Global Radiation Hardened Electronics Market

Market Size in USD Billion

CAGR :

%

USD

1.82 Billion

USD

2.60 Billion

2024

2032

USD

1.82 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.82 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Radiation Hardened Electronics Market Size

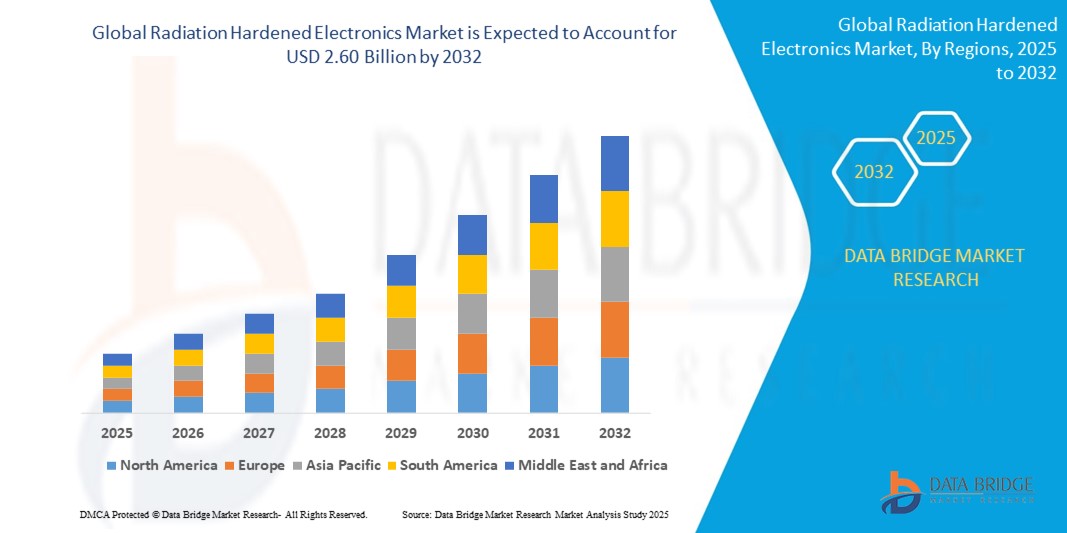

- The global radiation hardened electronics market size was valued at USD 1.82 billion in 2024 and is expected to reach USD 2.60 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by the increasing deployment of satellites and space missions, rising demand for military and defense applications, and growing adoption of radiation-hardened components in nuclear power plants and high-altitude aviation systems

- In addition, the miniaturization of radiation-hardened integrated circuits, coupled with advancements in material science and semiconductor processes, is opening new opportunities for compact and efficient electronic systems used in harsh radiation environments

Radiation Hardened Electronics Market Analysis

- The market is witnessing significant demand from the aerospace and defense sectors, where exposure to intense radiation levels can lead to potential system failures. As countries continue to invest in space exploration and advanced missile systems, the need for reliable, radiation-resistant electronics continues to rise

- Moreover, advancements in fabrication techniques and the integration of new shielding technologies are enhancing the performance and durability of radiation-hardened components. The emergence of commercial satellite constellations, such as those supporting global communications and Earth observation, further contributes to the expanding demand for radiation-tolerant microelectronics

- North America dominated the radiation hardened electronics market with the largest revenue share of 38.14% in 2024, fuelled by substantial defense expenditure, active space missions, and the rising deployment of secure satellite communication systems

- Asia-Pacific region is expected to witness the highest growth rate in the global radiation hardened electronics market, driven by expanding space missions, growing defense modernization programs, and rising investments from countries such as China, Japan, and India

- The processors and controllers segment held the largest market revenue share in 2024, driven by their integral role in mission-critical control functions for satellites, military systems, and nuclear applications. These components are engineered to operate efficiently under intense radiation exposure, ensuring performance stability in hostile environments. The market’s demand for processors and controllers is further supported by the increasing deployment of satellites and autonomous defense systems requiring real-time processing capabilities

Report Scope and Radiation Hardened Electronics Market Segmentation

|

Attributes |

Radiation Hardened Electronics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Miniaturized Radiation-Hardened Components in Small Satellite Platforms • Increasing Investments in Space Exploration and Interplanetary Missions by Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Radiation Hardened Electronics Market Trends

“Adoption of Commercial Off-The-Shelf (COTS) Components With Radiation Hardening”

- The use of commercial off-the-shelf (COTS) components with radiation hardening modifications is growing rapidly due to cost efficiency and faster deployment cycles. Companies are customizing standard COTS devices to meet space-grade radiation tolerance using shielding and redundancy without compromising functionality. This approach significantly reduces manufacturing lead time, making it ideal for high-volume satellite constellations.

- COTS-based designs enable greater flexibility and accessibility for new entrants in the space electronics market, especially for low-budget or university-led missions. These modified components help balance affordability and reliability, fostering innovation in research and development. For instance, NASA has implemented COTS-based systems for CubeSat missions in low-Earth orbit, promoting experimentation at lower cost.

- This trend supports the production of compact, modular, and scalable electronics suited for emerging space applications such as real-time Earth imaging and in-orbit servicing. The ability to scale operations while maintaining performance under radiation exposure is a key factor behind its rising popularity.

- For instance, Major companies such as BAE Systems and Texas Instruments are advancing this strategy by offering hybrid radiation-hardened COTS solutions. These offerings serve critical applications in satellite communication and defense surveillance, further encouraging industry-wide adoption.

- In conclusion, the adoption of radiation-hardened COTS components is reshaping the global market landscape, empowering stakeholders with cost-effective, reliable solutions while enabling rapid expansion across commercial, research, and military space missions.

Radiation Hardened Electronics Market Dynamics

Driver

“Increasing Demand From Satellite And Space Missions”

- The growing number of satellite launches for navigation, communication, and scientific research is significantly fueling the demand for radiation hardened electronics. Satellites face continuous exposure to cosmic rays and charged particles, which can degrade unprotected electronics and disrupt operations. To ensure uninterrupted mission performance, spacecraft are being equipped with radiation-tolerant semiconductors and control units

- Governments and private players are scaling up satellite constellations in low-Earth orbit (LEO) to expand internet connectivity and remote sensing capabilities. For instance, SpaceX’s Starlink and Amazon’s Project Kuiper are deploying thousands of satellites, all requiring radiation-hardened systems for long-term durability. These developments are accelerating the production and adoption of resilient space-grade electronics

- Deep space missions by agencies such as NASA and the European Space Agency demand extremely robust electronics that can operate in high-radiation environments such as Mars or the Van Allen Belts. These missions require long-lifespan electronics to support navigation, data collection, and autonomous decision-making

- Satellite manufacturers are also focusing on integrating high-performance, radiation-hardened components in miniaturized formats to accommodate size and weight constraints. As more demand emerges from compact satellite platforms, radiation-hardened electronics are becoming an essential component in satellite subsystems

- The global surge in satellite and space exploration missions is a key driver for the market, ensuring sustained demand for advanced, reliable, and radiation-resistant electronics across a wide spectrum of orbital and interplanetary applications

Restraint/Challenge

“High Development Cost And Complex Design Requirements”

- • Developing radiation hardened electronics requires extensive testing, high-cost materials, and advanced design protocols, significantly increasing production costs. These expenses often make it challenging for smaller firms and new entrants to compete or scale up operations, limiting market competitiveness

- • The process of qualifying electronics for radiation tolerance involves simulation and environmental testing that mimic space-like radiation conditions. These steps are time-consuming and require specialized infrastructure, leading to longer product development cycles and delayed time-to-market

- • Designing for radiation resistance often compromises on other key metrics such as power efficiency, performance speed, or device compactness. Engineers must balance trade-offs in design to meet mission-specific radiation thresholds, which adds to technical complexity

- • The absence of unified global standards for radiation hardening makes it difficult for manufacturers to create universally accepted products. For instance, U.S. and European space programs use different qualification protocols, creating challenges in meeting cross-border requirements

- • Although the market holds strong potential, high production costs and intricate design challenges remain key barriers to widespread adoption. Addressing these issues through standardization, automation, and material innovation will be critical to future market expansion

Radiation Hardened Electronics Market Scope

The market is segmented on the basis of component, manufacturing technique, product type, and application.

- By Component

On the basis of component, the radiation hardened electronics market is segmented into mixed signal ICs, processors and controllers, memory, and power management. The processors and controllers segment held the largest market revenue share in 2024, driven by their integral role in mission-critical control functions for satellites, military systems, and nuclear applications. These components are engineered to operate efficiently under intense radiation exposure, ensuring performance stability in hostile environments. The market’s demand for processors and controllers is further supported by the increasing deployment of satellites and autonomous defense systems requiring real-time processing capabilities.

The memory segment is expected to witness a fastest growth rate from 2025 to 2032, fueled by the rising need for secure, reliable data storage in space and military operations. Radiation-hardened memory solutions enable systems to retain data integrity during high-radiation events, making them indispensable for long-duration space missions and defense-grade embedded systems.

- By Manufacturing Technique

On the basis of manufacturing technique, the market is segmented into radiation hardening by design (RHBD) and radiation hardening by process (RHBP). The RHBD segment dominated the market in 2024 due to its ability to deliver design-level radiation tolerance using standard semiconductor fabrication processes. This approach allows for more flexibility and cost control while maintaining device resilience, especially suited for low-Earth orbit and commercial satellite applications.

The RHBP segment is expected to witness a fastest growth rate from 2025 to 2032, as it involves altering the semiconductor material or fabrication process to resist radiation effects. This technique is ideal for high-radiation environments such as deep space and nuclear applications, ensuring robust physical defense against charged particles and high-energy cosmic rays.

- By Product Type

On the basis of product type, the radiation hardened electronics market is segmented into commercial off-the-shelf (COTS) and custom made. The custom-made segment held the largest share in 2024, owing to the strict requirements of space, defense, and nuclear projects that demand precision engineering, long-term durability, and mission-specific functionality. Custom solutions often include redundancy, shielding, and enhanced error-correction, catering to critical use cases where system failure is not an option.

The COTS segment is expected to witness a fastest growth rate from 2025 to 2032, driven by cost-effective deployment, quick availability, and their increasing adaptability through radiation-hardening techniques. COTS-based systems are gaining momentum in CubeSat missions and low-budget government or university space programs, where flexibility and affordability are essential.

- By Application

On the basis of application, the market is segmented into aerospace and defense, medical, nuclear power plants, space, and others. The aerospace and defense segment held the largest revenue share in 2024, propelled by growing global investments in surveillance systems, missile guidance, radar, and navigation, all of which require hardened electronics to maintain functionality in radiation-intense environments. This segment benefits from national security priorities and increasing military modernization across developed and developing nations.

The space segment is expected to witness a fastest growth rate from 2025 to 2032, driven by the increasing number of satellite launches and interplanetary missions by public and private entities. The reliance on radiation-hardened electronics to ensure spacecraft longevity and system reliability in outer space is expected to boost adoption across multiple satellite platforms and orbital configurations.

Radiation Hardened Electronics Market Regional Analysis

- North America dominated the radiation hardened electronics market with the largest revenue share of 38.14% in 2024, fuelled by substantial defense expenditure, active space missions, and the rising deployment of secure satellite communication systems

- The region benefits from the presence of prominent defense contractors, space agencies, and semiconductor companies that are heavily investing in radiation-resistant components for extreme environments

- Strong support from government programs, coupled with technological advancements in aerospace and military-grade electronics, continues to reinforce North America’s leadership in the global radiation hardened electronics market

U.S. Radiation Hardened Electronics Market Insight

The U.S. radiation hardened electronics market captured the largest revenue share within North America in 2024, driven by its dominant role in space exploration, missile defense development, and military communications. High investment by the Department of Defense and NASA fuels demand for radiation-hardened memory, processors, and power components used in satellites, unmanned vehicles, and deep-space missions. The U.S. market continues to thrive on innovation, supported by collaborations among national agencies and private aerospace and semiconductor firms

Europe Radiation Hardened Electronics Market Insight

The Europe radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, supported by space research initiatives, growing nuclear energy programs, and the modernization of military capabilities. The European Space Agency (ESA) plays a key role in enhancing regional adoption, particularly for satellite and interplanetary mission applications. Strong manufacturing capabilities and government-backed investments across France, Germany, and the United Kingdom are further accelerating the integration of radiation-hardened solutions in aerospace and defense sectors.

Germany Radiation Hardened Electronics Market Insight

The Germany radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, bolstered by the country’s advanced defense infrastructure, nuclear energy development, and increasing satellite deployment. Germany’s robust engineering capabilities and emphasis on innovation position it as a central hub for radiation-hardened technology in Europe. Partnerships between defense contractors and research institutions continue to enhance localized production and application of radiation-resistant semiconductors across space, aviation, and nuclear sectors.

U.K. Radiation Hardened Electronics Market Insight

The U.K. radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, supported by strategic investments in defense modernization, aerospace innovation, and nuclear infrastructure. The United Kingdom’s collaboration with the European Space Agency and domestic initiatives to advance satellite and missile technologies are fueling demand for radiation-tolerant components. In addition, increased government focus on enhancing national security and strengthening domestic semiconductor supply chains is likely to contribute to market expansion.

Asia-Pacific Radiation Hardened Electronics Market Insight

The Asia-Pacific radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, driven by rising defense budgets, expanding space programs, and increasing investments in nuclear facilities across China, India, and Japan. The region's growing focus on indigenizing aerospace and defense technologies is stimulating demand for locally manufactured radiation-hardened components. Government initiatives supporting satellite development and missile technology are expected to create significant growth opportunities across the Asia-Pacific market.

China Radiation Hardened Electronics Market Insight

The China radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, underpinned by the country’s expansive space exploration programs, growing military modernization, and strong semiconductor manufacturing base. China’s ambitions in building a lunar base and expanding its satellite infrastructure are leading to higher demand for radiation-tolerant microelectronics. Continued investment in self-reliance and innovation across aerospace and nuclear domains is making China a major contributor to regional and global market growth.

Japan Radiation Hardened Electronics Market Insight

The Japan radiation hardened electronics market is expected to witness a fastest growth rate from 2025 to 2032, driven by the country’s advanced space exploration programs, robust nuclear energy sector, and defense modernization efforts. Japan’s space agency (JAXA) continues to deploy satellites and space probes, necessitating the use of high-reliability, radiation-hardened systems. Moreover, with a growing emphasis on disaster preparedness and national security, Japan is increasingly investing in the development of resilient electronics for both military and civil infrastructure.

Radiation Hardened Electronics Market Share

The radiation hardened electronics industry is primarily led by well-established companies, including:

- Raytheon Technologies (U.S.)

- Lockheed Martin (U.S.)

- Boeing (U.S.)

- Northrop Grumman (U.S.)

- Airbus (France)

- Thales Group (France)

- BAE Systems (U.K.)

- MAXIM Integrated (U.S.)

- Analog Devices (U.S.)

- Honeywell International (U.S.)

- Intersil (U.S.)

- Microchip Technology Inc. (U.S.)

- Texas Instruments (U.S.)

- STMicroelectronics (Switzerland)

Latest Developments in Global Radiation Hardened Electronics Market

- In June 2024, Teledyne e2v HiRel announced the launch of two enhanced plastic low noise amplifiers, the TDLNA2050EP and TDLNA0430EP, aimed at very high frequency to S-band applications. These components, built on a 250 nm pHEMT process, offer low noise figures, compact size, and low power consumption. Designed for high-reliability environments, the amplifiers are expected to enhance performance in aerospace and defense electronics, supporting market demand for efficient and miniaturized solutions

- In May 2024, Apogee Semiconductor introduced its AF54RHC GEO family of radiation-hardened integrated circuits, specifically built for use in medium Earth orbit, geosynchronous Earth orbit, and deep space missions. Along with this launch, the company also upgraded its LEO IC family’s TID radiation tolerance. These advancements significantly improve mission durability and reliability, boosting Apogee's presence in the space-grade electronics market

- In November 2023, Infineon Technologies expanded its portfolio by launching new radiation-hardened asynchronous static RAMs featuring RADSTOP technology. These QML-V certified memory components are tailored for space and extreme environment applications, offering unmatched access speeds and a small footprint. The products aim to meet the stringent radiation and performance needs of aerospace missions, strengthening Infineon's role in the high-density memory segment

- In July 2021, Renesas Electronics Corporation unveiled a new suite of radiation-hardened plastic ICs targeted at satellite power management. The product line includes buck regulators, digital isolators, and GaN FET drivers, delivering high reliability with a lower size, weight, and power (SWaP) profile. Offering a cost-effective alternative to ceramic solutions, the development enhances Renesas’ position in supporting advanced satellite systems operating in MEO and GEO environment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Radiation Hardened Electronics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Radiation Hardened Electronics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Radiation Hardened Electronics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.