Solid Organ Transplantation Market Analysis and Size

The global solid organ transplantation market is expected to witness significant growth during the forecast period. Increasing demand for novel tissue transplantation products and organ transplantation for the treatment of organ failure is a foremost factor leading to the market growth. Unhealthy dietary habits, lack of exercise, alcohol consumption, and drug abuse are some important causes of organ failure. It has been witnessed that tissue products were the highest revenue-generating segment in 2021 having a market share of 57.8%. COVID-19 also had a major impact on the market growth.

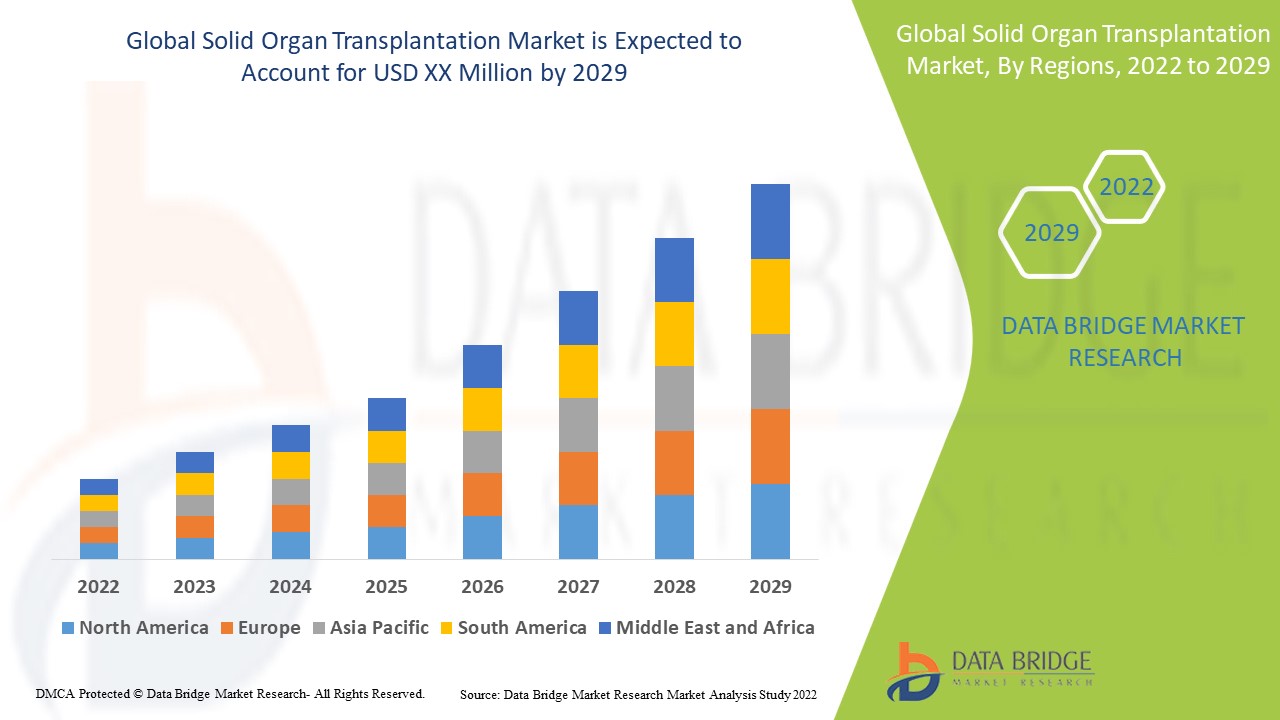

Data Bridge Market Research analyses a growth rate in the global solid organ transplantation market in the forecast period 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Market Definition

Solid organ transplantation works like an advantage for patients suffering from end-stage kidney, pancreas, small intestine, heart, liver, and lung diseases. Although, it is not a process that improves survival, certain quality-of-life improvements are realized with vascular composite allograft and uterus transplantation. It is of great importance to the healthcare sector and thus is expected to rise high in the forecast period.

Solid Organ Transplantation Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Organ (Kidney, Liver, Pancreas, Heart, Lung, Small Bowel, Kidney/Pancreas, Others), Product (Tissue Products, Immunosuppressive Drugs, Preservation Solution), Treatment (Immunosuppressive, Monoclonal Antibodies, Others), End-Users (Hospitals, Homecare, Speciality Centres, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Teva Pharmaceutical Industries Ltd (Israel), Mylan N.V (U.S.), Johnsons & Johnsons Services Inc (U.S.), F. Hoffman-La Roche Ltd. (Switzerland), Lilly (U.S.), Merck & Co., Inc. (U.S.), Aurobindo Pharma (India), Bristol-Myers Squibb Company (U.S.), GSK plc (U.K.), Ascendis Pharma A/S (Denmark), LEO Pharma A/S (Denmark), Genentech, Inc (U.S.), Celltrion Inc (South Korea) |

|

Market Opportunities |

|

Global Solid Organ Transplantation Market Dynamics

Drivers

- Growing Demand for Organ Transplant

The global rise in the organ transplant demand can be attributed to an increase in the occurrence of acute diseases, which in turn leads to an increase in the number of organ failures. For instance, diabetes and high blood pressure are considered to be the most common causes of end-stage renal disease, wherein kidney transplants or dialysis are the only treatment options to keep a patient alive. As per the records of the U.S. Department of Health & Human Services, about 122,913 patients in the U.S. were waiting to receive organs for transplant in 2019. Thus, the demand for advanced transplantation products for the treatment of organ failure is high.This boosts the market growth.

- Technological Advancements

Several technological advancemnets in this sector are expected to boost the growth of the market. For instance, in September 2015, Arthrex Inc. launched ArthroFlex Acellular Dermal Matrix, a new orthobiologic product proposed for use in capsular reconstruction. This product allows preservation of its growth factors and native collagen scaffold and elastin and permits transplant to be successfully incorporated into the recipient. All these factors boost the market growth.

Opportunities

- Higher Mergers and Acquisitions

Several manufacturers are aiming on new product development, mergers & acquisition, and collaborations to enlarge their current product portfolio and maintain their persistent position in the market. For instance, in September 2016, Stryker Corporation announced the acquisition of Instratek. It is a top manufacturer of minimally invasive soft tissue recession instruments for ankle, foot, and upper extremity procedures.

- Increasing Sales of Immunosuppressive Drugs

Tissue products for transplantation accounted for the largest share in 2021, and this category is projected to maintain its position in the upcoming future due to the increasing use of orthobiologics in orthopedic procedures for normal functioning restoration, tissue healing, and pain minimization, combined with the increasing elderly population across the globe. Moreover, startup companies in this field are receiving investments to expand their business. Thus, this factor is creating much opportunities for the market growth.

Restraints/Challenges

- High Cost

The huge association with organ transplantation and many other immunosuppressive drugs restrain the market growth.

- Unavailability of Treatment

Not all the treatments are available in all the countries which restrict the market growth. There are several underdeveloped countries wherein the modified treatments are not available. Thus, it restricts the growth of the market.

This global solid organ transplantation market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global solid organ transplantation market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Solid Organ Transplantation Market

There has been a significant proportion of coronavirus patients who were hospitalized in medical centers, governing bodies were bound to restrict to these patients. The pandemic also caused a drip in organ transplant surgery enrolment globally.

The reduction in the number of transplantation and organ donation procedures is mostly because of factors such as engaged surgeons, unavailability of resources, lockdown, and travel restrictions. Patients having positive reports for COVID-19 were restricted from donating organs because of the possibility of infection. Additionally, another major concern prompting transplantation operations was the possibility of immunosuppressant drug interactions with COVID-19 therapy agents, which had led to a substantial number of organ failures from graft donors.

Recent Development:

- In November 2020, Lupin launched a generic immunosuppressant drug, Tacrolimus in the U.S. market which is indicated for prophylaxis of organ rejection in the allogeneic liver, kidney, and heart transplant.

Global Solid Organ Transplantation Market Scope

The global solid organ transplantation market is segmented on the basis of organ, product, treatment, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Organ

- Kidney

- Liver

- Pancreas

- Heart

- Lung

- Small Bowel

- Kidney/Pancreas

- Others

Product

- Tissue Products

- Immunosuppressive Drugs

- Preservation Solution

Treatment

- Immunosuppressive

- Monoclonal Antibodies

- Others

End-Users

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Solid Organ Transplantation Market Regional Analysis/Insights

The global solid organ transplantation market is analysed and market size insights and trends are provided by organ, product, treatment, distribution channel and end-user as referenced above.

The major countries covered in the global solid organ transplantation market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to have the highest market growth due to the presence of key manufacture of the product and increased healthcare and R & D expenditure.

Asia-Pacific dominates the market due to increased prevalence of organ failure, and presence of generic drugs manufacturers.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Solid Organ Transplantation Market Share Analysis

The global solid organ transplantation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global solid organ transplantation market.

Key players operating in the global solid organ transplantation market include:

- Teva Pharmaceutical Industries Ltd (Israel)

- Mylan N.V (U.S.)

- Johnsons & Johnsons Services Inc (U.S.)

- F. Hoffman-La Roche Ltd. (Switzerland)

- Lilly (U.S.)

- Merck & Co., Inc. (U.S.)

- Aurobindo Pharma (India)

- Bristol-Myers Squibb Company (U.S.)

- GSK plc (U.K.)

- Ascendis Pharma A/S (Denmark)

- LEO Pharma A/S (Denmark)

- Genentech, Inc (U.S.)

- Celltrion Inc (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SOLID ORGAN TRANSPLANTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SOLID ORGAN TRANSPLANTATION MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR SOLID ORGAN TRANSPLANTATION MARKET

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE SOLID ORGAN TRANSPLANTATION MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE SOLID ORGAN TRANSPLANTATION MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE SOLID ORGAN TRANSPLANTATION MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR SOLID ORGAN TRANSPLANTATION MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY ORGAN

15.1 OVERVIEW

15.2 KIDNEY TRANSPLANTATION

15.3 LIVER TRANSPLANTATION

15.4 HEART TRANSPLANTATION

15.5 LUNG TRANSPLANTATION

15.6 PANCREAS TRANSPLANTATION

15.7 SMALL BOWEL TRANSPLANTATION

15.8 OTHERS

16 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY PRODUCT

16.1 OVERVIEW

16.2 THERAPY

16.2.1 IMMUNOSUPPRESSIVE DRUGS

16.2.1.1. CALCINEURIN INHIBITORS (CNI)

16.2.1.1.1. CYCLOSPORINE

16.2.1.1.1.1 NEORAL

16.2.1.1.1.2 SANDIMMUNE

16.2.1.1.1.3 OTHERS

16.2.1.1.2. TACROLIMUS (PROGRAF)

16.2.1.1.3. OTHERS

16.2.1.2. ANTIPROLIFERATIVE AGENTS

16.2.1.2.1. AZATHIOPRINE (IMURAN)

16.2.1.2.2. MYCOPHENOLATE MOFETIL (MMF)

16.2.1.2.3. CYCLOPHOSPHAMIDE

16.2.1.2.4. LEFLUNOMIDE

16.2.1.2.5. OTHERS

16.2.1.3. MTOR INHIBITORS

16.2.1.3.1. SIROLIMUS

16.2.1.3.2. EVEROLIMUS

16.2.1.3.3. TEMSIROLIMUS

16.2.1.3.4. RIDAFOROLIMUS

16.2.1.3.5. OTHERS

16.2.1.4. CORTICOSTEROIDS

16.2.1.4.1. METHYLPREDNISOLONE

16.2.1.4.2. DEXAMETHASONE

16.2.1.4.3. PREDNISOLONE

16.2.1.4.4. OTHERS

16.2.1.5. STATIN THERAPY

16.2.1.6. ALKYLATING AGENT

16.2.1.7. INTERLEUKIN INHIBITORS

16.2.1.8. SPECIFIC LYMPHOCYTE-SIGNALING INHIBITORS

16.2.2 ANTI-DRUG ANTIBODIES

16.2.2.1. MONOCLONAL ANTIBODIES

16.2.2.1.1. MARKETED

16.2.2.1.1.1 MUROMONAB-CD3

16.2.2.1.1.2 BASILIXIMAB

16.2.2.1.1.3 BELATACEPT

16.2.2.1.1.4 ALEMTUZUMAB

16.2.2.1.1.5 OTHERS

16.2.2.1.2. INVESTIGATIONAL

16.2.2.1.2.1 ALEMTUZUMAB

16.2.2.1.2.2 RITUXIMAB

16.2.2.1.2.3 OTHERS

16.2.2.2. TNF-ALPHA INHIBITORS

16.2.2.2.1. INFLIXIMAB

16.2.2.2.2. ADALIMUMAB

16.2.2.2.3. OTHERS

16.2.2.3. OTHERS

16.2.3 THERAPEUTIC PLASMA EXCHANGE (TPE)

16.2.4 INTRAVENOUS IMMUNOGLOBULIN (IVIG)

16.3 PRESERVATION SOLUTION

16.3.1 BY SOLUTION TYPE

16.3.1.1. UW

16.3.1.2. EURO-COLLINS

16.3.1.3. BELZER'S MPS

16.3.1.4. CUSTODIOL HTK

16.3.1.5. CELSIOR

16.3.1.6. PERFADEX

16.3.1.7. POLYSOL

16.3.1.8. VIASPAN

16.3.1.9. OTHERS

16.3.2 BY METHOD OF PRESERVATION

16.3.2.1. STATIC PRESERVATION METHOD

16.3.2.2. DYNAMIC PRESERVATION METHOD

16.3.2.2.1. HYPOTHERMIC MACHINE PERFUSION PERSERVATION

16.3.2.2.2. NORMOTHERIC MACHINE PERFUSION

16.3.2.2.3. OXYGEN PERSUFFLATION

16.3.2.2.4. OTHERS

16.3.2.3. OTHERS

16.4 TISSUE PRODUCTS

16.5 OTHERS

17 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY ROUTE OF ADMINISTRATION

17.1 ORAL

17.1.1 TABLET

17.1.2 CAPSULE

17.1.3 OTHERS

17.2 PARENTRAL

17.2.1 INTRAVENEOUS

17.2.2 SUBCUTANEOUS

17.2.3 OTHERS

17.3 OTHERS

18 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY TYPE OF ORGAN DONATION

18.1 OVERVIEW

18.2 DECEASED DONOR

18.3 LIVING DONOR

19 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY DRUG BRAND

19.1 OVERVIEW

19.2 BRANDED

19.2.1 PROGRAF

19.2.2 CELLCEPT

19.2.3 ZORTRESS

19.2.4 RAPAMUNE

19.2.5 OTHERS

19.3 GENERICS

20 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY PRESCRIPTION MODE

20.1 OVERVIEW

20.2 OVER THE COUNTER (OTC)

20.3 PRESCRIPTION BASED

21 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY POPULATION TYPE

21.1 OVERVIEW

21.2 MALE

21.2.1 YOUNG (BELOW 30 YEARS)

21.2.2 MIDDLE AGE (30–50 YEARS)

21.2.3 ELDERLY (65 YEARS OR OLDER)

21.3 FEMALE

21.3.1 YOUNG (BELOW 30 YEARS)

21.3.2 MIDDLE AGE (30–50 YEARS)

21.3.3 ELDERLY (65 YEARS OR OLDER)

22 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITAL

22.2.1 BY TYPE

22.2.1.1. PUBLIC

22.2.1.2. PRIVATE

22.2.2 BY TIER

22.2.2.1. TIER 1

22.2.2.2. TIER 2

22.2.2.3. TIER 3

22.3 SPECIALTY CLINICS

22.4 HOME HEALTHCARE

22.5 AMBULATORY SURGICAL CENTERS

22.6 ACADEMIC AND RESEARCH INSTITUTES

22.7 OTHERS

23 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 REATIL SALES

23.3.1 OFFLINE PHARMACY

23.3.1.1. HOSPITAL PHARMACY

23.3.1.2. MEDICAL STORES AND DRUGS

23.3.1.3. OTHERS

23.3.2 ONLINE PHARMACY

23.3.2.1. E-STORES

23.3.2.2. COMPANY WEBSITE

23.3.2.3. OTHERS

23.4 OTHERS

24 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

24.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

24.6 MERGERS & ACQUISITIONS

24.7 NEW PRODUCT DEVELOPMENT & APPROVALS

24.8 EXPANSIONS

24.9 REGULATORY CHANGES

24.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, BY GEOGRAPHY

GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 FRANCE

25.2.3 U.K.

25.2.4 HUNGARY

25.2.5 LITHUANIA

25.2.6 AUSTRIA

25.2.7 IRELAND

25.2.8 NORWAY

25.2.9 POLAND

25.2.10 ITALY

25.2.11 SPAIN

25.2.12 RUSSIA

25.2.13 TURKEY

25.2.14 NETHERLANDS

25.2.15 SWITZERLAND

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 AUSTRALIA

25.3.6 SINGAPORE

25.3.7 THAILAND

25.3.8 MALAYSIA

25.3.9 INDONESIA

25.3.10 PHILIPPINES

25.3.11 VIETNAM

25.3.12 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 PERU

25.4.4 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 GLOBAL

25.5.3 UAE

25.5.4 EGYPT

25.5.5 KUWAIT

25.5.6 ISRAEL

25.5.7 REST OF MIDDLE EAST AND AFRICA

25.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL SOLID ORGAN TRANSPLANTATION MARKET, COMPANY PROFILE

27.1 TEVA PHARMACEUTICALS USA, INC.

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 WEEFSELPHARMA.COM

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 ADVACARE PHARMA

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 NOVARTIS AG

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 DR. REDDY’S LABORATORIES, INC.

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 APOTEX INC.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 STRIDES PHARMA SCIENCE LIMITED

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 ASTELLAS PHARMA US, INC.

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 ACCORD HEALTHCARE US

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 BIOCON

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 GLENMARK PHARMACEUTICALS U.S. INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 TAJ PHARMA GROUP

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ALKEM

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 CONCORD BIOTECH

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 PANACEA BIOTEC

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 MYLAN N.V.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 NIKSAN PHARMACEUTICAL

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 WELLONA PHARMA

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 SANOFI

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 LUPIN PHARMACEUTICALS, INC.

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 OPELLA HEALTHCARE INTERNATIONAL SAS

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 HEALTHY LIFE PHARMA PRIVATE LIMITED

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 ZYDUS PHARMACEUTICALS, INC.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 AMNEAL PHARMACEUTICALS LLC

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 AADI BIOSCIENCE, INC.

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 PRESERVATION SOLUTION INC

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 ORGAN PRESERVATION SOLUTION

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 ORGANOX

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

27.29 OPSL GROUP

27.29.1 COMPANY OVERVIEW

27.29.2 REVENUE ANALYSIS

27.29.3 GEOGRAPHIC PRESENCE

27.29.4 PRODUCT PORTFOLIO

27.29.5 RECENT DEVELOPMENTS

27.3 XVIVO PERFUSION

27.30.1 COMPANY OVERVIEW

27.30.2 REVENUE ANALYSIS

27.30.3 GEOGRAPHIC PRESENCE

27.30.4 PRODUCT PORTFOLIO

27.30.5 RECENT DEVELOPMENTS

27.31 SANDOR

27.31.1 COMPANY OVERVIEW

27.31.2 REVENUE ANALYSIS

27.31.3 GEOGRAPHIC PRESENCE

27.31.4 PRODUCT PORTFOLIO

27.31.5 RECENT DEVELOPMENTS

27.32 PARAGONIX TECHNOLOGIES

27.32.1 COMPANY OVERVIEW

27.32.2 REVENUE ANALYSIS

27.32.3 GEOGRAPHIC PRESENCE

27.32.4 PRODUCT PORTFOLIO

27.32.5 RECENT DEVELOPMENTS

27.33 AOPO ORGANIZATION

27.33.1 COMPANY OVERVIEW

27.33.2 REVENUE ANALYSIS

27.33.3 GEOGRAPHIC PRESENCE

27.33.4 PRODUCT PORTFOLIO

27.33.5 RECENT DEVELOPMENTS

27.34 CARDIOLINK GROUP

27.34.1 COMPANY OVERVIEW

27.34.2 REVENUE ANALYSIS

27.34.3 GEOGRAPHIC PRESENCE

27.34.4 PRODUCT PORTFOLIO

27.34.5 RECENT DEVELOPMENTS

27.35 ESSENTIAL PHARMACEUTICALS LLC

27.35.1 COMPANY OVERVIEW

27.35.2 REVENUE ANALYSIS

27.35.3 GEOGRAPHIC PRESENCE

27.35.4 PRODUCT PORTFOLIO

27.35.5 RECENT DEVELOPMENTS

27.36 TRANSMEDICS

27.36.1 COMPANY OVERVIEW

27.36.2 REVENUE ANALYSIS

27.36.3 GEOGRAPHIC PRESENCE

27.36.4 PRODUCT PORTFOLIO

27.36.5 RECENT DEVELOPMENTS

27.37 SALF SPA

27.37.1 COMPANY OVERVIEW

27.37.2 REVENUE ANALYSIS

27.37.3 GEOGRAPHIC PRESENCE

27.37.4 PRODUCT PORTFOLIO

27.37.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.