Global Selective Estrogen Receptor Degraders Serd Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

16.46 Billion

2025

2033

USD

4.80 Billion

USD

16.46 Billion

2025

2033

| 2026 –2033 | |

| USD 4.80 Billion | |

| USD 16.46 Billion | |

|

|

|

|

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Size

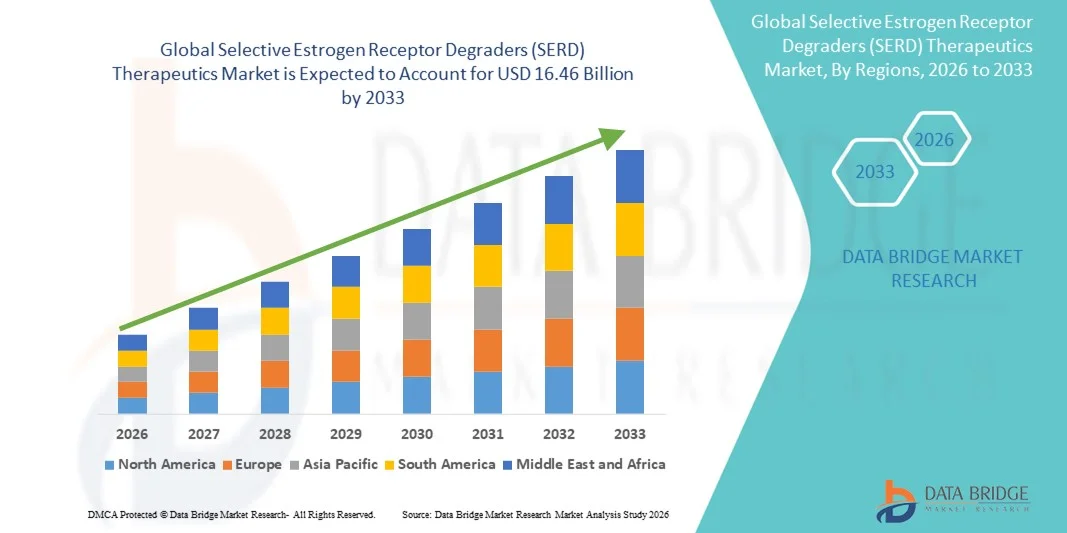

- The global Selective Estrogen Receptor Degraders (SERD) therapeutics market size was valued at USD 4.80 billion in 2025 and is expected to reach USD 16.46 billion by 2033, at a CAGR of 16.66% during the forecast period

- The market growth is largely fueled by the rising incidence of hormone receptor–positive (ER+) breast cancer and technological progress in drug development, including oral SERDs and combination therapies, leading to increased adoption of next-generation endocrine treatments in both clinical and research settings

- Furthermore, rising investment from pharmaceutical companies, growing clinical trial activity, and increasing demand for effective, personalized, and targeted therapies are establishing SERDs as the preferred endocrine treatment option. These converging factors are accelerating the uptake of SERD therapeutics, thereby significantly boosting the industry's growth

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Analysis

- Selective Estrogen Receptor Degraders (SERD) therapeutics, offering targeted degradation of estrogen receptors in hormone receptor–positive breast cancer, are increasingly vital components of modern oncology treatments in both early-stage and advanced settings due to their improved efficacy, oral administration options, and potential for combination with other therapies

- The escalating demand for Selective Estrogen Receptor Degraders (SERD) Therapeutics is primarily fueled by the rising incidence of ER+ breast cancer, growing awareness of targeted therapies, and a preference for more effective and personalized endocrine treatment options

- North America dominated the Selective Estrogen Receptor Degraders (SERD) therapeutics market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key pharmaceutical players

- Asia-Pacific is expected to be the fastest growing region in the Selective Estrogen Receptor Degraders (SERD) therapeutics market during the forecast period due to increasing healthcare access, rising incidence of breast cancer, and growing adoption of advanced oncology therapies

- Faslodex dominated the Selective Estrogen Receptor Degraders (SERD) therapeutics market with a market share of 42.8% in 2025, driven by its established clinical efficacy and widespread use as a first-line treatment

Report Scope and Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Segmentation

|

Attributes |

Selective Estrogen Receptor Degraders (SERD) Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Trends

Advancements in Oral SERDs and Combination Therapies

- A significant and accelerating trend in the global Selective Estrogen Receptor Degraders (SERD) therapeutics market is the rapid development of oral SERDs and their integration with combination therapies such as CDK4/6 inhibitors or targeted monoclonal antibodies. This fusion of therapeutic approaches is significantly enhancing treatment efficacy and patient convenience

- For instance, GDC-9545 and AZD9833 are emerging oral SERDs that allow for easier administration compared to traditional intramuscular injections, providing improved compliance and more flexible dosing schedules. Similarly, RAD1901 is being studied in combination with endocrine therapy for enhanced outcomes in advanced breast cancer

- Oral SERD integration with combination regimens enables features such as improved receptor degradation, overcoming resistance to previous endocrine therapies, and potentially reducing side effects compared to high-dose monotherapies. For instance, clinical trials have shown that SAR439859 combined with palbociclib improves progression-free survival in patients with ER+ breast cancer. Furthermore, oral administration offers patients the ease of self-managed therapy at home

- The seamless integration of SERDs with broader oncology treatment protocols facilitates personalized medicine approaches, allowing oncologists to optimize therapy based on tumor characteristics and prior treatment response, creating a more targeted and effective therapeutic experience

- This trend towards more effective, convenient, and combinable SERD therapies is fundamentally reshaping expectations for hormone receptor–positive breast cancer treatment. Consequently, companies such as Radius Therapeutics are developing oral SERDs with enhanced bioavailability and compatibility with combination regimens

- The demand for SERDs that offer oral administration and combination therapy potential is growing rapidly across both first-line and second-line treatment settings, as patients and clinicians increasingly prioritize efficacy, convenience, and precision therapy options

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Dynamics

Driver

Rising Incidence of ER+ Breast Cancer and Focus on Targeted Therapy

- The increasing prevalence of hormone receptor–positive (ER+) breast cancer, coupled with growing awareness of targeted endocrine therapies, is a significant driver for the heightened demand for SERD therapeutics

- For instance, in April 2025, Radius Therapeutics announced clinical trial progress for their oral SERD pipeline targeting advanced ER+ breast cancer, looking forward to providing more effective and patient-friendly therapy options. Such strategies by key companies are expected to drive market growth in the forecast period

- As patients and clinicians become more focused on personalized and targeted therapy options, SERDs offer advanced features such as oral administration, combination therapy potential, and improved efficacy over traditional treatments, providing a compelling alternative to older endocrine therapies

- Furthermore, the growing emphasis on clinical trial enrollment and accelerated regulatory approvals is making SERDs an integral component of modern oncology treatment protocols, offering seamless integration with other systemic therapies

- The convenience of oral dosing, combination therapy opportunities, and availability across hospital and clinic settings are key factors propelling the adoption of SERD therapeutics in both first-line and second-line treatment. The trend towards patient-centric therapy design and increasing availability of oral SERD options further contribute to market growth

Restraint/Challenge

Drug Resistance and High Development Costs

- Challenges surrounding acquired resistance to SERDs and potential adverse effects pose a significant hurdle to broader market penetration. As tumors evolve, some patients may develop resistance, limiting long-term efficacy and requiring alternative treatment strategies

- For instance, high-profile reports of endocrine therapy resistance in advanced breast cancer have made clinicians cautious about long-term monotherapy with SERDs

- Addressing these resistance concerns through combination therapies, novel drug candidates, and optimized dosing regimens is crucial for maximizing therapeutic outcomes. Companies such as AstraZeneca and Eli Lilly emphasize ongoing R&D and clinical studies to overcome these limitations. In addition, the high cost of drug development, including clinical trials and regulatory approvals, can be a barrier for new entrants and emerging SERD therapies, particularly in cost-sensitive healthcare markets

- While prices for oral SERDs are gradually stabilizing, the perceived premium for novel targeted therapies can still hinder widespread adoption, especially in regions with limited reimbursement coverage

- Overcoming these challenges through innovative drug design, combination strategies, patient support programs, and global access initiatives will be vital for sustained growth of the Selective Estrogen Receptor Degraders (SERD) Therapeutics market

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Scope

The market is segmented on the basis of type, application, end-users, and distribution channel.

- By Type

On the basis of type, the Selective Estrogen Receptor Degraders (SERD) Therapeutics market is segmented into Faslodex, GDC-9545, RAD1901, SAR439859, AZD9833, and Others. The Faslodex segment dominated the market with the largest market revenue share of 42.8% in 2025, driven by its established clinical efficacy, long-standing adoption in first-line and second-line treatments, and broad physician familiarity. Faslodex is widely used in both hospital and clinic settings due to its proven ability to degrade estrogen receptors effectively, particularly in hormone receptor–positive advanced breast cancer. Its dominance is also reinforced by strong global distribution networks and multiple dosing options, allowing treatment customization for patients. Ongoing clinical studies and continued regulatory approvals further solidify Faslodex’s leading position. The segment benefits from a well-documented safety profile, which encourages prescribers to rely on it over newer SERD options.

The GDC-9545 segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of oral SERDs and improved patient compliance. GDC-9545 offers enhanced convenience compared to intramuscular formulations, making it particularly attractive for outpatient treatment and home administration. Its development pipeline shows promising efficacy in combination therapy regimens with CDK4/6 inhibitors, driving interest from oncologists and healthcare providers. The increasing emphasis on targeted therapies in personalized oncology and favorable clinical trial outcomes further accelerate market uptake. In addition, biotech startups and pharmaceutical companies are actively promoting GDC-9545, expanding awareness and accessibility in multiple regions.

- By Application

On the basis of application, the market is segmented into first-line treatment and second-line treatment. The first-line treatment segment dominated the market with a 55% share in 2025, supported by the rising incidence of newly diagnosed ER+ breast cancer cases and the preference of oncologists for initiating therapy with effective SERDs. First-line applications provide patients with improved disease management and delay progression, leading to a higher adoption rate in hospitals and specialty clinics. The availability of oral SERDs for first-line therapy enhances patient adherence, allowing easier monitoring and flexible dosing. Strong clinical evidence supporting progression-free survival benefits in first-line settings further strengthens this segment. The widespread inclusion of SERDs in treatment guidelines and insurance coverage also contributes to dominance.

The second-line treatment segment is expected to witness the fastest CAGR from 2026 to 2033 due to the increasing need for effective therapy options in patients who develop resistance to aromatase inhibitors or tamoxifen. Oral SERDs such as RAD1901 and AZD9833 are being tested in second-line settings, offering targeted degradation with manageable safety profiles. The growing number of patients with advanced or metastatic ER+ breast cancer is driving demand. Second-line therapies are benefiting from accelerated regulatory approvals and increasing inclusion in clinical trial protocols. Hospitals and clinics prefer second-line SERDs for combination therapy potential, further fueling growth in this application segment.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated the market with the largest revenue share of 48% in 2025, supported by the presence of oncology departments capable of administering intravenous or injectable SERDs and monitoring patient outcomes effectively. Hospitals benefit from well-established pharmacy services and access to clinical trial programs, which facilitate the adoption of both established and emerging SERD therapeutics. Patients receiving first-line or advanced therapies often prefer hospital settings for comprehensive care and continuous monitoring. Large hospitals in North America and Europe are leading adopters due to robust healthcare infrastructure, reimbursement coverage, and high treatment affordability. Strategic collaborations between hospitals and pharmaceutical companies for drug access programs further reinforce hospital dominance.

The clinic segment is expected to witness the fastest growth rate from 2026 to 2033 due to the expansion of outpatient oncology services and the increasing availability of oral SERDs that can be administered outside hospital settings. Clinics are leveraging these therapies to provide patient-centric care with easier follow-ups and reduced hospital visits. The growing awareness among clinicians and patients about home-based therapy options is driving adoption. Clinics in emerging markets are rapidly integrating SERDs to improve accessibility and reduce the burden on hospitals. Telemedicine and digital health platforms further enable monitoring of clinic-based SERD administration, enhancing patient compliance and safety.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market with the largest share of 51% in 2025, as it provides direct access to SERDs during patient hospitalization or outpatient visits. Hospital pharmacies ensure controlled dispensing, maintain drug stability, and facilitate adherence monitoring. Large hospitals and oncology centers leverage these pharmacies for stocking both established (Faslodex) and emerging SERDs, aligning with treatment protocols and clinical trial needs. Hospitals also benefit from bulk procurement and reimbursement coverage, making this channel the preferred choice. Strategic partnerships between pharma companies and hospital pharmacy networks further enhance the distribution reach.

The online pharmacy segment is expected to witness the fastest growth rate from 2026 to 2033 due to increasing adoption of e-pharmacy platforms and the rising demand for home delivery of oral SERDs. Patients benefit from convenient access, reduced travel, and discreet delivery, which improves adherence to long-term therapy regimens. Regulatory approvals and digital prescriptions are enabling safer online distribution of prescription SERDs. Online pharmacies are increasingly collaborating with healthcare providers to integrate therapy monitoring, dosage tracking, and patient support programs. This segment is particularly growing in regions with high internet penetration and expanding telemedicine services.

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Regional Analysis

- North America dominated the Selective Estrogen Receptor Degraders (SERD) therapeutics market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high R&D investments, and a strong presence of key pharmaceutical players

- Patients and healthcare providers in the region highly value the clinical efficacy, safety profile, and availability of oral and injectable SERDs, along with their integration into combination therapy protocols for first-line and second-line treatments

- This widespread adoption is further supported by advanced healthcare facilities, strong R&D investment, high awareness of targeted therapies, and favorable reimbursement policies, establishing SERD therapeutics as a preferred treatment option for ER+ breast cancer across hospitals, clinics, and specialty care centers

U.S. Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The U.S. Selective Estrogen Receptor Degraders (SERD) therapeutics market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of hormone receptor–positive (ER+) breast cancer and the rapid adoption of oral SERDs. Patients and oncologists are increasingly prioritizing therapies that provide improved efficacy, safety, and convenience. The growing preference for outpatient and clinic-based treatments, combined with strong demand for combination therapy options, further propels the SERD market. Moreover, ongoing clinical trials and regulatory approvals for novel SERDs are significantly contributing to the market's expansion.

Europe Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The Europe Selective Estrogen Receptor Degraders (SERD) therapeutics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of ER+ breast cancer and the increasing adoption of advanced endocrine therapies. Strong healthcare infrastructure, coupled with supportive insurance coverage, is fostering the uptake of SERDs. European oncologists and patients are drawn to the clinical benefits, convenience of oral administration, and potential for combination therapy with CDK4/6 inhibitors or other targeted agents. The region is experiencing growth across hospital, clinic, and specialty oncology settings.

U.K. Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The U.K. Selective Estrogen Receptor Degraders (SERD) therapeutics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of oral SERDs and targeted endocrine therapies. Rising incidence of ER+ breast cancer and awareness about treatment personalization are encouraging healthcare providers to choose SERDs over traditional therapies. In addition, robust healthcare infrastructure, clinical trial activity, and the country’s strong regulatory framework are expected to continue to stimulate market growth.

Germany Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The Germany Selective Estrogen Receptor Degraders (SERD) therapeutics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of targeted breast cancer therapies and the demand for more effective, patient-centric treatments. Germany’s advanced healthcare system, emphasis on clinical research, and growing adoption of oral SERDs promote market growth, particularly in hospital and clinic settings. The integration of SERDs into combination therapy protocols and personalized oncology plans is also becoming increasingly prevalent, aligning with local clinical practices.

Asia-Pacific Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The Asia-Pacific Selective Estrogen Receptor Degraders (SERD) therapeutics market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing ER+ breast cancer incidence, rising healthcare expenditure, and improved access to advanced oncology treatments in countries such as China, Japan, and India. The region’s growing focus on patient-centric therapies and clinical trial participation is driving adoption. Furthermore, local pharmaceutical manufacturing and expanding distribution networks are enhancing the affordability and availability of SERDs across multiple care settings.

Japan Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The Japan Selective Estrogen Receptor Degraders (SERD) therapeutics market is gaining momentum due to the country’s high focus on advanced healthcare solutions, rising ER+ breast cancer cases, and emphasis on outpatient therapy convenience. The market growth is driven by the integration of oral SERDs with combination treatments and an increasing number of hospital and clinic oncology programs. Japan’s aging population is likely to further spur demand for safer, patient-friendly endocrine therapies in both residential and clinical care.

India Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Insight

The India Selective Estrogen Receptor Degraders (SERD) therapeutics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising awareness of breast cancer, increasing healthcare access, and growing adoption of oral SERDs. India is witnessing expansion across hospital, clinic, and specialty care segments. Government initiatives for cancer care, availability of cost-effective treatment options, and a growing number of domestic pharmaceutical players are key factors propelling market growth.

Selective Estrogen Receptor Degraders (SERD) Therapeutics Market Share

The Selective Estrogen Receptor Degraders (SERD) Therapeutics industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- F. Hoffmann La Roche Ltd (Switzerland)

- Eli Lilly and Company (U.S.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Radius Health, Inc. (U.S.)

- Olema Oncology, Inc. (U.S.)

- G1 Therapeutics, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Dr. Reddy’s Laboratories Ltd (India)

- Glenmark Pharmaceuticals Ltd (India)

- Amneal Pharmaceuticals, Inc. (U.S.)

- HBT Labs, Inc. (U.S.)

- InventisBio, Inc. (U.S.)

- Zenopharm LLC (U.S.)

- Zentalis Pharmaceuticals, Inc. (U.S.)

- EnhancedBio, Inc. (U.S.)

- Arvinas, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Atossa Therapeutics, Inc. (U.S.)

What are the Recent Developments in Global Selective Estrogen Receptor Degraders (SERD) Therapeutics Market?

- In November 2025, Roche announced that in the Phase III lidERA trial, its oral SERD giredestrant (GDC‑9545) demonstrated a statistically significant and clinically meaningful improvement in invasive disease‑free survival (iDFS) versus standard-of-care endocrine therapy in early‑stage ER‑positive, HER2‑negative breast cancer

- In June 2025, AstraZeneca announced positive interim results from the Phase III SERENA-6 trial: switching to camizestrant + a CDK4/6 inhibitor (versus continuing standard aromatase inhibitor + CDK4/6) in first-line treatment reduced risk of progression or death by 56%. The median PFS for the camizestrant arm was 16.0 months vs 9.2 months in the standard-of-care arm

- In May 2025, Olema Oncology announced their selection of 90 mg once-daily dose for palazestrant (OP-1250) in the pivotal Phase III OPERA-01 monotherapy trial. This dosing decision was made in agreement with the FDA, signaling regulatory alignment and increasing confidence in the chosen regimen

- In May 2023, Menarini (Stemline) presented a new subgroup analysis from the EMERALD trial at ASCO 2023, showing that elacestrant may benefit patients without detectable ESR1 mutations who progressed rapidly on a prior CDK4/6 inhibitor. In this analysis, patients who had disease progression within 6 months of prior CDK4/6 inhibitor therapy showed a median PFS of 5.32 months on elacestrant vs 1.87 months on standard-of-care

- In January 2023, the U.S. FDA approved elacestrant (Orserdu, RAD 1901) for ER positive, HER2 negative, ESR1 mutated advanced or metastatic breast cancer in patients whose disease progressed after at least one line of endocrine therapy. This was a landmark approval because elacestrant is an oral SERD, making it more convenient than older injectable endocrine therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.