Global Reprocessed Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.57 Billion

USD

21.17 Billion

2024

2032

USD

4.57 Billion

USD

21.17 Billion

2024

2032

| 2025 –2032 | |

| USD 4.57 Billion | |

| USD 21.17 Billion | |

|

|

|

|

Reprocessed Medical Devices Market Size

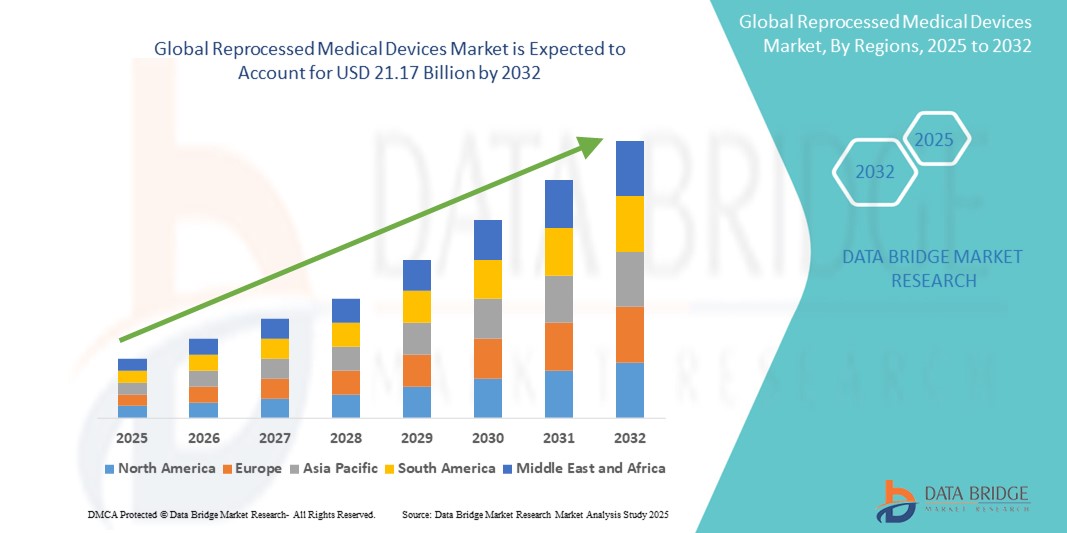

- The global reprocessed medical devices market size was valued at USD 4.57 billion in 2024 and is expected to reach USD 21.17 billion by 2032, at a CAGR of 21.10% during the forecast period

- The market growth is primarily driven by increasing healthcare cost containment pressures and the need for sustainable medical solutions, prompting hospitals and healthcare facilities to adopt reprocessed devices as a cost-effective alternative

- Moreover, the rise in regulatory support and technological advancements in sterilization and quality assurance are fostering confidence in the safety and efficacy of reprocessed devices. These combined factors are accelerating the market adoption, thereby contributing significantly to the industry's expansion

Reprocessed Medical Devices Market Analysis

- Reprocessed medical devices, which involve cleaning, sterilizing, and reusing single-use devices, are gaining significant traction across healthcare systems due to their cost-effectiveness, reduced environmental footprint, and regulatory endorsements ensuring safety and efficacy

- The growing demand for reprocessed devices is primarily fueled by increasing pressure to reduce healthcare expenditure, rising awareness of environmental sustainability in clinical settings, and the expanding availability of high-quality, FDA- and CE-approved reprocessed products

- North America dominated the reprocessed medical devices market with the largest revenue share of 42.2% in 2024, supported by favorable regulatory frameworks, rising hospital cost-saving initiatives, and the active presence of major reprocessing companies, particularly in the U.S., where third-party reprocessing is well-established and widely adopted in surgical centers and hospitals

- Asia-Pacific is expected to be the fastest growing region in the reprocessed medical devices market during the forecast period due to expanding healthcare infrastructure, increasing focus on cost containment, and gradual regulatory acceptance

- Third-party Reprocessing segment dominated the reprocessed medical devices market with a market share of 67.8% in 2024, driven by its regulatory compliance, cost-efficiency, and widespread acceptance among hospitals for high-quality, standardized reprocessing services

Report Scope and Reprocessed Medical Devices Market Segmentation

|

Attributes |

Reprocessed Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Reprocessed Medical Devices Market Trends

“Sustainability and Cost-Efficiency Driving Adoption”

- A prominent and accelerating trend in the global reprocessed medical devices market is the growing emphasis on sustainability and cost containment within healthcare systems. Hospitals and surgical centers are increasingly turning to reprocessed devices to reduce both environmental waste and procurement costs without compromising patient safety

- For instance, companies such as Stryker’s Sustainability Solutions and Innovative Health are working closely with healthcare providers to reprocess high-volume electrophysiology catheters and other devices, demonstrating significant cost savings and waste reduction

- Reprocessing involves validated procedures that ensure device performance and sterility, encouraging providers to adopt these solutions for economic and environmental reasons. With rising pressure to improve the circular economy in healthcare, more hospitals are signing contracts with FDA-compliant third-party reprocessors

- Governments and regulatory bodies, particularly in North America and parts of Europe, are supporting the use of reprocessed devices through clear regulatory frameworks and reimbursement incentives

- This shift towards value-based care and green procurement is influencing purchasing decisions at major healthcare institutions, which now increasingly include sustainability metrics in vendor evaluations. Consequently, companies are innovating reprocessing methods and expanding device categories that can be safely reused

- The increasing focus on sustainability, combined with strong economic incentives, is expected to reinforce the trend of reprocessed medical devices becoming standard practice in hospital procurement and clinical workflows

Reprocessed Medical Devices Market Dynamics

Driver

“Rising Cost Pressures and Regulatory Backing for Reprocessing”

- The global healthcare sector is under mounting financial strain due to increasing patient volumes and operational costs, making reprocessed medical devices a viable solution for cost reduction without compromising care quality

- For instance, in March 2024, Innovative Health reported a significant expansion in its reprocessing services for electrophysiology devices in U.S. hospitals, enabling facilities to save up to 40% on select device categories

- Support from regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA), which have issued stringent guidelines ensuring the safety and efficacy of reprocessed devices, further encourages adoption

- Third-party reprocessors are required to follow validated cleaning, sterilization, and testing protocols, reassuring hospitals about product integrity. These cost-effective and safe alternatives are increasingly used in cardiology, general surgery, and orthopedics

- As hospitals seek sustainable procurement practices aligned with green healthcare initiatives, the economic and environmental benefits of device reprocessing continue to drive demand across developed and emerging markets

Restraint/Challenge

“Perceived Safety Concerns and Limited Awareness in Emerging Markets”

- Despite regulatory validation and proven safety, lingering concerns about the performance reliability of reprocessed devices remain a barrier in certain regions. Healthcare professionals in emerging markets may perceive single-use devices as superior, leading to resistance against reuse even when reprocessed options are available and approved

- In addition, limited awareness and lack of robust infrastructure for reprocessing in low- and middle-income countries restrict the adoption of these cost-saving solutions

- For instance, while third-party reprocessing is well-established in the U.S., adoption remains limited in parts of Asia-Pacific and Latin America due to inadequate regulation or lack of standardized practices

- Furthermore, concerns related to liability, patient perception, and insurance reimbursement may deter some providers from transitioning fully to reprocessed devices

- To overcome these challenges, continued clinical education, transparent reporting on device performance, and expansion of reprocessing infrastructure are crucial

- Industry players are also investing in awareness campaigns and partnerships with local health authorities to build trust and expand access in untapped markets

Reprocessed Medical Devices Market Scope

The market is segmented on the basis of device type, type, and end-user.

- By Device Type

On the basis of device type, the reprocessed medical devices market is segmented into cardiovascular devices, general surgery devices, laparoscopic devices, orthopedic external fixation devices, and gastroenterology biopsy forceps. The cardiovascular devices segment dominated the market with the largest revenue share of 38.6% in 2024, driven by the high usage and reprocessing of electrophysiology and diagnostic catheters in hospitals and specialty clinics. These devices are frequently reprocessed due to their high cost and single-use labeling, offering significant savings without compromising patient safety. Their approval by regulatory bodies such as the U.S. FDA has further bolstered market confidence and adoption.

The laparoscopic devices segment is anticipated to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by increasing volumes of minimally invasive surgeries and the rising acceptance of reprocessed laparoscopic instruments. Their reuse significantly reduces surgical costs and aligns with hospital sustainability goals. Growing awareness and advancements in sterilization technologies are making these devices more appealing across healthcare systems.

- By Type

On the basis of type, the reprocessed medical devices market is segmented into third-party reprocessing and in-house reprocessing. The third-party reprocessing segment dominated the market with a revenue share of 67.8% in 2024, attributed to the growing preference for professional, compliant, and certified reprocessing services offered by specialized companies. These providers ensure regulatory compliance, validated performance, and cost-efficient reuse, making them the preferred choice for healthcare institutions seeking standardized quality and legal assurance.

The in-house reprocessing segment is anticipated to witness the fastest growth rate from 2025 to 2032, particularly in large hospitals with established sterilization departments. This approach allows greater control over inventory and turnaround times, but requires significant investment in staff training, quality control, and infrastructure.

- By End-User

On the basis of end-user, the reprocessed medical devices market is segmented into hospitals, home healthcare, and others. The hospitals segment led the market with the largest share of 76.4% in 2024, driven by the high procedural volume, cost-reduction pressures, and institutional readiness for reprocessed device adoption. Hospitals benefit significantly from savings on high-cost devices such as catheters and surgical tools, and are the primary adopters of third-party reprocessing services under FDA and EMA guidelines.

The home healthcare segment is is anticipated to witness the fastest growth rate from 2025 to 2032, due to the gradual inclusion of basic reprocessed medical tools in home-based care setups. Increasing chronic disease management at home and remote care models may support further uptake of simple, cost-effective reprocessed devices in this segment

Reprocessed Medical Devices Market Regional Analysis

- North America dominated the reprocessed medical devices market with the largest revenue share of 42.2% in 2024, supported by favorable regulatory frameworks, rising hospital cost-saving initiatives, and the active presence of major reprocessing companies

- Healthcare providers in the region prioritize both economic and environmental sustainability, with reprocessed devices offering a reliable solution to reduce procurement costs and medical waste without compromising patient safety

- This broad adoption is further fueled by high healthcare spending, robust hospital infrastructure, and an increasing shift toward value-based care models, establishing reprocessed medical devices as a standard component of procurement strategies in North American hospitals and surgical centers

U.S. Reprocessed Medical Devices Market Insight

The U.S. reprocessed medical devices market captured the largest revenue share of 83.2% in 2024 within North America, driven by mature regulatory support from the FDA, high healthcare expenditure, and well-established third-party reprocessing infrastructure. Hospitals and surgical centers in the U.S. are increasingly adopting reprocessed devices to manage operational costs without compromising quality. The country’s strong emphasis on sustainable healthcare practices and safety assurance through validated sterilization processes is further accelerating adoption.

Europe Reprocessed Medical Devices Market Insight

The Europe reprocessed medical devices market is projected to expand at a robust CAGR throughout the forecast period, fueled by environmental sustainability initiatives and cost-cutting measures in healthcare systems. Countries across the region are implementing regulations encouraging reuse of approved devices, particularly in cardiology and general surgery. Rising pressure to reduce medical waste and improve resource efficiency is driving hospitals and public health bodies to adopt reprocessed solutions in both public and private healthcare sectors.

U.K. Reprocessed Medical Devices Market Insight

The U.K. reprocessed medical devices market is anticipated to grow at a notable CAGR during the forecast period, supported by growing awareness of green healthcare initiatives and economic savings from reprocessed devices. The National Health Service (NHS) is increasingly incorporating sustainability into procurement policies, driving adoption. Furthermore, the focus on reducing single-use plastics and enhancing circular economy practices in the medical field aligns with the growth of reprocessing across various clinical specialties.

Germany Reprocessed Medical Devices Market Insight

The Germany reprocessed medical devices market is expected to expand steadily, backed by a highly organized hospital sector, strict quality compliance standards, and the country’s emphasis on sustainability and healthcare innovation. German hospitals are progressively adopting reprocessed surgical instruments and cardiology devices, encouraged by proven safety, lower procurement costs, and environmental advantages. Government and institutional support for resource optimization is also playing a pivotal role in market development.

Asia-Pacific Reprocessed Medical Devices Market Insight

The Asia-Pacific reprocessed medical devices market is poised to grow at the fastest CAGR of 22.9% during 2025 to 2032, driven by expanding healthcare infrastructure, increasing surgical volumes, and rising awareness of cost-effective care solutions. Countries such as China, India, and South Korea are witnessing growing interest in reprocessed devices amid efforts to improve healthcare affordability and reduce waste. Regulatory frameworks are gradually evolving, creating opportunities for third-party reprocessors to expand their footprint.

Japan Reprocessed Medical Devices Market Insight

The Japan reprocessed medical devices market is gaining traction due to increasing demand for cost-effective healthcare and a focus on reducing medical waste. Japan’s advanced hospital infrastructure and growing elderly population drive the need for efficient, affordable medical solutions. Hospitals are exploring reprocessing of high-cost devices such as electrophysiology catheters, supported by advances in sterilization and strong institutional protocols for quality assurance.

India Reprocessed Medical Devices Market Insight

The India reprocessed medical devices market accounted for the largest market revenue share in Asia Pacific in 2024, propelled by a rapidly growing healthcare sector, increasing number of surgeries, and government initiatives to promote affordable healthcare. India’s large hospital base and emerging third-party reprocessing facilities are supporting the expansion. Rising demand for cardiology and laparoscopic procedures, combined with a strong push for cost optimization, is further fueling the adoption of reprocessed medical devices.

Reprocessed Medical Devices Market Share

The reprocessed medical devices industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Medline Industries, LP (U.S.)

- Vanguard AG (Germany)

- Innovative Health, Inc. (U.S.)

- SterilMed, Inc. (U.S.)

- ReNu Medical, Inc. (U.S.)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Johnson & Johnson Services, Inc. (U.S.)

- Avante Health Solutions (U.S.)

- Soma Technology, Inc. (U.S.)

- SureTek Medical (U.S.)

- Arjo AB (Sweden)

- Zoll Medical Corporation (U.S.)

- 3M (U.S.)

- Siemens Healthineers AG (Germany)

- Nordion (Canada) Inc. (Canada)

- Scandinavian Health Ltd. (U.K.)

- BioMed Solutions, LLC (U.S.)

What are the Recent Developments in Global Reprocessed Medical Devices Market?

- In April 2023, Stryker’s Sustainability Solutions, a leader in third-party reprocessing, expanded its cardiovascular device reprocessing program to include more electrophysiology catheters, helping hospitals reduce costs and medical waste. This initiative underscores Stryker’s commitment to environmental stewardship and cost containment in healthcare, while ensuring safety through FDA-compliant reprocessing protocols. The expansion is part of a broader effort to increase the scope of devices eligible for high-quality reuse in U.S. healthcare systems

- In March 2023, Innovative Health, a prominent U.S.-based reprocessing company, announced a collaboration with a leading hospital network to reprocess advanced mapping catheters used in cardiac procedures. The partnership is expected to generate substantial cost savings for the network while promoting more sustainable procurement practices. This development reflects growing confidence in the safety and effectiveness of reprocessed high-tech medical devices

- In March 2023, the European Commission issued updated guidance on medical device reprocessing across EU member states, promoting the safe reuse of certain single-use devices under standardized conditions. This regulatory update supports harmonization and expands the adoption of reprocessing practices in public health institutions, further enabling cost-efficient healthcare delivery across the region. It also underscores Europe’s broader commitment to sustainability in medical systems

- In February 2023, Vanguard AG, a Germany-based reprocessing company, reported increased demand for its services in orthopedic and general surgery devices. The company highlighted a 25% year-over-year rise in contracts from hospitals aiming to reduce waste and operational costs. This surge illustrates the growing acceptance of reprocessing as a viable tool in Europe’s healthcare cost-containment strategies

- In January 2023, Medline ReNewal, a division of Medline Industries, announced the launch of an advanced tracking and reporting system for reprocessed surgical instruments. The new platform provides hospitals with real-time data on reprocessed device usage, savings, and environmental impact. This innovation reinforces Medline’s commitment to transparency, traceability, and sustainable healthcare solutions while enhancing operational efficiency for healthcare providers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.