Global Recycled Carbon Fiber Market

Market Size in USD Billion

CAGR :

%

USD

222.67 Billion

USD

470.42 Billion

2024

2032

USD

222.67 Billion

USD

470.42 Billion

2024

2032

| 2025 –2032 | |

| USD 222.67 Billion | |

| USD 470.42 Billion | |

|

|

|

|

Recycled Carbon Fiber Market Size

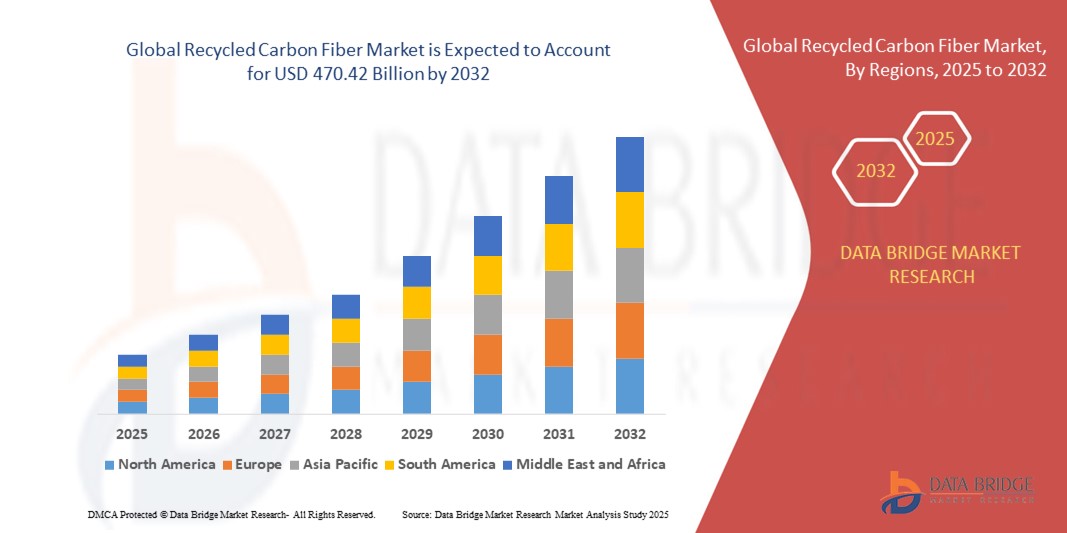

- The global recycled carbon fiber market size was valued at USD 222.67 million in 2024 and is expected to reach USD 470.42 billion by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the increasing emphasis on sustainability and waste reduction across key industries such as automotive, aerospace, and consumer goods, leading to a growing preference for eco-friendly materials such as recycled carbon fiber

- Furthermore, rising regulatory pressures and cost-effectiveness compared to virgin carbon fiber are encouraging manufacturers to adopt recycled alternatives. These converging factors are driving the demand for recycled carbon fiber, thereby significantly boosting the industry's growth

Recycled Carbon Fiber Market Analysis

- Recycled carbon fiber, known for retaining much of the strength of virgin carbon fiber at a reduced cost and environmental impact, is becoming an increasingly important material in automotive, aerospace, electronics, and sporting goods industries due to its lightweight nature and sustainability advantages

- The accelerating demand for recycled carbon fiber is primarily fueled by stricter environmental regulations, growing emphasis on circular economy practices, and rising demand for cost-effective, high-performance materials across manufacturing sectors

- North America dominated the recycled carbon fiber market with the largest revenue share of 39.7% in 2024, driven by strong demand from the aerospace and automotive industries, advancements in composite recycling technologies, and increasing manufacturer focus on sustainability across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the recycled carbon fiber market during the forecast period due to rapid industrialization, government support for green materials, and expanding automotive production

- Chopped carbon fiber segment dominated the recycled carbon fiber market with a market share of 47.2% in 2024, driven by its versatility, compatibility with thermoplastics, and widespread application in injection molding and reinforced composite components

Report Scope and Recycled Carbon Fiber Market Segmentation

|

Attributes |

Recycled Carbon Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recycled Carbon Fiber Market Trends

Sustainability-Driven Innovation in Composite Manufacturing

- A significant and accelerating trend in the global recycled carbon fiber market is the increasing adoption of sustainable composite materials driven by circular economy initiatives and environmental regulations. Manufacturers across automotive, aerospace, and consumer goods sectors are actively seeking lightweight, high-strength materials that reduce both cost and carbon footprint

- For instance, BMW Group has expanded its use of recycled carbon fiber in select vehicle components, notably in its i-series, aiming to reduce production emissions and material waste. Similarly, Boeing has partnered with composite recyclers to repurpose carbon fiber scrap from aircraft manufacturing into new structural materials

- Technological advancements now enable better retention of mechanical properties during the recycling process, making recycled carbon fiber a viable substitute for virgin alternatives in many applications. Emerging processing methods, such as pyrolysis and solvolysis, improve fiber quality and broaden end-use capabilities

- Integration of recycled carbon fiber into thermoplastics and injection molding processes allows for mass production of lightweight components, particularly in the mobility and electronics sectors. The compatibility of chopped recycled fiber with automation-driven composite part manufacturing is enhancing adoption rates in high-volume markets

- This trend towards high-performance, eco-friendly materials is encouraging key players such as ELG Carbon Fibre Ltd. and Carbon Conversions Inc. to invest in capacity expansion and technological innovation, catering to rising demand from OEMs and tier suppliers.

- The growing emphasis on material circularity, coupled with cost benefits and improved recycling infrastructure, is driving strong interest in recycled carbon fiber across global manufacturing hubs

Recycled Carbon Fiber Market Dynamics

Driver

Rising Demand for Lightweight, Sustainable Materials Across Industries

- The increasing demand for lightweight and sustainable materials across transportation, energy, and electronics industries is a major driver for the growing adoption of recycled carbon fiber. The need to meet fuel efficiency and emission reduction goals is pushing automotive and aerospace OEMs to adopt composite materials with a lower environmental footprint.

- For instance, in March 2024, Toray Industries, Inc. announced a collaboration with a European automotive supplier to integrate recycled carbon fiber into interior structural parts, demonstrating the material’s scalability and appeal in mass-market applications.

- As manufacturers aim to reduce raw material costs and industrial waste, recycled carbon fiber provides an effective solution by offering comparable performance at a lower price point

- The material’s reusability and compatibility with existing manufacturing systems enhance its attractiveness in cost-sensitive and environmentally conscious markets.

- In addition, global regulations promoting sustainable practices and carbon neutrality are accelerating industry efforts to shift from virgin to recycled carbon fiber, especially in regions such as North America and Europe

Restraint/Challenge

Processing Variability and Regulatory Standardization Barriers

- Despite its advantages, the recycled carbon fiber market faces challenges due to variability in fiber quality and performance, which can limit application in high-precision industries such as aerospace and medical devices. Inconsistencies in fiber length, strength retention, and surface properties across recycling methods make standardization difficult

- For instance, differences in processing techniques such as pyrolysis versus chemical recycling can lead to inconsistent output, making it harder for OEMs to adopt recycled fibers in critical load-bearing part

- Furthermore, the lack of universally accepted standards for recycled carbon fiber, especially for structural uses, hinders broader market penetration. Regulatory bodies are still evolving certification frameworks that match the stringent safety and performance benchmarks of virgin composites

- The limited number of large-scale recyclers and the high capital cost of advanced recycling technologies also pose barriers to scalability. To overcome these hurdles, industry stakeholders must focus on improving material consistency, establishing certification protocols, and investing in cost-effective recycling infrastructure

Recycled Carbon Fiber Market Scope

The market is segmented on the basis of type, source, and application.

- By Type

On the basis of type, the recycled carbon fiber market is segmented into chopped, milled, and others. The chopped segment dominated the market with the largest revenue share of 47.2% in 2024, driven by its widespread use in thermoplastic compounding, injection molding, and nonwoven mats. Chopped recycled carbon fiber is favored for its versatility, ease of processing, and compatibility with a range of resins, making it ideal for producing lightweight automotive parts, consumer electronics, and industrial goods. Its cost-effectiveness and structural integrity make it a preferred choice in mass-market applications.

The milled segment is anticipated to witness the fastest growth rate of 13.9% from 2025 to 2032, fueled by increasing adoption in high-precision applications such as conductive plastics, coatings, and adhesives. Milled recycled carbon fiber enhances mechanical, thermal, and electrical properties of composite materials, making it suitable for advanced applications in aerospace, electronics, and wind energy. Its fine particle size and uniformity allow for consistent dispersion in matrix systems, enabling manufacturers to achieve tailored performance characteristics.

- By Source

On the basis of source, the recycled carbon fiber market is segmented into automotive scrap, aerospace scrap, and others. The automotive scrap segment held the largest market share in 2024, driven by the significant volume of carbon fiber composites used in vehicle manufacturing and the industry's growing focus on end-of-life vehicle recycling. The push for lightweighting and carbon footprint reduction is leading automakers to invest in closed-loop recycling systems, contributing to the dominance of this segment.

The aerospace scrap segment is projected to grow at the fastest rate during the forecast period, owing to the high-performance carbon fiber waste generated from aircraft manufacturing. These scraps are increasingly being repurposed into cost-effective, high-strength materials suitable for secondary structural components, sporting goods, and industrial equipment. Government regulations encouraging sustainable aerospace practices are further supporting the segment's growth.

- By Application

On the basis of application, the recycled carbon fiber market is segmented into automotive, aerospace and defense, wind energy, sporting goods, and others. The automotive segment dominated the market with the largest revenue share in 2024, driven by the industry’s urgent need for cost-effective lightweight materials that meet fuel efficiency and emission standards. Recycled carbon fiber is increasingly used in under-the-hood parts, interior structures, and battery enclosures in electric vehicles.

The wind energy segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising investments in renewable energy infrastructure and the need to repurpose decommissioned turbine blades. Recycled carbon fiber is emerging as a sustainable material for blade reinforcements, nacelle covers, and related structural components. This aligns with the sector’s push toward eco-friendly, circular manufacturing practices.

Recycled Carbon Fiber Market Regional Analysis

- North America dominated the recycled carbon fiber market with the largest revenue share of 39.7% in 2024, driven by strong demand from the aerospace and automotive industries, advancements in composite recycling technologies, and increasing manufacturer focus on sustainability across the U.S. and Canada

- Manufacturers in the region are leveraging recycled carbon fiber for its cost-efficiency and performance benefits, particularly in applications where weight reduction and environmental impact are critical. The presence of key players, such as Carbon Conversions and Toray Carbon Fibers, supports robust domestic supply and technological advancement

- This widespread adoption is further supported by government incentives for sustainable practices, a mature composite materials industry, and increasing demand for eco-friendly alternatives in both industrial and consumer applications, positioning recycled carbon fiber as a strategic material choice across the region

U.S. Recycled Carbon Fiber Market Insight

The U.S. recycled carbon fiber market captured the largest revenue share of 82% in 2024 within North America, fueled by strong demand from the automotive and aerospace industries seeking lightweight, sustainable materials. The U.S. benefits from well-established recycling infrastructure, significant composite material waste streams, and a growing regulatory focus on circular economy practices. The presence of major players and increased adoption of recycled fiber in mass-market applications, such as electric vehicles and consumer goods, continues to drive the market forward.

Europe Recycled Carbon Fiber Market Insight

The Europe recycled carbon fiber market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s leadership in sustainability initiatives and strict environmental regulations. Automotive manufacturers and aerospace companies in countries such as Germany and France are incorporating recycled carbon fiber into lightweight components to reduce emissions and material costs. Ongoing R&D investment and public-private partnerships for composite recycling are further boosting market momentum across the region.

U.K. Recycled Carbon Fiber Market Insight

The U.K. recycled carbon fiber market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s focus on carbon reduction and the circular economy. Recycled carbon fiber is being increasingly adopted in automotive, aerospace, and construction sectors as companies seek to reduce material waste and comply with stringent environmental standards. Government funding for innovation in green manufacturing and composite reuse is also bolstering growth prospects.

Germany Recycled Carbon Fiber Market Insight

The Germany recycled carbon fiber market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s advanced manufacturing base and strong emphasis on sustainability. German firms are investing in closed-loop production systems and recycling technologies to minimize composite waste and improve cost-efficiency. Recycled carbon fiber is finding growing application in lightweight vehicle parts, consumer electronics, and industrial components.

Asia-Pacific Recycled Carbon Fiber Market Insight

The Asia-Pacific recycled carbon fiber market is poised to grow at the fastest CAGR of 25% during 2025 to 2032, driven by rising industrialization, environmental awareness, and growing demand for cost-effective composite materials in China, Japan, and India. Government-backed initiatives promoting recycling and green manufacturing are boosting market growth. The expansion of local recycling capabilities and increasing use of recycled fibers in automotive, electronics, and sporting goods sectors are driving broader regional adoption.

Japan Recycled Carbon Fiber Market Insight

The Japan recycled carbon fiber market is gaining traction due to the country’s strong commitment to innovation, sustainability, and advanced materials technology. Japanese manufacturers are leveraging recycled carbon fiber in lightweight transportation and consumer products, supported by a robust composite material industry. Government policies promoting circular resource use and advancements in clean manufacturing processes are expected to drive continued market expansion.

India Recycled Carbon Fiber Market Insight

The India recycled carbon fiber market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, increasing environmental regulations, and rising demand for sustainable materials in automotive and construction sectors. India is emerging as a key hub for low-cost, high-volume manufacturing of recycled carbon fiber components, with support from both private and public sectors in building recycling infrastructure and promoting green technologies.

Recycled Carbon Fiber Market Share

The recycled carbon fiber industry is primarily led by well-established companies, including:

- Toray Industries, Inc. (Japan)

- ELG Carbon Fibre Ltd. (U.K.)

- SGL Carbon SE (Germany)

- Carbon Conversions, Inc. (U.S.)

- Vartega Inc. (U.S.)

- Procotex Corporation SA (Belgium)

- Shocker Composites LLC (U.S.)

- CFK Valley Stade Recycling GmbH & Co. KG (Germany)

- Carbon Fiber Remanufacturing, LLC (U.S.)

- Innovative Recycling Solutions, Inc. (U.S.)

- Aditya Birla Advanced Materials (India)

- Hyosung Advanced Materials Corporation (South Korea)

- Carbon Fiber Recycling, Inc. (U.S.)

- Karborek Srl (Italy)

- Zoltek Companies, Inc. (U.S.)

- Carbon Clean Tech AG (Germany)

- Gen 2 Carbon Limited (U.K.)

- Composite Recycling Ltd. (Switzerland)

- SABIC Innovative Plastics US LLC (U.S.)

- Solvay S.A. (Belgium)

What are the Recent Developments in Global Recycled Carbon Fiber Market?

- In June 2025, Researchers at the U.S. National Renewable Energy Laboratory (NREL) unveiled a robust method to recycle both fibers and resins from carbon fiber composites, aiming to divert these materials from landfills and improve affordability of recycled composites. The technique addresses current limitations in recycling full composite structures.

- In June 2025, Westlake Corporation’s Epoxy division entered a strategic collaboration with France-based Alpha Recyclage Composites to boost recycling of carbon fiber composites. The partnership aims to ramp up capacity to 1,000 metric tonnes per year by 2027 using Alpha’s steam pyrolysis technology. This aligns with growing industrial demand for circular materials

- In April 2025, Germany’s Fraunhofer Institute (EMI) developed a novel laser-assisted local pyrolysis method. It enables reclaiming continuous carbon fibers from thermoset composites—such as hydrogen storage tanks without damaging their performance, using only one-fifth of the energy required for traditional methods

- In April 2025, Scientists at the University of Southern California (USC) introduced a process capable of upcycling carbon fibers from composites and restoring approximately 90% of their original strength. This breakthrough enhances the viability of recycled carbon fibers in high-performance applications

- In December 2023, Toray Industries, Inc. announced the successful development of recycled carbon fiber (rCF) derived from the production process of Boeing 787 components, using Toray’s advanced carbon fiber, TORAYCATM. The rCF, based on pyrolysis recycling, has been integrated into the Lenovo ThinkPad X1 Carbon Gen 12 as reinforcement filler for thermoplastic pellets. Toray and Lenovo will continue collaborating to expand rCF usage in other Lenovo products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recycled Carbon Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recycled Carbon Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recycled Carbon Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.