Global Relaxation Beverages Market

Market Size in USD Million

CAGR :

%

USD

529.58 Million

USD

1,654.13 Million

2024

2032

USD

529.58 Million

USD

1,654.13 Million

2024

2032

| 2025 –2032 | |

| USD 529.58 Million | |

| USD 1,654.13 Million | |

|

|

|

|

Relaxation Beverages Market Size

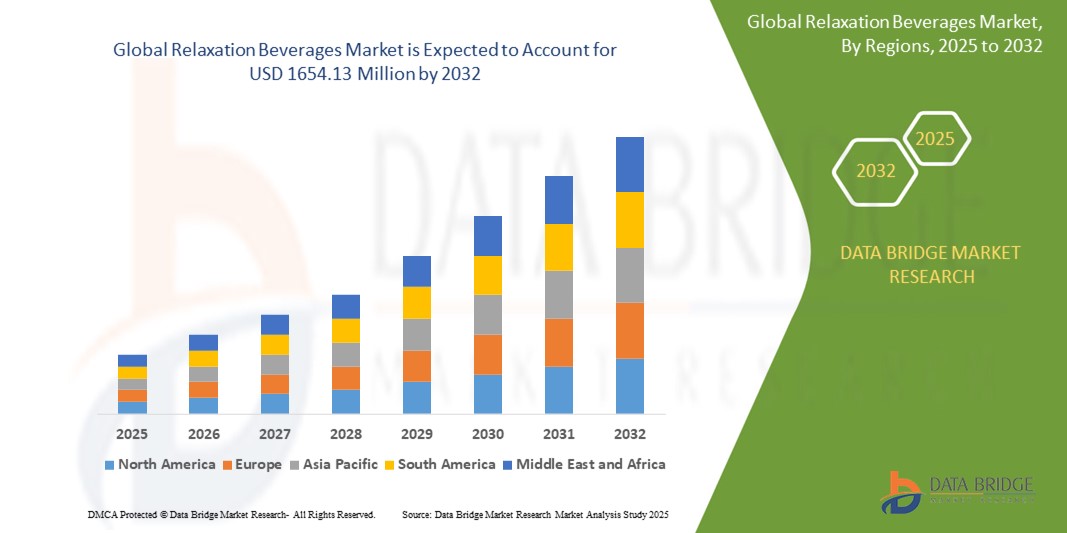

- The global relaxation beverages market size was valued at USD 529.58 million in 2024 and is expected to reach USD 1654.13 million by 2032, at a CAGR of 15.30% during the forecast period

- The market growth is largely fueled by rising consumer awareness around mental wellness, increasing stress levels due to fast-paced lifestyles, and growing demand for natural, non-pharmaceutical solutions to manage anxiety and sleep disorders

- Furthermore, the expanding availability of functional beverages infused with calming ingredients such as adaptogens, CBD, melatonin, and L-theanine, combined with aggressive marketing by wellness brands and health-focused startups, is accelerating product adoption and significantly boosting the industry's growth

Relaxation Beverages Market Analysis

- Relaxation beverages, offering natural and functional ingredients to reduce stress, promote calmness, and support better sleep, are becoming increasingly vital components of modern wellness routines among health-conscious consumers in both developed and emerging markets due to their convenience, clean-label appeal, and alignment with mental well-being trends

- The escalating demand for relaxation beverages is primarily fueled by rising stress and anxiety levels, growing preference for non-pharmaceutical alternatives, and increasing availability of innovative formulations infused with adaptogens, CBD, melatonin, and herbal extract

- Asia-Pacific dominated the relaxation beverages market with a share in 2024, due to growing consumer interest in mental wellness, expanding urban populations, and rising stress levels across densely populated nations

- North America is expected to be the fastest growing region in the relaxation beverages market with a share of during the forecast period due to increasing mental health awareness, rising cases of insomnia and anxiety, and growing demand for non-alcoholic stress relief options

- Insomnia segment dominated the market with a market share of 48.3% in 2024, due to the rising global prevalence of sleep disorders linked to high-stress lifestyles, digital overstimulation, and poor sleep hygiene. Consumers are increasingly turning to relaxation beverages as a natural, non-prescription alternative to manage sleep disturbances. Formulations targeting insomnia often include clinically supported ingredients such as melatonin and magnesium, and are marketed with claims of promoting sleep onset and improving sleep quality

Report Scope and Relaxation Beverages Market Segmentation

|

Attributes |

Relaxation Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Relaxation Beverages Market Trends

“Increasing Consumer Interest in Functional Beverages”

- A significant and accelerating trend in the relaxation beverages market is the growing consumer shift toward functional beverages that support mental well-being, stress relief, and sleep enhancement. As consumers increasingly prioritize health in their daily routines, demand for beverages offering specific wellness benefits has surged

- For instance, products such as Recess and Som Sleep are gaining popularity for their clean-label formulations, blending natural ingredients such as adaptogens, L-theanine, and melatonin, targeting stress and sleep concerns without pharmaceuticals

- The focus on natural functionality is leading to the development of multi-benefit beverages that calm the mind and also offer immunity-boosting or hydration support, further enhancing their appeal

- Innovation in packaging and flavor profiles is playing a vital role in attracting younger demographics, with ready-to-drink formats and modern branding positioning relaxation beverages as lifestyle choices rather than niche wellness products

- The integration of relaxation beverages into wellness regimens—often consumed as part of a wind-down routine or post-work relaxation—reflects a broader trend of incorporating food and drink into self-care

- This growing intersection of lifestyle, wellness, and convenience is reshaping consumer expectations and encouraging companies such as TranQuini and Kin Euphorics to launch versatile, mood-enhancing beverages in diverse retail channels

Relaxation Beverages Market Dynamics

Driver

“Rising Awareness of the Impact of Stress on the Well-Being”

- The increasing global prevalence of stress, anxiety, and sleep disorders—often linked to urban living, work pressure, and digital overexposure—is a key driver of relaxation beverage demand

- For instance, the World Health Organization has identified mental wellness as a growing public health priority, prompting consumers to seek out daily, natural methods of stress relief, including through beverages

- Products infused with calming ingredients such as magnesium, L-theanine, ashwagandha, and CBD are being embraced as accessible alternatives to medication, especially among millennials and Gen Z

- The growing integration of wellness practices into daily lifestyles and a preference for preventive health solutions are pushing the market toward functional, science-backed beverage innovations. Social media influencers, wellness communities, and online platforms are amplifying the awareness and adoption of relaxation drinks, contributing to the category's rising visibility

- The rising popularity of sober-curious lifestyles and reduced alcohol consumption is also fueling demand for functional relaxation beverages as healthy substitutes for evening unwinding

Restraint/Challenge

“Economic Uncertainties Limits the Consumer Spending Habits”

- Despite growing interest, economic uncertainties and inflationary pressures can limit consumer spending on premium wellness products, including relaxation beverages

- The higher price points of functional beverages—especially those with clean-label, organic, or CBD-based ingredients—can deter budget-conscious consumers from regular purchases

- For instance, while brands such as Kin Euphorics and Recess appeal to affluent health-focused consumers, mass-market adoption remains constrained by cost perceptions

- Retailers may be hesitant to allocate shelf space to emerging relaxation beverage brands with niche appeal, particularly in price-sensitive markets. Regulatory uncertainties surrounding ingredients such as CBD in certain regions can delay product launches or create compliance-related cost burdens for companies

- To overcome these barriers, brands must balance affordability with innovation, scale production efficiently, and increase consumer education to demonstrate the value and benefits of functional relaxation beverages

Relaxation Beverages Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the relaxation beverages market is segmented into relaxation shots, relaxation mixes, relaxation drinks, vitamin beverages, tea drinks, and others. The relaxation drinks segment dominated the market revenue share in 2024, primarily due to their ready-to-consume nature, widespread retail availability, and growing consumer preference for convenient wellness solutions. These beverages often contain functional ingredients such as L-theanine, melatonin, and herbal extracts such as chamomile and valerian root, which are associated with stress relief and sleep support. Their growing presence in both online and offline channels, coupled with attractive packaging and brand positioning around holistic well-being, has solidified their leadership in the market.

The relaxation shots segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for portable, fast-acting solutions among busy urban consumers. Relaxation shots, typically offered in small, concentrated volumes, are popular for their quick effect, ease of use, and minimal calorie content. Their popularity is further fueled by increasing awareness around mental wellness and the rising need for natural, non-addictive alternatives to pharmaceutical sleep aids or anti-anxiety medications.

• By Application

On the basis of application, the relaxation beverages market is segmented into insomnia, anxiety patients, and others. The insomnia segment held the largest revenue share of 48.3% in 2024, driven by the rising global prevalence of sleep disorders linked to high-stress lifestyles, digital overstimulation, and poor sleep hygiene. Consumers are increasingly turning to relaxation beverages as a natural, non-prescription alternative to manage sleep disturbances. Formulations targeting insomnia often include clinically supported ingredients such as melatonin and magnesium, and are marketed with claims of promoting sleep onset and improving sleep quality.

The anxiety patients segment is expected to register the fastest CAGR from 2025 to 2032, fueled by growing mental health awareness and the increasing normalization of stress management in daily routines. Relaxation beverages aimed at anxiety reduction often emphasize adaptogens, amino acids, and calming botanicals that help alleviate nervous tension without sedation. Their appeal lies in offering subtle, mood-balancing effects that support emotional wellness throughout the day, contributing to rising demand across workplace settings, student populations, and general wellness-focused consumers.

Relaxation Beverages Market Regional Analysis

- Asia-Pacific dominated the relaxation beverages market with the largest revenue share in 2024, driven by growing consumer interest in mental wellness, expanding urban populations, and rising stress levels across densely populated nations

- The region's increasing disposable income, preference for natural and functional beverages, and rising influence of Western health trends are key contributors to the market's expansion

- Moreover, the presence of herbal traditions, increasing availability of international and domestic wellness beverage brands, and rising awareness around sleep and stress issues are supporting strong demand across both urban and rural markets

Japan Relaxation Beverages Market Insight

The Japan market is expanding steadily due to its aging population, high levels of work-related stress, and cultural openness to functional food and beverages. Consumers show strong preference for beverages with calming ingredients such as L-theanine, found in green tea, and natural extracts such as yuzu or chamomile. Japanese companies are innovating in formulation and packaging, offering convenient, on-the-go formats that cater to busy professionals and elderly consumers seeking sleep and anxiety relief.

China Relaxation Beverages Market Insight

China held the largest market share in Asia-Pacific in 2024, supported by increasing stress among young professionals, high social media influence, and a growing focus on holistic health. Demand for natural, herb-infused beverages is surging, with both domestic startups and global wellness brands launching targeted relaxation products. Government focus on mental health awareness and expanding e-commerce platforms are further accelerating market penetration across major cities and second-tier urban clusters.

Europe Relaxation Beverages Market Insight

The Europe market is projected to grow at a steady CAGR, driven by increasing interest in natural, plant-based solutions to manage stress and sleep disorders. A strong tradition of functional drinks and herbal infusions, combined with growing preference for non-pharmaceutical mental wellness aids, is fueling demand. Regulatory support for clean-label ingredients and transparent marketing claims is also encouraging innovation in formulation and packaging.

U.K. Relaxation Beverages Market Insight

The U.K. market is poised for steady growth as consumers seek healthier alternatives to alcohol and prescription sleep aids. Demand is rising for natural, zero-sugar beverages containing ingredients such as CBD, ashwagandha, and magnesium. Health-conscious millennials and Gen Z are driving category growth, while the wellness retail boom and supermarket listings of premium relaxation drinks are improving accessibility and visibility.

Germany Relaxation Beverages Market Insight

Germany's relaxation beverages market is expanding due to high stress levels, rising adoption of wellness routines, and strong interest in organic and herbal solutions. Consumers prefer functional drinks with transparent labels, minimal additives, and traditional calming ingredients. The country's mature health food and beverage industry, along with innovation in relaxation-enhancing formulations, is strengthening its position as a key European market.

North America Relaxation Beverages Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, fueled by increasing mental health awareness, rising cases of insomnia and anxiety, and growing demand for non-alcoholic stress relief options. Consumers are shifting toward functional beverages that offer calm and focus, with clean-label formulations becoming mainstream. The presence of wellness-focused startups, health-oriented retail channels, and media-driven discussions on self-care are accelerating growth across both the U.S. and Canada.

U.S. Relaxation Beverages Market Insight

The U.S. held the largest revenue share in North America in 2024, supported by high consumer awareness, strong wellness culture, and early adoption of functional drinks. The market is driven by innovation in CBD-infused beverages, adaptogen-based drinks, and melatonin-enhanced sleep shots. Direct-to-consumer sales, functional grocery aisles, and a preference for alcohol-free relaxation alternatives are reinforcing rapid market expansion.

Relaxation Beverages Market Share

The relaxation beverages industry is primarily led by well-established companies, including:

- Encha (China)

- IPPODO TEA (China)

- TranQuini (U.S.)

- Chillbev (U.S.)

- Slow Cow (Canada)

- Som Sleep (U.S.)

- Harvestone Group LLC (Canada)

- Phi Drinks, Inc. (California)

- Recess (U.S.)

- Kin Euphorics (U.S.)

- PepsiCo – Driftwell (U.S.)

- Wowie by Innoviom (U.S.)

- Neuro Brands LLC (U.S.)

- Elements Drinks (U.K.)

- Heywell (U.S.)

- Bimble (U.S.)

- Just Chill (U.S.)

- Unwind Beverages (India)

- Drink Moment (U.S.)

- Hiyo (U.S.)

Latest Developments in Global Relaxation Beverages Market

- In March 2024, Lithios, in collaboration with BrandVault360 (formerly Gotham Beverage), launched its lithia-infused mineral seltzers in New York City, marking a strategic entry into the health-oriented beverage space. This introduction has contributed to diversifying the functional beverage landscape and is expected to influence premium wellness trends across urban markets through its expansive distribution plans

- In October 2020, Innoviom introduced its natural and hemp-infused relaxation beverages, Tranquini and Wowie, to major retail buyers at ECRM’s Annual Program. This move expanded consumer access to plant-based relaxation solutions and reinforced the role of adaptogen- and hemp-based formulations in shaping the evolving wellness beverage category

- In September 2020, PepsiCo launched Driftwell, a functional water enhanced with L-theanine and magnesium, aimed at addressing stress and promoting relaxation. The move by a major industry player brought heightened visibility to the relaxation beverage segment and signaled strong mainstream interest in stress-reducing functional drinks

- In July 2020, New Age Beverages Corporation announced the acquisition of ARIIX and four other firms in the e-commerce and direct selling sectors, forming a combined entity with projected revenues exceeding USD 500 million across more than 75 countries. This consolidation significantly strengthened New Age’s global reach and positioned it as a key player in the wellness and relaxation beverage space through integrated product and channel expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Relaxation Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Relaxation Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Relaxation Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.