Global Radial Piston Motor Market

Market Size in USD million

CAGR :

%

USD

356.60 million

USD

455.25 million

2024

2032

USD

356.60 million

USD

455.25 million

2024

2032

| 2025 –2032 | |

| USD 356.60 million | |

| USD 455.25 million | |

|

|

|

|

Radial Piston Motor Market Size

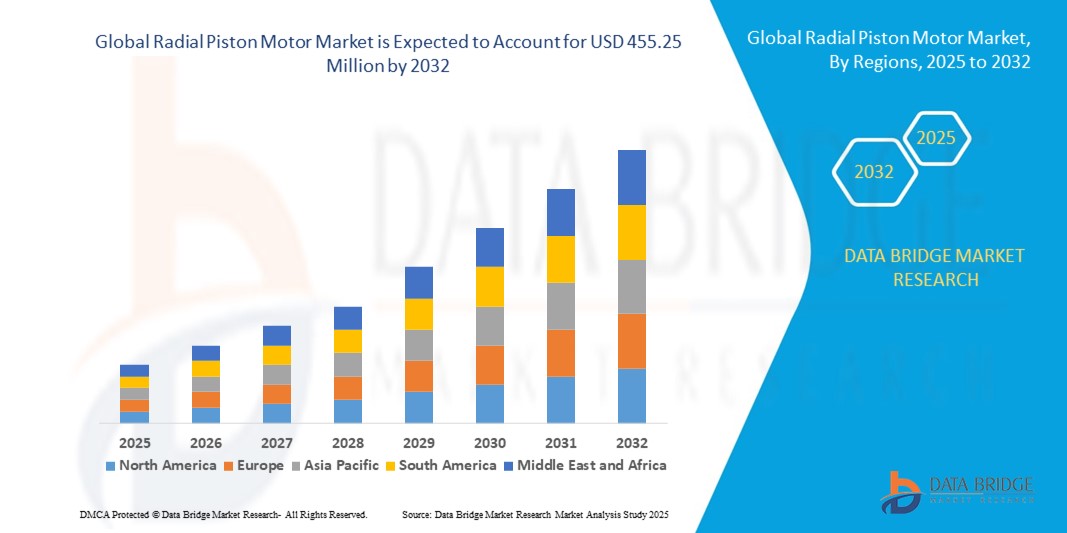

- The global radial piston motor market size was valued at USD 356.60 million in 2024 and is expected to reach USD 455.25 million by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is primarily driven by the increasing demand for high-torque, low-speed motors in heavy-duty industrial applications such as construction, mining, marine, and material handling, where radial piston motors offer superior efficiency and durability

- Moreover, advancements in hydraulic motor technologies, including improved sealing systems, modular designs, and enhanced power density, are accelerating adoption across sectors requiring reliable and high-performance motion control solutions, significantly contributing to the market’s expansion

Radial Piston Motor Market Analysis

- Radial piston motors are hydraulic motors designed with pistons arranged radially around a central drive shaft, delivering consistent torque output even at low speeds. These motors are widely used in applications demanding compact design, energy efficiency, and robustness under high-pressure operating conditions

- The rising adoption of automated and mobile machinery, coupled with increased investment in industrial infrastructure and mining equipment, is fueling demand for radial piston motors globally. The trend toward machine modernization and energy-efficient components is further supporting market growth across developed and emerging economies

- Asia-Pacific dominated the radial piston motor market with a share of 35.5% in 2024, due to rapid industrialization, expanding construction activity, and rising investments in mining and manufacturing sectors

- North America is expected to be the fastest growing region in the radial piston motor market during the forecast period due to the modernization of industrial infrastructure, expansion of mining and energy sectors, and increased demand for heavy-duty hydraulic motors

- Hydraulic radial piston motors segment dominated the market with a market share of 68.9% in 2024, due to their high torque output, energy efficiency, and superior performance under heavy load conditions. These motors are widely used in applications requiring continuous and powerful operation, such as in mining and heavy machinery. Their robustness and ability to perform in harsh environments make them a preferred choice across industrial sectors. Hydraulic variants are also favored for their compact size and flexibility in system integration. Manufacturers continue to invest in hydraulic innovations, enhancing their speed control, efficiency, and lifecycle

Report Scope and Radial Piston Motor Market Segmentation

|

Attributes |

Radial Piston Motor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Radial Piston Motor Market Trends

Integration of Radial Piston Motors in Electrified and Hybrid Industrial Equipment

- Radial piston motors are increasingly being integrated into electrified and hybrid industrial machinery, playing a crucial role in supporting the shift towards more energy-efficient, low-emission equipment across sectors such as construction, mining, and manufacturing, where stringent environmental regulations are pushing electrification

- For instance, Bosch Rexroth and Parker Hannifin have developed advanced hybrid hydraulic systems featuring radial piston motors that optimize power delivery, enhance fuel efficiency, and significantly reduce emissions in heavy-duty construction and mining equipment

- The rise of Industry 4.0 and smart manufacturing is accelerating the adoption of IoT-enabled radial piston motors that offer real-time performance monitoring, predictive maintenance alerts, and remote diagnostics, helping to minimize unplanned downtime and improve operational productivity

- Medium-speed radial piston motors (operating typically between 500-2,000 rpm) are favored for their ability to provide precise and controllable torque, which is increasingly important in hybrid systems requiring smooth power transitions and better energy management

- Growing focus on energy efficiency and stricter regulatory mandates in developed regions such as Europe and North America is driving continuous innovation in motor design, including use of advanced materials, improved sealing technology, and enhanced durability to reduce energy losses and extend motor lifespan

- Emerging industrial markets such as China and India are rapidly adopting radial piston motors in hybrid and electrified equipment to meet the rising demand for automation combined with cost-effective and reliable powertrain solutions

Radial Piston Motor Market Dynamics

Driver

Growing Demand for High-Torque Solutions in Heavy-Duty Applications

- The increasing need for robust, high-torque motor solutions capable of handling challenging heavy-duty workloads in sectors such as construction, mining, agriculture, and various manufacturing processes is a key factor driving growth in the radial piston motor market

- For instance, Eaton Corp. Plc has expanded its portfolio of radial piston motors to cater to the booming infrastructure development and industrialization projects in Asia-Pacific, supplying motors designed for robust performance and long service life under harsh working conditions

- Accelerating industry-wide adoption of smart hydraulic systems and automation requires reliable and efficient power transmission components, further propelling the demand for radial piston motors capable of supporting intricate machine functionalities

- The motors’ applicability in renewable energy equipment, for instance within wind turbines and small hydroelectric setups, is creating new avenues for growth by leveraging their superior torque and durability in sustainable energy production

- Technological advances in materials science and manufacturing precision have improved motor efficiency, reliability, and service intervals, enabling industries to minimize operational costs while maximizing equipment uptime

Restraint/Challenge

High Initial Cost and Maintenance Complexity

- The relatively high initial investment required to procure and install radial piston motors, combined with their maintenance complexity, limits adoption especially among small- and medium-sized enterprises and budget-sensitive industries

- For instance, premium radial piston motor installations at large European industrial plants by companies such as Kawasaki Heavy Industries encounter extended timelines and increased costs due to integration complexities and the need for skilled operator and maintenance training

- Maintenance activities often require specialized technical know-how and precision tooling, which raises operational expenses and constrains rapid troubleshooting or repair, posing challenges in regions with limited skilled labor availability

- Variability in regulatory requirements and certification standards across different regions complicates production and deployment, making compliance management costly and administratively demanding for manufacturers and users operating across multiple markets

- Ongoing fluctuations in raw material costs and supply chain disruptions—particularly for precision components such as high-grade metals and seals—can delay manufacturing schedules and reduce availability of radial piston motors, impacting market growth

Radial Piston Motor Market Scope

The market is segmented on the basis of type, application, distribution channel, and component.

- By Type

On the basis of type, the radial piston motor market is segmented into pneumatic radial piston motors and hydraulic radial piston motors. The hydraulic radial piston motors segment dominated the largest market revenue share of 68.9% in 2024 due to their high torque output, energy efficiency, and superior performance under heavy load conditions. These motors are widely used in applications requiring continuous and powerful operation, such as in mining and heavy machinery. Their robustness and ability to perform in harsh environments make them a preferred choice across industrial sectors. Hydraulic variants are also favored for their compact size and flexibility in system integration. Manufacturers continue to invest in hydraulic innovations, enhancing their speed control, efficiency, and lifecycle.

The pneumatic radial piston motors segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing use in industries prioritizing clean and low-maintenance energy solutions. Pneumatic systems offer simplified design, reduced heat generation, and easy serviceability, making them attractive for operations involving light-duty cycles. They are also increasingly adopted where explosion-proof and safe operations are mandatory, such as in chemical processing and textiles. Lower operational costs and advances in compressed air efficiency are further expanding their applicability.

- By Application

On the basis of application, the market is segmented into mining, rubber, paper and pulp, material handling, chemical processing, oil and gas, manufacturing, textile, and construction. The mining segment accounted for the largest market share in 2024, attributed to the extensive use of radial piston motors in drilling equipment, conveyor systems, and crushers. These motors provide high torque at low speeds, ideal for heavy-duty applications in underground and surface mining. Their ability to withstand dust, moisture, and high pressures adds to their durability and operational reliability.

The construction segment is expected to register the fastest CAGR from 2025 to 2032 due to rising infrastructure development globally and growing adoption of radial piston motors in construction equipment such as excavators, cranes, and concrete pumps. These motors provide reliable performance, smooth motion control, and long service life, which are essential for demanding construction environments. Increased mechanization in emerging markets and a shift toward energy-efficient hydraulic systems support this growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, distributors, and retailers. The direct sales segment held the largest revenue share in 2024 as industrial clients and OEMs prefer direct engagement with manufacturers for customized solutions, technical support, and better pricing. Direct sales channels enable manufacturers to offer tailored motor configurations, after-sales services, and faster delivery timelines, which are crucial for project-based industries such as mining and oil & gas.

The distributor segment is projected to grow at the fastest rate from 2025 to 2032, driven by expanding industrial networks and the need for broader market reach, particularly in emerging economies. Distributors act as vital links in regions where manufacturers lack a local presence, offering inventory management, regional support, and technical assistance. Their partnerships with system integrators and resellers further help penetrate small and medium-scale enterprises.

- By Component

On the basis of component, the market is segmented into motor housing, pistons, thrust plate, shafts, and seals. The motor housing segment captured the largest market share in 2024 due to its critical role in structural integrity, heat dissipation, and protection against external contaminants. High-performance motor housings ensure proper alignment of internal components and reduce operational vibrations, contributing to motor longevity. Material innovations, such as high-strength alloys and coatings, are further enhancing housing performance under extreme industrial conditions.

The seals segment is expected to record the fastest growth during the forecast period owing to the rising demand for leak-proof and high-pressure resistant sealing solutions. Seals are essential for maintaining hydraulic fluid integrity and preventing contamination in piston motor assemblies. With industries prioritizing maintenance-free and high-efficiency systems, the need for advanced sealing technologies using composite and polymeric materials has increased. Enhanced sealing solutions contribute significantly to motor performance, efficiency, and lifecycle.

Radial Piston Motor Market Regional Analysis

- Asia-Pacific dominated the radial piston motor market with the largest revenue share of 35.5% in 2024, driven by rapid industrialization, expanding construction activity, and rising investments in mining and manufacturing sectors

- The region’s cost-effective production capabilities, large-scale infrastructure development, and increasing adoption of hydraulic equipment are accelerating market growth

- Government initiatives promoting automation and modernization, along with the growing presence of OEMs and component suppliers, are contributing to strong demand across key end-use industries

China Radial Piston Motor Market Insight

China held the largest share in the Asia-Pacific radial piston motor market in 2024, supported by its dominant manufacturing base and aggressive investment in infrastructure and mining operations. The country’s thriving heavy machinery and construction sectors, along with a high concentration of hydraulic system manufacturers, are key growth drivers. Favorable industrial policies and domestic availability of components further strengthen China’s leadership in the regional market.

India Radial Piston Motor Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by increasing industrial automation, robust infrastructure development, and a surge in mining and material handling activities. Government initiatives such as "Make in India" and rapid expansion in sectors such as textiles and construction are boosting the adoption of radial piston motors. The growing preference for efficient, high-torque hydraulic solutions is expected to further accelerate market expansion.

Europe Radial Piston Motor Market Insight

The Europe radial piston motor market is expanding steadily, supported by high adoption of advanced industrial machinery, strong focus on energy efficiency, and demand for reliable hydraulic systems. The region’s emphasis on sustainable industrial operations, coupled with innovation in equipment design, is encouraging the use of radial piston motors in sectors such as manufacturing, paper & pulp, and construction. A well-developed engineering ecosystem and strict quality standards continue to support growth across the continent.

Germany Radial Piston Motor Market Insight

Germany’s radial piston motor market is driven by its leadership in precision engineering and strong demand for high-efficiency hydraulic solutions in manufacturing and heavy industries. The country’s commitment to industrial automation, energy conservation, and advanced machinery supports the deployment of radial piston motors across a wide range of applications. Collaborative R&D and innovation-focused production further enhance the market’s competitiveness.

U.K. Radial Piston Motor Market Insight

The U.K. market is supported by a shift toward modernized industrial equipment, growing infrastructure investments, and efforts to strengthen domestic manufacturing capabilities. Increasing focus on safety, reliability, and performance in machinery is encouraging adoption of radial piston motors in sectors such as construction, oil & gas, and textiles. In addition, support for sustainable technology and industrial modernization continues to shape demand across key applications.

North America Radial Piston Motor Market Insight

North America is projected to grow at a strong CAGR from 2025 to 2032, driven by the modernization of industrial infrastructure, expansion of mining and energy sectors, and increased demand for heavy-duty hydraulic motors. A growing focus on automation, high productivity standards, and the replacement of legacy systems are fueling market growth. Supportive government policies and a push for reshoring critical manufacturing operations are also strengthening regional demand.

U.S. Radial Piston Motor Market Insight

The U.S. accounted for the largest share in the North America radial piston motor market in 2024, owing to its highly developed industrial sector, robust demand from oil & gas and material handling industries, and strong emphasis on innovation and performance efficiency. Presence of key manufacturers, widespread adoption of automated systems, and ongoing investments in industrial upgrades are reinforcing the U.S.’s position as a leading market in the region.

Radial Piston Motor Market Share

The radial piston motor industry is primarily led by well-established companies, including:

- Bosch Rexroth AG (Germany)

- Rotary Power (U.K.)

- Salami SpA (Italy)

- Eaton (Ireland)

- Intermot S.r.l. (Italy)

- Black Bruin Inc. (Finland)

- Kawasaki Precision Machinery Company (Japan)

- Schaeffler AG (Germany)

- PARKER HANNIFIN CORP (U.S.)

- Italgroup S.l.r (Italy)

- KYB Corporation (Japan)

- Dongguan Blince Machinery & Electronics Co., Ltd (China)

Latest Developments in Global Radial Piston Motor Market

- In May 2024, Finnish hydraulic motor manufacturer Black Bruin announced the launch of its new X-series rotating shaft motors, marking a significant expansion of its product portfolio. This product development aims to address growing market demand across a wide range of industrial sectors, including recycling, marine and offshore, pulp and paper, construction, mining, and material handling. The X-series, featuring a patent-pending design, is engineered to improve the performance of both newly manufactured and retrofitted machinery, with a focus on enhanced durability, ease of maintenance, and cost-efficiency. The currently available models offer displacements ranging from 2512 to 8800 cm³. This launch represents a strategic move by Black Bruin to strengthen its position in high-demand application areas and extend its global footprint in the hydraulic motor market

- In July 2023, Bosch Rexroth opened new plant in Mexico. The company invests about 160 million euros and creates about 900 jobs by 2027. The plant manufactures hydraulic pumps, motors, valves, transmission units, radial piston motors and linear motion technology products for various applications. The company increased the capacity, flexibility and robustness of supply chains, reduces the CO2 footprint and achieves shorter delivery times for customers in North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Radial Piston Motor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Radial Piston Motor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Radial Piston Motor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.