Global Protein Liquid Feed Supplements Market

Market Size in USD Billion

CAGR :

%

USD

2.99 Billion

USD

4.70 Billion

2024

2032

USD

2.99 Billion

USD

4.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.99 Billion | |

| USD 4.70 Billion | |

|

|

|

|

Protein Liquid Feed Supplements Market Size

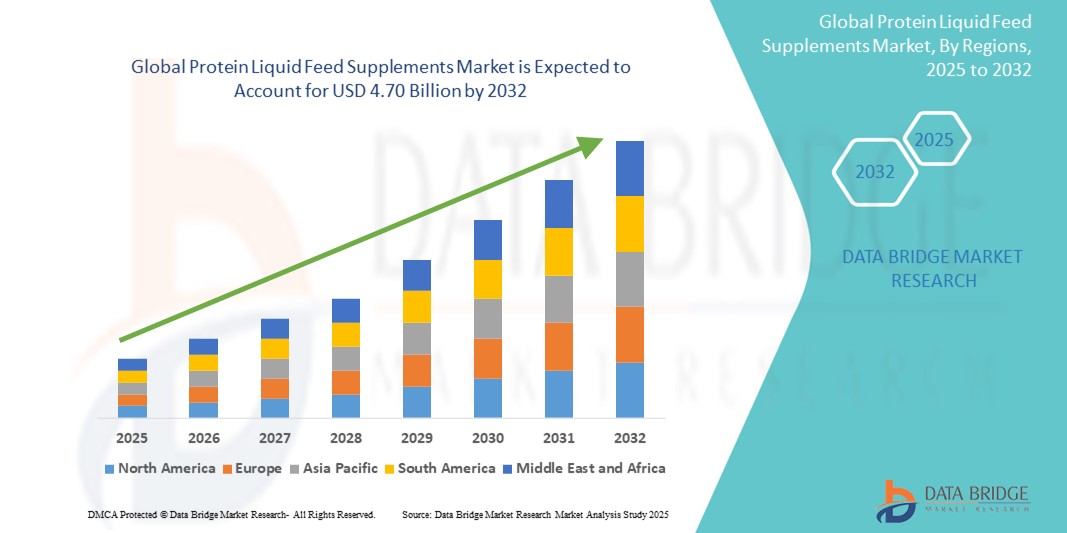

- The global protein liquid feed supplements market size was valued at USD 2.99 billion in 2024 and is expected to reach USD 4.70 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the rising demand for efficient, cost-effective livestock nutrition solutions, coupled with the rapid expansion of commercial animal farming across both developed and emerging markets

- Furthermore, increasing awareness among farmers about the benefits of liquid feed supplements—such as improved feed conversion, ease of mixing, and nutrient uniformity—is driving widespread adoption across ruminants, swine, poultry, and aquaculture sectors, thereby significantly boosting the industry's growth

Protein Liquid Feed Supplements Market Analysis

- Protein liquid feed supplements are nutrient-dense formulations, often molasses-based, designed to improve animal performance by enhancing energy intake, digestion, and overall productivity. These supplements are easily mixed with other feed components or administered directly, making them ideal for large-scale livestock operations

- The growing focus on animal health, rising global demand for meat and dairy products, and advancements in feed processing technologies are accelerating the use of liquid protein formulations as a strategic tool to maximize output while maintaining cost efficiency in livestock management

- Asia-Pacific dominated the protein liquid feed supplements market with a share of 34.2% in 2024, due to the region’s large livestock population, rapid expansion of commercial animal farming, and increasing demand for efficient, protein-rich feed solutions

- North America is expected to be the fastest growing region in the protein liquid feed supplements market during the forecast period due to large-scale commercial livestock farming, advanced feed delivery technologies, and rising awareness regarding feed efficiency and animal performance

- Ruminants segment dominated the market with a market share of 47.8% in 2024, due to the widespread use of liquid protein supplements in cattle and dairy feed to enhance milk yield, fertility, and overall animal health. Ruminant farmers often rely on protein-rich liquid formulations to address dietary imbalances during forage scarcity and seasonal changes. The market benefits from rising demand for dairy products and meat, especially in emerging economies, which is translating into increased investments in high-performance ruminant nutrition

Report Scope and Protein Liquid Feed Supplements Market Segmentation

|

Attributes |

Protein Liquid Feed Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Liquid Feed Supplements Market Trends

“Rising Adoption of Advanced Farming Practices”

- The protein liquid feed supplements market is rapidly evolving as livestock producers embrace advanced farming technologies such as precision feeding, automated dosing systems, and sensor-driven livestock management, which streamline nutrient delivery for optimal animal health and productivity

- For instance, industry leaders such as Cargill and Archer Daniels Midland (ADM) are investing in feed technology innovations and developing protein-rich liquid supplement solutions that are easily integrated with automated feeders on large commercial farms, enabling cost-effective and efficient nutrient administration

- The growing focus on feed efficiency and sustainability is driving producers to adopt liquid supplements that minimize waste, enhance digestibility, and support better feed conversion ratios, directly impacting livestock growth and profitability

- Enhanced traceability and data-driven nutrition programs enabled by digital platforms are fostering the use of tailored liquid protein supplements, allowing farmers to fine-tune diets based on animal performance metrics and health status

- The increased adoption of sustainable ingredient sourcing, including plant-based and organic protein sources, reflects industry adaptation to evolving consumer and regulatory demands for environmentally friendly and traceable feed solutions

- As commercial farming scales up globally, the ease of storage, handling, and mixing associated with liquid feed supplements is making them increasingly attractive in both developed and emerging markets, supporting expanded market penetration

Protein Liquid Feed Supplements Market Dynamics

Driver

“Rising Demand for Protein in Livestock Nutrition”

- Demand for high-quality animal protein is escalating worldwide, fueling the need for protein-dense diets that maximize livestock growth, reproduction, and milk production

- For instance, BASF SE and Land O’Lakes are witnessing increased orders for their protein liquid feed supplements as global meat and dairy consumption continues to rise, prompting integrated supply agreements with major feedlots and dairy farms

- The transition from traditional dry feed to liquid feed supplements is enhancing nutrient absorption and palatability, further boosting adoption in both ruminant and non-ruminant animal sectors

- Growing scientific awareness about the critical role of protein in preventing illness and optimizing animal welfare is inspiring more producers to invest in liquid supplements to maintain herd health and productivity

- Expanding intensive livestock operations in Asia-Pacific, Latin America, and other high-growth markets are driving demand for cost-effective protein supplementation, creating lucrative opportunities for both established and emerging brands

Restraint/Challenge

“Fluctuations in Raw Material Prices”

- Price volatility for key protein ingredients—such as soybean meal, corn, and molasses—creates instability for manufacturers, directly affecting production costs and pricing flexibility for liquid supplements

- For instance, during supply chain disruptions in recent years, companies such as Nutreco and Alltech reported margin pressures and had to adjust sourcing or pass on higher costs to customers, highlighting the impact of raw material market fluctuations on profitability

- Regulatory restrictions and shifting consumer preference toward non-GMO or organic feed sources add additional constraints to ingredient sourcing, often requiring further investment and supply chain diversification

- Increased competition among global and regional feed supplement players, combined with high input costs, can lead to thinner margins and may inhibit growth, especially for smaller producers without robust procurement strategies

- Supply chain disruptions—resulting from climate events, geopolitical tensions, or pandemics—can further exacerbate shortages and price swings, increasing operational uncertainty across the value chain

Protein Liquid Feed Supplements Market Scope

The market is segmented on the basis of source, livestock, and animal type.

- By Source

On the basis of source, the protein liquid feed supplements market is segmented into molasses, corn, urea, and others. The molasses segment dominated the largest market revenue share in 2024, driven by its cost-effectiveness, widespread availability, and high palatability for livestock. Molasses-based supplements are especially favored in ruminant nutrition due to their natural sugar content, which enhances microbial fermentation in the rumen and supports better digestion. The sticky texture of molasses also serves as an effective carrier for other nutrients, making it a preferred base in compound feed formulations.

The corn segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising global demand for energy-dense animal feed and increasing production of corn by-products from ethanol and food processing industries. Corn-derived protein supplements are rich in digestible proteins and essential amino acids, which are critical for growth and productivity in poultry and swine. The growing emphasis on optimizing feed conversion ratios in intensive livestock farming further boosts the appeal of corn-based protein feed solutions.

- By Livestock

On the basis of livestock, the market is categorized into ruminants, poultry, swine, aquaculture, and others. The ruminants segment accounted for the largest market share of 47.8% in 2024, supported by the widespread use of liquid protein supplements in cattle and dairy feed to enhance milk yield, fertility, and overall animal health. Ruminant farmers often rely on protein-rich liquid formulations to address dietary imbalances during forage scarcity and seasonal changes. The market benefits from rising demand for dairy products and meat, especially in emerging economies, which is translating into increased investments in high-performance ruminant nutrition.

The aquaculture segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the rapid expansion of fish farming and shrimp cultivation across Asia-Pacific and Latin America. Protein liquid feed supplements in aquaculture enhance growth rates, feed efficiency, and disease resistance, aligning with the industry's focus on sustainability and reduced dependency on wild fishmeal. Technological advancements in water-stable formulations and customized nutrient profiles are further accelerating adoption in the aquaculture sector.

- By Animal Type

On the basis of animal type, the protein liquid feed supplements market is segmented into ruminant, poultry, swine, aquaculture, and others. The ruminant segment dominated the market share in 2024, propelled by the high consumption of liquid feed supplements in dairy and beef cattle to improve nutrient intake, reproductive efficiency, and feed utilization. Livestock producers are increasingly turning to ruminant-specific formulations that support optimal rumen function, especially in high-output dairy operations.

The poultry segment is projected to witness the fastest growth from 2025 to 2032, owing to intensifying poultry farming practices and growing global demand for poultry meat and eggs. Liquid supplements in poultry diets provide essential proteins and amino acids that support rapid growth, immune health, and feed efficiency, particularly in broilers and layers. The ability to integrate these supplements easily into automated water or feeding systems makes them a scalable solution for large-scale poultry farms.

Protein Liquid Feed Supplements Market Regional Analysis

- Asia-Pacific dominated the protein liquid feed supplements market with the largest revenue share of 34.2% in 2024, driven by the region’s large livestock population, rapid expansion of commercial animal farming, and increasing demand for efficient, protein-rich feed solutions

- The rising consumption of meat and dairy products across emerging economies, coupled with investments in modernizing feed infrastructure, supports strong market performance

- Favorable government initiatives promoting livestock productivity and nutritional self-sufficiency, along with easy access to low-cost feed ingredients such as molasses and urea, are propelling the adoption of liquid feed supplements

India Protein Liquid Feed Supplements Market Insight

The India market is witnessing strong growth driven by increasing demand for dairy products, rising awareness among farmers regarding animal nutrition, and expansion of organized livestock farming. The government’s support for improving cattle productivity and emphasis on feed enrichment programs are stimulating market adoption. Locally sourced molasses and growing integration of feed management technologies are further accelerating usage.

China Protein Liquid Feed Supplements Market Insight

China held the largest share in Asia-Pacific in 2024, supported by its dominant role in global pork and aquaculture production. High demand for cost-efficient, protein-dense feed formulations in intensive farming systems is fueling market growth. Government-backed initiatives aimed at improving feed efficiency, along with the scale of commercial livestock operations, are creating robust opportunities for liquid feed supplement suppliers.

Europe Protein Liquid Feed Supplements Market Insight

Europe is expected to grow at a moderate pace over the forecast period, driven by strong animal welfare regulations, growing consumer demand for high-quality animal products, and adoption of sustainable feed practices. The region’s emphasis on traceability, precision feeding, and environmental compliance is pushing livestock producers to incorporate advanced liquid supplementation systems. Countries such as Germany, France, and the Netherlands are at the forefront due to their advanced dairy and swine industries.

Germany Protein Liquid Feed Supplements Market Insight

Germany’s market is expanding steadily owing to its focus on feed optimization, high standards for animal productivity, and stringent sustainability targets. The shift toward nutrient-specific feeding and integration of liquid supplements in automated systems is supporting growth. Rising costs of traditional feed materials have also pushed producers to adopt efficient liquid protein alternatives.

North America Protein Liquid Feed Supplements Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by large-scale commercial livestock farming, advanced feed delivery technologies, and rising awareness regarding feed efficiency and animal performance. The increasing need for cost-effective, scalable nutrition solutions in beef, dairy, and swine production is encouraging the use of liquid protein feeds. Industry investments in R&D and automation are also bolstering market expansion.

U.S. Protein Liquid Feed Supplements Market Insight

The U.S. captured the largest revenue share in North America in 2024, supported by its well-established livestock industry and early adoption of advanced feed technologies. High demand for customized, performance-enhancing feed supplements in cattle and swine operations is driving growth. The country’s strong agricultural infrastructure and favorable policies promoting livestock productivity are contributing to sustained market leadership.

Protein Liquid Feed Supplements Market Share

The protein liquid feed supplements industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- BASF (Germany)

- ADM (U.S.)

- Land O’Lakes, Inc. (U.S.)

- Graincorp Ltd (Australia)

- Ridley Corporation Limited (Australia)

- Quality Liquid Feeds (U.S.)

- Performance Feeds (U.S.)

- WESTWAY FEED PRODUCTS (U.S.)

- Dallas Keith Ltd. (U.K.)

- Cattle-Lac Liquids Inc (U.S.)

- Bundaberg Molasses (Australia)

- Plains States Commodities, LLC. (U.S.)

- Animax Pharma Pvt. Ltd. (India)

- Cure Up Pharma (India)

- Midwest Liquid Feeds, LLC (U.S.)

- CowBos (U.S.)

- Chaitanya Biologicals Pvt. Ltd (India)

- Yara (Norway)

- Hubbard Feeds (U.K.)

Latest Developments in Global Protein Liquid Feed Supplements Market

- In 2024, Archer Daniels Midland Company (ADM) significantly enhanced its market presence by expanding its liquid feed supplement portfolio with amino acid-enriched formulations aimed at improving dairy cattle productivity. The company's strategic partnership with a leading molasses supplier ensured a stable, high-quality raw material supply, reinforcing its supply chain resilience and enabling consistent product quality. These initiatives bolstered ADM’s competitive edge and supported its growth in high-demand regions

- In 2024, Cargill Incorporated advanced its position by launching a molasses-based liquid feed supplement line designed to improve energy intake and feed efficiency in beef cattle. This product innovation targeted performance enhancement in livestock, addressing growing demand for efficiency-boosting feed solutions. In addition, the company’s investment in expanding its production facilities across Asia-Pacific underscored its commitment to serving rapidly growing emerging markets, thereby strengthening its footprint and capacity to meet rising regional demand

- In December 2021, BASF introduced a revolutionary feed enzyme named Natupulse TS. This innovative enzyme is designed to enhance digestion and improve the overall effectiveness of animal feed by being rich in nutrients. With this launch, BASF has solidified its position in the animal feed market

- In March 2021, Farmers Business Network (FBN) made a strategic entry into the livestock nutrition segment by launching FBM Feed and FBN Pharmacy. By offering liquid supplements, dry feed, and comprehensive nutritional support, the company strengthened its position in the animal feed value chain. This move expanded competitive dynamics in the market, especially in North America, by introducing digitally driven, farmer-focused solutions that address both feed quality and accessibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.