Global Sepsis Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

2.27 Billion

2025

2033

USD

1.23 Billion

USD

2.27 Billion

2025

2033

| 2026 –2033 | |

| USD 1.23 Billion | |

| USD 2.27 Billion | |

|

|

|

|

Sepsis Diagnostics Market Size

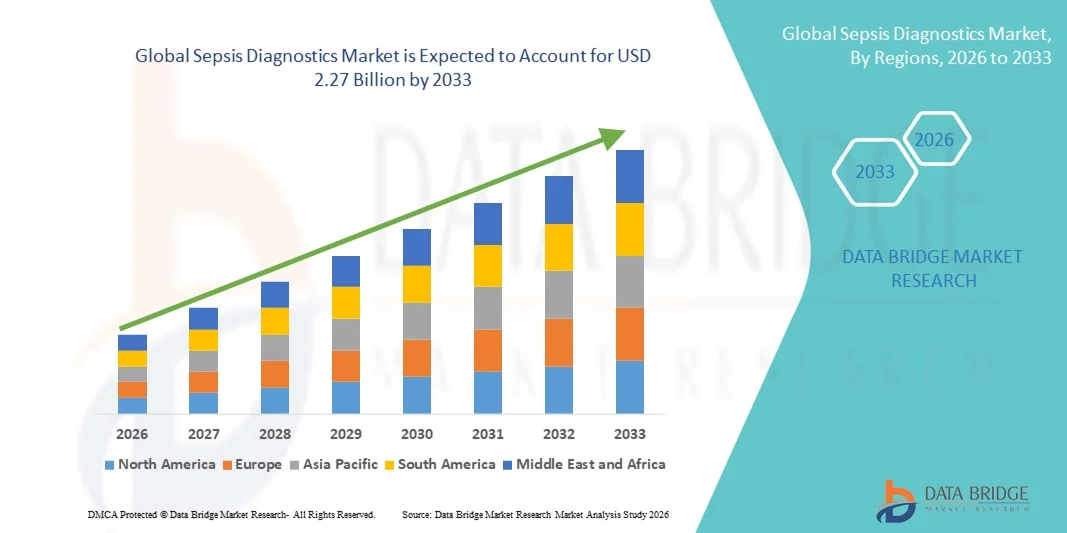

- The global sepsis diagnostics market size was valued at USD 1.23 billion in 2025 and is expected to reach USD 2.27 billion by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by the rising global incidence of sepsis, increasing hospital-acquired infections, and growing awareness regarding the importance of early and accurate diagnosis, leading to greater adoption of advanced molecular and biomarker-based diagnostic technologies across healthcare settings

- Furthermore, continuous technological advancements in rapid diagnostic platforms, expanding investments in critical care infrastructure, and strong government initiatives aimed at reducing sepsis-related mortality are establishing sepsis diagnostics as an essential component of modern clinical decision-making. These converging factors are accelerating the demand for innovative diagnostic solutions, thereby significantly boosting the industry's growth

Sepsis Diagnostics Market Analysis

- Sepsis diagnostics, encompassing molecular assays, immunoassays, blood culture systems, and biomarker-based tests for the early and accurate detection of systemic infections, are increasingly vital components of modern critical care and emergency medicine in hospitals and diagnostic laboratories due to their ability to enable timely therapeutic intervention and reduce mortality rates

- The escalating demand for sepsis diagnostics is primarily fueled by the rising global burden of sepsis, increasing prevalence of hospital-acquired infections, growing antimicrobial resistance, and a heightened emphasis on rapid and precise diagnosis to improve patient outcomes and optimize antibiotic stewardship programs

- North America dominated the sepsis diagnostics market with the largest revenue share of 44.2% in 2025, characterized by advanced healthcare infrastructure, high awareness among clinicians, and strong presence of leading diagnostic companies, with the U.S. witnessing substantial adoption of rapid molecular and biomarker-based testing solutions supported by government initiatives aimed at reducing sepsis-related deaths

- Asia-Pacific is expected to be the fastest growing region in the sepsis diagnostics market during the forecast period due to expanding healthcare infrastructure, rising incidence of infectious diseases, and increasing government investments in improving hospital diagnostic capabilities

- Molecular diagnostics segment dominated the sepsis diagnostics market with a market share of 46.5% in 2025, driven by its superior sensitivity, reduced turnaround time, and ability to identify pathogens and resistance markers more accurately compared to conventional blood culture methods

Report Scope and Sepsis Diagnostics Market Segmentation

|

Attributes |

Sepsis Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Sepsis Diagnostics Market Trends

Accelerated Adoption of Rapid Molecular and Biomarker-Based Testing

- A significant and accelerating trend in the global sepsis diagnostics market is the increasing adoption of rapid molecular assays and advanced biomarker-based testing platforms such as procalcitonin (PCT) and interleukin markers. This convergence of technologies is significantly improving early detection capabilities and clinical decision-making in critical care settings

- For instance, leading diagnostic companies such as bioMérieux have expanded rapid molecular testing panels for bloodstream infections, enabling faster pathogen identification and antimicrobial resistance detection directly from positive blood cultures. Similarly, Roche Diagnostics continues to enhance its automated platforms to support timely sepsis-related biomarker analysis

- The integration of multiplex PCR systems and automated immunoassay analyzers enables reduced turnaround times, improved sensitivity, and earlier initiation of targeted therapy. For instance, certain platforms combine pathogen detection with resistance gene identification, allowing clinicians to make more informed treatment decisions and reduce inappropriate antibiotic usage

- The seamless incorporation of rapid sepsis diagnostics into hospital laboratory information systems and antimicrobial stewardship programs facilitates centralized monitoring and data-driven clinical workflows. Through integrated digital reporting, healthcare providers can coordinate diagnostic insights with intensive care protocols and infection control strategies, creating a more responsive and efficient care environment

- This trend toward faster, more precise, and technology-driven diagnostic solutions is fundamentally reshaping expectations for sepsis management in hospitals. Consequently, companies such as Thermo Fisher Scientific are advancing molecular diagnostic instruments designed to support high-throughput testing and improved workflow efficiency in acute care settings

- The demand for rapid and highly accurate sepsis diagnostic solutions is growing steadily across developed and emerging healthcare markets, as providers increasingly prioritize early intervention, reduced mortality rates, and optimized antibiotic stewardship practices

Sepsis Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Sepsis Incidence and Emphasis on Early Intervention

- The increasing global burden of sepsis cases, combined with stronger clinical emphasis on early diagnosis and timely therapeutic intervention, is a significant driver for the heightened demand for advanced sepsis diagnostic solutions

- For instance, in September 2023, U.S. Food and Drug Administration cleared new rapid diagnostic assays aimed at improving bloodstream infection detection, supporting hospitals in accelerating treatment decisions and improving patient outcomes

- As healthcare systems recognize the high mortality and economic burden associated with delayed sepsis diagnosis, hospitals are investing in rapid testing technologies that enable earlier pathogen identification and targeted antimicrobial therapy, reducing intensive care stays and complications

- Furthermore, the increasing implementation of antimicrobial stewardship programs and government-led initiatives to reduce sepsis-related deaths are encouraging healthcare facilities to adopt advanced molecular and biomarker-based diagnostics as standard practice

- The rising incidence of antimicrobial resistance (AMR) worldwide is increasing the need for precise and rapid pathogen identification, thereby driving demand for advanced molecular and resistance-marker-based sepsis diagnostic tools

- Increasing healthcare expenditure and modernization of hospital laboratory infrastructure across emerging economies are encouraging procurement of automated blood culture systems and multiplex PCR platforms for improved sepsis management

- The ability to obtain faster and more reliable diagnostic insights, along with improved workflow automation in hospital laboratories, is a key factor propelling the adoption of modern sepsis diagnostic systems across tertiary care centers and emergency departments. The expansion of critical care infrastructure in emerging economies further contributes to market growth

Restraint/Challenge

High Testing Costs and Infrastructure Limitations

- Concerns surrounding the high cost of advanced molecular diagnostic platforms and the requirement for specialized laboratory infrastructure pose a significant challenge to broader market penetration, particularly in low- and middle-income regions

- For instance, limited access to fully automated PCR-based systems in smaller hospitals and rural healthcare centers restricts the widespread implementation of rapid sepsis testing despite its clinical benefits

- Addressing cost and infrastructure barriers through scalable testing platforms, reagent rental models, and public–private funding initiatives is crucial for expanding accessibility. Companies such as Danaher Corporation emphasize workflow optimization and modular system designs to improve affordability and laboratory efficiency. In addition, variability in reimbursement policies across different healthcare systems can delay procurement decisions and limit adoption rates

- While technological advancements continue to improve diagnostic accuracy and reduce turnaround times, the need for trained personnel and quality control standards can still hinder rapid deployment in resource-constrained settings

- The lack of standardized diagnostic protocols for sepsis across different healthcare systems can create variability in testing practices, limiting uniform adoption of advanced diagnostic technologies

- Stringent regulatory approval requirements and lengthy validation processes for novel molecular assays may delay product launches and increase development costs, thereby restricting faster market expansion

- Overcoming these challenges through cost-effective innovation, broader reimbursement coverage, and capacity-building initiatives in laboratory infrastructure will be vital for sustained market growth

Sepsis Diagnostics Market Scope

The market is segmented on the basis of techniques and test type.

- By Techniques

On the basis of techniques, the global sepsis diagnostics market is segmented into immunoassay, molecular diagnostic, microbiology, and flow cytometry. The molecular diagnostic segment dominated the market with the largest revenue share of 46.5% in 2025, driven by its superior sensitivity, specificity, and rapid turnaround time compared to conventional diagnostic methods. Molecular platforms such as multiplex PCR enable direct pathogen identification and detection of antimicrobial resistance genes from blood samples, significantly reducing diagnostic delays. Hospitals increasingly prefer molecular assays because early and precise pathogen identification directly impacts survival outcomes in septic patients. The integration of automated molecular systems into hospital laboratories has further strengthened adoption. In addition, strong investments by major diagnostic companies and the expansion of high-throughput testing platforms continue to support segment leadership. The growing emphasis on antimicrobial stewardship programs also reinforces demand for rapid molecular testing solutions in critical care settings.

The immunoassay segment is expected to witness the fastest growth during the forecast period, fueled by the rising use of biomarkers such as procalcitonin (PCT), C-reactive protein (CRP), and interleukins for early sepsis detection. Immunoassay-based testing offers cost-effective and relatively quick results, making it highly suitable for routine screening in hospitals and emergency departments. Increasing clinical awareness regarding biomarker-guided antibiotic therapy is driving wider adoption of immunoassay platforms. Technological advancements in automated immunoassay analyzers are improving accuracy and workflow efficiency. Furthermore, expanding accessibility in emerging economies due to lower infrastructure requirements compared to molecular systems is accelerating growth. The combination of affordability, scalability, and clinical utility positions immunoassays as a rapidly expanding segment within the market.

- By Test Type

On the basis of test type, the global sepsis diagnostics market is segmented into laboratory testing and point of care testing. The laboratory testing segment dominated the market in 2025, supported by the widespread use of centralized laboratory infrastructure in tertiary hospitals and diagnostic centers. Laboratory-based testing allows the use of advanced molecular platforms, automated blood culture systems, and high-throughput immunoassay analyzers for comprehensive pathogen detection. These facilities offer standardized quality control procedures and skilled personnel, ensuring high diagnostic accuracy. The ability to perform multiplex and confirmatory testing within centralized labs strengthens clinical reliability. In addition, hospital-based laboratories are well-integrated with electronic health record systems, facilitating coordinated patient management. Continuous investments in hospital laboratory modernization further reinforce the dominance of this segment.

The point of care testing segment is projected to be the fastest growing during the forecast period, driven by the need for rapid decision-making in emergency departments and intensive care units. Point-of-care platforms enable near-patient testing with significantly reduced turnaround times, which is critical in time-sensitive sepsis management. Technological advancements are leading to the development of compact, user-friendly devices capable of delivering actionable results within hours. Growing demand for decentralized healthcare delivery, particularly in remote and resource-limited settings, is further supporting segment expansion. In addition, the increasing focus on reducing hospital stays and improving workflow efficiency is encouraging adoption of bedside diagnostic solutions. The combination of speed, convenience, and expanding clinical applications positions point of care testing as the fastest-growing segment in the global sepsis diagnostics market.

Sepsis Diagnostics Market Regional Analysis

- North America dominated the sepsis diagnostics market with the largest revenue share of 44.2% in 2025, characterized by advanced healthcare infrastructure, high awareness among clinicians, and strong presence of leading diagnostic companies

- Healthcare providers in the region highly value the rapid turnaround time, high sensitivity, and integration capabilities offered by advanced molecular and biomarker-based diagnostic platforms with hospital laboratory information systems and antimicrobial stewardship programs

- This widespread adoption is further supported by substantial healthcare expenditure, favorable reimbursement frameworks, strong presence of leading diagnostic companies, and ongoing government initiatives focused on reducing sepsis-related mortality, establishing advanced diagnostic solutions as a standard component of hospital-based patient management

U.S. Sepsis Diagnostics Market Insight

The U.S. sepsis diagnostics market captured the largest revenue share within North America in 2025, fueled by the high burden of sepsis cases and strong emphasis on early detection in hospital settings. Healthcare providers are increasingly prioritizing rapid molecular and biomarker-based testing solutions to improve patient survival rates and reduce intensive care unit stays. The growing implementation of antimicrobial stewardship programs, combined with advanced laboratory infrastructure, further propels market expansion. Moreover, support from federal health agencies and continuous product innovations by major diagnostic companies are significantly contributing to the market’s growth across acute care hospitals and emergency departments.

Europe Sepsis Diagnostics Market Insight

The Europe sepsis diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness regarding early sepsis identification and stringent clinical guidelines for infection management. The increase in hospital-acquired infections, coupled with expanding healthcare expenditure, is fostering adoption of advanced diagnostic platforms. European healthcare systems are also focusing on reducing antibiotic misuse through biomarker-guided therapy. The region is experiencing notable growth across tertiary hospitals and centralized laboratories, with sepsis testing increasingly integrated into routine critical care workflows and infection control programs.

U.K. Sepsis Diagnostics Market Insight

The U.K. sepsis diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national healthcare initiatives aimed at improving early recognition and timely treatment of sepsis. In addition, heightened awareness campaigns and standardized hospital protocols are encouraging healthcare providers to adopt rapid diagnostic technologies. The country’s well-structured public healthcare system supports centralized laboratory testing and biomarker utilization. Increasing investments in hospital modernization and digital health integration are expected to continue stimulating demand for advanced sepsis diagnostic solutions across NHS facilities.

Germany Sepsis Diagnostics Market Insight

The Germany sepsis diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure and increasing emphasis on precision diagnostics. Germany’s focus on technological advancement and clinical research promotes the adoption of automated molecular and immunoassay systems in hospitals. The integration of sepsis diagnostics with laboratory information systems and antimicrobial stewardship programs is becoming increasingly prevalent. A strong preference for high-quality, accurate, and regulatory-compliant medical technologies aligns with local healthcare standards, supporting sustained market development.

Asia-Pacific Sepsis Diagnostics Market Insight

The Asia-Pacific sepsis diagnostics market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by expanding healthcare infrastructure, rising incidence of infectious diseases, and increasing government initiatives to improve critical care services in countries such as China, Japan, and India. The region's growing healthcare awareness and investments in hospital laboratory capabilities are accelerating adoption of rapid diagnostic platforms. Furthermore, as APAC strengthens its role in medical device manufacturing and distribution, the accessibility and affordability of sepsis diagnostic solutions are expanding to a broader patient population.

Japan Sepsis Diagnostics Market Insight

The Japan sepsis diagnostics market is gaining momentum due to the country’s advanced healthcare system, aging population, and strong demand for early-stage disease detection. The Japanese market places significant emphasis on precision medicine and infection control, driving the adoption of rapid molecular and biomarker-based testing solutions. Integration of sepsis diagnostics with automated laboratory systems and digital hospital networks is fueling growth. Moreover, Japan’s focus on improving clinical efficiency and reducing hospital stays is likely to spur demand for fast, accurate diagnostic technologies in both public and private healthcare institutions.

India Sepsis Diagnostics Market Insight

The India sepsis diagnostics market accounted for a major revenue share in Asia Pacific in 2025, attributed to the country’s large patient population, rising awareness about infectious diseases, and rapid expansion of private healthcare facilities. India stands as one of the fastest-growing markets for hospital-based diagnostic services, and sepsis testing is becoming increasingly essential in tertiary care centers and multi-specialty hospitals. Government initiatives to strengthen healthcare infrastructure, along with increasing availability of cost-effective diagnostic platforms and growing domestic manufacturing capabilities, are key factors propelling the market in India.

Sepsis Diagnostics Market Share

The Sepsis Diagnostics industry is primarily led by well-established companies, including:

- BIOMÉRIEUX (France)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Danaher (U.S.)

- BD (U.S.)

- Bruker Corporation (U.S.)

- DiaSorin S.p.A. (Italy)

- Luminex Corporation (U.S.)

- T2 Biosystems, Inc. (U.S.)

- Immunexpress, Inc. (U.S.)

- Cytovale, Inc. (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Cepheid (U.S.)

- Siemens Healthineers AG (Germany)

- Accelerate Diagnostics, Inc. (U.S.)

- Abionic SA (Switzerland)

- Response Biomedical Corp. (Canada)

- Seegene Inc. (South Korea)

- QuidelOrtho Corporation (U.S.)

What are the Recent Developments in Global Sepsis Diagnostics Market?

- In May 2025, researchers developed a low-cost, rapid sepsis diagnostic test using gold nanoparticles at Osmania University, designed for resource-limited settings and delivering results in ~30 minutes, representing innovative advances outside of commercial diagnostics

- In January 2025, Inflammatix received FDA clearance for its first-in-class TriVerity™ test system a molecular blood test that measures immune response gene expression to rapidly differentiate infection type and severity in suspected sepsis patients, enabling faster and more precise clinical decisions

- In October 2024, Abionic’s IVD CAPSULE PSP test received FDA 510(k) clearance for early detection of sepsis, using pancreatic stone protein (PSP) as a biomarker to identify sepsis risk 24-48 hours earlier than conventional methods, with rapid near-patient diagnostics on the abioSCOPE platform

- In June 2024, Cytovale announced that its FDA-cleared rapid sepsis diagnostic (IntelliSep®) screened its first 5,000 patients, demonstrating early clinical adoption and real-world use, which paves the way for new sepsis management protocols in hospitals

- In April 2024, FDA authorized the first AI-powered diagnostic tool for sepsis, Prenosis’ Sepsis ImmunoScore, marking the first artificial-intelligence based test legally cleared to diagnose sepsis by evaluating 22 clinical parameters simultaneously and integrated into electronic health records to support rapid risk assessment in hospitals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.