Global Small Bone And Joint Orthopedic Devices Market

Market Size in USD Billion

CAGR :

%

USD

8.13 Billion

USD

14.92 Billion

2025

2033

USD

8.13 Billion

USD

14.92 Billion

2025

2033

| 2026 –2033 | |

| USD 8.13 Billion | |

| USD 14.92 Billion | |

|

|

|

|

Small Bone and Joint Orthopedic Devices Market Size

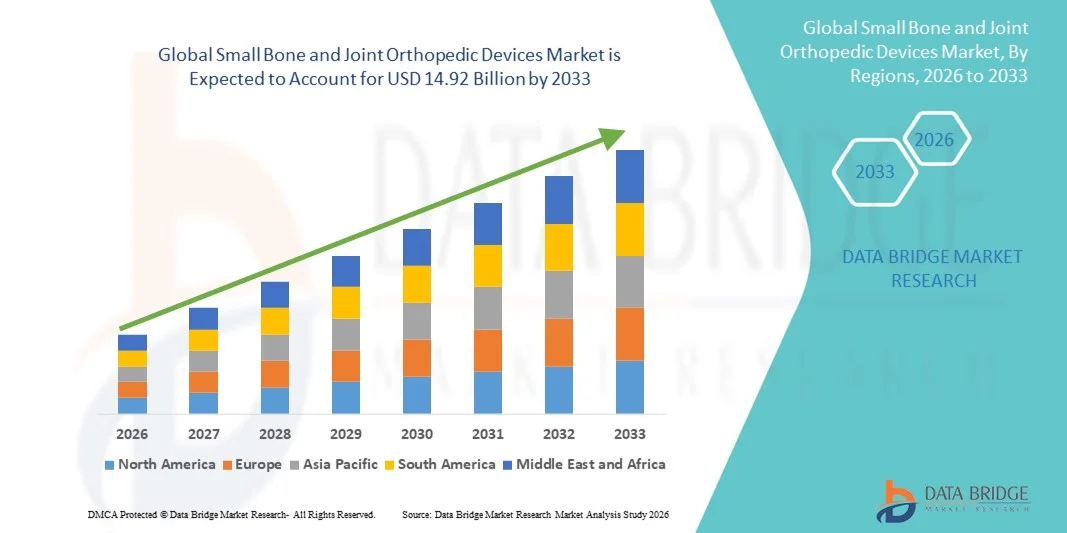

- The global small bone and joint orthopedic devices market size was valued at USD 8.13 billion in 2025 and is expected to reach USD 14.92 billion by 2033, at a CAGR of 7.89% during the forecast period

- The market growth is primarily driven by the rising prevalence of musculoskeletal disorders, fractures, and joint injuries, coupled with advancements in minimally invasive surgical techniques and implant technologies

- In addition, increasing geriatric population, growing awareness of early diagnosis and treatment options, and demand for faster recovery solutions are positioning small bone and joint orthopedic devices as essential tools in modern orthopedic care. These factors are collectively propelling the adoption of these devices, thereby supporting robust market expansion

Small Bone and Joint Orthopedic Devices Market Analysis

- Small bone and joint orthopedic devices, including plates, screws, pins, and fixation systems, are increasingly essential for treating fractures, deformities, and joint injuries in both upper and lower extremities, offering improved surgical outcomes, faster recovery, and enhanced mobility for patients

- The growing demand for these devices is primarily driven by the rising prevalence of musculoskeletal disorders, fractures from accidents and sports injuries, and the increasing adoption of minimally invasive surgical procedures that reduce recovery time and complications

- North America dominated the small bone and joint orthopedic devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading orthopedic device manufacturers. The U.S. witnessed substantial growth in small bone and joint procedures, particularly among the elderly and trauma patients, fueled by technological innovations and the adoption of 3D-printed implants and navigation-assisted surgeries

- Asia-Pacific is expected to be the fastest growing region in the small bone and joint orthopedic devices market during the forecast period due to increasing incidence of orthopedic injuries, rising healthcare awareness, and expanding hospital infrastructure across emerging economies such as China and India

- Plate and screw segment dominated the small bone and joint orthopedic devices market with a market share of 41.7% in 2025, attributed to their proven effectiveness, versatility, and ease of use in stabilizing fractures and facilitating bone healing

Report Scope and Small Bone and Joint Orthopedic Devices Market Segmentation

|

Attributes |

Small Bone and Joint Orthopedic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Small Bone and Joint Orthopedic Devices Market Trends

Innovation in 3D-Printed and Patient-Specific Implants

- A significant and accelerating trend in the global small bone and joint orthopedic devices market is the growing adoption of 3D-printed and patient-specific implants, enabling personalized surgical solutions and improved clinical outcomes

- For instance, Medartis has developed 3D-printed small bone plates customized to patient anatomy, enhancing fit, reducing surgical time, and promoting faster healing. Similarly, Stryker’s patient-matched implants allow precise reconstruction of complex bone and joint defects

- Advanced imaging and CAD/CAM technologies integrated with 3D printing allow surgeons to pre-plan procedures, simulate outcomes, and optimize implant designs for individual patients, minimizing intraoperative adjustments and improving surgical precision

- The trend towards personalized orthopedic solutions is driving R&D investments in additive manufacturing, biomaterials, and software-assisted surgical planning, resulting in more accurate, durable, and biocompatible implants

- This innovation is reshaping surgeon and patient expectations for orthopedic care, as personalized implants offer better functional recovery, reduced complications, and enhanced long-term outcomes. Consequently, companies such as DePuy Synthes are expanding their portfolio of patient-specific fixation devices and small joint implants to meet this rising demand

- The demand for 3D-printed, patient-specific orthopedic implants is increasing rapidly across hospitals and specialized orthopedic centers, as clinicians and patients prioritize tailored solutions for complex fractures and joint reconstructions

- Growing collaborations between orthopedic device manufacturers and research institutions are accelerating development of bioactive and resorbable implants that enhance bone healing and reduce long-term complications

Small Bone and Joint Orthopedic Devices Market Dynamics

Driver

Increasing Prevalence of Musculoskeletal Disorders and Fractures

- The rising incidence of fractures, trauma cases, and musculoskeletal disorders across all age groups is a major driver for the growing adoption of small bone and joint orthopedic devices. For instance, in March 2025, Smith & Nephew reported an increase in distal radius fracture procedures in North America, highlighting the growing need for advanced fixation systems to improve patient outcomes

- Patients and clinicians are increasingly seeking minimally invasive procedures that reduce surgical time, hospital stay, and rehabilitation duration, creating strong demand for innovative plates, screws, and fixation devices

- The aging population with degenerative joint diseases and osteoporosis further contributes to the expanding market, as elderly patients often require specialized implants for small bone and joint stabilization

- Hospitals and orthopedic centers are upgrading surgical facilities and incorporating advanced devices for fracture management and joint reconstruction, making these devices an integral part of modern orthopedic care

- Rising sports-related injuries and high-impact accidents in younger populations are increasing demand for durable and reliable orthopedic devices to ensure rapid recovery and return to activity

- Government initiatives and insurance coverage for orthopedic procedures in key regions are supporting wider adoption of advanced small bone and joint devices, particularly in developed markets

Restraint/Challenge

High Cost and Regulatory Approval Complexity

- The high cost of advanced small bone and joint orthopedic devices, particularly patient-specific and 3D-printed implants, poses a significant challenge for adoption in cost-sensitive markets

- For instance, customized implants from companies such as DePuy Synthes or Stryker can be significantly more expensive than standard plates and screws, limiting their accessibility in emerging economies

- Stringent regulatory requirements and lengthy approval processes for new orthopedic devices add complexity and delay market entry, increasing development costs and impacting ROI for manufacturers

- In addition, the need for surgeon training and adaptation to novel surgical systems can hinder widespread adoption of new technologies in smaller hospitals or clinics

- Overcoming these challenges through cost optimization, simplified regulatory pathways, and enhanced surgeon training programs will be crucial for sustained market growth

- Limited awareness among patients and some healthcare providers regarding advanced fixation techniques can slow adoption, particularly in rural or underserved regions

- Supply chain disruptions or raw material shortages for specialized implants can temporarily affect product availability and impact market growth in certain regions

Small Bone and Joint Orthopedic Devices Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the market is segmented into shoulder reconstruction devices, elbow repair devices, fracture fixation and replacement systems, foot and ankle devices, external fixation devices, plates and screws, joint prosthesis, and others. The plates and screws segment dominated the market with the largest market revenue share of 41.7% in 2025, driven by their proven effectiveness in stabilizing fractures and facilitating bone healing. Surgeons often prefer plates and screws due to their versatility across small bones and joints, ease of intraoperative handling, and compatibility with minimally invasive techniques. The segment also benefits from continuous innovations, including locking plates and bioresorbable screws, which enhance surgical outcomes and reduce post-operative complications. In addition, plates and screws are widely used in both trauma and elective orthopedic procedures, supporting consistent demand across hospitals and clinics. Their established clinical track record and broad availability make them a standard choice for fracture fixation, contributing to their dominance in the market.

The joint prosthesis segment is expected to witness the fastest growth rate during the forecast period, driven by increasing prevalence of degenerative joint diseases and rising adoption of joint replacement surgeries in emerging regions. Advances in biomaterials, modular designs, and patient-specific prostheses are enhancing functional outcomes and implant longevity. The segment growth is also supported by rising awareness among patients and surgeons about early intervention in joint disorders, expanding the pool of potential candidates. Furthermore, improved surgical techniques, including robotic-assisted and minimally invasive joint replacement procedures, are increasing the adoption of prosthetic implants. Growing geriatric populations and higher healthcare spending in developed countries further fuel the demand for joint prostheses.

- By Application

On the basis of application, the market is segmented into foot and hand. The hand segment dominated the market in 2025, largely due to the high incidence of fractures, tendon injuries, and joint deformities in the upper extremities. Hand surgeries often require precise and delicate fixation devices, including specialized plates, screws, and external fixators, which support functional recovery and mobility. Surgeons prefer advanced small bone devices for hand reconstruction because of their compatibility with minimally invasive techniques and ability to maintain anatomical alignment. In addition, the demand for hand orthopedic procedures is rising with increasing occupational injuries, sports-related trauma, and rising awareness of early intervention to prevent long-term disability. Hospitals and specialized orthopedic centers are increasingly investing in devices for hand reconstruction, further reinforcing the segment’s dominance.

The foot segment is anticipated to witness the fastest growth during the forecast period, driven by increasing prevalence of foot and ankle injuries, diabetic foot complications, and sports-related trauma. Advanced fixation systems, plates, and prostheses for the foot enable precise correction of deformities and accelerated post-surgical recovery. Rising geriatric population and increasing participation in recreational and professional sports contribute to higher incidence of fractures and joint degeneration in the foot. The segment growth is also supported by technological innovations in minimally invasive foot surgery and improved implant materials. Expanding orthopedic care infrastructure and growing awareness about mobility and functional rehabilitation further propel adoption in the foot segment.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, and ambulatory surgical centers (ASCs). The hospitals segment dominated the market in 2025 due to the availability of advanced surgical facilities, trained orthopedic surgeons, and comprehensive post-operative care services. Hospitals often handle complex fractures and joint reconstructions requiring specialized devices, making them primary buyers of small bone and joint orthopedic products. Large hospitals also have higher purchasing power and established supply chain networks, enabling bulk procurement of orthopedic implants and instruments. The segment benefits from increasing trauma cases, aging populations, and rising elective orthopedic surgeries, sustaining strong demand for advanced devices. In addition, hospitals are early adopters of innovative implants such as patient-specific plates and 3D-printed prostheses, reinforcing their dominant position in the market.

The ASCs segment is expected to witness the fastest growth rate during the forecast period, fueled by the rising preference for outpatient procedures and minimally invasive surgeries. ASCs provide cost-effective and convenient care for patients requiring fracture fixation or small joint procedures without extended hospital stays. Growing awareness among patients and insurers about the benefits of outpatient surgeries, combined with expansion of orthopedic ASCs in developed and emerging regions, drives adoption. The shift toward outpatient surgical settings encourages manufacturers to develop compact, easy-to-use devices suitable for ASCs. Furthermore, ASCs are increasingly investing in advanced surgical tools and implants, creating new opportunities for orthopedic device manufacturers.

Small Bone and Joint Orthopedic Devices Market Regional Analysis

- North America dominated the small bone and joint orthopedic devices market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading orthopedic device manufacturers

- The region’s strong presence of leading orthopedic device manufacturers, coupled with continuous technological innovations such as 3D-printed implants, navigation-assisted surgery, and minimally invasive fixation systems, is fueling adoption across both trauma and elective procedures

- Surgeons in North America prefer advanced plates, screws, and joint prostheses due to their reliability, proven clinical outcomes, and compatibility with modern surgical techniques, supporting consistent usage across hospitals and specialized orthopedic centers

U.S. Small Bone and Joint Orthopedic Devices Market Insight

The U.S. small bone and joint orthopedic devices market captured the largest revenue share of 37% in 2025 within North America, driven by advanced healthcare infrastructure, high patient awareness, and a strong network of hospitals and orthopedic centers. The rising prevalence of fractures, sports injuries, and musculoskeletal disorders is fueling demand for innovative fixation systems, plates, screws, and joint prostheses. Growing adoption of minimally invasive and patient-specific surgical solutions, including 3D-printed implants and navigation-assisted procedures, further propels market growth. Moreover, favorable reimbursement policies, government initiatives for orthopedic care, and high healthcare expenditure are supporting market expansion. The increasing geriatric population, coupled with higher expectations for post-surgical recovery and mobility, is also contributing to strong adoption of advanced small bone and joint devices.

Europe Small Bone and Joint Orthopedic Devices Market Insight

The Europe small bone and joint orthopedic devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing incidence of fractures, degenerative joint conditions, and trauma cases. Rising awareness of advanced orthopedic solutions, coupled with urbanization and expansion of healthcare infrastructure, is fostering adoption of surgical fixation devices, joint prostheses, and external fixation systems. The market benefits from a strong presence of established orthopedic manufacturers and technological collaborations with research institutions, enabling access to patient-specific and bioresorbable implants. European healthcare systems are increasingly integrating minimally invasive and robotic-assisted procedures, enhancing clinical outcomes. Furthermore, the adoption of small bone and joint devices spans hospitals, specialty clinics, and ambulatory surgical centers, supporting steady market growth.

U.K. Small Bone and Joint Orthopedic Devices Market Insight

The U.K. small bone and joint orthopedic devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of orthopedic surgeries, including fracture repair and joint reconstruction. Increasing awareness of innovative fixation technologies, 3D-printed implants, and modular prostheses is encouraging surgeons and hospitals to adopt advanced solutions. In addition, the prevalence of sports-related injuries, osteoporosis, and degenerative joint conditions among the aging population is boosting demand. The U.K.’s robust healthcare infrastructure, combined with favorable insurance coverage and patient access to orthopedic care, further supports market expansion. Hospitals and specialized orthopedic centers are investing in modern surgical tools and implants, strengthening market penetration.

Germany Small Bone and Joint Orthopedic Devices Market Insight

The Germany small bone and joint orthopedic devices market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of orthopedic health, advanced surgical techniques, and strong healthcare infrastructure. Germany’s emphasis on innovation, research, and sustainability promotes the adoption of patient-specific implants, minimally invasive fixation systems, and bioresorbable devices. Surgeons are increasingly utilizing navigation-assisted and robotic-assisted procedures for precise implant placement, driving demand for advanced small bone and joint devices. The market growth is further supported by the high prevalence of fractures, degenerative joint diseases, and trauma-related injuries. Integration of orthopedic devices with hospital surgical systems and the presence of leading manufacturers enhance accessibility and adoption across both public and private healthcare facilities.

Asia-Pacific Small Bone and Joint Orthopedic Devices Market Insight

The Asia-Pacific small bone and joint orthopedic devices market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by rising incidence of orthopedic injuries, sports trauma, and age-related musculoskeletal disorders. Rapid urbanization, expanding healthcare infrastructure, and increasing disposable incomes are accelerating adoption of advanced fixation systems, joint prostheses, and 3D-printed implants in countries such as China, India, and Japan. Government initiatives promoting digital healthcare and orthopedic care are further supporting market expansion. Moreover, the region’s emergence as a manufacturing hub for orthopedic devices enhances affordability and accessibility. Hospitals, specialty orthopedic centers, and ambulatory surgical centers are increasingly investing in modern surgical tools and implants to meet growing clinical demand.

Japan Small Bone and Joint Orthopedic Devices Market Insight

The Japan small bone and joint orthopedic devices market is gaining momentum due to the country’s aging population, high awareness of advanced healthcare solutions, and rising demand for minimally invasive procedures. Surgeons are increasingly adopting patient-specific implants, modular prostheses, and external fixation systems for small bone and joint reconstruction. The Japanese market emphasizes functional recovery, precision, and post-surgical rehabilitation, driving demand for technologically advanced orthopedic devices. Integration of orthopedic devices with hospital surgical systems and high-quality manufacturing standards further supports growth. In addition, the prevalence of sports injuries and degenerative joint disorders contributes to sustained adoption in both residential and commercial healthcare settings.

India Small Bone and Joint Orthopedic Devices Market Insight

The India small bone and joint orthopedic devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rising incidence of fractures and musculoskeletal injuries, and increasing healthcare awareness. The expansion of hospitals, specialty clinics, and ambulatory surgical centers is driving adoption of plates, screws, prostheses, and external fixation devices. Government initiatives for digital and orthopedic healthcare, combined with growing urbanization and higher disposable incomes, are promoting access to advanced surgical solutions. Availability of cost-effective implants, increasing domestic manufacturing, and rising patient preference for minimally invasive and early recovery procedures are key factors fueling market growth.

Small Bone and Joint Orthopedic Devices Market Share

The Small Bone and Joint Orthopedic Devices industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Arthrex, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- CONMED Corporation (U.S.)

- Acumed (U.S.)

- MicroPort Scientific Corporation (China)

- OsteoMed L.P. (U.S.)

- Treace Medical Concepts, Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- Meril Life Sciences (India)

- DJO, LLC (U.S.)

- Össur (Iceland)

- NuVasive, Inc. (U.S.)

- Conventus Orthopaedics, Inc. (U.S.)

- CERAVER (France)

- Nutek Orthopaedics (U.S.)

- B. Braun SE (Germany)

- Tecomet, Inc. (U.S.)

What are the Recent Developments in Global Small Bone and Joint Orthopedic Devices Market?

- In October 2025, Onkos Surgical gained FDA clearance for its ELEOS Proximal Tibia implant incorporating NanoCept Antibacterial Technology, providing proactive bacterial contamination protection in complex limb salvage and orthopedic reconstruction procedures a notable development for surgical site infection mitigation

- In October 2025, OrthoPediatrics Corp. secured FDA 510(k) clearance for its Pediatric Plating Platform | Small-Mini, expanding fixation options for small bone fractures in pediatric orthopedic surgery. The platform includes multiple plate and screw configurations specifically engineered for young patients’ anatomy, enhancing stabilization and reducing implant-related complications in children’s fracture management

- In March 2025 at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, Johnson & Johnson MedTech unveiled a suite of digital orthopaedics innovations, including next‑generation implants and data‑driven surgical technologies spanning joint reconstruction, trauma, extremities, and more signaling expanded capabilities for precision orthopedic care

- In January 2025, Zimmer Biomet agreed to acquire Paragon 28 for approximately USD 1.1 billion, a move to significantly broaden its small bone and joint orthopedic implant offerings especially in foot‑and‑ankle, fracture, trauma, and joint replacement segments enhancing its surgical device lineup globally

- In June 2024, Orthoíx Medical Inc. announced it received U.S. FDA 510(k) clearance for its Rodeo™ Telescopic Nail, a novel orthopedic implant designed to treat deformities and fractures in patients with osteogenesis imperfecta (OI). The telescoping nail stabilizes the limb while accommodating natural bone growth, addressing biomechanical and procedural challenges associated with current OI rod systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.