Global Ranitidine Market

Market Size in USD Million

CAGR :

%

USD

453.37 Million

USD

556.72 Million

2024

2032

USD

453.37 Million

USD

556.72 Million

2024

2032

| 2025 –2032 | |

| USD 453.37 Million | |

| USD 556.72 Million | |

|

|

|

|

Ranitidine Market Size

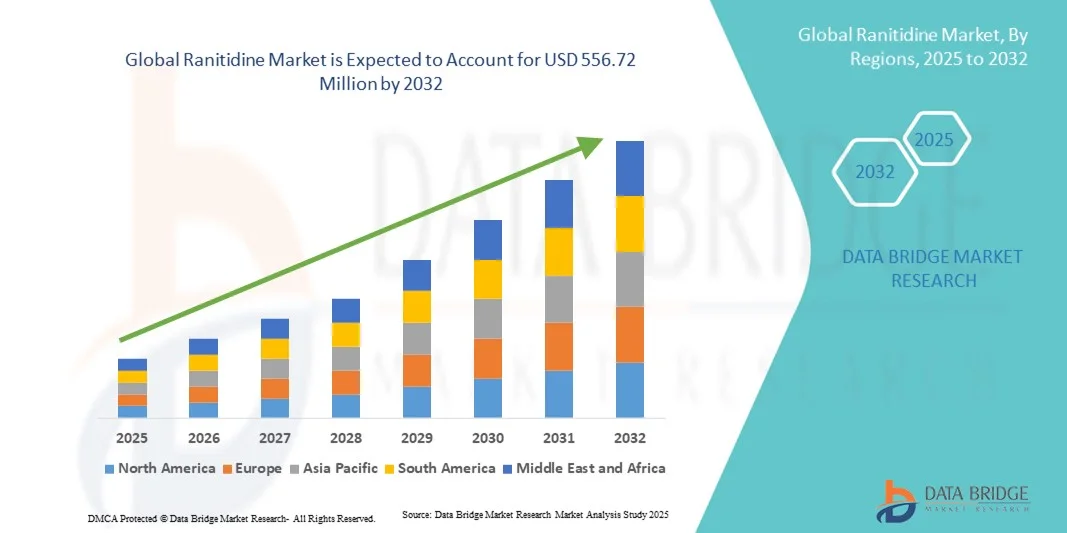

- The global ranitidine market size was valued at USD 453.37 million in 2024 and is expected to reach USD 556.72 million by 2032, at a CAGR of 2.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of gastrointestinal disorders, such as acid reflux, peptic ulcers, and heartburn, driving higher demand for effective H2 receptor antagonists like Ranitidine

- Furthermore, rising awareness among patients and healthcare providers regarding the benefits of Ranitidine for reducing stomach acid production, combined with improved access to pharmacies and healthcare facilities, is accelerating its adoption

Ranitidine Market Analysis

- Ranitidine, a widely used H2 receptor antagonist for treating acid-related gastrointestinal disorders such as GERD and peptic ulcers, is increasingly vital in modern healthcare due to its effectiveness, safety profile, and availability in both prescription and over-the-counter formulations

- The escalating demand for ranitidine is primarily fueled by the rising prevalence of gastrointestinal disorders, growing healthcare awareness among consumers, and the need for affordable and effective acid-reducing therapies

- North America dominated the ranitidine market with the largest revenue share of 38.7% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies, with the U.S. experiencing substantial growth in prescriptions due to increased incidence of acid reflux and ulcer-related conditions

- Asia-Pacific is expected to be the fastest growing region in the Ranitidine market during the forecast period, due to rising urbanization, increasing disposable incomes, and expanding access to healthcare services

- The Adults segment dominated the ranitidine market with a revenue share of 78% in 2024, driven by the higher prevalence of acid-related disorders in the adult population and frequent prescriptions of Ranitidine for conditions like GERD and ulcers

Report Scope and Ranitidine Market Segmentation

|

Attributes |

Ranitidine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ranitidine Market Trends

Innovations Enhancing Patient-Centric Treatment

- A significant and accelerating trend in the global ranitidine market is the increasing integration of artificial intelligence (AI) and data-driven platforms to optimize treatment outcomes, drug formulation, and patient safety. This integration is enhancing the precision of therapeutic interventions and enabling more personalized care for gastrointestinal disorders

- For instance, AI-driven platforms can analyze patient responses to Ranitidine, optimize dosing regimens, and identify potential drug interactions, improving overall treatment efficacy. Similarly, predictive analytics help in monitoring patient adherence and assessing the effectiveness of treatment protocols in real time

- AI integration supports research into novel H2 receptor antagonists and optimized Ranitidine formulations, allowing pharmaceutical companies to develop safer, more effective therapies. Advanced modeling also helps identify patients at higher risk of adverse effects or drug-drug interactions, improving clinical decision-making

- The seamless application of data analytics and AI in healthcare systems facilitates centralized monitoring of therapeutic outcomes, enabling clinicians to tailor treatment strategies for individual patients. Through integrated platforms, healthcare providers can manage patient data, monitor therapy response, and adjust treatment plans efficiently

- This trend towards more intelligent, data-driven, and patient-centered therapies is reshaping expectations for gastrointestinal care. Consequently, pharmaceutical companies are developing AI-enabled Ranitidine formulations with enhanced safety, bioavailability, and personalized dosing recommendations

- The demand for Ranitidine with improved efficacy, safety, and patient adherence is growing rapidly across both clinical and over-the-counter applications, as healthcare providers and patients increasingly prioritize evidence-based, targeted treatment strategies

Ranitidine Market Dynamics

Driver

Growing Need Due to Rising Gastrointestinal Disorders and Personalized Medicine

- The increasing prevalence of acid reflux, ulcers, and other gastrointestinal disorders is a significant driver for the heightened demand for Ranitidine

- For instance, In 2024, pharmaceutical companies expanded research initiatives to improve Ranitidine efficacy and minimize side effects, supporting broader therapeutic adoption. Such strategies are expected to drive Ranitidine market growth during the forecast period

- As clinicians focus on safer and more targeted therapies, Ranitidine offers advantages such as effective acid suppression, reduced gastrointestinal irritation, and compatibility with combination therapies

- Furthermore, the growing emphasis on personalized medicine, including patient-specific dosing and monitoring, is increasing the clinical utility of Ranitidine

- Advancements in formulation technology, including extended-release and orally disintegrating tablets, are enhancing patient compliance and treatment convenience

- The availability of Ranitidine across multiple treatment settings, combined with increasing patient awareness of gastrointestinal health, is propelling market expansion

Restraint/Challenge

Concerns Regarding Regulatory Scrutiny and Competition from Alternative Therapies

- Regulatory restrictions and safety-related recalls in certain regions pose challenges to market growth, requiring stringent monitoring and compliance to maintain approvals and consumer trust

- Competition from alternative acid-reducing therapies, such as proton pump inhibitors, can limit market penetration in specific therapeutic segments

- The need for robust clinical evidence and ongoing post-marketing surveillance to ensure long-term safety increases operational costs for manufacturers

- While generic formulations provide affordability, high-quality branded Ranitidine products often come at a premium, potentially affecting adoption among price-sensitive consumers

- Variations in regional regulatory frameworks can slow market entry in certain countries, creating barriers for global expansion

- Supply chain disruptions and raw material availability challenges may impact consistent production and distribution of Ranitidine formulations

- Limited awareness or misconceptions about the long-term safety of Ranitidine can influence prescriber and patient preferences

- The increasing focus on alternative therapies, including natural remedies and dietary interventions, may reduce demand in some patient segments

- Overcoming these challenges will require enhanced safety monitoring, development of innovative formulations, and effective patient education to improve awareness and build confidence

- Collaboration between healthcare providers, pharmaceutical companies, and regulatory authorities is critical to ensure consistent availability of safe and effective Ranitidine therapies globally

- Price sensitivity in emerging markets may slow adoption of newer or branded Ranitidine formulations despite therapeutic benefits

Ranitidine Market Scope

The market is segmented on the basis of indication, population type, dosage form, dosage strength, mode of purchase, end user, and distribution channel.

- By Indication

On the basis of indication, the Ranitidine market is segmented into Intestinal & Stomach Ulcers, Gastroesophageal Reflux Disease (GERD), Esophagitis, Zollinger-Ellison Syndrome, and Others. The Gastroesophageal Reflux Disease (GERD) segment dominated the market with a revenue share of 35% in 2024, driven by the high prevalence of acid reflux and heartburn among adults and increasing awareness about the importance of early treatment. Physicians and gastroenterologists frequently prescribe Ranitidine as a first-line therapy due to its proven efficacy and fast-acting relief. GERD management in hospitals and specialty clinics requires reliable acid suppression, reinforcing the segment’s market leadership. Rising healthcare expenditure and better access to diagnostic facilities further support growth. Patient adherence is enhanced by convenient dosage forms and effective symptom control. Continuous awareness campaigns by healthcare providers promote early diagnosis and treatment. The segment also benefits from strong brand recognition and well-established clinical guidelines. Public health initiatives focusing on gastrointestinal disorders increase patient outreach. The wide applicability across adult and pediatric populations ensures sustained demand. Overall, these factors collectively reinforce GERD as the dominant indication in the Ranitidine market.

The Zollinger-Ellison Syndrome segment is expected to witness the fastest CAGR of 6.2% from 2025 to 2032, driven by growing recognition of this rare condition and the need for specialized treatment options. Hospitals and specialty clinics are increasingly diagnosing and managing this syndrome with Ranitidine due to its potent acid-suppressing effects. Adoption is fueled by rising awareness among physicians about early intervention to prevent complications. The segment benefits from targeted clinical protocols and specialized care programs. Advances in diagnostic techniques allow earlier identification of patients, supporting timely treatment. Patient preference for well-tolerated and effective therapies further contributes to growth. Healthcare providers are increasingly incorporating Ranitidine into comprehensive care plans. Insurance coverage and government support for rare diseases are accelerating uptake. Awareness campaigns and physician education programs enhance clinical adoption. The expanding patient base in developed and emerging regions ensures steady demand. Overall, the combination of specialized treatment requirements and increasing disease awareness drives the rapid growth of this segment.

- By Population Type

On the basis of population type, the market is segmented into Children and Adults. The Adults segment dominated the market with a revenue share of 78% in 2024, driven by the higher prevalence of acid-related disorders in the adult population and frequent prescriptions of Ranitidine for conditions like GERD and ulcers. Adults are more prone to lifestyle-related gastrointestinal issues, making them the primary consumers. Hospitals, specialty clinics, and pharmacies report the majority of prescriptions for adult patients. Clinical studies and treatment guidelines emphasize Ranitidine as a preferred therapy in adult populations. Growing awareness about digestive health and preventive care encourages early adoption. The segment also benefits from well-established dosing protocols and patient familiarity. Increased healthcare access and insurance coverage ensure consistent demand. Patient adherence is strengthened by the availability of multiple dosage forms. The widespread use in both inpatient and outpatient care further consolidates dominance. Overall, adults remain the largest population segment for Ranitidine treatment globally.

The Children segment is expected to witness the fastest CAGR of 5.8% from 2025 to 2032, driven by rising diagnosis of pediatric GERD and ulcers, along with growing awareness of safe pediatric dosing. Pediatricians and hospitals increasingly recommend Ranitidine for safe and effective symptom control. Pediatric-friendly formulations like liquids and syrups enhance adherence. The segment benefits from improved parental awareness and physician education. Pediatric healthcare infrastructure expansion and home healthcare adoption support growth. Clinical research highlighting safe use in children further boosts confidence. Increasing incidence of acid-related disorders in younger populations drives prescriptions. Hospitals and specialty clinics play a key role in promoting early treatment. Insurance coverage for pediatric medications facilitates access. Overall, rising awareness and specialized care needs contribute to rapid growth in the children’s segment.

- By Dosage Form

On the basis of dosage form, the market is segmented into Solid Oral, Liquid, and Parenteral. The Solid Oral segment dominated the market with a revenue share of 60% in 2024, driven by ease of administration, convenience, and widespread acceptance among patients. Tablets and capsules are preferred in hospitals, pharmacies, and home care settings. They allow precise dosing, better stability, and easy distribution. Solid oral dosage forms are recommended for long-term treatment and chronic management. Physicians prefer tablets due to predictable pharmacokinetics and patient adherence. Hospitals and specialty clinics stock them extensively due to high demand. The segment benefits from strong supply chains and consistent availability. Cost-effectiveness and patient familiarity strengthen adoption. Public awareness campaigns and OTC availability contribute to dominance. Overall, solid oral formulations remain the primary choice for Ranitidine globally.

The Liquid segment is expected to witness the fastest CAGR of 6% from 2025 to 2032, fueled by increasing demand for pediatric and geriatric-friendly formulations. Liquid Ranitidine allows accurate dosing and easy swallowing for patients with difficulty taking tablets. Hospitals, specialty clinics, and home healthcare providers increasingly adopt liquid forms to enhance adherence. Rising awareness about patient-centric care drives adoption. Caregivers and parents prefer liquids for children and elderly patients. Growing OTC availability and convenience for home use support growth. The segment benefits from improved stability and taste-masked formulations. Liquid forms facilitate rapid administration in clinical settings. Enhanced accessibility and portability further promote adoption. Overall, the liquid dosage form segment is rapidly expanding due to its flexibility and patient-friendly nature.k

- By Dosage Strength

On the basis of dosage strength, the market is segmented into Oral Strength and Parenteral Strength. The Oral Strength segment dominated the market with a revenue share of 70% in 2024, driven by the popularity of tablets and capsules for long-term therapy. Oral strength formulations are convenient, widely prescribed, and suitable for outpatient and home use. They offer precise dosing, high stability, and easy administration. The segment benefits from robust supply chains and well-established distribution channels. Hospitals, specialty clinics, and retail pharmacies prioritize oral strength due to high patient preference. Clinical guidelines and treatment protocols favor oral dosing for most gastrointestinal disorders. Improved patient adherence further reinforces dominance. The cost-effectiveness and widespread availability enhance market penetration. Overall, oral strength Ranitidine remains the most utilized dosage form globally.

The Parenteral Strength segment is expected to witness the fastest CAGR of 5.5% from 2025 to 2032, fueled by growing hospital and ICU administration needs for severe cases. Intravenous Ranitidine allows rapid onset of action and precise control in critical care settings. Hospitals and specialty clinics increasingly adopt parenteral forms for inpatient care. The segment benefits from rising demand for hospital-based acute management. Physicians prefer parenteral strength for patients unable to take oral formulations. Advanced hospital infrastructure and trained personnel support adoption. The growth is further supported by emergency and procedural applications. Parenteral formulations enhance treatment flexibility and rapid efficacy. Overall, the segment is expanding due to critical care requirements and hospital adoption.

- By Mode of Purchase

On the basis of mode of purchase, the market is segmented into Over The Counter and Prescription. The Prescription segment dominated the market with a revenue share of 65% in 2024, driven by the need for physician oversight for accurate diagnosis and dosing. Hospitals, specialty clinics, and pharmacies require prescriptions to ensure safe and effective use. The segment benefits from strong regulatory frameworks and physician recommendations. Prescription-based sales ensure adherence to clinical guidelines. The segment also enjoys established distribution channels and bulk procurement for hospitals. Patient trust in prescription medications supports continued demand. Clinical monitoring and dosage adjustments reinforce physician preference. Overall, prescription remains the dominant mode of purchase for Ranitidine.

The Over The Counter segment is expected to witness the fastest CAGR of 6.3% from 2025 to 2032, fueled by increasing consumer awareness and preference for self-medication for mild acid-related disorders. OTC availability enables easier access in retail and online pharmacies. Rising public education campaigns promote safe use for occasional symptoms. Patients prefer OTC forms for convenience and cost-effectiveness. Growing urbanization and pharmacy accessibility further support adoption. Marketing and awareness initiatives drive OTC demand. OTC options increase reach to a broader population. The segment also benefits from pediatric and adult-friendly dosage forms. Overall, OTC purchase is expanding rapidly due to convenience and self-care trends.

- By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, and Others. The Hospitals segment dominated the market with a revenue share of 55% in 2024, driven by high patient inflow, structured treatment protocols, and the need for controlled administration of Ranitidine. Hospitals ensure accurate dosing, monitoring, and management of gastrointestinal disorders. Specialty clinics and inpatient wards rely on hospitals for bulk supply. Hospitals benefit from established procurement channels and trained healthcare professionals. Clinical protocols and guideline-based treatment reinforce adoption. Hospitals stock both oral and parenteral forms, covering acute and chronic cases. The segment also enjoys strong distribution and supply chain efficiency. Overall, hospitals remain the primary end users of Ranitidine globally.

The Specialty Clinics segment is expected to witness the fastest CAGR of 5.7% from 2025 to 2032, driven by increasing outpatient visits and focused management of gastrointestinal disorders. Specialty clinics provide personalized care, monitoring, and treatment plans. Clinics increasingly adopt Ranitidine due to patient convenience and adherence advantages. Physician-driven recommendations and preventive care initiatives support growth. Clinics serve both adult and pediatric populations, boosting demand. Advanced diagnostic capabilities in clinics ensure targeted therapy. Marketing and awareness programs enhance adoption. Clinics’ integration with pharmacy supply chains supports consistent availability. Overall, the specialty clinic segment is expanding rapidly due to personalized treatment trends.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others. The Hospital Pharmacies segment dominated the market with a revenue share of 50% in 2024, attributed to direct access to inpatient care, bulk procurement, and controlled administration. Hospitals manage accurate dosing, inventory, and monitoring of Ranitidine. Hospital pharmacies ensure continuous availability for acute and chronic cases. Structured distribution networks reinforce reliability. Integration with treatment protocols ensures safe and effective therapy. Staff training enhances dispensing accuracy. The segment benefits from stable supply chains and procurement contracts. Overall, hospital pharmacies remain the dominant channel for Ranitidine distribution.

The Online Pharmacies segment is expected to witness the fastest CAGR of 7% from 2025 to 2032, fueled by rising digital adoption, e-commerce penetration, and consumer preference for home delivery. Online platforms offer convenience, accessibility, and patient support. Telehealth integration with online ordering accelerates adoption. Competitive pricing, subscription models, and wide availability enhance uptake. OTC and prescription orders can be delivered directly to patients. Awareness campaigns drive trust in digital channels. Growing smartphone and internet usage further supports expansion. Overall, online pharmacies are rapidly emerging as a preferred channel due to convenience and accessibility.

Ranitidine Market Regional Analysis

- North America dominated the ranitidine market with the largest revenue share of 38.7% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies

- Consumers in the region increasingly rely on Ranitidine for managing acid reflux, peptic ulcers, and other gastrointestinal disorders, supported by widespread availability in hospitals, specialty clinics, and pharmacies

- High healthcare expenditure, increasing prevalence of gastrointestinal conditions, and awareness campaigns by healthcare providers are further driving adoption across both adult and pediatric populations

U.S. Ranitidine Market Insight

The U.S. ranitidine market captured the largest revenue share in 2024 within North America, fueled by rising prescriptions for acid-related disorders and increasing patient awareness about gastrointestinal health. Hospitals, specialty clinics, and pharmacies report robust demand for both OTC and prescription forms. The growing emphasis on preventive care, coupled with technological integration in healthcare systems for better monitoring and adherence, further propels the market. Strong presence of pharmaceutical manufacturers and widespread distribution channels enhance accessibility. Educational campaigns promoting early diagnosis and treatment of ulcers and GERD contribute to the market expansion. Overall, the U.S. remains the dominant country in the North American Ranitidine market.

Europe Ranitidine Market Insight

The Europe ranitidine market is projected to expand at a substantial CAGR during the forecast period, driven by increasing incidence of gastrointestinal disorders and rising awareness about preventive care. Urbanization, improved healthcare access, and well-developed hospital networks are supporting Ranitidine adoption. The region is witnessing strong growth across hospitals, specialty clinics, and outpatient care settings, with both adult and pediatric populations contributing to demand. Clinical guidelines and physician recommendations further reinforce usage. Overall, Europe continues to show steady growth for Ranitidine therapies.

U.K. Ranitidine Market Insight

The U.K. ranitidine market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising incidence of GERD and ulcer-related conditions. Increased awareness among patients and healthcare providers, coupled with robust healthcare infrastructure, encourages early treatment. Hospitals and clinics are seeing higher prescriptions for both adult and pediatric populations. Overall, the U.K. market is steadily expanding due to improved access to medications and growing patient awareness.

Germany Ranitidine Market Insight

The Germany ranitidine market is expected to expand at a considerable CAGR during the forecast period, driven by increasing prevalence of gastrointestinal disorders and high patient awareness. Advanced healthcare infrastructure, strong hospital networks, and emphasis on preventive care support market growth. Hospitals and specialty clinics continue to adopt Ranitidine for chronic and acute conditions, while pharmacy availability ensures accessibility. Overall, Germany represents a significant market in Europe for Ranitidine treatments.

Asia-Pacific Ranitidine Market Insight

The Asia-Pacific ranitidine market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and expanding access to healthcare services in countries such as China, Japan, and India. Growing awareness of gastrointestinal health and government initiatives supporting healthcare infrastructure contribute to increasing prescriptions. Hospitals, clinics, and pharmacies are expanding availability across both adult and pediatric populations. Overall, APAC is the fastest-growing region for Ranitidine adoption globally.

Japan Ranitidine Market Insight

The Japan ranitidine market is gaining momentum due to rising incidence of GERD and ulcer-related disorders, increasing awareness among patients, and expanding healthcare facilities. Hospitals and specialty clinics are key contributors to market growth. The aging population is expected to further drive demand for Ranitidine due to higher prevalence of gastrointestinal conditions. Overall, Japan is witnessing steady growth in Ranitidine consumption.

China Ranitidine Market Insight

The China ranitidine market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing healthcare expenditure, and growing patient awareness of gastrointestinal disorders. Hospitals, specialty clinics, and retail pharmacies are widely distributing Ranitidine, while expanding insurance coverage and government health initiatives enhance access. Overall, China remains the largest market within APAC for Ranitidine therapies.

Ranitidine Market Share

The Ranitidine industry is primarily led by well-established companies, including:

- Sanofi (France)

- GSK Plc (U.K.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Abbott (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma Limited (India)

- Bayer AG (Germany)

- Zydus Group (India)

- Neuland Laboratories Ltd. (India)

- Heumann Pharma GmbH & Co. Generica KG (Germany)

- Apotex Inc. (Canada)

Latest Developments in Global Ranitidine Market

- In June 2024, GlaxoSmithKline (GSK) agreed to settle approximately 70,000 lawsuits in the United States related to its discontinued heartburn drug Zantac, which contains ranitidine. The settlement allowed the lawsuits to proceed, addressing claims that the drug caused cancer

- In February 2025, Boehringer Ingelheim won a trial in two lawsuits alleging that its discontinued heartburn drug, Zantac, caused cancer. A state court jury in Chicago ruled in favor of Boehringer Ingelheim following a joint trial involving two plaintiffs who claimed they developed prostate cancer from taking the drug

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.