Global Satellite Payloads Market

Market Size in USD Billion

CAGR :

%

USD

6.25 Billion

USD

25.30 Billion

2024

2032

USD

6.25 Billion

USD

25.30 Billion

2024

2032

| 2025 –2032 | |

| USD 6.25 Billion | |

| USD 25.30 Billion | |

|

|

|

|

Satellite Payloads Market Analysis

The satellite payloads market has experienced significant growth, driven by advancements in satellite technologies and the rising demand for telecommunications, earth observation, and defense applications. Payloads, which include equipment such as communication systems, sensors, and imaging devices, are integral components of satellites, enabling them to perform specific functions. With increased investments in space technology by governments and private companies, the satellite payloads market is expanding rapidly. Technological advancements, such as the development of smaller, more efficient payloads, are fueling the growth of the market. For instance, the rise of software-defined payloads allows for more flexible and reconfigurable satellite operations, increasing the longevity and versatility of satellites. In addition, the growing adoption of small satellites and CubeSats is driving demand for compact, low-cost payloads, offering efficient solutions for various industries, from telecommunications to scientific research. As countries such as the U.S., China, and India continue to invest in space exploration, satellite communication, and defense systems, the market for satellite payloads is expected to grow further. The development of advanced payload technologies will continue to play a crucial role in enabling next-generation space missions and satellite operations across the globe.

Satellite Payloads Market Size

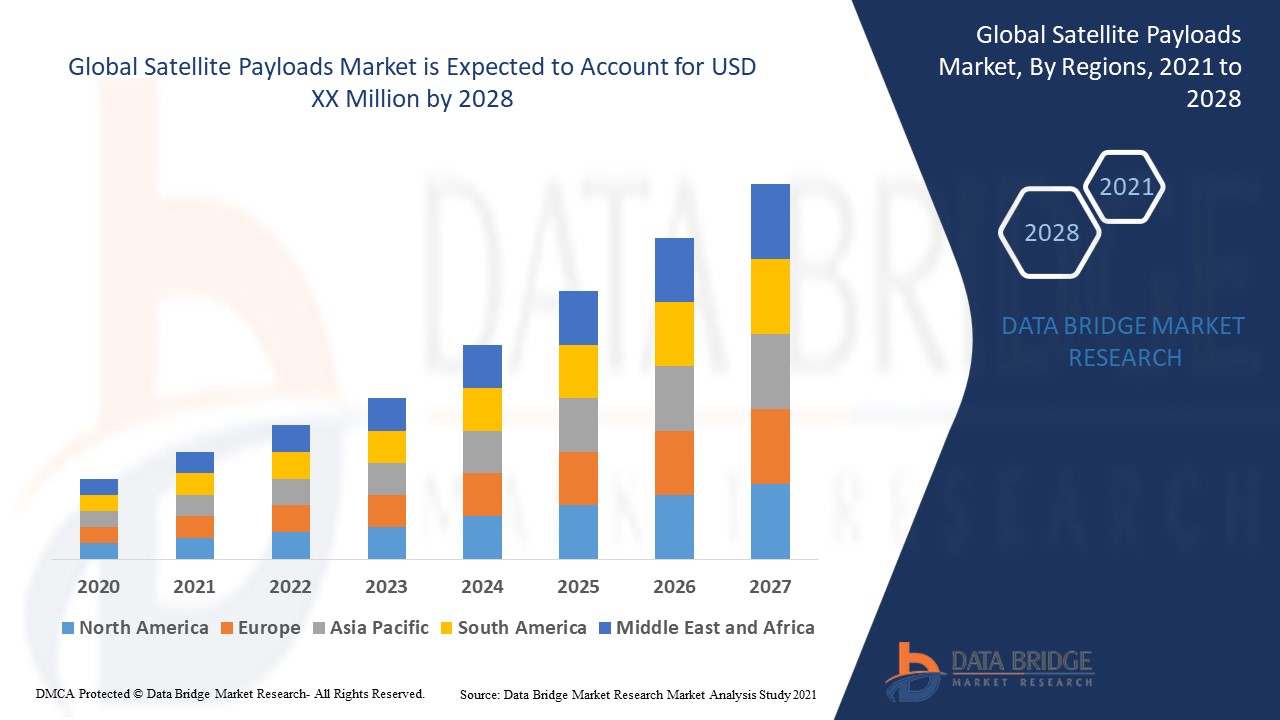

The global satellite payloads market size was valued at USD 6.25 billion in 2024 and is projected to reach USD 25.30 billion by 2032, with a CAGR of 19.10 % during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Satellite Payloads Market Trends

“Increasing Demand for High-Performance Communication”

The satellite payloads market is witnessing significant growth driven by the increasing demand for high-performance communication, earth observation, and defense satellite applications. One notable trend is the rise of software-defined payloads, which allow satellites to reconfigure their operations remotely, offering enhanced flexibility and operational efficiency. This trend is exemplified by Airbus's development of the OneSat satellites, which feature fully reconfigurable payloads that can adapt to changing user requirements in real-time. As more organizations and governments invest in satellite technology, the demand for versatile payloads capable of supporting a variety of functions, such as remote sensing, GPS, and communications, is expected to surge. Furthermore, advancements in miniaturization have led to the growth of small satellites, which require compact, cost-effective payloads. The increased use of small and medium satellites in commercial and defense applications is thus driving the satellite payloads market, with companies such as SpaceX and Lockheed Martin investing heavily in these technologies for future space missions.

Report Scope and Satellite Payloads Market Segmentation

|

Attributes |

Satellite Payloads Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Airbus (France), Boeing (U.S.), Thales (France), Lockheed Martin Corporation (U.S.), Mitsubishi Electric Corporation (Japan), Honeywell International Inc (U.S.), L3Harris Technologies, Inc (U.S.), LUCIX CORPORATION (Japan), SPACEX (U.S.), Intelsat (Luxembourg), Viasat Inc (U.S.), RTX (U.S.), Northrop Grumman (U.S.), SSC (Sweden), Collins Aerospace (U.S.), General Dynamics Mission Systems Inc (U.S.), OneWeb (U.K.), Sierra Nevada Corporation (U.S.), ST Engineering (Singapore), and Surrey Satellite Technology Ltd (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Satellite Payloads Market Definition

Satellite payloads refer to the components or instruments carried by a satellite that are responsible for its primary mission. These payloads are designed to perform specific functions such as communication, imaging, navigation, remote sensing, weather monitoring, or scientific research. Essentially, the payload is the part of the satellite that provides the essential services or data the satellite was launched to deliver.

Satellite Payloads Market Dynamics

Drivers

- Rising Demand for Communication Services

The rising demand for communication services is a major driver in the satellite payloads market, fueled by the increasing need for high-speed internet, broadcasting, and secure communication systems across various sectors, including defense, commercial, and government. With the growing reliance on satellite technology to provide global coverage, especially in remote areas, the demand for communication-specific payloads is accelerating. For instance, communication satellites equipped with high-capacity transponders and antennas, such as those used by companies such as Viasat Inc. and Intelsat, enable seamless global connectivity for broadband services and secure communication for defense operations. This demand is further amplified by the expansion of 5G networks, where satellite payloads play a critical role in extending coverage to underserved regions. As a result, the need for efficient, high-performance satellite payloads for communication purposes is significantly increasing, driving the growth of the market.

- Growing Interest in Space Exploration and Scientific Research

The growing interest in space exploration and scientific research is a key driver for the satellite payloads market, as missions focused on space weather, planetary exploration, and technological advancements require specialized payloads such as scientific instruments and sensors. For instance, NASA's Mars rovers and space telescopes depend heavily on advanced payloads to collect data on planetary surfaces and atmospheric conditions. Similarly, the European Space Agency’s space weather research, which tracks solar radiation and cosmic rays, relies on specialized satellite payloads equipped with sensors that provide critical data for understanding space weather patterns. These payloads are crucial for the success of missions aimed at expanding our knowledge of the universe and enabling technological innovations. As space exploration missions increase, both government and private organizations, such as SpaceX and Lockheed Martin, continue to develop and deploy sophisticated satellite payloads to support scientific endeavors, thereby driving the demand for more advanced technologies and further contributing to the market's growth.

Opportunities

- Growing Demand for Earth Observation and Remote Sensing

The growing demand for earth observation and remote sensing is creating a significant market opportunity for satellite payloads, driven by the increasing need for accurate climate monitoring, environmental surveillance, and disaster management. Specialized payloads equipped with advanced imaging and sensing technologies, such as synthetic aperture radar (SAR) and multispectral cameras, are becoming crucial for applications such as tracking deforestation, monitoring weather patterns, and assessing natural disasters. For instance, satellites equipped with these payloads, such as those launched by companies such as Airbus and Lockheed Martin, are used by governments and research organizations to gather real-time data for climate change studies and agricultural monitoring. This shift toward high-resolution, data-rich satellite payloads is expanding the scope of satellite-based services and fueling innovation in payload technology. As the demand for precise, timely data continues to grow, satellite payloads designed for earth observation are seen as a promising market opportunity, driving investment and development in this field.

- Increasing Supportive Government Initiatives and Space Policies

Government initiatives and space policies are creating a significant market opportunity for satellite payloads, as governments worldwide continue to invest in satellite technologies for national security, communication, and scientific research. For instance, NASA's space programs, including the Artemis mission to the Moon and Mars exploration initiatives, require advanced payloads to gather crucial data for planetary exploration and environmental monitoring. Similarly, defense-related satellite launches, such as those supported by the U.S. Department of Defense, require high-performance payloads for secure communication and surveillance. These investments in space infrastructure are fostering demand for cutting-edge satellite payloads, including those for Earth observation, navigation, and scientific research. Governments are also encouraging collaboration between the private sector and space agencies, as seen with contracts awarded to companies such as SpaceX, Lockheed Martin, and Thales. As governments continue to prioritize space exploration and national security, the market for advanced satellite payloads is expected to expand, driving innovation and creating new opportunities in the satellite industry.

Restraints/Challenges

- High Development Costs

High development costs and limited payload capacity are significant challenges in the satellite payloads market. Developing satellite payloads demands substantial investment in research, technology, and manufacturing, with costs rising due to the need for advanced materials and precision engineering. For instance, designing high-performance communication or imaging payloads requires intricate technological solutions, which increase both initial and operational expenses. In addition, the limited payload capacity of satellites restricts the weight and size of components that can be launched, limiting the potential for larger or more complex payloads. This results in a need for highly efficient design solutions to optimize payloads while staying within size and weight constraints. These challenges impact the growth of the market, particularly for smaller or emerging space companies aiming to compete with established players.

- Lack of Highly Skilled Workforce

The need for a highly skilled workforce is a significant challenge in the satellite payloads market, as the development, integration, and operation of payload systems require specialized expertise in fields such as aerospace engineering, electronics, and data processing. For instance, designing payloads for scientific satellites or military applications demands a deep understanding of both cutting-edge technology and space mission requirements. However, the limited availability of qualified professionals in this niche field makes it difficult for companies to scale up operations, leading to increased costs and potential delays in satellite launches.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Satellite Payloads Market Scope

The market is segmented on the basis of type, satellite, orbit, frequency, applications, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Communication

- Imagery

- Software-defined Payload

- Navigation

- Radar

- Automatic Identification System

- Scientific/Technical

Satellite

- CubeSat

- Small Satellite

- Medium Satellite

- Large Satellite

Orbit

- Low Earth Orbit (LEO)

- Geosynchronous Earth Orbit (GEO)

- Beyond Geosynchronous Orbit (GEO)

- Medium Earth Orbit (MEO)

Frequency

- S-band

- L-band

- C-band

- X-band

- Ku-band

- Ka-band

- Q/V-band

- VHF/UHF-band

- SHF/EHF-band

Applications

- Communication

- Earth Observation and Remote Sensing

- Mapping and Navigation

- Surveillance and Security

- Meteorology

- Scientific Research and Exploration

- Space Observation

- Exploration Of Outer Planets

End User

- Commercial

- Government and Defence

- Dual Users

Satellite Payloads Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, satellite, orbit, frequency, applications, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the satellite payloads market due to its access to cutting-edge technologies and substantial investments in space-related advancements. The region benefits from a strong infrastructure, with leading companies and government agencies such as NASA driving innovation in satellite payload development. In addition, increased funding for space exploration and commercial satellite launches further propels market growth. As a result, North America remains at the forefront of the satellite payloads market, fostering a competitive edge in both military and civilian satellite applications.

Asia-Pacific is projected to experience highest growth in the satellite payloads market from 2025 to 2032, driven by a surge in investments in earth observation and telecommunication satellites in rapidly developing nations such as India and China. The region's expansion is further fueled by the growing adoption of advanced technologies and a rising demand for enhanced communication and data transmission capabilities. In addition, the increasing focus on space exploration and infrastructure development in these emerging economies is contributing to the region's rapid advancements in satellite technology. As a result, Asia-Pacific is becoming a key player in the global satellite payloads market, attracting both public and private sector investments.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Satellite Payloads Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Satellite Payloads Market Leaders Operating in the Market Are:

- Airbus (France)

- Boeing (U.S.)

- Thales (France)

- Lockheed Martin Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Honeywell International Inc (U.S.)

- L3Harris Technologies, Inc (U.S.)

- LUCIX CORPORATION (Japan)

- SPACEX (U.S.)

- Intelsat (Luxembourg)

- Viasat Inc (U.S.)

- RTX (U.S.)

- Northrop Grumman (U.S.)

- SSC (Sweden)

- Collins Aerospace (U.S.)

- General Dynamics Mission Systems Inc (U.S.)

- OneWeb (U.K.)

- Sierra Nevada Corporation (U.S.)

- ST Engineering (Singapore)

- Surrey Satellite Technology Ltd (U.K.)

Latest Developments in Satellite Payloads Market

- In March 2021, SKY Perfect JSAT (Japan) entered into an agreement with Airbus to construct the Superbird-9, a fully digital telecommunications satellite with in-orbit reconfigurability. The total investment, including the contract, is projected to be around USD 273.95 million

- In March 2021, Lockheed Martin (U.S.) secured contracts worth USD 7.8 billion, the first to develop three geostationary satellites, along with a separate contract modification for the manufacturing, assembly, integration, and testing processes

- In February 2021, L3Harris was awarded a USD 137 million contract from Lockheed Martin to provide four digital payloads for GPS navigation satellites

- In January 2021, Airbus signed an agreement with Intelsat to develop two OneSat satellites, which will operate in multiple frequency bands for Intelsat’s next-generation software-defined network. These satellites are expected to be delivered by 2023

- In January 2021, the Space Development Agency granted SpaceX a USD 149 million contract and L3Harris a USD 193.5 million contract to each build four satellites aimed at detecting and tracking ballistic and hypersonic missiles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.