Global Protein Hydrolysis Enzyme Market

Market Size in USD Billion

CAGR :

%

USD

2.54 Billion

USD

3.69 Billion

2024

2032

USD

2.54 Billion

USD

3.69 Billion

2024

2032

| 2025 –2032 | |

| USD 2.54 Billion | |

| USD 3.69 Billion | |

|

|

|

|

Protein Hydrolysis Enzyme Market Size

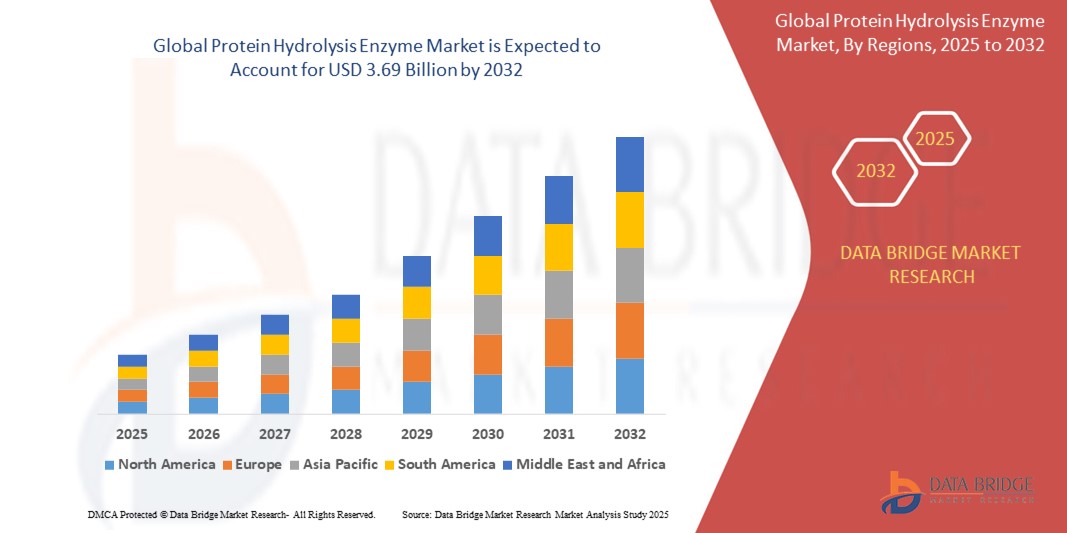

- The global protein hydrolysis enzyme market size was valued at USD 2.54 billion in 2024 and is expected to reach USD 3.69 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is primarily driven by increasing demand for protein-based products in food, pharmaceutical, and detergent industries, coupled with advancements in enzyme technology and bioprocessing

- Rising consumer awareness of health and nutrition, along with the growing adoption of sustainable and eco-friendly production methods, is further propelling the market for protein hydrolysis enzymes

Protein Hydrolysis Enzyme Market Analysis

- Protein hydrolysis enzymes, which break down proteins into peptides and amino acids, are critical in various industries, including food processing, pharmaceuticals, and detergents, due to their ability to enhance product functionality, nutritional value, and production efficiency

- The surge in demand is driven by the growing need for high-quality protein ingredients, increasing applications in functional foods and dietary supplements, and the rising preference for eco-friendly and sustainable enzyme-based processes

- North America dominated the protein hydrolysis enzyme market with the largest revenue share of 42.5% in 2024, attributed to advanced biotechnological infrastructure, high R&D investments, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing demand for processed foods, and growing pharmaceutical manufacturing in countries such as China and India

- The micro-organism segment dominated the largest market revenue share of 60% in 2024, driven by the high efficiency, stability, and scalability of microbial enzymes, particularly in large-scale industrial applications such as food processing, detergents, and pharmaceuticals

Report Scope and Protein Hydrolysis Enzyme Market Segmentation

|

Attributes |

Protein Hydrolysis Enzyme Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Hydrolysis Enzyme Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global protein hydrolysis enzyme market is experiencing a notable trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into enzyme performance, production efficiency, and application-specific optimization

- AI-powered solutions allow for predictive modeling of enzyme activity, optimizing production processes and identifying potential inefficiencies before they impact output

- For instance, companies are developing AI-driven platforms to analyze enzyme performance in real-time, enabling tailored formulations for applications such as food processing or pharmaceutical development, improving product consistency and cost-effectiveness

- This trend enhances the value proposition of protein hydrolysis enzymes, making them more appealing to industries such as food and beverage, pharmaceuticals, and detergents

- AI algorithms can analyze vast datasets from production processes, including enzyme stability, substrate specificity, and reaction conditions, to enhance yield and functionality across applications

Protein Hydrolysis Enzyme Market Dynamics

Driver

“Rising Demand for Clean-Label and Functional Products”

- Increasing consumer demand for clean-label, natural, and functional products, such as protein-enriched foods, dietary supplements, and eco-friendly detergents, is a major driver for the global protein hydrolysis enzyme market

- Protein hydrolysis enzymes enhance product functionality by improving nutritional profiles, flavor, and digestibility in food and beverage applications, such as meat tenderization, dairy processing, and plant-based protein products

- Government regulations, particularly in regions such as Europe, promoting natural and sustainable ingredients, are contributing to the widespread adoption of these enzymes

- The proliferation of biotechnology and advancements in fermentation technologies are further enabling the expansion of enzyme applications, offering higher efficiency and scalability for industrial processes

- Manufacturers are increasingly incorporating protein hydrolysis enzymes into production as standard solutions to meet consumer expectations for healthier and environmentally friendly products

Restraint/Challenge

“High Production Costs and Regulatory Compliance Concerns”

- The substantial initial investment required for enzyme production, including specialized facilities, raw materials, and advanced biotechnological processes, can be a significant barrier to adoption, especially in emerging markets

- Integrating protein hydrolysis enzymes into industrial processes, particularly for small-scale manufacturers, can be complex and costly

- In addition, regulatory compliance and safety concerns pose major challenges. Enzyme production and application involve strict adherence to food safety, pharmaceutical, and environmental regulations, which vary across regions and can complicate operations for global manufacturers

- The fragmented regulatory landscape across countries regarding enzyme usage, labeling, and safety standards further complicates market expansion for international producers and service providers

- These factors can deter adoption and limit market growth, particularly in regions with high cost sensitivity or stringent regulatory oversight

Protein Hydrolysis Enzyme market Scope

The market is segmented on the basis of source, method of production, and application.

- By Source

On the basis of source, the global protein hydrolysis enzyme market is segmented into animal, plant, and micro-organism. The micro-organism segment dominated the largest market revenue share of 60% in 2024, driven by the high efficiency, stability, and scalability of microbial enzymes, particularly in large-scale industrial applications such as food processing, detergents, and pharmaceuticals. Their advantages include cost-effective production, genetic manipulability, and suitability for fermentation processes.

The plant segment is expected to witness the fastest growth rate of 6.3% from 2025 to 2032, fueled by increasing consumer demand for eco-friendly and sustainable products. Plant-based enzymes, such as papain, are gaining traction for their ability to enhance protein solubility and digestibility, particularly in plant-based food and beverage applications.

- By Method of Production

On the basis of method of production, the global protein hydrolysis enzyme market is segmented into extraction and fermentation. The fermentation segment dominated the market with a revenue share of 65% in 2024, attributed to its cost-effectiveness and ability to produce high-purity enzymes on a large scale, making it ideal for industrial applications in food, pharmaceuticals, and detergents.

The extraction segment is anticipated to experience significant growth from 2025 to 2032, driven by its use in niche applications requiring high-purity, specialized enzymes from animal or plant sources. Advancements in extraction technologies are improving yields and reducing costs, further boosting adoption in targeted industries.

- By Application

On the basis of application, the global protein hydrolysis enzyme market is segmented into detergent and cleansing, pharmaceutical, food and beverages, textile, and others. The food and beverages segment accounted for the largest market revenue share of 30% in 2024, propelled by the rising demand for protein-enriched foods, functional foods, and clean-label products. Enzymes in this segment enhance texture, flavor, and nutritional profiles in applications such as dairy, meat processing, and baking.

The pharmaceutical segment is expected to witness the fastest growth rate of 7.2% from 2025 to 2032, driven by the increasing use of protein hydrolysis enzymes in therapeutic peptide production and protein-based drug formulations. The growing prevalence of chronic diseases and demand for personalized medicine further accelerate adoption.

Protein Hydrolysis Enzyme Market Regional Analysis

- North America dominated the protein hydrolysis enzyme market with the largest revenue share of 42.5% in 2024, attributed to advanced biotechnological infrastructure, high R&D investments, and a strong presence of key industry players

- Consumers prioritize protein hydrolysis enzymes for enhancing nutritional profiles, improving product functionality, and supporting eco-friendly industrial processes, particularly in regions with advanced technological infrastructure

- Growth is supported by advancements in enzyme engineering, such as genetic manipulation and fermentation technologies, alongside rising adoption in both industrial and consumer applications

U.S. Protein Hydrolysis Enzyme Market Insight

The U.S. protein hydrolysis enzyme market captured the largest revenue share of 87,9% in 2024 within North America, fueled by strong demand in the pharmaceutical and food industries, as well as growing consumer awareness of health and sustainability benefits. The trend towards clean-label products and increasing regulations promoting eco-friendly processes further boost market expansion. The integration of enzymes in food processing and pharmaceutical formulations complements industrial applications, creating a diverse market ecosystem.

Europe Protein Hydrolysis Enzyme Market Insight

The Europe protein hydrolysis enzyme market is expected to witness significant growth, supported by regulatory emphasis on sustainable and natural ingredients. Consumers seek enzymes that enhance food quality, improve pharmaceutical efficacy, and support environmentally friendly processes. The growth is prominent in both food and beverage processing and pharmaceutical applications, with countries such as Germany and France showing significant uptake due to rising health consciousness and industrial advancements.

U.K. Protein Hydrolysis Enzyme Market Insight

The U.K. market for protein hydrolysis enzymes is expected to witness rapid growth, driven by demand for improved nutritional content and sustainable processing in food and beverage applications. Increased interest in health-focused products and rising awareness of enzyme benefits in detergents and textiles encourage adoption. Evolving regulations promoting clean-label and eco-friendly products influence consumer choices, balancing functionality with compliance.

Germany Protein Hydrolysis Enzyme Market Insight

Germany is expected to witness rapid growth in the protein hydrolysis enzyme market, attributed to its advanced biotechnology sector and high consumer focus on health and sustainability. German industries prefer technologically advanced enzymes that enhance food digestibility, improve pharmaceutical outcomes, and contribute to eco-friendly manufacturing. The integration of these enzymes in food processing and pharmaceutical industries supports sustained market growth.

Asia-Pacific Protein Hydrolysis Enzyme Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrialization, rising disposable incomes, and increasing demand for processed foods in countries such as China, India, and Japan. Growing awareness of nutritional benefits, health-focused products, and sustainable industrial practices boosts demand. Government initiatives promoting eco-friendly manufacturing and food safety further encourage the use of advanced protein hydrolysis enzymes.

Japan Protein Hydrolysis Enzyme Market Insight

Japan’s protein hydrolysis enzyme market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced enzymes that enhance food functionality and pharmaceutical efficacy. The presence of major biotechnology firms and integration of enzymes in food and beverage processing accelerate market penetration. Rising interest in health supplements and sustainable industrial applications also contributes to growth.

China Protein Hydrolysis Enzyme Market Insight

China holds the largest share of the Asia-Pacific protein hydrolysis enzyme market, propelled by rapid urbanization, rising health consciousness, and increasing demand for functional foods and pharmaceuticals. The country’s growing middle class and focus on sustainable manufacturing support the adoption of advanced enzymes. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Protein Hydrolysis Enzyme Market Share

The protein hydrolysis enzyme industry is primarily led by well-established companies, including:

- Novozymes A/S (Denmark)

- BASF SE (Germany)

- DuPont (U.S.)

- Associated British Foods (U.K.)

- DSM (Netherlands)

- Dyadic International Inc., (U.S.)

- Aumgene Biosciences (India)

- Chr. Hansen Holding A/S (Denmark)

- Amano Enzyme Inc. (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Codexis, Inc. (U.S.)

- Sanofi (France)

- Creative Protein hydrolysis enzyme (U.S.)

- Enzyme Solutions (U.S.)

- Enzymatic Deinking Technologies, LLC (U.S.)

- Biocatalysts (U.K.)

What are the Recent Developments in Global Protein Hydrolysis Enzyme Market?

- In June 2024, Lallemand Inc. acquired BASF SE’s bioenergy enzymes business, including the Spartec product portfolio and associated technologies in development. The acquisition was carried out through Lallemand’s subsidiaries—Danstar Ferment AG and Lallemand Specialties Inc.—and integrates the business into its Lallemand Biofuels & Distilled Spirits (LBDS) unit. This move builds on a long-standing partnership between the two companies and enhances Lallemand’s capabilities in the fuel ethanol and alcohol industries. Meanwhile, BASF will continue to focus on its enzyme activities in the animal feed and detergent markets, aligning with its broader sustainability and innovation goals

- In December 2023, the European Commission approved the merger of Novozymes and Chr. Hansen, paving the way for the formation of Novonesis, a global leader in biosolutions. The merger officially closed in January 2024, combining the strengths of both companies in enzyme and microbial technologies. Novonesis now operates with around 10,000 employees and serves over 30 industries, including food, beverage, and pharmaceuticals, with a strong focus on protein hydrolysis enzymes and sustainable innovation. The merger was subject to certain divestments to address competition concerns, particularly in the lactase enzyme market

- In December 2022, Ingredient Optimized (io) partnered with Nutrabound Labs to launch ioCollagen, a next-generation collagen protein designed to enhance taste and absorption without relying on traditional enzymatic hydrolysis. Using io’s patented atmospheric plasma technology, ioCollagen improves bioavailability and solubility, delivering up to 3–5 times higher blood levels of essential amino acids compared to unoptimized proteins. This innovation addresses common challenges in collagen supplementation—such as poor taste and limited absorption—while reinforcing both companies’ positions in the nutritional supplement market with a focus on performance and consumer experience

- In September 2022, Royal DSM introduced DelvoPlant Go, an innovative enzyme solution tailored for oat-based dairy alternatives. This product streamlines production by combining liquefaction and saccharification into a single-step hydrolysis, reducing processing time by up to 30%. It also cuts down on energy and water usage, making it a more sustainable option for manufacturers. DelvoPlant Go supports organic and non-GMO formulations, helping producers meet rising consumer demand for nutritious, eco-friendly plant-based products while maintaining taste and texture

- In November 2021, Novozymes launched Formea Prime, a microbial endo-protease developed to improve the taste and stability of whey protein hydrolysates used in high-protein beverages. Unsuch as traditional proteases that often produce bitterness, Formea Prime generates medium- to long-chain peptides with minimal exposure of hydrophobic amino acids, resulting in low bitterness and enhanced heat stability—ideal for ready-to-drink applications. This innovation supports the growing demand for clean-label, protein-enriched beverages in the sports nutrition and functional wellness markets, offering manufacturers a solution that balances flavor, solubility, and nutritional value

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OUTLOOK

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY TYPE OF ENZYME, 2014-2024 (USD MILLION) (TONS)

11.1 OVERVIEW

11.2 PROTEASES/PEPTIDASES

11.2.1 ENDOPEPTIDASES

11.2.1.1. SERINE PROTEASES

11.2.1.1.1. TRYPSIN

11.2.1.1.2. CHYMOTRYPSIN

11.2.1.1.3. ELASTASE

11.2.1.1.4. THROMBIN

11.2.1.1.5. SUBTILISIN

11.2.1.2. CYSTEINE PROTEASES

11.2.1.2.1. PAPAIN

11.2.1.2.2. BROMELAIN

11.2.1.2.3. CALPAINS

11.2.1.2.4. CATHEPSINS

11.2.1.3. ASPARTIC PROTEASES

11.2.1.3.1. PEPSIN

11.2.1.3.2. RENIN

11.2.1.3.3. CATHEPSINS D AND E

11.2.1.3.4. HIV PROTEASE

11.2.1.4. METALLOPROTEASES

11.2.1.4.1. THERMOLYSIN

11.2.1.4.2. COLLAGENASE

11.2.1.4.3. CARBOXYPEPTIDASE A AND B

11.2.2 EXOPEPTIDASES

11.2.2.1. AMINOPEPTIDASES

11.2.2.1.1. LEUCINE AMINOPEPTIDASE

11.2.2.1.2. DIPEPTIDYL PEPTIDASE

11.2.2.1.3. TRIPEPTIDYL PEPTIDASE

11.2.2.2. CARBOXYPEPTIDASES

11.2.2.2.1. CARBOXYPEPTIDASE A

11.2.2.2.2. CARBOXYPEPTIDASE B

11.2.2.3. DIPEPTIDASES

11.2.2.3.1. DIPEPTIDYL PEPTIDASE-IV

11.2.2.3.2. PROLIDASE

11.3 TRYPSIN

11.4 CHYMOTRYPSIN

11.5 PAPAIN

11.6 PEPSIN

11.7 BROMELAIN

11.8 ALKALINE PROTEASES

11.9 ACIDIC PROTEASES

11.1 NEUTRAL PROTEASES

11.11 MICROBIAL PROTEASES

11.11.1 FUNGAL PROTEASES

11.11.2 BACTERIAL PROTEASES

11.11.3 YEAST-DERIVED PROTEASES

11.12 OTHERS

12 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY SOURCE, 2014-2024 (USD MILLION)

12.1 OVERVIEW

12.2 ANIMAL-DERIVED ENZYMES

12.2.1 BOVINE-DERIVED PROTEASES

12.2.2 PORCINE-DERIVED PROTEASES

12.2.3 MARINE ANIMAL-DERIVED PROTEASES

12.2.3.1. FISH

12.2.3.2. CRUSTACEANS

12.2.3.3. MOLLUSKS

12.2.3.4. OTHERS

12.3 PLANT-DERIVED ENZYMES

12.3.1 BROMELAIN

12.3.2 PAPAIN

12.3.3 FICIN

12.3.4 ACTINIDIN

12.3.5 ZINGIBAIN

12.4 MICROBIAL ENZYMES

12.4.1 FUNGAL ENZYMEE

12.4.1.1. ASPERGILLUS

12.4.1.2. TRICHODERMA

12.4.1.3. RHIZOPUS

12.4.2 BACTERIAL ENZYMES

12.4.2.1. BACILLUS

12.4.2.2. PSEUDOMONAS

12.4.2.3. STREPTOMYCES

12.4.3 YEAST ENZYMES

12.4.3.1. SACCHAROMYCES

12.4.3.2. CANDIDA

12.4.3.3. PICHIA

13 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY FORM, 2014-2024 (USD MILLION)

13.1 OVERVIEW

13.2 LIQUID

13.3 POWDER

13.4 GRANULES

13.5 LYOPHILIZED (FREEZE-DRIED)

13.6 ENCAPSULATED

13.7 TABLETS/CAPSULES

13.8 OTHERS

14 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY PRODUCTION METHOD, 2014-2024 (USD MILLION)

14.1 OVERVIEW

14.2 FERMENTATION-BASED

14.2.1 SUBMERGED FERMENTATION (SMF)

14.2.2 SOLID-STATE FERMENTATION (SSF)

14.3 NATURAL EXTRACTION

14.4 GENETICALLY ENGINEERED ENZYMES

14.5 CHEMICAL SYNTHESIS

14.6 OTHERS

15 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY FUNCTION, 2014-2024 (USD MILLION)

15.1 OVERVIEW

15.2 PROTEIN HYDROLYSIS

15.3 MEAT & DAIRY TEXTURE MODIFICATION

15.4 EMULSIFICATION & STABILIZATION

15.5 FOAMING & GELLING PROPERTIES

15.6 NUTRIENT ABSORPTION ENHANCEMENT

15.7 BIODEGRADATION & BIOREMEDIATION

15.8 OTHERS

16 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY APPLICATION, 2014-2024 (USD MILLION) (TONS)

16.1 OVERVIEW

16.2 FOOD & BEVERAGE INDUSTRY

16.2.1 DAIRY INDUSTRY

16.2.1.1. CHEESE PRODUCTION

16.2.1.2. WHEY PROTEIN HYDROLYSIS

16.2.1.3. CASEIN HYDROLYSIS

16.2.2 MEAT PROCESSING

16.2.2.1. MEAT TENDERIZATION

16.2.2.2. FLAVOR ENHANCEMENT

16.2.3 BAKERY & CONFECTIONERY

16.2.3.1. DOUGH CONDITIONING

16.2.3.2. GLUTEN HYDROLYSIS

16.2.4 BEVERAGES

16.2.4.1. BEER BREWING

16.2.4.2. PROTEIN HYDROLYSIS IN PLANT-BASED BEVERAGES

16.2.5 INFANT FORMULA AND BABY FOOD

16.2.6 PROTEIN FORTIFICATION IN FUNCTIONAL FOODS & SPORTS NUTRITION

16.2.7 HYDROLYZED VEGETABLE PROTEIN (HVP) PRODUCTION

16.3 ANIMAL FEED INDUSTRY

16.3.1 POULTRY FEED

16.3.2 SWINE FEED

16.3.3 AQUAFEED

16.3.3.1. FISH FEED

16.3.3.2. SHRIMP FEED

16.3.3.3. OTHERS

16.3.4 RUMINANT FEED

16.3.5 PET FOOD

16.3.5.1. DOGS

16.3.5.2. CATS

16.3.5.3. EXOTIC PETS

16.3.5.4. OTHERS

16.4 PHARMACEUTICALS & HEALTHCARE

16.4.1 DIGESTIVE ENZYME SUPPLEMENTS

16.4.2 WOUND HEALING & BURN TREATMENT

16.4.3 ANTI-INFLAMMATORY & ANTIMICROBIAL THERAPY

16.4.4 ENZYMES IN CANCER THERAPY (PROTEASE INHIBITORS)

16.4.5 THROMBOLYTIC AGENTS (CLOT DISSOLUTION)

16.4.6 ENZYME-BASED DRUG DELIVERY SYSTEMS

16.5 BIOTECHNOLOGY & RESEARCH

16.5.1 ENZYMATIC HYDROLYSIS IN LABORATORY RESEARCH

16.5.2 DRUG DISCOVERY & BIOPHARMACEUTICALS

16.5.3 BIOREMEDIATION & WASTE PROCESSING

16.6 COSMETICS & PERSONAL CARE

16.6.1 SKIN EXFOLIATION (ENZYME PEELS)

16.6.2 ANTI-AGING & COLLAGEN HYDROLYSIS

16.6.3 HAIR CARE

16.6.4 ORAL CARE

16.7 DETERGENT INDUSTRY

16.7.1 LAUNDRY DETERGENTS

16.7.2 DISHWASHING LIQUIDS

16.7.3 INDUSTRIAL CLEANING SOLUTIONS

16.8 LEATHER & TEXTILE INDUSTRY

16.8.1 LEATHER PROCESSING

16.8.2 SILK & WOOL PROCESSING

16.8.3 FABRIC FINISHING & BIO-POLISHING

16.9 DIETARY SUPPLEMENTS

16.1 SPORTS NUTRITION

16.11 WASTE MANAGEMENT & BIOREMEDIATION

16.11.1 INDUSTRIAL EFFLUENT TREATMENT

16.11.2 AGRICULTURAL WASTE PROCESSING

16.11.3 SOIL & WATER REMEDIATION

16.12 OTHERS

17 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIAP-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, BY GEOGRAPHY, 2014-2024 (USD MILLION) (TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 SWITZERLAND

18.2.8 TURKEY

18.2.9 BELGIUM

18.2.10 POLAND

18.2.11 DENMARK

18.2.12 NORWAY

18.2.13 SWEDEN

18.2.14 NETHERLANDS

18.2.15 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 SINGAPORE

18.3.6 THAILAND

18.3.7 INDONESIA

18.3.8 MALAYSIA

18.3.9 PHILIPPINES

18.3.10 AUSTRALIA

18.3.11 NEW ZEALAND

18.3.12 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 SAUDI ARABIA

18.5.4 UNITED ARAB EMIRATES

18.5.5 ISRAEL

18.5.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL PROTEIN HYDROLYSIS ENZYME MARKET, COMPANY PROFILE

20.1 NOVOZYMES A/S

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 BASF

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 AB ENZYMES

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.4 DSM-FIRMENICH

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 BIOCATALYSTS

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 ENZYMATIC DEINKING TECHNOLOGIES, LLC.

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 CREATIVE ENZYMES

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENTS

20.8 F. HOFFMANN-LA ROCHE LTD

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 AMANO ENZYME INC.

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 AUMGENE BIOSCIENCES

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENTS

20.11 ADVANCED ENZYME TECHNOLOGIES

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 KERRY GROUP PLC.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENTS

20.13 CRESCENT BIOTECH

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENTS

20.14 KRISHNAENZYTECH

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 YESRAJ AGRO EXPORTS PVT. LTD.

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Protein Hydrolysis Enzyme Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protein Hydrolysis Enzyme Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protein Hydrolysis Enzyme Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.