Global Renting And Leasing Test And Measurement Equipment Market

Market Size in USD Billion

CAGR :

%

USD

6.48 Billion

USD

9.29 Billion

2024

2032

USD

6.48 Billion

USD

9.29 Billion

2024

2032

| 2025 –2032 | |

| USD 6.48 Billion | |

| USD 9.29 Billion | |

|

|

|

|

What is the Global Renting and Leasing Test and Measurement Equipment Market Size and Growth Rate?

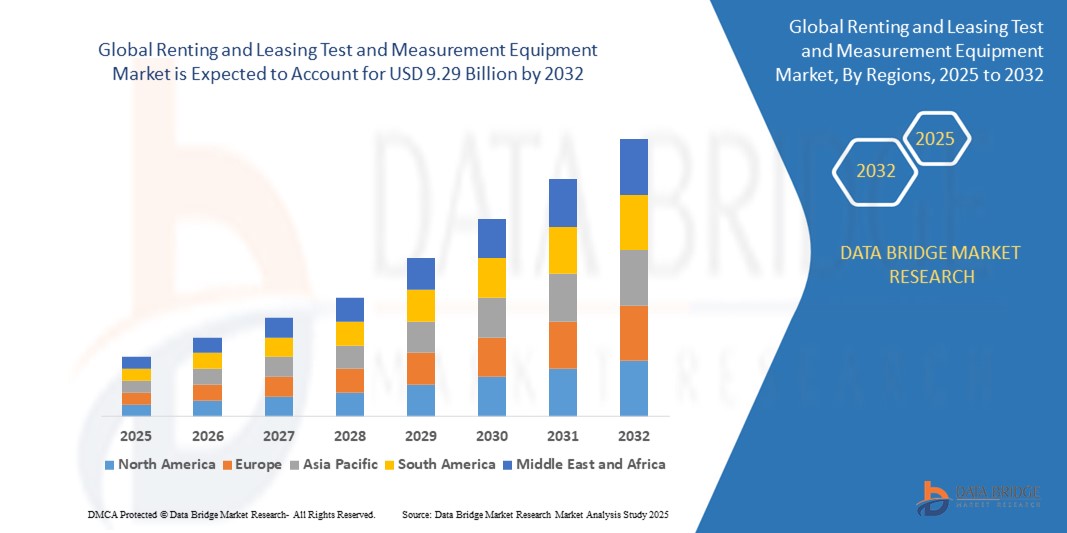

- The global renting and leasing test and measurement equipment market size was valued at USD 6.48 billion in 2024 and is expected to reach USD 9.29 billion by 2032, at a CAGR of 4.6% during the forecast period

- The global renting and leasing test and measurement equipment market is witnessing significant growth driven by the need to reduce operational burdens through maintenance support services, the increasing demand for project-based equipment, and the rapid pace of technological innovation, which allows companies to minimize depreciation risks and avoid financial loss

- However, the market faces restraints such as high capital investment and the limited availability of specialized equipment. Opportunities lie in forming partnerships and collaborations with technology providers, embracing green initiatives and sustainability, and capitalizing on growing industrialization and technological adoption. Despite these prospects, the market is challenged by inventory management complexities and intense competition, leading to market saturation

What are the Major Takeaways of Renting and Leasing Test and Measurement Equipment Market?

- Sustainability and eco-conscious choices are becoming increasingly important in the global renting and leasing market as consumers prioritize environmentally friendly options. Companies are responding by offering sustainable products, such as electric vehicles and energy-efficient appliances, which attract eco-conscious renters. This trend helps reduce the carbon footprint and aligns with the growing demand for corporate social responsibility

- In addition, many businesses are incorporating sustainable practices into their operations, such as reducing waste and using recyclable materials. By embracing sustainability, companies can differentiate themselves and build brand loyalty among environmentally aware consumers

- North America led the renting and leasing test and measurement equipment market with the largest revenue share of 38.7% in 2024, driven by strong R&D activity across electronics, aerospace, telecom, and automotive sectors, where testing precision is essential

- Asia-Pacific market is projected to grow at the fastest CAGR of 5.2% from 2025 to 2032, fueled by rapid industrialization, digital transformation, and smart manufacturing initiatives in China, India, Japan, and South Korea

- The hardware segment dominated the market with the largest revenue share of 67.4% in 2024, driven by the high demand for physical testing instruments such as oscilloscopes, signal generators, and analyzers in R&D labs, telecom centers, and electronics manufacturing units

Report Scope and Renting and Leasing Test and Measurement Equipment Market Segmentation

|

Attributes |

Renting and Leasing Test and Measurement Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Renting and Leasing Test and Measurement Equipment Market?

“Integration of AI and Predictive Analytics for Smarter Equipment Management”

- A significant and growing trend in the global renting and leasing test and measurement equipment market is the integration of artificial intelligence (AI) and predictive analytics to enhance equipment utilization, maintenance scheduling, and overall rental efficiency

- Companies are leveraging AI-powered software to track usage patterns, predict equipment failure, and suggest optimal rental durations. This enables customers to avoid unnecessary costs and ensures better asset management

- For instance, Keysight Technologies (U.S.) and Rohde & Schwarz (Germany) have incorporated cloud-based platforms and machine learning capabilities into their rental programs, offering data-driven insights for test optimization

- The use of remote monitoring and voice-controlled interfaces is also expanding, allowing engineers and technicians to interact with equipment through mobile apps and even voice assistants for basic status updates or controls

- Furthermore, AI integration supports automated calibration tracking, smart alerts, and asset recovery mechanisms essential for large rental operations across industries such as aerospace, automotive, and telecom

- This trend is reshaping customer expectations by reducing downtime, improving ROI, and enabling faster, data-backed decision-making in test and measurement equipment rentals

What are the Key Drivers of Renting and Leasing Test and Measurement Equipment Market?

- The rising cost of advanced test equipment is encouraging businesses, especially SMEs and R&D labs, to shift towards flexible rental and leasing options rather than upfront capital purchases

- The rapid pace of technological innovation in electronics and telecommunications increases the need for temporary access to the latest testing devices without long-term commitment, thus fueling market demand

- For instance, in July 2023, Electro Rent (U.S.) introduced a platform upgrade that provides real-time inventory and usage tracking, helping users make informed rental decisions

- In addition, the growth of 5G, IoT, EVs, and autonomous vehicles is pushing companies to rent highly specialized equipment for short-term product development and compliance testing

- Renting allows cost optimization, faster access to updated tools, and hassle-free maintenance, which is particularly appealing during uncertain economic conditions or short-term projects

Which Factor is challenging the Growth of the Renting and Leasing Test and Measurement Equipment Market?

- The high cost of advanced test and measurement equipment, along with limited availability of high-end devices for lease in certain regions, poses a major challenge for the global renting and leasing test and measurement equipment market. Many SMEs and research institutions find it difficult to access the latest technology due to budget constraints or lack of local rental partners

- For instance, high-performance instruments such as RF analyzers, oscilloscopes, or 5G test systems from companies such as Keysight Technologies or Rohde & Schwarz can be expensive to lease, particularly when bundled with calibration, maintenance, or software updates

- Furthermore, logistical and regulatory constraints related to international shipping, equipment certification, and cross-border rental agreements can delay deployment timelines and increase operational complexity. These barriers are especially common in regions such as Latin America, Southeast Asia, or parts of Africa, where local infrastructure for test equipment leasing remains underdeveloped

- Another limiting factor is the lack of skilled personnel required to operate, calibrate, and interpret data from advanced equipment. In many cases, leasing companies must also provide training, which adds to the overall cost and complexity for the customer

- Overcoming these challenges requires wider geographical penetration, affordable leasing models, and value-added services such as virtual training or remote diagnostics, to ensure that cutting-edge test solutions are accessible and usable across diverse industries and markets

How is the Renting and Leasing Test and Measurement Equipment Market Segmented?

The market is segmented on the basis offering, component, system type, type, features, and end-user.

- By Offering

On the basis of offering, the renting and leasing test and measurement equipment market is segmented into hardware and services. The hardware segment dominated the market with the largest revenue share of 67.4% in 2024, driven by the high demand for physical testing instruments such as oscilloscopes, signal generators, and analyzers in R&D labs, telecom centers, and electronics manufacturing units. These instruments form the backbone of critical measurement and calibration processes.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032 due to increasing reliance on calibration, maintenance, and technical support services provided by leasing companies. Businesses prefer outsourcing technical services to reduce in-house costs and ensure regulatory compliance.

- By Component

On the basis of component, the market is segmented into cable assemblies, connectors, value-added accessories, and others. The cable assemblies segment held the largest market share of 32.6% in 2024, due to their essential role in enabling connectivity and accurate signal transmission between various test instruments.

The value-added accessories segment is projected to grow at the fastest CAGR from 2025 to 2032, as companies seek bundled solutions that offer portability, convenience, and customization—such as protective cases, calibration kits, and adapters.

- By System Type

Based on system type, the market is segmented into sensing system, connectivity system, safety & security system, human-machine interface (HMI), power & energy management system, motor control system, and lighting system. The sensing system segment led the market in 2024 with a market share of 28.9%, owing to its extensive use in monitoring voltage, temperature, pressure, and other parameters across industrial and electronics applications.

The connectivity system segment is expected to register the fastest CAGR, propelled by the rise of Industry 4.0 and IoT integration, which demands continuous real-time data exchange and remote monitoring capabilities.

- By Type

On the basis of type, the market is bifurcated into lease and rent. The lease segment dominated the market in 2024 with a revenue share of 61.3%, as long-term leasing is often preferred by companies to access high-end test equipment without capital expenditure. Leases often come with added benefits such as calibration and upgrade options, making them more cost-effective for continuous operations.

The rent segment is expected to grow at the highest CAGR between 2025 and 2032, fueled by short-term project needs, startups, and academic institutions that prefer flexible rental durations.

- By Features

The market is segmented by features into diagnostic equipment, electrical sensing, metering ICs, and others. The diagnostic equipment segment held the largest market share of 34.1% in 2024, driven by its wide use in automotive, aerospace, and telecom sectors for performance verification and failure detection.

The electrical sensing segment is projected to grow at the fastest rate, as demand surges for precise electrical signal monitoring in renewable energy systems, EVs, and smart grids.

- By End-User

On the basis of end-user, the market is segmented into IT & telecommunication, automotive, aerospace & defense, industrial, consumer electronics, energy & utilities, medical equipment, and others. The IT & telecommunication segment dominated the market with the largest revenue share of 26.5% in 2024, due to increasing demand for leased network analyzers, spectrum analyzers, and signal testers during 5G deployment and infrastructure upgrades.

The automotive segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the rise of electric vehicles (EVs), ADAS systems, and complex embedded electronics requiring rigorous testing and validation throughout the production cycle.

Which Region Holds the Largest Share of the Renting and Leasing Test and Measurement Equipment Market?

- North America led the renting and leasing test and measurement equipment market with the largest revenue share of 38.7% in 2024, driven by strong R&D activity across electronics, aerospace, telecom, and automotive sectors, where testing precision is essential

- The region benefits from established infrastructure, high capital investment in innovation, and a rising demand for advanced measurement systems in 5G, EVs, and semiconductor manufacturing

- Growth is further supported by the rental model's cost-efficiency, which appeals to small and medium enterprises (SMEs) and startups seeking access to high-end testing instruments without significant capital expenditure

U.S. Renting and Leasing Test and Measurement Equipment Market Insight

The U.S. held the dominant share in 2024 within North America, supported by growing demand in aerospace, defense, and automotive testing. Increased deployment of 5G networks and development of autonomous vehicles are prompting organizations to lease high-performance T&M devices. The presence of key players such as Keysight Technologies, Tektronix, and National Instruments, offering flexible rental options, supports rapid technology access and ensures regulatory compliance for testing standards.

Europe Renting and Leasing Test and Measurement Equipment Market Insight

The European market is projected to grow steadily, fueled by stringent product quality norms, regulatory testing mandates, and sustainability-focused R&D. Industries such as telecommunications, renewable energy, and industrial automation are increasingly relying on test and measurement equipment rentals to reduce costs and optimize equipment use. Germany, U.K., and France lead regional demand due to their robust automotive, aerospace, and electronics sectors, where testing precision is crucial.

U.K. Renting and Leasing Test and Measurement Equipment Market Insight

The U.K. market is expected to expand at a noteworthy CAGR, driven by investments in 5G rollout, electric vehicle R&D, and electronics manufacturing. Companies are increasingly opting for rental models to stay technologically up-to-date while minimizing depreciation and maintenance costs. In addition, increased government funding for tech startups and universities is boosting the demand for rented lab-grade test equipment.

Germany Renting and Leasing Test and Measurement Equipment Market Insight

Germany’s market is growing due to its high industrial output and strong focus on innovation in the automotive and electronics sectors. Rental solutions are gaining popularity among mid-sized firms involved in advanced prototyping and product development. Moreover, Germany’s shift toward Industry 4.0 and factory automation has elevated the need for high-frequency, reliable, and traceable testing instruments, making leasing an attractive choice.

Which Region is the Fastest Growing in the Renting and Leasing Test and Measurement Equipment Market?

Asia-Pacific market is projected to grow at the fastest CAGR of 5.2% from 2025 to 2032, fueled by rapid industrialization, digital transformation, and smart manufacturing initiatives in China, India, Japan, and South Korea. The expansion of telecom infrastructure, especially 5G and IoT, combined with the proliferation of electronics manufacturing, is boosting demand for flexible, cost-effective test equipment access via renting or leasing.

Japan Renting and Leasing Test and Measurement Equipment Market Insight

Japan’s market is expanding steadily due to the country’s advanced tech environment, focus on miniaturization, and quality testing in electronics and robotics. Increasing use of T&M devices in semiconductor testing, automotive electronics, and research labs is driving leasing adoption. Moreover, rising demand for energy-efficient, compact equipment in R&D labs is supporting rental business models among academic and commercial users.

China Renting and Leasing Test and Measurement Equipment Market Insight

China accounted for the largest share in Asia-Pacific in 2024, backed by its status as the largest electronics manufacturing hub and massive investments in telecom and renewable energy sectors. Growing adoption of smart factories, EVs, and semiconductor fabs has created strong demand for versatile, precision-driven test instruments. Domestic players are increasingly offering customized, short-term leasing options, expanding access to small businesses and contract manufacturers.

Which are the Top Companies in Renting and Leasing Test and Measurement Equipment Market?

The renting and leasing test and measurement equipment industry is primarily led by well-established companies, including:

- ROHDE & SCHWARZ (Germany)

- Keysight Technologies (U.S.)

- Electrorent.com, Inc. (U.S.)

- Transcat, Inc. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- General Electric Company (U.S.)

- Leonardo DRS (U.S.)

- Saluki Technology (Taiwan)

- Boonton Electronics (U.S.)

- FLUKE NETWORKS (U.S.)

- Bird (U.S.)

- Good Will Instrument Co., Ltd. (Taiwan)

- ADLINK Technology Inc. (Taiwan)

- Leader Electronics of Europe Limited (England)

- Anritsu (Japan)

- Yokogawa Electric Corporation (Japan)

- Fortive (U.S.)

- Siemens (Germany)

- Megger (U.K.)

- EXFO Inc. (Canada)

- Emerson Electric Co. (U.S.)

- Doble Engineering Company (U.S.)

- ADVANTEST CORPORATION (Japan)

- Texas Instruments Incorporated (U.S.)

- DS INSTRUMENTS (U.S.)

- STMicroelectronics (Switzerland)

What are the Recent Developments in Global Renting and Leasing Test and Measurement Equipment Market?

- In May 2024, Extech introduced a new lineup of measurement tools, which includes the IAQ320 air quality monitor, the enhanced EX series of multimeters and clamp meters, and the BR450 W borescopes. These products are designed to deliver high performance and safety at competitive prices. This product expansion is expected to strengthen Extech’s position in the test and measurement equipment rental market

- In May 2024, IDEAL Electrical™ launched two new circuit tracer models—the SureTrace™ Plus Circuit Tracer (61-948) and the SureTrace™ Circuit Tracer (61-946)—which integrate the latest technologies at budget-friendly prices. These advanced tools are poised to attract more rental customers seeking affordable and precise tracing solutions

- In March 2024, a blog by Booqable.com pointed out that managing inventory in the rental sector remains a key challenge due to the complexities involved in tracking various types of equipment, scheduling maintenance, and ensuring availability. Addressing these gaps with efficient inventory systems is essential for improving customer experience and sustaining competitiveness

- In January 2024, a LinkedIn article by Iravati M. emphasized the ongoing difficulties of inventory management in the renting and leasing test and measurement equipment market, including handling specialized tools and ensuring accurate tracking and availability. Improving inventory systems is critical to achieving operational efficiency in this saturated industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.