Global Retinal Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.97 Billion

2025

2033

USD

2.88 Billion

USD

4.97 Billion

2025

2033

| 2026 –2033 | |

| USD 2.88 Billion | |

| USD 4.97 Billion | |

|

|

|

|

Retinal Surgery Devices Market Size

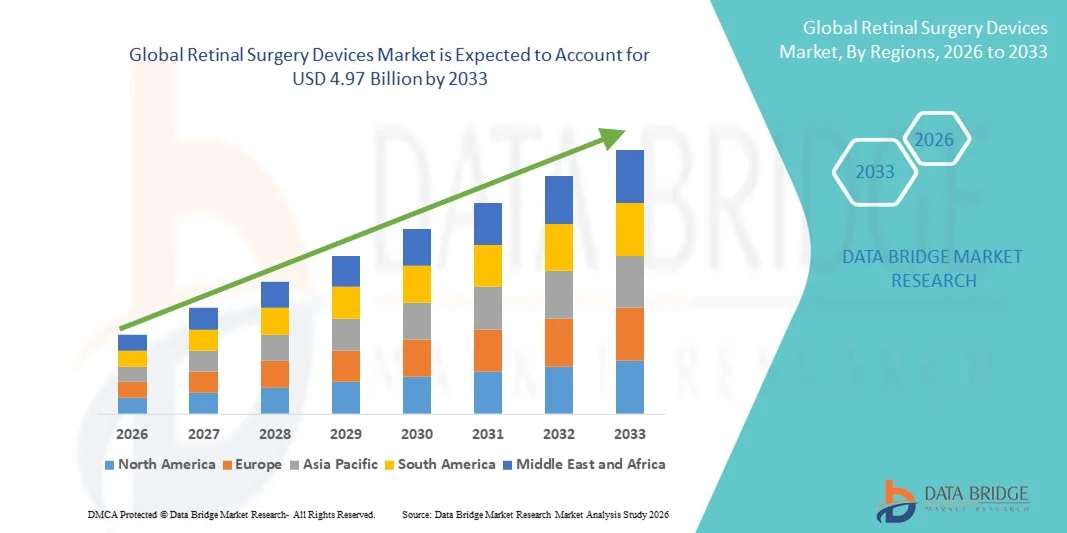

- The global retinal surgery devices market size was valued at USD 2.88 billion in 2025 and is expected to reach USD 4.97 billion by 2033, at a CAGR of 7.06% during the forecast period

- The market growth is largely driven by the increasing prevalence of retinal disorders, technological advancements in surgical equipment, and rising adoption of minimally invasive procedures in ophthalmology

- In addition, the growing geriatric population, expanding healthcare infrastructure, and increasing awareness about early diagnosis and treatment of retinal diseases are fueling demand for advanced retinal surgery devices. These combined factors are significantly propelling market expansion and adoption across both developed and emerging regions

Retinal Surgery Devices Market Analysis

- Retinal surgery devices, including vitrectomy systems, retinal imaging tools, and laser photocoagulation equipment, are increasingly essential in ophthalmic surgical procedures due to their precision, minimally invasive capabilities, and integration with advanced imaging technologies

- The growing demand for retinal surgery devices is primarily driven by the rising prevalence of retinal disorders such as diabetic retinopathy, macular degeneration, and retinal detachment, along with increasing awareness about early diagnosis and treatment

- North America dominated the retinal surgery devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, early adoption of innovative surgical technologies, and a strong presence of leading medical device manufacturers, particularly in the U.S., where high patient awareness and surgeon expertise are accelerating device utilization

- Asia-Pacific is expected to be the fastest-growing region in the retinal surgery devices market during the forecast period due to increasing geriatric population, improving healthcare facilities, and rising investments in ophthalmic care in countries such as China and India

- Vitrectomy Machines segment dominated the retinal surgery devices market with a market share of 41.7% in 2025, driven by their critical role in treating complex retinal disorders and their continuous technological enhancements for safer and more efficient surgeries

Report Scope and Retinal Surgery Devices Market Segmentation

|

Attributes |

Retinal Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Retinal Surgery Devices Market Trends

Integration of AI and 3D Visualization in Retinal Surgeries

- A significant and accelerating trend in the global retinal surgery devices market is the integration of artificial intelligence (AI) and advanced 3D visualization systems into surgical platforms, enhancing precision and procedural outcomes

- For instance, the NGENUITY 3D Visualization System by Alcon provides surgeons with high-definition 3D imaging during vitrectomy procedures, improving visibility and reducing surgical errors

- AI-enabled retinal surgery devices can assist in real-time decision-making, such as identifying retinal tears or abnormal tissue, providing predictive guidance, and optimizing surgical workflows for improved patient outcomes

- The combination of AI and enhanced imaging allows surgeons to perform complex procedures with minimally invasive techniques, reducing recovery time and improving safety for patients

- This trend towards more intelligent and precise surgical systems is reshaping expectations for retinal care, driving device manufacturers such as Leica Microsystems to develop AI-assisted and 3D-capable surgical platforms

- The demand for AI-integrated and 3D visualization retinal surgery devices is growing rapidly across hospitals and specialized ophthalmic centers, as clinicians increasingly prioritize surgical accuracy, safety, and efficiency

- Tele-surgery and remote-assisted retinal procedures, supported by AI and cloud-connected devices, are emerging as a trend, allowing expert surgeons to guide operations in remote or under-served regions

Retinal Surgery Devices Market Dynamics

Driver

Rising Prevalence of Retinal Disorders and Advanced Surgical Adoption

- The increasing prevalence of retinal diseases such as diabetic retinopathy, age-related macular degeneration, and retinal detachment, coupled with the rising adoption of advanced surgical techniques, is a key driver for market growth

- For instance, in March 2025, Alcon launched the CONSTELLATION Vision System with advanced vitrectomy and illumination features, aimed at improving surgical outcomes and efficiency for complex retinal cases

- As the geriatric population expands and ophthalmic awareness rises, hospitals and clinics are investing in state-of-the-art retinal surgery devices to meet growing patient demand

- The demand for minimally invasive procedures, shorter recovery times, and enhanced surgical precision is increasing the adoption of modern retinal surgery systems in both developed and emerging regions

- Continuous technological innovations, such as high-speed vitrectomy cutters and AI-assisted imaging, are making procedures safer, faster, and more effective, further propelling the market

- Increasing healthcare spending, coupled with rising awareness of retinal health, is accelerating investments in retinal surgical technologies and encouraging hospitals to upgrade their ophthalmic equipment

- Rising collaborations between device manufacturers and research institutions are fostering the development of next-generation retinal surgery systems with improved outcomes and reduced complication rates

- Expanding government initiatives for diabetic retinopathy and vision care screening programs are driving higher demand for advanced retinal surgical solutions

Restraint/Challenge

High Device Costs and Regulatory Approval Hurdles

- The high cost of advanced retinal surgery devices, along with stringent regulatory approvals, poses a significant challenge to widespread adoption in both developed and developing regions

- For instance, the cost of systems such as the Alcon CONSTELLATION or NGENUITY 3D Visualization can limit access for smaller clinics or budget-conscious healthcare providers, restricting market penetration

- Regulatory compliance requirements from authorities such as the FDA and CE can delay product launches and increase development costs for device manufacturers

- In addition, the need for specialized training for surgeons to operate advanced retinal systems can slow adoption, as institutions may hesitate to invest without skilled personnel

- While technological innovations are improving surgical outcomes, the perceived premium for high-end retinal surgery devices remains a barrier for hospitals with limited budgets or low patient volumes

- Addressing these challenges through cost-reduction strategies, simplified user interfaces, and faster regulatory approvals will be critical for sustained market expansion

- Limited availability of maintenance services and technical support in emerging regions can impede adoption and consistent device performance

- Potential risks related to device malfunction or surgical complications during complex procedures may make some healthcare providers hesitant to adopt newer technologies without extensive clinical validation

Retinal Surgery Devices Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the retinal surgery devices market is segmented into vitrectomy machines, vitrectomy packs, retinal laser equipment, microscopic illumination equipment, surgical instruments, and others. The vitrectomy machines segment dominated the market with the largest revenue share of 41.7% in 2025, driven by their essential role in performing complex retinal surgeries such as retinal detachment repair and macular hole treatment. These machines are highly valued for their precision, efficiency, and integration with advanced imaging and illumination systems. Surgeons often prefer vitrectomy machines due to their ability to minimize tissue damage and reduce patient recovery time. The high adoption in hospitals and specialty eye clinics, combined with continuous technological innovations, is further strengthening this segment’s dominance. Increasing prevalence of diabetic retinopathy and age-related retinal disorders is also fueling demand for vitrectomy systems globally.

The retinal laser equipment segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising use in minimally invasive procedures for diabetic retinopathy, macular edema, and retinal vein occlusion. Laser systems are increasingly preferred due to their precision, reduced risk of complications, and faster procedural times compared to traditional surgical methods. Technological advancements such as pattern scanning lasers and automated laser delivery systems are boosting adoption in both developed and emerging markets. The segment benefits from expanding healthcare infrastructure and growing awareness of early retinal disease intervention.

- By Application

On the basis of application, the market is segmented into diabetic retinopathy, retinal detachment, epiretinal membrane, macular hole, and others. The diabetic retinopathy segment dominated the market in 2025 due to the rising global prevalence of diabetes and associated retinal complications, which are driving consistent demand for surgical interventions. Hospitals and eye clinics prioritize devices capable of handling complex diabetic retinal cases, including vitrectomy machines and laser systems, to prevent vision loss. Continuous screening programs and early intervention initiatives by governments and healthcare organizations are further boosting demand. Technological advancements that enhance treatment efficacy and reduce surgical risks are also contributing to the segment’s strong market position. Surgeons prefer using modern retinal surgery devices to improve patient outcomes in diabetic retinopathy cases.

The retinal detachment segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing awareness of timely surgical intervention and the rising incidence of retinal injuries and degenerative disorders. Advanced vitrectomy systems, illumination equipment, and micro-instruments are critical for efficient retinal reattachment procedures. Adoption of minimally invasive techniques and 3D visualization platforms is encouraging hospitals and eye clinics to invest in these devices. Improved patient recovery times and better visual outcomes are driving adoption in both developed and emerging regions.

- By End User

On the basis of end user, the market is segmented into hospitals, eye clinics, and others. The hospitals segment dominated the market in 2025 with the largest revenue share, owing to well-established ophthalmic departments, high surgical volumes, and availability of advanced surgical infrastructure. Hospitals are the preferred choice for complex retinal surgeries that require multiple device integrations, such as vitrectomy machines with 3D imaging and laser systems. Rising prevalence of retinal disorders and increasing healthcare spending in developed countries are reinforcing hospital demand. In addition, hospitals invest heavily in training surgeons and maintaining device upgrades, which supports sustained market growth.

The eye clinics segment is expected to witness the fastest growth from 2026 to 2033, driven by rising patient awareness and the increasing trend of specialized outpatient retinal care. Clinics are adopting portable and cost-efficient retinal surgery devices, including compact vitrectomy and laser systems, to provide high-quality care in a faster, outpatient-friendly setting. Expanding urban healthcare networks in emerging markets are contributing to the rapid adoption of retinal surgery devices in clinics. Convenience, accessibility, and increasing patient load in specialized eye centers are major factors boosting the segment’s growth.

Retinal Surgery Devices Market Regional Analysis

- North America dominated the retinal surgery devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, early adoption of innovative surgical technologies, and a strong presence of leading medical device manufacturers, particularly in the U.S., where high patient awareness and surgeon expertise are accelerating device utilization

- Hospitals and specialized eye clinics in the region prioritize investment in state-of-the-art retinal surgery devices such as vitrectomy machines, laser systems, and 3D visualization platforms to enhance surgical precision and patient outcomes

- This widespread adoption is further supported by a strong presence of key market players, high healthcare spending, and the growing geriatric population, which collectively contribute to increasing demand for advanced retinal surgical interventions

U.S. Retinal Surgery Devices Market Insight

The U.S. retinal surgery devices market captured the largest revenue share of 42% in 2025 within North America, fueled by the increasing prevalence of retinal disorders and advanced healthcare infrastructure. Hospitals and specialized eye clinics are prioritizing investments in state-of-the-art vitrectomy machines, retinal laser systems, and 3D visualization platforms to improve surgical precision and patient outcomes. Rising awareness of retinal health, along with growing geriatric population, is driving demand for early diagnosis and intervention. In addition, the strong presence of key ophthalmic device manufacturers and continuous product innovations are further propelling market growth. The high adoption of minimally invasive surgical techniques and government initiatives promoting vision care programs are also significant contributors.

Europe Retinal Surgery Devices Market Insight

The Europe retinal surgery devices market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising cases of diabetic retinopathy and retinal detachment. Increasing investments in healthcare infrastructure, coupled with growing awareness about advanced ophthalmic procedures, are fostering the adoption of retinal surgery devices. European hospitals and eye clinics are integrating vitrectomy systems, laser equipment, and microscopic illumination devices to enhance surgical outcomes. The focus on improving patient care, coupled with technological advancements in minimally invasive devices, is accelerating growth across both public and private healthcare facilities. The trend of specialized retinal treatment centers is also encouraging market expansion.

U.K. Retinal Surgery Devices Market Insight

The U.K. retinal surgery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of age-related macular degeneration and diabetic retinopathy. The demand for precision surgical tools and advanced imaging systems is increasing in hospitals and ophthalmic clinics to improve procedural efficiency and outcomes. In addition, government-supported eye health programs and growing patient awareness are encouraging early interventions using modern retinal surgery devices. The country’s adoption of minimally invasive surgeries and technologically advanced devices, alongside a strong healthcare infrastructure, is expected to continue stimulating market growth.

Germany Retinal Surgery Devices Market Insight

The Germany retinal surgery devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong healthcare system, high patient awareness, and increasing prevalence of retinal diseases. Hospitals and specialized eye clinics are adopting cutting-edge vitrectomy machines, retinal lasers, and microscopic illumination equipment to enhance surgical accuracy. The emphasis on technological innovation and precision care in ophthalmology is driving growth. Moreover, integration of AI-assisted imaging and minimally invasive procedures is becoming increasingly prevalent in German medical facilities. The focus on patient safety and improved visual outcomes aligns with local healthcare priorities, promoting adoption.

Asia-Pacific Retinal Surgery Devices Market Insight

The Asia-Pacific retinal surgery devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing prevalence of diabetic retinopathy and age-related macular degeneration in countries such as China, India, and Japan. Expanding healthcare infrastructure, rising healthcare expenditure, and increasing number of specialized eye clinics are fueling demand. The region’s growing focus on early detection and minimally invasive retinal surgeries is encouraging adoption of vitrectomy machines, laser systems, and advanced surgical instruments. Government initiatives promoting vision health and the growing accessibility of affordable retinal surgery devices are also key factors driving market growth.

Japan Retinal Surgery Devices Market Insight

The Japan retinal surgery devices market is gaining momentum due to the country’s aging population, high prevalence of retinal disorders, and advanced healthcare infrastructure. Hospitals and ophthalmic clinics are increasingly adopting AI-integrated vitrectomy systems, retinal lasers, and 3D visualization platforms for precise and minimally invasive procedures. The demand for improved surgical efficiency and better patient outcomes is driving investments in advanced retinal surgery technologies. In addition, Japan’s culture of embracing high-tech medical devices, coupled with strong R&D focus, is fueling market growth. Integration of devices with digital imaging and telemedicine capabilities further supports adoption in both residential and commercial healthcare setups.

India Retinal Surgery Devices Market Insight

The India retinal surgery devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of diabetic retinopathy, increasing geriatric population, and expanding healthcare infrastructure. Eye clinics and hospitals are rapidly adopting vitrectomy machines, retinal laser equipment, and microscopic illumination systems to address the growing patient demand. Government initiatives promoting vision care and early detection programs are boosting market growth. The availability of cost-effective retinal surgery devices, along with increasing awareness about advanced ophthalmic treatments, is driving adoption across both urban and semi-urban regions. Rising private investments and the emergence of specialized ophthalmology centers are also key factors propelling the market in India.

Retinal Surgery Devices Market Share

The Retinal Surgery Devices industry is primarily led by well-established companies, including:

- Alcon, Inc. (Switzerland)

- Bausch + Lomb (Canada)

- Carl Zeiss Meditec AG (Germany)

- Topcon Corporation (Japan)

- NIDEK CO., LTD. (Japan)

- IRIDEX Corporation (U.S.)

- Lumenis Ltd. (Israel)

- OCULUS Optikgeräte GmbH (Germany)

- Synergetics USA, Inc. (U.S.)

- Ellex Medical Lasers Ltd. (Australia)

- Optos plc (U.K.)

- Second Sight Medical Products, Inc. (U.S.)

- Peregrine Surgical Ltd. (U.S.)

- Geuder AG (Germany)

- MedOne Surgical, Inc. (U.S.)

- Katalyst Surgical, LLC (U.S.)

- BVI Medical (U.S.)

- Designs for Vision, Inc. (U.S.)

- HOYA Corporation (Japan)

What are the Recent Developments in Global Retinal Surgery Devices Market?

- In May 2025, the U.S. FDA approved Roche’s Susvimo implant for the treatment of diabetic retinopathy (DR) This marks a major regulatory milestone, expanding indications for continuous‑delivery retinal therapy beyond wet AMD and DME, offering retinal specialists a less frequent treatment regimen for DR patients

- In April 2025, Alcon announced the commercial launch of its UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS) These next‑generation surgical platforms combine vitreoretinal and cataract capabilities with first‑to‑market features such as the HYPERVIT 30K vitrectomy probe and Intelligent Fluidics, designed to improve efficiency and outcomes in both retinal and cataract surgeries

- In April 2025, Icare received FDA clearance and launched its MAIA Microperimeter in the U.S. This advanced diagnostic device enhances retinal imaging precision for geographic atrophy and research applications, enabling clinicians to better assess retinal function alongside structural changes

- In February 2025, Norlase’s LYNX pattern scanning laser indirect ophthalmoscope won the Biomedical Optics 2025 PRISM Award, highlighting its innovation as the world’s first integrated portable pattern laser LIO system that enhances efficiency and accessibility of retinal laser treatments globally

- In February 2025, Optos PLC unveiled the MonacoPro ultra‑widefield retinal imaging system with integrated spectral domain OCT, advancing retinal diagnostics by improving imaging accuracy and workflow efficiency for eye care specialists worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.