Global Smart Dental Imaging

Market Size in USD Million

CAGR :

%

USD

764.47 Million

USD

1,879.34 Million

2025

2033

USD

764.47 Million

USD

1,879.34 Million

2025

2033

| 2026 –2033 | |

| USD 764.47 Million | |

| USD 1,879.34 Million | |

|

|

|

|

Global Smart Dental Imaging & AI Interpretation Devices Market Segmentation, By Technology (Machine Learning, Deep Learning, Natural Language Processing, Computer Vision, and Others), Imaging Type (Intraoral Imaging and Extraoral Imaging), Application (Dental Implantology, Orthodontics, Endodontics, Periodontology, Dental Caries Detection, and Others), End User (Dental Clinics & Laboratories, Hospitals, Research Institutes, and Others)- Industry Trends and Forecast to 2033

Smart Dental Imaging & AI Interpretation Devices Market Size

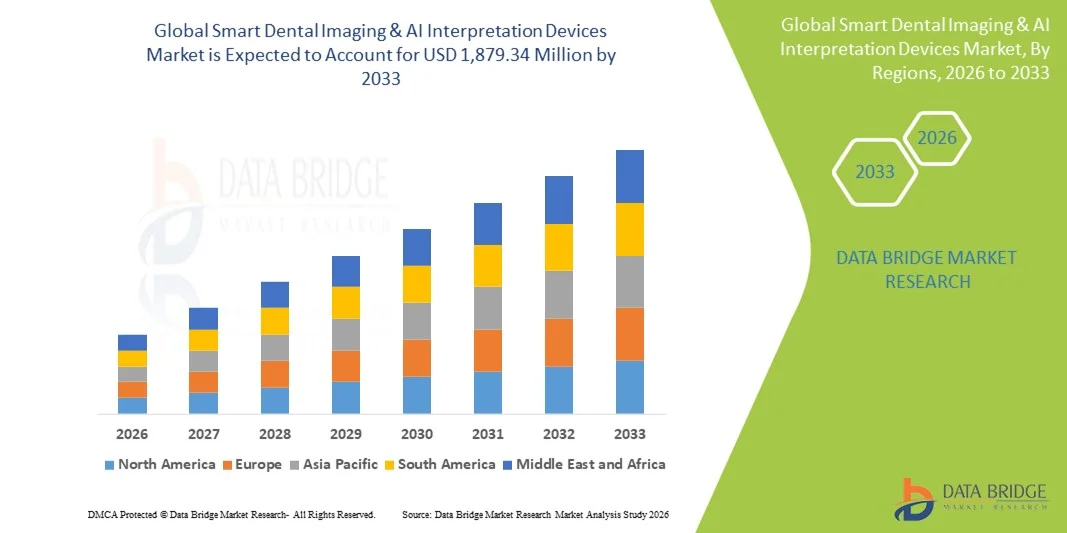

- The global smart dental imaging & AI interpretation devices market size was valued at USD 764.47 million in 2025 and is expected to reach USD 1,879.34 million by 2033, at a CAGR of 11.90% during the forecast period

- The market growth is largely driven by the increasing prevalence of dental disorders, the rapid transition from conventional imaging to digital and AI-integrated dental imaging systems, and continuous technological advancements in machine learning and deep learning algorithms that significantly improve diagnostic accuracy and clinical efficiency

- Furthermore, rising demand from dental clinics, hospitals, and diagnostic centers for automated, precise, and user-friendly imaging and interpretation solutions, along with growing investments in digital dentistry infrastructure and smart diagnostic platforms, is establishing smart dental imaging and AI interpretation devices as a critical component of modern dental care, thereby accelerating overall market growth

Smart Dental Imaging & AI Interpretation Devices Market Analysis

- Smart dental imaging and AI interpretation devices, which integrate advanced digital imaging modalities with artificial intelligence–driven diagnostic and analytical capabilities, are increasingly vital components of modern dental care workflows across clinics, hospitals, and diagnostic centers due to their ability to enhance diagnostic accuracy, streamline treatment planning, and improve overall clinical efficiency

- The escalating demand for these solutions is primarily driven by the rising prevalence of dental disorders, the accelerating shift toward digital dentistry, and growing clinician preference for automated, data-driven interpretation tools that reduce diagnostic variability and support faster, more precise decision-making

- North America dominated the global market with a revenue share of 40.6% in 2025, supported by early adoption of AI-enabled healthcare technologies, high dental care expenditure, and the strong presence of leading dental imaging and software providers, with the U.S. accounting for the majority of regional demand through advanced private practices and hospital-based dental departments

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, projected to register the highest CAGR, driven by rapid expansion of dental care infrastructure, increasing awareness of oral health, growing middle-class populations, and rising investments in digital and AI-powered diagnostic technologies across emerging economies

- The extraoral imaging segment dominated the market with an estimated share of 58.9% in 2025, led by strong adoption of AI-enabled CBCT and panoramic imaging systems, as these modalities are extensively used in implantology, orthodontics, and complex diagnostic applications that benefit significantly from AI-powered image interpretation and 3D analytical capabilities

Report Scope and Smart Dental Imaging & AI Interpretation Devices Market Segmentation

|

Attributes |

Smart Dental Imaging & AI Interpretation Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Smart Dental Imaging & AI Interpretation Devices Market Trends

AI-Driven Diagnostic Precision and Workflow Automation

- A significant and accelerating trend in the global smart dental imaging and AI interpretation devices market is the deepening integration of artificial intelligence into dental imaging systems to enable automated diagnostics, real-time clinical insights, and enhanced precision across preventive and restorative dentistry workflows

- For instance, AI-enabled dental imaging platforms are increasingly being embedded into intraoral scanners and CBCT systems to automatically detect caries, bone loss, and anatomical landmarks, supporting dentists with faster and more consistent diagnostic assessments during chairside consultations

- AI integration in smart dental imaging enables features such as automated image segmentation, pathology highlighting, and predictive analytics that assist clinicians in treatment planning. For instance, several AI-powered systems continuously improve diagnostic accuracy by learning from large imaging datasets and can flag potential abnormalities that may be overlooked in manual interpretation

- The seamless integration of smart dental imaging devices with digital dental workflows and practice management software facilitates centralized data management and streamlined clinical operations. Through a unified digital interface, dental professionals can manage imaging, diagnosis, treatment planning, and patient communication more efficiently, enhancing overall practice productivity

- This trend toward more intelligent, intuitive, and interconnected dental imaging systems is reshaping clinical expectations for diagnostic reliability and efficiency. Consequently, manufacturers are focusing on developing AI-enabled imaging solutions with real-time interpretation, cloud connectivity, and compatibility with digital dentistry ecosystems

- The demand for smart dental imaging systems offering AI-based interpretation and workflow automation is growing rapidly across dental clinics and hospitals, as providers increasingly prioritize diagnostic accuracy, reduced chair time, and improved patient outcomes

- The incorporation of AI-driven visualization tools, such as 3D rendering and automated measurement analysis, is further enhancing clinician confidence and patient communication by providing clearer and more interactive diagnostic insights

Smart Dental Imaging & AI Interpretation Devices Market Dynamics

Driver

Rising Burden of Dental Disorders and Digital Dentistry Adoption

- The increasing prevalence of dental diseases worldwide, combined with the accelerating adoption of digital dentistry technologies, is a major driver fueling demand for smart dental imaging and AI interpretation devices

- For instance, in recent years, dental equipment manufacturers have expanded AI-enabled imaging portfolios to address growing clinical demand for early detection and accurate diagnosis of caries, periodontal disease, and implant-related complications, supporting market growth during the forecast period

- As dental professionals seek improved diagnostic confidence and efficiency, AI-powered imaging systems offer advanced capabilities such as automated detection, quantitative analysis, and decision support, providing a compelling upgrade over conventional imaging technologies

- Furthermore, the growing emphasis on minimally invasive and precision-based dental treatments is increasing reliance on advanced imaging and AI interpretation tools that support accurate planning and predictable clinical outcomes

- The rising number of dental clinics, expanding access to oral healthcare, and increasing investments in modern dental infrastructure across both developed and emerging economies are key factors propelling market adoption. The shift toward fully digital dental workflows further accelerates demand for smart imaging solutions

- Increasing patient expectations for faster diagnosis, transparent treatment planning, and improved clinical outcomes are encouraging dental providers to adopt AI-enabled imaging technologies as a standard of care

- Supportive government initiatives and reimbursement policies promoting digital healthcare adoption in several regions are also contributing to increased uptake of advanced dental imaging and AI interpretation systems

Restraint/Challenge

High System Costs and Regulatory & Data Security Concerns

- Concerns related to the high initial cost of smart dental imaging systems and AI software integration present a significant challenge to broader market adoption, particularly among small and cost-sensitive dental practices

- For instance, advanced AI-enabled CBCT systems and cloud-based interpretation platforms often require substantial upfront investment, making adoption slower in developing regions and among independent clinics with limited capital budgets

- Addressing regulatory compliance and data security requirements is another critical challenge, as AI-based dental imaging solutions must comply with strict medical device regulations and patient data protection standards, increasing development and implementation complexity for manufacturers

- In addition, concerns regarding data privacy, cloud storage security, and algorithm transparency can make some dental professionals cautious about adopting AI-driven diagnostic tools without clear validation and regulatory approval

- Overcoming these challenges through cost-effective product offerings, clear regulatory pathways, robust data security frameworks, and clinician education on AI reliability and benefits will be essential for sustained long-term growth of the smart dental imaging and AI interpretation devices market

- Limited availability of skilled professionals trained to interpret AI-assisted imaging outputs and integrate them effectively into clinical decision-making can also slow adoption in certain regions

- Variability in regulatory approval timelines across countries may delay product launches and limit market penetration for manufacturers operating in multiple geographic regions

Smart Dental Imaging & AI Interpretation Devices Market Scope

The market is segmented on the basis of technology, imaging type, application, and end user.

- By Technology

On the basis of technology, the global smart dental imaging & AI interpretation devices market is segmented into machine learning, deep learning, natural language processing, computer vision, and others. The deep learning segment dominated the market in 2025, driven by its superior capability to analyze complex dental images with high accuracy and consistency. Deep learning algorithms are extensively used in detecting dental caries, bone loss, anatomical structures, and pathologies from both 2D and 3D images. Their ability to continuously improve performance through exposure to large imaging datasets makes them highly valuable in clinical diagnostics. In addition, deep learning models are increasingly integrated directly into CBCT systems and imaging software, enabling real-time interpretation. Growing reliance on precision dentistry and implant planning further strengthens this segment’s dominance. Regulatory approvals and increasing clinician confidence have also supported widespread adoption.

The computer vision segment is expected to witness the fastest growth during the forecast period, owing to its expanding use in automated image segmentation, measurements, and 3D visualization. Computer vision technologies help transform raw imaging data into actionable clinical insights such as tooth identification, nerve tracing, and bone density evaluation. Their integration with digital workflows enhances treatment planning accuracy and efficiency. Rising adoption of 3D imaging in orthodontics and implantology is accelerating demand. Continuous advancements in real-time processing are further improving usability at the chairside level. These factors are expected to drive rapid growth of this segment.

- By Imaging Type

On the basis of imaging type, the market is segmented into intraoral imaging and extraoral imaging. The extraoral imaging segment dominated the market in 2025 with a market share of 58.9%, supported by strong adoption of AI-enabled CBCT, panoramic, and cephalometric imaging systems. Extraoral imaging plays a crucial role in complex diagnostics, orthodontics, and implant planning, where AI-driven 3D analysis significantly improves accuracy. The ability of AI to automate volumetric measurements and anatomical landmark detection has increased clinical reliance on these systems. Extraoral imaging devices are widely used in hospitals and advanced dental clinics managing complex cases. Their higher average selling price also contributes to greater revenue share. Continuous innovation in low-dose imaging further reinforces dominance.

The intraoral imaging segment is anticipated to register the fastest growth rate during the forecast period, driven by increasing use of AI-enabled intraoral scanners and sensors in routine dental care. Chairside AI tools provide instant feedback on caries detection, restorations, and periodontal conditions, supporting preventive dentistry. The growing number of small and mid-sized dental clinics adopting digital workflows is boosting demand. Ease of use, faster diagnostics, and integration with cloud-based AI platforms are key growth factors. Rising patient awareness of early diagnosis further supports adoption. This combination of accessibility and efficiency is accelerating growth.

- By Application

On the basis of application, the market is segmented into dental implantology, orthodontics, endodontics, periodontology, dental caries detection, and others. The dental implantology segment dominated the market in 2025, due to heavy dependence on advanced imaging and AI-based planning tools for precise implant placement. AI interpretation enables accurate assessment of bone quality, nerve positioning, and optimal implant angles, improving clinical outcomes. Rising demand for restorative and cosmetic dental procedures has increased implant volumes globally. CBCT combined with AI analytics is widely regarded as a standard tool in implant planning. Higher procedure costs and extensive use of advanced imaging systems contribute to revenue dominance. Growth in minimally invasive and guided implant techniques further supports this segment.

The orthodontics segment is expected to grow at the fastest pace during the forecast period, driven by increasing demand for aesthetic treatments and digital orthodontic solutions. AI-powered imaging supports automated cephalometric analysis, treatment simulation, and growth prediction. The rapid expansion of clear aligner therapy has significantly increased reliance on digital imaging and AI-based planning. These tools reduce manual effort and enhance treatment precision. Growing adoption among younger populations and rising awareness of orthodontic care are key drivers. The shift toward fully digital orthodontic workflows is expected to sustain rapid growth.

- By End User

On the basis of end user, the market is segmented into dental clinics & laboratories, hospitals, research institutes, and others. The dental clinics & laboratories segment dominated the market in 2025, driven by the high volume of routine diagnostic and imaging procedures performed in private practices. Clinics are increasingly adopting AI-enabled imaging to improve diagnostic speed, reduce chair time, and enhance patient communication. Compact and cloud-connected imaging systems have made advanced diagnostics accessible even for smaller practices. Dental laboratories also utilize smart imaging for accurate case planning and collaboration with clinicians. Growing investments in digital dentistry infrastructure further support dominance. Preference for in-house diagnostics over external referrals also boosts adoption.

The hospital segment is projected to witness the fastest growth during the forecast period, supported by increasing integration of advanced dental departments within multi-specialty hospitals. Hospitals manage complex and surgical dental cases that require high-end imaging and AI interpretation. Rising investments in healthcare digitalization are driving adoption of advanced diagnostic tools. AI-enabled imaging supports multidisciplinary collaboration and standardized diagnostics. Increasing patient inflow for trauma and maxillofacial care further boosts demand. These factors position hospitals as the fastest-growing end-user segment.

Smart Dental Imaging & AI Interpretation Devices Market Regional Analysis

- North America dominated the global market with a revenue share of 40.6% in 2025, supported by early adoption of AI-enabled healthcare technologies, high dental care expenditure, and the strong presence of leading dental imaging and software providers, with the U.S. accounting for the majority of regional demand through advanced private practices and hospital-based dental departments

- Dental professionals in the region place high value on diagnostic accuracy, workflow efficiency, and data-driven treatment planning, which has accelerated adoption of AI-integrated imaging systems across dental clinics, hospitals, and specialized diagnostic centers

- This widespread adoption is further supported by high disposable incomes, a technologically advanced healthcare ecosystem, favorable reimbursement environments, and the presence of leading dental imaging and AI solution providers, positioning North America as a key hub for innovation and commercialization in this market

U.S. Smart Dental Imaging & AI Interpretation Devices Market Insight

The U.S. smart dental imaging & AI interpretation devices market captured the largest revenue share of 82% in 2025 within North America, driven by early adoption of AI-enabled healthcare technologies and strong investment in advanced dental diagnostics. Dental professionals in the country increasingly prioritize precision diagnostics, workflow automation, and data-driven treatment planning. The widespread presence of advanced dental clinics and hospital-based dental departments further supports adoption. In addition, high healthcare spending and rapid integration of AI software with imaging hardware continue to propel market growth. The strong ecosystem of dental technology developers and research institutions also contributes significantly to market expansion.

Europe Smart Dental Imaging & AI Interpretation Devices Market Insight

The Europe smart dental imaging & AI interpretation devices market is projected to expand at a notable CAGR during the forecast period, primarily driven by stringent medical device regulations and growing emphasis on accurate, standardized diagnostics. Increasing awareness of oral health and rising adoption of digital dentistry across Western and Northern Europe are fostering market growth. European dental providers are increasingly adopting AI-assisted imaging to improve efficiency and diagnostic reliability. Growth is observed across dental clinics, hospitals, and academic institutions. The incorporation of advanced imaging systems in both new dental facilities and modernization projects further supports expansion.

U.K. Smart Dental Imaging & AI Interpretation Devices Market Insight

The U.K. smart dental imaging & AI interpretation devices market is anticipated to grow at a healthy CAGR during the forecast period, supported by rising adoption of digital healthcare solutions and growing demand for advanced dental diagnostics. Increasing awareness of preventive dentistry and early disease detection is encouraging clinics to invest in AI-enabled imaging systems. The U.K.’s strong digital health infrastructure and emphasis on innovation support market growth. Adoption is further aided by the expansion of private dental practices and modernization of hospital dental departments. Continued investment in healthcare digitalization is expected to sustain momentum.

Germany Smart Dental Imaging & AI Interpretation Devices Market Insight

The Germany smart dental imaging & AI interpretation devices market is expected to expand at a steady CAGR during the forecast period, driven by strong demand for high-precision and technology-driven diagnostic solutions. Germany’s well-developed healthcare infrastructure and focus on innovation support adoption of AI-enabled dental imaging. Dental providers emphasize diagnostic accuracy, efficiency, and compliance with regulatory standards. Integration of advanced imaging systems into both private practices and hospitals is increasing. A strong preference for reliable, data-secure solutions aligns well with AI-powered diagnostic technologies, supporting sustained growth.

Asia-Pacific Smart Dental Imaging & AI Interpretation Devices Market Insight

The Asia-Pacific smart dental imaging & AI interpretation devices market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by expanding dental care infrastructure, rising disposable incomes, and rapid healthcare digitalization. Countries such as China, Japan, and India are witnessing increased adoption of advanced diagnostic technologies in dental practices. Growing awareness of oral health and increasing demand for quality dental care are key growth drivers. Government initiatives supporting healthcare modernization further accelerate adoption. The region’s growing role as a manufacturing and innovation hub also improves accessibility and affordability of advanced imaging solutions.

Japan Smart Dental Imaging & AI Interpretation Devices Market Insight

The Japan smart dental imaging & AI interpretation devices market is gaining traction due to the country’s advanced healthcare ecosystem, high technology adoption, and emphasis on diagnostic accuracy. Dental providers increasingly adopt AI-enabled imaging to support precise treatment planning and efficient workflows. Integration of imaging systems with digital platforms and hospital information systems is contributing to growth. Japan’s aging population is increasing demand for accurate diagnostics and efficient dental care delivery. These factors collectively support steady market expansion across both clinical and hospital settings.

India Smart Dental Imaging & AI Interpretation Devices Market Insight

The India smart dental imaging & AI interpretation devices market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding middle-class population, and increasing adoption of digital dentistry. India’s growing number of dental clinics and hospitals is boosting demand for advanced imaging and AI-based interpretation tools. Rising awareness of oral health and preventive care is further supporting market growth. Government initiatives promoting healthcare infrastructure development and digital health adoption play a key role. The availability of cost-effective imaging solutions and strong domestic manufacturing capabilities are accelerating market penetration across the country.

Smart Dental Imaging & AI Interpretation Devices Market Share

The Smart Dental Imaging & AI Interpretation Devices industry is primarily led by well-established companies, including:

- Carestream Dental LLC (U.S.)

- VATECH Networks (South Korea)

- Planmeca Oy (Finland)

- Dentsply Sirona Inc. (U.S.)

- Morita Corporation (Japan)

- KaVo Kerr Group (U.S.)

- Acteon Group (France)

- 3Shape A/S (Denmark)

- Midmark Corporation (U.S.)

- Dürr Dental SE (Germany)

- SOREDEX (Finland)

- Konica Minolta Healthcare Americas, Inc. (U.S.)

- DEXIS LLC (U.S.)

- i-CAT FLX (U.S.)

- X-Mind (Italy)

- Air Techniques, Inc. (U.S.)

- Vatech America, Inc. (U.S.)

- Owandy Radiology (France)

- Ray Co., Ltd. (South Korea)

- Dental Wings Inc. (Canada)

What are the Recent Developments in Global Smart Dental Imaging & AI Interpretation Devices Market?

- In October 2025, Carestream Dental launched CS 3D Imaging Premium, an AI-powered software upgrade that streamlines implant planning, automates routine tasks, and simplifies case sharing for dental professionals, significantly accelerating workflow efficiency. This premium AI upgrade enables automatic teeth identification and virtual implant positioning based on integrated CBCT data

- In July 2025, the Maulana Azad Institute of Dental Sciences implemented an AI-powered dental scanner (ScanOair) for preliminary diagnosis of common dental conditions, improving diagnostic efficiency and reducing patient wait times in clinical settings. This real-world implementation highlights the growing use of AI imaging technology beyond product launches to practical diagnostic applications

- In March 2025, Align Technology launched Align X-ray Insights, an AI computer-aided detection software to automatically analyze 2D radiographs and enhance diagnostics, patient communication, and treatment planning across the EU and UK dental markets. This AI tool integrates with Align’s digital platform and is being introduced at major events such as IDS 2025, receiving regulatory clearances in multiple countries

- In March 2025, Align Technology announced enhanced restorative workflows for the iTero Lumina™ intraoral scanner and introduced the new iTero Lumina™ Pro dental imaging system, combining AI scanning and Near Infra-Red Imaging (NIRI) to support comprehensive diagnostics and restorative treatments. The improved system delivers faster scanning, wider field capture, and enhanced 3D imaging capabilities

- In March 2024, Align Technology unveiled the iTero Lumina™ intraoral scanner, featuring a 3× wider field of capture, 50% smaller wand, faster scanning speeds, and higher accuracy, advancing AI-ready imaging for dental practices globally. This device represents a major advancement in intraoral digital imaging hardware, improving workflow and patient comfort

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.