Global Processed Seafood Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.41 Billion

USD

2.11 Billion

2024

2032

USD

1.41 Billion

USD

2.11 Billion

2024

2032

| 2025 –2032 | |

| USD 1.41 Billion | |

| USD 2.11 Billion | |

|

|

|

|

Processed Seafood Processing Equipment Market Size

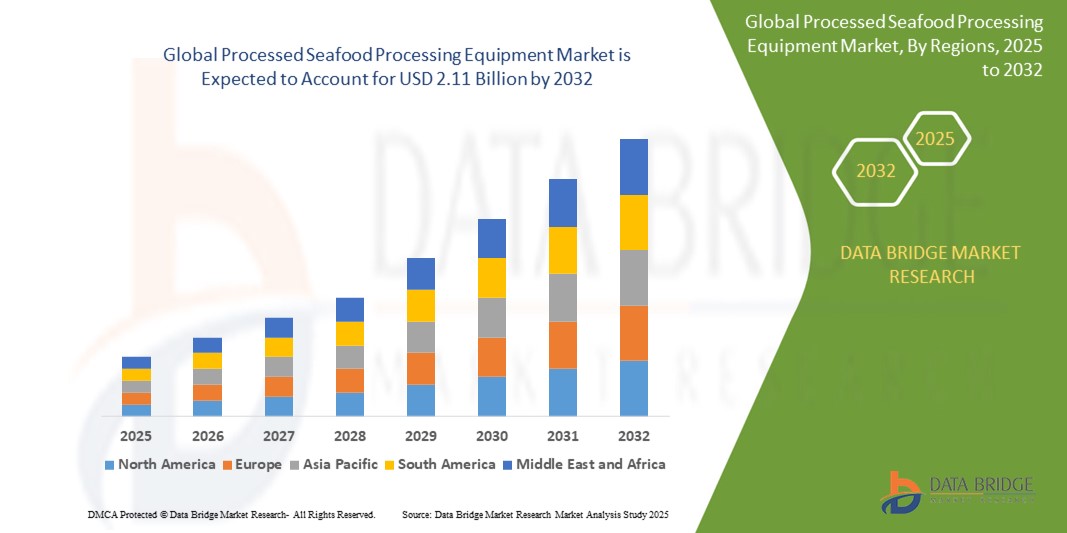

- The global processed seafood processing equipment market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.11 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is primarily driven by increasing global demand for processed seafood products, advancements in automation technologies, and the need for efficient, high-capacity processing equipment to meet rising consumer preferences for convenience foods

- In addition, growing awareness of sustainable seafood processing practices and stringent food safety regulations are pushing manufacturers to adopt advanced equipment, further propelling market expansion

Processed Seafood Processing Equipment Market Analysis

- Processed seafood processing equipment, encompassing machinery for slaughtering, gutting, filleting, smoking, and packaging, is critical for enhancing productivity, ensuring food safety, and meeting the growing demand for processed seafood in both retail and foodservice sectors

- The surge in demand is fueled by rising global seafood consumption, increaing urbanization, and a shift toward ready-to-eat and value-added seafood products.

- Asia-Pacific dominated the processed seafood processing equipment market with the largest revenue share of 42.5% in 2024, driven by high seafood production and consumption in countries such as China, Japan, and India, coupled with significant investments in processing infrastructure

- Europe is expected to be the fastest-growing region during the forecast period, attributed to increasing adoption of automated processing technologies, stringent food safety standards, and growing demand for processed seafood in countries such as Germany, France, and the U.K

- The fish segment dominated the largest market revenue share of 45% in 2024, driven by its widespread consumption globally and high demand for processed fish products such as fillets and canned goods

Report Scope and Processed Seafood Processing Equipment Market Segmentation

|

Attributes |

Processed Seafood Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Processed Seafood Processing Equipment Market Trends

“Increasing Integration of Automation and IoT Technologies”

- The global processed seafood processing equipment market is experiencing a significant trend toward the integration of automation and Internet of Things (IoT) technologies

- These technologies enable real-time monitoring, predictive maintenance, and enhanced operational efficiency in seafood processing, providing deeper insights into equipment performance and product quality

- Automated systems, such as AI-integrated filleting machines and IoT-enabled sensors, allow for proactive issue detection, reducing downtime and minimizing waste during processing

- For instance, companies such as Marel have introduced advanced filleting machines, such as the MS 2750, which use machine learning algorithms to optimize yield and precision for various fish sizes

- IoT-enabled equipment facilitates real-time data analysis, enabling processors to optimize production lines, ensure compliance with safety standards, and enhance traceability of seafood products

- This trend is increasing the appeal of advanced processing equipment for large-scale seafood processing plants and smaller operations aiming to improve efficiency and sustainability

Processed Seafood Processing Equipment Market Dynamics

Driver

“Rising Demand for Processed Seafood and Stringent Quality Standards”

- The growing consumer demand for convenient, ready-to-eat seafood products, such as frozen, smoked, and canned seafood, is a major driver for the global processed seafood processing equipment market

- Processing equipment enhances product safety and shelf life through features such as high-pressure processing (HPP), automated filleting, and advanced packaging solutions, meeting consumer expectations for high-quality seafood

- Government regulations, particularly in regions such as Europe with stringent food safety and sustainability standards, are driving the adoption of advanced processing equipment to ensure compliance

- The expansion of aquaculture and the adoption of 5G technology are enabling faster data transmission and more sophisticated processing capabilities, supporting the production of value-added seafood products

- Manufacturers are increasingly integrating advanced equipment as standard in processing plants to meet rising global demand and enhance product value in competitive markets

Restraint/Challenge

“High Capital Investment and Regulatory Compliance Issues”

- The high initial costs associated with acquiring, installing, and maintaining advanced seafood processing equipment, such as automated filleting or freezing systems, pose a significant barrier to adoption, particularly in emerging markets

- Retrofitting existing facilities with modern equipment can be complex and expensive, limiting adoption among smaller processors

- In addition, compliance with diverse food safety and environmental regulations across regions presents challenges. Seafood processing equipment must meet strict standards for hygiene, waste management, and sustainability, increasing operational complexity

- Data security concerns related to IoT-enabled equipment, such as potential breaches of production data, further complicate adoption, particularly in regions with stringent data protection laws

- These factors can deter investment in advanced equipment and slow market growth in cost-sensitive regions or areas with fragmented regulatory frameworks

Processed Seafood Processing Equipment market Scope

The market is segmented on the basis of food type, processing equipment products, processing equipment type, automation level, end-use, and distribution channel.

- By Food Type

On the basis of food type, the global processed seafood processing equipment market is segmented into fish, crustaceans, mollusks, and others. The fish segment dominated the largest market revenue share of 45% in 2024, driven by its widespread consumption globally and high demand for processed fish products such as fillets and canned goods. The growing production of fish in Asia-Pacific, particularly in countries such as China and India, supports this dominance.

The crustaceans segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for processed shrimp, crabs, and lobsters in both domestic and export markets. Rising consumer preference for convenient, ready-to-eat crustacean products and advancements in processing technologies are key growth drivers.

- By Processing Equipment Products

On the basis of processing equipment products, the global processed seafood processing equipment market is segmented into frozen seafood, smoked seafood, canned seafood, dried seafood, and others. The frozen seafood segment accounted for the largest market revenue share of 38% in 2024, driven by the global demand for extended shelf-life products and advancements in freezing technologies that preserve quality. Frozen seafood's popularity is particularly strong in Asia-Pacific due to robust export markets.

The canned seafood segment is anticipated to experience the fastest growth rate from 2025 to 2032, propelled by rising consumer demand for convenient, long-lasting protein sources, especially in developed economies such as the U.S. and Europe. Innovations in canning processes, such as high hydrostatic pressure processing (HPP), further enhance product yield and quality.

- By Processing Equipment Type

On the basis of processing equipment type products, the global processed seafood processing equipment market is segmented into slaughtering, smoking, curing and filling, gutting, scaling, skinning, filleting, deboning, and others. The slaughtering segment held the largest market revenue share of 30% in 2024, attributed to its critical role in large-scale seafood processing and the availability of advanced, corrosion-resistant equipment supporting various cut types.

The filleting segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for ready-to-cook and value-added fish products. Automated filleting machines enhance efficiency, reduce labor costs, and meet consumer preferences for convenient seafood formats.

- By Automation Level

On the basis of automation level, the global processed seafood processing equipment market is segmented into manual, semi-automatic, and fully automatic systems. The fully automatic segment dominated with a market revenue share of 50% in 2024, driven by its adoption in large-scale seafood processing plants to enhance efficiency, reduce labor costs, and ensure compliance with stringent food safety standards.

The semi-automatic segment is anticipated to grow at the fastest rate from 2025 to 2032, as small and medium-sized enterprises in emerging markets increasingly adopt cost-effective, partially automated solutions to balance efficiency and affordability.

- By End-Use

On the basis of end-use, the global processed seafood processing equipment market is segmented into seafood processing plants, restaurants & foodservice, retail, and others. The seafood processing Plants segment held the largest market revenue share of 55% in 2024, driven by the need for high-capacity, automated equipment to meet global demand for processed seafood. This segment benefits from investments in advanced technologies in Asia-Pacific.

The restaurants & foodservice segment is expected to witness significant growth from 2025 to 2032, fueled by the rising popularity of seafood-based dishes and the need for efficient processing equipment to ensure consistent quality and safety in high-volume foodservice operations.

- By Distribution Channel

On the basis of distribution channel, the global processed seafood processing equipment market is segmented into direct sales, authorized dealers & distributors, e-commerce platforms, specialty equipment retailers, and others. The direct sales segment accounted for the largest market revenue share of 40% in 2024, driven by manufacturers’ direct relationships with large seafood processing companies, ensuring customized solutions and reliable after-sales support.

The e-commerce platforms segment is projected to grow at the fastest rate from 2025 to 2032, driven by the increasing adoption of online procurement channels for processing equipment. The convenience of e-commerce, coupled with the growing availability of specialized equipment, supports this trend, particularly in Europe and North America.

Processed Seafood Processing Equipment Market Regional Analysis

- Asia-Pacific dominated the processed seafood processing equipment market with the largest revenue share of 42.5% in 2024, driven by high seafood production and consumption in countries such as China, Japan, and India, coupled with significant investments in processing infrastructure

- Consumers prioritize equipment that enhances efficiency, ensures food safety, and extends shelf life, particularly for frozen, smoked, and canned seafood products, catering to diverse culinary preferences and health-conscious diets

- Growth is supported by advancements in automation, including AI-integrated filleting and gutting systems, alongside rising demand in both large-scale processing plants and smaller foodservice applications

U.S. Processed Seafood Processing Equipment Market Insight

The U.S. processed seafood processing equipment market is expected to witness significant growth, fueled by high seafood consumption and strong demand for automated processing solutions. The trend towards ready-to-eat seafood products and stringent food safety regulations drive the adoption of advanced equipment such as filleting and freezing systems. Both industrial processing plants and aftermarket foodservice applications contribute to a robust market ecosystem.

Europe Processed Seafood Processing Equipment Market Insight

The European processed seafood processing equipment market is expected to witness the fastest growth rate, driven by increasing health awareness and demand for high-quality processed seafood. Consumers seek equipment that ensures hygiene, efficiency, and compliance with strict regulatory standards. Growth is prominent in both large-scale processing facilities and retrofit projects, with countries such as Germany and Norway showing significant adoption due to advanced aquaculture industries and sustainability focus.

U.K. Processed Seafood Processing Equipment Market Insight

The U.K. market for processed seafood processing equipment is expected to experience rapid growth, driven by rising demand for processed seafood products such as smoked and canned fish in urban and suburban settings. Increased awareness of nutritional benefits and the need for efficient processing to meet consumer demand for convenience foods encourage equipment adoption. Evolving food safety regulations balance efficiency with compliance, further boosting market growth.

Germany Processed Seafood Processing Equipment Market Insight

Germany is expected to witness rapid growth in the processed seafood processing equipment market, attributed to its advanced food processing sector and high consumer focus on quality and sustainability. German processors prefer technologically advanced equipment such as automated filleting and deboning systems that enhance productivity and reduce waste. The integration of these technologies in both large-scale plants and smaller foodservice operations supports sustained market expansion.

Asia-Pacific Processed Seafood Processing Equipment Market Insight

The Asia-Pacific region dominates the global processed seafood processing equipment market and is expected to maintain strong growth, driven by expanding aquaculture production and rising disposable incomes in countries such as China, India, and Vietnam. Increasing demand for processed seafood products, including frozen and canned varieties, boosts equipment adoption. Government initiatives promoting food safety and export standards further encourage the use of advanced processing technologies.

Japan Processed Seafood Processing Equipment Market Insight

Japan’s processed seafood processing equipment market is expected to witness rapid growth due to strong consumer preference for high-quality processed seafood products such as surimi and smoked fish. The presence of major seafood processing companies and the integration of advanced equipment in both OEM and aftermarket applications accelerate market penetration. Rising interest in automation and smart machinery also contributes to growth.

China Processed Seafood Processing Equipment Market Insight

China holds the largest share of the Asia-Pacific processed seafood processing equipment market, propelled by rapid urbanization, increasing seafood consumption, and growing demand for efficient processing solutions. The country’s expanding middle class and focus on food safety and quality support the adoption of advanced equipment such as automated gutting and filleting systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Processed Seafood Processing Equipment Market Share

The processed seafood processing equipment industry is primarily led by well-established companies, including:

- Baader Global SE (Germany)

- Marel (Iceland)

- GEA Group Aktiengesellschaft (Germany)

- Biro Manufacturing (U.S.)

- Arenco AB (China)

- Polar Systems Ltd. (U.K.)

- Uni-Food Technic (Denmark)

- Optimar AS (Norway)

- SEAC AB (Sweden)

- JBT (U.S.)

- Cabinplant A/S (Denmark)

- M.T.C. Food Equipment, Inc. (U.S.)

What are the Recent Developments in Global Processed Seafood Processing Equipment Market?

- In April 2025, the seafood processing industry continues to embrace automation and robotics across production lines—particularly for tasks such as cutting, filleting, and packaging. Companies such as Marel are leading this transformation with advanced systems such as the RoboBatcher, RoboOptimizer, and the newly launched RoboPacker, which use AI, computer vision, and specialized grippers to handle delicate seafood products with precision and minimal human input. These innovations not only boost efficiency and reduce labor dependency, but also enhance food safety and product consistency, reflecting a broader shift toward smart, integrated processing solutions

- In October 2024, Cité Marine, a subsidiary of Japan’s Nissui Group, acquired a seafood processing facility in Saint-Hernin, France from Guyader Traiteur Frais. The factory began operations under Cité Marine’s subsidiary Miti on July 1, 2024, and is dedicated to producing tapas-style seafood products such as octopus, squid, and sardines. This move marks a strategic expansion into the fast-growing tapas category, complementing Miti’s existing shrimp-based offerings. The acquisition supports Nissui’s “Good Foods 2030” vision and reflects a broader trend of market consolidation and diversification in the global seafood industry

- In May 2024, Maruha Nichiro, one of Japan’s largest seafood companies, reported a record consolidated revenue for the fiscal year ending March 2024, reflecting a 1% year-over-year growth. This financial milestone underscores the company’s strong performance across its global operations and signals robust demand in the processed seafood sector. While not tied to a specific equipment launch, such growth often translates into increased investment in advanced processing technologies, automation, and sustainability initiatives to meet rising production needs and quality standards

- In October 2023, India’s Central Institute of Fisheries Technology (CIFT) introduced solar-based hybrid dryers for seafood such as fish, salmon, and prawns, with capacities ranging from 10 to 500 kg. These dryers offer a sustainable alternative to traditional open sun drying, which often compromises hygiene and product quality. Equipped with backup heating sources such as LPG, biomass, or electricity, the dryers ensure continuous and hygienic drying even during unfavorable weather. This innovation supports longer shelf life, reduces contamination risks, and promotes eco-friendly seafood processing, gaining traction among fish entrepreneurs and startups

- In May 2023, Marel unveiled its Crown Jewel filleting machine, officially known as the MS 2750, at Seafood Processing Global in Barcelona. This next-generation equipment is IoT-enabled and packed with advanced sensor technologies, allowing for real-time monitoring, automatic size adjustments, and optimized yield. Designed for salmon and trout weighing between 1.5 to 10 kg, the MS 2750 can process up to 25 fish per minute, while using just 15 liters of water per minute, making it one of the most sustainable and connected filleting solutions on the market. Its modular design also supports easy maintenance and integration with Marel’s SmartBase platform for data-driven decision-making

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Processed Seafood Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Processed Seafood Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Processed Seafood Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.