Global Rheumatoid Arthritis Treatment Market

Market Size in USD Billion

CAGR :

%

USD

31.77 Billion

USD

53.77 Billion

2024

2032

USD

31.77 Billion

USD

53.77 Billion

2024

2032

| 2025 –2032 | |

| USD 31.77 Billion | |

| USD 53.77 Billion | |

|

|

|

|

Rheumatoid Arthritis Treatment Market Size

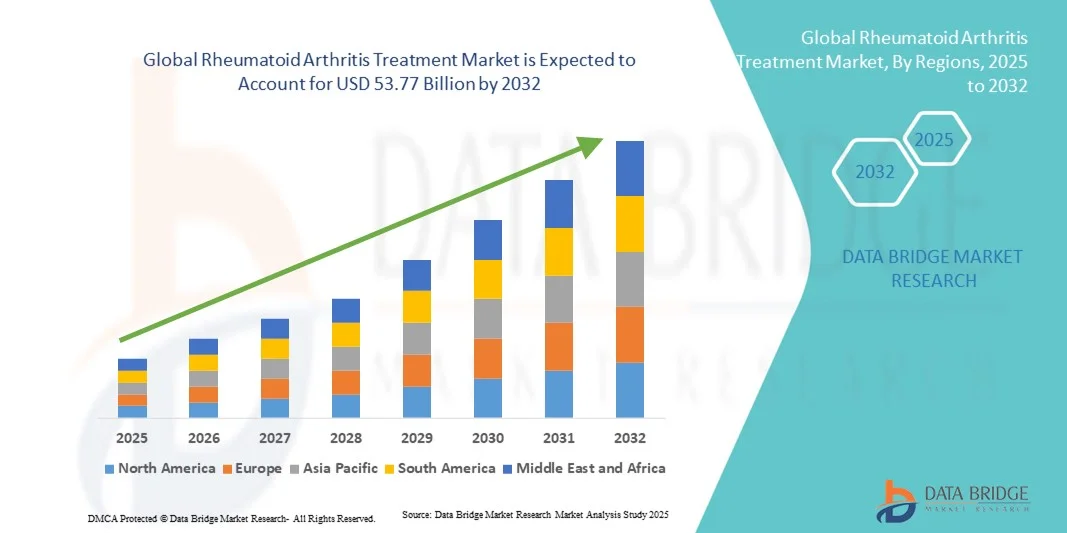

- The global rheumatoid arthritis treatment market size was valued at USD 31.77 billion in 2024 and is expected to reach USD 53.77 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of rheumatoid arthritis worldwide and advancements in therapeutic approaches, including biologics, targeted synthetic disease-modifying antirheumatic drugs (DMARDs), and combination therapies, which are improving patient outcomes and quality of life

- Furthermore, rising awareness among patients and healthcare providers, along with the growing availability of innovative and personalized treatment options, is establishing Rheumatoid Arthritis Treatment as a key focus area in chronic disease management. These converging factors are accelerating the adoption of Rheumatoid Arthritis Treatment solutions, thereby significantly boosting the industry's growth

Rheumatoid Arthritis Treatment Market Analysis

- Rheumatoid Arthritis Treatment, encompassing pharmacological therapies, biologics, and targeted disease-modifying antirheumatic drugs (DMARDs), has become an essential component of modern chronic disease management due to its effectiveness in reducing inflammation, slowing disease progression, and improving patient quality of life

- The growing demand for rheumatoid arthritis treatment is primarily fueled by the increasing prevalence of rheumatoid arthritis, advancements in diagnostic and therapeutic technologies, and rising awareness among healthcare professionals and patients about early disease management

- North America dominated the rheumatoid arthritis treatment market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high patient awareness, favorable reimbursement policies, and strong research and development activities, particularly in the U.S., where adoption of innovative therapies is steadily increasing

- Asia-Pacific is expected to be the fastest-growing region in the rheumatoid arthritis treatment market during the forecast period due to increasing prevalence of rheumatoid arthritis, expanding healthcare access, and rising disposable incomes in countries such as China and India

- The Adults segment held the largest market revenue share of 78.6% in 2024, owing to the higher prevalence of RA in individuals aged 30–60 years. Adults are more susceptible to chronic inflammation, joint pain, and functional limitations, which creates sustained demand for medication, therapy, and procedural interventions

Report Scope and Rheumatoid Arthritis Treatment Market Segmentation

|

Attributes |

Rheumatoid Arthritis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Rheumatoid Arthritis Treatment Market Trends

Advancements in Precision Therapies and Digital Health Integration

- A significant and accelerating trend in the global rheumatoid arthritis (RA) treatment market is the integration of digital health tools, AI-assisted diagnostics, and personalized medicine approaches to improve patient outcomes and streamline therapy management

- For instance, in June 2023, AbbVie expanded the use of AI-based monitoring for patients on Humira, enabling clinicians to track disease activity remotely and adjust therapy schedules based on real-time data, improving personalized treatment adherence

- The rise of telemedicine platforms is also transforming care delivery. For instance, in September 2022, Pfizer partnered with digital health provider Omada Health to deliver virtual RA management programs that guide patients on medication adherence, lifestyle adjustments, and symptom monitoring

- Moreover, the trend toward targeted biologics and JAK inhibitors is reshaping treatment expectations. For instance, in May 2024, Eli Lilly launched Olumiant (baricitinib) for RA in new adult populations, offering a more effective therapy for patients with inadequate response to conventional DMARDs

- These developments, combining advanced therapeutics with AI-enabled monitoring and telehealth, are creating more precise, proactive, and patient-centric RA care models globally

Rheumatoid Arthritis Treatment Market Dynamics

Driver

Rising RA Prevalence and Increasing Access to Advanced Therapies

- The increasing prevalence of rheumatoid arthritis, driven by aging populations and higher awareness of early diagnosis, is a major driver of market growth

- For instance, in March 2023, Johnson & Johnson reported a 12% year-on-year increase in patients initiating biologic therapies for RA in North America, reflecting greater detection and therapy adoption

- Advances in treatment options, such as next-generation biologics, biosimilars, and small molecule inhibitors, are further encouraging uptake. For instance, in October 2024, Sandoz launched the biosimilar Hyrimoz, significantly expanding access to affordable anti-TNF therapy in Europe and the U.S.

- Government initiatives and insurance coverage expansions are also contributing. For instance, in August 2022, the Australian Government allocated USD 11.54 million in grants to support RA immunotherapy research, enabling broader access to novel treatments and clinical trials

- Patient education programs and awareness campaigns are increasing early diagnosis rates, enabling clinicians to initiate therapy sooner, improving long-term outcomes and fueling market demand

- Rising healthcare infrastructure in emerging economies is also driving market growth. For instance, in July 2023, Novartis collaborated with hospitals in India to enhance access to RA biologics through patient support programs, increasing treatment availability in underserved regions

- Increasing adoption of combination therapies and personalized treatment plans is further boosting demand

Restraint/Challenge

High Therapy Costs and Limited Accessibility

- Despite advances, high therapy costs remain a significant barrier, particularly for biologics and JAK inhibitors

- For instance, in April 2024, CVS Health adjusted its formulary, favoring biosimilars over Humira, reflecting cost pressures and highlighting the affordability challenge for premium therapies

- Limited availability of specialists and advanced therapies in developing regions restricts access. For instance, in December 2023, a survey in Southeast Asia found that over 35% of RA patients had delayed biologic therapy due to lack of rheumatology specialists and high treatment costs

- Long-term safety concerns and regulatory hurdles for newer therapies also pose challenges. For instance, in September 2025, AbbVie announced that Rinvoq would retain market exclusivity until 2037, delaying wider access to lower-cost alternatives

- Patient adherence challenges due to complex treatment regimens and side effects can hinder effectiveness and limit market growth. For instance, in January 2024, a multi-center study reported that 25% of RA patients discontinued biologic therapy within the first year due to side effects or injection-related difficulties

- Unequal distribution of advanced treatment infrastructure between urban and rural areas restricts access in certain regions. For instance, in March 2025, WHO highlighted that many rural communities in Latin America still lack access to biologics, limiting market penetration

- Overcoming these challenges through biosimilar adoption, patient assistance programs, telemedicine expansion, and policy reforms is critical for sustainable RA treatment market growth

Rheumatoid Arthritis Treatment Market Scope

The market is segmented on the basis of disease type, age, treatment type, and end user.

- By Disease Type

On the basis of disease type, the Rheumatoid Arthritis Treatment market is segmented into Seropositive RA, Seronegative RA, and Juvenile Idiopathic Arthritis (JIA). The Seropositive RA segment dominated the largest market revenue share of 52.4% in 2024, driven by its higher prevalence and more severe disease progression compared with other RA types. Seropositive RA patients often experience joint deformities, persistent inflammation, and increased disability, which creates significant demand for advanced treatments and long-term management strategies. The segment benefits from widespread clinical awareness and early diagnostic testing using biomarkers such as rheumatoid factor (RF) and anti-CCP antibodies, which guide treatment decisions. Availability of targeted medications, biologics, and combination therapy protocols ensures consistent patient management. Research and development in immunomodulatory drugs, along with government initiatives supporting autoimmune disease management, further strengthen market dominance. In addition, strong patient adherence to prescribed therapies, rising access to specialty clinics, and increasing hospital-based interventions contribute to the segment’s robust growth. The high burden of disease among adults, the need for continuous monitoring, and the adoption of both pharmacological and non-pharmacological interventions make this segment critical for market revenue.

The Juvenile Idiopathic Arthritis (JIA) segment is anticipated to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by increasing awareness of pediatric autoimmune disorders and emphasis on early diagnosis. Rising availability of pediatric-friendly medications, specialized rheumatology centers for children, and government programs promoting early intervention are key growth drivers. The long-term impact of untreated JIA on joint health and quality of life is prompting parents and healthcare providers to seek timely and effective treatments. Clinical research and new therapy development for pediatric patients are expanding treatment options. In addition, the segment is benefiting from initiatives by patient advocacy groups and non-governmental organizations to increase disease awareness. Telemedicine and remote monitoring solutions for children are also supporting faster adoption. Early intervention and adherence to treatment plans help prevent disability, improving long-term outcomes and contributing to rising market demand. The growing focus on comprehensive pediatric care and increased collaboration between healthcare providers and families further drives market expansion in this segment.

- By Age

On the basis of age, the Rheumatoid Arthritis Treatment market is segmented into Children and Adults. The Adults segment held the largest market revenue share of 78.6% in 2024, owing to the higher prevalence of RA in individuals aged 30–60 years. Adults are more susceptible to chronic inflammation, joint pain, and functional limitations, which creates sustained demand for medication, therapy, and procedural interventions. The segment benefits from strong clinical guidelines recommending early and aggressive management to prevent joint damage. Widespread access to diagnostic facilities, availability of specialized hospitals, and multidisciplinary care teams enhance treatment adoption. Adults are increasingly using combination therapies, including DMARDs, biologics, corticosteroids, and lifestyle modifications. Rising healthcare expenditure, insurance coverage for advanced treatments, and patient education programs further support market dominance. In addition, adults tend to seek regular monitoring and follow-up care, increasing hospital visits and pharmaceutical consumption. Long-term treatment adherence and preventive care strategies in adults reinforce the segment’s stable revenue contribution. The focus on improving quality of life and productivity in working-age populations also drives the sustained growth of the adult segment.

The Children segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, due to growing recognition of pediatric RA and early intervention strategies. Increasing pediatric rheumatology awareness, the availability of specialized clinics, and tailored medications for children are major growth factors. Early diagnosis programs and government-funded initiatives are improving access to care for young patients. Parents and caregivers are becoming more proactive in seeking treatment to prevent long-term joint damage and disability. Telehealth and remote consultation services for pediatric patients are accelerating treatment uptake. Pediatric-focused physiotherapy, occupational therapy, and lifestyle guidance are increasingly integrated into care plans. Research and development in child-specific biologics and DMARDs is enhancing treatment effectiveness. Growing collaborations between hospitals, homecare providers, and specialty clinics strengthen market adoption. Patient advocacy and awareness campaigns targeting JIA also contribute to rapid segment growth. Expansion of healthcare infrastructure in emerging regions further supports this trend. Overall, improved access to early diagnosis and effective management drives the fastest CAGR in this age segment.

- By Treatment Type

On the basis of treatment type, the Rheumatoid Arthritis Treatment market is segmented into Nutrition, Medication, Procedures and Therapy, and Self-care. The Medication segment dominated the largest market revenue share of 61.7% in 2024, driven by the widespread reliance on DMARDs, biologics, corticosteroids, and combination therapies to control inflammation, reduce joint damage, and improve patient outcomes. Medication remains the first-line treatment for most RA patients due to its effectiveness in slowing disease progression. The segment benefits from strong clinical guidelines, increasing availability of generics, and high patient adherence programs. Research and development in new biologic agents and targeted therapies are continuously expanding treatment options. Hospitals, specialty clinics, and homecare services provide structured support for medication management. Increased awareness of disease management protocols, coupled with insurance coverage and reimbursement policies, strengthens market dominance. Physicians and healthcare providers increasingly emphasize early initiation of medication to prevent long-term complications. Long-term management plans, patient education initiatives, and monitoring programs further reinforce the segment’s leading revenue share. Rising prevalence of moderate-to-severe RA cases and increasing adoption of advanced therapies drive sustained demand.

The Procedures and Therapy segment is anticipated to witness the fastest CAGR of 13.1% from 2025 to 2032, fueled by growing adoption of physiotherapy, occupational therapy, joint injections, and minimally invasive procedures. Patients increasingly prefer integrated care plans that combine medication with rehabilitation to improve mobility and reduce pain. Expansion of specialty therapy centers, enhanced availability of trained therapists, and home-based therapy options support accelerated growth. Government initiatives and insurance coverage for procedural therapies further boost accessibility. Rising awareness about the benefits of therapy in improving functional outcomes and quality of life is driving adoption. Technological advancements in therapy devices, including digital monitoring and tele-rehabilitation, enhance treatment effectiveness. The segment also benefits from growing patient focus on non-pharmacological interventions. Rehabilitation programs tailored for adults and children, alongside preventive strategies to avoid joint deformities, contribute to segment growth. Increasing clinical research on therapy efficacy and patient education campaigns further accelerate adoption. Overall, procedures and therapy are becoming a preferred complement to medication, driving rapid CAGR.

- By End User

On the basis of end user, the Rheumatoid Arthritis Treatment market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. The Hospitals segment accounted for the largest market revenue share of 57.8% in 2024, due to the availability of comprehensive care facilities, multidisciplinary treatment teams, and advanced diagnostic and therapeutic equipment. Hospitals manage moderate-to-severe RA cases and provide long-term monitoring, ensuring consistent treatment outcomes. Rising hospital admissions, specialized rheumatology departments, and collaborations with research institutions enhance the segment’s dominance. Access to advanced medication, procedures, and therapy under one roof attracts patients. Insurance coverage, government healthcare initiatives, and clinical trials conducted in hospital settings further support revenue growth. Hospitals also provide patient education, follow-up programs, and lifestyle management guidance. The increasing burden of RA, rising prevalence in adults, and demand for early diagnosis reinforce the segment’s strong market position. In addition, hospitals serve as centers for adoption of innovative therapies and multidisciplinary interventions.

The Homecare segment is expected to witness the fastest CAGR of 14.2% from 2025 to 2032, driven by growing preference for home-based management, telemedicine support, and patient-centric care models. Homecare allows elderly, mobility-impaired, or chronic RA patients to access treatment conveniently. Expansion of home-delivered medications, digital monitoring tools, and remote physiotherapy programs supports adoption. Patient awareness campaigns, caregiver training, and telehealth services enhance treatment adherence. Integration of lifestyle guidance, nutritional support, and exercise routines into homecare plans further drives growth. Homecare is increasingly preferred for long-term disease management, especially in pediatric and adult patients requiring continuous monitoring. Government initiatives supporting home-based healthcare, insurance coverage for home services, and increasing healthcare infrastructure in emerging regions accelerate adoption. Convenience, reduced hospital visits, and personalized care contribute to the rapid CAGR in this segment.

Rheumatoid Arthritis Treatment Market Regional Analysis

- North America dominated the rheumatoid arthritis treatment market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high patient awareness, favorable reimbursement policies, and strong research and development activities

- The market captured the majority of the regional market share, fueled by the adoption of innovative therapies, increasing clinical trials, and rising awareness programs for early diagnosis and disease management. High patient engagement, widespread access to specialized hospitals and rheumatology clinics, and the presence of advanced diagnostic and treatment facilities contribute to robust market growth

- The segment also benefits from strong government initiatives, insurance coverage, and healthcare policies supporting chronic disease management. Increasing adoption of combination therapies, biologics, and DMARDs further strengthens the market. The focus on improving patient quality of life and functional outcomes, alongside ongoing R&D in advanced treatment protocols, reinforces North America’s leadership in the global market

U.S. Rheumatoid Arthritis Treatment Market Insight

The U.S. rheumatoid arthritis treatment market captured the largest revenue share in 2024 within North America, driven by increasing adoption of innovative therapies, high patient awareness, and rising preference for early diagnosis and specialized care. Growing clinical trials, research initiatives, and government-supported awareness campaigns enhance adoption of advanced pharmacological and non-pharmacological treatments. Access to specialty clinics, high-quality hospitals, and multidisciplinary care teams further propels market expansion. The increasing prevalence of RA, coupled with robust healthcare infrastructure and insurance coverage, supports sustained growth in treatment uptake and long-term management strategies.

Europe Rheumatoid Arthritis Treatment Market Insight

The Europe rheumatoid arthritis treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of RA, availability of advanced treatment options, and the growing number of specialized healthcare centers. The increase in urbanization and access to modern medical facilities is fostering adoption of innovative therapies. European patients are increasingly seeking effective disease management solutions, including DMARDs, biologics, therapy, and rehabilitation services. Countries such as Germany and the U.K. are witnessing rising demand for evidence-based treatment, early diagnosis, and multidisciplinary care approaches. Stringent healthcare regulations, government support for chronic disease management, and growing patient education campaigns further stimulate market growth.

U.K. Rheumatoid Arthritis Treatment Market Insight

The U.K. rheumatoid arthritis treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising RA prevalence, increasing patient awareness, and growing access to specialized treatment centers. Government health campaigns and patient education programs are encouraging early diagnosis and adoption of advanced therapies. The robust healthcare infrastructure and rising demand for quality care enhance market growth.

Germany Rheumatoid Arthritis Treatment Market Insight

The Germany rheumatoid arthritis treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of RA, availability of technologically advanced treatment options, and well-developed healthcare infrastructure. Increasing adoption of multidisciplinary care approaches, advanced diagnostics, and biologic therapies in hospitals and specialty clinics supports market growth. Patients are increasingly seeking evidence-based interventions to manage chronic RA symptoms effectively.

Asia-Pacific Rheumatoid Arthritis Treatment Market Insight

The Asia-Pacific rheumatoid arthritis treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by the increasing prevalence of RA, expanding healthcare access, rising disposable incomes, and growing investment in specialized treatment centers across countries such as China and India. Increasing government initiatives, patient awareness programs, and availability of advanced therapies are further propelling market adoption. Rising healthcare infrastructure and increasing affordability of treatment options are enabling broader access to care. The growing middle-class population, expansion of hospitals and specialty clinics, and higher patient engagement are key factors supporting rapid growth in the region.

Japan Rheumatoid Arthritis Treatment Market Insight

The Japan rheumatoid arthritis treatment market is gaining momentum due to increasing RA prevalence, aging population, and high awareness of chronic disease management. The country is witnessing growing adoption of advanced therapies, physiotherapy, and rehabilitation services. Increasing availability of specialty clinics and integrated care programs enhances treatment accessibility. Focus on improving patient quality of life and long-term disease management contributes to market expansion.

China Rheumatoid Arthritis Treatment Market Insight

The China rheumatoid arthritis treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the rising prevalence of RA, rapid urbanization, expanding healthcare infrastructure, and increasing disposable incomes. China’s growing middle-class population, rising patient awareness, and government initiatives to improve chronic disease management are driving treatment adoption. Increasing availability of specialized hospitals, clinics, and advanced treatment options such as biologics and combination therapies further supports market growth. The focus on early diagnosis, access to care in urban and semi-urban regions, and ongoing R&D initiatives enhance the country’s leading position in the regional market.

Rheumatoid Arthritis Treatment Market Share

The Rheumatoid Arthritis Treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Lilly (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Johnson & Johnson Services and its affiliates (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- UCB S.A. (Belgium)

- Novartis AG (Switzerland)

Latest Developments in Global Rheumatoid Arthritis Treatment Market

- In March 2024, the U.S. Food and Drug Administration (FDA) approved TYENNE® (tocilizumab-aazg), the first interchangeable biosimilar to Actemra (tocilizumab), for both intravenous and subcutaneous administration. TYENNE is indicated for adults with moderately to severely active rheumatoid arthritis who have not responded adequately to one or more disease-modifying antirheumatic drugs (DMARDs), as well as for patients aged two years and older with active polyarticular juvenile idiopathic arthritis or active systemic juvenile idiopathic arthritis. This approval expands treatment options and accessibility for RA patients in the U.S.

- In September 2024, a groundbreaking clinical trial published in The Lancet demonstrated that abatacept, a biologic therapy, could potentially prevent the onset of rheumatoid arthritis in individuals displaying early symptoms. The study, involving 213 patients at high risk for RA, found that 92.8% of participants treated with abatacept remained arthritis-free after 12 months, compared to 69.2% in the placebo group. After two years, only 25% in the abatacept group progressed to RA versus 37% in the placebo group. These promising results suggest that abatacept not only prevents the onset of RA but also alleviates symptoms like pain and fatigue

- In September 2024, Eli Lilly signed a licensing agreement with Eva Pharma, an Egyptian pharmaceutical company, to manufacture and distribute Olumiant (baricitinib), a Janus kinase (JAK) inhibitor used to treat moderate to severe rheumatoid arthritis, in 49 African countries. This collaboration aims to enhance access to Olumiant in Africa, where the prevalence of rheumatoid arthritis is rising, and to support the local production of biologic therapies, thereby reducing costs and improving availability

- In November 2024, the FDA expanded the approval of Kevzara (sarilumab), a monoclonal antibody targeting the interleukin-6 receptor, to include the treatment of polyarticular juvenile idiopathic arthritis (PJIA) in patients weighing at least 39 kg (approximately 86 pounds). This expanded indication provides an additional treatment option for pediatric patients with PJIA, a chronic inflammatory disease affecting multiple joints, thereby broadening the therapeutic landscape for juvenile arthritis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.