Global Rare Inherited Metabolic Disorders Drug Market

Market Size in USD Million

CAGR :

%

USD

217.80 Million

USD

530.10 Million

2025

2033

USD

217.80 Million

USD

530.10 Million

2025

2033

| 2026 –2033 | |

| USD 217.80 Million | |

| USD 530.10 Million | |

|

|

|

|

Rare Inherited Metabolic Disorders Drug Market Size

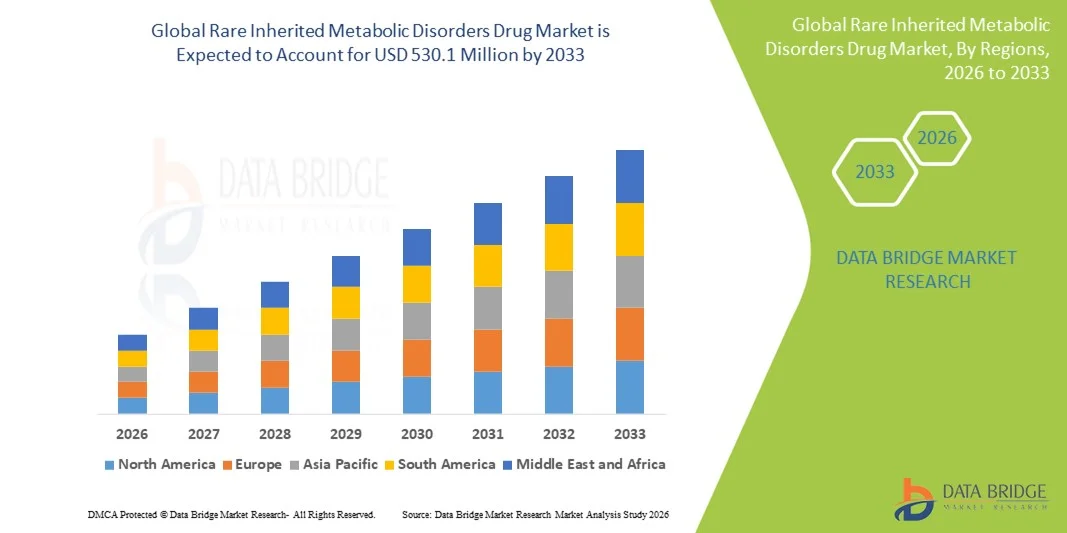

- The global rare inherited metabolic disorders drug market size was valued at USD 217.8 million in 2025 and is expected to reach USD 530.1 million by 2033, at a CAGR of 11.80% during the forecast period

- The market growth is largely fueled by increasing diagnosis rates, advancements in precision therapeutics, and strong regulatory support for orphan drugs, which continue to drive innovation across enzyme replacement, small-molecule, RNA-based, and emerging gene therapy treatments

- Furthermore, rising demand for effective, disease-modifying therapies among pediatric and adult patient populations is strengthening adoption, as healthcare systems prioritize early intervention and improved long-term outcomes. These converging factors are accelerating the uptake of targeted IMD drugs, thereby significantly boosting the industry's growth

Rare Inherited Metabolic Disorders Drug Market Analysis

- Drugs targeting rare inherited metabolic disorders including enzyme replacement drugs, gene therapy drugs, substrate reduction drugs, small-molecule drugs, oligonucleotide drugs, and protein drugs are becoming essential therapeutic pillars across multiple rare IMDs, as they improve metabolic correction, slow disease progression, and enhance long-term patient outcomes in pediatric and adult populations

- The rising demand is fueled by advancements in genetic medicine, expanding newborn screening programs, increased diagnostic accuracy, and strong prioritization of orphan-drug R&D, which together boost development pipelines and accelerate clinical translation across parenteral, oral, and intrathecal routes of administration

- North America dominated the market with the largest revenue share of 42.9% in 2025, supported by robust infrastructure for metabolic disease management, high utilization of marketed enzyme replacement therapies, rapid adoption of gene therapy technologies, and an active pipeline spanning marketed, Phase III, Phase I–II, and preclinical IMD candidates

- Asia-Pacific is expected to be the fastest-growing region during the forecast period owing to rising healthcare expenditure, growing awareness of urea-cycle, amino-acid, and mitochondrial disorders, and expanding access to both oral small-molecule drugs and complex parenteral therapies

- The lysosomal storage disorders segment dominated the market with a market share of 45.2% in 2025, driven by the high prevalence of LSDs within overall IMDs, extensive availability of enzyme replacement drugs, and continued investment in substrate-reduction, gene-based, and protein-based therapies tailored for LSD subtypes

Report Scope and Rare Inherited Metabolic Disorders Drug Market Segmentation

|

Attributes |

Rare Inherited Metabolic Disorders Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Rare Inherited Metabolic Disorders Drug Market Trends

Acceleration of Gene and Molecular Therapies for Long-Term Disease Modification

- A significant and accelerating trend in the global rare inherited metabolic disorders drug market is the rapid advancement of gene therapy, oligonucleotide therapy, and next-generation protein therapeutics, which are enabling more targeted metabolic correction and long-term disease modification across multiple IMD categories

- For instance, AAV-based gene therapy platforms under development for conditions such as OTC deficiency and Pompe disease are demonstrating durable enzyme expression and potential single-dose therapeutic benefit, reshaping expectations for long-term management

- AI-driven drug discovery is enabling deeper understanding of enzyme misfolding, metabolic pathway disruption, and genotype–phenotype correlations, which supports more precise drug candidate selection; for instance, emerging platforms are identifying optimized small-molecule correctors and substrate-reduction pathways for LSDs and mitochondrial disorders

- The seamless integration of genetic diagnostics, expanded newborn screening, and biomarker-guided treatment selection is enabling earlier therapeutic intervention, allowing physicians to pair patients with the most suitable parenteral, oral, or intrathecal therapies

- This shift toward more personalized, mechanism-specific therapies is fundamentally reshaping clinical pipelines, prompting companies to expand portfolios across gene therapy drugs, enzyme replacement drugs, and oligonucleotide drugs targeting rare metabolic phenotypes

- The demand for advanced therapies that offer deeper metabolic correction and improved functional outcomes is growing rapidly, as patients and health systems increasingly prioritize disease-modifying treatments over traditional symptomatic management

Rare Inherited Metabolic Disorders Drug Market Dynamics

Driver

Growing Need Driven by Rising Diagnosis Rates and Advancements in Genetic Medicine

- The increasing global diagnosis of rare IMDs supported by expanded newborn screening, broader genomic testing, and rising clinician awareness is significantly driving demand for specialized drug therapies across enzyme replacement, gene therapy, and small-molecule segments

- For instance, in 2025 several biopharmaceutical companies advanced Phase III metabolic disorder programs utilizing AAV and mRNA-based approaches, accelerating market momentum for disease-modifying treatments

- As more patients are diagnosed earlier and present with clearer molecular profiles, the adoption of targeted drugs offering enzyme replenishment, metabolic pathway correction, or substrate reduction is rapidly increasing across clinical settings

- Furthermore, the growing emphasis on precision medicine and the clinical success of orphan-drug development frameworks are making IMD therapies central to rare disease pipelines globally

- The convenience of diverse administration routes including parenteral ERTs, oral small molecules, and intrathecal therapies for neuro-metabolic conditions continues to strengthen adoption in both pediatric and adult metabolic centers, with increased treatment accessibility supporting overall market growth

- The expansion of patient registries, improved genetic counseling infrastructure, and rising investment in IMD drug development further contribute to strong and sustained long-term market demand

Restraint/Challenge

High Treatment Costs and Stringent Regulatory Pathways as Major Barriers

- Concerns surrounding the extremely high cost of enzyme replacement therapies, gene therapies, and other advanced biologics pose a significant challenge to wider market penetration, particularly in regions with limited reimbursement infrastructure

- For instance, high-profile discussions around the pricing of one-time gene therapies for metabolic disorders have raised questions among payers and health agencies regarding long-term affordability and sustainability

- Addressing these financial concerns through value-based pricing, outcome-linked reimbursement, and broader insurance coverage is critical for supporting patient access, as many IMD therapies exceed the affordability threshold for most families without structured support

- In addition, strict regulatory requirements for clinical validation—including long-term safety follow-up for gene therapies and complex CMC standards for biologics—extend development timelines and increase overall manufacturing challenges

- While regulatory initiatives in the U.S. and Europe support orphan-drug development, the complexity of producing high-purity enzymes, viral vectors, and specialized oligonucleotides continues to hinder scalability, especially for smaller biotechs entering the IMD space

- Overcoming these challenges through improved manufacturing technologies, coordinated reimbursement models, and global regulatory harmonization will be vital for enabling broader adoption and sustained market expansion

Rare Inherited Metabolic Disorders Drug Market Scope

The market is segmented on the basis of drug class, route of administration, clinical development stage, and indication.

- By Drug Class

On the basis of drug class, the market is segmented into enzyme replacement drugs, gene therapy drugs, substrate reduction drugs, small-molecule drugs, oligonucleotide drugs, and protein drugs. The enzyme replacement drugs segment dominated the market in 2025, supported by its long-established clinical use for lysosomal storage disorders and strong reimbursement frameworks in major markets. These therapies remain the frontline approach for conditions such as Pompe disease, Fabry disease, and Gaucher disease due to their proven ability to replenish deficient enzymes and slow disease progression. Their consistent adoption in pediatric and adult metabolic centers reinforces their leadership position across rare IMDs. Widespread clinician familiarity, standardized dosing regimens, and expanding indications further strengthen the segment’s dominance. Manufacturers continue to invest in improved formulations, extended half-life variants, and next-generation recombinant enzymes to maintain market relevance.

The gene therapy drugs segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the shift toward long-term or potentially curative metabolic correction through AAV, lentiviral, and gene-editing platforms. Gene therapy programs are rapidly expanding for urea cycle disorders, mitochondrial disorders, and severe lysosomal storage disorders with high unmet need. Increasing regulatory support, breakthrough designations, and maturing clinical outcomes fuel strong momentum for this class. Rising investment from biotech innovators and strategic partnerships with CDMOs are accelerating manufacturing scalability. As single-dose durable therapies gain clinical validation, adoption is expected to surge globally.

- By Route of Administration

On the basis of route of administration, the market is segmented into parenteral, oral, and intrathecal. The parenteral segment dominated the market with the largest revenue share in 2025, primarily due to the prevalence of enzyme replacement therapies and protein therapeutics requiring intravenous or subcutaneous delivery. Parenteral administration continues to be the standard for high-molecular-weight biologics used in LSDs, mitochondrial disorders, and organic acidemias. Clinical centers worldwide are well-equipped for infusion-based therapies, making this route the most adopted. Growing availability of home-infusion models and long-acting formulations further supports its dominance. Parenteral routes ensure high bioavailability and consistent systemic exposure, making them indispensable for severe IMDs.

The intrathecal segment is expected to witness the fastest growth rate during 2026–2033, fueled by the increasing development of CNS-targeted metabolic disorder therapies. Many rare IMDs involve neurological manifestations, and intrathecal delivery allows direct access to the central nervous system where systemic administration is less effective. Advancements in catheter-based administration and engineered vectors designed for CNS penetration support adoption. Companies are increasingly pursuing intrathecal gene therapies, oligonucleotides, and enzyme delivery for neuro-metabolic indications. Rising clinical activity and improved procedural safety are accelerating growth.

- By Clinical Development Stage

On the basis of clinical development, the market is segmented into marketed drugs, late-stage clinical (Phase III), early-stage clinical (Phase I–II), and preclinical candidates. The marketed segment dominated the market in 2025, driven by the long-standing presence of enzyme replacement drugs, established small-molecule treatments, and the initial commercialization of select gene therapies. Marketed products remain the primary revenue source due to strong physician trust, proven long-term outcomes, and widespread reimbursement coverage. Established products for Gaucher disease, Fabry disease, OTC deficiency, and other IMDs continue to generate robust clinical demand. Ongoing lifecycle management, label expansions, and improved formulations further reinforce their leading share. The availability of structured patient-monitoring frameworks also strengthens the adoption of marketed therapies.

The preclinical candidates segment is projected to experience the fastest growth from 2026 to 2033, reflecting the surge in novel metabolic drug discovery pipelines. Preclinical innovation is expanding rapidly across gene-editing, substrate-reduction pathways, oligonucleotide platforms, and engineered protein therapies. Growing investments from biotech startups and pharmaceutical companies are creating a strong pipeline foundation. The availability of advanced disease models, high-throughput screening, and AI-enabled metabolic pathway mapping is accelerating early-stage progress. As more candidates transition from discovery to IND-enabling studies, the segment is expected to grow aggressively.

- By Indication

On the basis of indication, the market is segmented into lysosomal storage disorders, urea cycle disorders, amino-acid metabolic disorders, organic acidemias, mitochondrial disorders, peroxisomal disorders, and other rare IMDs. The lysosomal storage disorders segment dominated the market in 2025 with a market share of 45.2%, owing to the high prevalence of LSDs within the IMD landscape and the strong availability of enzyme replacement and substrate-reduction therapies. LSDs such as Gaucher, Fabry, and Pompe disease account for a major portion of treated rare metabolic conditions globally. Established diagnostic pathways, robust patient registries, and multi-product pipelines continue to support strong demand. Continuous development of next-generation ERTs, oral SRTs, and emerging gene therapies further reinforces the leadership of this segment. Significant pharmaceutical investment and global clinical trial activity sustain long-term dominance.

The mitochondrial disorders segment is expected to witness the fastest growth during 2026–2033, driven by rising research focus on mitochondrial dysfunction and the emergence of innovative small-molecule, gene therapy, and protein replacement strategies. Improved diagnostic technologies are increasing detection rates, particularly in infants and young children. Companies are developing targeted therapies that address oxidative stress, energy metabolism defects, and mitochondrial DNA abnormalities. Growing regulatory support for high-need orphan indications accelerates pipeline advancement. As novel mitochondrial therapeutics achieve clinical milestones, adoption is expected to rise sharply.

Rare Inherited Metabolic Disorders Drug Market Regional Analysis

- North America dominated the market with the largest revenue share of 42.9% in 2025, supported by robust infrastructure for metabolic disease management, high utilization of marketed enzyme replacement therapies, rapid adoption of gene therapy technologies, and an active pipeline spanning marketed, Phase III, Phase I–II, and preclinical IMD candidates

- Patients and healthcare providers in the region increasingly value early diagnosis, advanced treatment options, and comprehensive care management programs, which include access to parenteral, oral, and intrathecal therapies tailored to lysosomal storage, amino-acid, and mitochondrial disorders

- This widespread adoption is further supported by favorable reimbursement policies, well-established newborn screening programs, and high R&D activity, which collectively facilitate faster market uptake of marketed drugs as well as late-stage and early-stage clinical candidates

U.S. Rare Inherited Metabolic Disorders Drug Market Insight

The U.S. market captured the largest revenue share of 40% in 2025 within North America, driven by advanced healthcare infrastructure, early diagnosis through expanded newborn screening, and high adoption of enzyme replacement, gene therapy, and small-molecule drugs. Patients and providers increasingly prioritize access to precision therapies that address underlying metabolic defects. The growing use of parenteral, oral, and intrathecal treatment options, combined with active clinical pipelines and strong reimbursement frameworks, further propels market expansion. Moreover, the integration of genomic testing and digital health platforms for patient monitoring is significantly contributing to the market’s growth.

Europe Rare Inherited Metabolic Disorders Drug Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by government initiatives supporting rare-disease therapies, stringent healthcare regulations, and the growing need for advanced treatments across lysosomal, mitochondrial, and urea cycle disorders. Rising urbanization, increasing diagnostic capabilities, and the availability of both marketed and pipeline therapies are fostering adoption. European healthcare systems emphasize early intervention and access to enzyme replacement and small-molecule therapies, contributing to growth in hospitals, specialty clinics, and research centers.

U.K. Rare Inherited Metabolic Disorders Drug Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing awareness of inherited metabolic disorders, government support for orphan-drug access, and rising adoption of advanced therapies including gene therapy drugs. Concerns regarding early diagnosis and long-term disease management encourage both clinicians and patients to adopt precision-targeted therapies. The country’s well-developed healthcare infrastructure and strong research and clinical trial activity continue to stimulate market growth.

Germany Rare Inherited Metabolic Disorders Drug Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of metabolic disorders, robust healthcare infrastructure, and adoption of technologically advanced therapies such as enzyme replacement, gene therapy, and oligonucleotide drugs. German healthcare emphasizes patient-centered treatment and early therapeutic intervention, which supports demand for parenteral and oral therapies. The integration of innovative treatment platforms with clinical guidelines and patient management systems promotes steady growth.

Asia-Pacific Rare Inherited Metabolic Disorders Drug Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, fueled by rising healthcare expenditure, increasing diagnosis rates, and growing awareness of rare inherited metabolic disorders in countries such as China, Japan, and India. Expansion of specialty clinics, government support for orphan drugs, and increasing availability of enzyme replacement and small-molecule therapies are driving adoption. The region’s growing pharmaceutical manufacturing capabilities and improving affordability of therapies are further accelerating market growth.

Japan Rare Inherited Metabolic Disorders Drug Market Insight

The Japan market is gaining momentum due to the country’s high healthcare standards, advanced genomic diagnostics, and demand for long-term metabolic disorder management. Adoption of enzyme replacement and gene therapies is increasing alongside growing integration of clinical monitoring and digital health platforms. Moreover, Japan’s aging population and the focus on early intervention for pediatric and adult patients are expected to spur demand for precision-targeted treatments in hospitals and specialty care centers.

India Rare Inherited Metabolic Disorders Drug Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising healthcare awareness, expanding diagnostic infrastructure, and increasing adoption of enzyme replacement, small-molecule, and emerging gene therapy drugs. India represents one of the largest emerging markets for rare-disease therapies, with growing demand in hospitals, specialty clinics, and urban healthcare centers. Government initiatives for rare diseases, expansion of specialty pharmacies, and availability of cost-effective therapy options are key factors propelling market growth.

Rare Inherited Metabolic Disorders Drug Market Share

The Rare Inherited Metabolic Disorders Drug industry is primarily led by well-established companies, including:

- Sanofi (France)

- Takeda Pharmaceutical Company Limited (Japan)

- BioMarin (U.S.)

- Amicus Therapeutics, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Alexion Pharmaceuticals, Inc. (U.S.)

- Ultragenyx Pharmaceutical Inc. (U.S.)

- Protalix BioTherapeutics, Inc. (U.S.)

- Avrobio, Inc. (U.S.)

- Sigilon Therapeutics, Inc. (U.S.)

- Orphazyme A/S (Denmark)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- REGENXBIO Inc. (U.S.)

- Homology Medicines, Inc. (U.S.)

- Abeona Therapeutics, Inc. (U.S.)

- LYSOGENE (France)

- Allievex Corporation (U.S.)

- Bellicum Pharmaceuticals (U.S.)

- Denali Therapeutics Inc. (U.S.)

What are the Recent Developments in Global Rare Inherited Metabolic Disorders Drug Market?

- In July 2025, the FDA approved Sephience an oral drug from PTC Therapeutics for patients with Phenylketonuria (PKU), expanding the therapeutic options for amino‑acid metabolic disorders beyond restrictive diets

- In May 2025, a personalized gene‑editing therapy using CRISPR successfully treated an infant diagnosed with CPS1 deficiency (a rare urea‑cycle disorder), representing a major milestone as the first bespoke genomic therapy for a metabolic disease

- In April 2025, Glycomine raised USD 115 million in a Series C financing round to advance its lead experimental therapy (GLM101) for a form of congenital disorders of glycosylation (CDG), boosting investment backing for metabolic‑disorder drug development

- In November 2024, the Kebilidi (eladocagene exuparvovec‑tneq) gene therapy was approved by U.S. Food and Drug Administration (FDA) for treatment of Aromatic L‑amino acid decarboxylase deficiency (AADC deficiency), marking the first FDA‑approved gene therapy for that condition

- In September 2024, the FDA approved Miplyffa (arimoclomol) the first approved therapy for Niemann‑Pick disease type C (NPC) offering a long‑awaited treatment for neurological and metabolic symptoms associated with this rare lysosomal storage disorder

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.