Global Ready To Drink Rtd Mocktails Market

Market Size in USD Billion

CAGR :

%

USD

6.54 Billion

USD

13.61 Billion

2024

2032

USD

6.54 Billion

USD

13.61 Billion

2024

2032

| 2025 –2032 | |

| USD 6.54 Billion | |

| USD 13.61 Billion | |

|

|

|

|

Ready to Drink (RTD) Mocktails Market Size

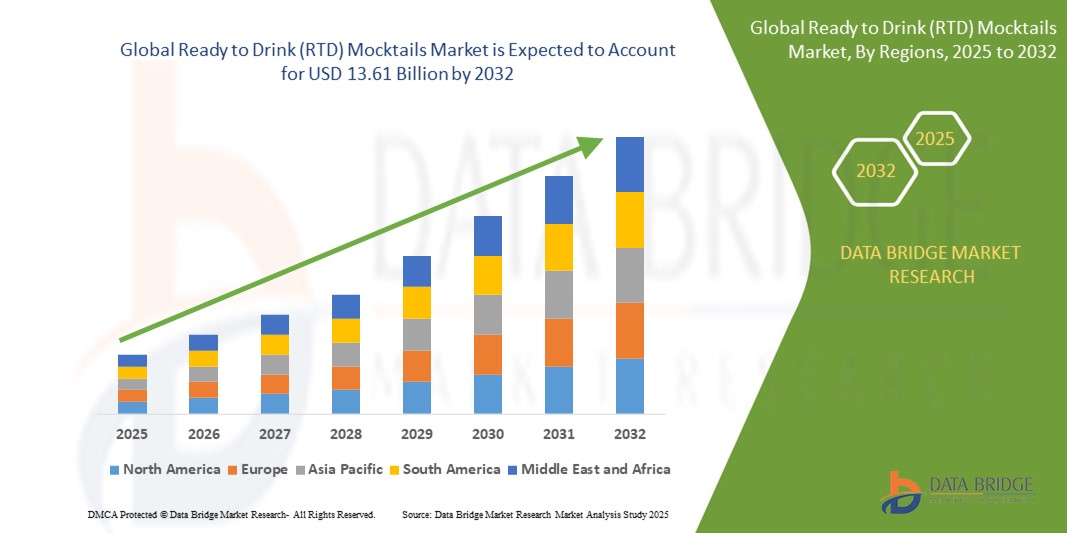

- The global ready to drink (RTD) mocktails market was valued at USD 6.54 million in 2024 and is expected to reach USD 13.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.60% primarily driven by the rising demand for healthier, non-alcoholic beverage options

- This growth is driven by factors such as the increasing health consciousness among consumers, the rise of alcohol-free social occasions, and the expansion of innovative flavours and premium offerings

Ready to Drink (RTD) Mocktails Market Analysis

- Ready to Drink (RTD) Mocktails are pre-mixed, alcohol-free beverages that mimic the taste and experience of traditional cocktails, offering consumers a convenient and flavourful alternative to alcoholic drinks

- The Ready to Drink Mocktails market is growing as consumers increasingly seek non-alcoholic alternatives to traditional alcoholic beverages, driven by health-conscious trends and the rise in wellness lifestyles

- For instance, brands such as Seedlip have successfully tapped into this demand by offering non-alcoholic spirits that are used in mocktails at popular bars and restaurants

- Brands are innovating with a variety of exciting and diverse flavours, catering to different preferences. Popular choices include fruit-infused mocktails such as virgin mojitos and berry spritzers

- For instance, Coca-Cola launched its "Coca-Cola with Coffee" and mocktail line, meeting the growing demand for unique, flavourful, non-alcoholic beverages

- Convenience plays a major role in market growth, as ready-to-drink mocktails provide a hassle-free option for busy individuals. Brands such as the "Mocktail Club" offer pre-mixed mocktails in single-serve cans, which can be purchased at supermarkets or online, making it easy for consumers to enjoy a refreshing drink without the need for preparation

- The rise of alcohol-free bars and social clubs in various cities reflects the growing acceptance and demand for mocktails as mainstream beverages

- For instance, bars such as "The Virgin Mary" in Dublin or "Minus 8" in New York City are dedicated entirely to alcohol-free cocktails, showcasing the increasing social space for mocktails

- E-commerce platforms such as Amazon and specialty drink retailers are expanding the availability of mocktail products, allowing consumers to easily explore and purchase different brands and flavours. Brands such as Ritual Zero Proof and Lyre's are seeing significant growth through online platforms, further increasing accessibility for consumers looking for alcohol-free options

Report Scope and Ready to Drink (RTD) Mocktails Market Segmentation

|

Attributes |

Ready to Drink (RTD) Mocktails Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink (RTD) Mocktails Market Trends

“Shift Toward Healthier Ingredients”

- The shift toward healthier ingredients is a significant trend in the Ready to Drink Mocktails market, driven by consumers' growing preference for beverages with natural and clean ingredients such as fresh fruits, herbs, and botanicals instead of artificial flavours and additives

- Brands such as Seedlip have led the way by creating non-alcoholic spirits using botanicals such as allspice, cardamom, and citrus, offering sophisticated, zero-alcohol alternatives that cater to health-conscious drinkers

- There is an increasing demand for mocktails made with organic and low-sugar ingredients, with companies such as Sipsmith releasing sugar-free variants, responding to consumers' desires for healthier, lower-calorie options without sacrificing taste

- Functional ingredients are becoming popular in mocktails, with some brands incorporating superfoods, adaptogens, and antioxidants to appeal to wellness-focused consumers

- For instance, brands such as Free AF Drinks have introduced mocktails infused with botanical extracts and vitamin-rich ingredients

- The rise of plant-based diets has also influenced the mocktail market, with products such as kombucha-based mocktails and coconut water cocktails gaining popularity, reflecting the broader trend of consumers seeking plant-based, nutrient-rich beverages

Ready to Drink (RTD) Mocktails Market Dynamics

Driver

“Premiumization and Experience-Driven Branding”

- Modern drinkers, especially Millennials and Gen Z, are not just seeking alcohol alternatives, but premium, ritual-driven moments that mimic the sophistication of classic cocktails

- For instance, Curious Elixirs offers ready-to-drink blends inspired by Negronis and Spritzes, targeting those who want an at-home craft cocktail experience without the alcohol

- RTD mocktail brands are using high-quality ingredients such as cold-pressed juices, rare botanicals, adaptogens, and natural extracts to elevate their offerings

- For instance, Three Spirit formulates its drinks with functional plants such as lion’s mane, yerba mate, and valerian root to promote mood-based experiences such as energy or relaxation

- Mocktail branding now leans heavily into design, storytelling, and wellness aesthetics to create emotional and lifestyle resonance

- For instance, Ghia uses a minimalist bottle design, Mediterranean-inspired flavor notes, and curated social media content that appeals to trend-conscious, health-forward consumers

- Brands are using platforms such as Instagram, TikTok, and influencer collaborations to amplify the experience-driven aspect of mocktails

- For instance, influencers such as TheSoberCurator and content around #SoberOctober or #DryJanuary have helped position RTD mocktails as part of a conscious, aspirational lifestyle

- Consumers are willing to pay a premium for mocktails that feel indulgent and curated, especially for occasions such as dinner parties or wellness gifting

Opportunity

“Expanding Distribution Channels and E-Commerce Growth”

- An exciting opportunity in the Ready to Drink Mocktails market lies in the expansion of distribution channels, especially through e-commerce platforms. Online retailers such as Amazon and Walmart allow consumers to access a wide range of mocktail brands and flavors from the comfort of their homes, bypassing traditional retail limitations and offering more variety than local stores

- With the rise of online shopping and home delivery services, consumers now have greater convenience in purchasing mocktails. Busy individuals, particularly in urban areas, can easily order mocktails online and have them delivered quickly, making it a perfect solution for those looking for refreshing non-alcoholic beverages without leaving their homes

- The growing preference for convenience supports the success of e-commerce, as Ready to Drink Mocktails fit well into this trend. Consumers are increasingly seeking products that offer quick and easy access, and mocktails, which can be consumed on-the-go or at home, cater to this demand for accessible and enjoyable drinks

- Partnerships between mocktail brands and e-commerce platforms or subscription box services present further growth opportunities

- For instance, brands could offer subscription services where customers receive monthly deliveries of new and seasonal mocktail flavors, fostering brand loyalty while creating a consistent revenue stream

- The expansion of e-commerce channels thus presents a significant opportunity for mocktail brands to increase their market reach and visibility, ultimately helping them grow their customer base and drive sales in an increasingly digital marketplace

Restraint/Challenge

“Limited Consumer Awareness and Market Education”

- One of the primary challenges in the Ready to Drink Mocktails market is the limited consumer awareness and the need for market education. Despite the growing popularity of non-alcoholic beverages, mocktails remain relatively unknown to a significant portion of the population, particularly in regions where alcohol consumption is culturally ingrained

- For instance, in many countries, alcoholic drinks are deeply embedded in social and cultural traditions, which can make it difficult for non-alcoholic alternatives such as mocktails to gain traction

- Many consumers still associate mocktails with bland or less enjoyable alternatives to alcoholic drinks, leading to lower adoption rates. Overcoming this perception requires brands to educate the public that mocktails can be flavourful, sophisticated, and enjoyable, offering more than just a simple alcohol-free option

- For instance, Seedlip, which has successfully positioned its non-alcoholic spirits as premium products that are more than just alcohol substitutes, showing that mocktails can be a luxurious choice rather than a compromise

- Brands need to invest in promoting the idea that mocktails are not just alcohol substitutes but can be a vibrant and appealing choice on their own. By showcasing a diverse range of flavours and offering premium options such as tropical mocktails or botanical-infused varieties, brands can demonstrate that mocktails can be just as indulgent and satisfying as traditional cocktails

- For instance, the "Ritual Zero Proof" line offers sophisticated mocktails that mimic the taste of traditional alcoholic cocktails such as whiskey and gin, helping bridge the gap for consumers who still crave that cocktail experience without alcohol

- Another challenge is convincing alcohol drinkers that mocktails can provide the same level of enjoyment and satisfaction as alcoholic beverages. Many people may feel that drinking a mocktail lacks the social or sensory experience that comes with alcohol, making it essential for brands to create mocktails that rival traditional cocktails in taste, presentation, and overall experience

- To overcome these challenges, educating consumers through marketing campaigns, tastings, and social media platforms will be critical in building trust and awareness around the mocktail category. As brands focus on quality, variety, and education, the market is likely to see more widespread acceptance and growth

- For instance, the growing presence of alcohol-free bars and social events, such as the “Sober Curious” movement, has already helped elevate mocktails, with social media influencers and wellness advocates pushing for more alcohol-free options in the beverage space

Ready to Drink (RTD) Mocktails Market Scope

The market is segmented on the basis of type, flavors, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Flavours |

|

|

By Distribution Channel |

|

Ready to Drink (RTD) Mocktails Market Regional Analysis

“North America is the Dominant Region in the Ready to Drink (RTD) Mocktails Market”

- North America dominates the market, with the U.S. setting the pace in product innovation, high consumption, and wide flavour variety, driven by a shift toward healthier and alcohol-free lifestyle choices

- The popularity of wellness trends and movements such as “sober curious” and “mindful drinking” has reshaped social drinking habits, encouraging more consumers to choose premium mocktails as alternatives to alcohol

- A highly developed beverage industry and strong retail and online distribution systems make it easy for consumers to access a wide range of mocktail products, both in stores and online

- Brands across the region are quickly responding to consumer trends by launching mocktails with natural ingredients, functional benefits, and clean labels that appeal to modern health-focused preferences

- Ready to drink mocktails are becoming a staple on menus at restaurants, bars, and events, reflecting their growing mainstream appeal and reinforcing North America's position as the dominant player in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is witnessing the fastest growth in the market, driven by changing lifestyles, increasing urbanization, and a growing preference for health-conscious beverage choices, especially among younger consumers in Japan, South Korea, and China

- The influence of Western culture has played a role in shifting social norms around alcohol, encouraging more people in the region to try alcohol-free alternatives such as ready to drink mocktails during casual gatherings and formal events

- Convenience and variety are key factors attracting consumers, as mocktails offer a quick, flavourful option that fits well into the fast-paced, modern lifestyles common in Asia’s urban centers

- The expansion of retail outlets, convenience stores, and online shopping platforms has improved access to mocktail products, enabling both local and international brands to reach a broader audience

- Brands are increasingly launching region-specific flavours and formulations to appeal to local taste preferences, contributing to the rapid rise of mocktail consumption and positioning Asia-Pacific as a major growth engine in the global market

Ready to Drink (RTD) Mocktails Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Pernod Ricard (France)

- SHS Group (U.K.)

- E & J Gallo (U.S.)

- William Grant & Sons (U.K.)

- Miller Coors (U.S.)

- Diageo (U.K.)

- Treasury Wine Estates (Australia)

- Jose Cuervo (Mexico)

- Constellation Brands (U.S.)

- Beam-Suntory (U.S.)

- Mast-Jaegermeister (Germany)

- Bacardi (Bermuda)

- Pernod Ricard (France)

- Edrington Group (U.K.)

- Brown-Forman (U.S.)

- Pabst Brewing (U.S.)

- Anheuser-Busch (U.S.)

- China Resource Enterprise (China)

- Accolade Wines (Australia)

- Vina Concha y Toro (Chile)

- Torres (Spain)

- Heineken (Netherlands)

- The Wine Group (U.S.)

- Craft Brew Alliance Inc. (U.S.)

- Molson Coors Brewing Co. (U.S.)

- Haelwood International Holdings Plc (U.K.)

Latest Developments in Global Ready to Drink (RTD) Mocktails Market

- In May 2024, Waterloo Sparkling Water (U.S.) introduced new mocktail-inspired flavors—All Day Rosé, Pi-Ño Colada, and Mojito—through a product development collaboration with celebrity chef Guy Fieri. This launch aims to offer vibrant, alcohol-free options that align with the growing consumer shift toward healthier and more sophisticated beverage choices. The flavors are now available nationwide through major retailers, enhancing accessibility. This development boosts Waterloo’s position in the non-alcoholic segment and supports the rising popularity of mocktails in mainstream markets

- In April 2024, The Free Spirits Company (U.S.) launched non-alcoholic Ready-to-Drink California Craft Cocktails in two classic flavours: The Kentucky Mule and The Margarita. Crafted with their signature alcohol-free spirits and real fruit juice, these canned cocktails cater to consumers seeking premium, alcohol-free convenience. Available via Total Wine and online platforms, the launch strengthens the brand’s position in the growing mocktail market. It reflects increasing demand for flavourful, ready-to-enjoy non-alcoholic options

- In September 2023, Britvic (U.K.) expanded its J2O brand by launching its first ready-to-drink mocktail range. The new offerings include three premium non-alcoholic flavours: Strawberry & Orange Blossom Mojito, White Peach & Mango Daiquiri, and Blackberry & Blueberry Martini. Available in 250ml cans at GBP 3.49 RRP, these mocktails aim to provide consumers with elevated, alcohol-free alternatives that emulate the taste and experience of traditional cocktails. This launch aligns with the growing demand for non-alcoholic beverages in the U.K., where a third of adults abstain from alcohol, and the market is projected to reach GBP 432 million by 2027. By introducing these mocktails, J2O seeks to expand its appeal into more occasions and offer consumers a convenient, high-quality option for social settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ready To Drink Rtd Mocktails Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ready To Drink Rtd Mocktails Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ready To Drink Rtd Mocktails Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.