Global Sleep Apnea Implants Market

Market Size in USD Million

CAGR :

%

USD

545.02 Million

USD

810.79 Million

2024

2032

USD

545.02 Million

USD

810.79 Million

2024

2032

| 2025 –2032 | |

| USD 545.02 Million | |

| USD 810.79 Million | |

|

|

|

|

Sleep Apnea Implants Market Size

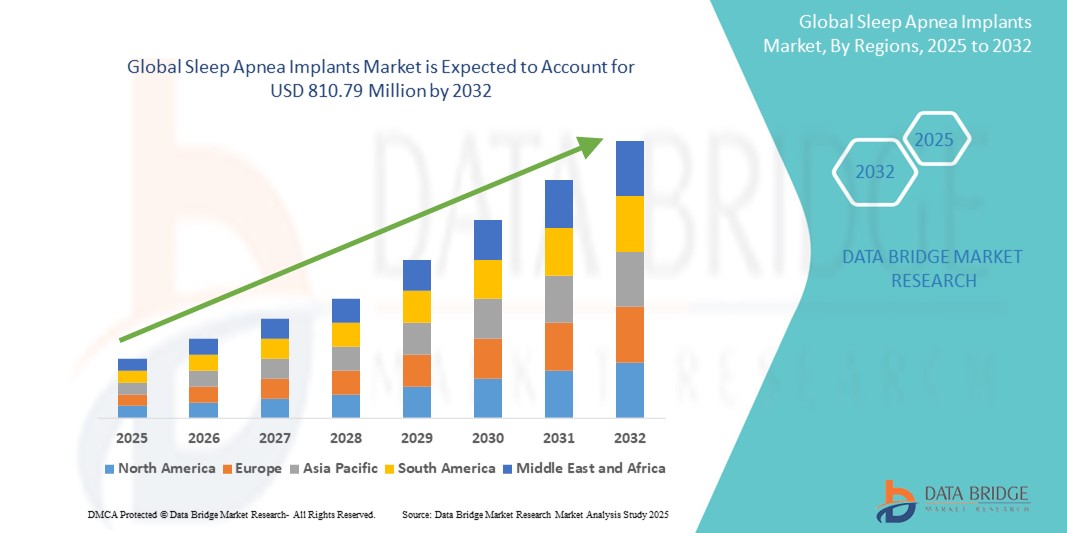

- The global sleep apnea implants market size was valued at USD 545.02 million in 2024 and is expected to reach USD 810.79 million by 2032, at a CAGR of 5.09% during the forecast period

- The market growth is largely fueled by the rising prevalence of obstructive sleep apnea (OSA) worldwide, alongside increasing awareness and diagnosis rates, prompting greater adoption of implantable therapies as alternatives to CPAP and other non-invasive treatments

- Furthermore, advancements in neurostimulation technology and favorable reimbursement policies in key markets are driving clinical acceptance and patient preference for implantable solutions. These converging factors are accelerating the demand for sleep apnea implants, thereby significantly boosting the industry’s growth

Sleep Apnea Implants Market Analysis

- Sleep apnea implants, which deliver targeted neurostimulation or structural support to alleviate obstructive sleep apnea (OSA), are becoming essential alternatives to traditional therapies due to their high compliance rates, minimally invasive nature, and long-term efficacy in managing moderate to severe OSA

- The escalating demand for sleep apnea implants is primarily fueled by growing awareness of untreated OSA health risks, increasing intolerance to CPAP devices among patients, and ongoing innovation in implantable neuromodulation technologies

- North America dominated the sleep apnea implants market with the largest revenue share of 50.3% in 2024, driven by high diagnosis rates, favorable reimbursement policies, and strong clinical adoption in the U.S., where leading companies are expanding patient access through advanced surgical centers and sleep disorder clinics

- Asia-Pacific is expected to be the fastest growing region in the sleep apnea implants market during the forecast period due to increasing healthcare investments, rising awareness of sleep disorders, and improving access to advanced medical technologies across emerging economies

- Hypoglossal neurostimulation devices segment dominated the sleep apnea implants market with a market share of 68.3% in 2024, attributed to its proven therapeutic outcomes, FDA approvals, and its ability to treat OSA at the source by activating airway muscles during sleep

Report Scope and Sleep Apnea Implants Market Segmentation

|

Attributes |

Sleep Apnea Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sleep Apnea Implants Market Trends

“Technological Advancements in Neurostimulation and Personalized Therapies”

- A significant and accelerating trend in the global sleep apnea implants market is the advancement of neurostimulation technologies and the shift toward personalized, patient-specific therapies that optimize treatment effectiveness and long-term compliance. These innovations are transforming the way obstructive sleep apnea (OSA) is managed, particularly among patients intolerant to traditional CPAP therapy

- For instance, Inspire Medical Systems’ hypoglossal nerve stimulation implant offers a user-friendly remote control that allows patients to activate therapy before sleep. The device uses a personalized algorithm to synchronize stimulation with each patient’s breathing cycle, delivering targeted therapy and improving quality of life

- Technological improvements now enable more compact and longer-lasting implants, refined sensor capabilities, and wireless programming tools for clinicians to remotely monitor and fine-tune therapy settings. These features help ensure optimal therapeutic outcomes and encourage ongoing patient engagement

- Furthermore, companies such as LivaNova and Nyxoah are investing in bilateral stimulation systems and minimally invasive procedures that reduce surgical complexity and recovery time. These systems also offer compatibility with diagnostic software and sleep tracking, further enhancing patient-centered care

- Integration with digital platforms for real-time data transmission and cloud-based monitoring enables physicians to make evidence-based decisions and promptly adjust therapy, driving better outcomes

- This trend toward highly customized, intelligent, and minimally invasive implants is reshaping the landscape of OSA treatment. As patient demand grows for alternatives to CPAP, and as clinicians seek more effective long-term solutions, the market is responding with advanced, integrated implant systems designed for comfort, efficacy, and user control

Sleep Apnea Implants Market Dynamics

Driver

“Rising CPAP Intolerance and Increased Diagnosis of Sleep Apnea”

- The rising number of patients unable to tolerate continuous positive airway pressure (CPAP) devices, combined with growing awareness and diagnosis of obstructive sleep apnea, is a key driver behind the increased demand for implant-based solutions

- For instance, according to the American Academy of Sleep Medicine, nearly 40–50% of CPAP users discontinue treatment due to discomfort or non-compliance. This has led clinicians and patients to seek more effective and patient-friendly alternatives such as hypoglossal nerve stimulation implants

- Additionally, improvements in diagnostic tools and screening initiatives, including at-home sleep tests and AI-driven detection software, are contributing to early and accurate diagnosis of OSA, expanding the candidate pool for implantable therapies

- The convenience of a surgically implanted device that offers long-term efficacy without the nightly hassle of masks and machines is especially appealing to working professionals and elderly populations. This appeal is further supported by clinical studies and real-world evidence demonstrating the sustained benefits of neurostimulation implants

- As healthcare systems increasingly recognize the cost burden of untreated OSA—linked to cardiovascular disease, diabetes, and accidents—there is growing institutional support for alternative therapies, fueling market adoption across both developed and emerging markets

Restraint/Challenge

“High Cost and Regulatory Hurdles in Emerging Markets”

- Despite their effectiveness, the high cost of sleep apnea implants and limited insurance coverage in many regions present significant challenges to broader market penetration. The initial surgical costs, device pricing, and post-implantation follow-up can make these treatments inaccessible to patients in lower-income or underinsured populations

- For instance, in many Asia-Pacific and Latin American countries, lack of reimbursement frameworks for neurostimulation-based therapies hinders adoption, even as diagnosis rates rise

- Additionally, regulatory approvals for novel implant systems can be lengthy and region-specific, requiring substantial clinical evidence and long-term data, which can delay market entry and raise development costs for manufacturers

- Patient hesitation regarding surgical intervention, coupled with the need for specialized surgical expertise and follow-up care, also poses adoption barriers in less-developed healthcare settings

- Addressing these challenges through expanded reimbursement, cost reduction strategies, clinical education, and simplification of implant procedures will be critical to unlocking the full potential of the global sleep apnea implants market

Sleep Apnea Implants Market Scope

The market is segmented on the basis of product, indication, and end user.

- By Product

On the basis of product, the sleep apnea implants market is segmented into phrenic nerve stimulator, hypoglossal neurostimulation devices, bone screw implant system, flexible tongue retractor system, and palatal implants. The hypoglossal neurostimulation devices segment dominated the market with the largest revenue share of 68.3% in 2024, driven by its proven efficacy in treating obstructive sleep apnea (OSA), particularly in patients intolerant to CPAP. These implants stimulate the hypoglossal nerve to maintain an open airway during sleep and have shown high patient adherence and satisfaction. Widespread clinical acceptance, FDA approvals, and robust supporting data further solidify this segment’s leadership.

The phrenic nerve stimulator segment is expected to witness the fastest growth from 2025 to 2032, propelled by increasing diagnosis of central sleep apnea (CSA) and the need for targeted therapies in heart failure-associated CSA patients. These devices help regulate breathing by stimulating the diaphragm, and their use is expanding as awareness and diagnosis of CSA improve.

- By Indication

On the basis of indication, the sleep apnea implants market is segmented into obstructive sleep apnea (OSA) and central sleep apnea (CSA). The obstructive sleep apnea (OSA) segment accounted for the largest market share in 2024 due to its significantly higher global prevalence compared to CSA. With millions of people worldwide suffering from undiagnosed or untreated OSA, the need for effective alternatives to CPAP therapy has spurred the adoption of implant-based solutions.

The central sleep apnea (CSA) segment is expected to witness the fastest CAGR from 2025 to 2032, especially due to its link with heart failure and the emerging role of phrenic nerve stimulators as a clinically approved solution, improving outcomes for high-risk patients.

- By End User

On the basis of end user, the sleep apnea implants market is segmented into hospitals, ambulatory surgical centers (ASCs), and office-based clinics. The hospitals segment led the market in 2024 with the highest revenue share, attributed to the availability of advanced surgical infrastructure, comprehensive post-operative care, and specialized sleep disorder units that facilitate implant placement and follow-up.

The ambulatory surgical centers (ASCs) segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the growing preference for minimally invasive, cost-effective outpatient procedures. The reduced hospital stay, quicker recovery, and lower overall cost make ASCs an attractive option for both patients and providers in implant-based OSA treatment.

Sleep Apnea Implants Market Regional Analysis

- North America dominated the sleep apnea implants market with the largest revenue share of 50.3% in 2024, driven by high diagnosis rates, favorable reimbursement policies, and strong clinical adoption in the U.S., where leading companies are expanding patient access through advanced surgical centers and sleep disorder clinics

- Consumers in the region increasingly seek long-term, user-friendly treatment options due to widespread CPAP intolerance and a rising awareness of the health risks associated with untreated sleep apnea

- This growth is further supported by favorable reimbursement policies, a well-established network of specialized sleep clinics, and the presence of key market players, positioning North America as a leading hub for innovation and adoption in sleep apnea implant solutions

U.S. Sleep Apnea Implants Market Insight

The U.S. sleep apnea implants market captured the largest revenue share of 82% in 2024 within North America, driven by high diagnosis rates, widespread CPAP intolerance, and growing clinical preference for implantable alternatives. Increasing awareness of the long-term health impacts of untreated obstructive sleep apnea (OSA) is encouraging patients to seek more effective and permanent solutions. The strong presence of companies such as Inspire Medical Systems, along with extensive healthcare infrastructure and favorable reimbursement frameworks, further fuels market expansion. Additionally, the rise of personalized medicine and integration of digital health monitoring tools supports broader adoption across sleep centers and outpatient settings.

Europe Sleep Apnea Implants Market Insight

The Europe sleep apnea implants market is projected to grow at a significant CAGR during the forecast period, fueled by expanding awareness of sleep disorders and increased investment in sleep medicine. Countries such as Germany, France, and the U.K. are witnessing growing adoption of implantable therapies as alternatives to CPAP, especially among patients with moderate to severe OSA. Regulatory approvals for innovative neurostimulation devices and the inclusion of sleep apnea treatment under public health coverage are further supporting regional market growth. The rising geriatric population and demand for less invasive, compliance-friendly treatment options also contribute to the market’s acceleration.

U.K. Sleep Apnea Implants Market Insight

The U.K. sleep apnea implants market is anticipated to grow at a strong CAGR during the forecast period, driven by increasing public and clinical awareness of the health risks associated with untreated OSA. The National Health Service (NHS) and private providers are gradually adopting implantable devices for patients with CPAP intolerance. The presence of advanced diagnostic centers and rising demand for user-friendly, long-term treatment solutions are expected to boost market penetration. Additionally, research collaborations and government-backed initiatives aimed at improving sleep disorder management contribute to the country's expanding adoption of implant-based therapies.

Germany Sleep Apnea Implants Market Insight

The Germany sleep apnea implants market is expected to grow at a considerable CAGR, supported by the country’s robust healthcare infrastructure, advanced surgical capabilities, and increasing preference for high-tech medical solutions. German clinicians and hospitals are showing greater acceptance of hypoglossal nerve stimulation systems, particularly for OSA patients with low CPAP compliance. Regulatory clarity, health insurance coverage expansion, and the country's emphasis on long-term patient outcomes are key factors fueling market growth. Moreover, Germany's strong focus on innovation positions it as a key adopter of next-generation implantable therapies.

Asia-Pacific Sleep Apnea Implants Market Insight

The Asia-Pacific sleep apnea implants market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rising OSA prevalence, increasing diagnosis rates, and improving access to advanced healthcare technologies in countries such as China, Japan, and India. Government initiatives to improve sleep disorder awareness, coupled with growing urban populations and a burgeoning middle class, are expanding the candidate pool for implant-based treatments. Moreover, regional investment in healthcare infrastructure and growing interest in non-CPAP therapies are accelerating adoption. The presence of domestic device manufacturers and increasing affordability are helping bridge access gaps across emerging economies.

Japan Sleep Apnea Implants Market Insight

The Japan sleep apnea implants market is gaining traction due to the country’s aging population, widespread use of health technologies, and clinical demand for less invasive, compliance-driven solutions. Japan’s strong medical device industry and growing network of sleep specialists are supporting the uptake of neurostimulation implants, particularly in urban centers. Integration of these implants with digital health platforms and ongoing clinical research initiatives are helping validate their long-term efficacy and appeal. Additionally, the cultural emphasis on quality of life and personal health supports the expansion of innovative treatments for OSA.

India Sleep Apnea Implants Market Insight

The India sleep apnea implants market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by growing diagnosis rates, increasing healthcare investment, and widespread CPAP non-compliance. With a rising middle class, urbanization, and government-backed health initiatives, India is seeing greater demand for innovative, long-term solutions for sleep apnea. Leading hospitals and private clinics are beginning to offer implant-based treatments, and domestic manufacturers are helping lower costs and improve accessibility. The country's digital health push and smart city initiatives also support growth by fostering greater awareness and expanding infrastructure for sleep disorder management.

Sleep Apnea Implants Market Share

The sleep apnea implants industry is primarily led by well-established companies, including:

- Inspire Medical Systems, Inc. (U.S.)

- LinguaFlex (U.S.)

- LivaNova PLC (U.K.)

- Medtronic (Ireland)

- Siesta Medical Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Nihon Kohden Corporation (Japan)

- Nyxoah SA (Belgium)

- ResMed (U.S.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- SomnoMed (Australia)

- VYAIRE (U.S.)

- Drive DeVilbiss International (U.S.)

- Somnowell (U.K.)

- Natus Medical Incorporated. (U.S.)

- CONTEC MEDICAL SYSTEMS CO., LTD (China)

- CLEVELAND MEDICAL DEVICES INC. (U.S.)

- Nox Medical (Iceland)

- Advanced Brain Monitoring, Inc. (U.S.)

What are the Recent Developments in Global Sleep Apnea Implants Market?

- In April 2023, Inspire Medical Systems, Inc., a pioneer in hypoglossal nerve stimulation therapy, announced the expansion of its therapy access program across multiple regions in Europe and Asia-Pacific, aiming to increase patient access to implant-based treatments for obstructive sleep apnea (OSA). The initiative includes partnerships with regional healthcare providers and training programs for surgeons, reinforcing Inspire’s commitment to global accessibility and addressing the growing demand for alternatives to CPAP therapy.

- In March 2023, Nyxoah SA, a Belgium-based medical device company, received expanded CE Mark approval for its Genio® bilateral hypoglossal nerve stimulation system, allowing broader patient eligibility in the European market. This regulatory milestone enables the company to reach more OSA patients and affirms the safety and efficacy of bilateral stimulation technology, positioning Genio as a next-generation solution in implantable sleep apnea therapies

- In March 2023, LivaNova PLC announced positive preliminary results from its OSCAR trial, which evaluates the effectiveness of its implantable phrenic nerve stimulation device for central sleep apnea (CSA). Conducted in collaboration with leading cardiac and sleep centers, the trial demonstrated promising efficacy and patient tolerance, highlighting LivaNova’s commitment to addressing the unmet clinical needs in CSA treatment

- In February 2023, Fisher & Paykel Healthcare entered into a strategic agreement with a major academic medical center in New Zealand to co-develop next-generation sleep apnea monitoring and implant integration technologies. This partnership aims to combine diagnostic precision with implant-based therapeutic delivery, supporting a more personalized and data-driven approach to sleep apnea management

- In January 2023, Respicardia, Inc., a subsidiary of Zoll Medical Corporation, launched a clinician training initiative across the United States to expand awareness and surgical expertise in implanting its Remedē System, a fully implantable device for treating CSA. The training program is designed to increase the availability of therapy and accelerate adoption among sleep specialists and cardiologists, reflecting the company’s mission to advance implant-based solutions for underserved sleep apnea patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.