Global Smart Clothing Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

27.92 Billion

2024

2032

USD

4.20 Billion

USD

27.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 27.92 Billion | |

|

|

|

|

Smart Clothing Market Size

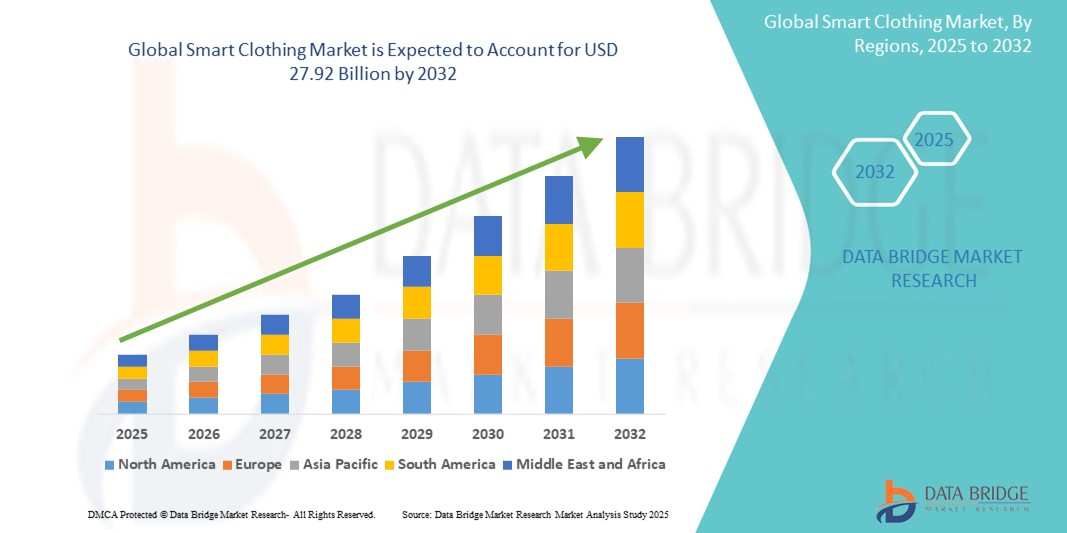

- The global smart clothing market size was valued at USD 4.20 billion in 2024 and is expected to reach USD 27.92 billion by 2032, at a CAGR of 26.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within wearable electronics and IoT-integrated garments, leading to increased digitalization in both consumer and healthcare settings

- Furthermore, rising consumer demand for health monitoring, fitness tracking, and performance optimization through textile-based sensors is establishing smart clothing as the next evolution in wearable technology. These converging factors are accelerating the uptake of Smart Clothing solutions, thereby significantly boosting the industry's growth

Smart Clothing Market Analysis

- Smart clothing, incorporating embedded sensors and connected technologies, is becoming an essential component of modern wearable technology, offering real-time health monitoring, performance tracking, and biometric data integration for both consumer and professional applications

- The growing demand for smart clothing is primarily fueled by increasing health awareness, rising adoption of fitness and sports wearables, and advancements in textile-based electronics and e-textiles

- North America dominated the smart clothing market with the largest revenue share of 38.6% in 2024, driven by a strong presence of tech-savvy consumers, early adoption of wearable innovations, and significant investments by leading market players. The U.S. leads the region, with rapid expansion in athletic wearables, healthcare garments, and military-grade smart uniforms

- Asia-Pacific is expected to be the fastest growing region in the smart clothing market, projected to register a CAGR of 24.3% from 2025 to 2032, fueled by a booming middle-class population, urbanization, and increased focus on health and fitness

- The passive segment dominated the smart clothing market with a market share of 44.6% in 2024, primarily due to its widespread adoption in fitness and everyday wellness wear. These garments offer basic functionality without embedded electronics, making them more affordable and accessible to a broader consumer base

Report Scope and Smart Clothing Market Segmentation

|

Attributes |

Smart Clothing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Clothing Market Trends

“Enhanced Convenience Through Intelligent Functionality and Interconnectivity”

- A significant and accelerating trend in the global smart clothing market is the deepening integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies is significantly enhancing user convenience and control over their wearable health and performance monitoring systems

- For instance, Hexoskin smart shirts are increasingly being paired with AI-powered analytics platforms that track respiration, ECG, and activity data, allowing for voice-assisted updates on vital health metrics. Similarly, Xenoma’s e-skin apparel enables gesture recognition and motion capture, which can be synchronized with home assistants for a more immersive digital experience

- AI integration in smart clothing enables features such as adaptive data tracking, predictive health alerts, and personalized fitness coaching. For instance, Athos smart apparel uses AI to analyze muscle activation and send real-time insights, helping athletes improve form and prevent injuries. Furthermore, voice-controlled smart systems allow users to receive verbal updates on performance metrics or physical condition, offering hands-free utility during workouts or therapy

- The seamless integration of smart clothing with health-monitoring apps and broader connected ecosystems (such as smartphones, fitness trackers, or telemedicine platforms) allows centralized control and visibility of personal health and fitness data. This interoperability supports real-time feedback and longitudinal tracking for both consumers and healthcare providers

- This trend toward more intelligent, intuitive, and interconnected smart garments is fundamentally transforming consumer expectations in fitness, wellness, and medical wearables. Consequently, companies such as Sensoria, Myontec, and Wearable X are developing AI-enabled clothing with features like gait analysis, ECG monitoring, and haptic feedback to provide enhanced user experience.

- The demand for smart clothing offering seamless integration with digital health tools and virtual assistants is rapidly growing across both consumer wellness and clinical applications, as users increasingly prioritize functionality, data accessibility, and real-time insight over traditional wearables

Smart Clothing Market Dynamics

Driver

“Growing Need Due to Rising Health Monitoring and Fitness Awareness”

- The increasing awareness regarding health and fitness, coupled with a rising interest in wearable technology, is significantly driving the demand for smart clothing in both consumer and healthcare sectors

- For instance, in March 2024, Hexoskin launched its next-generation smart shirt, equipped with biometric sensors capable of monitoring heart rate, breathing rate, and sleep patterns. Such innovations are expected to propel the growth of the smart clothing industry during the forecast period

- As consumers seek more proactive health monitoring tools, smart clothing offers seamless biometric data tracking integrated into everyday wear, providing a comfortable and continuous alternative to traditional wearables like wristbands and watches

- Furthermore, the integration of smart clothing into fitness routines, sports training, and occupational health is becoming more prevalent, supported by advanced features such as posture correction, muscle activity monitoring, and thermal regulation

- The convenience of real-time data feedback, improved athletic performance, and the ability to sync with smartphones and fitness platforms are key factors boosting adoption across a wide demographic, including athletes, patients, and tech-savvy consumers. The trend toward personalized health insights and connected living continues to push the market forward

Restraint/Challenge

“Concerns Regarding Durability, Data Privacy, and High Costs”

- Issues surrounding the durability of embedded electronics and the complexity of maintaining smart clothing present significant challenges to widespread consumer adoption

- For instance, frequent laundering may degrade sensor functionality or reduce the lifespan of conductive fabrics, causing skepticism among potential buyers regarding product longevity.

In addition, concerns over data privacy and security—especially regarding personal health information collected by smart clothing—have raised red flags. Consumers are wary of how their biometric data is stored, shared, or potentially misused

- For instance, frequent laundering may degrade sensor functionality or reduce the lifespan of conductive fabrics, causing skepticism among potential buyers regarding product longevity.

- To address these concerns, companies like Sensoria and Myant are investing in robust data encryption, privacy-by-design protocols, and secure cloud storage to ensure user trust

- Moreover, the relatively high initial costs of smart clothing compared to traditional apparel may deter price-sensitive buyers. While costs are slowly declining with technological advancements and mass production, premium models with advanced features remain expensive

- To ensure broader adoption, market players will need to focus on enhancing fabric resilience, providing transparent data policies, and introducing more cost-effective product lines tailored to specific user groups

Smart Clothing Market Scope

The market is segmented on the basis of treatment type, product, connectivity, and end users.

• By Treatment Type

On the basis of treatment type, the smart clothing market is segmented into passive, active, and ultra-smart. The passive segment held the largest market revenue share of 44.6% in 2024, primarily due to its wide adoption in fitness and everyday wellness wear, offering basic functionality without embedded electronics.

The ultra-smart segment is expected to witness the fastest CAGR of 25.3% from 2025 to 2032, fueled by rising demand in medical diagnostics, defense, and elite sports applications, where real-time physiological data analysis is critical.

• By Product

On the basis of product, the smart clothing market is segmented into apparel, footwear, wearable patches, and others. The apparel segment dominated the market in 2024 with the largest revenue share of 52.1%, driven by smart t-shirts, bras, and jackets that track biometrics such as ECG, EMG, posture, and temperature.

The wearable patches segment is expected to grow at the highest CAGR of 24.6% during the forecast period, supported by increased use in chronic disease monitoring and elder care.

• By Connectivity

On the basis of connectivity, the smart clothing market is segmented into Wi-Fi, Bluetooth, GPS, and RFID. The bluetooth segment held the largest share of 46.9% in 2024 due to its energy efficiency, ease of integration, and compatibility with smartphones and fitness trackers.

The GPS segment is projected to grow at the fastest CAGR of 23.4% from 2025 to 2032, particularly in applications like military gear, child tracking wearables, and athletic performance optimization.

• By End-Users

On the basis of end users, the smart clothing market is segmented into healthcare, fitness and sports, fashion and entertainment, military and defense, mining, and others. The fitness and sports segment held the largest market revenue share of 40.2% in 2024, driven by a growing focus on performance tracking and recovery optimization among both amateur and professional athletes.

The healthcare segment is anticipated to grow at the fastest CAGR of 26.7% during the forecast period, attributed to rising demand for non-invasive monitoring, remote patient care, and early diagnostics in both hospital and homecare settings.

Smart Clothing Market Regional Analysis

- North America dominated the smart clothing market with the largest revenue share of 38.6% in 2024, driven by increasing health awareness, the adoption of wearable technologies, and rising demand for real-time physiological monitoring across sports, fitness, and healthcare applications

- Consumers in the region value convenience, continuous health tracking, and data-driven insights offered by smart clothing integrated with mobile and cloud platforms

- This widespread adoption is further supported by high disposable income, increasing fitness trends, and strong investment in wearable healthcare innovation—establishing smart clothing as a mainstream solution for preventive care, performance optimization, and chronic condition monitoring

U.S. Smart Clothing Market Insight

The U.S. smart clothing market captured the largest revenue share of 75.4% in 2024 within North America, driven by a tech-savvy population and the rapid expansion of fitness wearables, military-grade biometric clothing, and remote patient monitoring garments. The presence of leading innovators such as Hexoskin, Myzone, and DuPont, alongside a robust startup ecosystem, fuels continued development and commercialization of smart fabrics and electronic textiles. Moreover, demand for post-operative recovery monitoring and elderly care solutions using sensor-embedded garments is accelerating market growth.

Europe Smart Clothing Market Insight

The Europe smart clothing market is projected to grow at a substantial CAGR during the forecast period, driven by government-supported digital healthcare initiatives, rising fitness culture, and increasing investments in wearable health technology. Key countries such as Germany, the U.K., and France are witnessing growing adoption of smart garments in hospitals, sports academies, and rehabilitation centers. The EU’s focus on sustainability and smart textiles R&D is also fostering innovation across the continent.

U.K. Smart Clothing Market Insight

The U.K. smart clothing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing integration of health and fitness tracking into daily lifestyles. Adoption is being supported by consumer wearables for posture correction, temperature regulation, and heart rate monitoring. The country's strong retail infrastructure and openness to healthtech innovation are expected to further support market expansion.

Germany Smart Clothing Market Insight

The Germany smart clothing market is expected to expand at a considerable CAGR during the forecast period, supported by advancements in smart textile engineering and government investment in digital healthcare. Germany’s leading position in automotive and industrial wearables is also opening new avenues for smart protective clothing that monitors worker fatigue, heat exposure, and ergonomic posture in industrial environments.

Asia-Pacific Smart Clothing Market Insight

The Asia-Pacific smart clothing market is poised to grow at the fastest CAGR of 24.3% from 2025 to 2032, driven by increasing health consciousness, smart city initiatives, and growing urban populations. Countries such as China, Japan, South Korea, and India are leading the adoption of smart garments in sectors such as healthcare, sports, military, and fashion. The presence of textile manufacturing hubs and affordable production capabilities enhances regional competitiveness in the global market.

Japan Smart Clothing Market Insight

The Japan smart clothing market is expanding steadily, backed by a strong culture of technological innovation and demand for eldercare solutions. Japan is investing in smart garments for fall detection, vital sign tracking, and motion analysis in the elderly population. The combination of miniaturized electronics, sensor-rich fabrics, and a digitally mature healthcare system contributes to rapid adoption across both medical and consumer segments.

China Smart Clothing Market Insight

The China smart clothing market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a booming middle class, the fitness tech boom, and aggressive development of smart city infrastructure. The country’s emphasis on wearable technology integration, rising health expenditure, and extensive domestic manufacturing of electronic textiles are positioning China as a major global player in the smart clothing industry.

Smart Clothing Market Share

The smart clothing industry is primarily led by well-established companies, including:

- AiQ Smart Clothing (Taiwan)

- Athos (U.S.)

- Sensoria (U.S.)

- Clothingplus (Finland)

- Vulpés Electronics GmbH (Germany)

- DuPont (U.S.)

- Wearable X (U.S.)

- Applycon, s. r. o. (Czechia)

- TORAY INTERNATIONAL, INC. (Japan)

- Myontec (Finland)

- Myzone (U.S.)

- Siren (U.S.)

- Xenoma Inc. (Japan)

- Smart Solutions Technologies S.L. (Spain)

- Hexoskin (Canada)

- Emglare Inc. (Netherlands)

- Owlet (U.S.)

Latest Developments in Global Smart Clothing Market

- In April 2025, researchers at Cornell University introduced a new line of smart garments embedded with posture-monitoring sensors designed for continuous use without discomfort. These garments utilize fiber-based sensors woven directly into fabric, enabling accurate and unobtrusive tracking of user movements. This innovation highlights the growing role of smart textiles in preventive healthcare and rehabilitation monitoring

- In March 2025, Toyoda Gosei unveiled its prototype smart clothing powered by perovskite solar cells, capable of generating electricity in both indoor and outdoor light. This advancement supports the development of energy-autonomous smart garments for fitness and safety applications, reinforcing the shift towards sustainable, wearable electronics

- In March 2023, Schoeller Textil AG introduced Re-Source, a sustainable textile line boasting breathability, thermal regulation, wind, and water resistance. Crafted from bio-based, post- and pre-consumer materials such as recycled polyester and spandex, Re-Source aligns with eco-conscious principles while offering functional benefits

- In April 2022, Advanced Functional Fabrics of America (AFFOA) showcases advanced functional fiber preforms and LED-chipped fibers at the Smart Textiles Summit. As a pioneering force in high-tech textile systems, AFFOA continuously drives innovation, positioning itself as a leader in the field of smart textiles

- In July 2021, Isko collaborated with MIT's Computer Science and Artificial Intelligence Institute (CSAIL) to delve into wearable technology and smart fabrics research. This partnership expands isko's reach into various sectors, reinforcing its commitment to advancing textile technology and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.