Global Professional Footwear Market

Market Size in USD Billion

CAGR :

%

USD

10.64 Billion

USD

16.95 Billion

2024

2032

USD

10.64 Billion

USD

16.95 Billion

2024

2032

| 2025 –2032 | |

| USD 10.64 Billion | |

| USD 16.95 Billion | |

|

|

|

|

Professional Footwear Market Analysis

The professional footwear market is evolving rapidly with advancements in materials and production methods. Technologies such as 3D printing enable manufacturers to produce customized and ergonomic designs tailored to workers' needs. Enhanced materials, such as composite safety toes and slip-resistant rubber, ensure durability and protection while maintaining comfort. Incorporating smart technology, such as sensors to monitor foot pressure or fatigue, is gaining traction in industries such as healthcare and construction, improving worker safety and productivity.

Sustainable practices are also transforming the market, with eco-friendly materials such as recycled rubber and biodegradable textiles gaining popularity. Advanced manufacturing techniques such as injection molding and automated cutting reduce waste and improve efficiency.

The usage of professional footwear is expanding due to stricter workplace safety regulations globally, particularly in sectors such as construction, oil and gas, and healthcare. The growing emphasis on employee well-being and productivity has spurred demand for innovative, comfortable footwear solutions. These factors are projected to drive the market's growth, reaching significant valuations in the coming years.

Professional Footwear Market Size

The global professional footwear market size was valued at USD 10.64 billion in 2024 and is projected to reach USD 16.95 billion by 2032, with a CAGR of 6.00% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Professional Footwear Market Trends

“Growth of Sustainable Materials in Professional Footwear”

The professional footwear market is experiencing growth driven by the increasing emphasis on sustainability. Consumers and companies are actively seeking eco-friendly alternatives that reduce environmental impact without compromising on quality or safety. For instance, brands such as Timberland Pro and Keen Utility have launched work boots made from recycled materials and sustainable leather. These products align with global green initiatives and corporate sustainability goals, attracting environmentally conscious buyers. In addition, advancements in biodegradable and water-based adhesive technologies are enhancing the durability and ecological value of professional footwear. This trend not only boosts sales but also promotes brand loyalty as companies align with consumers' environmental values.

Report Scope and Professional Footwear Market Segmentation

|

Attributes |

Professional Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

PUMA SE (Germany), Nike, Inc. (U.S.), JACK WOLFSKIN (Germany), Woodland Worldwide (India), The Aldo Group Inc. (Canada), Under Armour, Inc. (U.S.), Bata Corporation (Switzerland), SKECHERS (U.S.), adidas A.G. (Germany), New Balance (U.S.), ASICS Corporation (Japan), Columbia Sportswear Company (U.S.), ECCO Sko A/S (Denmark), Geox S.p.A. (Italy), Hermès (France), KERING (France), TBL Licensing L.L.C. (U.S.), Tapestry, Inc. (U.S.), and Louis Vuitton Malletier SAS (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Professional Footwear Market Definition

Professional Footwear refers to shoes designed specifically for workplace environments, prioritizing functionality, safety, and style. These shoes cater to industries such as healthcare, construction, hospitality, and corporate settings. Key features include durability, slip resistance, ergonomic design, and compliance with safety standards such as steel-toe protection or anti-static properties. For office settings, professional footwear emphasizes formal aesthetics, such as leather dress shoes or polished flats. In contrast, industries requiring physical labor prioritize comfort and protection, such as safety boots or non-slip clogs. Professional footwear supports prolonged use, enhances employee performance, and aligns with occupational safety guidelines while complementing professional attire.

Professional Footwear Market Dynamics

Drivers

- Growing Focus on Workplace Safety

Workplace safety regulations, such as OSHA standards in the U.S. and European CE directives, mandate protective footwear in hazardous work environments such as construction, manufacturing, and mining. These rules ensure employees are shielded from risks such as slips, punctures, and electrical hazards, driving demand for safety shoes. For instance, the adoption of safety protocols in India's booming construction sector has significantly boosted sales of steel-toe boots and slip-resistant footwear. Similarly, industries such as oil and gas are investing in high-performance safety footwear to comply with stringent safety norms. This growing emphasis on employee safety across industries globally is propelling the professional footwear market forward.

- Rise of E-commerce

The rise of e-commerce has significantly transformed the professional footwear market, making it more accessible to consumers. Platforms such as Amazon and Zappos provide a vast selection of brands and styles, allowing shoppers to compare prices and read detailed product descriptions and reviews before making a purchase. For instance, during the COVID-19 pandemic, online sales for footwear surged, with Nike reporting a 30% increase in digital sales. This shift not only enhances convenience but also offers competitive pricing and promotional discounts, driving sales and attracting new customers. The trend toward online shopping continues to shape consumer behavior, propelling the growth of the professional footwear market.

Opportunities

- Fashion Integration in Professional Footwear

Fashion integration in professional footwear is creating new opportunities by blending aesthetics with functionality. Companies such as Red Wing Shoes and Timberland are introducing stylish yet performance-driven footwear to meet the demand for products that cater to both safety regulations and modern design preferences. For instance, lightweight safety sneakers with trendy designs are gaining traction among younger workers in industries such as hospitality and retail, were style matters alongside utility. This shift is particularly impactful in urban markets, where professionals seek footwear that transitions seamlessly between workplace and casual settings. As a result, the market is expanding, attracting customers valuing both safety and style.

- Expansion in Construction and Manufacturing

The rapid expansion of the construction and manufacturing industries has significantly increased the demand for durable, protective footwear. As construction sites and manufacturing plants grow, workers require footwear designed to withstand challenging environments, such as heavy-duty safety boots with steel toes, slip-resistant soles, and water-resistant materials. For instance, during the boom in infrastructure development across Asia-Pacific, countries such as China and India saw a surge in demand for safety footwear, creating opportunities for brands such as Caterpillar and Timberland Pro to cater to these growing markets. This trend highlights the potential for manufacturers to innovate and offer specialized footwear solutions to meet the diverse needs of these industries.

Restraints/Challenges

- High Cost of Quality Products

The high cost of quality products is a significant restraint in the professional footwear market. Premium footwear designed for durability, comfort, and specific professional needs often comes at a high price. This can limit accessibility for a large portion of consumers, particularly in regions with lower disposable income. Many potential buyers may opt for more affordable, less specialized alternatives, which impacts demand for high-end professional footwear. Furthermore, the price gap between premium and standard footwear creates a barrier to market penetration in emerging economies, where cost sensitivity is high. As a result, this pricing challenge restricts the growth potential of the professional footwear market in several regions.

- Increased Competition from Non-Specialized Footwear

Increased competition from non-specialized footwear is a significant restraint for the professional footwear market. Many consumers prefer casual or non-specialized footwear due to their lower prices and perceived comfort, even though these shoes may not offer the specific features required for professional environments such as medical or industrial settings. This trend is particularly prevalent in price-sensitive regions where budget constraints drive purchasing decisions. The availability of cheaper alternatives without compromising on comfort and style further challenges the growth of professional footwear, as consumers often opt for more affordable options. This shift towards non-specialized footwear undermines the demand for shoes designed with specific features for safety, support, and durability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Professional Footwear Market Scope

The market is segmented on the basis of type, leather type, end-users, material, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Ballerinas

- Boots

- Brogue

- Derby

- Flat

- High Heels

- Loafers

- Sandals

- Slip- On’s

- Oxfords

- Wedge

- Others

Leather Type

- Full Grain

- Patent Leather

- Pebble

- Suede Leather

- Synthetic Leather

- Top Grain

- Others

End-Users

- Men’s Footwear

- Women’s Footwear

Material

- Rubber

- Plastic

Distribution Channel

- Online Channel

- Shoe Stores

- Supermarkets and Hypermarkets

- Independent Retail Stores

- Textile Retailers

- Departmental Stores

- Others

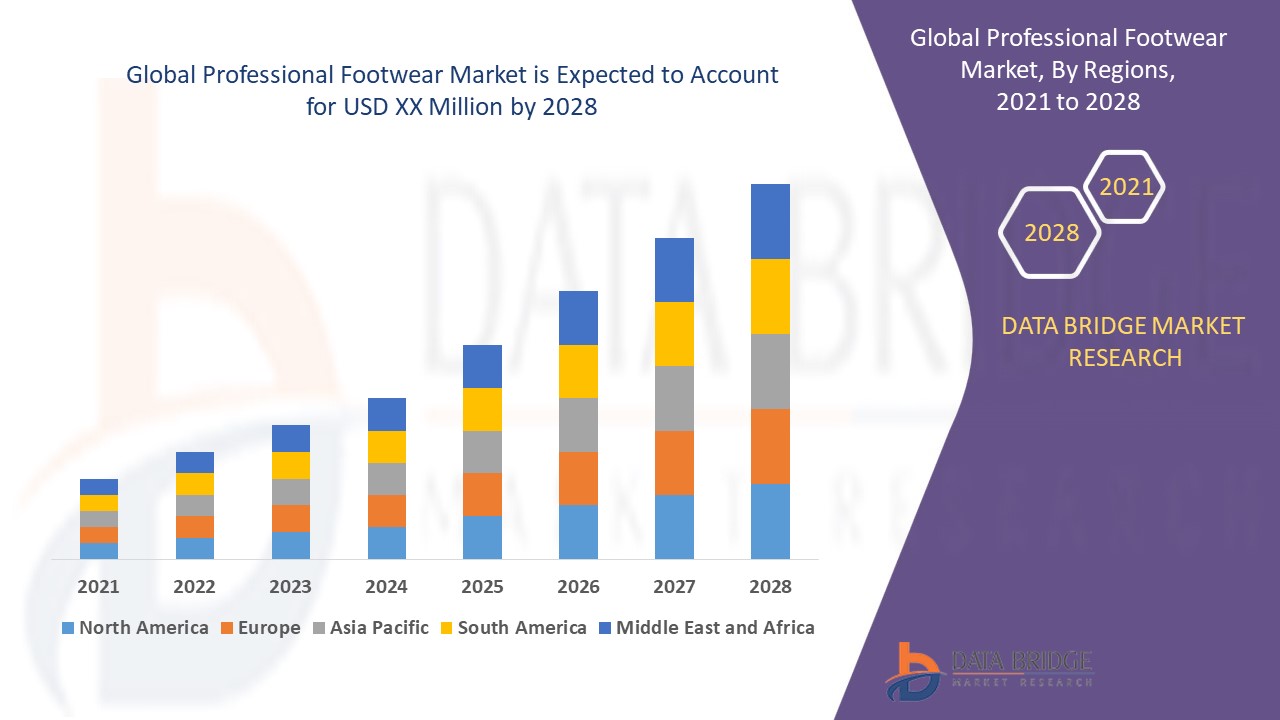

Professional Footwear Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, leather type, end-users, material, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the professional footwear market due to the increasing demand for both athletic and non-athletic footwear. The region benefits from the presence of major footwear brands, a strong consumer base, and growing interest in performance and comfort, ensuring continued market dominance in the coming years.

Asia-Pacific is expected to show significant growth in the professional footwear market due to factors such as rising personal disposable income, rapid globalization, and modernization. The increasing consumer base in developing countries such as China, India, and Indonesia, along with an ever-growing population, will drive the market's expansion in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Professional Footwear Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Professional Footwear Market Leaders Operating in the Market Are:

- PUMA SE (Germany)

- Nike, Inc. (U.S.)

- JACK WOLFSKIN (Germany)

- Woodland Worldwide (India)

- The Aldo Group Inc. (Canada)

- Under Armour, Inc. (U.S.)

- Bata Corporation (Switzerland)

- SKECHERS (U.S.)

- adidas A.G. (Germany)

- New Balance (U.S.)

- ASICS Corporation (Japan)

- Columbia Sportswear Company (U.S.)

- ECCO Sko A/S (Denmark)

- Geox S.p.A. (Italy)

- Hermès (France)

- KERING (France)

- TBL Licensing L.L.C. (U.S.)

- Tapestry, Inc. (U.S.)

- Louis Vuitton Malletier SAS (France)

Latest Developments in Professional Footwear Market

- In September 2023, Puma SA launched an exclusive collaboration with pop sensation Rihanna, unveiling a new collection of athletic footwear and sportswear under the Fenty * Puma brand. The standout piece in the collection was a football-inspired shoe made from premium vintage leather, showcasing a bold, avant-garde design that drew inspiration from modern football trends and fashion

- In April 2022, Centro Brands, in partnership with U.S.-based footwear brand Toms, launched the brand in India, specifically targeting Gen-Z consumers. The collaboration led to Toms' products being available across popular multi-brand outlets such as Tata Cliq Luxe, Myntra, Ajio Gold, Tata Cliq, Nykaa, and a dedicated e-commerce platform tailored to the Indian market

- In February 2022, Crocs, Inc., a global leader in casual footwear, completed its acquisition of HEYDUDETM, a popular brand specializing in casual footwear. This strategic acquisition, finalized on February 17, 2022, allowed Crocs to expand its product offerings and strengthen its position in the global footwear market, further enhancing brand visibility and market reach

- In November 2020, LionRock Capital, based in Hong Kong, made a significant investment in Clark International (Clarks), helping the company expand its international footprint. This acquisition enabled Clarks to strengthen its presence in the Asia-Pacific region, marking a critical step in the brand's global expansion strategy and further establishing itself as a leader in the footwear industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.