Global Secure Sockets Layer Certification Market

Market Size in USD Billion

CAGR :

%

USD

209.44 Billion

USD

518.57 Billion

2024

2032

USD

209.44 Billion

USD

518.57 Billion

2024

2032

| 2025 –2032 | |

| USD 209.44 Billion | |

| USD 518.57 Billion | |

|

|

|

|

Secure Sockets Layer Certification Market Size

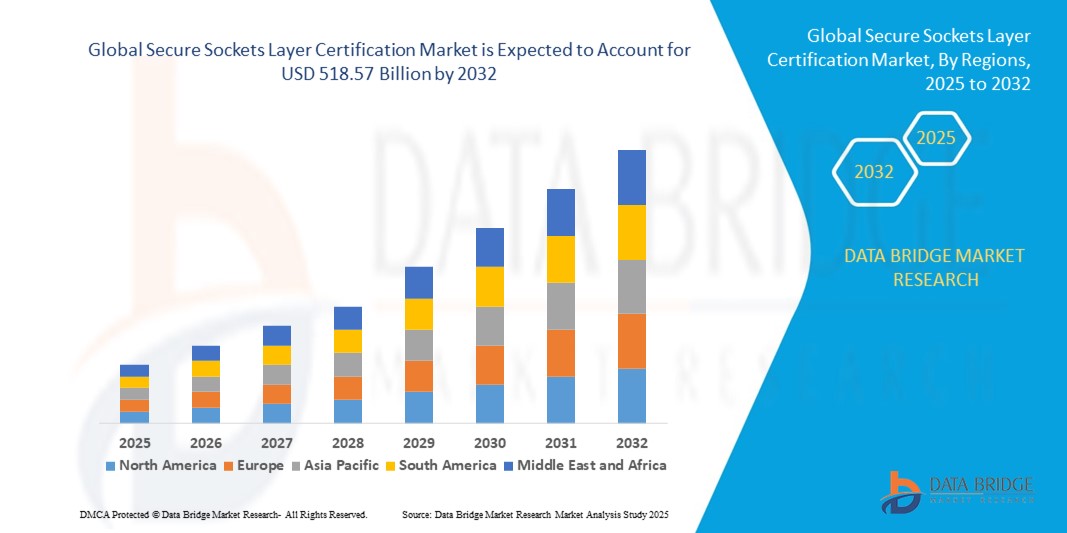

- Global secure sockets layer certification market size was valued at USD 209.44 Billion in 2024 and is projected to reach USD 518.57 Billion by 2032, with a CAGR of 12.00% during the forecast period of 2025 to 2032.

- The global Secure Sockets Layer (SSL) certification market is driven by the rising demand for data security amid increasing cyber threats, growing digital transactions, and the expansion of online services across industries such as e-commerce, banking, and healthcare.

- The push for data privacy regulations such as GDPR in Europe and similar initiatives worldwide further fuels market growth

Secure Sockets Layer Certification Market Analysis

- SSL certificates, which enable encrypted and authenticated connections between web servers and browsers, have become critical components of online security frameworks across industries, especially in financial services, healthcare, e-commerce, and government sectors where the protection of sensitive data is paramount

- The increasing demand for secure sockets layer certification is primarily driven by rising cybersecurity threats, the growing emphasis on digital trust, and regulatory requirements for encrypted data transmission under frameworks such as GDPR, HIPAA, and PCI-DSS

- North America dominated the secure sockets layer certification market with the largest revenue share of 42.3% in 2024, driven by stringent regulatory frameworks, high internet penetration, and the growing need for secure digital communication across enterprises and public sectors

- Asia-Pacific secure sockets layer certification market is forecast to grow at the fastest CAGR of 8.6% from 2025 to 2032, driven by increasing digitization, expanding internet usage, and rising concerns over cybercrime

- The DV certificates segment dominated the market with the largest market revenue share of 46.7% in 2024, driven by their affordability, quick issuance, and wide adoption among SMEs and personal websites

Report Scope and Global Secure Sockets Layer Certification Market Segmentation

|

Attributes |

Global Secure sockets layer certification Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Secure Sockets Layer (SSL) Certification Market Trends

Seamless Integration with Automation and Cloud Security Platforms

- A significant and accelerating trend in the global secure sockets layer certification market is the growing integration of SSL lifecycle management with automated tools and cloud-based security platforms. This integration is dramatically enhancing efficiency, compliance, and overall digital trust across diverse IT environment

- For instance, platforms such as DigiCert ONE and Sectigo Certificate Manager offer automated certificate issuance, renewal, and revocation, minimizing human error and preventing service disruptions caused by expired certificates. These tools integrate seamlessly with DevOps workflows, cloud services, and IT service management systems, enabling centralized control of digital certificates across complex infrastructure

- Automation reduces the operational burden and enhances security posture by ensuring timely updates and compliance with corporate and regulatory policies. Many enterprise platforms now support APIs and policy-based automation, allowing certificates to be provisioned automatically in response to changes in the IT environment

- In addition, SSL certificates are increasingly being embedded into broader cybersecurity architectures such as Zero Trust models, where continuous identity verification and encrypted communication are essential. Integration with cloud-native solutions—such as secure email gateways, application delivery controllers, and endpoint security platforms—further elevates their role in holistic threat mitigation

- This seamless alignment of SSL with cloud, automation, and identity solutions is transforming how businesses manage digital trust at scale. Providers such as Entrust and GlobalSign are expanding their offerings to include end-to-end visibility, analytics, and orchestration features that support multi-cloud and hybrid deployments

- As enterprises increasingly prioritize speed, scalability, and secure digital operations, the demand for SSL solutions that offer automated management, cloud integration, and enhanced interoperability is growing rapidly across sectors including finance, healthcare, e-commerce, and government

SSL Certification Market Dynamics

Driver

Growing Need for Data Privacy and Regulatory Compliance

- The rising incidence of cyberattacks, data breaches, and online fraud is driving organizations to adopt SSL certificates as a foundational layer of digital trust. Securing data in transit through robust encryption is essential for protecting sensitive customer information and complying with data privacy regulations

- For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the U.S., and the Personal Data Protection Bill in India mandate strong encryption practices, pushing companies to implement secure sockets layer certification across their digital assets

- In addition, secure sockets layer certification help authenticate websites, reduce phishing risks, and build user confidence—critical in sectors such as banking, healthcare, e-commerce, and government services. The increasing use of online platforms for financial transactions and personal data exchange further amplifies the need for secure digital communication

- The shift to remote work and cloud computing has also expanded the enterprise attack surface, prompting greater investment in secure sockets layer technologies to ensure end-to-end protection of online systems. Enterprises now prioritize organization and extended validation certificates for internal and customer-facing applications asuch as

- As cybersecurity awareness rises and regulations tighten globally, SSL certificates are no longer optional but essential, accelerating their adoption as part of broader information security strategies.

Restraint/Challenge

Complexity in Management and Threats from Free Alternatives

- Despite their importance, secure sockets layer certification pose management challenges, especially for enterprises handling hundreds or thousands of certificates across domains, servers, and geographies. Without centralized oversight and automated tools, expired or misconfigured certificates can lead to outages, security lapses, and compliance violations

- In addition, the rise of free secure sockets layer certification providers such as Let’s Encrypt has disrupted traditional revenue models for certificate authorities. While these free certificates increase accessibility, they may lack advanced features, warranties, and enterprise-level support, raising concerns about misuse or limited suitability for high-security environments

- Organizations face a balancing act between cost and security. Premium SSL certificates with extended validation, multi-domain coverage, or advanced support often come at a higher price, which may deter adoption among small businesses or cost-sensitive sectors

- Moreover, some threat actors have been found to exploit free or poorly validated certificates to mask malicious websites, undermining user trust in basic SSL indicators such as padlocks or HTTPS URLs

- To address these issues, vendors are investing in enterprise-grade management platforms, offering enhanced visibility, automation, and reporting tools. Educating users on the differences between certificate types and the benefits of high-assurance options is also key to rebuilding trust and reinforcing market value

Secure Sockets Layer Certification Market Scope

The market is segmented on the basis of certificate type, validation level, subscription duration, validation process, encryption strength, organization size, end user, and industry vertical.

- By Certificate Type

On the basis of certificate type, the secure sockets layer certification market is segmented into Domain Validated (DV) Certificates, Organization Validated (OV) Certificates, and Extended Validation (EV) Certificates. The DV certificates segment dominated the market with the largest market revenue share of 46.7% in 2024, driven by their affordability, quick issuance, and wide adoption among SMEs and personal websites. DV certificates are widely preferred by small businesses and startups seeking basic encryption without lengthy validation.

The EV certificates segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by increasing demand from e-commerce, banking, and financial services sectors where higher trust indicators such as the green address bar and extended organization validation are critical. Large enterprises prefer EV certificates to boost customer trust, ensure compliance, and secure sensitive transactions.

- By Validation Level

On the basis of validation level, the market is segmented into Single Domain SSL Certificates, Multi-Domain SSL Certificates (SAN Certificates), and Wildcard SSL Certificates. The Single Domain SSL Certificates segment held the largest market revenue share of 41.3% in 2024, driven by its cost-effectiveness and suitability for businesses securing one primary domain. These certificates are widely adopted by SMEs, bloggers, and small e-commerce websites that require a straightforward security solution.

The Multi-Domain SSL Certificates (SAN Certificates) segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, as organizations increasingly manage multiple domains, subdomains, and websites under one certificate. This cost and time efficiency, combined with centralized management, is fueling rapid adoption in large enterprises, IT service providers, and global corporations.

- By Subscription Duration

On the basis of subscription duration, the secure sockets layer certification market is segmented into 1-Year, 2-Year, and More than 2-Year subscriptions. The 1-Year segment dominated the market with the largest revenue share of 52.5% in 2024, as shorter terms are preferred for flexibility, regulatory compliance, and frequent security updates. The shorter cycle also ensures businesses can respond quickly to evolving cyber threats and changes in certificate authorities’ policies.

The 2-Year subscription segment is projected to register the fastest CAGR of 17.6% during 2025–2032, driven by demand for cost savings, reduced administrative renewals, and continuous website protection. Enterprises looking for mid-term stability without frequent renewals are increasingly opting for 2-year certificates, especially in industries such as healthcare and e-commerce where constant revalidation is time-consuming.

- By Validation Process

On the basis of validation process, the market is segmented into Manual Validation, Automated Validation, DNS Validation, and Email Validation. The Email Validation segment accounted for the largest market revenue share of 38.9% in 2024, as it is the simplest and most widely used method for issuing SSL certificates, especially in SMEs and low-security applications. Email validation’s ease of use, fast turnaround, and cost-effectiveness make it highly popular.

The Automated Validation segment is projected to grow at the fastest CAGR of 18.9% from 2025 to 2032, driven by enterprises’ increasing need for speed, scalability, and reduction in human errors. Automated validation allows organizations to streamline SSL certificate issuance at scale, supporting DevOps practices and continuous website deployments.

- By Encryption Strength

On the basis of encryption strength, the market is segmented into 128-bit SSL Encryption and 256-bit SSL Encryption. The 256-bit SSL Encryption segment dominated with a revenue share of 57.6% in 2024, driven by the rising need for stronger security protocols in banking, government, and e-commerce applications. Enterprises prefer 256-bit certificates for their enhanced cryptographic strength against modern cyberattacks.

The 128-bit SSL Encryption segment is expected to grow at the fastest CAGR of 16.4% from 2025 to 2032, supported by its continued adoption among SMEs, blogs, and personal websites where moderate encryption suffices at a lower cost. Its balance between performance and security makes it attractive for lightweight applications.

- By Organization Size

On the basis of organization size, the secure sockets layer certification market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. The SME segment dominated the market with a revenue share of 61.2% in 2024, driven by growing digitization among small businesses, rising e-commerce websites, and low-cost SSL solutions such as DV certificates. SMEs prioritize SSL for compliance with search engine requirements and customer trust.

The Large Enterprise segment is expected to witness the fastest CAGR of 18.7% during 2025–2032, fueled by increasing regulatory pressure, higher cybersecurity investments, and the adoption of advanced EV and SAN certificates. Enterprises in BFSI, healthcare, and IT prioritize stronger authentication and multi-domain coverage to safeguard customer data and brand reputation.

- By End User

On the basis of end user, the secure sockets layer certification market is segmented into Business-to-Business (B2B) and Business-to-Consumer (B2C). The B2C segment dominated with 54.8% of market revenue share in 2024, as online retail, fintech, and e-commerce platforms widely adopt SSL certificates to secure transactions and build customer confidence. The rapid growth of digital payments and consumer awareness of security seals also boost adoption.

The B2B segment is projected to grow at the fastest CAGR of 17.2% from 2025 to 2032, driven by demand from IT service providers, SaaS companies, and cloud platforms that require SSL for secure integrations, data exchange, and third-party collaborations.

- By Industry Vertical

On the basis of industry vertical, the secure sockets layer certification market is segmented into Financial Services, Healthcare, Government, E-commerce, Education, Media and Entertainment, and Others. The E-commerce segment accounted for the largest revenue share of 32.6% in 2024, supported by rising online shopping, payment gateway security needs, and customer demand for safe transactions. SSL certificates are essential for cart checkouts, digital wallets, and PCI-DSS compliance.

The Healthcare segment is expected to register the fastest CAGR of 19.4% during 2025–2032, driven by digitization of patient data, telemedicine platforms, and stricter regulations such as HIPAA. Ensuring end-to-end encryption for sensitive medical records and patient communication is driving adoption in this sector.

Secure Sockets Layer (SSL) Certification Market Regional Analysis

- North America dominated the secure sockets layer certification market with the largest revenue share of 42.3% in 2024, driven by stringent regulatory frameworks, high internet penetration, and the growing need for secure digital communication across enterprises and public sectors

- Organizations in the region place strong emphasis on data privacy, secure online transactions, and compliance with standards such as GDPR, HIPAA, and PCI-DSS, fueling demand for robust SSL/TLS certificates

- The proliferation of e-commerce, cloud computing, and financial technology solutions, along with increasing cyber threats, continues to reinforce the critical need for trusted digital identity and encryption technologies

U.S. SSL Certification Market Insight

The U.S. secure sockets layer certification market captured the largest revenue share of 79% in 2024 within North America, driven by a well-established digital infrastructure and growing reliance on secure digital platforms. Enterprises across sectors are prioritizing digital trust to protect customer data and maintain compliance. In addition, the widespread use of web-based services, coupled with increasing adoption of automated certificate lifecycle management, is accelerating market expansion. The U.S. also leads in innovation, with several major certificate authorities headquartered in the country.

Europe SSL Certification Market Insight

The Europe secure sockets layer certification market is projected to grow at a steady CAGR during the forecast period, driven by increasing awareness of cybersecurity, rising cyberattacks, and the enforcement of strict data protection laws such as GDPR. The growing demand for secure transactions in e-commerce, online banking, and public sector services has prompted a surge in SSL adoption. Governments and enterprises across the region are investing in digital security infrastructure to bolster online trust and safeguard sensitive information.

U.K. SSL Certification Market Insight

The U.K. secure sockets layer certification market is expected to grow at a notable CAGR, supported by the expansion of online services in banking, healthcare, and retail. The rising need to protect customer data and ensure secure communication has prompted companies to invest in high-assurance secure sockets layer certificates. The country’s progressive cybersecurity strategies and the presence of a thriving digital economy further drive demand for reliable encryption and authentication solutions.

Germany SSL Certification Market Insight

The Germany secure sockets layer certification market is anticipated to grow significantly during the forecast period, owing to the country's emphasis on data protection, privacy, and compliance. Germany’s industrial and technological sectors are embracing SSL to secure IoT systems, enterprise networks, and online platforms. With a strong regulatory environment and a culture that values data integrity, demand for extended validation and organization validation certificates remains strong, particularly in banking and industrial applications.

Asia-Pacific SSL Certification Market Insight

Asia-Pacific secure sockets layer certification market is forecast to grow at the fastest CAGR of 8.6% from 2025 to 2032, driven by increasing digitization, expanding internet usage, and rising concerns over cybercrime. Countries such as China, India, Japan, and South Korea are experiencing rapid growth in online services, pushing both public and private sectors to adopt encryption technologies. Government-led initiatives promoting digital identity and secure digital infrastructure further support SSL market expansion.

Japan SSL Certification Market Insight

The Japan secure sockets layer certification market is experiencing steady growth due to a high level of digital maturity, increased use of online banking and e-commerce, and a strong cultural focus on security and privacy. Businesses in Japan are increasingly deploying SSL certificates to comply with local data protection norms and enhance customer trust. The integration of SSL into enterprise IT ecosystems and government services is also a key contributor to market expansion.

China SSL Certification Market Insight

The China secure sockets layer certification market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by massive internet user growth, a thriving e-commerce sector, and government initiatives supporting cybersecurity. Local companies and platforms are adopting SSL certificates at scale to comply with evolving security standards and build consumer trust. Domestic certificate authorities and cloud service providers play a crucial role in increasing SSL accessibility and adoption across industries.

Secure Sockets Layer Certification Market Share

Secure sockets layer certification market Leaders Operating in the Market Are:

- DigiCert Inc. (U.S.)

- Entrust Datacard Corporation (U.S.)

- GlobalSign (GMO GlobalSign, Inc.) (Japan)

- Comodo CA (Sectigo) (U.S.)

- Symantec Corporation (Now part of DigiCert) (U.S.)

- GoDaddy Inc. (U.S.)

- Izenpe S.A. (Spain)

- Network Solutions LLC (U.S.)

- T-Systems International GmbH (Germany)

- Actalis S.p.A. (Italy)

- Trustwave Holdings, Inc. (U.S.)

- Certum (Asseco Group) (Poland)

- StartCom (StartCom Certification Authority) (China)

- SwissSign Group AG (Switzerland)

- Buypass AS (Norway)

Latest Developments in Global Secure Sockets Layer Certification Market

- In July 2023, DigiCert Inc., a leading global provider of digital trust solutions, launched an upgraded version of its DigiCert ONE platform, integrating advanced automation and lifecycle management capabilities for SSL/TLS certificates. This development aims to help enterprises manage increasing certificate volumes efficiently, reduce outages, and strengthen overall cybersecurity posture in complex IT environments.

- In June 2023, GlobalSign, a major certificate authority and cybersecurity provider, introduced a new high-assurance SSL certificate package designed specifically for financial institutions and healthcare organizations. The solution includes enhanced encryption, validation, and trust indicators to meet rising compliance demands in heavily regulated sectors.

- In May 2023, Sectigo announced a strategic partnership with Acronis, a global leader in cyber protection, to integrate SSL certificate management into Acronis’ cyber protection platform. This collaboration enhances security for Acronis users by enabling seamless certificate issuance, renewal, and monitoring, directly from within the Acronis environment.

- In April 2023, GoDaddy Inc. expanded its SSL portfolio with the release of a simplified SSL management dashboard for small and medium businesses. The tool helps users easily track, renew, and configure SSL certificates across multiple websites, reducing risk and improving website security with minimal technical expertise required.

- In March 2023, Entrust Corporation launched a new quantum-ready PKI and SSL offering, preparing businesses for the future threat of quantum computing. The new solution is designed to help organizations begin migrating to quantum-resistant algorithms, marking a key milestone in long-term cryptographic security planning.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Secure Sockets Layer Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Secure Sockets Layer Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Secure Sockets Layer Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.