Global Small Animal Imaging In Vivo Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

2.54 Billion

2025

2033

USD

1.31 Billion

USD

2.54 Billion

2025

2033

| 2026 –2033 | |

| USD 1.31 Billion | |

| USD 2.54 Billion | |

|

|

|

|

Small Animal Imaging (In-Vivo) Market Size

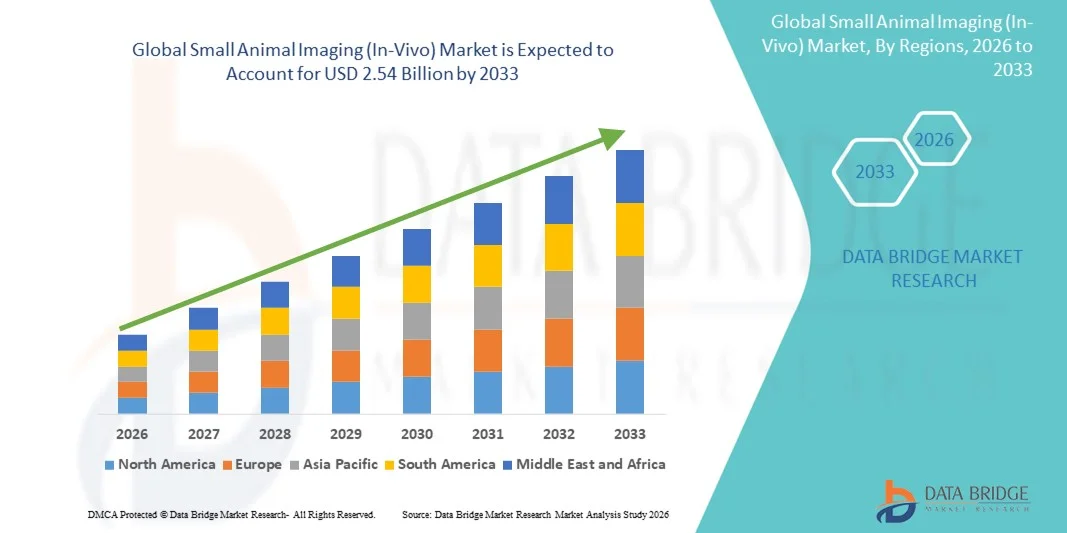

- The global small animal imaging (in-vivo) market size was valued at USD 1.31 billion in 2025 and is expected to reach USD 2.54 billion by 2033, at a CAGR of 8.55% during the forecast period

- The market growth is largely driven by increasing adoption of advanced imaging modalities in preclinical research, coupled with technological advancements in non-invasive in-vivo imaging systems, enabling more precise disease modeling and drug development

- Furthermore, rising investments by pharmaceutical and biotechnology companies in translational research, along with growing demand for efficient and high-throughput preclinical studies, is positioning small animal imaging as a critical tool in modern biomedical research. These factors are collectively accelerating the uptake of in-vivo imaging solutions, thereby significantly boosting the industry's growth

Small Animal Imaging (In-Vivo) Market Analysis

- Small animal imaging (in-vivo) systems, providing non-invasive visualization and quantification of biological processes in live animals, are increasingly critical in preclinical research and drug development due to their ability to offer precise, real-time insights into disease progression, treatment efficacy, and molecular interactions

- The rising demand for in-vivo imaging is primarily driven by growing investments in pharmaceutical and biotechnology R&D, the push for more predictive preclinical models, and the need for high-throughput, non-destructive imaging solutions in translational research

- North America dominated the small animal imaging market with the largest revenue share of 39.2% in 2025, characterized by strong research infrastructure, high adoption of advanced imaging modalities, and the presence of leading industry players. The U.S. led market growth with increasing use of multi-modal imaging platforms and advanced imaging software in preclinical studies

- Asia-Pacific is expected to be the fastest-growing region in the small animal imaging market during the forecast period due to expanding pharmaceutical research, growing academic collaborations, and increasing government support for life sciences research

- Micro-Magnetic Resonance Imaging (MRI) segment dominated the small animal imaging market with a market share of 42% in 2025, driven by its superior soft-tissue contrast, non-ionizing nature, and applicability across diverse preclinical studies, making it a preferred choice for longitudinal studies, biomarker analysis, and monitoring drug treatment response

Report Scope and Small Animal Imaging (In-Vivo) Market Segmentation

|

Attributes |

Small Animal Imaging (In-Vivo) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Small Animal Imaging (In-Vivo) Market Trends

Advancements in Multi-Modal Imaging and AI Integration

- A significant and accelerating trend in the global small animal imaging market is the growing integration of multi-modal imaging systems with artificial intelligence (AI) for enhanced image analysis, disease modeling, and drug evaluation

- For instance, the IVIS Spectrum CT system combines optical and micro-CT imaging modalities, enabling comprehensive preclinical studies with high-resolution anatomical and functional data

- AI integration allows automated segmentation, quantitative analysis, and predictive modeling, improving accuracy and reducing manual interpretation errors. For instance, Bruker’s AI-enabled imaging software assists in real-time tumor growth tracking and drug response monitoring

- The integration of multi-modal imaging with AI facilitates simultaneous visualization of molecular, cellular, and anatomical changes, providing more holistic insights in preclinical research and translational studies

- This trend towards intelligent and multi-functional imaging platforms is fundamentally enhancing research productivity and experimental reproducibility, with companies such as PerkinElmer developing AI-assisted imaging solutions that support longitudinal studies and biomarker monitoring

- The demand for integrated, AI-enabled, and multi-modal small animal imaging systems is rapidly increasing as pharmaceutical and academic research institutions prioritize faster, more precise preclinical analysis

- For instance, laboratories are increasingly adopting hybrid PET/MRI and PET/CT systems to simultaneously track anatomical and metabolic changes in disease models, improving study efficiency

- Enhanced optical imaging modalities, such as bioluminescence and fluorescence systems, are being coupled with real-time analytics to facilitate early detection of disease progression and treatment response in small animals

Small Animal Imaging (In-Vivo) Market Dynamics

Driver

Increasing Preclinical Research and Translational Studies

- The rising investment in preclinical drug development, translational research, and biomarker discovery is a significant driver for the growing adoption of small animal imaging systems

- For instance, in March 2025, Bruker announced an expansion of its small animal imaging solutions with enhanced PET/MRI capabilities for preclinical oncology studies, supporting high-throughput research

- As pharmaceutical and biotech companies seek to improve drug candidate selection and accelerate timelines, small animal imaging provides crucial non-invasive monitoring and longitudinal study capabilities

- Furthermore, the expansion of academic research centers and contract research organizations (CROs) globally is increasing demand for advanced in-vivo imaging systems

- High-resolution imaging, multi-modal capabilities, and non-destructive analysis offered by these systems are critical for effective evaluation of disease progression, therapeutic efficacy, and biodistribution studies. The growing focus on predictive preclinical models and personalized medicine is propelling the adoption of small animal imaging platforms across pharmaceutical and academic research sectors

- For instance, increased R&D in oncology, neurology, and cardiology is boosting demand for imaging systems that can provide accurate longitudinal tracking of disease progression

- The rising collaboration between imaging system providers and pharmaceutical companies for customized solutions is further accelerating the adoption of advanced small animal imaging technologies

Restraint/Challenge

High Equipment Cost and Regulatory Compliance Complexity

- The high initial cost of advanced small animal imaging systems and the complexity of meeting regulatory standards pose significant challenges for widespread market adoption

- For instance, state-of-the-art MRI and PET/CT systems can cost several hundred thousand dollars, making them inaccessible for smaller research facilities

- Compliance with animal welfare regulations and imaging safety protocols adds operational complexity and requires specialized training for personnel

- Furthermore, integrating multi-modal systems with AI software requires additional investment in infrastructure and skilled staff, which can be a barrier for smaller laboratories or emerging markets

- While leasing options and collaborative research models are emerging, the high capital expenditure and regulatory requirements remain key adoption hurdles

- Overcoming these challenges through cost-effective imaging solutions, standardized protocols, and training programs will be essential for sustainable market growth in the coming years. For instance, smaller CROs may face delays in acquiring approvals for new imaging studies due to regulatory hurdles, slowing adoption rates

- In addition, ongoing maintenance, software updates, and calibration of complex imaging systems increase operational costs, discouraging smaller research institutions from adopting these technologies

Small Animal Imaging (In-Vivo) Market Scope

The market is segmented on the basis of modality, application, and reagents.

- By Modality

On the basis of modality, the small animal imaging market is segmented into Optical Imaging Systems, Nuclear Imaging, Micro-Magnetic Resonance Imaging (MRI), Micro-Ultrasound, Micro-CT, Magnetic Particle Imaging (MPI) systems, and photoacoustic imaging systems. The Micro-Magnetic Resonance Imaging (MRI) segment dominated the small animal imaging market with a market share of 42% in 2025, driven by its exceptional ability to deliver high-resolution, non-invasive anatomical and functional imaging in preclinical research. Micro-MRI is widely used across oncology, neurology, and cardiovascular studies, enabling researchers to visualize soft tissue structures with superior clarity compared to other modalities. Its strength lies in providing longitudinal assessments of disease progression without exposing animals to ionizing radiation, making it ideal for repeated studies. The modality’s broad compatibility with advanced contrast agents enhances its utility in tracking biomarkers and physiological changes. Growing investments by pharmaceutical and biotech companies in high-quality in-vivo imaging platforms further reinforce its leadership position.

The Micro-Magnetic Resonance Imaging (MRI) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its superior soft-tissue contrast, non-ionizing nature, and increasing demand for high-resolution anatomical and functional assessment in neurology, cardiology, and oncology research. Micro-MRI’s capability for multiparametric imaging (e.g., diffusion, functional MRI) supports translational studies that require precise longitudinal structural and functional measurements. Advances such as higher field magnets, improved coils, AI-assisted reconstruction, and easier integration with PET or optical modalities are lowering barriers and expanding applications. As pharmaceutical and biotech firms place greater emphasis on predictive preclinical models, demand for MRI’s non-destructive, detailed imaging continues to accelerate.

- By Application

On the basis of application, the small animal imaging market is segmented into monitoring drug treatment response, biodistribution studies, cancer cell detection, biomarkers, longitudinal studies, and epigenetics. The Monitoring Drug Treatment Response segment dominated the market in 2025 due to the critical role imaging plays in evaluating therapeutic efficacy, enabling non-invasive, repeated measures of tumor regression, metabolic shifts, and physiological responses that inform go/no-go decisions in development pipelines. Imaging reduces the need for terminal endpoints by enabling longitudinal assessment in the same cohort, improving statistical power and ethical use of animals. Pharmaceutical companies and CROs increasingly invest in imaging-capable preclinical services to accelerate candidate selection and de-risk clinical translation. Enhanced quantitative tools, image-based biomarkers, and AI analytics further strengthen this segment’s dominance by improving sensitivity and interpretability of treatment effects.

The Cancer Cell Detection segment is expected to be the fastest-growing application from 2026 to 2033, propelled by expanding oncology R&D, immuno-oncology advances, and the need to detect early tumorigenesis, micrometastases, and tumor microenvironment changes at cellular and molecular resolution. Modalities such as optical imaging, PET, and photoacoustic imaging are increasingly used with targeted probes and tracers for early detection and monitoring of metastatic spread. Innovations in tumor-specific radiotracers, fluorescent probes, and reporter models are improving detection thresholds and specificity. As oncology remains a major focus of preclinical investment, demand for imaging tailored to cancer cell detection is rising rapidly across academia and industry.

- By Reagents

On the basis of reagents, the market is segmented into optical imaging reagents, mri contrast agents, ultrasound contrast agents, nuclear imaging reagents, and CT contrast agents. The Optical Imaging Reagents segment dominated the reagents market in 2025, supported by the ubiquity of fluorescence and bioluminescence assays in preclinical studies that require high sensitivity, specificity, and temporal resolution for molecular and cellular investigations. Optical probes (targeted dyes, activatable probes, luciferase reporters) are widely used across cancer, infection, inflammation, and metabolic research because they are relatively affordable and compatible with high-throughput workflows. The steady introduction of next-generation probes and genetically encoded reporters enhances utility and drives procurement across research labs. Academic centers and smaller biotechs especially favor optical reagents due to lower barrier to entry and strong integration with existing optical imaging platforms.

The Nuclear Imaging Reagents segment is projected to be the fastest-growing reagents category from 2026 to 2033, driven by the expanding use of PET and SPECT radiotracers for highly sensitive, receptor- and pathway-specific imaging in oncology, neurology, and cardiology preclinical studies. Radiotracers enable ultra-sensitive quantification of molecular interactions, biodistribution, and target engagement essential for drug development. The adoption of PET/MRI and PET/CT hybrid platforms increases the value of nuclear reagents by combining functional sensitivity with anatomical context. Advances in radiochemistry, new tracer chemistries, and longer-half-life isotopes improving logistics are making nuclear reagents more accessible and attractive for translational research, accelerating market growth.

Small Animal Imaging (In-Vivo) Market Regional Analysis

- North America dominated the small animal imaging market with the largest revenue share of 39.2% in 2025, characterized by strong research infrastructure, high adoption of advanced imaging modalities, and the presence of leading industry players

- The region’s leadership is driven by the rapid adoption of advanced imaging modalities such as micro-MRI, micro-PET/CT, and optical imaging, which are widely used in oncology, neurology, and metabolic disorder studies

- Growing emphasis on non-invasive, high-resolution imaging techniques for longitudinal animal studies continues to push demand, supported by well-established research infrastructure and high funding availability

U.S. Small Animal Imaging (In-Vivo) Market Insight

The U.S. small animal imaging market accounted for the overwhelming majority of North America’s revenue share in 2025, propelled by the country's strong biomedical research ecosystem and robust investments in preclinical studies. Research universities, government-funded laboratories, pharmaceutical giants, and CROs extensively deploy small animal imaging technologies to accelerate therapeutic development and precision medicine programs. Growing adoption of hybrid imaging modalities and high-resolution systems supports deeper visualization of disease pathways. The increasing focus on non-invasive longitudinal studies, paired with the presence of leading imaging manufacturers and innovative startups, continues to stimulate market growth in the U.S.

Europe Small Animal Imaging (In-Vivo) Market Insight

The Europe small animal imaging market is projected to grow at a substantial CAGR throughout the forecast period, supported by strong scientific research output and rising investments in preclinical imaging infrastructure. The region is experiencing significant adoption across oncology, cardiovascular, and molecular biology studies due to the need for high-precision, non-invasive imaging tools. Academic institutions and research hospitals are increasingly utilizing small animal imaging systems for biomarker discovery and drug evaluation. Europe’s emphasis on research quality, strict compliance with laboratory standards, and expansion of funded R&D programs further enhance market penetration. Growth is occurring across both established Western European research hubs and emerging Eastern European laboratories.

U.K. Small Animal Imaging (In-Vivo) Market Insight

The U.K. small animal imaging market is anticipated to grow at a notable CAGR during the forecast period, driven by the country’s strong academic research base and expanding focus on advanced biomedical studies. Rising interest in cancer research, genetic studies, and drug development initiatives is accelerating the adoption of multi-modal imaging platforms. The presence of leading universities, well-funded research networks, and collaborations between government bodies and private entities strengthen the market outlook. In addition, increasing demand for high-resolution imaging tools to support precision medicine research and longitudinal animal studies continues to propel growth in the U.K.

Germany Small Animal Imaging (In-Vivo) Market Insight

The Germany small animal imaging market is expected to expand at a considerable CAGR during the forecast period, supported by the nation’s strong emphasis on scientific innovation and cutting-edge medical research. German research institutions actively adopt micro-MRI, micro-CT, and nuclear imaging technologies to support advanced disease modeling and therapeutic evaluation. High investments in preclinical infrastructure, combined with collaborations between universities and biotechnology firms, are driving adoption. Germany’s focus on engineering excellence and precision technologies also fosters the development and deployment of sophisticated imaging systems that cater to complex research needs.

Asia-Pacific Small Animal Imaging (In-Vivo) Market Insight

The Asia-Pacific small animal imaging market is projected to grow at the fastest CAGR during the forecast period, fueled by rapid expansion in biomedical research, rising healthcare investments, and growing interest in translational studies in countries such as China, Japan, and India. Government initiatives promoting scientific innovation and the establishment of advanced preclinical laboratories are accelerating the adoption of imaging technology. Increasing focus on oncology research, genetic studies, and biologics development is supporting demand for high-resolution and hybrid imaging modalities. In addition, APAC’s emergence as a cost-effective research hub is drawing global pharmaceutical companies to expand preclinical operations in the region.

Japan Small Animal Imaging (In-Vivo) Market Insight

The Japan small animal imaging market is gaining momentum due to the country’s strong technological foundation, high research intensity, and growing demand for precise diagnostic evaluation in preclinical studies. Japanese universities and research centers are early adopters of micro-MRI, micro-PET, and optical imaging technologies to support oncology, regenerative medicine, and neuroscience research. The nation’s leadership in automation and imaging innovation further drives the development of sophisticated systems. Moreover, Japan’s aging population contributes indirectly to increased research on age-related diseases, fueling the need for advanced in-vivo imaging tools.

India Small Animal Imaging (In-Vivo) Market Insight

The India small animal imaging market captured a significant revenue share within Asia Pacific in 2025, driven by rapid growth in preclinical research, expanding biotechnology and pharmaceutical industries, and rising government support for biomedical innovation. Increasing establishment of advanced research centers and CROs is boosting demand for imaging modalities such as micro-CT, optical imaging, and micro-MRI. India’s focus on drug discovery, vaccine development, and cancer research has led to growing adoption of non-invasive small animal imaging systems. Affordable imaging solutions and rising investment from domestic manufacturers are further contributing to strong market expansion across the country.

Small Animal Imaging (In-Vivo) Market Share

The Small Animal Imaging (In-Vivo) industry is primarily led by well-established companies, including:

- Bruker Corporation (U.S.)

- PerkinElmer (U.S.)

- FUJIFILM VisualSonics Inc. (Canada)

- MILabs B.V. (Netherlands)

- Mediso Medical Imaging Systems (Hungary)

- MR Solutions Ltd. (U.K.)

- Aspect Imaging Ltd. (Israel)

- TriFoil Imaging Inc. (U.S.)

- Scanco Medical AG (Switzerland)

- Cubresa Inc. (Canada)

- SOFIE Biosciences (U.S.)

- Berthold Technologies GmbH & Co. KG (Germany)

- Miltenyi Biotec GmbH (Germany)

- LI-COR Biosciences (U.S.)

- IVIM Technology Corp. (South Korea)

- Kub Technologies (U.S.)

- Rigaku Corporation (Japan)

- United Imaging Healthcare (China)

- Thermo Fisher Scientific Inc. (U.S.)

- Faxitron Bioptics (U.S.)

What are the Recent Developments in Global Small Animal Imaging (In-Vivo) Market?

- In November 2024, a research team at POSTECH (Pohang University of Science & Technology) developed a high-speed rotational-scanning photoacoustic computed tomography (PACT) system for whole-body small animal imaging, enabling complete 360° anatomical scans of a rat torso in just 9 seconds and full whole-body scans in as little as 54 seconds with spatial resolution around 212 µm

- In March 2024, researchers published a breakthrough in preclinical molecular imaging: a zirconium-89–labeled, fully human antibody-based immunoPET probe targeting CD133, a key cancer stem cell marker. This development enables high-precision visualization of cancer stem cells in mouse models, supporting early-stage therapeutic evaluation and improving understanding of tumor resistance mechanisms

- In March 2023, Bruker rolled out the Bioscan Fusion 3 multi-modality preclinical imaging system, integrating PET, SPECT, and CT technologies within a single platform for small-animal studies. This combination enables researchers to obtain molecular, anatomical, and functional imaging data without transferring subjects between instruments, significantly improving workflow efficiency and data consistency

- In May 2022, Bruker Corporation launched its new 7 Tesla and 9.4 Tesla “Maxwell” preclinical MRI magnets, featuring conduction-cooled technology that eliminates the need for liquid helium or nitrogen. This innovation significantly reduces operational costs and site-planning constraints, making high-field micro-MRI systems more accessible for academic labs and pharmaceutical research centers

- In April 2022, PerkinElmer, Inc. introduced the Vega widefield preclinical ultrasound imaging system, a fully automated and hands-free platform designed to deliver high-throughput small animal imaging. Vega reduces operator dependency and variability by automating image acquisition and animal positioning, enabling more consistent and reproducible results across studies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.