Global Procurement Software Market

Market Size in USD Billion

CAGR :

%

USD

8.63 Billion

USD

18.31 Billion

2024

2032

USD

8.63 Billion

USD

18.31 Billion

2024

2032

| 2025 –2032 | |

| USD 8.63 Billion | |

| USD 18.31 Billion | |

|

|

|

|

Procurement Software Market Size

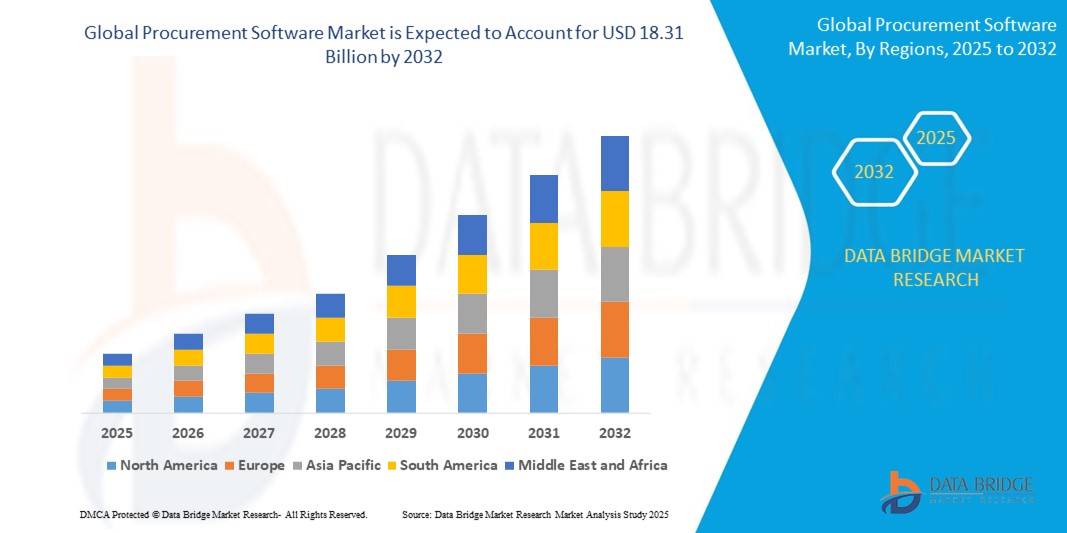

- The global procurement software market size was valued at USD 8.63 billion in 2024 and is expected to reach USD 18.31 billion by 2032, at a CAGR of 9.86% during the forecast period

- The market growth is primarily driven by the increased demand for digital transformation in procurement processes across industries such as manufacturing, retail, healthcare, and BFSI. Organizations are increasingly shifting from traditional procurement practices to automated platforms to improve transparency, reduce operational costs, and streamline supplier management

- Furthermore, the integration of AI, machine learning, and data analytics in procurement software solutions is enabling smarter decision-making, predictive analytics, and real-time visibility into procurement operations. This trend is fueling enterprise-wide adoption

Procurement Software Market Analysis

- Procurement software, offering digital tools for automating sourcing, purchasing, and supplier management, has become an essential component of enterprise resource planning systems across industries due to its ability to enhance efficiency, transparency, and cost-effectiveness in procurement operations.

- The surging demand for procurement software is primarily driven by the widespread digital transformation of business operations, the need for centralized supplier data, and increasing emphasis on compliance, risk mitigation, and cost savings.

- North America dominates the procurement software market with the largest revenue share of 38.6% in 2024, attributed to the early adoption of cloud-based enterprise software, strong presence of global software providers, and rapid deployment across industries such as manufacturing, retail, and BFSI, particularly in the U.S., where businesses prioritize automation and analytics-driven decision-making.

- Asia-Pacific is expected to be the fastest growing region in the procurement software market during the forecast period due to accelerating enterprise digitalization, rapid economic development, and increased IT investments across China, India, and Southeast Asia

- The E-Procurement segment is expected to dominate the procurement software market with a market share of 45.3% in 2024, driven by growing enterprise demand for transparent, automated purchasing workflows, enhanced supplier engagement, and integration with financial systems for improved spend management

Report Scope and Procurement Software Market Segmentation

|

Attributes |

Procurement Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Procurement Software Market Trends

“Automation and Intelligence Through AI and Predictive Analytics”

- A significant and accelerating trend in the global procurement software market is the integration of artificial intelligence (AI), machine learning (ML), and predictive analytics into procurement platforms. These technologies are transforming traditional procurement processes by automating routine tasks, enhancing decision-making, and providing real-time insights for more strategic sourcing and supplier management

- For instance, platforms such as SAP Ariba and Oracle Procurement Cloud are embedding AI to automate supplier selection, assess risk, and forecast demand based on historical and market data. This allows procurement professionals to make more informed and proactive decisions, improving cost efficiency and risk mitigation

- AI-driven chatbots and virtual procurement assistants are gaining traction, enabling procurement teams to manage routine queries, track orders, and interact with suppliers through natural language interfaces. These tools significantly reduce manual workload and improve response times, contributing to a more agile procurement function

- Predictive analytics tools are increasingly used to analyze spending patterns, supplier performance, and contract compliance, allowing organizations to optimize procurement strategies and anticipate market disruptions. For example, Coupa’s Business Spend Management platform uses AI to detect anomalies in spending behavior and suggest corrective actions

- Cloud-based procurement software integrated with AI capabilities facilitates centralized and automated purchasing decisions across global operations. These systems also support sustainability tracking and ethical sourcing, aligning with corporate social responsibility (CSR) objectives

- The demand for AI-powered, predictive, and self-learning procurement platforms is growing rapidly across industries as organizations seek smarter, faster, and more efficient procurement operations. Vendors are responding by investing heavily in intelligent automation and data-driven insights, reshaping the future of procurement software

Procurement Software Market Dynamics

Driver

“Growing Need for Process Efficiency and Cost Optimization in Procurement Operations”

- The increasing pressure on organizations to improve procurement efficiency, reduce operational costs, and streamline purchasing activities is a major driver for the global procurement software market

- For instance, in January 2024, SAP SE enhanced its procurement suite within SAP Business Network by introducing AI-based features for automated sourcing and contract management. These updates aim to boost supplier collaboration and reduce sourcing cycle times, reinforcing the value of digital procurement solutions

- As companies expand globally and manage complex supply chains, procurement software enables better visibility, automation of repetitive tasks, and data-driven decision-making—providing a significant improvement over traditional, manual procurement practices.

- Furthermore, the rise in remote and hybrid work models post-pandemic has emphasized the need for cloud-based procurement solutions that support real-time collaboration, compliance tracking, and centralized management across geographies

- Features such as automated invoice matching, supplier risk analysis, and dynamic discounting are driving adoption across sectors such as manufacturing, retail, healthcare, and BFSI, where procurement efficiency directly impacts bottom-line performance

- The demand for integrated, user-friendly procurement platforms that can unify sourcing, purchasing, and contract management is increasing as organizations look to align procurement with broader digital transformation and sustainability goals

Restraint/Challenge

“Concerns Over Data Security Risks and High Implementation Costs”

- Concerns related to data security vulnerabilities and the risk of cyberattacks pose significant challenges to the wider adoption of procurement software solutions, as these systems handle sensitive supplier and financial information.

- For instance, notable cyber incidents targeting enterprise software platforms have made organizations cautious about migrating critical procurement processes to cloud-based or integrated digital solutions.

- Addressing these security concerns requires procurement software providers to implement stringent encryption standards, multi-factor authentication, and continuous security audits. Leading companies such as Oracle and Coupa Systems emphasize their compliance with global security certifications (e.g., ISO 27001, SOC 2) to build customer confidence.

- In addition, the high initial costs of software licensing, system customization, and employee training can act as barriers for small and medium-sized enterprises, especially in emerging markets where budgets are constrained. While subscription-based and SaaS models are increasing affordability, the total cost of ownership remains a concern for some buyers.

- Despite the gradual reduction in pricing and availability of modular procurement solutions, the upfront investment and ongoing maintenance expenses still deter some potential users from fully adopting these advanced procurement technologies.

- Overcoming these challenges through enhanced cybersecurity protocols, transparent pricing models, and scalable deployment options will be critical to fostering sustained growth in the global procurement software market

Procurement Software Market Scope

The market is segmented on the basis of deployment, software type, organization size, and vertical.

By Deployment

On the basis of deployment, the procurement software market is segmented into On-Cloud, On-Premise, and Others. The On-Cloud segment is expected to dominate the market owing to its scalability, cost-effectiveness, and ease of integration with other enterprise systems.

Cloud-based procurement solutions enable real-time access, enhanced collaboration, and faster deployment, which attract small to large enterprises alike. The On-Premise segment remains relevant for organizations with stringent data security requirements or legacy IT infrastructure, particularly in highly regulated industries.

• By Software Type

On the basis of software type, the market is segmented into Spend Analytics, E-Sourcing, E-Procurement, Contract Management, Supplier Management, and Others. E-Procurement is expected to dominate the market due to its ability to streamline purchasing processes, improve cost management, and enhance transparency across the supply chain.

Contract Management and Supplier Management segments are also witnessing significant growth as enterprises seek to automate compliance and supplier collaboration to mitigate risks and improve efficiency.

• By Organization Size

On the basis of organization size, the market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. Large enterprises currently hold the larger market share due to their extensive procurement needs and greater IT budgets.

SMEs are expected to register the fastest growth rate during the forecast period, driven by increasing digital adoption and availability of affordable, scalable procurement solutions tailored to smaller organizations.

• By Vertical

On the basis of vertical, the procurement software market is segmented into Retail & e-Commerce, Healthcare and Pharmaceutical, Manufacturing & Automotive, Travel and Logistics, Electronics, IT and Telecommunication, Mining, BFSI, Oil & Gas, Energy & Utilities, and Others. The Manufacturing & Automotive vertical dominates the market, leveraging procurement software to optimize supply chains, reduce costs, and enhance supplier collaboration.

The Healthcare and Pharmaceutical sector is rapidly adopting procurement software to manage regulatory compliance and ensure supply continuity, while BFSI and IT & Telecommunication are witnessing growing demand for automated spend management and contract compliance tools.

Procurement Software Market Regional Analysis

- North America dominates the procurement software market with the largest revenue share of 38.6% in 2024, driven by early adoption of digital procurement solutions, high IT spending, and a mature enterprise ecosystem.

- Businesses and government organizations in the region are increasingly investing in cloud-based procurement platforms to enhance operational efficiency, transparency, and cost savings, fueling market growth.

- The region's robust technological infrastructure, stringent regulatory compliance requirements, and focus on supply chain resilience contribute to widespread adoption of advanced procurement software solutions across various industries.

U.S. Procurement Software Market Insight

The U.S. procurement software market captured the largest revenue share of 65% within North America in 2024, driven by rapid digital transformation across enterprises and government sectors. The increasing demand for cloud-based solutions, automation of procurement processes, and enhanced spend visibility are major growth factors. Additionally, the rising adoption of AI and analytics for supplier management and contract optimization further propels market expansion. Strong emphasis on compliance, cost efficiency, and supply chain resilience also contributes to the U.S. market’s dominant position.

Europe Procurement Software Market Insight

The European procurement software market is expected to grow at a significant CAGR during the forecast period, driven by increasing regulatory compliance requirements and digitalization initiatives across various industries. The demand for cloud-based and AI-powered procurement solutions is rising, fueled by enterprises seeking to enhance operational efficiency and cost control. Additionally, the growing focus on sustainable sourcing and supplier risk management is accelerating adoption. Strong investments in technology infrastructure across key economies such as Germany, the UK, and France further support the region’s market expansion.

U.K. Procurement Software Market Insight

The U.K. procurement software market is projected to witness strong growth at a notable CAGR during the forecast period, driven by increased digital transformation initiatives across public and private sectors. Rising demand for cloud-based and AI-enabled procurement solutions is fueling efficiency and transparency in supply chain management. Additionally, stringent regulatory frameworks and a focus on cost optimization in industries such as retail, healthcare, and manufacturing are accelerating adoption. The U.K.’s advanced IT infrastructure and growing investments in smart technologies further support the market expansion.

Germany Procurement Software Market Insight

The German procurement software market is anticipated to grow at a considerable CAGR over the forecast period, driven by the country’s strong industrial base and emphasis on digital transformation. Growing demand for efficient, secure, and compliant procurement processes in manufacturing, automotive, and healthcare sectors is accelerating market adoption. Additionally, Germany’s focus on sustainability and eco-friendly business practices is encouraging the use of procurement solutions that support transparency and responsible sourcing. Robust IT infrastructure and government initiatives promoting Industry 4.0 further bolster market growth.

Asia-Pacific Procurement Software Market Insight

The Asia-Pacific procurement software market is projected to grow at the fastest CAGR over the forecast period, driven by rapid digital transformation, increasing adoption of cloud-based solutions, and government initiatives promoting smart infrastructure in countries such as China, Japan, and India. The rising number of small and medium enterprises (SMEs) embracing automation to optimize procurement processes is fueling growth. Additionally, the region’s expanding manufacturing and retail sectors, coupled with growing demand for transparency and efficiency in supply chains, are accelerating procurement software adoption.

Japan Procurement Software Market Insight

The Japan procurement software market is witnessing steady growth, propelled by the country’s advanced technology landscape and focus on operational efficiency. The demand for integrated procurement solutions is increasing across manufacturing, healthcare, and retail sectors to enhance compliance and cost control. Japan’s aging workforce is also driving the adoption of automated systems to streamline procurement processes and reduce manual workload. Moreover, strong government support for digital innovation and Industry 4.0 initiatives is bolstering market expansion.

China Procurement Software Market Insight

China leads the Asia-Pacific procurement software market with the largest revenue share, fueled by rapid urbanization, a burgeoning middle class, and aggressive digitalization strategies. The country’s strong manufacturing base and emphasis on supply chain optimization are major growth drivers. Additionally, government policies promoting smart cities and digital commerce are encouraging enterprises to adopt cloud-based and AI-driven procurement solutions. Competitive pricing and the presence of numerous domestic software providers are also enhancing market penetration.

Procurement Software Market Share

The procurement software industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- IBM Corporation (U.S.)

- Coupa Software Inc. (U.S.)

- Epicor Software Corporation (U.S.)

- Mercateo (Germany)

- SAP SE (Germany)

- Zycus Inc (U.S.)

- Infor (U.S.)

- Tungsten Automation Corporation (U.K.)

- OpusCapita Solutions Oy (Finland)

- Ivalua Inc. (France)

- Epicor Software Corporation (U.S.)

- Proactis Holdings Limited (U.K.)

- JAGGAER (U.S.)

- Tradeshift Holdings, Inc. (U.S.)

- Basware Oy (Finland)

- HCL Technologies Limited (India)

Latest Developments in Global Procurement Software Market

- In April 2024, Iris Software Group partnered with Amazon Business to streamline procurement for UK schools. This collaboration enables 5,254 Iris customers to purchase supplies directly from Amazon Business through Iris Financials, the group's cloud-based school finance software. The integration simplifies purchasing by offering automatic purchase order generation, approvals, and reconciliation, reducing manual steps for school administrators. Schools can now access Amazon Business’s digital catalogue within Iris Financials, ensuring a seamless procurement experience

- In January 2024, Ever.Ag acquired PrairiE Systems, reinforcing its commitment to enhancing the global food supply chain, particularly in animal protein production. PrairiE Systems specializes in feed management software, including the Feed Allocation System (FAS) and Smart Order, an e-procurement system for streamlined feed ordering. This acquisition highlights the integration of technology into procurement processes, shaping the evolving landscape of agricultural software solutions

- In January 2024, Relish introduced its Procurement Assistant, an AI-powered tool designed to streamline enterprise application interactions and optimize procurement workflows. Using natural language processing, this assistant enables intuitive, conversational engagement, allowing users to efficiently manage supplier relationships, sourcing, contract management, and purchasing. The solution spans multiple procurement systems, ensuring seamless integration and uninterrupted workflows. By leveraging large language models, Relish aims to enhance efficiency and decision-making in procurement operations

- In December 2023, Pivot, a French procurement software startup, secured €20 million in Series A funding, highlighting investor confidence and the rapid growth of the procurement software market. The funding round was led by Visionaries, Emblem, Anamcara, and Oliver Samwer, reinforcing the industry's recognition of innovative tools that streamline procurement processes. Pivot's solution integrates seamlessly with ERPs, offering automation and spend management capabilities tailored for modern enterprises. This investment reflects the increasing demand for efficient procurement solutions across various sectors

- In October 2023, Atamis announced its partnership with Maximus UK to provide advanced procurement software, optimizing sourcing processes and enhancing efficiency and cost-effectiveness. This collaboration aims to streamline procurement operations, ensuring data-driven decision-making and risk management improvements. By integrating Atamis software, Maximus UK is set to modernize supplier management, reduce costs, and boost operational transparency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROCUREMENT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROCUREMENT SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PROCUREMENT SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.3.1 ARTIFICIAL INTELLIGENCE (AI)

5.3.2 ROBOTIC PROCESS AUTOMATION (RPA)

5.3.3 BIG DATA ANALYTICS

5.3.4 OTHERS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 PRICING ANALYSIS

6 GLOBAL PROCUREMENT SOFTWARE MARKET, BY SOFTWARE TYPE

6.1 OVERVIEW

6.2 SPEND ANALYSIS

6.3 RISK ANALYTICS

6.4 E-SOURCING

6.5 DEMAND FORECASTING

6.6 E-PROCUREMENT

6.7 E-INVOICING

6.8 CONTRACT MANAGEMENT

6.9 SUPPLIER MANAGEMENT

6.1 OTHERS

7 GLOBAL PROCUREMENT SOFTWARE MARKET, BY PLATFORM TYPE

7.1 OVERVIEW

7.2 MOBILE BASED

7.2.1 BY OPERATING SYSTEM

7.2.1.1. ANDROID

7.2.1.2. IPHONE

7.2.1.3. IPAD

7.3 DESKTOP BASED

7.3.1 BY OPERATING SYSTEM

7.3.1.1. MAC

7.3.1.2. WINDOWS

7.3.1.3. LINUX

7.3.1.4. CHROMEBOOK

8 GLOBAL PROCUREMENT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 GLOBAL PROCUREMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 SMALL & MEDIUM SIZE ENTERPRISE

9.2.1 BY DEPLOYMENT MODE

9.2.1.1. CLOUD

9.2.1.2. ON-PREMISE

9.3 LARGE SIZE ENTERPRISES

9.3.1 BY DEPLOYMENT MODE

9.3.1.1. CLOUD

9.3.1.2. ON-PREMISE

10 GLOBAL PROCUREMENT SOFTWARE MARKET, BY PRICING MODEL

10.1 OVERVIEW

10.2 FREE TRIAL

10.3 OPEN SOURCE

10.4 ONE TIME LICENSE

10.5 SUBSCRIPTION

10.5.1 MONTHLY SUBSCRIPTION/ PER USER MONTHLY SUBSCRIPTION

10.5.2 ANNUAL SUBSCRIPTION

11 GLOBAL PROCUREMENT SOFTWARE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BUDGETING/FORECASTING

11.3 INVENTORY CONTROL & MANAGEMENT

11.4 INVOICE PROCESSING

11.5 APPROVAL/PROCESS CONTROL

11.6 SOURCING MANAGEMENT

11.7 PURCHASE ORDER MANAGEMENT

11.8 SUPPLIER & VENDOR MANAGEMENT

11.9 SPEND ANALYSIS & CONTROL

11.1 CONTRACT/LICENSE MANAGEMENT

11.11 OTHERS

12 GLOBAL PROCUREMENT SOFTWARE MARKET, BY END USER

12.1 OVERVIEW

12.2 RETAIL & E-COMMERCE

12.2.1 BY SOFTWARE TYPE

12.2.1.1. SPEND ANALYSIS

12.2.1.2. RISK ANALYTICS

12.2.1.3. E-SOURCING

12.2.1.4. DEMAND FORECASTING

12.2.1.5. E-PROCUREMENT

12.2.1.6. E-INVOICING

12.2.1.7. CONTRACT MANAGEMENT

12.2.1.8. SUPPLIER MANAGEMENT

12.2.1.9. OTHERS

12.3 MANUFACTURING

12.3.1 BY SOFTWARE TYPE

12.3.1.1. SPEND ANALYSIS

12.3.1.2. RISK ANALYTICS

12.3.1.3. E-SOURCING

12.3.1.4. DEMAND FORECASTING

12.3.1.5. E-PROCUREMENT

12.3.1.6. E-INVOICING

12.3.1.7. CONTRACT MANAGEMENT

12.3.1.8. SUPPLIER MANAGEMENT

12.3.1.9. OTHERS

12.4 AUTOMOTIVE

12.4.1 BY SOFTWARE TYPE

12.4.1.1. SPEND ANALYSIS

12.4.1.2. RISK ANALYTICS

12.4.1.3. E-SOURCING

12.4.1.4. DEMAND FORECASTING

12.4.1.5. E-PROCUREMENT

12.4.1.6. E-INVOICING

12.4.1.7. CONTRACT MANAGEMENT

12.4.1.8. SUPPLIER MANAGEMENT

12.4.1.9. OTHERS

12.5 IT & TELECOMMUNICATION

12.5.1 BY SOFTWARE TYPE

12.5.1.1. SPEND ANALYSIS

12.5.1.2. RISK ANALYTICS

12.5.1.3. E-SOURCING

12.5.1.4. DEMAND FORECASTING

12.5.1.5. E-PROCUREMENT

12.5.1.6. E-INVOICING

12.5.1.7. CONTRACT MANAGEMENT

12.5.1.8. SUPPLIER MANAGEMENT

12.5.1.9. OTHERS

12.6 TRANSPORTATION AND LOGISTICS

12.6.1 BY SOFTWARE TYPE

12.6.1.1. SPEND ANALYSIS

12.6.1.2. RISK ANALYTICS

12.6.1.3. E-SOURCING

12.6.1.4. DEMAND FORECASTING

12.6.1.5. E-PROCUREMENT

12.6.1.6. E-INVOICING

12.6.1.7. CONTRACT MANAGEMENT

12.6.1.8. SUPPLIER MANAGEMENT

12.6.1.9. OTHERS

12.7 HEALTHCARE

12.7.1 BY SOFTWARE TYPE

12.7.1.1. SPEND ANALYSIS

12.7.1.2. RISK ANALYTICS

12.7.1.3. E-SOURCING

12.7.1.4. DEMAND FORECASTING

12.7.1.5. E-PROCUREMENT

12.7.1.6. E-INVOICING

12.7.1.7. CONTRACT MANAGEMENT

12.7.1.8. SUPPLIER MANAGEMENT

12.7.1.9. OTHERS

12.8 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

12.8.1 BY SOFTWARE TYPE

12.8.1.1. SPEND ANALYSIS

12.8.1.2. RISK ANALYTICS

12.8.1.3. E-SOURCING

12.8.1.4. DEMAND FORECASTING

12.8.1.5. E-PROCUREMENT

12.8.1.6. E-INVOICING

12.8.1.7. CONTRACT MANAGEMENT

12.8.1.8. SUPPLIER MANAGEMENT

12.8.1.9. OTHERS

12.9 EDUCATION

12.9.1 BY SOFTWARE TYPE

12.9.1.1. SPEND ANALYSIS

12.9.1.2. RISK ANALYTICS

12.9.1.3. E-SOURCING

12.9.1.4. DEMAND FORECASTING

12.9.1.5. E-PROCUREMENT

12.9.1.6. E-INVOICING

12.9.1.7. CONTRACT MANAGEMENT

12.9.1.8. SUPPLIER MANAGEMENT

12.9.1.9. OTHERS

12.1 HOSPITALITY

12.10.1 BY SOFTWARE TYPE

12.10.1.1. SPEND ANALYSIS

12.10.1.2. RISK ANALYTICS

12.10.1.3. E-SOURCING

12.10.1.4. DEMAND FORECASTING

12.10.1.5. E-PROCUREMENT

12.10.1.6. E-INVOICING

12.10.1.7. CONTRACT MANAGEMENT

12.10.1.8. SUPPLIER MANAGEMENT

12.10.1.9. OTHERS

12.11 MINING

12.11.1 BY SOFTWARE TYPE

12.11.1.1. SPEND ANALYSIS

12.11.1.2. RISK ANALYTICS

12.11.1.3. E-SOURCING

12.11.1.4. DEMAND FORECASTING

12.11.1.5. E-PROCUREMENT

12.11.1.6. E-INVOICING

12.11.1.7. CONTRACT MANAGEMENT

12.11.1.8. SUPPLIER MANAGEMENT

12.11.1.9. OTHERS

12.12 OTHERS

13 GLOBAL PROCUREMENT SOFTWARE MARKET, BY GEOGRAPHY

GLOBAL PROCUREMENT SOFTWARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 FRANCE

13.2.3 U.K.

13.2.4 ITALY

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 TURKEY

13.2.8 BELGIUM

13.2.9 NETHERLANDS

13.2.10 NORWAY

13.2.11 FINLAND

13.2.12 SWITZERLAND

13.2.13 DENMARK

13.2.14 SWEDEN

13.2.15 POLAND

13.2.16 REST OF EUROPE

13.3 ASIA PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA

13.3.6 NEW ZEALAND

13.3.7 SINGAPORE

13.3.8 THAILAND

13.3.9 MALAYSIA

13.3.10 INDONESIA

13.3.11 PHILIPPINES

13.3.12 TAIWAN

13.3.13 VIETNAM

13.3.14 REST OF ASIA PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 U.A.E

13.5.5 OMAN

13.5.6 BAHRAIN

13.5.7 ISRAEL

13.5.8 KUWAIT

13.5.9 QATAR

13.5.10 REST OF MIDDLE EAST AND AFRICA

13.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL PROCUREMENT SOFTWARE MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL PROCUREMENT SOFTWARE MARKET, SWOT & DBMR ANALYSIS

16 GLOBAL PROCUREMENT SOFTWARE MARKET, COMPANY PROFILE

16.1 KISSFLOW INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IVALUA INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 ZYCUS INC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SAP (ARIBA)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 COUPA SOFTWARE INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 TEAM PROCURE, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENT

16.7 GEP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENT

16.8 ORACLE

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENT

16.9 PRECORO, INC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENT

16.1 PLANERGY

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENT

16.11 JAGGAER

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENT

16.12 WORKDAY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENT

16.13 BASWARE

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENT

16.14 TRADOGRAM INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENT

16.15 PROCURIFY TECHNOLOGIES INC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENT

16.16 PROACTIS HOLDINGS LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENT

16.17 FRAPPE (ERPNEXT)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENT

16.18 SUNSMART TECHNOLOGIES

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 MEDIUS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENT

16.2 ZOHO CORPORATION PVT. LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENT

16.21 CERTINIA (A PART OF SALESFORCE INC)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENT

16.22 PENNY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 GEOGRAPHIC PRESENCE

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENT

16.23 SYSPRO

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 PRODUCT PORTFOLIO

16.23.5 RECENT DEVELOPMENT

16.24 TRADESHIFT HOLDINGS, IN

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 PRODUCT PORTFOLIO

16.24.5 RECENT DEVELOPMENT

16.25 SUTISOFT, INC

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 GEOGRAPHIC PRESENCE

16.25.4 PRODUCT PORTFOLIO

16.25.5 RECENT DEVELOPMENT

16.26 SIMFONI

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 GEOGRAPHIC PRESENCE

16.26.4 PRODUCT PORTFOLIO

16.26.5 RECENT DEVELOPMENT

16.27 ESKER

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 GEOGRAPHIC PRESENCE

16.27.4 PRODUCT PORTFOLIO

16.27.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Procurement Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Procurement Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Procurement Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.