Global Radial Farm Tire Market

Market Size in USD Billion

CAGR :

%

USD

9.16 Billion

USD

13.13 Billion

2024

2032

USD

9.16 Billion

USD

13.13 Billion

2024

2032

| 2025 –2032 | |

| USD 9.16 Billion | |

| USD 13.13 Billion | |

|

|

|

|

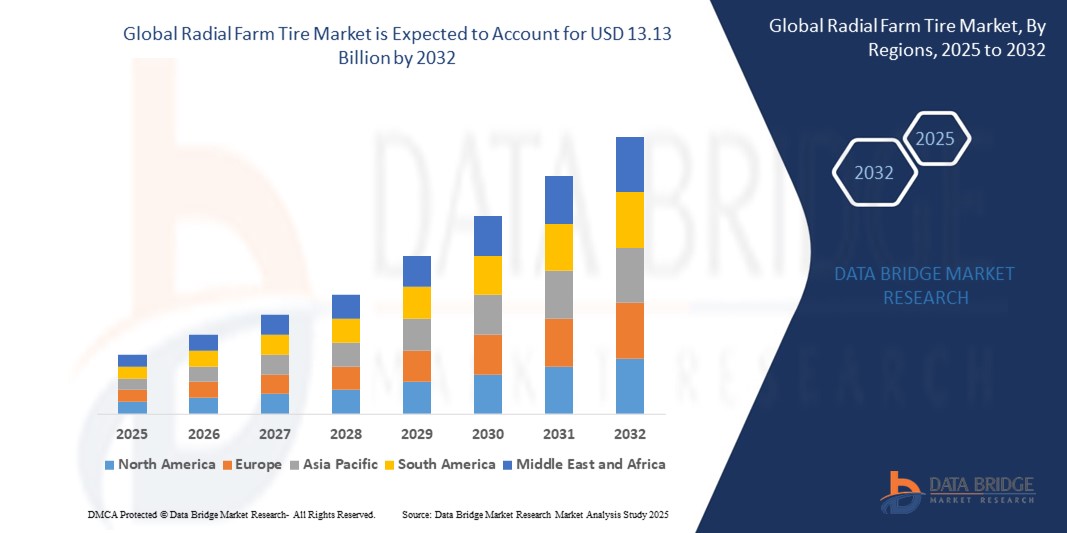

What is the Global Radial Farm Tire Market Size and Growth Rate?

- The global radial farm tire market size was valued at USD 9.16 billion in 2024 and is expected to reach USD 13.13 billion by 2032, at a CAGR of 4.60% during the forecast period

- Radial farm tire market advancements include the integration of precision agriculture technologies and enhanced tire compounds for better traction and durability. These tires are increasingly used in modern farming equipment to improve efficiency and reduce soil compaction. Growth is driven by the rising adoption of smart farming techniques, boosting demand for high-performance radial tires in the agricultural sector

What are the Major Takeaways of Radial Farm Tire Market?

- The growing trend of precision farming, which utilizes advanced technology for optimized crop management, drives demand for radial farm tires. These tires enhance the performance of high-tech machinery used in precision agriculture by offering superior traction and durability

- For instance, John Deere's precision farming equipment, which relies on robust tires, highlights the need for radial tires to support sophisticated farming operations efficiently

- Asia-Pacific dominated the Radial Farm Tire market with the largest revenue share of 41.7% in 2024, driven by rising agricultural mechanization, expanding farming acreage, and increasing government subsidies for modern equipment across countries such as China, India, and Japan

- North America is expected to grow at the fastest CAGR of 9.2% from 2025 to 2032, driven by advanced mechanized farming, large-scale commercial agriculture, and the rising replacement rate of conventional bias tires with radials for better yield and lower fuel consumption

- The Radial Tires segment dominated the market with the largest revenue share of 67.5% in 2024, attributed to their superior durability, reduced soil compaction, and better fuel efficiency compared to bias tires

Report Scope and Radial Farm Tire Market Segmentation

|

Attributes |

Radial Farm Tire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Radial Farm Tire Market?

“Smart Farming and Sensor-Integrated Tires for Precision Agriculture”

- A leading trend in the global radial farm tire market is the adoption of sensor-embedded tires that enable real-time monitoring of pressure, temperature, and soil conditions, supporting the evolution of precision agriculture. These tires help optimize equipment performance while minimizing soil compaction and improving crop yields

- For instance, Michelin has introduced connected tire systems that alert farmers to underinflation or uneven wear, enhancing fuel efficiency and machine longevity. Similarly, Trelleborg offers smart tire solutions with integrated sensors and telematics capabilities for data-driven decision-making

- These intelligent tires support automated tractor guidance systems, adjust inflation levels dynamically, and relay performance data to farm management software, helping optimize traction, reduce downtime, and improve operational efficiency

- As demand for sustainable and precision-driven agriculture grows, these innovations are transforming traditional farm equipment into data-enabled assets, aligning with global food security and environmental sustainability goals

- Companies such as Continental AG and Bridgestone are also investing in R&D to develop next-gen sensor-enabled radial farm tires to enhance productivity across a range of crop types and terrains

- This trend is expected to accelerate the market shift toward intelligent, adaptive, and sustainable farm tire solutions, redefining the role of tires in next-generation agriculture

What are the Key Drivers of Radial Farm Tire Market?

- The increasing mechanization in agriculture, coupled with the growing need for high-load capacity and better traction, is driving demand for radial farm tires globally. These tires offer better flotation, lower soil compaction, and extended tire life compared to bias-ply tires

- For instance, in June 2024, Apollo Tyres expanded its radial agricultural tire line in India and Europe to meet the rising needs of high-horsepower tractors used in modern farming practices

- The surge in global food demand, especially in developing economies, is pushing farmers to adopt efficient and durable farming equipment, further supporting market growth

- In addition, the government support for smart farming technologies, subsidies for mechanized farming, and the rise of contract farming in emerging markets are reinforcing the adoption of advanced radial tire systems

- The fuel efficiency and improved ride comfort offered by radial tires are also influencing large-scale replacement of legacy bias tires across tractors, combines, and harvesters, especially in North America and Europe

- With an increased focus on climate-resilient farming, radial farm tires that reduce operational costs while improving field productivity are becoming a strategic choice for commercial farms

Which Factor is challenging the Growth of the Radial Farm Tire Market?

- A major challenge facing the radial farm tire market is the high initial cost and replacement expenses, which can deter adoption among smallholder and marginal farmers, particularly in cost-sensitive regions such as Sub-Saharan Africa and parts of Southeast Asia

- For instance, bias tires still account for a major share in rural regions where access to capital and modern equipment remains limited, slowing the transition to radial tires

- In addition, the lack of awareness about long-term benefits of radial tires such as fuel savings and longer service life limits market penetration in developing markets where immediate affordability drives purchase decisions

- The availability of counterfeit or low-quality radial tires in some regions also affects brand trust and can lead to poor performance, resulting in user reluctance

- Companies such as MRF and BKT are working to address these challenges by introducing cost-effective radial variants and launching dealer education programs to raise awareness among farmers

- To overcome these barriers, the industry must focus on affordable pricing, aftermarket support, and financing solutions, alongside efforts to educate farmers on the operational and environmental benefits of switching to radial tires

How is the Radial Farm Tire Market Segmented?

The market is segmented on the basis of tire type, application type, and sales channel.

- By Tire Type

On the basis of tire type, the radial farm tire market is segmented into Bias Tires and Radial Tires. The Radial Tires segment dominated the market with the largest revenue share of 67.5% in 2024, attributed to their superior durability, reduced soil compaction, and better fuel efficiency compared to bias tires. These characteristics make radial tires highly favorable for modern high-horsepower tractors and heavy-duty farm equipment.

The Bias Tires segment is expected to grow at a modest rate due to continued use in budget-constrained regions and specific applications such as low-speed trailers and smaller implements. However, market share is gradually shifting toward radial variants as farm mechanization improves in emerging economies.

- By Application Type

On the basis of application type, the market is segmented into Tractors, Combine Harvesters, Sprayers, Trailers, Loaders, and Others. The Tractors segment held the largest market revenue share of 42.3% in 2024, driven by the widespread deployment of tractors in global agricultural operations for plowing, tilling, planting, and hauling.

The Sprayers segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for precision agriculture, especially in developed regions where efficient pesticide and fertilizer application is critical. Tires used on sprayers require specific tread patterns and load capacities, pushing demand for advanced radial solutions.

- By Sales Channel

On the basis of sales channel, the radial farm tire market is segmented into OEM (Original Equipment Manufacturer) and Replacement/Aftermarket. The Replacement/Aftermarket segment dominated the market with a revenue share of 58.6% in 2024, due to the frequent need for tire replacement in farming environments and the large installed base of agricultural machinery requiring ongoing maintenance.

The OEM segment is projected to grow steadily, driven by increasing farm machinery production and rising mechanization rates, particularly in Asia-Pacific and South America. OEM partnerships also play a role in the adoption of premium radial tires in new tractors and harvesters.

Which Region Holds the Largest Share of the Radial Farm Tire Market?

- Asia-Pacific dominated the radial farm tire market with the largest revenue share of 41.7% in 2024, driven by rising agricultural mechanization, expanding farming acreage, and increasing government subsidies for modern equipment across countries such as China, India, and Japan

- The region's dominance is further supported by rapid rural infrastructure development, a growing population-dependent agricultural economy, and the emergence of regional tire manufacturers offering competitively priced radial tire solutions

- Moreover, favorable policies promoting sustainable farming practices, improved irrigation systems, and the adoption of precision agriculture technologies are collectively fueling the demand for durable and fuel-efficient radial farm tires across APAC

China Radial Farm Tire Market Insight

The China radial farm tire market accounted for the largest share in Asia-Pacific in 2024, owing to the country’s extensive agricultural base, modernization of farming machinery, and strategic initiatives to reduce soil degradation using low-compaction radial tires. A robust domestic manufacturing base and high exports of agricultural equipment are further supporting market expansion, with key players investing in advanced tire technologies and localized production.

India Radial Farm Tire Market Insight

The India radial farm tire market is projected to grow at a significant CAGR during the forecast period, fueled by government schemes such as PM-KUSUM and the push for self-reliant agriculture. Growing demand for energy-efficient and high-traction tires among small and medium-scale farmers, coupled with expanding irrigation coverage, is bolstering adoption. Domestic brands and OEM collaborations are also playing a key role in strengthening supply and affordability.

Japan Radial Farm Tire Market Insight

Japan’s radial farm tire market is gaining steady momentum due to its focus on smart farming, automation, and sustainability. As the country deals with an aging agricultural workforce, there is a growing preference for compact and efficient tractors equipped with premium radial tires. The integration of IoT-enabled tractors and precision farming tools is enhancing the value proposition of radial tires in high-tech farming environments.

Which Region is the Fastest Growing Region in the Radial Farm Tire Market?

North America is expected to grow at the fastest CAGR of 9.2% from 2025 to 2032, driven by advanced mechanized farming, large-scale commercial agriculture, and the rising replacement rate of conventional bias tires with radials for better yield and lower fuel consumption. The region’s growth is bolstered by strong OEM partnerships, widespread use of high-horsepower tractors, and investments in sustainable agriculture. U.S. and Canadian farmers are increasingly focusing on tire technology that supports precision farming and environmental conservation.

U.S. Radial Farm Tire Market Insight

The U.S. dominated the North American radial farm tire market in 2024, supported by massive land under cultivation, well-established OEM networks, and a proactive shift towards low compaction and high flotation tires. Premium tire brands are innovating to cater to demand for greater durability, fuel efficiency, and load-bearing performance across diverse soil types and farming applications.

Canada Radial Farm Tire Market Insight

Canada is witnessing strong growth in radial farm tire adoption, driven by its grain and livestock sectors. Government support for sustainable farming, increased mechanization of prairie farms, and extreme weather resilience requirements are promoting the shift from bias to radial tires. The growing aftermarket for radial tires is also supported by a well-structured dealer network and seasonal demand patterns.

Which are the Top Companies in Radial Farm Tire Market?

The radial farm tire industry is primarily led by well-established companies, including:

- Balkrishna Industries Limited (BKT) (India)

- Bridgestone Corporation (Japan)

- Continental AG (Germany)

- MICHELIN (France)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Titan International, Inc. (U.S.)

- Trelleborg Wheel Systems Czech Republic a.s. (Czech Republic)

- TBC Corporation (U.S.)

- Apollo Tyres (India)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- MRF Tyres (India)

- JK Tyre & Industries Ltd (India)

- CEAT Tyres (India)

- The Carlstar Group, LLC (U.S.)

- Specialty Tires of America, Inc. (U.S.)

- ATG Cognizant (India)

- Nokian Tyres plc (Finland)

- Prometeon Tyre Group S.R.L. (Italy)

- The Goodyear Tire & Rubber Company (U.S.)

What are the Recent Developments in Global Radial Farm Tire Market?

- In February 2023, Continental unveiled its largest tractor tire, specifically designed for high-horsepower tractors. This tire boasts enhanced load-carrying capacity, superior traction, and minimized soil compaction. Its robust construction and advanced tread pattern cater to modern agricultural demands, promising increased efficiency and productivity for farming operations

- In May 2022, Apollo Tyres introduced a new line of agricultural tires for tractors, focusing on improved traction, fuel efficiency, and load-carrying capacity. These tires feature durable construction and innovative tread designs, aimed at reducing soil compaction and boosting tractor performance and productivity in agricultural tasks

- In January 2022, Magna Tyres expanded its global footprint by acquiring Industra Ltd, strengthening its position in the Polish market. Industra Ltd, known for its agricultural, earthmoving, and industrial tires, will enhance Magna's market presence and offer a broader range of tire solutions for various applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.