis of end user, the real-time health monitoring via IoT market is segmented into hospitals & clinics, home care settings, clinical research organizations (CROs), diagnostic laboratories, government & defense institutions, and insurance providers. The hospitals & clinics segment led the market in 2024, with the largest revenue share due to the increasing deployment of IoT-enabled devices for inpatient monitoring, workflow automation, and clinical diagnostics. These institutions benefit from centralized health dashboards, predictive alerts, and improved resource utilization through real-time tracking.

The home care settings segment is expected to register the fastest growth rate from 2025 to 2032, driven by patient demand for personalized care, cost-efficiency, and advancements in consumer-grade medical wearables. The proliferation of smart health devices and government incentives for remote care are supporting the shift toward home-based monitoring models for chronic and elderly patients.

Real-Time Health Monitoring via IoT Market Regional Analysis

- North America dominated the real-time health monitoring via IoT market with the largest revenue share of 39.1% in 2024, supported by wide adoption of Bluetooth and Wi-Fi–enabled devices, strong healthcare IT infrastructure, and active government initiatives promoting telehealth and patient monitoring in hospitals and home care

- Consumers and healthcare providers in the region value the ability of IoT-enabled health solutions to deliver continuous, non-invasive, and personalized care, especially in managing chronic conditions and supporting aging populations

- This widespread adoption is further supported by favorable reimbursement policies, government initiatives promoting telehealth, and the presence of key market players developing AI-powered and interoperable monitoring systems, making real-time health monitoring a foundational element in North America’s transition toward preventive and patient-centric healthcare models

U.S. Real-Time Health Monitoring via IoT Market Insight

The U.S. real-time health monitoring via IoT market captured the largest revenue share of 79% in 2024 within North America, fueled by rapid adoption of connected medical devices and the growing emphasis on remote patient care. Healthcare providers are increasingly investing in IoT-enabled solutions for chronic disease management, real-time diagnostics, and hospital-to-home transitions. Strong reimbursement frameworks, technological advancements in wearables, and integration with platforms such as electronic health records and telehealth services continue to drive growth. In addition, partnerships between tech firms and healthcare organizations are enhancing system interoperability and expanding use across public and private sectors.

Europe Real-Time Health Monitoring via IoT Market Insight

The Europe real-time health monitoring via IoT market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by regulatory focus on patient safety and efficiency in healthcare delivery. Rising incidence of chronic diseases and aging populations are prompting greater use of connected devices for continuous monitoring. Adoption is supported by strong digital health initiatives across countries such as Germany, France, and the Netherlands. Europe’s emphasis on secure data handling and integration within clinical IT systems is fostering trust in IoT solutions across both inpatient and outpatient environments

U.K. Real-Time Health Monitoring via IoT Market Insight

The U.K. real-time health monitoring via IoT market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by NHS-led digital transformation efforts and growing public awareness of preventive healthcare. Increasing deployment of remote monitoring tools for post-acute care and chronic disease management is reducing hospital burden and enabling early intervention. Supportive government programs, data-sharing frameworks, and collaborations between public health institutions and health-tech startups are further accelerating market expansion.

Germany Real-Time Health Monitoring via IoT Market Insight

The Germany real-time health monitoring via IoT market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's focus on innovation, data privacy, and healthcare digitization. Integration of AI with real-time monitoring devices is gaining traction in hospitals and specialty clinics, enabling more accurate diagnostics and continuous care. The strong presence of health-tech manufacturers, government support for telehealth, and consumer interest in wellness monitoring are contributing to the rapid adoption of connected health technologies across both urban and rural regions.

Asia-Pacific Real-Time Health Monitoring via IoT Market Insight

The Asia-Pacific real-time health monitoring via IoT market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid digital transformation, urbanization, and healthcare infrastructure development across countries such as China, India, and Japan. The region’s focus on smart healthcare and government-backed eHealth initiatives is fostering widespread adoption of IoT-enabled monitoring. Growing health awareness, mobile-first ecosystems, and the rise of low-cost wearable technology are enabling broader access to remote care solutions across income groups.

Japan Real-Time Health Monitoring via IoT Market Insight

The Japan real-time health monitoring via IoT market is gaining momentum due to the country’s emphasis on technology-driven healthcare, an aging population, and expanding smart hospital infrastructure. The integration of wearable and home-based health monitoring devices with national health IT systems is enabling seamless care transitions and personalized treatment. Demand is rising for contactless and AI-powered diagnostics, particularly in urban centers. The convergence of robotics, IoT, and health analytics is also paving the way for innovative home-care solutions for elderly patients.

India Real-Time Health Monitoring via IoT Market Insight

The India real-time health monitoring via IoT market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rising healthcare digitization, the spread of wearable technology, and strong policy support for telemedicine and smart healthcare initiatives. The government's focus on Ayushman Bharat Digital Mission and smart cities is encouraging large-scale IoT deployment in health services. Local innovation, increasing smartphone penetration, and affordable medical IoT solutions are driving adoption across tier-1 to tier-3 cities, especially in managing chronic diseases and providing rural health access.

Real-Time Health Monitoring via IoT Market Share

The real-time health monitoring via IoT industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Abbott (U.S.)

- DexCom, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- BioIntelliSense, Inc. (U.S.)

- iRhythm Technologies, Inc. (U.S.)

- Masimo Corporation (U.S.)

- AliveCor, Inc. (U.S.)

- Garmin Ltd. (U.S.)

- Withings S.A.S. (France)

- VitalConnect, Inc. (U.S.)

- Nokia Solutions and Networks Oy (Finland)

- Tenovi, Inc. (U.S.)

- Qardio, Inc. (U.S.)

- Eko Health, Inc. (U.S.)

What are the Recent Developments in Global Real-Time Health Monitoring via IoT Market?

- In May 2023, Medtronic plc announced the launch of its next-generation continuous glucose monitoring (CGM) system, designed to offer real-time glucose data with improved sensor accuracy and AI-driven alerts. This system enables proactive diabetes management, highlighting Medtronic’s commitment to advancing wearable IoT-based solutions for chronic disease monitoring and personalized healthcare. The development marks a significant step in improving patient engagement and remote care delivery through enhanced real-time tracking technologies

- In April 2023, Philips introduced its expanded portfolio of connected care solutions during HIMSS 2023, including AI-enabled patient monitoring platforms that integrate seamlessly with hospital IT systems. These platforms utilize IoT to track patient vitals in real-time across multiple care settings, improving clinical workflow and patient outcomes. This development reinforces Philips’ leadership in the digital health space and supports the broader trend of scalable, interoperable health monitoring infrastructures

- In March 2023, GE HealthCare unveiled its Virtual Care Platform, an IoT-powered solution for continuous patient monitoring and remote clinical decision-making. Designed to reduce the burden on hospital resources, the platform enables real-time data collection from wearable devices and transmits actionable insights to care teams. This innovation is part of GE HealthCare’s broader strategy to deliver AI-integrated, IoT-based systems that support decentralized and value-based healthcare delivery models

- In February 2023, BioIntelliSense launched the BioButton Rechargeable device, a multi-parameter wearable sensor that offers continuous health monitoring for up to 30 days. Capable of tracking temperature, respiratory rate, and heart rate, the device supports remote patient monitoring across post-acute care, chronic illness management, and infectious disease screening. This development underscores BioIntelliSense’s focus on expanding real-time IoT health monitoring in both clinical and consumer health environments

- In January 2023, Siemens Healthineers announced enhancements to its AI-supported remote monitoring platforms, integrating with wearable IoT devices to provide personalized risk assessment tools. These updates allow clinicians to monitor high-risk patients in real-time and intervene earlier using predictive insights. The company’s investment in connected monitoring technologies reflects a growing emphasis on scalable and proactive care models within the global healthcare system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.