Global Smart Contact Lenses For Disease Monitoring Market

Market Size in USD Million

CAGR :

%

USD

313.63 Million

USD

883.41 Million

2024

2032

USD

313.63 Million

USD

883.41 Million

2024

2032

| 2025 –2032 | |

| USD 313.63 Million | |

| USD 883.41 Million | |

|

|

|

|

Smart Contact Lenses for Disease Monitoring Market Size

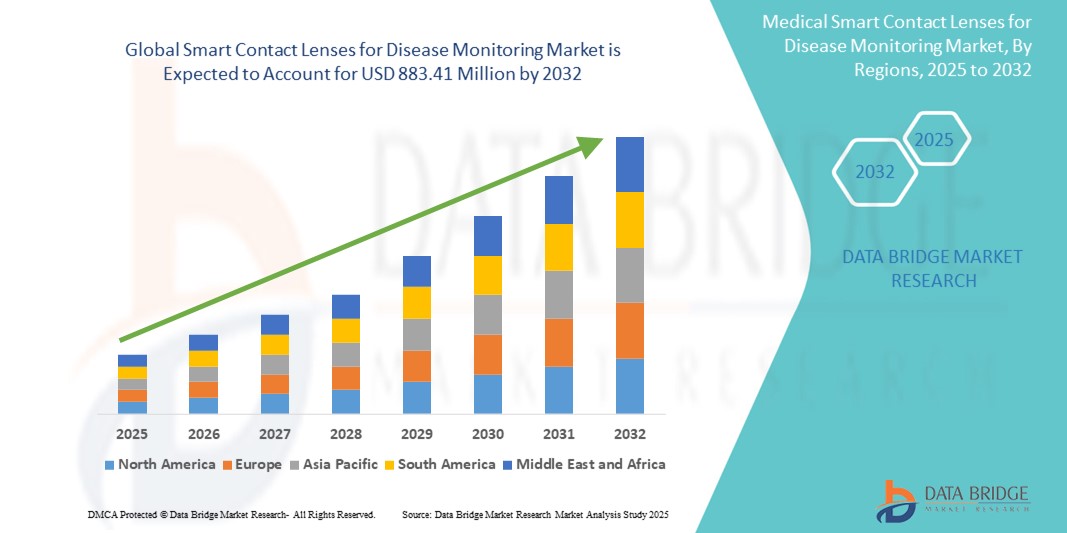

- The global smart contact lenses for disease monitoring market size was valued at USD 313.63 million in 2024 and is expected to reach USD 883.41 million by 2032, at a CAGR of 13.82% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic conditions such as diabetes and glaucoma, which require continuous, non-invasive monitoring solutions—driving interest in smart lens technologies integrated with biosensors and wireless communication

- Furthermore, increasing investments in wearable medical technology, miniaturization of electronics, and consumer preference for real-time health tracking are positioning smart contact lenses as a transformative tool in digital healthcare. These converging factors are accelerating the adoption of smart lenses in clinical and home-based care, significantly boosting the industry's growth

Smart Contact Lenses for Disease Monitoring Market Analysis

- Smart contact lenses, equipped with embedded sensors and microelectronics, are emerging as a transformative healthcare technology for continuous, non-invasive disease monitoring—particularly for conditions such as diabetes and glaucoma—by analyzing biomarkers in tear fluid and transmitting data wirelessly for real-time insights

- The escalating demand for smart contact lenses is primarily driven by the global rise in chronic diseases, advancements in biosensor technology, increasing awareness of personalized healthcare, and the growing preference for wearable health-monitoring devices that offer comfort and convenience

- North America dominated the smart contact lenses for disease monitoring market with the largest revenue share of 41.7% in 2024, characterized by robust R&D investments, high healthcare expenditure, favorable regulatory support, and the presence of key players driving innovation in lens-based diagnostics, particularly in the U.S., which is witnessing strong clinical adoption

- Asia-Pacific is expected to be the fastest growing region in the smart contact lens market during the forecast period due to a rising diabetic population, increasing healthcare awareness, and expanding access to advanced ophthalmic care technologies

- Intraocular pressure monitoring segment dominated the smart contact lenses for disease monitoring market with a market share of 60.5% in 2024, driven by its critical role in early detection and continuous management of glaucoma through non-invasive, real-time monitoring

Report Scope and Smart Contact Lenses for Disease Monitoring Market Segmentation

|

Attributes |

Smart Contact Lenses for Disease Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Contact Lenses for Disease Monitoring Market Trends

“Advancements in Miniaturized Biosensors and Wireless Health Monitoring”

- A significant and accelerating trend in the global smart contact lenses for disease monitoring market is the rapid advancement in miniaturized biosensors and their seamless integration with wireless health monitoring systems. This innovation is enhancing the ability of lenses to provide real-time, non-invasive data on chronic health conditions such as diabetes and glaucoma

- For instance, companies such as Google (via Verily) and Novartis have been developing smart lenses capable of continuously monitoring glucose levels in tears, transmitting data wirelessly to mobile apps for instant analysis and tracking. Similarly, startups are innovating in IOP-monitoring lenses for glaucoma patients, offering precise, 24/7 monitoring without clinical visits

- These lenses incorporate microelectronics and nanomaterials that are biocompatible, transparent, and capable of transmitting physiological data through wireless interfaces such as Bluetooth or NFC. Some prototypes even offer solar or tear-powered functionality to enable longer wear and reduce battery dependency

- The ability to sync data with smartphones, cloud platforms, and telemedicine systems makes smart contact lenses an integral component of the broader digital health ecosystem, improving patient compliance and enabling physicians to monitor disease progression remotely

- This convergence of smart optics, wearable biosensors, and wireless health platforms is transforming how chronic diseases are managed. Companies such as Mojo Vision and Sensimed are leading the charge in creating intelligent lenses that not only detect but predict fluctuations in key health parameters—pushing the market toward proactive and personalized care

- The demand for compact, user-friendly, and continuous health monitoring devices is rising across both clinical and at-home care settings, with smart contact lenses positioned to play a pivotal role in the future of digital diagnostics and remote patient monitoring

Smart Contact Lenses for Disease Monitoring Market Dynamics

Driver

“Surging Chronic Disease Burden and Demand for Non-Invasive Monitoring”

- The rising global prevalence of chronic conditions such as diabetes and glaucoma, coupled with the increasing need for continuous, non-invasive health monitoring, is a major driver fueling demand for smart contact lenses in healthcare settings

- For instance, in March 2024, Innovega Inc. announced progress in its clinical trials of an AR-enabled contact lens capable of health monitoring, positioning itself for FDA submission—a move indicating strong commercial readiness in the medical wearables space

- As healthcare systems shift toward preventive care, smart lenses offer a discreet, comfortable, and efficient way to monitor vital health parameters such as glucose levels and intraocular pressure without disrupting daily routines

- These lenses allow patients to avoid frequent blood draws or clinic visits, thereby increasing compliance and reducing the burden on healthcare providers

- With the backing of growing investments in telehealth infrastructure and AI-driven diagnostic platforms, smart lenses are emerging as valuable components in next-generation remote patient monitoring systems

Restraint/Challenge

“Biocompatibility Concerns and Regulatory Complexity”

- Despite promising benefits, challenges such as ensuring biocompatibility of embedded electronic components, potential eye irritation, and strict regulatory pathways pose significant barriers to mass adoption

- For instance, previous attempts to commercialize glucose-monitoring lenses by major players such as Google faced technical hurdles, including inconsistent tear-based glucose readings and biocompatibility issues, leading to halted development

- Moreover, gaining approval from regulatory bodies such as the FDA and EMA requires extensive clinical validation to demonstrate safety, efficacy, and long-term wearability—adding time and cost to market entry

- In addition, concerns around data privacy and cybersecurity of transmitted health information, especially for cloud-connected devices, add another layer of complexity for developers

- Overcoming these challenges will require collaboration among tech companies, regulators, and healthcare providers to ensure safe product design, data security, and cost-effective production that can drive wider accessibility in both developed and emerging markets

Smart Contact Lenses for Disease Monitoring Market Scope

The market is segmented on the basis of application, material, usability, and end user.

- By Application

On the basis of application, the smart contact lenses for disease monitoring market is segmented into continuous glucose monitoring (CGM), intraocular pressure (IOP) monitoring, and others. The intraocular pressure monitoring segment dominated the market with the largest market revenue share of 60.5% in 2024, driven by its critical role in the early detection and continuous management of glaucoma. This application is gaining traction due to the non-invasive, real-time nature of IOP monitoring through tears, enabling better disease control and compliance in at-risk populations. The ability to reduce the need for frequent in-clinic pressure tests further supports adoption in clinical and home settings.

The continuous glucose monitoring segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the growing global diabetes burden and the increasing demand for non-invasive alternatives to blood glucose meters. CGM smart lenses offer real-time insights into glucose fluctuations, enhancing personalized diabetes care and remote patient monitoring.

- By Material

On the basis of material, the smart contact lenses for disease monitoring market is segmented into poly-hema, polyacrylamide, polyvinyl alcohol (PVA), polydimethylsiloxane (PDMS), polyethylene terephthalate (PET), and others. The Poly-HEMA segment held the largest market revenue share in 2024, accounting for 34.3%, due to its favorable characteristics including high oxygen permeability, transparency, and compatibility with sensor embedding. Poly-HEMA-based lenses are widely used in medical-grade soft lenses for their comfort and safety in long-term wear.

The Polydimethylsiloxane (PDMS) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior gas permeability, optical clarity, and chemical stability. PDMS is especially suitable for smart lenses used in chronic disease monitoring where sensor accuracy and extended wear time are crucial. Its integration potential with flexible electronics makes it a preferred choice in ongoing R&D.

- By Usability

On the basis of usability, the smart contact lenses for disease monitoring market is segmented into disposable lenses and reusable lenses. The disposable lenses segment dominated the market with a share of around 70% in 2024, driven by user preference for hygiene, safety, and convenience. These lenses reduce infection risk and are favored for short-term or daily monitoring applications, particularly in diabetic care and postoperative glaucoma patients.

The reusable lenses segment is projected to grow steadily during forecast period, due to their cost-effectiveness for long-term users and their integration with advanced biosensing technologies. Reusable lenses are often chosen in clinical trials and controlled monitoring programs where extended wear time and durability are prioritized.

- By End User

On the basis of end user, the smart contact lenses for disease monitoring market is segmented into hospitals, ophthalmology clinics, home care settings, and others. The hospitals segment held the largest market revenue share of 57% in 2024, driven by the use of smart lenses in inpatient care and clinical research settings. Hospitals benefit from the integration of smart contact lenses with electronic health records (EHRs) and continuous data transmission to medical staff, supporting early diagnosis and treatment adjustments.

The home care settings segment is expected to experience the fastest growth from 2025 to 2032, as smart lenses become more user-friendly and compatible with mobile health platforms. Increasing patient demand for self-monitoring tools and remote consultations is promoting the use of these lenses in at-home disease management, especially among aging populations and chronic disease patients.

Smart Contact Lenses for Disease Monitoring Market Regional Analysis

- North America dominated the smart contact lenses for disease monitoring market with the largest revenue share of 41.7% in 2024, characterized by robust R&D investments, high healthcare expenditure, favorable regulatory support, and the presence of key players driving innovation in lens-based diagnostics, particularly in the U.S., which is witnessing strong clinical adoption

- Consumers and healthcare providers in the region are increasingly adopting non-invasive, wearable monitoring devices for real-time disease management, with smart contact lenses offering a discreet and continuous health-tracking solution

- The region's dominance is further supported by strong R&D infrastructure, high healthcare spending, favorable regulatory frameworks, and early adoption of telehealth and connected medical devices, positioning smart lenses as a key innovation in personalized healthcare

U.S. Smart Contact Lenses for Disease Monitoring Market Insight

The U.S. smart contact lenses for disease monitoring market captured the largest revenue share of 81% in 2024 within North America, driven by the country’s advanced healthcare infrastructure and high adoption of digital health technologies. The increasing burden of chronic conditions such as diabetes and glaucoma, along with strong investment in wearable medical devices, supports the widespread use of smart lenses. Moreover, robust R&D initiatives by companies such as Sensimed and Mojo Vision, along with FDA regulatory pathways encouraging innovation, continue to accelerate market expansion.

Europe Smart Contact Lenses for Disease Monitoring Market Insight

The Europe smart contact lenses for disease monitoring market is projected to grow at a substantial CAGR throughout the forecast period, supported by the rising demand for early diagnostic tools and non-invasive monitoring solutions. Increasing prevalence of eye diseases and diabetic populations, coupled with government-backed digital health initiatives, is fostering adoption across clinics and hospitals. Consumers are also responding positively to the convenience and real-time data access smart lenses offer, especially in managing chronic ocular and metabolic conditions.

U.K. Smart Contact Lenses for Disease Monitoring Market Insight

The U.K. smart contact lenses for disease monitoring market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by growing awareness of glaucoma and diabetes management solutions. The country’s strong public-private healthcare ecosystem, along with rising emphasis on remote patient monitoring technologies, supports adoption. In addition, the U.K.’s digital health transformation and favorable reimbursement environment are expected to further boost market growth.

Germany Smart Contact Lenses for Disease Monitoring Market Insight

The Germany smart contact lenses for disease monitoring market is expected to expand at a considerable CAGR during the forecast period, driven by growing investment in wearable medical technologies and increased focus on preventive healthcare. With Germany’s emphasis on innovation and stringent health regulations, smart contact lenses are being adopted in specialized eye care and research centers. The country’s strong demand for eco-friendly, safe, and technologically advanced solutions is further supporting market expansion.

Asia-Pacific Smart Contact Lenses for Disease Monitoring Market Insight

The Asia-Pacific smart contact lenses for disease monitoring market is poised to grow at the fastest CAGR during 2025 to 2032, owing to rapid urbanization, increasing diabetic population, and growing access to advanced ophthalmic care in countries such as China, Japan, and India. Government-led digital health campaigns and the expanding base of local manufacturers are improving affordability and adoption. The integration of smart lenses into telehealth platforms is also enhancing healthcare delivery across both rural and urban settings.

Japan Smart Contact Lenses for Disease Monitoring Market Insight

The Japan smart contact lenses for disease monitoring market is gaining momentum due to the nation’s technological leadership, aging population, and demand for advanced chronic disease management tools. The country’s focus on smart medical devices, supported by strong domestic innovation and a highly connected population, is facilitating adoption in both clinical and at-home settings. Japan’s preference for discreet, non-invasive health technologies aligns well with smart lens applications in diabetes and glaucoma monitoring.

India Smart Contact Lenses for Disease Monitoring Market Insight

The India smart contact lenses for disease monitoring market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. India stands as one of the largest markets for smart home devices, and Smart Contact Lenses for Disease Monitorings are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable Smart Contact Lenses for Disease Monitoring options, alongside strong domestic manufacturers, are key factors propelling the market in India.

Smart Contact Lenses for Disease Monitoring Market Share

The smart contact lenses for disease monitoring industry is primarily led by well-established companies, including:

- Mojo Vision (U.S.)

- Innovega Inc. (U.S.)

- Sensimed AG (Switzerland)

- Alcon Inc. (Switzerland)

- Bausch + Lomb Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Google LLC (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Sony Corporation (Japan)

- Novartis AG (Switzerland)

- Smartlens Inc. (U.S.)

- Ocumedic Inc. (U.S.)

- Medella Health (Canada)

- Eyenuk, Inc. (U.S.)

- Terepac Corporation (Canada)

- SEED Co., Ltd. (Japan)

- Leo Lens Technology, Inc. (U.S.)

- Pixium Vision (France)

- Sensirion AG (Switzerland)

- EP Global Communications, Inc. (U.S.)

What are the Recent Developments in Global Smart Contact Lenses for Disease Monitoring Market?

- In March 2024, Mojo Vision, a U.S.-based smart contact lens innovator, announced successful clinical testing of its prototype smart lens featuring real-time data display and biosensor integration for chronic disease monitoring. The lens uses microelectronics to track health metrics and relay data wirelessly to connected devices, marking a major advancement in wearable medical technology. This milestone underscores Mojo Vision’s leadership in next-gen diagnostic wearables and its focus on merging vision enhancement with disease management

- In February 2024, Innovega Inc. revealed progress in U.S. FDA trials for its iOptik smart contact lens platform, which combines augmented reality with continuous biometric tracking. The lens is designed to aid users with chronic health conditions by integrating display optics and health monitoring systems in a single wearable. This innovation reflects the increasing convergence of medical wearables and AR for personalized healthcare solutions

- In December 2023, Sensimed AG, a Swiss company known for its Triggerfish smart lens, expanded its global distribution network in Asia and the Middle East to support the growing demand for intraocular pressure monitoring in glaucoma patients. This move strengthens its market presence and meets the need for accessible, non-invasive ocular diagnostics in underserved regions

- In October 2023, Samsung Electronics filed new patents for biosensor-enabled contact lenses capable of measuring glucose levels and intraocular pressure through tear fluid. These developments indicate the company's potential entry into the smart medical lens space and reflect the growing interest of consumer tech giants in health-focused wearables

- In August 2023, Bausch + Lomb, in collaboration with a leading biotech firm, announced the initiation of research into biodegradable smart lenses for disease monitoring applications. The initiative aims to improve comfort, reduce waste, and support sustainability while integrating advanced diagnostic features.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.