Global Reconditioned Steel Drum Market

Market Size in USD Billion

CAGR :

%

USD

2.99 Billion

USD

4.45 Billion

2024

2032

USD

2.99 Billion

USD

4.45 Billion

2024

2032

| 2025 –2032 | |

| USD 2.99 Billion | |

| USD 4.45 Billion | |

|

|

|

|

What is the Global Reconditioned Steel Drum Market Size and Growth Rate?

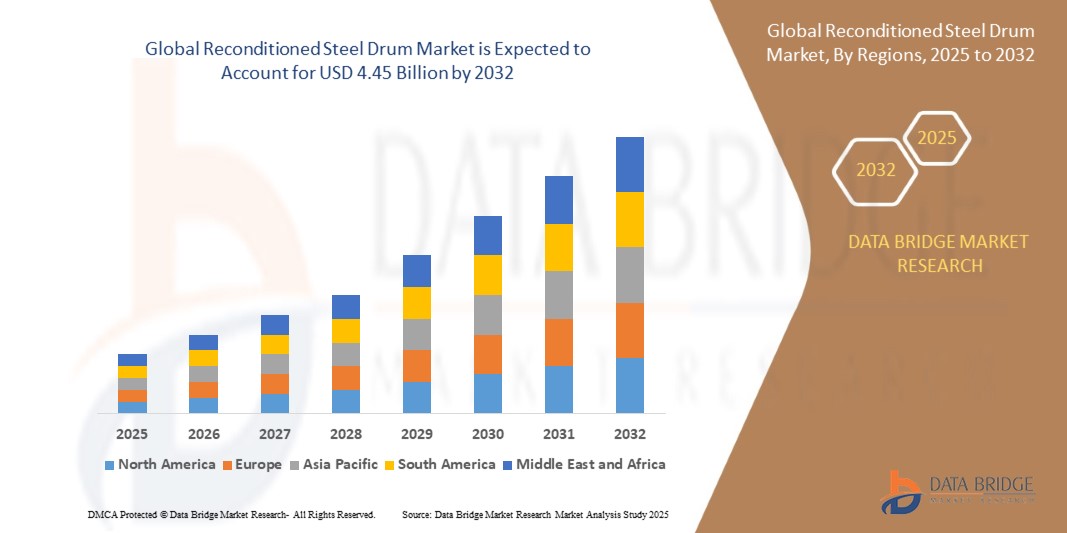

- The global Reconditioned Steel Drum market size was valued at USD 2.99 billion in 2024 and is expected to reach USD 4.45 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is being driven by rising demand for sustainable packaging solutions, especially in the chemical, oil, and food sectors, which increasingly prioritize cost-effectiveness and environmental responsibility

What are the Major Takeaways of Reconditioned Steel Drum Market?

- Regulatory mandates promoting circular economy practices and waste reduction initiatives are strengthening the adoption of reconditioned steel drums, positioning them as a preferred alternative to new drum manufacturing

- North America dominated the reconditioned steel drum market, capturing the largest revenue share of 38.6% in 2024, driven by strong demand from chemical, petrochemical, and food industries focused on sustainability and cost-effectiveness

- Asia-Pacific is the fastest-growing region in the reconditioned steel drum market, projected to grow at a CAGR of 6.8% from 2025 to 2032. This growth is fueled by rapid industrialization, expanding manufacturing bases, and increasing environmental awareness in countries such as China, India, and Japan

- The Cold Rolled Steel segment dominated the market with the largest revenue share of 46.8% in 2024, owing to its high strength, durability, and cost-effectiveness

Report Scope and Reconditioned Steel Drum Market Segmentation

|

Attributes |

Reconditioned Steel Drum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Reconditioned Steel Drum Market?

Sustainability and Circular Economy Integration

- A major trend driving the global reconditioned steel drum market is the increasing emphasis on sustainability and circular economy practices. Manufacturers and end-users are focusing on extending the lifecycle of steel drums through cleaning, repainting, and refurbishing—minimizing waste and reducing the demand for virgin materials.

- Reconditioned steel drums offer a cost-effective and eco-friendly alternative to new drums, helping companies reduce carbon footprints and meet stringent environmental regulations. Industry initiatives to standardize reconditioning processes are further enhancing product consistency and reliability

- For instance, Mauser Packaging Solutions has scaled its global reconditioning network to offer closed-loop collection and reconditioning programs for industrial packaging, enabling customers to comply with sustainability goals while ensuring safety and performance.

- These practices are especially appealing in industries such as chemicals, food & beverage, and pharmaceuticals, where the reuse of drums—when handled properly—helps meet green packaging requirements

- This trend is reinforced by supportive government policies and customer preferences shifting toward environmentally responsible packaging solutions. Regulatory frameworks in the U.S., U.K., and the E.U. encourage the use of UN-rated reconditioned drums, boosting industry credibility

- The growing integration of circular economy models, cost savings, and global ESG mandates is expected to significantly expand the adoption of reconditioned steel drums across industrial sectors worldwide

What are the Key Drivers of Reconditioned Steel Drum Market?

- Growing global awareness of environmental sustainability and the circular economy is fueling demand for reconditioned steel drums as industries seek to reduce waste and comply with green regulations

- For instance, in January 2024, Greif, Inc. announced an expansion of its drum reconditioning facility in Germany to cater to growing European demand for eco-conscious industrial packaging, reinforcing its commitment to a sustainable supply chain

- Compared to new steel drums, reconditioned drums offer lower cost, reduced material usage, and faster lead times, making them attractive across multiple sectors including chemicals, lubricants, and food processing

- Strong government mandates for recycling and reuse of industrial packaging—particularly in the E.U. and North America—have further strengthened the market, encouraging manufacturers to invest in automated cleaning and testing equipment for higher throughput and safety

- In addition, rising raw material prices are encouraging businesses to adopt cost-efficient packaging alternatives such as reconditioned drums. With consistent quality and safety certification (e.g., UN ratings), these drums are becoming a viable substitute for new containers across many regulated industries

Which Factor is challenging the Growth of the Reconditioned Steel Drum Market?

- A significant challenge for the market is limited awareness and acceptance of reconditioned steel drums in certain regions and industries, primarily due to perceived safety concerns and lack of standardization

- For instance, in emerging economies, small- and medium-scale manufacturers often opt for new drums over reconditioned ones due to unfamiliarity with regulatory certifications and worries about residual contamination risks, especially in sensitive sectors such as pharmaceuticals or food & beverage

- Furthermore, despite advancements in reconditioning technologies, inconsistent reconditioning practices among small service providers can lead to quality and safety variances, which may undermine end-user confidence

- The capital-intensive nature of setting up high-quality reconditioning plants—with equipment for shot blasting, leak testing, painting, and certification—can also deter new entrants or limit expansion, particularly in cost-sensitive markets

- Overcoming these obstacles will require greater industry collaboration, awareness programs, and the enforcement of international reconditioning standards such as those from RECON (Reusable Industrial Packaging Association) to assure users of product integrity and performance

- As customer education increases and sustainability becomes central to procurement strategies, the market is expected to gradually overcome these challenges

How is the Reconditioned Steel Drum Market Segmented?

The market is segmented on the basis of material, head type, size/capacity, and application.

• By Material

On the basis of Material, the reconditioned steel drum market is segmented into Stainless Steel, Cold Rolled Steel, and Carbon Steel. The Cold Rolled Steel segment dominated the market with the largest revenue share of 46.8% in 2024, owing to its high strength, durability, and cost-effectiveness. These drums are widely preferred for reconditioning due to their structural integrity and recyclability, making them ideal for repeated industrial use.

The Stainless Steel segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing demand in the pharmaceutical and food industries where hygiene and corrosion resistance are crucial. The higher upfront cost is offset by longevity and performance in sensitive applications.

• By Head Type

On the basis of head type, the market is segmented into Tight Head and Open Head variants. The Tight Head segment held the largest revenue share of 57.3% in 2024, primarily due to its superior leak-proof qualities and suitability for storing and transporting liquids such as chemicals, solvents, and oils. These drums are often reconditioned for repeated liquid transport due to safety standards compliance.

The Open Head variant is expected to grow at the fastest rate, favored for its versatility in storing solid and semi-solid contents, and ease of cleaning and reusability, making it a popular choice in agriculture and construction industries.

• By Size/Capacity

On the basis of Size/Capacity, the market is categorized into 10 to 25 Gallons, 25 to 40 Gallons, 40 to 55 Gallons, and 55 Gallons and above. The 40 to 55 Gallons segment dominated the market in 2024 with a share of 61.5%, as this size range is the industry standard for reconditioning and widely used across chemical, lubricant, and paint sectors. These drums strike a balance between storage capacity and handling convenience.

The 10 to 25 Gallons segment is projected to witness the highest CAGR, driven by its growing adoption in specialized applications such as food-grade packaging, pharmaceuticals, and high-value chemicals, where smaller volumes are frequently used.

• By Application

On the basis of application, the reconditioned steel drum market is segmented into Food & Beverages, Pharmaceuticals & Healthcare, Building and Construction, Oils & Lubricants, Chemicals and Solvents, Paints & Dyes, Agriculture & Allied Industry (Fertilizers/Pesticides), and Others. The Chemicals and Solvents segment held the largest revenue share of 32.9% in 2024, due to the wide use of steel drums in the transport and storage of hazardous and non-hazardous chemicals. Their strength, reusability, and regulatory compliance make them ideal for this application.

The Pharmaceuticals & Healthcare segment is expected to grow at the fastest pace, driven by rising demand for safe, clean, and tamper-proof reconditioned drums for medical-grade content storage. The emphasis on sustainable packaging in this sector further supports reconditioned drum adoption.

Which Region Holds the Largest Share of the Reconditioned Steel Drum Market?

- North America dominated the reconditioned steel drum market, capturing the largest revenue share of 38.6% in 2024, driven by strong demand from chemical, petrochemical, and food industries focused on sustainability and cost-effectiveness

- The region’s well-established industrial infrastructure, along with stringent environmental regulations, has fostered the reuse and reconditioning of steel drums to reduce waste and support circular economy initiatives

- In addition, increased investment in sustainable packaging and logistics operations across the U.S. and Canada is further boosting the demand for reconditioned steel drums across various sectors

U.S. Reconditioned Steel Drum Market Insight

The U.S. reconditioned steel drum market held the largest revenue share of 83% in North America in 2024, supported by a robust manufacturing base, strict EPA regulations, and corporate sustainability goals. Businesses are increasingly opting for reconditioned drums to meet waste reduction targets and lower operational costs. The presence of key market players and large-scale industrial usage in chemicals, lubricants, and food-grade applications is reinforcing the country’s dominance in the regional market.

Europe Reconditioned Steel Drum Market Insight

The European reconditioned steel drum market is projected to grow at a solid CAGR over the forecast period, propelled by strong environmental policies, waste management standards, and increasing adoption of circular economy practices. Major economies such as Germany, France, and Italy are actively promoting reconditioning and reuse to minimize the use of new packaging materials. In addition, the region’s focus on reducing carbon emissions across supply chains is bolstering market adoption across both manufacturing and transportation sectors

U.K. Reconditioned Steel Drum Market Insight

The U.K. reconditioned steel drum market is expected to witness promising growth, owing to government initiatives supporting waste reduction and reuse of packaging. Industries across chemicals, lubricants, and food production are increasingly adopting reconditioned drums to comply with sustainability goals and reduce costs. The demand is further driven by the country’s focus on circular logistics systems and the rising cost of new raw materials, making reconditioning an economically viable choice.

Germany Reconditioned Steel Drum Market Insight

The Germany reconditioned steel drum market is projected to expand steadily, driven by a strong commitment to green industrial practices and sustainable packaging solutions. With Germany being a manufacturing powerhouse, the use of steel drums for transporting chemicals and industrial goods is widespread, making reconditioning a practical and environmentally responsible alternative. Local reconditioning service providers and advanced drum cleaning technologies are also supporting growth across the country.

Which Region is the Fastest Growing in the Reconditioned Steel Drum Market?

Asia-Pacific is the fastest-growing region in the reconditioned steel drum market, projected to grow at a CAGR of 6.8% from 2025 to 2032. This growth is fueled by rapid industrialization, expanding manufacturing bases, and increasing environmental awareness in countries such as China, India, and Japan. The region’s strong push towards sustainable practices, supported by government regulations and growing export activities, is making reconditioned steel drums a preferred choice for industrial packaging.

Japan Reconditioned Steel Drum Market Insight

The Japan reconditioned steel drum market is expanding due to rising awareness about sustainable packaging and stringent waste disposal laws. Japan’s large-scale use of drums in pharmaceuticals, chemicals, and food industries, combined with its cultural emphasis on resource efficiency, is accelerating adoption. Moreover, the presence of local manufacturers specializing in high-quality reconditioning services is playing a key role in market development.

China Reconditioned Steel Drum Market Insight

The China reconditioned steel drum market held the largest share in Asia-Pacific in 2024, supported by its massive industrial base, large exports, and growing environmental consciousness. The government's strong backing for reuse and recycling programs, along with the increasing cost of raw steel, has made reconditioning an attractive option. As domestic and international demand for eco-friendly packaging rises, China is poised to maintain its lead in the regional market.

Which are the Top Companies in Reconditioned Steel Drum Market?

The reconditioned steel drum industry is primarily led by well-established companies, including:

- Greif, Inc. (U.S.)

- Mauser Packaging Solutions (U.S.)

- Industrial Container Services (ICS) (U.S.)

- Peninsula Drums (South Africa)

- Clouds Drums Dubai LLC (U.A.E.)

- THIELMANN (Germany)

- Myers Container LLC (U.S.)

- Eagle Manufacturing Company (U.S.)

- Sonoco Products Company (U.S.)

- Tielman Group (Netherlands)

What are the Recent Developments in Global Reconditioned Steel Drum Market?

- In May 2025, Mauser launched a new series of stainless steel intermediate bulk containers (IBCs), aimed at catering to the evolving needs of diverse industries. This move highlights the company’s commitment to innovation and customized packaging solutions

- In May 2024, Electra, a renewable energy-powered company backed by Bill Gates and Amazon, announced the establishment of a green steel production facility in Colorado, U.S., designed to convert high-grade ores into clean metallic iron using sustainable energy. This marks a significant step forward in reducing the carbon footprint of the steel industry

- In May 2024, Tosyali Algeria, a subsidiary of Turkey’s Tosyalı Holding, inaugurated a state-of-the-art flat-rolled steel mill in Algeria to enhance production capacity in the region. This expansion strengthens the company’s foothold in North African steel markets

- In March 2024, Greif successfully acquired Ipackchem Group SAS, a move that significantly broadened its offerings in the industrial packaging sector. The acquisition reinforces Greif’s position as a key player in high-performance container solutions

- In August 2024, Mauser bolstered its presence in the African market by acquiring a plastic drum manufacturing business in South Africa. This strategic acquisition supports Mauser’s global growth and regional expansion efforts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Reconditioned Steel Drum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Reconditioned Steel Drum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Reconditioned Steel Drum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.