Global Ruminant Feed Fat And Proteins Market

Market Size in USD Billion

CAGR :

%

USD

4.60 Billion

USD

7.05 Billion

2024

2032

USD

4.60 Billion

USD

7.05 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 7.05 Billion | |

|

|

|

|

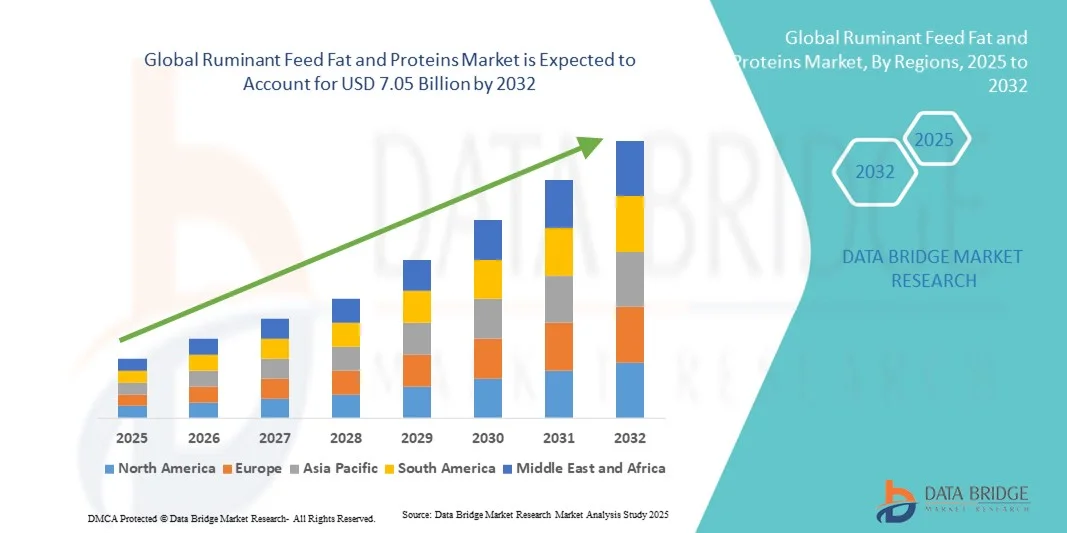

What is the Global Ruminant Feed Fat and Proteins Market Size and Growth Rate?

- The global ruminant feed fat and proteins market size was valued at USD 4.6 billion in 2024 and is expected to reach USD 7.05 billion by 2032, at a CAGR of 5.50% during the forecast period

- Increasing awareness among the people regarding the role of nutritional feed products in well-being of the animals, increasing demand for milk and milk products, rapid industrialization of animal husbandry, adoption of animal protein and fat in processed food products are some of the major as well as impactful factors which will likely to uplift the growth of the ruminant feed fat and proteins market

What are the Major Takeaways of Ruminant Feed Fat and Proteins Market?

- Development in the rendering industry, rising applications from emerging economies which will further contribute by generating immense opportunities that will led to the growth of the ruminant feed fat and proteins market in the above mentioned projected timeframe

- Growing number of environmental concerns along with outbreak of diseases which will such asly to act as market restraints for the growth of the ruminant feed fat and proteins

- Asia-Pacific dominated the ruminant feed fat and proteins market with the largest revenue share of 41.2% in 2024, driven by the region’s expanding livestock production, rising dairy consumption, and increasing awareness of feed quality enhancement

- The North America ruminant feed fat and proteins market is projected to grow at the fastest CAGR of 9.5% from 2025 to 2032, fueled by rising demand for nutrient-rich feed formulations and growing emphasis on improving livestock performance

- The Animal Source segment dominated the market with the largest revenue share of 58.4% in 2024, primarily due to the high concentration of essential fatty acids and amino acids found in tallow, fish oil, and animal by-products

Report Scope and Ruminant Feed Fat and Proteins Market Segmentation

|

Attributes |

Ruminant Feed Fat and Proteins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Ruminant Feed Fat and Proteins Market?

Rising Adoption of Functional and Sustainable Feed Ingredients

- A prominent and accelerating trend in the global ruminant feed fat and proteins market is the growing shift toward functional and sustainable feed ingredients that enhance animal productivity while reducing environmental impact. Manufacturers are increasingly focusing on developing feed formulations with high digestibility, balanced amino acid profiles, and reduced carbon footprints

- For instance, Cargill introduced a new line of sustainable ruminant feed fats derived from renewable sources to help dairy farmers reduce methane emissions and improve milk yield efficiency. Similarly, ADM expanded its functional protein range to support enhanced feed conversion and animal growth rates

- The integration of plant-based and algae-derived proteins and fats is also reshaping feed composition, as these sources offer improved nutritional value and align with global sustainability targets. Producers are leveraging bio-based materials to substitute traditional animal fats, minimizing environmental burdens

- In addition, the increasing use of enzyme technology and encapsulated nutrients ensures optimal nutrient absorption, boosting animal performance and health outcomes. These advancements also address consumer demand for ethically sourced and environmentally friendly animal products

- This shift towards eco-friendly and functional feed innovations is redefining ruminant nutrition standards worldwide. Consequently, companies are investing in R&D and sustainable ingredient sourcing to align with green regulations and growing market preferences for climate-resilient feed solutions

- The focus on sustainability, nutrient efficiency, and animal welfare is expected to remain central to product innovation, driving long-term transformation across the global Ruminant Feed Fat and Proteins industry

What are the Key Drivers of Ruminant Feed Fat and Proteins Market?

- The increasing demand for high-quality dairy and meat products, coupled with rising awareness about animal nutrition and productivity enhancement, is a major driver for the ruminant feed fat and proteins market

- For instance, in March 2024, Bunge Limited launched high-energy fat blends tailored for dairy cattle to improve feed efficiency and lactation performance, reflecting growing investment in performance-boosting feed additives

- The rising prevalence of nutritional deficiencies in ruminants, particularly in developing agricultural economies, is further propelling the adoption of feed fats and proteins. These products offer enhanced energy density and amino acid balance, leading to improved feed conversion ratios

- In addition, technological advancements in feed formulation such as microencapsulation and precision nutrition are enabling better nutrient utilization and digestion, ensuring higher yield and cost efficiency for farmers

- The global focus on sustainable livestock production and regulatory encouragement for efficient feed solutions is also boosting the adoption of premium fat and protein supplements in ruminant diets

- Overall, increasing livestock populations, coupled with a growing emphasis on feed optimization, are expected to accelerate the demand for ruminant feed fat and proteins across both commercial and industrial farming operations

Which Factor is Challenging the Growth of the Ruminant Feed Fat and Proteins Market?

- Volatility in raw material prices and limited availability of high-quality plant and animal-derived sources pose major challenges to the ruminant feed fat and proteins market. The dependence on agricultural commodities such as soybeans, palm oil, and fishmeal makes the market highly sensitive to global supply fluctuations

- For instance, disruptions in palm oil production and trade restrictions in 2023 led to substantial price hikes, increasing feed manufacturing costs and squeezing profit margins for producers

- Furthermore, stringent sustainability regulations and environmental concerns surrounding the use of certain animal-based fats are compelling manufacturers to reformulate products or seek alternative protein sources. This transition requires significant investment and technological adaptation

- The lack of awareness among small-scale farmers regarding the benefits of balanced fat and protein feed supplements also limits market penetration in some regions. Cost-conscious buyers often prioritize cheaper feed options, reducing demand for high-performance formulations

- While global producers are actively developing cost-efficient and sustainable alternatives, addressing raw material volatility, enhancing farmer education, and strengthening supply chain resilience remain crucial for overcoming market restraints

- Continuous innovation, along with improved sourcing transparency and pricing stability, will be essential to ensure sustained growth and competitiveness in the Ruminant Feed Fat and Proteins industry

How is the Ruminant Feed Fat and Proteins Market Segmented?

The market is segmented on the basis of source and ruminant type.

- By Source

On the basis of source, the ruminant feed fat and proteins market is segmented into Animal, Plant, and Other Sources. The Animal Source segment dominated the market with the largest revenue share of 58.4% in 2024, primarily due to the high concentration of essential fatty acids and amino acids found in tallow, fish oil, and animal by-products. These sources are widely used in dairy and beef feed formulations to enhance milk yield, growth rate, and reproductive performance. In addition, their superior digestibility and high energy content make them a preferred choice for livestock nutrition.

The Plant Source segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the rising demand for sustainable and non-GMO feed ingredients. Plant-derived fats and proteins from soybeans, rapeseed, and palm offer eco-friendly alternatives and align with the global shift toward greener feed production. Increasing consumer awareness regarding ethical sourcing is further accelerating plant-based adoption.

- By Ruminant Type

On the basis of ruminant type, the ruminant feed fat and proteins market is segmented into Cattle, Sheep, Goats, Buffalo, Deer, Elk, Giraffes, and Camels. The Cattle segment dominated the market with the largest revenue share of 65.7% in 2024, driven by the high global population of dairy and beef cattle and the increasing need for nutrient-rich feed to support higher milk and meat productivity. Feed fats and proteins play a vital role in improving energy density and metabolic efficiency, directly impacting yield performance in cattle farming.

The Sheep segment is expected to record the fastest CAGR during the forecast period (2025–2032), propelled by the growing demand for premium-quality wool and mutton across Asia-Pacific and the Middle East. The rising adoption of balanced feed formulations and nutritional supplements to improve fertility and wool quality is fostering market expansion. In addition, government-backed livestock enhancement programs in developing nations are supporting this growth trend.

Which Region Holds the Largest Share of the Ruminant Feed Fat and Proteins Market?

- Asia-Pacific dominated the ruminant feed fat and proteins market with the largest revenue share of 41.2% in 2024, driven by the region’s expanding livestock production, rising dairy consumption, and increasing awareness of feed quality enhancement. Countries such as China, India, and Australia are witnessing a surge in demand for nutrient-enriched feed formulations that improve animal health and productivity

- The strong presence of local feed manufacturers, favorable government initiatives for livestock development, and growing investments in animal nutrition are accelerating the adoption of ruminant feed fats and proteins

- This dominance is further supported by the increasing shift toward sustainable feed sources and the development of regionally optimized feed blends, positioning Asia-Pacific as a global leader in ruminant nutrition solutions

China Ruminant Feed Fat and Proteins Market Insight

The China Ruminant feed fat and proteins market accounted for the largest market revenue share of 46% in 2024 within Asia-Pacific, driven by a rapidly expanding dairy and beef industry. Government-led initiatives promoting high-quality livestock production and the presence of large-scale feed manufacturers have accelerated market growth. Increasing consumer demand for protein-rich dairy and meat products, coupled with advancements in feed technology and the growing use of plant-based proteins, are propelling market expansion. Moreover, collaborations between domestic producers and international nutrition firms are strengthening China’s position in the regional market.

India Ruminant Feed Fat and Proteins Market Insight

The India market is projected to witness a substantial CAGR during the forecast period, supported by a rapidly growing livestock population and a strong focus on improving milk productivity. Government programs such as the National Dairy Plan and Rashtriya Gokul Mission are fostering the use of balanced feed supplements. Increasing demand for high-energy feed products and the rise of organized dairy farming are also encouraging the adoption of fats and proteins in feed formulations. With expanding distribution networks and technological advancements in feed production, India is emerging as a key market in Asia-Pacific.

Australia Ruminant Feed Fat and Proteins Market Insight

The Australia market is anticipated to experience steady growth through 2032, driven by the country’s well-developed livestock sector and growing export demand for high-quality dairy and beef products. Feed manufacturers are increasingly incorporating animal and plant-based fat sources to enhance energy content in ruminant diets. In addition, rising awareness regarding sustainable feed solutions and feed efficiency optimization is encouraging investments in feed innovations. The country’s advanced agricultural infrastructure and regulatory support further contribute to steady market expansion.

Which Region is the Fastest Growing Region in the Ruminant Feed Fat and Proteins Market?

The North America ruminant feed fat and proteins market is projected to grow at the fastest CAGR of 9.5% from 2025 to 2032, fueled by rising demand for nutrient-rich feed formulations and growing emphasis on improving livestock performance. The expansion of dairy and beef production in the U.S. and Canada, coupled with increasing adoption of precision feeding technologies, is boosting market growth. In addition, the rising trend of sustainable and traceable feed ingredients is influencing feed manufacturers to adopt advanced fat and protein supplements.

U.S. Ruminant Feed Fat and Proteins Market Insight

The U.S. market captured the largest revenue share of 78% in 2024 within North America, driven by the high demand for efficient feed formulations that improve milk yield, fertility, and weight gain. Innovations in encapsulated fat products and protein concentrates, along with strong investments by key feed companies, are driving market growth. Furthermore, increasing awareness of animal welfare and the use of eco-friendly feed additives are influencing purchasing patterns in the livestock industry.

Canada Ruminant Feed Fat and Proteins Market Insight

The Canada market is expected to witness robust growth during the forecast period, supported by the country’s focus on dairy herd improvement and sustainable agriculture practices. Government-backed initiatives for livestock productivity and the growing use of customized feed solutions are driving market expansion. The integration of plant-based fats and protein supplements is also increasing, as producers aim to reduce dependency on imported animal-derived feed ingredients while maintaining nutritional efficiency.

Which are the Top Companies in Ruminant Feed Fat and Proteins Market?

The ruminant feed fat and proteins industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Darling Ingredients Inc. (U.S.)

- The Scoular Company (U.S.)

- Omega Protein Corporation (U.S.)

- Roquette Frères (France)

- AAK AB (Sweden)

- Bunge Limited (U.S.)

- EURODUNA Rohstoffe GmbH (Germany)

- AGRANA Beteiligungs-AG (Austria)

- BRF (Brazil)

- Purina Animal Nutrition LLC. (U.S.)

- Tyson Foods, Inc. (U.S.)

- Smithfield Foods, Inc. (U.S.)

- Wudi Deda Agriculture Co., Limited (China)

- Qingzhou Ekato Commercial Co., Ltd. (China)

- Nutricorn Co., Limited (China)

- Chengdu Chelation Biology Technology Co., Ltd. (China)

- CropEnergies AG (Germany)

- Volac International Ltd. (U.K.)

- Sonac USA LLC (U.S.)

What are the Recent Developments in Global Ruminant Feed Fat and Proteins Market?

- In January 2025, Cargill’s facility in Scotland achieved Aquaculture Stewardship Council (ASC) certification, demonstrating responsible sourcing and processing of ingredients, including fats, for the aquafeed industry, and enhancing traceability and sustainability standards, marking a key milestone in sustainable feed production

- In August 2024, Bunge’s North American refined and specialty oils division launched a new deoiled soybean lecithin line (powdered and granulated) near its Bellevue, Ohio plant, designed to improve feed digestibility and pellet stability, strengthening its position in functional animal feed ingredients

- In February 2024, Cargill expanded its collaboration with fermentation-tech company ENOUGH to advance the production and commercialization of a sustainable fungal protein with a complete amino acid profile, while integrating fat formulations and plant-based ingredients for innovative monogastric feed and alternative-protein solutions, supporting growth in sustainable feed applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.