Global Ready To Drink Coffee Market

Market Size in USD Billion

CAGR :

%

USD

28.64 Billion

USD

46.76 Billion

2024

2032

USD

28.64 Billion

USD

46.76 Billion

2024

2032

| 2025 –2032 | |

| USD 28.64 Billion | |

| USD 46.76 Billion | |

|

|

|

|

Ready to Drink Coffee Market Size

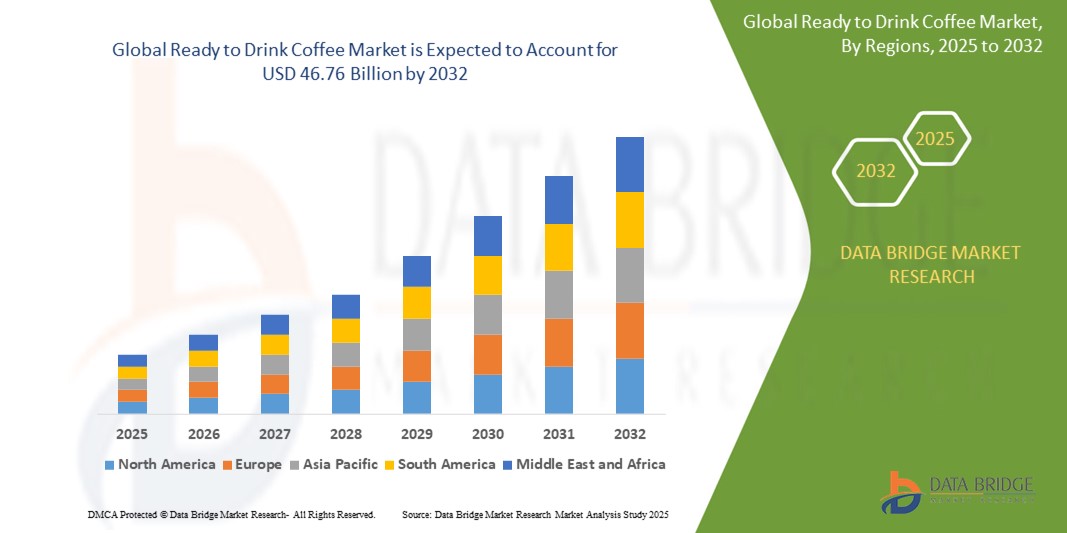

- The global ready to drink coffee market size was valued at USD 28.64 billion in 2024 and is expected to reach USD 46.76 billion by 2032, at a CAGR of 6.32% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenient, on-the-go beverage options that align with fast-paced lifestyles, particularly among urban populations and working professionals

- Furthermore, rising demand for premium, functional, and health-focused beverages—such as low-sugar, plant-based, and energy-enhancing ready to drink coffee—is reshaping product innovation and portfolio expansion. These evolving consumption patterns are significantly accelerating the growth of the ready to drink coffee market

Ready to Drink Coffee Market Analysis

- Ready-to-drink coffee offers convenience without compromising on flavor. Perfect for busy mornings or on-the-go lifestyles, these beverages provide a quick caffeine fix in a portable package. With various flavors and styles available, from classic brews to indulgent lattes, there's a ready-to-drink coffee option to suit every taste preference and schedule

- The escalating demand for ready to drink coffee is primarily fueled by shifting consumer lifestyles toward convenience, the growing trend of premiumization in beverages, and rising health consciousness driving innovation in low-sugar and functional ready to drink coffee formulations

- North America dominated the ready to drink coffee market with a share of 27.79% in 2024, due to the region’s strong coffee culture, demand for convenient beverage options, and the rapid expansion of premium and functional ready to drink coffee products

- Asia-Pacific is expected to be the fastest growing region in the ready to drink coffee market with a share of during the forecast period due to changing consumption habits, rapid urbanization, and rising disposable income across developing countries

- Conventional segment dominated the market with a market share of 96.14% due to its widespread use in clinical settings and the established efficacy and regulatory approval of synthetic antiviral compounds. Conventional antivirals are typically backed by extensive clinical data and are readily available through mainstream pharmaceutical supply chains, making them the first line of treatment for a broad range of viral infections

Report Scope and Ready to Drink Coffee Market Segmentation

|

Attributes |

Ready to Drink Coffee Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink Coffee Market Trends

“Rising Innovation in Flavors and Formulations”

- A significant and accelerating trend in the global ready to drink coffee market is the rapid innovation in flavors and formulations aimed at catering to evolving consumer palates and functional preferences. Brands are developing unique blends, including indulgent and health-conscious variants, to expand their appeal across diverse demographics and consumption occasions

- For instance, Nestlé Thailand launched NESCAFÉ GOLD Creama Craft Latte and Creama Craft Americano, enhancing its ready to drink portfolio with barista-style flavor profiles tailored to local tastes. Similarly, Starbucks and PepsiCo introduced Nitro Cold Brew cans in flavors such as dark caramel, vanilla sweet cream, and black, targeting consumers seeking premium and differentiated ready to drink experiences

- Flavor innovation is expanding traditional offerings such as mocha, caramel, and vanilla and also introducing seasonal, limited-edition, and region-specific variants that increase consumer engagement and brand loyalty. Functional ingredients such as adaptogens, collagen, oat milk, or added protein are also being incorporated to align with wellness trends

- These innovations are being supported by advancements in food technology and consumer insights that allow brands to craft products with better texture, reduced sugar, or plant-based alternatives without compromising taste. Craft-style cold brews and nitro infusions are gaining popularity for their smoother texture and café-like experience

- The continued development of unique formulations that deliver both indulgence and health benefits is helping brands to differentiate themselves in an increasingly crowded market. Players such as La Colombe and Keurig Dr Pepper are leveraging partnerships to accelerate innovation and reach wider audiences with diverse ready to drink coffee offerings

- The demand for varied and functional flavors is rising across global markets, reinforcing innovation as a key strategy for attracting health-conscious consumers, flavor explorers, and premium beverage buyers in the ready to drink coffee segment

Ready to Drink Coffee Market Dynamics

Driver

“Changing Lifestyles and the Surge in Convenience Beverages”

- The shift in consumer lifestyles toward faster-paced routines, increased work hours, and on-the-go consumption has significantly fueled the demand for ready to drink coffee as a convenient alternative to brewed coffee

- For instance, Keurig Dr Pepper's partnership with La Colombe expanded the distribution of premium canned coffee into mass retail channels, increasing accessibility for time-constrained consumers

- With rising urbanization and a growing working population, especially in developing markets, consumers are looking for beverages that combine quality, speed, and portability. ready to drink coffee perfectly aligns with these expectations, offering a quick energy boost without compromising flavor or freshness

- Busy professionals, students, and commuters are the primary consumers of ready to drink coffee, relying on single-serve formats to meet their caffeine needs throughout the day. Moreover, innovations in cold chain logistics and packaging have enhanced product availability and shelf life, further driving adoption

- The convergence of convenience, accessibility, and evolving consumption habits has established ready to drink coffee as a staple in modern beverage consumption, with its demand continuing to grow across retail and foodservice environments

Restraint/Challenge

“Intense Competition and Price Sensitivity in Mass Segments”

- The highly competitive nature of the ready to drink coffee market, characterized by a growing number of local and global players, presents a major challenge for sustained profitability and brand differentiation, particularly in price-sensitive segments

- For instance, while premium brands such as Starbucks dominate urban retail shelves, numerous private label and local competitors offer similar products at significantly lower prices, often capturing price-conscious consumers in developing markets

- This saturation makes it difficult for newer or smaller brands to establish shelf presence and consumer loyalty without significant promotional investment. Additionally, flavor fatigue and lack of differentiation among traditional ready to drink offerings can lead to stagnant repeat purchases

- Brands often face pressure to innovate rapidly while maintaining competitive pricing, a balance that can strain margins—especially when production costs rise due to premium ingredients or sustainable packaging. In many regions, lower disposable incomes restrict consumer willingness to pay a premium for ready to drink coffee

- To address these challenges, companies must focus on strategic pricing, differentiated product positioning, and cost-effective innovation while expanding their market reach through diverse retail channels and localized offerings

Ready to Drink Coffee Market Scope

The market is segmented on the basis of nature, product type, price range, packaging, flavour, and sales channel.

• By Nature

On the basis of nature, the ready to drink coffee market is segmented into natural, conventional, and organic. The conventional segment accounted for the largest market share of 96.14% in 2024, primarily due to its widespread use in clinical settings and the established efficacy and regulatory approval of synthetic antiviral compounds. Conventional antivirals are typically backed by extensive clinical data and are readily available through mainstream pharmaceutical supply chains, making them the first line of treatment for a broad range of viral infections.

The natural segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer interest in plant-based therapies and reduced side effects associated with naturally derived compounds. Innovations in phytochemistry and increasing support for integrative medicine are also promoting research and adoption of natural antivirals in both developed and developing regions.

• By Product Type

On the basis of product type, the ready to drink coffee market is categorized into iced coffee, coffee latte, black coffee, and others. The black coffee segment held the largest revenue share in 2024 due to its direct, unblended formulation that aligns with consumer preferences for potent, high-purity antiviral agents, especially in critical care scenarios. Black coffee-type antivirals reflect drugs that deliver rapid action with fewer excipients, making them highly favored in emergency viral outbreaks.

The coffee latte segment is expected to register the highest growth rate from 2025 to 2032, owing to increasing demand for combination antivirals that blend efficacy with enhanced patient compliance. These formulations typically involve dual- or multi-action mechanisms, offering improved therapeutic coverage, especially in immunocompromised patients or those with co-infections.

• By Price Range

On the basis of price range, the market is segmented into economical, mid-range, and premium. The mid-range segment dominated the market in 2024, as it offers a balance between affordability and effectiveness, catering to a wide demographic including government healthcare programs and insurance-backed prescriptions. This segment is especially strong in emerging economies where cost-sensitive consumers seek reliable yet reasonably priced treatment options.

The premium segment is forecasted to exhibit the fastest growth during 2025–2032, supported by the rising prevalence of drug-resistant viral strains that require next-generation, high-cost antivirals. Premium-priced drugs also encompass recently patented therapies, offering novel modes of action and targeted delivery technologies that justify their higher costs.

• By Packaging

On the basis of packaging, the ready to drink coffee market is segmented into bottles, cans, carton packaging, tubs, and others. Bottles held the largest market share in 2024 due to their dominance in liquid oral antivirals and easy dosage control, particularly in pediatric and elderly patient groups. Bottled formats also allow for tamper-proof sealing and measured dispensing, enhancing patient safety and adherence.

Carton packaging is expected to record the highest growth rate from 2025 to 2032, driven by the surge in tablet and blister-pack antiviral formats. Cartons offer convenience in labeling, better protection from light and humidity, and are increasingly being adopted for sustainable, recyclable medical packaging, aligning with global environmental goals.

• By Flavour

On the basis of flavour, the ready to drink coffee market is segmented into vanilla, mocha, caramel, and other flavours. The vanilla segment led the market in 2024, owing to its long-standing use in masking the bitterness of antiviral syrups and chewables, particularly in pediatric formulations. Vanilla’s broad acceptability and proven compatibility with drug ingredients make it the top choice among flavoring agents.

The mocha segment is projected to grow at the highest CAGR from 2025 to 2032 as manufacturers target teen and adult patients with more palatable formulations to improve treatment adherence. Flavored antivirals are gaining traction in outpatient care settings, with mocha providing a bolder taste profile that appeals to a growing market of flavor-conscious consumers.

• By Sales Channel

On the basis of sales channel, the market is bifurcated into store-based retailing and e-commerce. The store-based retailing segment dominated in 2024, as pharmacies, hospitals, and healthcare centers continue to be the primary points of access for prescription antivirals. Face-to-face consultations and in-person verification requirements reinforce the dominance of physical retail outlets.

The e-commerce segment is expected to expand at the fastest pace between 2025 and 2032, bolstered by increasing digitization of healthcare services and the convenience of remote purchasing. The growth of online pharmacy platforms, coupled with home delivery models and telemedicine integration, is significantly enhancing access to antivirals, particularly in urban and semi-urban areas.

Ready to Drink Coffee Market Regional Analysis

- North America dominated the ready to drink coffee market with the largest revenue share of 27.79% in 2024, driven by the region’s strong coffee culture, demand for convenient beverage options, and the rapid expansion of premium and functional ready to drink coffee products

- Consumers across North America are highly responsive to innovation in flavor, packaging, and ingredients, favoring health-conscious and energy-boosting ready to drink coffee variants

- The market benefits from an extensive distribution network, high per capita coffee consumption, and the rising influence of on-the-go lifestyles, making ready to drink coffee a staple among busy consumers, especially in metropolitan areas

U.S. Ready to Drink Coffee Market Insight

The U.S. ready to drink coffee market captured the largest revenue share in 2024 within North America, driven by increasing demand for functional beverages and clean-label products. The shift toward healthier alternatives and growing consumer preference for plant-based or low-sugar ready to drink coffee options are significantly influencing market dynamics. The strong presence of major coffee brands, a highly developed retail landscape, and consumer affinity for convenience are further accelerating the adoption of ready to drink coffee across multiple demographic segments.

Europe Ready to Drink Coffee Market Insight

The Europe ready to drink coffee market is projected to grow at a notable CAGR throughout the forecast period, primarily influenced by rising demand for premium coffee experiences and increased health awareness. The region’s consumers are gravitating toward organic, dairy-free, and sustainably sourced ready to drink coffee products. Growth is also supported by increased café culture, evolving work-life patterns, and the expansion of chilled beverage offerings in retail and convenience stores across Western and Northern Europe.

U.K. Ready to Drink Coffee Market Insight

The U.K. ready to drink coffee market is expected to witness substantial growth during the forecast period, driven by the growing appeal of cold coffee formats and a consumer shift toward functional and low-calorie beverages. Younger consumers, in particular, are embracing ready to drink coffee for its convenience and trendy image, while the popularity of coffee on-the-go continues to support category expansion. The strong e-commerce infrastructure and premiumization trends are also playing key roles in market development.

Germany Ready to Drink Coffee Market Insight

The Germany ready to drink coffee market is expected to register significant growth, backed by rising demand for natural and health-enhancing beverage options. German consumers show increasing interest in clean-label ready to drink coffee with functional ingredients such as protein, fiber, or adaptogens. Sustainability concerns and preference for environmentally friendly packaging further influence purchasing behavior, prompting innovation from both local and global brands operating in the country.

Asia-Pacific Ready to Drink Coffee Market Insight

The Asia-Pacific ready to drink coffee market is set to grow at the fastest CAGR of 6.8% during the forecast period of 2025 to 2032, driven by changing consumption habits, rapid urbanization, and rising disposable income across developing countries. A strong café culture, expanding youth population, and interest in Western-style beverages are accelerating ready to drink coffee demand. Market growth is further amplified by convenience retail expansion and aggressive marketing by domestic and international players.

Japan Ready to Drink Coffee Market Insight

The Japan ready to drink coffee market remains one of the most mature globally, characterized by a high level of product diversity and strong consumer loyalty. The culture of vending machine purchases and convenience store distribution continues to fuel sales, while health-focused ready to drink variants such as low-sugar and functional coffees gain traction. Innovations in packaging, such as resealable and recyclable containers, also support ongoing market evolution in Japan.

China Ready to Drink Coffee Market Insight

The China ready to drink coffee market accounted for the largest revenue share in Asia Pacific in 2024, led by growing urban middle-class consumers, Western lifestyle influence, and digital retail integration. The increasing adoption of premium coffee and rapid penetration of cold brews, especially through online platforms and convenience stores, are driving substantial growth. Rising health awareness is also pushing demand for clean-label and plant-based ready to drink coffee products, while local and global brands invest heavily in product innovation and marketing campaigns.

Ready to Drink Coffee Market Share

The ready to drink coffee industry is primarily led by well-established companies, including:

- The Coffee Bean & Tea Leaf (U.S.)

- Unilever (U.K.)

- Gourmesso (U.S.)

- Harney & Sons Fine Teas (U.S.)

- Dualit (U.K.)

- Nestlé SA (Switzerland)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Ippodo Tea Co. Ltd. (China)

- Tranquini (U.S.)

- Chillbev (U.S.)

- Som Sleep (U.S.)

- Phi Drinks, Inc. (U.S.)

- BevNET (U.S.)

Latest Developments in Global Ready to Drink Coffee Market

- In December 2023, Goldex Morocco’s plan to open five new Costa Coffee outlets across Casablanca, Rabat, and Bouskoura is expected to strengthen the ready to drink coffee market in North Africa by expanding brand visibility and consumer access. This regional investment highlights increasing demand for premium coffee experiences and contributes to the globalization of ready to drink coffee consumption trends

- In July 2023, Keurig Dr Pepper Inc.’s strategic partnership and investment in La Colombe significantly boost the distribution and retail reach of La Colombe's ready to drink coffee products across the U.S. This collaboration enhances category competitiveness and accelerates the penetration of artisanal, premium cold coffee offerings in mainstream channels

- In July 2023, Nestlé Thailand’s launch of NESCAFÉ GOLD Creama Craft Latte and Americano marked a strategic expansion of its ready to drink portfolio in Southeast Asia, catering to evolving consumer preferences for high-quality, café-style cold coffee at home. This move is likely to reinforce Nestlé’s market position and stimulate growth in Thailand’s premium ready to drink segment

- In March 2021, the strategic partnership between J.M. Smucker Co. and JDE Peet's aimed at supporting Smucker’s Away From Home liquid coffee business strengthens innovation and product development for foodservice ready to drink offerings. This collaboration enhances operational efficiency and expands availability in non-retail settings, including offices and hospitality

- In February 2020, the collaboration between Starbucks and PepsiCo Inc. to launch nitrogen-infused Starbucks Nitro Cold Brew cans expanded the market for functional and premium ready to drink beverages. The introduction of unique flavor profiles and nitrogen technology helped differentiate offerings and attracted new consumers seeking innovation in cold coffee formats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ready To Drink Coffee Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ready To Drink Coffee Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ready To Drink Coffee Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.