Global Radiation Sterilized Uhmw Polyethylene Market

Market Size in USD Million

CAGR :

%

USD

310.00 Million

USD

808.49 Million

2024

2032

USD

310.00 Million

USD

808.49 Million

2024

2032

| 2025 –2032 | |

| USD 310.00 Million | |

| USD 808.49 Million | |

|

|

|

|

Radiation-Sterilized UHMW Polyethylene Market Size

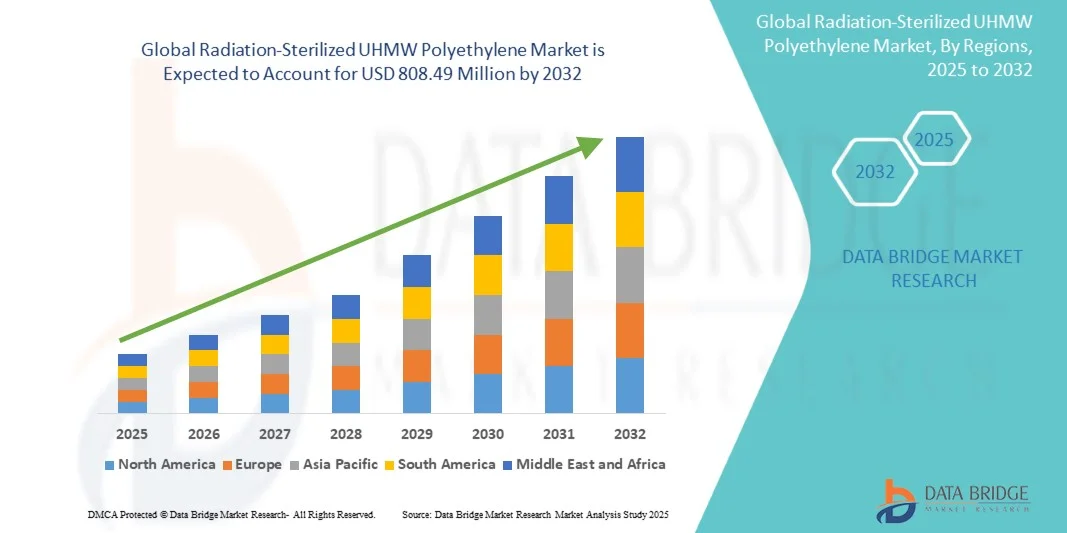

- The global radiation-sterilized UHMW polyethylene market size was valued at USD 310.00 million in 2024 and is expected to reach USD 808.49 million by 2032, at a CAGR of 12.73% during the forecast period

- The market growth is largely fueled by the rising demand for advanced orthopedic implants and prosthetics, where radiation sterilization ensures safety, longevity, and biocompatibility of UHMWPE components used in joint replacements and other medical applications

- Furthermore, increasing adoption of crosslinked and antioxidant-stabilized UHMWPE, coupled with advancements in sterilization methods such as gamma and electron-beam irradiation, is driving industry innovation. These factors, alongside growing global surgical volumes and aging populations, are accelerating the uptake of radiation-sterilized UHMWPE solutions, thereby significantly boosting the market’s expansion

Radiation-Sterilized UHMW Polyethylene Market Analysis

- Radiation-sterilized UHMW polyethylene, widely used in orthopedic implants such as hip and knee replacements, has become a critical biomaterial due to its exceptional wear resistance, biocompatibility, and durability, with sterilization ensuring product safety and performance in long-term medical applications

- The escalating demand for radiation-sterilized UHMWPE is primarily fueled by the global rise in joint replacement surgeries, the aging population, and advancements in crosslinked and antioxidant-stabilized UHMWPE that enhance implant longevity and reduce revision rates

- North America dominated the global radiation-sterilized UHMW polyethylene market with the largest revenue share of 42% in 2024, supported by a high prevalence of orthopedic disorders, advanced healthcare infrastructure, and strong presence of implant manufacturers, with the U.S. leading adoption through innovation in highly crosslinked and vitamin-E stabilized UHMWPE materials

- Asia-Pacific is expected to be the fastest growing region in the global radiation-sterilized UHMW polyethylene market during the forecast period, projected to expand at a CAGR higher than the global average, driven by expanding healthcare access, increasing surgical volumes, and rising demand for cost-effective implant solutions across emerging economies

- Orthopedic implant applications dominated the global radiation-sterilized UHMW polyethylene market with a market share of 72.8% in 2024, driven by their widespread use in hip and knee replacement procedures, supported by continuous R&D efforts to improve wear resistance and oxidative stability in clinical practice

Report Scope and Radiation-Sterilized UHMW Polyethylene Market Segmentation

|

Attributes |

Radiation-Sterilized UHMW Polyethylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Radiation-Sterilized UHMW Polyethylene Market Trends

“Advancements in Crosslinking and Antioxidant Stabilization”

- A significant and accelerating trend in the global radiation-sterilized UHMW polyethylene market is the adoption of highly crosslinked UHMWPE and vitamin-E stabilized variants, which improve implant longevity, wear resistance, and oxidative stability

- For instance, Zimmer Biomet introduced vitamin-E infused UHMWPE liners that demonstrated reduced oxidation while maintaining mechanical properties in hip replacements. Similarly, Stryker has advanced its crosslinking technologies to enhance the durability of knee implant components

- Crosslinking with radiation followed by thermal treatments such as annealing or remelting allows manufacturers to fine-tune mechanical properties while maintaining resistance to oxidation. For instance, Smith & Nephew’s OXINIUM technology integrates such processes to achieve greater wear performance

- Antioxidant stabilization through vitamin-E infusion or blending is enabling implants to resist long-term oxidative degradation. For instance, DePuy Synthes has adopted antioxidant-stabilized UHMWPE in acetabular liners to reduce revision rates in joint replacements

- This trend towards more durable and biologically stable materials is reshaping clinical outcomes, with patients experiencing fewer complications and longer implant lifespans. Consequently, companies are investing in R&D to produce next-generation UHMWPE with superior resistance to wear and oxidation

- The demand for radiation-sterilized UHMWPE incorporating crosslinking and antioxidant strategies is growing rapidly across both hip and knee implants, as healthcare providers increasingly prioritize patient safety and reduced revision surgeries

Radiation-Sterilized UHMW Polyethylene Market Dynamics

Driver

“Rising Surgical Volumes and Growing Orthopedic Burden”

- The increasing prevalence of osteoarthritis, osteoporosis, and trauma-related conditions, coupled with an aging global population, is a significant driver for the heightened demand for radiation-sterilized UHMWPE implants

- For instance, in March 2024, Exactech expanded its hip and knee implant portfolio with radiation-sterilized UHMWPE components designed to extend longevity and improve wear resistance in joint replacements

- As surgical volumes continue to rise, radiation-sterilized UHMWPE offers advanced features such as high biocompatibility, excellent wear resistance, and mechanical durability, providing a compelling upgrade over conventional polyethylene

- Furthermore, the growing popularity of minimally invasive orthopedic procedures and the rising adoption of premium implant solutions are making radiation-sterilized UHMWPE an integral component of modern orthopedic practices

- The reliability of radiation-sterilized UHMWPE in critical load-bearing applications such as acetabular cups, tibial inserts, and spinal devices is a key factor propelling adoption across global healthcare markets. The trend towards earlier surgical interventions and improved implant longevity further contributes to market growth

Restraint/Challenge

“Oxidation Risk and High Production Cost”

- Concerns surrounding post-irradiation oxidation of UHMWPE, particularly with gamma sterilization, pose a significant challenge to broader market adoption. Prolonged exposure to oxygen can degrade mechanical properties and compromise implant performance

- For instance, clinical reports of early implant failures in gamma-sterilized UHMWPE without antioxidant stabilization raised concerns, leading to stricter material standards and demand for improved processing techniques

- Addressing these oxidation risks through controlled radiation processes, vacuum packaging, and antioxidant incorporation is crucial for ensuring material stability. Companies such as Zimmer Biomet and DePuy emphasize their stabilized UHMWPE solutions in product portfolios to reassure healthcare providers

- In addition, the relatively high production cost of crosslinked and vitamin-E stabilized UHMWPE compared to conventional polyethylene can be a barrier for cost-sensitive markets and healthcare systems in developing regions

- While prices are gradually decreasing, the perceived premium for advanced UHMWPE materials can hinder widespread adoption, particularly where reimbursement systems do not fully cover implant costs

- Overcoming these challenges through continuous innovation, cost optimization, and education of surgeons and healthcare providers on the long-term benefits will be vital for sustained market growth

Radiation-Sterilized UHMW Polyethylene Market Scope

The market is segmented on the basis of sterilization method, product type, form, application, and end user.

- By Sterilization Method

On the basis of sterilization method, the global radiation-sterilized UHMW polyethylene market is segmented into gamma irradiation, electron-beam irradiation, and radiation + barrier packaging. The Gamma Irradiation segment dominated the market with the largest market revenue share in 2024, primarily due to its widespread adoption in orthopedic and surgical implants. Gamma irradiation ensures deep and uniform sterilization of UHMWPE, making it the standard method used by most medical device manufacturers. Its reliability, scalability for high-volume sterilization, and long history of proven effectiveness in healthcare applications further reinforce its dominance. In addition, regulatory acceptance and established infrastructure for gamma sterilization across multiple regions make it the most preferred choice. The orthopedic sector heavily depends on gamma-irradiated UHMWPE for joint replacements, strengthening its market position.

The Radiation + Barrier Packaging segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising concerns over oxidation and degradation post-sterilization. Barrier packaging techniques combined with irradiation help preserve mechanical integrity and extend the shelf life of UHMWPE components. This method is gaining traction as device OEMs increasingly prioritize performance longevity and patient safety. Moreover, its role in reducing free radicals while maintaining sterilization efficacy is encouraging adoption. The growing emphasis on advanced packaging solutions in surgical centers and OEM supply chains further accelerates this segment’s growth.

- By Product Type

On the basis of product type, the global radiation-sterilized UHMW polyethylene market is segmented into Virgin UHMWPE, Highly Crosslinked UHMWPE, Antioxidant-stabilized UHMWPE, and UHMWPE Fibres. The Highly Crosslinked UHMWPE segment dominated the market with the largest revenue share in 2024, owing to its superior wear resistance and reduced particle generation in orthopedic implants. Surgeons and hospitals increasingly prefer crosslinked UHMWPE for hip and knee replacements as it significantly improves implant longevity. The rising prevalence of osteoarthritis and the growing geriatric population worldwide are directly fueling its demand. In addition, multiple studies validating its reduced risk of osteolysis and implant failures further strengthen adoption. OEMs continue to prioritize this product for its balance of strength, durability, and clinical outcomes.

The Antioxidant-stabilized UHMWPE segment is projected to register the fastest growth during the forecast period, driven by its advanced resistance to oxidative degradation. Incorporating vitamin E or other antioxidants into UHMWPE helps maintain material strength after radiation sterilization, making it highly attractive for next-gen implants. Growing regulatory support for safer, long-lasting orthopedic materials is boosting uptake among OEMs. Moreover, the emphasis on reducing revision surgeries and improving patient quality of life adds momentum to this segment. Its potential to deliver superior clinical performance positions it as the most rapidly expanding subsegment.

- By Form

On the basis of form, the global radiation-sterilized UHMW polyethylene market is segmented into powder, sheets, pre-formed liners, and tapes. The Pre-formed Liners segment dominated the market with the largest share in 2024, primarily because they are the most widely used form in joint replacement implants. Their ability to directly integrate into hip and knee prosthetics makes them essential for orthopedic OEMs. Pre-formed liners save time in manufacturing, reduce variability, and meet stringent clinical performance standards. Hospitals and surgical centers rely heavily on these components for standard procedures, further reinforcing demand. In addition, their compatibility with both gamma and e-beam sterilization processes ensures broad acceptance. The aging population and rising surgical volumes globally continue to fuel their dominance.

The UHMWPE Sheets segment is expected to be the fastest-growing during forecast period, supported by increasing use in medical device prototyping, industrial wear parts, and defense applications. Sheets offer versatility and customization, making them ideal for manufacturers seeking precision-engineered solutions. Their growing role in non-orthopedic applications such as ballistic protection and industrial machinery enhances market scope. Furthermore, their cost-effectiveness and adaptability for advanced machining and fabrication attract industrial users. This flexibility across industries positions UHMWPE sheets as the fastest-expanding form segment.

- By Application

On the basis of application, the global radiation-sterilized UHMW polyethylene market is segmented into orthopedic implants, other medical devices, defense & ballistics, and industrial wear parts. The Orthopedic Implants segment dominated the market with the largest revenue share of 72.8% in 2024, owing to the critical role of UHMWPE in hip, knee, and shoulder replacements. The material’s combination of biocompatibility, strength, and wear resistance makes it the gold standard for load-bearing implants. Rising cases of arthritis, fractures, and joint injuries globally continue to drive demand. In addition, growing surgical volumes in developed and emerging markets sustain its dominance. Clinical evidence supporting long-term implant success with radiation-sterilized UHMWPE further reinforces trust among surgeons and patients. Investments in innovative implant designs also strengthen this segment’s position.

The Defense & Ballistics segment is projected to witness the fastest growth rate during forecast period, driven by UHMWPE’s exceptional strength-to-weight ratio and resistance to impact. Increasing defense budgets, modernization programs, and rising geopolitical tensions are fueling demand for ballistic armor, helmets, and vehicle protection systems. The material’s lightweight properties enhance mobility while maintaining protection, making it highly attractive for military applications. Furthermore, innovations in fiber-based UHMWPE for personal protection gear accelerate adoption. This rising defense integration positions it as the fastest-growing subsegment.

- By End User

On the basis of end user, the global radiation-sterilized UHMW polyethylene market is segmented into medical device OEMS, surgical centers, military suppliers, and industrial manufacturers. The Medical Device OEMs segment dominated the market with the largest share in 2024, as they are the primary consumers of UHMWPE for orthopedic and surgical applications. OEMs rely heavily on consistent, high-quality sterilized UHMWPE to ensure the safety and efficacy of implants. Strategic collaborations with material suppliers and sterilization service providers further reinforce this segment. In addition, stringent regulatory requirements encourage OEMs to adopt proven sterilization methods, bolstering demand. Rising global joint replacement surgeries, combined with the need for innovation in implant design, solidify the dominance of this segment.

The Military Suppliers segment is expected to expand at the fastest pace from 2025 to 2032, driven by increasing defense applications of UHMWPE in ballistic armor and protective gear. Military procurement programs worldwide are increasingly integrating lightweight UHMWPE solutions for soldiers and vehicles. The rising need for advanced protective equipment in both combat and peacekeeping missions adds momentum. Moreover, continuous R&D investments in defense-grade UHMWPE fibers strengthen supply chains. With heightened focus on safety and mobility, military suppliers are emerging as the fastest-growing end user category.

Radiation-Sterilized UHMW Polyethylene Market Regional Analysis

- North America dominated the global radiation-sterilized UHMW polyethylene market with the largest revenue share of 42% in 2024, supported by a high prevalence of orthopedic disorders, advanced healthcare infrastructure, and strong presence of implant manufacturers, with the U.S. leading adoption through innovation in highly crosslinked and vitamin-E stabilized UHMWPE materials

- The region’s leadership is supported by well-established healthcare infrastructure, strong presence of leading medical device OEMs, and robust R&D investments in biomaterials

- Growing demand for hip and knee replacements, alongside regulatory approvals favoring radiation-sterilized UHMWPE, has further accelerated adoption. Patients and healthcare providers in North America prioritize implant durability, wear resistance, and safety, reinforcing the preference for crosslinked and antioxidant-stabilized UHMWPE

U.S. Radiation-Sterilized UHMW Polyethylene Market Insight

The U.S. radiation-sterilized UHMW polyethylene market captured the largest revenue share of 82% in 2024 within North America, fueled by high volumes of orthopedic procedures and early adoption of advanced implant materials. Hospitals and surgical centers increasingly prioritize crosslinked and antioxidant-stabilized UHMWPE for hip, knee, and spinal implants due to its superior wear resistance and biocompatibility. Rising cases of osteoarthritis, fractures, and joint disorders are boosting surgical volumes, further propelling demand. Moreover, the country’s advanced healthcare infrastructure, strong presence of OEMs, and focus on research and innovation contribute to widespread adoption. The growing preference for longer-lasting implants with reduced revision risk is driving continuous market expansion.

Europe Radiation-Sterilized UHMW Polyethylene Market Insight

The Europe radiation-sterilized UHMW polyethylene market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing demand for high-performance orthopedic implants and stringent regulatory requirements. Rising urbanization, growing geriatric populations, and higher healthcare spending foster adoption of advanced UHMWPE materials. European hospitals and surgical centers are increasingly incorporating crosslinked and antioxidant-stabilized UHMWPE in new implants and revision surgeries. The focus on patient safety, implant longevity, and cost-effectiveness supports continuous market growth across countries such as Germany, France, and Italy. In addition, Europe’s strong medical device manufacturing ecosystem encourages technological advancements and adoption.

U.K. Radiation-Sterilized UHMW Polyethylene Market Insight

The U.K. radiation-sterilized UHMW polyethylene market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of orthopedic disorders and the increasing number of joint replacement surgeries. Hospitals and private surgical centers are adopting advanced UHMWPE implants that provide improved wear resistance and reduced risk of implant failure. The focus on patient outcomes, combined with government support for healthcare modernization and investment in medical technology, is encouraging market growth. Furthermore, the U.K.’s adoption of innovative crosslinked and vitamin-E stabilized UHMWPE contributes to increased demand for sterile, high-performance implants.

Germany Radiation-Sterilized UHMW Polyethylene Market Insight

The Germany radiation-sterilized UHMW polyethylene market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of advanced orthopedic materials and high surgical volumes. The country’s well-established healthcare infrastructure, focus on innovation, and stringent regulatory standards drive adoption of gamma- and e-beam-sterilized UHMWPE implants. Germany’s hospitals and orthopedic centers prefer implants that combine biocompatibility with long-term durability. In addition, the increasing use of antioxidant-stabilized UHMWPE in hip and knee replacements supports the segment’s growth. Growing investments in R&D and medical device development further strengthen market expansion.

Asia-Pacific Radiation-Sterilized UHMW Polyethylene Market Insight

The Asia-Pacific radiation-sterilized UHMW polyethylene market is poised to grow at the fastest CAGR during 2025–2032, driven by increasing surgical volumes, rising healthcare access, and growing awareness of advanced implants in countries such as China, Japan, and India. The expanding middle class, urbanization, and rising incidence of orthopedic disorders are driving demand for high-quality radiation-sterilized UHMWPE implants. In addition, government initiatives promoting digital healthcare infrastructure and investment in modern hospitals are encouraging adoption. APAC is also emerging as a manufacturing hub for medical-grade UHMWPE, improving affordability and availability. The region’s focus on improving patient outcomes and reducing revision surgeries further fuels market growth.

Japan Radiation-Sterilized UHMW Polyethylene Market Insight

The Japan radiation-sterilized UHMW polyethylene market is gaining momentum due to the country’s aging population, high healthcare standards, and emphasis on quality medical materials. Hospitals and orthopedic centers are increasingly adopting crosslinked and antioxidant-stabilized UHMWPE for joint replacement surgeries. Integration with advanced surgical technologies, including robotic-assisted procedures, is boosting demand. Japan’s focus on patient safety, implant longevity, and reducing post-surgical complications supports continued market expansion. Furthermore, awareness campaigns and clinical validation studies encourage widespread adoption of radiation-sterilized UHMWPE in both public and private healthcare sectors.

India Radiation-Sterilized UHMW Polyethylene Market Insight

The India radiation-sterilized UHMW polyethylene market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing surgical volumes, and rising awareness of advanced implant materials. Hospitals and private orthopedic centers are increasingly adopting radiation-sterilized UHMWPE implants for hip and knee replacements. The growing middle class, expansion of healthcare infrastructure, and government initiatives promoting modern medical facilities support market growth. In addition, affordability of locally manufactured UHMWPE components and increasing clinical adoption of crosslinked and antioxidant-stabilized variants are key factors driving expansion. The market continues to benefit from rising incidence of joint disorders and increased healthcare access across urban and semi-urban regions.

Radiation-Sterilized UHMW Polyethylene Market Share

The Radiation-Sterilized UHMW Polyethylene industry is primarily led by well-established companies, including:

- Celanese Corporation (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- dsm-firmenich. (Netherlands)

- Mitsubishi Chemical Group Corporation.(Japan)

- Asahi Kasei Corporation (Japan)

- Arkema (France)

- Honeywell International Inc. (U.S.)

- TEIJIN LIMITED (Japan)

- Braskem (Brazil)

- Avient Corporation (U.S.)

- MITSUI CHEMICALS AMERICA, INC (Japan)

- Kraton Corporation (U.S.)

- Quadrant Engineering Plastic Products (U.S.)

- Global Polymer Industries (U.S.)

- Duro-Glide Polymer Sheets (U.S.)

- Orthoplastics Ltd (U.K.)

- Salco Products, Inc. (U.S.)

- Trelleborg AB (Sweden)

- SABIC (Saudi Arabia)

- Evonik Industries AG (Germany)

What are the Recent Developments in Radiation-Sterilized UHMW Polyethylene Market?

- In April 2025, STERIS announced a strategic partnership with the University of Sydney to develop advanced electron-beam (e-beam) sterilization techniques for UHMWPE medical devices. This collaboration focuses on optimizing e-beam processing to improve the mechanical properties and sterilization efficiency of UHMWPE components, offering an alternative to traditional gamma irradiation methods. The initiative aims to meet the growing demand for more durable and sterile medical materials

- In March 2025, researchers from Massachusetts General Hospital and the University of Sydney unveiled a novel UHMWPE formulation incorporating antioxidants to mitigate oxidation during radiation crosslinking. This advancement aims to enhance the longevity and wear resistance of orthopedic implants, addressing concerns associated with gamma irradiation-induced oxidation

- In December 2023, DSM Biomedical, part of dsm-firmenich, announced the rebranding of its leading high-performance UHMWPE portfolio, previously known as Dyneema Purity® UHMWPE, under the new name Ulteeva Purity UHMWPE fiber, membrane, and powder. This consolidation streamlines the brand identity for a key supplier of the base polymer used in orthopedic implants

- In November 2023, Exactech announced the successful first surgeries using its new, advanced Activit-E polyethylene for the Truliant knee replacement system. This material is a next-generation highly cross-linked polyethylene with a Vitamin E antioxidant, which achieves its cross-linking through a chemical process (peroxide) instead of the high doses of gamma irradiation used in previous HXLPEs, while maintaining active oxidative resistance and an optimal balance of strength and toughness

- In May 2023, STERIS announced the expansion of its electron beam (e-beam) processing facility in Biassono, Italy. This move aims to support the growing demand for medical device sterilization, including UHMWPE components, by increasing e-beam capacity. E-beam sterilization offers advantages such as reduced sterilization time and the elimination of toxic residues, making it a preferred method for sterilizing sensitive medical materials

- In April 2023, The U.S. Food and Drug Administration (FDA) Center for Devices and Radiological Health (CDRH) announced the Radiation Sterilization Master File Pilot Program. This voluntary program is intended to help companies that sterilize PMA-approved medical devices using gamma radiation to explore and expedite the adoption of alternatives, such as changing radiation sources (such as E-beam or X-ray) or lowering the gamma radiation dose, which is significant for reducing the residual free radicals that cause oxidation in UHMWPE

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.