Global Sepsis Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

1.98 Billion

2023

2031

USD

1.07 Billion

USD

1.98 Billion

2023

2031

| 2024 –2031 | |

| USD 1.07 Billion | |

| USD 1.98 Billion | |

|

|

|

|

Market Analysis and Size

Surging cases of various infectious diseases which results in growing sepsis prevalence is estimated to drive the market’s growth across the globe. The sepsis market is largely influenced by surging focus of key players towards technological advances in the field of molecular diagnostics and indulging towards collaboration and partnerships with other organizations. Owing to the presence of various growth determinants the market is being propelled forward and is projected to show substantial growth over the forecasted period.

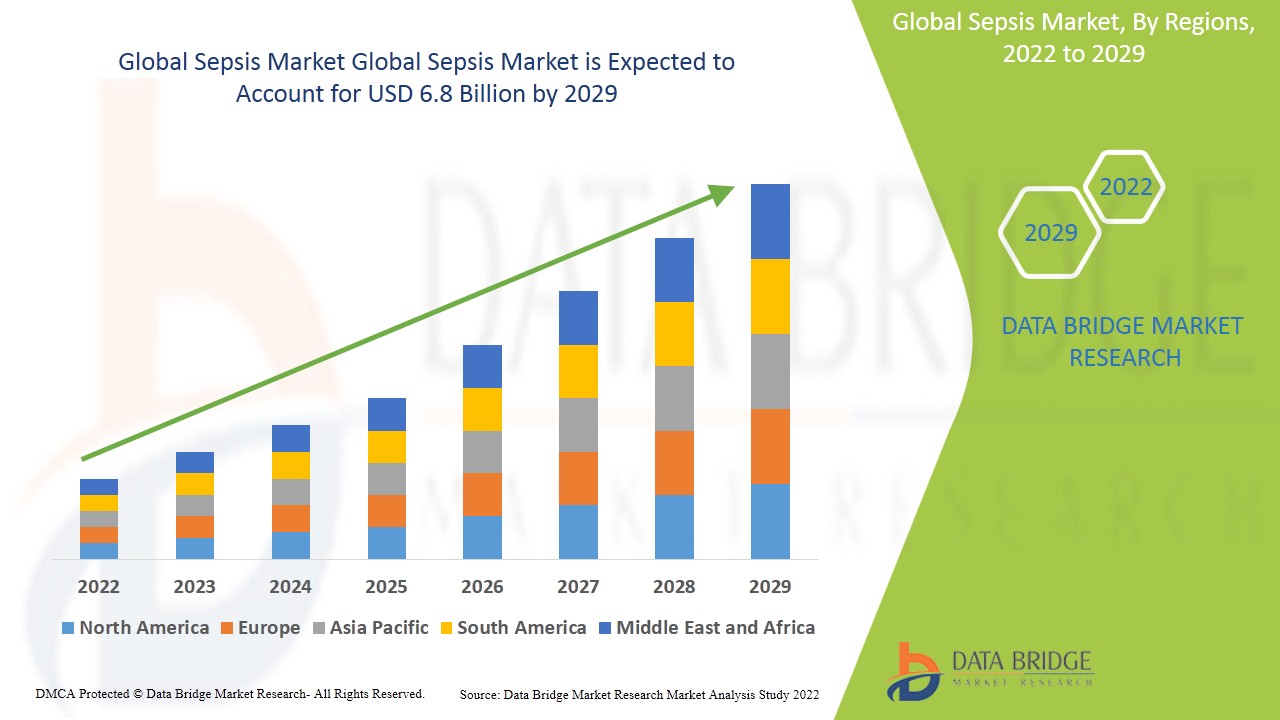

- Global sepsis market was valued at USD 3.3 billion in 2021 and is expected to reach USD 6.8 billion by 2029, registering a CAGR of 8.5% during the forecast period of 2022-2029. The “bacterial” accounts for the largest pathogen segment in the sepsis market within the forecasted period owing to the rise in the bacterial sepsis cases and the rising prevalence of HAIs. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Market Definition

Sepsis is a dangerous consequence that results from a weakened immune system, making patients vulnerable to bacterial, viral, fungal, parasitic, and other illnesses. It's one of the leading causes of mortality in hospitals. When the host's immune system responds to an infection, chemicals are produced by the immune system to treat the infection, resulting in sepsis. As it enters the bloodstream, it induces inflammation throughout the body. It further leads to the blood vessel leakage, blood clots, and poor blood flow, depriving the body's critical organs of oxygen and nutrition.

The sepsis is also considered as a three-staged illness that generally starts with sepsis, then progresses to severe sepsis, and lastly to septic shock, which is a medical emergency. People with a weakened immune system, youngsters, the elderly, and those suffering from chronic illnesses including diabetes, AIDS, cancer and others are at a higher risk of acquiring sepsis.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Diagnosis, Therapeutics), Product (Reagents, Assay, Instruments, Software), Technology (Microbiology, PCR, Sequencing, Biomarkers), Test Type (Lab, POC), Pathogen (Bacterial, Viral, Fungal), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), End User (Hospitals, Pathology and Reference Laboratories), Application (Sepsis, Severe Sepsis, Septic Shock) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

bioMérieux (France), BD (US), Danaher (US), Biosystems Inc., (US), Luminex Corporation (US), F. Hoffmann-La Roche Ltd., (Switzerland), Thermo Fisher Scientific Inc., (US), Bruker (US), Abbott (US), Immunexpress Inc. (U.S), Axis-Shield Diagnostics Ltd. UK), Quidel Corporation (US), Siemens (Germany), EKF Diagnostics (UK), Seegene Inc., (South Korea), Boditech Med Inc., (South Korea), and Alifax S.r.l. Italy (Italy), |

Sepsis Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

-

Growing Burden Of Infectious Diseases

The growing burden of infectious diseases which leads to the rising number of sepsis incidences, is the most significant factor driving the growth for this market. Growing cases of the hospital-acquired infections (HAIs) such as urinary tract infections, pneumonia and sepsis are also expected to accelerate the overall growth of the market.

Growing Investments and Advancements

An increase in funding for sepsis-related research activities combined with the rising investments in extensive research and development activities that include new blood culture approaches for identifying and treating chronic infections are also projected to cushion the growth of the market. Moreover, the technological advances in the field of molecular diagnostics, coupled with surging requirement for quick and accurate results are estimated to generate lucrative opportunities for the market. Various technological advancements have led to the emergence of novel immunological and molecular biomarkers that enable the early detection of sepsis, which will further expand the sepsis market's growth rate in the future.

Furthermore, the expanding healthcare sector along with the increasing penetration of advanced data analytics tools are also expected to fuel market growth. Moreover, the rising awareness among the patients and doctors regarding the chronic diseases and hospital acquired infections also cushions the market’s growth within the forecasted period.

Restraints/Challenges

-

High Costs of Diagnosis

On the other hand, cost of molecular diagnostic tests is very high, which is expected to obstruct market growth.

-

Dearth of Professionals

Also, the sepsis needs to be diagnosed and treated early with help of skilled healthcare professionals. The shortage of skilled professionals or lack of trained paramedics are projected to challenge the sepsis market in the forecast period of 2022-2029.

This sepsis market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the sepsis market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post Covid-19 Impact on Sepsis Market

The sepsis market was largely industry impacted by the outbreak of COVID-19. The sepsis symptoms such as multiorgan damage emerged in approximately 2- 5% of COVID patients, that too after 8-10 days of admission. To deal with the dilemma, the Biomedical Advanced Research and Development Authority collaborated with Beckman Coulter to build a digital algorithm to detect sepsis in COVID-19 patients. The outbreak of coronavirus and the emergence of sepsis cases among covid-19 patients boosted the demand for quick diagnosis, resulting in a faster adoption of devices, reagents, and test kits for sepsis detection. Moreover, the geriatric population are vulnerable to complications such as acute respiratory distress syndrome (ARDS) that is caused by pneumonia and raises the risk of sepsis.

Recent Developments

- In June 2021, BioMérieux, a global pioneer in in vitro diagnostics, and Special Diagnostics, a business that brings new in vitro diagnostic methods to clinical microbiology, have inked a distribution agreement for a specific reveal fast AST system in Europe. The REVEAL Rapid AST system, developed by Specific Diagnostics and based on its patented metabolomic signature technology, provides actionable results for bloodstream infections (in an average of 5 hours* directly from positive blood culture), allowing either timely de-escalation to a more focused, more appropriate, and lower-cost therapy, or life-saving rapid escalation to a more effective drug when a multidrug-resistant (MDR) infection is present.

Global Sepsis Market Scope

The sepsis market is segmented on the basis of type, product, technology, test type, pathogen, distribution channel, end user and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Diagnosis

- Therapeutics

On the basis of type, the sepsis market is segmented into diagnosis and therapeutics.

Product

- Reagents

- Assay

- Instruments

- Software

On the basis of product, the sepsis market is segmented into reagents, assay, instruments and software.

Technology

- Microbiology

- PCR

- Sequencing

- Biomarkers

On the basis of technology, the sepsis market is segmented into microbiology, PCR, sequencing and biomarkers.

Test Type

- Lab

- POC

On the basis of test type, the sepsis market is segmented into lab and POC.

Pathogen

- Bacterial

- Viral

- Fungal

On the basis of pathogen, the sepsis market is segmented into bacterial, viral and fungal. The bacterial segment accounts for the largest share of market during the forecast period due to the rise in the bacterial sepsis cases and the rising prevalence of HAIs.

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

On the basis of distribution channel, the sepsis market is segmented into hospital pharmacies, retail pharmacies and online pharmacies.

End User

- Hospitals

- Pathology

- Reference Laboratories

On the basis of end user, the sepsis market is bifurcated into hospitals, pathology and reference laboratories.

Application

- Sepsis

- Severe Sepsis

- Septic Shock

On the basis of application, the sepsis market is bifurcated into sepsis, severe sepsis and septic shock.

Sepsis Market Regional Analysis/Insights

The sepsis market is analyzed and market size insights and trends are provided by country, type, product, technology, test type, pathogen, distribution channel, end user and application as referenced above.

The countries covered in the sepsis market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the sepsis market because of the increased per capita healthcare expenditure, high demand for better healthcare facilities, growing adoption of new and advanced diagnostic techniques and increasing incidences of chronic diseases such as cancer, diabetes leading to sepsis within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 due to the high geriatric population, increasing prevalence of cancer and diabetes in countries such of India, China, and Australia along with the developing healthcare infrastructure within the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The sepsis market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for sepsis market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the sepsis market. The data is available for historic period 2010-2020.

Competitive Landscape and Sepsis Market Share Analysis

The sepsis market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to sepsis market.

Some of the major players operating in the sepsis market are bioMérieux (France), BD (US), Danaher (US), Biosystems Inc., (US), Luminex Corporation (US), F. Hoffmann-La Roche Ltd., (Switzerland), Thermo Fisher Scientific Inc., (US), Bruker (US), Abbott (US), Immunexpress Inc. (U.S), Axis-Shield Diagnostics Ltd. UK), Quidel Corporation (US), Siemens (Germany), EKF Diagnostics (UK), Seegene Inc., (South Korea), Boditech Med Inc., (South Korea) and Alifax S.r.l. Italy (Italy), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SEPSIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SEPSIS MARKET SIZE

2.2.1.1. VENDOR POSITIONING GRID

2.2.1.2. TECHNOLOGY LIFE LINE CURVE

2.2.1.3. TRIPOD DATA VALIDATION MODEL

2.2.1.4. MARKET GUIDE

2.2.1.5. MULTIVARIATE MODELLING

2.2.1.6. TOP TO BOTTOM ANALYSIS

2.2.1.7. CHALLENGE MATRIX

2.2.1.8. APPLICATION COVERAGE GRID

2.2.1.9. STANDARDS OF MEASUREMENT

2.2.1.10. VENDOR SHARE ANALYSIS

2.2.1.11. SALES VOLUME

2.2.1.12. DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.1.13. DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SEPSIS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

5.5 PATEINT TREATMENT SUCCESS RATES

6 PREMIUM INSIGHTS

6.1 PATENT ANALYSIS

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH HEMATOLOGISTS

6.8 INTERVIEWS WITH PHYSICIAN

6.9 OTHER KOL SNAPSHOTS

7 INDUSTRY INSIGHTS

8 REGULATORY SCENARIO

9 GLOBAL SEPSIS MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 DIAGNOSIS

9.2.1.1. BY PRODUCT

9.2.1.2. INSTRUMENTS

9.2.1.2.1. MOLECULAR DIAGNOSTIC INSTRUMENT

9.2.1.2.1.1 MARKET SHARE (USD)

9.2.1.2.1.2 MARKET VOLUME (UNITS)

9.2.1.2.1.3 AVERAGE SELLING PRICE (ASP- USD)

9.2.1.2.2. IN-VITRO DIAGNOSTIC INSTRUMENT

9.2.1.2.2.1 MARKET SHARE (USD)

9.2.1.2.2.2 MARKET VOLUME (UNITS)

9.2.1.2.2.3 AVERAGE SELLING PRICE (ASP- USD)

9.2.1.2.3. POINT OF CARE TESTING INSTRUMENT

9.2.1.2.3.1 MARKET SHARE (USD)

9.2.1.2.3.2 MARKET VOLUME (UNITS)

9.2.1.2.3.3 AVERAGE SELLING PRICE (ASP- USD)

9.2.1.3. ASSAYS & REAGENTS

9.2.1.3.1. PCR-BASED KITS

9.2.1.3.1.1 MARKET SHARE (USD)

9.2.1.3.1.2 MARKET VOLUME (UNITS)

9.2.1.3.1.3 AVERAGE SELLING PRICE (ASP- USD)

9.2.1.3.2. IMMUNOASSAY-BASED KITS

9.2.1.3.2.1 MARKET SHARE (USD)

9.2.1.3.2.2 MARKET VOLUME (UNITS)

9.2.1.3.2.3 AVERAGE SELLING PRICE (ASP- USD)

9.2.1.3.3. OTHERS

9.2.1.4. BLOOD CULTURE MEDIA

9.2.1.4.1. BROTH

9.2.1.4.2. AGAR

9.2.1.4.3. OTHERS

9.2.1.5. SOFTWARE

9.2.1.6. BY METHOD

9.2.1.7. CONVENTIONAL DIAGNOSTICS

9.2.1.8. AUTOMATED DIAGNOSTICS

9.2.1.9. BY TECHNOLOGY

9.2.1.10. MICROBIOLOGY

9.2.1.11. MOLECULAR DIAGNOSTICS

9.2.1.11.1. POLYMERASE CHAIN REACTION

9.2.1.11.2. MICROARRAYS

9.2.1.11.3. PEPTIDE NUCLEIC ACID-FLUORESCENT IN SITU HYBRIDIZATION

9.2.1.11.4. SYNDROMIC PANEL-BASED TESTING

9.2.1.12. IMMUNOASSAYS

9.2.1.13. FLOW CYTOMETRY

9.2.1.14. BY USABILITY

9.2.1.15. LABORATORY TESTING

9.2.1.16. POINT-OF-CARE TESTING

9.3 THERAPEUTICS

9.3.1.1. BY TYPE

9.3.1.2. ANTIBIOTICS

9.3.1.2.1. CEFTRIAXONE

9.3.1.2.2. MEROPENEM

9.3.1.2.3. CEFTAZIDIME

9.3.1.2.4. CEFOTAXIME

9.3.1.2.5. CEFEPIME

9.3.1.2.6. PIPERACILLIN AND TAZOBACTAM

9.3.1.2.7. AMPICILLIN AND SULBACTAM

9.3.1.2.8. IMIPENEM/CILASTATIN

9.3.1.2.9. LEVOFLOXACIN

9.3.1.2.10. CLINDAMYCIN

9.3.1.3. INTRAVENOUS FLUID REPLACEMENT

9.3.1.4. INSULIN

9.3.1.5. CYTOKINE ANTAGONISTS

9.3.1.5.1. INTERLEUTIN-1 RECEPTOR ANTAGONIST(IL-1RA)

9.3.1.5.2. INTERLEUKIN-10(IL-10)

9.3.1.5.3. TNF-Α,IL-1Β,IL-6

9.3.1.5.4. IL-8

9.3.1.6. PRR ANTAGONIST

9.3.1.6.1. TLRS

9.3.1.6.2. TLR1/TLR2

9.3.1.6.3. TLR2/TLR6

9.3.1.6.4. NLRS

9.3.1.6.5. OTHERS

9.3.1.7. PATHOGEN-ASSOCIATED MOLECULAR ANTAGONISTS

9.3.1.8. RECOMBINANT HUMAN APC (RHAPC)

9.3.1.8.1. DROTRECOGIN ALFA

9.3.1.8.2. XIGRIS

9.3.1.8.3. OTHERS

9.3.1.9. RECOMBINANT HUMAN SOLUBLE THROMBOSIS REGULATORS

9.3.1.10. PENTOXIFYLLINE

9.3.1.11. CO-INHIBITING MOLECULAR INHIBITOR

9.3.1.11.1. CYTOTOXIC T LYMPHOCYTE ANTIGEN 4

9.3.1.11.2. T-CELL IMMUNOGLOBULIN AND MUCIN DOMAIN PROTEIN 3

9.3.1.11.3. OTHERS

9.3.1.12. OTHERS

9.3.1.13. BY ROUTE OF ADMINISTRATION

9.3.1.14. INTRAVENOUS

9.3.1.15. ORAL

9.3.1.16. OTHERS

10 GLOBAL SEPSIS MARKET, BY PATHOGEN

10.1 OVERVIEW

10.2 BACTERIAL SEPSIS

10.2.1.1. GRAM-NEGATIVE BACTERIAL SEPSIS

10.2.1.2. GRAM-POSITIVE BACTERIAL SEPSIS

10.3 FUNGAL SEPSIS

10.3.1.1. CANDIDIASIS

10.3.1.2. INVASIVE CANDIDIASIS

10.3.1.3. ASPERGILLUS

10.3.1.4. OTHERS

10.4 OTHERS

11 GLOBAL SEPSIS MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERIC

11.3 BRANDED

11.3.1.1. ROCEPHIN

11.3.1.2. MERREM

11.3.1.3. FORTAZ

11.3.1.4. CLAFORAN

11.3.1.5. MAXIPIME

11.3.1.6. ZOSYN

11.3.1.7. UNASYN

11.3.1.8. PRIMAXIN

11.3.1.9. LEVAQUIN

11.3.1.10. CLEOCIN

12 GLOBAL SEPSIS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 PATHOLOGY & REFERENCE LABORATORIES

12.4 AMBULATORY SURGICAL CENTERS

12.5 DIAGNOSTIC LABORATORY

12.6 OTHERS

13 GLOBAL SEPSIS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 OVERVIEW

13.3 DIRECT TENDER

13.4 RETAIL SALES

13.4.1.1. HOSPITAL PHARMACIES

13.4.1.2. RETAIL PHARMACIES

13.4.1.3. ONLINE PHARMACIES

14 GLOBAL SEPSIS MARKET, BY REGION

14.1 GLOBAL SEPSIS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1.1. U.S.

14.2.1.2. CANADA

14.2.1.3. MEXICO

14.3 EUROPE

14.3.1.1. GERMANY

14.3.1.2. FRANCE

14.3.1.3. U.K.

14.3.1.4. ITALY

14.3.1.5. SPAIN

14.3.1.6. RUSSIA

14.3.1.7. TURKEY

14.3.1.8. BELGIUM

14.3.1.9. NETHERLANDS

14.3.1.10. SWITZERLAND

14.3.1.11. REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1.1. JAPAN

14.4.1.2. CHINA

14.4.1.3. SOUTH KOREA

14.4.1.4. INDIA

14.4.1.5. AUSTRALIA

14.4.1.6. SINGAPORE

14.4.1.7. THAILAND

14.4.1.8. MALAYSIA

14.4.1.9. INDONESIA

14.4.1.10. PHILIPPINES

14.4.1.11. REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1.1. BRAZIL

14.5.1.2. ARGENTINA

14.5.1.3. REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1.1. SOUTH AFRICA

14.6.1.2. SAUDI ARABIA

14.6.1.3. UAE

14.6.1.4. EGYPT

14.6.1.5. ISRAEL

14.6.1.6. REST OF MIDDLE EAST AND AFRICA

14.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL SEPSIS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL SEPSIS MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL SEPSIS MARKET, COMPANY PROFILE

17.1 ABBOTT

17.1.1.1. COMPANY OVERVIEW

17.1.1.2. REVENUE ANALYSIS

17.1.1.3. GEOGRAPHIC PRESENCE

17.1.1.4. PRODUCT PORTFOLIO

17.1.1.5. RECENT DEVELOPMENTS

17.2 BECKMAN COULTER (DANAHER)

17.2.1.1. COMPANY OVERVIEW

17.2.1.2. REVENUE ANALYSIS

17.2.1.3. GEOGRAPHIC PRESENCE

17.2.1.4. PRODUCT PORTFOLIO

17.2.1.5. RECENT DEVELOPMENTS

17.3 BD

17.3.1.1. COMPANY OVERVIEW

17.3.1.2. REVENUE ANALYSIS

17.3.1.3. GEOGRAPHIC PRESENCE

17.3.1.4. PRODUCT PORTFOLIO

17.3.1.5. RECENT DEVELOPMENTS

17.4 BIOMÉRIEUX

17.4.1.1. COMPANY OVERVIEW

17.4.1.2. REVENUE ANALYSIS

17.4.1.3. GEOGRAPHIC PRESENCE

17.4.1.4. PRODUCT PORTFOLIO

17.5 BIO-RAD LABORATORIES

17.5.1.1. COMPANY OVERVIEW

17.5.1.2. REVENUE ANALYSIS

17.5.1.3. GEOGRAPHIC PRESENCE

17.5.1.4. PRODUCT PORTFOLIO

17.5.1.5. RECENT DEVELOPMENTS

17.6 BRUKER CORPORATION

17.6.1.1. COMPANY OVERVIEW

17.6.1.2. REVENUE ANALYSIS

17.6.1.3. GEOGRAPHIC PRESENCE

17.6.1.4. PRODUCT PORTFOLIO

17.6.1.5. RECENT DEVELOPMENTS

17.7 CEPHEID

17.7.1.1. COMPANY OVERVIEW

17.7.1.2. REVENUE ANALYSIS

17.7.1.3. GEOGRAPHIC PRESENCE

17.7.1.4. PRODUCT PORTFOLIO

17.7.1.5. RECENT DEVELOPMENTS

17.8 CHEMBIO DIAGNOSTIC SYSTEMS

17.8.1.1. COMPANY OVERVIEW

17.8.1.2. REVENUE ANALYSIS

17.8.1.3. GEOGRAPHIC PRESENCE

17.8.1.4. PRODUCT PORTFOLIO

17.8.1.5. RECENT DEVELOPMENTS

17.9 NANOSPHERE, INC.

17.9.1.1. COMPANY OVERVIEW

17.9.1.2. REVENUE ANALYSIS

17.9.1.3. GEOGRAPHIC PRESENCE

17.9.1.4. PRODUCT PORTFOLIO

17.9.1.5. RECENT DEVELOPMENTS

17.1 ORTHO-CLINICAL DIAGNOSTICS

17.10.1.1. COMPANY OVERVIEW

17.10.1.2. REVENUE ANALYSIS

17.10.1.3. GEOGRAPHIC PRESENCE

17.10.1.4. PRODUCT PORTFOLIO

17.10.1.5. RECENT DEVELOPMENTS

17.11 F. HOFFMANN-LA ROCHE LTD

17.11.1.1. COMPANY OVERVIEW

17.11.1.2. REVENUE ANALYSIS

17.11.1.3. GEOGRAPHIC PRESENCE

17.11.1.4. PRODUCT PORTFOLIO

17.11.1.5. RECENT DEVELOPMENTS

17.12 SIEMENS HEALTHCARE GMBH

17.12.1.1. COMPANY OVERVIEW

17.12.1.2. REVENUE ANALYSIS

17.12.1.3. GEOGRAPHIC PRESENCE

17.12.1.4. PRODUCT PORTFOLIO

17.12.1.5. RECENT DEVELOPMENTS

17.13 T2 BIOSYSTEMS, INC.

17.13.1.1. COMPANY OVERVIEW

17.13.1.2. REVENUE ANALYSIS

17.13.1.3. GEOGRAPHIC PRESENCE

17.13.1.4. PRODUCT PORTFOLIO

17.13.1.5. RECENT DEVELOPMENTS

17.14 THERMO FISHER SCIENTIFIC INC.

17.14.1.1. COMPANY OVERVIEW

17.14.1.2. REVENUE ANALYSIS

17.14.1.3. GEOGRAPHIC PRESENCE

17.14.1.4. PRODUCT PORTFOLIO

17.14.1.5. RECENT DEVELOPMENTS

17.15 LUMINEX CORPORATION

17.15.1.1. COMPANY OVERVIEW

17.15.1.2. REVENUE ANALYSIS

17.15.1.3. GEOGRAPHIC PRESENCE

17.15.1.4. PRODUCT PORTFOLIO

17.15.1.5. RECENT DEVELOPMENTS

17.16 IMMUNEXPRESS INC

17.16.1.1. COMPANY OVERVIEW

17.16.1.2. REVENUE ANALYSIS

17.16.1.3. GEOGRAPHIC PRESENCE

17.16.1.4. PRODUCT PORTFOLIO

17.16.1.5. RECENT DEVELOPMENTS

17.17 GENTIAN DIAGNOSTICS AS

17.17.1.1. COMPANY OVERVIEW

17.17.1.2. REVENUE ANALYSIS

17.17.1.3. GEOGRAPHIC PRESENCE

17.17.1.4. PRODUCT PORTFOLIO

17.17.1.5. RECENT DEVELOPMENTS

17.18 CALA MEDICAL

17.18.1.1. COMPANY OVERVIEW

17.18.1.2. REVENUE ANALYSIS

17.18.1.3. GEOGRAPHIC PRESENCE

17.18.1.4. PRODUCT PORTFOLIO

17.18.1.5. RECENT DEVELOPMENTS

17.19 ALIFAX S.R.L.

17.19.1.1. COMPANY OVERVIEW

17.19.1.2. REVENUE ANALYSIS

17.19.1.3. GEOGRAPHIC PRESENCE

17.19.1.4. PRODUCT PORTFOLIO

17.19.1.5. RECENT DEVELOPMENTS

17.2 ALPHA LABORATORIES

17.20.1.1. COMPANY OVERVIEW

17.20.1.2. REVENUE ANALYSIS

17.20.1.3. GEOGRAPHIC PRESENCE

17.20.1.4. PRODUCT PORTFOLIO

17.20.1.5. RECENT DEVELOPMENTS

17.21 BODITECH MED

17.21.1.1. COMPANY OVERVIEW

17.21.1.2. REVENUE ANALYSIS

17.21.1.3. GEOGRAPHIC PRESENCE

17.21.1.4. PRODUCT PORTFOLIO

17.21.1.5. RECENT DEVELOPMENTS

17.22 GENMARK DIAGNOSTICS

17.22.1.1. COMPANY OVERVIEW

17.22.1.2. REVENUE ANALYSIS

17.22.1.3. GEOGRAPHIC PRESENCE

17.22.1.4. PRODUCT PORTFOLIO

17.22.1.5. RECENT DEVELOPMENTS

17.23 SEEGENE

17.23.1.1. COMPANY OVERVIEW

17.23.1.2. REVENUE ANALYSIS

17.23.1.3. GEOGRAPHIC PRESENCE

17.23.1.4. PRODUCT PORTFOLIO

17.23.1.5. RECENT DEVELOPMENTS

17.24 EKF DIAGNOSTICS

17.24.1.1. COMPANY OVERVIEW

17.24.1.2. REVENUE ANALYSIS

17.24.1.3. GEOGRAPHIC PRESENCE

17.24.1.4. PRODUCT PORTFOLIO

17.24.1.5. RECENT DEVELOPMENTS

17.25 AXIS-SHIELD DIAGNOSTICS

17.25.1.1. COMPANY OVERVIEW

17.25.1.2. REVENUE ANALYSIS

17.25.1.3. GEOGRAPHIC PRESENCE

17.25.1.4. PRODUCT PORTFOLIO

17.25.1.5. RECENT DEVELOPMENTS

17.26 TRINITY BIOTECH

17.26.1.1. COMPANY OVERVIEW

17.26.1.2. REVENUE ANALYSIS

17.26.1.3. GEOGRAPHIC PRESENCE

17.26.1.4. PRODUCT PORTFOLIO

17.26.1.5. RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.