Global Robotic Gripper Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

3.88 Billion

2024

2032

USD

1.79 Billion

USD

3.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.79 Billion | |

| USD 3.88 Billion | |

|

|

|

|

What is the Global Robotic Gripper Market Size and Growth Rate?

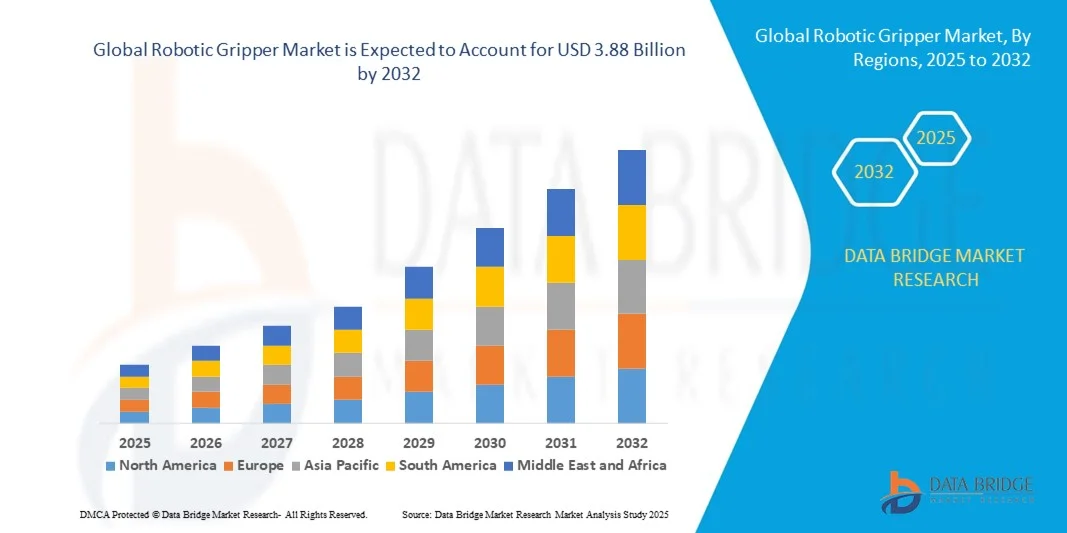

- The global robotic gripper market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 3.88 billion by 2032, at a CAGR of 10.10% during the forecast period

- Rising globalization and growth in the demand for automotive industrial solutions that reduce the damage will emerge as the major market growth driving factors. Growing awareness about the advantages of robotic grippers, surging demand for modular soft grippers, increasing adoption of industrial collaborative robots and widespread industrialization will further aggravate the market value

What are the Major Takeaways of Robotic Gripper Market?

- Growing expenditure to undertake research and development proficiencies and growth and expansion of various end user verticals especially in the developing regions will further carve the way for the growth of the market

- However, dearth of knowledge and technological expertise will act as a growth restraint for the market. Technological challenges, interoperability issues and high installation and maintenance costs will further dampen the growth rate of the market. Large scale technological limitations in the underdeveloped economies and difficulty in integration of different robotic framework with existing facilities will further challenge the market growth rate

- North America dominated the robotic gripper market with the largest revenue share of 38.12% in 2024, driven by rapid industrial automation, strong demand for collaborative robots, and widespread adoption of robotic gripping systems across manufacturing sectors

- The Asia-Pacific Robotic Gripper market is projected to grow at the fastest CAGR of 8.54% between 2025 and 2032, fueled by rapid industrialization, urbanization, and automation adoption across industries such as automotive, electronics, and logistics

- The Pneumatic Grippers segment dominated the market with the largest revenue share of 37.5% in 2024, owing to their cost-effectiveness, simple design, and widespread use in manufacturing, automotive, and packaging industries

Report Scope and Robotic Gripper Market Segmentation

|

Attributes |

Robotic Gripper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Robotic Gripper Market?

Integration of AI and Machine Learning for Smart Automation

- A major trend reshaping the global robotic gripper market is the integration of artificial intelligence (AI) and machine learning (ML) to enhance precision, adaptability, and operational efficiency in industrial automation. AI-powered robotic grippers can adapt to variable product shapes, weights, and textures, significantly reducing the need for custom end-effectors

- For instance, SCHUNK introduced AI-enabled grippers that adjust grip strength dynamically, optimizing handling in sectors such as food, electronics, and automotive. Similarly, Soft Robotics Inc. leverages ML algorithms to enhance its soft grippers’ adaptability for delicate product handling

- AI integration also facilitates predictive maintenance, reducing downtime by monitoring wear and predicting failures in advance. This trend is accelerating across industries such as logistics, packaging, and e-commerce where flexibility and speed are critical

- The rise of collaborative robots (cobots) equipped with intelligent grippers further emphasizes user-friendly, safe, and versatile automation. As companies demand scalable and adaptable solutions, AI-driven robotic grippers are set to redefine industry standards, ensuring greater efficiency and reliability

What are the Key Drivers of the Robotic Gripper Market?

- The rising adoption of industrial automation and robotics across manufacturing, e-commerce, and food & beverage industries is driving demand for robotic grippers. Flexible handling and precision are key requirements fueling this growth

- For instance, in May 2024, Zimmer Group launched a new adaptive gripper series designed to meet the needs of Industry 4.0 applications, enabling greater flexibility and efficiency. Such innovations reinforce market growth

- The surge in collaborative robots (cobots) has further propelled demand for lightweight and safe grippers designed to work alongside humans. These solutions address labor shortages and improve productivity in repetitive tasks

- In addition, the expansion of e-commerce and logistics industries requires robotic grippers for packaging, sorting, and order fulfillment. With rising consumer demand for speed and accuracy, automation adoption continues to escalate

- Overall, the combination of cost savings, operational efficiency, and rising need for advanced automation is positioning robotic grippers as an essential component of modern industrial workflows

Which Factor is Challenging the Growth of the Robotic Gripper Market?

- One of the major challenges is the high initial cost and integration complexity of robotic gripper systems, particularly for small and medium-sized enterprises (SMEs)

- For instance, industries with tight margins in developing regions often hesitate to adopt advanced automation due to capital investment concerns. This slows down wider adoption despite long-term efficiency benefits

- Another key issue is the lack of standardization in robotic grippers, as diverse end-use industries require highly customized solutions. This limits interoperability and raises overall system costs

- In addition, concerns around handling flexibility especially for fragile or irregularly shaped products pose limitations, despite advancements in soft robotics and adaptive gripping technologies

- Overcoming these challenges through cost-effective modular gripper designs, open integration standards, and wider availability of flexible gripping solutions will be crucial to unlock the full growth potential of the robotic gripper market in the coming years

How is the Robotic Gripper Market Segmented?

The market is segmented on the basis of type, design, application, and industry vertical.

- By Type

On the basis of type, the robotic gripper market is segmented into Vacuum Grippers, Hydraulic Grippers, Electric Grippers, Pneumatic Grippers, Magnetic Grippers, and Servo-Electric Grippers. The Pneumatic Grippers segment dominated the market with the largest revenue share of 37.5% in 2024, owing to their cost-effectiveness, simple design, and widespread use in manufacturing, automotive, and packaging industries. Their ability to deliver high-speed operations and reliable grip strength makes them a preferred choice for repetitive tasks.

The Electric Grippers segment, however, is projected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by the growing demand for precision handling, programmability, and compatibility with collaborative robots. Electric grippers are increasingly being adopted in electronics, medical devices, and precision engineering industries where accuracy and control are critical. The shift toward Industry 4.0 and energy-efficient automation systems is expected to further strengthen demand for electric grippers.

- By Design

On the basis of design, the robotic gripper market is segmented into Robot Grippers with Two Fingers, Robot Grippers with Three Fingers, and Robot Grippers with Flexible Fingers. The Two-Finger Grippers segment held the largest revenue share of 46.8% in 2024, as these designs are versatile, simple to operate, and widely used across packaging, logistics, and electronics assembly. Their ability to handle objects of varied sizes with high speed makes them a staple in industrial automation.

Meanwhile, the Flexible Finger Grippers segment is projected to grow at the fastest CAGR of 20.6% from 2025 to 2032, supported by the rising adoption of soft robotics in food, beverage, and healthcare sectors. These grippers offer adaptability for handling delicate or irregularly shaped items without damage, making them suitable for industries where product integrity is critical. The growing trend of human-robot collaboration also contributes to the rising demand for flexible finger designs.

- By Application

On the basis of application, the robotic gripper market is segmented into Handling, Assembly, Dispensing, Processing, and Others. The Handling segment dominated the market with the largest revenue share of 41.2% in 2024, owing to the widespread adoption of robotic grippers in logistics, packaging, and e-commerce industries. Automated material handling solutions are increasingly used to streamline warehouse operations and enhance productivity, particularly in high-volume environments.

The Assembly segment is expected to record the fastest CAGR of 19.8% from 2025 to 2032, fueled by the growth of electronics, automotive, and precision engineering industries. Robotic grippers play a critical role in small-parts assembly, circuit board handling, and component placement, where high precision and speed are required. The demand for miniaturized and intricate assembly tasks in semiconductors and electronics further accelerates this segment’s growth, making it a major focus area for manufacturers.

- By Industry Vertical

On the basis of industry vertical, the robotic gripper market is segmented into Packaging, Automotive, Electrical and Electronics, Plastics, Rubber, and Chemicals, Metals and Machinery, Food and Beverages, Precision Engineering and Optics, Pharmaceuticals, Cosmetics, and Others. The Automotive segment dominated with the largest revenue share of 34.6% in 2024, driven by the widespread use of robotic grippers in component handling, assembly, and welding applications. The automotive industry’s high reliance on automation for precision and efficiency continues to make it a core market.

However, the Food and Beverages segment is projected to grow at the fastest CAGR of 23.4% from 2025 to 2032, driven by the need for hygienic, flexible, and delicate handling solutions. Increasing demand for packaged foods, coupled with strict safety regulations, fuels the adoption of robotic grippers in this sector. The integration of soft and adaptive grippers for fragile food items is further boosting growth.

Which Region Holds the Largest Share of the Robotic Gripper Market?

- North America dominated the robotic gripper market with the largest revenue share of 38.12% in 2024, driven by rapid industrial automation, strong demand for collaborative robots, and widespread adoption of robotic gripping systems across manufacturing sectors

- Industries such as automotive, electronics, and packaging are leading the adoption, benefiting from precision, reliability, and productivity improvements offered by robotic grippers

- The region’s robust technological infrastructure, high R&D investments, and presence of global robotic leaders strengthen its position, with companies increasingly integrating robotic grippers to optimize labor efficiency and meet advanced automation needs

U.S. Robotic Gripper Market Insight

The U.S. robotic gripper market captured the largest revenue share of 78% in 2024 within North America, supported by accelerated adoption of smart factories and Industry 4.0 initiatives. The country’s dominance is reinforced by the presence of key players such as Zimmer Group, SCHUNK, and SMC, alongside strong government initiatives to promote robotics in manufacturing. The surge in demand for automation in logistics, food processing, and healthcare further boosts adoption. In addition, increasing integration of AI-driven gripping solutions for precision and flexibility is expected to propel the U.S. market in the coming years.

Europe Robotic Gripper Market Insight

The Europe robotic gripper market is projected to expand at a notable CAGR during the forecast period, driven by strict safety regulations, automation demand in automotive and electronics, and sustainable manufacturing goals. Countries such as Germany, France, and Italy are at the forefront, with strong adoption in automotive assembly lines and electronics manufacturing. European manufacturers emphasize energy efficiency and eco-friendly robotic grippers, aligning with regional sustainability goals. The rising trend of human-robot collaboration (HRC) in European factories is also a significant growth factor.

U.K. Robotic Gripper Market Insight

The U.K. robotic gripper market is anticipated to grow at a strong CAGR, fueled by the government’s “Made Smarter” initiative and the rising adoption of automation in packaging, logistics, and electronics. Growing concerns about workforce shortages and demand for flexible, reconfigurable robotic solutions are driving adoption. The U.K.’s strong e-commerce and warehousing infrastructure also plays a key role, as robotic grippers are widely deployed in order fulfillment and packaging operations.

Germany Robotic Gripper Market Insight

The Germany robotic gripper market is expected to expand significantly, owing to its role as a global leader in industrial automation and robotics engineering. German manufacturers, particularly in automotive and machinery, are increasingly deploying robotic grippers for precision assembly, welding, and inspection tasks. The country’s emphasis on Industrie 4.0 and sustainability drives innovation, with demand for lightweight, energy-efficient, and adaptive gripping technologies. Collaborative robots equipped with advanced grippers are being rapidly adopted in both SMEs and large-scale enterprises.

Which Region is the Fastest Growing Region in the Robotic Gripper Market?

The Asia-Pacific robotic gripper market is projected to grow at the fastest CAGR of 8.54% between 2025 and 2032, fueled by rapid industrialization, urbanization, and automation adoption across industries such as automotive, electronics, and logistics. Countries such as China, Japan, South Korea, and India are leading this surge, supported by government-backed manufacturing initiatives, growing robotics adoption in SMEs, and the availability of cost-effective solutions from regional manufacturers. APAC’s emergence as a global manufacturing hub further accelerates demand, with increasing investment in smart factories and advanced automation systems.

Japan Robotic Gripper Market Insight

The Japan robotic gripper market is advancing quickly due to its robotics-driven industrial culture and rising demand for automation in electronics, healthcare, and precision engineering. The country’s aging workforce encourages businesses to invest in robotic grippers to maintain productivity. Integration with IoT and AI-driven robotics systems is fueling efficiency, while adoption in logistics and food packaging industries continues to expand. Japan’s expertise in advanced robotics technology ensures strong long-term growth.

China Robotic Gripper Market Insight

The China robotic gripper market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its expanding industrial base, rising labor costs, and strong government support for smart manufacturing through “Made in China 2025”. The market benefits from widespread deployment of robotic grippers in automotive, electronics assembly, and consumer goods manufacturing. Local companies are increasingly developing affordable, high-quality grippers, enhancing accessibility for SMEs. In addition, China’s push toward smart cities and automated logistics strengthens market growth.

Which are the Top Companies in Robotic Gripper Market?

The Robotic Gripper industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- FANUC Corporation (Japan)

- Nachi Robotic Systems, Inc. (Japan)

- Rethink Robotics (U.S.)

- KUKA AG (Germany)

- Robert Bosch GmbH (Germany)

- Kawasaki Heavy Industries, Ltd (Japan)

- Precise Automation, Inc. (U.S.)

- MRK-Systeme GmbH (Germany)

- Energid Technologies Corporation (U.S.)

- F&P Robotics AG (Switzerland)

- Productive Robotics, Inc. (U.S.)

- MABI ROBOTIC AG (Switzerland)

- Quanta Storage Inc. (Taiwan)

- Franka Emika GmbH (Germany)

- AUBO Robotics (China)

- Techman Robots (Taiwan)

- Stäubli International AG (Switzerland)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Comau S.p.A. (Italy)

- Teradyne Inc. (U.S.)

- Automatica Kassow Robots (Denmark)

- Vecna (U.S.)

- Robotiq Inc. (Canada)

- OMRON Corporation (Japan)

What are the Recent Developments in Global Robotic Gripper Market?

- In September 2024, researchers from the Japan Advanced Institute of Science and Technology (JAIST) introduced the innovative soft robotic gripper named ROtation-based Squeezing grippEr (ROSE), designed to handle complex shapes, varying sizes, and delicate crops. This breakthrough provides an efficient solution to the limitations of conventional robotic grippers in agriculture, paving the way for more reliable and sustainable crop harvesting

- In August 2024, the Singapore University of Technology and Design (SUTD) unveiled a soft gripper developed for versatile applications across multiple industries, earning the prestigious Iron A' Design Award. This achievement highlights SUTD’s unique integration of design and technology in research, accelerating the transformation of prototypes into commercially viable products for broader industry use

- In April 2024, Soft Robotics Inc. announced the expansion of its mGrip Modular Gripping System with enhanced features, including an IP69K rating, enabling safe handling of proteins and dairy products. These improvements give machine builders greater flexibility in creating durable end-of-arm tools capable of withstanding high-pressure washdown environments, thereby strengthening automation in the food sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotic Gripper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Gripper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Gripper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.