Global Skincare Packaging Market

Market Size in USD Billion

CAGR :

%

USD

14.20 Billion

USD

22.35 Billion

2024

2032

USD

14.20 Billion

USD

22.35 Billion

2024

2032

| 2025 –2032 | |

| USD 14.20 Billion | |

| USD 22.35 Billion | |

|

|

|

|

Skincare Packaging Market Size

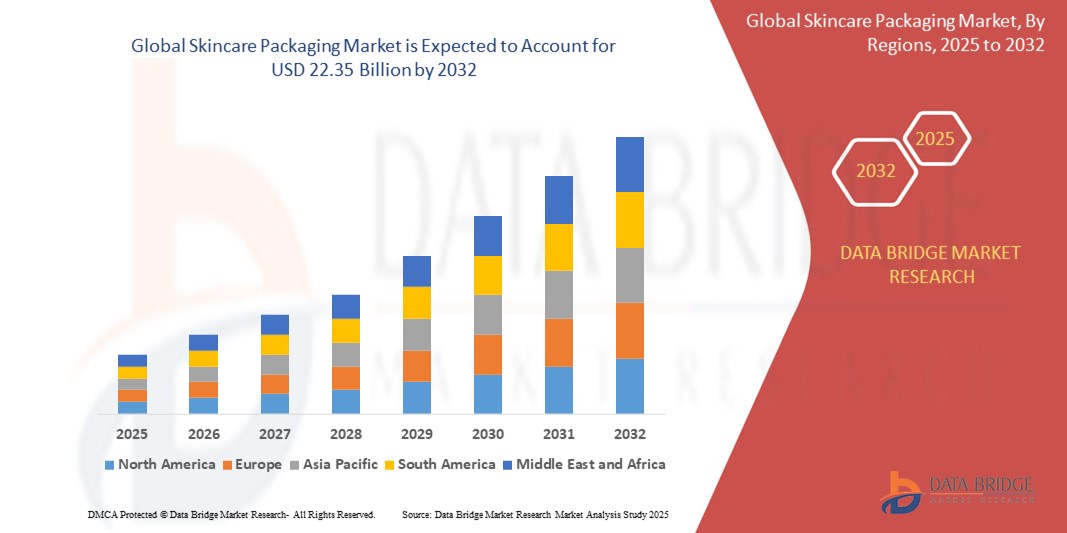

- The Global Skincare Packaging Market size was valued at USD 14.20 Billion in 2024 and is projected to reach USD 22.35 Billion by 2032, at a CAGR of 6.2% during the forecast period.

- Market growth is primarily driven by expanding premium skincare segments—particularly in luxury serums, high-end facial masks, and limited-edition beauty kits—where aesthetic appeal, tactile functionality, and brand differentiation are paramount. Innovations in airless pump technologies, multi-layer barrier films, and dropper bottles enhance product stability and user experience, commanding a price premium.

- Additionally, stringent regulatory guidelines and consumer preference for sustainable, recyclable, and refillable packaging solutions are prompting manufacturers to invest in bio-based polymers, glass compacts, and paperboard cartons with minimal plastic content. Investments in digital printing capabilities for variable data labeling, holographic embellishments, and embossed finishes are further bolstering market expansion. Skincare brands are collaborating closely with packaging converters to achieve a balance between hygienic dispensing, premium aesthetics, and environmental credentials—driving technological advancements and vertical integration within the value chain

Skincare Packaging Market Analysis

- Skincare packaging represents a high-value segment defined by functional integrity, premium substrates, and specialized dispensing mechanisms that preserve product efficacy and shelf life while elevating brand perception. Packaging formats such as airless pumps, dropper bottles, tubes, jars, and compacts are widely used for serums, creams, lotions, and masks, catering to diverse formulations (viscous creams, delicate oils, hydrating gels).

- Heightened consumer inclination toward “clean beauty” and eco-responsible packaging—where recyclability, refillability, and minimalistic design become part of the brand narrative—is fueling adoption of mono-material structures and paperboard combiners in luxury and mass segments alike. Leading converters are investing in multi-layer co-extrusion lines, high-precision injection molding, and aseptic filling equipment to meet stringent barrier and aseptic requirements, while also pursuing certifications (FSC, ISO 15378) to satisfy eco-conscious end-users.

- North America held a dominant share of 30.1% in 2024, supported by a robust premium skincare sector, elevated consumer spending on anti-aging and organic products, and well-established infrastructure for advanced packaging converting. The U.S. leads regional consumption, driven by direct-to-consumer prestige brands, dermatologist-endorsed formulations, and specialty beauty boutiques emphasizing limited-edition packaging as a marketing differentiator.

- Europe is the second-largest region, accounting for 28.4% of global revenue in 2024. Heritage skincare houses in France, Italy, and the U.K. invest heavily in bespoke glass compacts, eco-refill pouches, and aluminum jars—often produced domestically to control quality and ensure fast turnaround. Regulatory emphasis on plastic reduction, extended producer responsibility (EPR) laws, and EU Single-Use Plastics Directive is accelerating adoption of recycled PET (rPET) bottles and paperboard sleeves.

- Asia-Pacific is forecast to be the fastest-growing region over 2025–2032, with a CAGR of 7.0%. Growth is fueled by rising disposable incomes in China and India, rapid urbanization, and surging demand for prestige packaged cosmetics, K-beauty innovations, and premium sun-care products. Leading e-commerce platforms are also promoting premium unboxing experiences—prompting local brands to upgrade packaging aesthetics (foil stamping, holographic labels) and functionality (airless vials, dropper pumps)

Report Scope and Skincare Packaging Market Segmentation

|

Attributes |

Skincare Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Skincare Packaging Market Trends

“Premiumization and Eco-Responsible Innovation in Skincare Packaging”

- A dominant trend in the Global Skincare Packaging Market is the convergence of high-end aesthetics and eco-responsible materials. Manufacturers are formulating barrier films composed of mono-material polyethylene with compostable outer layers to balance product protection with recyclability. Surface enhancements—such as soft-touch varnishes, metallic foil stamping, and precision embossing—are increasingly paired with eco-coatings (bio-based lacquers) that facilitate recyclability without sacrificing tactile appeal.

- Leading converters like AptarGroup and Berry Global are investing heavily in digital finishing lines capable of mixing metallic inks, tactile coatings, and variable data printing for personalized skincare packaging. These systems enable short runs for seasonal collections and influencer collaborations, allowing brands to respond rapidly to consumer trends and social media campaigns.

- Collaboration between skincare brands and packaging suppliers is intensifying around innovating “smart” skincare packages—embedding NFC chips or QR codes in jar lids for authentication, virtual skincare consultations, and loyalty integrations. These technologies strengthen anti-counterfeiting measures and deepen consumer engagement (e.g., “scan to access formulation details” features).

- There is a notable shift toward bio-resin tubes and PCR (Post-Consumer Recycled) PET bottles to comply with stringent regulatory standards (EU Single-Use Plastics Directive, California’s SB 54). This sustainable thrust is incentivizing investments in solar-powered converting facilities, responsibly sourced glass compacts, and closed-loop water management systems—transforming conventional skincare packaging into a more eco-conscious value proposition.

- Regional digital penetration is fostering growth in local premium converters—particularly in Asia-Pacific, where digital printing platforms enable cost-effective short runs for domestic beauty brands aiming to mimic global luxury packaging aesthetics

Skincare Packaging Market Dynamics

Driver

“Increasing Demand for Premium, Functional, and Sustainable Skincare Packaging”

- The proliferation of direct-to-consumer (D2C) prestige skincare brands and subscription beauty boxes is driving unparalleled demand for packaging that offers both aesthetic appeal and functional integrity. Consumers are willing to pay a premium (8–12% price uplift) for packaging that visually and tactilely reinforces brand positioning—spurring manufacturers to adopt high-barrier films, airless vials, and multi-component jars with magnetic closures.

- For instance, in Q1 2025, AptarGroup introduced a new line of “EcoAir” airless pump systems featuring 50% bio-based polypropylene and an internal silicone membrane to eliminate oxidation—enabling sensitive serums and retinol formulations to maintain efficacy longer, while reducing plastic usage by 20%.

- The organic and clean-label skincare segment remains a core demand pillar, with limited-edition holiday gift sets, eco-refill pods, and luxury sheet mask packs operating on seasonal cycles. Skincare converters collaborate closely with brand design studios to engineer shorter runs with customized embossing, inner UV varnishes, and tamper-evident seals that enhance perceived value and justify elevated retail prices.

- Growth in men’s grooming and dermatologist-prescribed topical treatments further propels demand for functional secondary and tertiary packaging—balancing cost, protection, and design flexibility.

- Geographic diversification of skincare manufacturing—especially in Asia and the Middle East—is expanding local converter capabilities. In India, for example, growing domestic premium ayurvedic skincare brands are adopting airless pump tubes previously reserved for international luxury imports, opening new avenues for regional players

Restraint/Challenge

“Volatility in Raw Material Costs and Technical Complexity of Eco-Materials”

- The primary restraint in the Skincare Packaging Market stems from fluctuations in resin, aluminum, and glass prices—driven by global supply chain disruptions, raw material shortages (virgin PET, bauxite for aluminum), and geopolitical tensions affecting trade flows. Year-on-year resin price volatility (±18–25%) can dramatically affect packaging costs, challenging converters to maintain margin stability while honoring long-term contracts with skincare brands.

- Skilled labor shortages and rising energy costs in key production hubs (Europe, North America) add to operational expenditure pressures. Specialized processes—multi-layer co-extrusion, aseptic filling, UV-curable coatings—require highly trained operators and precise maintenance, elevating cost of goods sold (COGS) by an estimated 10–15% compared to standard single-layer formats.

- Strict environmental regulations—particularly under the EU’s Circular Economy Action Plan and California’s SB 54 plastic reduction targets—impose additional compliance costs (certification audits, investment in recyclability testing) that can deter small and mid-sized converters from entering the premium segment. Those unable to invest in sustainable infrastructure risk losing clients in prestige skincare segments that prioritize eco-credentials.

- Moreover, the adoption of emerging materials (biodegradable polymers, molded pulp sleeves) often entails longer lead times, technical validation, and potential compatibility issues with existing filling lines—posing integration challenges for new entrants and incumbent converters alike

Skincare Packaging Market Scope

The market is segmented on the basis of packaging type, material, end-use, and printing technology

- By Packaging Type

On the basis of packaging type, the Skincare Packaging Market is segmented into Primary (Airless Pumps, Dropper Bottles, Tubes, Jars, Compacts), Secondary (Cartons, Sleeves, Trays), and Tertiary (Corrugated Boxes, Pallets).

The Primary Packaging segment dominates with a 58.3% revenue share in 2024, owing to its direct contact with formulations requiring barrier protection, UV resistance, and hygienic dispensing. Airless pumps alone accounted for 22.5% of the primary packaging subsegment in 2024, driven by demand for preservative-free serums and advanced vitamin C formulations

- By Material

On the basis of material, the Skincare Packaging Market is segmented into Plastic (PET, PP, HDPE), Glass, Metal (Aluminum, Tinplate), Paper & Paperboard, and Others (Silicone, Biopolymers).

The Plastic segment leads with a 47.0% revenue share in 2024, owing to its cost efficiency, lightweight nature, and versatility across formats. Within plastic, PET-based airless bottles are particularly favored for their clarity, UV protection (with barrier coatings), and 100% recyclability in many regions. Glass held the second-largest share at 28.6% in 2024, driven by luxury serums and creams seeking a premium, recyclable aesthetic

- By End-Use

On the basis of end-use, the Skincare Packaging Market is segmented into Luxury Cosmetics, Mass Cosmetics, OTC Skincare, Dermatological Products, and Others (Sun Care, Body Care).

The Luxury Cosmetics segment accounts for the largest share at 36.7% in 2024, propelled by high-value serums, bespoke creams, and limited-edition beauty collaborations requiring specialized packaging such as frosted glass jars with metal caps and laser-etched labels. OTC Skincare (e.g., acne treatments, therapeutic lotions) follows closely with 24.1%, driven by dermatologist-recommended brands investing in child-resistant caps and tamper-evident seals

- By Printing Technology

On the basis of printing technology, the Skincare Packaging Market is segmented into Offset, Flexographic, and Digital.

The Offset Printing segment dominates with a 49.5% revenue share in 2024, as it offers superior image fidelity, precise color registration, and cost efficiency for large-volume runs of cartons and sleeves. Digital printing is the fastest-growing subsegment (CAGR 10.8%), enabling short runs, variable data personalization, and quick turnarounds for seasonal collections and influencer-driven packaging collaborations

Skincare Packaging Market Regional Analysis

- North America dominates the Skincare Packaging Market with a 30.1% revenue share in 2024, driven by high consumer spending on premium beauty products, robust e-commerce penetration, and a strong base of specialized converters. The U.S. beauty and personal care segment remains a primary demand driver, while Canada’s niche organic skincare market contributes incremental growth. Local converters are investing in hybrid filling lines that combine airless pump assembly with aseptic blow-fill-seal technology to enhance efficiency and customization

U.S. Skincare Packaging Market Insight

The U.S. Skincare Packaging Market captured a 75% share of North American revenue in 2024, underpinned by major skincare conglomerates (e.g., Estée Lauder, L’Oréal, Procter & Gamble), indie clean-beauty brands (e.g., Drunk Elephant, Tatcha), and dermatologist-led OTC product lines (e.g., CeraVe, La Roche-Posay). Rising demand for sustainable yet visually striking packaging has led converters to adopt mono-material airless vials and PCR-PET bottles—reducing solvent emissions and aligning with state-level environmental regulations

Europe Skincare Packaging Market Insight

Europe holds 28.4% of global revenue in 2024, with France, Italy, and the U.K. as leading markets. Heritage luxury perfume and skincare houses (e.g., Chanel, Dior, Clarins) prioritize on-shore packaging production to maintain extravagant design quality and tight turnaround schedules. European converters benefit from established supply chains of specialty glass furnaces in Germany and eco-certified resin suppliers in Scandinavia, ensuring consistent material availability. Regulatory frameworks such as the EU Cosmetics Regulation (EC No 1223/2009) and the Single-Use Plastics Directive are accelerating adoption of coated glass jars and paperboard cartons with minimal plastic lamination

France Skincare Packaging Market Insight

In France, the skincare packaging segment is anchored by flagship luxury brands releasing limited-edition collections. Local converters leverage ultrawhite glass manufacture and high-rigidity aluminum compacts sourced from domestic mills—enabling impeccable foil stamping and deep embossing. Recent government incentives for reducing carbon emissions in manufacturing have accelerated adoption of solar-powered filling lines and solvent-free lacquer systems

Germany Skincare Packaging Market Insight

Germany’s market is driven by a robust OTC skincare segment (e.g., dermatological creams, therapeutic ointments) and organic body care packaging. Local regulations on recyclable packaging and the Verpackungsordnung (Packaging Act) promote adoption of mono-material tubes and easily separable components (container, cap, label) to facilitate recycling. Digital print adoption is rising among mid-sized converters to serve regional organic beauty brands with seasonal packaging innovations

Asia-Pacific is poised to grow at the fastest CAGR of 7.0% from 2025 to 2032, capturing 25.3% of revenue in 2024. China dominates regional consumption due to its burgeoning domestic beauty market, rapid adoption of K-beauty-inspired skincare packaging (e.g., cushion compacts, sheet mask sachets), and government incentives for recycled plastic usage. Japan contributes heavily through high-precision glass manufacture for premium serums, while India’s rising middle class and policy support for Make in India are fostering growth in domestic skincare packaging. Southeast Asia’s e-commerce boom is generating demand for premium unboxing experiences in countries like Indonesia, Thailand, and Malaysia.

China Skincare Packaging Market Insight

China held the largest share in Asia-Pacific at 42.0% in 2024. The country’s rising indigenous beauty brands (e.g., Perfect Diary, Florasis) are investing in local high-end converters capable of delivering bespoke packaging—often incorporating augmented reality (AR) triggers and NFC-enabled jar lids for interactive product information. The government’s extended producer responsibility program for packaging is also spurring greater use of PCR-PET and lightweight glass alternatives.

India Skincare Packaging Market Insight

India’s skincare packaging market is registering a CAGR of 8.5%. Premium ayurvedic skincare, artisanal oils, and boutique jamun seed face packs are driving demand for eco-refill pouches and glass dropper bottles. Converters are collaborating with local resin suppliers (e.g., Reliance Industries) to source PCR-loaded PET and biodegradable PLA for tubes. In Q2 2025, several converters launched capacity expansions to introduce inline lamination and UV varnish finishing, catering to domestic brands seeking international packaging aesthetics

Skincare Packaging Market Share

The sustained release coating is primarily led by well-established companies, including:

- AptarGroup, Inc. (U.S.)

- Albéa S.A. (France)

- Berry Global, Inc. (U.S.)

- WestRock Company (U.S.)

- Amcor plc (Australia)

- Gerresheimer AG (Germany)

- Quadpack Industries S.A. (Spain)

- Mold-Rite Plastics Company (U.S.)

- Schott AG (Germany)

- Pujolasos (Spain)

- Mespack (Spain)

- O.Berk Company (U.S.)

- Essel Propack Limited (India)

- Huhtamaki Oyj (Finland)

- Uflex Limited (India)

- RPC Group plc (U.K.)

- Packsize International (U.S.)

- Sonoco Products Company (U.S.)

- Stora Enso Oyj (Finland)

- Sappi Limited (South Africa)

Latest Developments in Global Skincare Packaging Market

- May 2025 – AptarGroup, Inc. launched its “EcoAir 2.0” airless pump system featuring 60% post-consumer recycled polypropylene, a patented zero-oxygen membrane, and a refillable cartridge design—targeting premium serum and retinol lines in North America and Europe.

- April 2025 – Albéa S.A. opened a new digital finishing facility in Lyon, France, equipped with inline laser engraving, cold foil stamping, and variable data printing capabilities—reducing lead times for European luxury skincare packaging runs by 30% and supporting sustainable paperboard sleeves.

- March 2025 – Berry Global, Inc. announced a strategic partnership with L’Oréal to co-develop PCR-loaded PET airless bottles for global skincare launches, aiming for a 40% reduction in carbon footprint compared to virgin PET alternatives.

- February 2025 – Gerresheimer AG rolled out its “GlassRenew” line of ultra-thin glass vials with bio-based silicone seals that eliminate the need for plastic liners—targeted at high-end facial oils and serums in Asia-Pacific and North America.

- January 2025 – Essel Propack Limited (India) invested in an automated multi-layer tube extrusion and lamination line imported from Germany, enabling in-house production of high-barrier, aluminum-laminated tubes for domestic and export skincare brands. The capacity expansion addresses the 35% year-on-year growth in India’s premium tube segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Skincare Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Skincare Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Skincare Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.