Global Skin Replacements And Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

916.40 Billion

USD

1,472.77 Billion

2025

2033

USD

916.40 Billion

USD

1,472.77 Billion

2025

2033

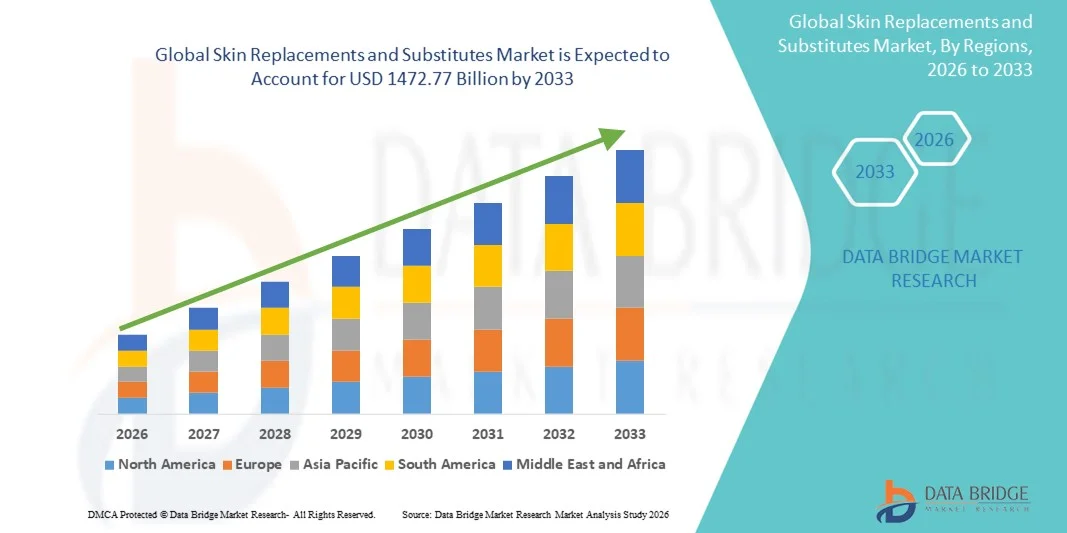

| 2026 –2033 | |

| USD 916.40 Billion | |

| USD 1,472.77 Billion | |

|

|

|

|

Skin Replacements and Substitutes Market Size

- The global skin replacements and substitutes market size was valued at USD 916.40 billion in 2025 and is expected to reach USD 1472.77 billion by 2033, at a CAGR of 6.11% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced wound care technologies and rapid progress in tissue engineering and regenerative medicine, which are driving greater digitalization, innovation, and efficiency across healthcare settings

- Furthermore, rising patient demand for effective, safe, and minimally invasive treatment solutions—along with the growing preference for biologically compatible and integrated skin substitute products—is establishing skin replacements and substitutes as a preferred option in modern wound management. These converging factors are accelerating the uptake of Skin Replacements and Substitutes solutions, thereby significantly boosting the industry's growth

Skin Replacements and Substitutes Market Analysis

- Skin replacements and substitutes, encompassing bioengineered skin, allografts, xenografts, and synthetic substitutes, are increasingly vital in modern wound care and reconstructive procedures due to their ability to enhance healing, reduce infection risks, and improve patient outcomes in acute, chronic, and burn-related wounds

- The escalating demand for skin replacement solutions is primarily driven by the rising prevalence of chronic wounds, diabetic ulcers, burns, and trauma injuries, coupled with growing awareness among healthcare professionals about the clinical benefits of advanced skin substitute technologies.

- North America dominated the skin replacements and substitutes market with the largest revenue share of 41.5% in 2025, supported by advanced healthcare infrastructure, higher treatment adoption rates, strong reimbursement systems, and the presence of leading biotechnology companies driving continuous innovation

- Asia-Pacific is expected to be the fastest-growing region in the skin Replacements and substitutes market during the forecast period, driven by rapid urbanization, an increasing diabetic population, improving healthcare expenditure, and rising accessibility to advanced wound care solutions

- The Class III segment held the largest market revenue share of 55.4% in 2025, owing to the extensive use of highly advanced and regulated biologic skin substitutes in critical wound treatment

Report Scope and Skin Replacements and Substitutes Market Segmentation

|

Attributes |

Skin Replacements and Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Smith & Nephew (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Skin Replacements and Substitutes Market Trends

Advancements in Bioengineered Skin and Regenerative Technologies

- A significant and accelerating trend in the global skin replacements and substitutes market is the increasing integration of advanced bioengineering technologies, including biomaterials, tissue-engineered constructs, and stem-cell-based therapies. These innovations are helping create more functional, biocompatible, and durable skin substitutes that closely mimic the properties of natural ski

- For instance, next-generation acellular dermal matrices (ADMs) and collagen-based scaffolds are being developed with enhanced structural integrity, improved vascularization potential, and reduced immunogenicity. These improvements are enabling better patient outcomes in wound healing, burn care, and reconstructive procedures

- The incorporation of 3D bioprinting technology is also gaining momentum, allowing for the creation of layered skin tissues with precise architecture. Companies and research institutions are actively developing customizable printed skin grafts designed to accelerate healing and reduce scarring

- Furthermore, the growing trend toward autologous cell–based substitutes, such as cultured epithelial autografts (CEA), is reshaping clinical approaches, especially for patients with extensive burns or chronic ulcers. These substitutes offer reduced rejection risk and improved tissue integration

- The continued development of bioengineered skin technologies is fundamentally transforming expectations for wound management and reconstructive treatments, as medical providers increasingly prioritize solutions that blend convenience, reduced recovery time, and long-term functional performance

- As a result, demand for innovative, clinically effective, and customizable skin substitute solutions is rising across hospitals, burn centers, and specialty dermatology practices worldwide

Skin Replacements and Substitutes Market Dynamics

Driver

Growing Need for Advanced Wound Care Amid Rising Burns, Ulcers, and Chronic Conditions

- Increasing incidences of burn injuries, diabetic foot ulcers, venous leg ulcers, pressure ulcers, and surgical wounds are driving the demand for effective skin replacement solutions. The global rise in chronic diseases, particularly diabetes and vascular disorders, has significantly increased the number of patients requiring advanced wound care

- For instance, in April 2025, advanced its involvement in medical technology by exploring new integrations of high-precision sensors for monitoring healing conditions in wound-care applications—demonstrating how companies are expanding capabilities to support next-gen clinical solutions in the Skin Replacements and Substitutes space

- As healthcare providers aim to improve healing rates, reduce infection risks, and minimize hospital stay durations, advanced skin substitutes offer superior benefits compared to traditional wound dressings. These include enhanced moisture balance, support for cellular regeneration, improved vascularization, and reduced scarring

- Furthermore, the increasing use of minimally invasive and regenerative therapies is making tissue-engineered skin substitutes a preferred choice in both inpatient and outpatient settings

- The rising adoption of biologics, growing awareness of advanced wound care, and expanding healthcare infrastructure—particularly in emerging economies—are key factors accelerating market demand

- In addition, the availability of ready-to-use, user-friendly skin substitute products is contributing to increased usage in acute care, long-term care facilities, and surgical centers

Restraint/Challenge

High Treatment Costs and Limited Accessibility in Developing Regions

- High costs associated with advanced skin substitutes—especially bioengineered, cellular, and stem-cell-based constructs—remain a major challenge limiting widespread adoption. These products often require specialized storage, handling, and trained clinicians, which significantly increases overall treatment expenses

- For instance, advanced tissue-engineered skin substitutes such as Apligraf and Dermagraft are priced significantly higher than traditional wound dressings, making them unaffordable for a large proportion of patients in low-income and developing countries. The high cost of procurement and application discourages hospitals—especially government and rural healthcare centers—from adopting such advanced solutions

- Limited reimbursement coverage in many regions further adds to the financial burden, making advanced wound-care therapies inaccessible to low-income patients. Insufficient insurance support for chronic wound treatments often results in delayed care or preference for cheaper but less effective alternatives

- In addition, shortages of trained clinicians capable of managing and applying sophisticated skin substitute products create adoption barriers in developing healthcare systems. Many advanced products require surgical expertise, controlled environments, and post-application monitoring that are not consistently available in resource-limited settings

- Regulatory hurdles also slow adoption, as clinical evaluation of biocompatibility, immunogenicity, and long-term wound integration often requires lengthy approval cycles

- Furthermore, concerns about product stability, risk of infection, and the potential for immune reactions—particularly in allogeneic or xenogeneic substitutes—can reduce provider confidence in adopting these solutions

- Overcoming these challenges will require broader reimbursement support, cost-efficient manufacturing, increased clinician training, and continued research to develop scalable, affordable, and high-quality Skin Replacement and Substitute solutions

Skin Replacements and Substitutes Market Scope

The market is segmented on the basis of Product, Class, Application, and End User.

- By Product

On the basis of product, the Skin Replacements and Substitutes market is segmented into Acellular, Cellular, and Others. The Acellular segment dominated the largest market revenue share of 48.6% in 2025, driven by its high usage in burn care, chronic wound healing, and reconstructive surgeries. Acellular matrices are widely preferred because of their strong biocompatibility, low immunogenicity, and ability to support natural tissue regeneration. Healthcare providers rely on acellular products due to their long shelf life, reduced infection risks, and strong clinical outcomes across multiple wound types. Rising incidences of diabetic ulcers and traumatic injuries further boost demand, along with increasing adoption in cosmetic procedures. Continuous advancements in decellularization technologies and improved processing standards enhance product reliability. Favorable reimbursement in major markets and strong penetration across hospitals and wound care centers also contribute to the dominant market share of the acellular segment.

The Cellular segment is anticipated to witness the fastest growth rate of 21.3% from 2026 to 2033, fueled by rising adoption of advanced biologically active skin substitutes containing living cells. Cellular products offer superior regenerative potential, enabling faster wound closure and improved patient recovery. High demand in full-thickness burns, complex ulcers, and surgical reconstruction is accelerating uptake. Ongoing developments in tissue engineering, stem-cell integration, and biofabrication are expanding clinical applications. Increasing investment in advanced regenerative medicine and personalized skin substitutes is driving strong market growth. Rising awareness among clinicians, expanding approvals, and growing accessibility in developed and developing regions also contribute to the segment’s rapid expansion from 2026 to 2033.

- By Class

On the basis of class, the Skin Replacements and Substitutes market is segmented into Class III, Class II, and Class I. The Class III segment held the largest market revenue share of 55.4% in 2025, owing to the extensive use of highly advanced and regulated biologic skin substitutes in critical wound treatment. Class III devices are widely preferred due to their strong clinical effectiveness, long-term regenerative outcomes, and suitability for severe burns and deep-tissue injuries. Increasing numbers of trauma cases, surgical interventions, and chronic wound occurrences continue to drive demand. Hospitals and specialized burn centers rely on Class III products for improved healing, reduced complications, and better graft acceptance. Strong R&D activities in bioengineered tissue solutions and innovations in complex wound management further reinforce segment dominance. Favorable clinical outcomes and regulatory approvals strengthen long-term adoption across global markets.

The Class II segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by growing adoption of intermediate-complexity skin substitutes for moderate burns, pressure ulcers, and surgical wounds. These products offer a balance of safety, cost-effectiveness, and clinical performance, making them highly attractive for hospitals and outpatient wound care centers. Technological advancements in synthetic scaffolds, acellular matrices, and hybrid products are increasing usage. Rising wound care awareness, expanding healthcare infrastructure, and favorable regulatory pathways support accelerated growth. The segment also benefits from increasing chronic wound cases and broader availability in emerging markets. Continuous innovation across Class II materials further strengthens its high growth potential through 2033.

- By Application

On the basis of application, the Skin Replacements and Substitutes market is segmented into Burns, Ulcers, Cosmetic Surgery, and Others. The Burns segment accounted for the largest market revenue share of 41.7% in 2025, driven by rising global burn incidences and the essential need for skin substitutes in emergency wound management. Burn injuries require rapid and advanced reconstructive interventions, making both cellular and acellular substitutes critical components of treatment. Improvements in trauma care infrastructure, increasing government support for burn treatment, and advanced biologic graft availability are key contributors to dominance. Healthcare providers prefer these products for reducing infection, promoting rapid healing, and minimizing scarring. Strong clinical success rates in full-thickness burns and reconstructive procedures further enhance adoption. The growing number of specialized burn centers worldwide also supports high demand within the segment.

The Ulcers segment is expected to witness the fastest growth rate of 20.6% from 2026 to 2033, primarily due to rising prevalence of diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Chronic ulcers pose long-term healthcare challenges, and skin substitutes play a critical role in faster healing, reduced complications, and improved patient outcomes. Increasing diabetic population, aging demographics, and sedentary lifestyles are major growth drivers. Advanced bioengineered tissues and regenerative therapies have shown strong clinical effectiveness in ulcer management. Expanding wound care centers, improved reimbursement landscapes, and rising preference for minimally invasive treatments further accelerate segment growth. Growing awareness of chronic wound complications continues to support robust market expansion through 2033.

- By End User

On the basis of end user, the Skin Replacements and Substitutes market is segmented into Wound Care Clinics and Hospitals, Beauty and Cosmetics Industry, and Others. The Wound Care Clinics and Hospitals segment dominated the largest market revenue share of 64.1% in 2025, driven by their central role in the treatment of burns, trauma, surgical wounds, and chronic ulcers. Healthcare facilities rely heavily on advanced skin substitutes due to their strong clinical efficacy, standardized protocols, and access to specialized professionals. Increasing hospital admissions for chronic wounds, rising burn accidents, and higher surgical volumes support segment leadership. Hospitals and dedicated wound care clinics provide advanced wound therapy infrastructure, making them the primary users of biologic and synthetic substitutes. Growing government support for wound management, along with increased adoption of innovative skin replacement therapies, contributes significantly to the segment’s dominance.

The Beauty and Cosmetics Industry segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by growing demand for regenerative aesthetic treatments and post-procedural skin repair. Skin substitutes are increasingly used in scar reduction, anti-aging interventions, and cosmetic reconstruction, improving healing quality and skin texture. Expanding aesthetic clinics, rising consumer spending on cosmetic enhancement, and growing preference for minimally invasive procedures drive segment growth. Technological advancements in regenerative biomaterials and growing acceptance of bioengineered tissues in beauty treatments further support rapid expansion. Media influence, lifestyle improvements, and increasing adoption of high-end cosmetic solutions continue to strengthen growth prospects through 2033.

Skin Replacements and Substitutes Market Regional Analysis

- North America dominated the skin replacements and substitutes market with the largest revenue share of 41.5% in 2025, supported by advanced healthcare infrastructure, higher treatment adoption rates, strong reimbursement systems, and the presence of leading biotechnology companies driving continuous innovation

- The growing prevalence of chronic wounds, diabetic foot ulcers, and pressure injuries is further fueling demand

- Consumers and healthcare providers are increasingly prioritizing advanced wound-care solutions, including tissue-engineered and bioengineered skin substitutes, to improve patient outcomes and reduce healing times

U.S. Skin Replacements and Substitutes Market Insight

The U.S. skin replacements and substitutes market captured the largest revenue share within North America in 2025, fueled by widespread adoption of advanced wound-care therapies and regenerative medicine solutions. Hospitals, specialized clinics, and outpatient care centers are increasingly using bioengineered and tissue-engineered skin substitutes to manage chronic wounds and burns. The growing preference for clinically proven, fast-healing wound-care solutions, combined with strong reimbursement coverage and robust healthcare infrastructure, continues to drive market expansion in the U.S.

Europe Skin Replacements and Substitutes Market Insight

The Europe skin replacements and substitutes market is projected to expand at a substantial CAGR during the forecast period, driven by increasing incidences of chronic wounds, diabetic ulcers, and surgical wounds. Rising awareness among healthcare providers about the benefits of tissue-engineered and biologic skin substitutes is promoting adoption in hospitals and specialized wound-care centers. Increasing urbanization, coupled with improved healthcare expenditure, supports the expansion of advanced wound-care solutions across residential and clinical applications.

U.K. Skin Replacements and Substitutes Market Insight

The U.K. skin replacements and substitutes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for advanced wound-care therapies and regenerative treatment solutions. Rising prevalence of chronic wounds and pressure ulcers, coupled with initiatives to improve clinical outcomes, is encouraging greater adoption of tissue-engineered and biologic skin substitutes in hospitals and clinics. The U.K.’s strong healthcare infrastructure and growing clinical awareness are expected to continue stimulating market growth.

Germany Skin Replacements and Substitutes Market Insight

The Germany skin replacements and substitutes market is expected to expand at a considerable CAGR during the forecast period, fueled by rising incidences of chronic wounds and surgical injuries. The country’s well-developed healthcare infrastructure, strong focus on clinical innovation, and preference for high-quality biomedical products are driving the adoption of tissue-engineered and bioengineered skin substitutes. Germany’s hospitals and specialized wound-care centers are increasingly implementing advanced wound-care solutions to improve patient outcomes and reduce recovery times.

Asia-Pacific Skin Replacements and Substitutes Market Insight

The Asia-Pacific skin replacements and substitutes market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, increasing diabetic populations, improving healthcare expenditure, and rising accessibility to advanced wound-care solutions. Countries such as China, Japan, and India are witnessing growing adoption of tissue-engineered and bioengineered skin substitutes across hospitals, clinics, and outpatient centers. Expanding healthcare infrastructure, government support for modern wound-care treatments, and rising awareness of advanced therapies are key factors propelling market growth in the region.

Japan Skin Replacements and Substitutes Market Insight

The Japan skin replacements and substitutes market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and increasing prevalence of chronic wounds and ulcers. Hospitals and specialized clinics are increasingly implementing bioengineered and tissue-engineered skin substitutes to enhance wound healing and reduce hospitalization time. The growing demand for convenient, effective, and clinically proven treatments is supporting market expansion in both residential and medical care settings.

China Skin Replacements and Substitutes Market Insight

The China skin replacements and substitutes market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, an expanding middle class, and high prevalence of chronic wounds. Strong domestic manufacturing capabilities, increasing hospital infrastructure, and growing clinical adoption of tissue-engineered skin substitutes are fueling market growth. Government healthcare initiatives and rising awareness of advanced wound-care therapies further support the wide adoption of bioengineered skin substitutes in clinical settings.

Skin Replacements and Substitutes Market Share

The Skin Replacements and Substitutes industry is primarily led by well-established companies, including:

• Smith & Nephew (U.K.)

• Organogenesis (U.S.)

• MiMedx Group (U.S.)

• AlloSource (U.S.)

• Vericel Corporation (U.S.)

• Molnlycke Health Care (Sweden)

• Kerecis (Iceland)

• 3M Health Care (U.S.)

• Regenicin (U.S.)

• Avita Medical (Australia)

• BSN Medical (Germany)

• Exsurco Medical (U.S.)

• BioTissue (U.S.)

• Human Biosciences (U.S.)

• Stryker (U.S.)

• Zimmer Biomet (U.S.)

• Teijin Pharma (Japan)

• Gunze Limited (Japan)

• Tissue Regenix Group (U.K.)

Latest Developments in Global Skin Replacements and Substitutes Market

- In October 2021, Kerecis received FDA authorization to market its Omega3 SurgiBind fish-skin graft, expanding its use in plastic and reconstructive procedures and strengthening the presence of biologic skin substitutes in the U.S. market

- In January 2022, researchers at the University of Birmingham and University of Huddersfield developed a new 3D-bioprinting technique—SLAM (Suspended Layer Additive Manufacturing)—that successfully produced full-thickness skin, marking a significant step forward for next-generation bioengineered skin substitutes

- In January 2023, Kerecis introduced GraftGuide Mano and GraftGuide Micro, two specialized fish-skin skin-substitute grafts designed specifically for burn treatment, particularly improving outcomes for burns on hands and delicate area

- In April 2023, Kerecis launched MariGen Shield, a next-generation fish-skin graft combined with a silicone contact layer, designed to support faster healing in chronic and complex wounds while simplifying clinical application

- In July 2023, Coloplast announced its acquisition of Kerecis for up to USD 1.3 billion, a major industry move aimed at strengthening its biologics wound-care portfolio and scaling fish-skin graft technology worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.